Key Insights

The Saudi Arabia Fuel Station Market is projected for robust growth, anticipated to reach 901.44 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.4% from 2019-2024 and extending to 2033. This expansion is fueled by strong economic activity and sustained demand for petroleum products in the transportation and industrial sectors. Key growth drivers include increasing vehicle fleet size, government-led economic diversification and infrastructure development initiatives, and continued reliance on oil and gas as primary energy sources. The market is undergoing a significant transformation with the adoption of advanced technologies, including digital payment solutions, customer loyalty programs, and enhanced convenience retail offerings. A focus on elevating customer experience through improved amenities and efficient service delivery further supports market dynamics, aligning with evolving consumer expectations.

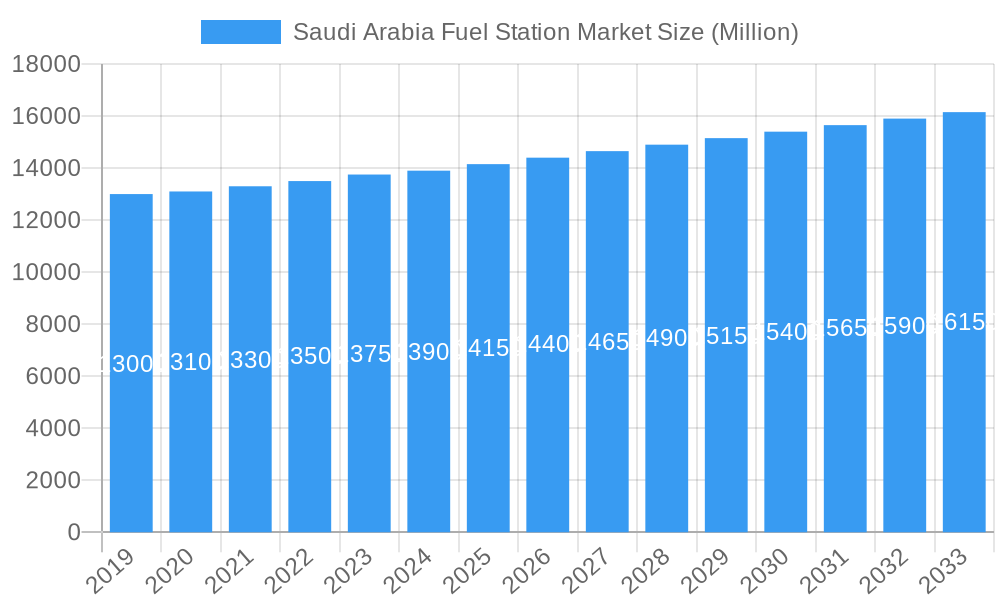

Saudi Arabia Fuel Station Market Market Size (In Million)

While the outlook is positive, potential restraints include the global transition to alternative energy sources and the growing adoption of electric vehicles, which could impact long-term demand for traditional fuels. Volatility in global oil prices also presents a market risk. However, within Saudi Arabia, the fuel station sector is expected to remain strong in the near to medium term due to existing infrastructure and ongoing dependence on petrochemicals. The market is highly competitive, with major players like Saudi Aramco, ADNOC Distribution, and TotalEnergies SE focusing on strategic expansion, service innovation, and competitive pricing. Diversifying revenue streams through non-fuel offerings, such as convenience stores, is a crucial strategy for profitability and market leadership.

Saudi Arabia Fuel Station Market Company Market Share

Gain comprehensive insights into the Saudi Arabia Fuel Station Market. This report analyzes production, consumption, trade, pricing, and key industry developments, providing a holistic market overview. Understand growth catalysts, emerging trends, dominant market segments, and competitive strategies shaping the future of fuel retail in Saudi Arabia. Essential for stakeholders, investors, and industry professionals seeking actionable intelligence on the Saudi Arabia petrol station market, Saudi Arabia fuel retail market, and Saudi Arabia automotive fuel market. Data covers the 2019-2024 historical period, with 2025 as the base year, and forecasts through 2033.

Saudi Arabia Fuel Station Market Market Structure & Competitive Dynamics

The Saudi Arabia fuel station market exhibits a moderately concentrated structure, with a few major players dominating the landscape, alongside a growing number of independent operators. Saudi Aramco, Petromin Corporation, and Aldrees Petroleum and Transport Services Company (APTSCO) hold significant market share, driven by extensive networks and integrated service offerings. The market is characterized by increasing innovation, particularly in the adoption of digital payment solutions, loyalty programs, and convenience store integration. Regulatory frameworks, driven by Vision 2030 initiatives, are pushing for greater efficiency, sustainability, and the integration of new energy sources, impacting the competitive dynamics. Product substitutes are evolving, with the nascent but growing presence of electric vehicle charging infrastructure posing a long-term consideration. End-user trends are shifting towards a demand for enhanced convenience, diverse retail offerings beyond fuel, and environmentally conscious solutions. Mergers and acquisitions are anticipated to play a crucial role in market consolidation, with estimated M&A deal values poised to increase as companies seek to expand their geographical reach and service portfolios. The market's competitive intensity is expected to rise due to these factors.

Saudi Arabia Fuel Station Market Industry Trends & Insights

The Saudi Arabia fuel station market is experiencing robust growth, fueled by a confluence of factors including a burgeoning population, expanding automotive fleet, and government initiatives aimed at economic diversification and infrastructure development. The Saudi Arabia petrol station market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period. A significant trend is the increasing integration of convenience retail and food services at fuel stations, transforming them into one-stop destinations for consumers. This shift caters to evolving consumer preferences for time-saving and diverse offerings. Technological disruptions are a key area of focus, with the implementation of digital payment systems, mobile apps for loyalty programs and pre-ordering, and the exploration of autonomous fueling solutions. The push towards sustainability and clean energy is also reshaping the industry, evidenced by investments in electric vehicle (EV) charging infrastructure and the potential introduction of alternative fuels. Competitive dynamics are intensifying as both established players and new entrants strive to capture market share through strategic expansions, service innovations, and customer engagement strategies. Market penetration of advanced services like car wash facilities, automotive repair, and specialized retail outlets within fuel stations is on an upward trajectory. The sustained economic growth in Saudi Arabia, coupled with ongoing infrastructure projects, further bolsters demand for fuel and associated services. The market is also benefiting from the government's focus on enhancing the customer experience and modernizing retail infrastructure across the Kingdom.

Dominant Markets & Segments in Saudi Arabia Fuel Station Market

The Saudi Arabia fuel station market exhibits dominance across several key segments, driven by economic policies and infrastructure development.

Consumption Analysis: The major consumption hubs are concentrated in the heavily populated and economically active regions of Riyadh, Jeddah, and Dammam. The increasing disposable incomes and a growing expatriate population in these urban centers are primary drivers for high fuel consumption. The expansion of road networks and the burgeoning automotive sector further bolster demand.

Production Analysis: While Saudi Arabia is a global leader in oil production, the production analysis for fuel stations pertains more to the distribution and retail aspects. The domestic refining capacity ensures ample supply for the retail market. The focus here is on the efficiency and reach of the distribution network.

Import Market Analysis (Value & Volume): While Saudi Arabia is a net exporter of refined petroleum products, the import market analysis for fuel stations primarily concerns specialized lubricants, additives, and potentially equipment. The value of imports for these niche products is significant, driven by demand for high-performance automotive fluids and advanced retail technologies. The volume, while lower than refined fuels, represents a segment with high-value components.

Export Market Analysis (Value & Volume): The export market analysis for fuel stations is less direct, focusing more on the export of refined fuels that ultimately feed into global distribution networks. For the fuel station retail segment itself, exports are not a primary consideration.

Price Trend Analysis: The price trend analysis is intrinsically linked to global crude oil prices, government subsidies (though these are being phased out), and retail markup strategies. Historical data shows volatility influenced by geopolitical factors and supply-demand dynamics. The trend is towards price liberalization and market-driven pricing, encouraging competition and service innovation.

Saudi Arabia Fuel Station Market Product Innovations

Product innovations in the Saudi Arabia fuel station market are increasingly focusing on enhancing the customer experience and embracing sustainability. This includes the integration of advanced payment systems, mobile applications for loyalty programs and seamless transactions, and the expansion of non-fuel retail offerings such as convenience stores, cafes, and quick-service restaurants. Furthermore, a significant trend is the development of electric vehicle (EV) charging infrastructure at existing fuel stations, demonstrating a proactive approach to the evolving automotive landscape. These innovations aim to increase dwell time, diversify revenue streams, and align with the Kingdom's vision for a cleaner energy future.

Report Segmentation & Scope

This report segments the Saudi Arabia fuel station market across critical analytical areas, including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. Each segment is meticulously analyzed to provide granular insights into market dynamics. Projections for market size, growth rates, and competitive landscapes are detailed within each segmentation, offering a comprehensive outlook.

Key Drivers of Saudi Arabia Fuel Station Market Growth

The Saudi Arabia fuel station market is propelled by several key drivers. The Kingdom's ambitious economic diversification strategy, Vision 2030, is a significant catalyst, promoting infrastructure development and urban expansion, which in turn increases fuel demand. A rapidly growing population and an expanding automotive fleet are fundamental demand drivers. Technological advancements, such as the adoption of digital payment systems and the integration of EV charging, are enhancing operational efficiency and customer convenience. Furthermore, government support for modernization and the development of integrated service stations contribute to market expansion.

Challenges in the Saudi Arabia Fuel Station Market Sector

Despite robust growth, the Saudi Arabia fuel station market faces certain challenges. The ongoing subsidy reforms, while aimed at fiscal prudence, can lead to short-term price volatility and impact consumer spending patterns. Intense competition among existing players and the potential entry of new disruptors necessitate continuous innovation and efficient operations. Adapting to the long-term shift towards electric vehicles requires significant investment in new infrastructure and business models. Supply chain complexities, particularly in remote areas, and the need for skilled labor to manage advanced technologies also present hurdles.

Leading Players in the Saudi Arabia Fuel Station Market Market

- Aldrees Petroleum and Transport Services Company (APTSCO)

- Emirates National Oil Co Ltd LLC (ENOC)

- Wafi Energy Co

- Oman Oil Marketing Company (OOMCO)

- ADNOC Distribution

- TotalEnergies SE

- NAFT Services Co Ltd

- Petromin Corporation

- Saudi Arabian Oil Company (Saudi Aramco)

Key Developments in Saudi Arabia Fuel Station Market Sector

- November 2022: The Al-Sharif group signed a long-term contract with Benzene Petrol Stations Company Limited to operate electric vehicle charging stations in its gas stations across Saudi Arabia, signifying a commitment to clean energy technologies.

- March 2022: Oman Oil Marketing Company (OOMCO) opened its fifth fuel service station in the Kingdom of Saudi Arabia, as part of its expansion strategy. As of this date, OOMCO had secured 11 additional fuel station locations in Saudi Arabia at various development stages.

Strategic Saudi Arabia Fuel Station Market Market Outlook

The strategic outlook for the Saudi Arabia fuel station market is characterized by continued expansion driven by demographic growth and infrastructure development. The integration of digital technologies and the nascent but growing adoption of EV charging infrastructure present significant growth accelerators. Companies that focus on diversified retail offerings, exceptional customer service, and strategic partnerships will be well-positioned for success. The market's transition towards a more integrated service hub model, encompassing fuel, convenience retail, and emerging energy solutions, points towards a dynamic and evolving future, offering substantial opportunities for sustained growth and profitability.

Saudi Arabia Fuel Station Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Saudi Arabia Fuel Station Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Fuel Station Market Regional Market Share

Geographic Coverage of Saudi Arabia Fuel Station Market

Saudi Arabia Fuel Station Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales In Saudi Arabia4.; Increasing Investments In Fuel Station Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption Of Alternate Fuel Vehicles

- 3.4. Market Trends

- 3.4.1. Increasing Automotive Sales In Saudi Arabia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Fuel Station Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aldrees Petroleum and Transport Services Company (APTSCO)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Emirates National Oil Co Ltd LLC (ENOC)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wafi Energy Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oman Oil Marketing Company (OOMCO)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ADNOC Distribution

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TotalEnergies SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NAFT Services Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Petromin Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi Arabian Oil Company (Saudi Aramco)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Aldrees Petroleum and Transport Services Company (APTSCO)

List of Figures

- Figure 1: Saudi Arabia Fuel Station Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Fuel Station Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Fuel Station Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Saudi Arabia Fuel Station Market Volume Thousand Forecast, by Production Analysis 2020 & 2033

- Table 3: Saudi Arabia Fuel Station Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Saudi Arabia Fuel Station Market Volume Thousand Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Saudi Arabia Fuel Station Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Saudi Arabia Fuel Station Market Volume Thousand Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Saudi Arabia Fuel Station Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Saudi Arabia Fuel Station Market Volume Thousand Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Saudi Arabia Fuel Station Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Saudi Arabia Fuel Station Market Volume Thousand Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Saudi Arabia Fuel Station Market Revenue million Forecast, by Region 2020 & 2033

- Table 12: Saudi Arabia Fuel Station Market Volume Thousand Forecast, by Region 2020 & 2033

- Table 13: Saudi Arabia Fuel Station Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 14: Saudi Arabia Fuel Station Market Volume Thousand Forecast, by Production Analysis 2020 & 2033

- Table 15: Saudi Arabia Fuel Station Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Saudi Arabia Fuel Station Market Volume Thousand Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Saudi Arabia Fuel Station Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Saudi Arabia Fuel Station Market Volume Thousand Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Saudi Arabia Fuel Station Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Saudi Arabia Fuel Station Market Volume Thousand Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Saudi Arabia Fuel Station Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Saudi Arabia Fuel Station Market Volume Thousand Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Saudi Arabia Fuel Station Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Saudi Arabia Fuel Station Market Volume Thousand Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Fuel Station Market?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Saudi Arabia Fuel Station Market?

Key companies in the market include Aldrees Petroleum and Transport Services Company (APTSCO), Emirates National Oil Co Ltd LLC (ENOC), Wafi Energy Co, Oman Oil Marketing Company (OOMCO), ADNOC Distribution, TotalEnergies SE, NAFT Services Co Ltd, Petromin Corporation, Saudi Arabian Oil Company (Saudi Aramco).

3. What are the main segments of the Saudi Arabia Fuel Station Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 901.44 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales In Saudi Arabia4.; Increasing Investments In Fuel Station Infrastructure.

6. What are the notable trends driving market growth?

Increasing Automotive Sales In Saudi Arabia.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption Of Alternate Fuel Vehicles.

8. Can you provide examples of recent developments in the market?

November 2022: the Al-Sharif group signed a long-term contract with Benzene Petrol Stations Company Limited to operate electric vehicle charging stations in its gas stations across Saudi Arabia. The partnership came as an extension of Al-Sharif Holding’s commitment to contributing to the transfer of the latest clean energy technologies to the Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Fuel Station Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Fuel Station Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Fuel Station Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Fuel Station Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence