Key Insights

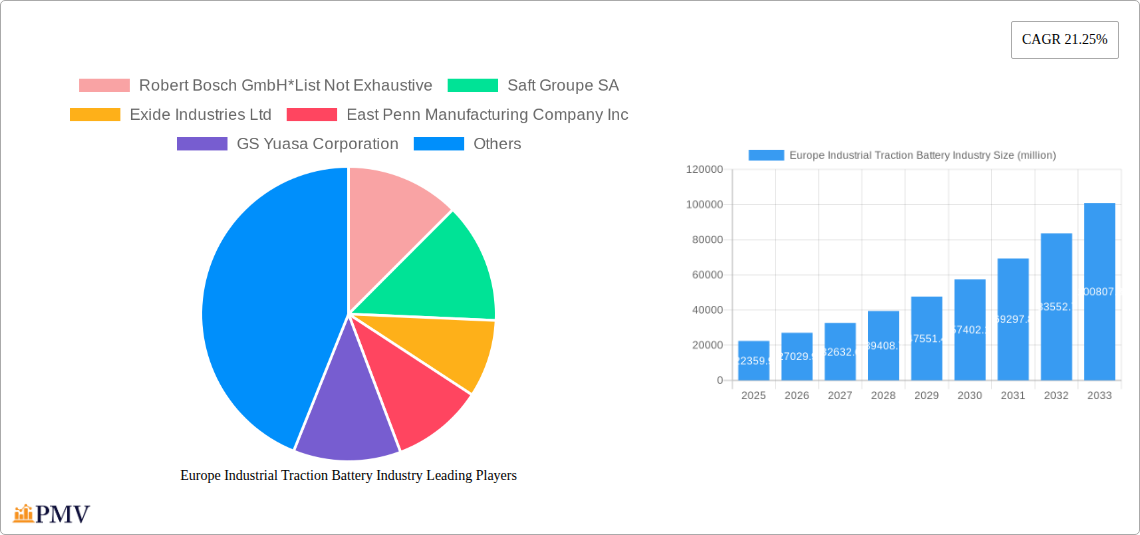

The Europe Industrial Traction Battery Industry is poised for robust expansion, with a projected market size of $22,359.9 million in 2025. This impressive growth trajectory is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 21.25%, indicating a dynamic and rapidly evolving market. The primary drivers of this expansion include the increasing adoption of electric forklifts in warehouses and logistics, the growing demand for reliable backup power solutions in the burgeoning telecommunications sector, and the widespread use of uninterruptible power supply (UPS) systems across various industries. Technological advancements, particularly in Lithium-ion battery technology, are offering superior energy density, longer lifespans, and faster charging capabilities, making them increasingly attractive for industrial traction applications. This shift away from traditional Lead-acid batteries is a significant trend shaping the market's future.

Europe Industrial Traction Battery Industry Market Size (In Billion)

Further reinforcing this positive outlook are key market trends such as the emphasis on sustainable energy solutions and the push for electrification of industrial equipment to reduce operational costs and environmental impact. The European Union's stringent emission regulations and its commitment to a green economy are significant catalysts for this transition. While the market demonstrates strong growth, potential restraints could emerge from the initial high cost of advanced battery technologies and the need for robust charging infrastructure development. However, the overwhelming demand for efficient, high-performance industrial traction batteries, coupled with ongoing innovation and economies of scale, is expected to mitigate these challenges, ensuring continued market dominance for leading players like Robert Bosch GmbH, Saft Groupe SA, and Exide Industries Ltd. The European region, with its strong industrial base and focus on sustainability, is expected to remain a key market for these essential power solutions.

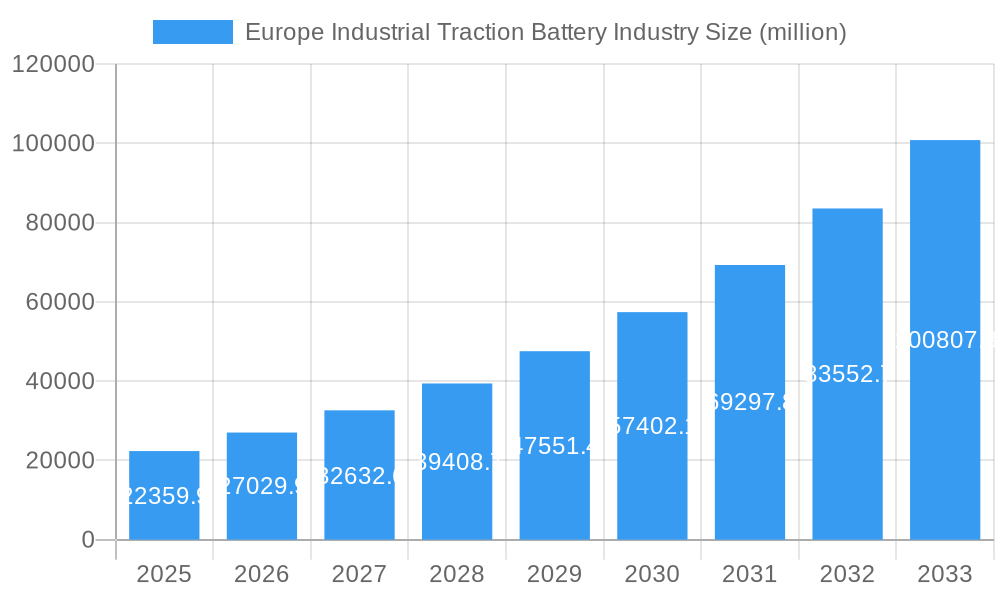

Europe Industrial Traction Battery Industry Company Market Share

Here's the SEO-optimized, detailed report description for the Europe Industrial Traction Battery Industry, incorporating your specifications:

Report Title: Europe Industrial Traction Battery Market: Size, Share, Growth, Trends, Technology, Application, and Forecast 2025-2033

Report Description: Unlock comprehensive insights into the Europe Industrial Traction Battery Market. This in-depth report analyzes market size, growth drivers, emerging trends, and competitive landscapes across the Lithium-ion Battery and Lead-acid Battery segments. Explore the pivotal applications in Forklift, Telecom, and UPS, and understand the strategic moves of key players like Robert Bosch GmbH, Saft Groupe SA, and Northvolt AB. With a study period spanning 2019–2033 and a base year of 2025, this report provides critical data for stakeholders seeking to capitalize on the burgeoning demand for industrial traction batteries driven by electrification and sustainability initiatives. Gain actionable intelligence on battery technology advancements, market penetration strategies, and the impact of significant investments in sustainable battery materials.

Europe Industrial Traction Battery Industry Market Structure & Competitive Dynamics

The Europe Industrial Traction Battery Market is characterized by a dynamic and evolving structure, with a moderate to high degree of market concentration. Leading manufacturers such as Robert Bosch GmbH, Saft Groupe SA, Exide Industries Ltd, East Penn Manufacturing Company Inc, GS Yuasa Corporation, C&D Technologies Pvt Ltd, and Panasonic Corporation hold significant market share, driving innovation and shaping competitive dynamics. The innovation ecosystem is particularly robust in the Lithium-ion Battery segment, fueled by substantial research and development investments and government support for green technologies. Regulatory frameworks, particularly those concerning emissions and energy efficiency, play a crucial role in dictating market direction. Product substitutes, while present in niche applications, are increasingly challenged by the superior performance and lifespan of advanced battery technologies. End-user trends are heavily influenced by the push for electrification across logistics, material handling, and telecommunications, demanding higher energy density and faster charging capabilities. Merger and acquisition (M&A) activities are on the rise as larger players seek to consolidate market presence, acquire technological expertise, and secure supply chains. For instance, significant investments in battery material production, such as Vianode's USD 195 million investment in Norway, underscore this trend.

- Market Concentration: Moderate to high, with key players dominating specific segments.

- Innovation Ecosystems: Strong focus on Lithium-ion Battery technology and sustainable materials.

- Regulatory Frameworks: Driven by environmental policies, emission standards, and energy transition goals.

- Product Substitutes: Primarily challenged by advancements in Lithium-ion Battery technology.

- End-User Trends: Electrification of material handling, logistics, and increasing demand for UPS and telecom power solutions.

- M&A Activities: Strategic acquisitions and investments aimed at market consolidation and technology acquisition.

Europe Industrial Traction Battery Industry Industry Trends & Insights

The Europe Industrial Traction Battery Industry is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive economic policies. The market is projected to witness a significant Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period of 2025–2033. This robust expansion is primarily fueled by the accelerating adoption of electric forklifts and other material handling equipment across burgeoning e-commerce and logistics sectors. The increasing demand for reliable and uninterrupted power in Telecom infrastructure and UPS systems further bolsters market penetration. Technological disruptions, particularly the advancements in Lithium-ion Battery chemistries offering higher energy density, longer cycle life, and faster charging capabilities, are reshaping the competitive landscape. Lead-acid batteries, while still prevalent due to their cost-effectiveness and established infrastructure, are facing increasing competition. Consumer preferences are shifting towards solutions that offer lower total cost of ownership, reduced environmental impact, and enhanced operational efficiency. This is evident in the growing interest in battery management systems (BMS) and integrated charging solutions. Competitive dynamics are intensifying, with established players investing heavily in R&D to stay ahead of innovation curves and new entrants challenging the status quo with disruptive technologies and business models. The ongoing shift towards a circular economy and sustainable manufacturing practices is also influencing product development and supply chain strategies. For example, Northvolt AB's massive investment in a European mega-factory for lithium-ion batteries signifies a strong commitment to localized production and supply chain resilience, a trend expected to accelerate across the industry.

Dominant Markets & Segments in Europe Industrial Traction Battery Industry

Within the Europe Industrial Traction Battery Industry, the Lithium-ion Battery segment is emerging as the dominant force, driven by its superior performance characteristics and increasing cost-competitiveness. This technology is witnessing rapid market penetration across key applications, particularly in Forklift operations where its benefits in terms of energy density, faster charging, and longer lifespan translate into significant operational efficiencies and reduced downtime. Economic policies encouraging the adoption of electric vehicles and sustainable industrial practices further amplify the demand for lithium-ion solutions. Infrastructure development, including the expansion of charging facilities and grid enhancements, supports the widespread deployment of these batteries. Germany, as a major industrial hub with a strong automotive and manufacturing sector, represents a leading country within the European market, exhibiting high demand for industrial traction batteries across various applications. The Forklift application segment is particularly robust, benefiting from the automation and electrification trends in warehousing and logistics. The Telecom sector also contributes significantly, with the increasing reliance on reliable backup power solutions. The forecast period (2025–2033) anticipates continued growth in these dominant segments, with lithium-ion batteries capturing an ever-larger share of the market from traditional lead-acid technologies.

- Dominant Technology: Lithium-ion Battery

- Key Drivers: Higher energy density, longer cycle life, faster charging times, reduced maintenance, environmental benefits.

- Market Penetration: Rapid adoption in Forklift and growing influence in UPS and Telecom.

- Dominant Application: Forklift

- Key Drivers: E-commerce growth, warehouse automation, logistics efficiency demands, electrification mandates.

- Market Penetration: High and increasing, replacing internal combustion engine (ICE) forklifts.

- Leading Country: Germany

- Key Drivers: Strong industrial base, automotive manufacturing dominance, supportive government incentives for electrification, robust logistics infrastructure.

- Emerging Segments: While currently smaller, Other Te applications are expected to grow as new use cases for industrial traction batteries emerge.

Europe Industrial Traction Battery Industry Product Innovations

Product innovation in the Europe Industrial Traction Battery Industry is primarily centered on enhancing energy density, improving safety, and extending the lifespan of batteries. Advances in Lithium-ion Battery chemistries, such as nickel-manganese-cobalt (NMC) and lithium iron phosphate (LFP), offer tailored performance characteristics for specific industrial applications. Innovations also focus on faster charging technologies, enabling quick top-ups during operational shifts, and integrated battery management systems (BMS) that optimize performance and ensure safety. The development of more sustainable battery materials and recycling processes is also a key area of focus, aligning with circular economy principles and regulatory demands. These innovations are crucial for maintaining competitive advantage and meeting the evolving demands of the Forklift, Telecom, and UPS sectors, contributing to more efficient, reliable, and environmentally friendly industrial operations.

Report Segmentation & Scope

This report segments the Europe Industrial Traction Battery Market by key technology and application categories. The primary technology segments analyzed include Lithium-ion Battery, Lead-acid Battery, and Other Te. On the application front, the report covers Forklift, Telecom, UPS, and Others. Each segment is analyzed for its market size, growth projections, and competitive dynamics. The scope encompasses the European region, with a detailed examination of market trends from the historical period 2019–2024, a base year of 2025, and a comprehensive forecast period from 2025–2033.

- Technology Segmentation:

- Lithium-ion Battery: Expected to exhibit the highest growth due to technological advantages.

- Lead-acid Battery: Mature technology with established market share but facing growth challenges.

- Other Te: Encompasses emerging battery chemistries and technologies gaining traction.

- Application Segmentation:

- Forklift: A primary growth driver, fueled by logistics and e-commerce expansion.

- Telecom: Driven by the need for reliable backup power solutions.

- UPS: Consistent demand for uninterrupted power supply in critical infrastructure.

- Others: Includes emerging applications and niche industrial uses.

Key Drivers of Europe Industrial Traction Battery Industry Growth

The Europe Industrial Traction Battery Industry is propelled by several significant growth drivers. The overarching trend towards electrification across industrial sectors, particularly in material handling and logistics, is a primary catalyst. Government initiatives and subsidies promoting green technologies and reducing carbon footprints further incentivize the adoption of electric traction batteries. Advancements in Lithium-ion Battery technology, leading to higher energy density, faster charging, and extended lifespans, are making these batteries increasingly attractive. The growing demand for reliable and uninterrupted power in critical applications such as Telecom and UPS systems also contributes significantly to market expansion. Furthermore, rising operational costs associated with traditional internal combustion engines, coupled with a focus on total cost of ownership, are shifting preferences towards more efficient and sustainable battery solutions.

Challenges in the Europe Industrial Traction Battery Industry Sector

Despite robust growth, the Europe Industrial Traction Battery Industry faces several challenges. High upfront costs associated with advanced battery technologies, particularly Lithium-ion Batteries, can be a barrier for some businesses. Supply chain disruptions, especially concerning raw materials like lithium, cobalt, and nickel, pose significant risks and can lead to price volatility. Intense competition from established players and emerging manufacturers can also put pressure on profit margins. Furthermore, evolving regulatory landscapes and the need for standardization in battery safety and recycling present ongoing complexities. The development of adequate charging infrastructure and grid capacity to support widespread electrification of industrial fleets also remains a critical consideration.

Leading Players in the Europe Industrial Traction Battery Industry Market

- Robert Bosch GmbH

- Saft Groupe SA

- Exide Industries Ltd

- East Penn Manufacturing Company Inc

- GS Yuasa Corporation

- C&D Technologies Pvt Ltd

- Panasonic Corporation

- Northvolt AB

- Vianode

Key Developments in Europe Industrial Traction Battery Industry Sector

- September 2022: Vianode, a company owned by Elkem, Hydro, and Altor, announced an investment of USD 195 million in its first industrial-scale plant for sustainable battery materials at Heroya in Norway. The investment is an important step towards establishing a complete battery value chain in Norway for the European market. This development signifies a crucial move towards localized and sustainable battery material production.

- December 2021: Northvolt AB, a Swedish battery developer and manufacturer specialized in lithium-ion technology for electric vehicles, established its first industrial battery mega-factory in Europe with the capacity to produce 60 gigawatt/hours of power, which could charge one million EVs annually. As a part of this, Northvolt has already received an order worth 30 billion USD from various European EV companies, including BMW, Volkswagen, Sweden's Volvo, etc. This marks a significant milestone in European battery manufacturing capacity and a substantial commitment from major automotive players.

Strategic Europe Industrial Traction Battery Industry Market Outlook

The strategic outlook for the Europe Industrial Traction Battery Market is highly promising, driven by continuous technological advancements and a strong policy push towards sustainability. The increasing adoption of Lithium-ion Battery technology, coupled with the expansion of charging infrastructure, will unlock new growth avenues. Strategic opportunities lie in developing advanced battery management systems, investing in battery recycling capabilities, and forging partnerships to secure raw material supply chains. The growth in e-commerce and automation in logistics will continue to fuel demand for efficient Forklift solutions. Furthermore, the burgeoning renewable energy sector will necessitate robust UPS and backup power systems, creating sustained demand. Companies that can offer innovative, cost-effective, and sustainable battery solutions are well-positioned for significant market expansion in the coming years.

Europe Industrial Traction Battery Industry Segmentation

-

1. Technology

- 1.1. Lithium-ion Battery

- 1.2. Lead-acid Battery

- 1.3. Other Te

-

2. Application

- 2.1. Forklift

- 2.2. Telecom

- 2.3. UPS

- 2.4. Others

Europe Industrial Traction Battery Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Rest of Europe

Europe Industrial Traction Battery Industry Regional Market Share

Geographic Coverage of Europe Industrial Traction Battery Industry

Europe Industrial Traction Battery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Lithium-ion Battery Prices4.; Rising Renewable Energy Integration Worldwide

- 3.3. Market Restrains

- 3.3.1. 4.; Uncertainty in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery (LIB) Technology to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Industrial Traction Battery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-acid Battery

- 5.1.3. Other Te

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Forklift

- 5.2.2. Telecom

- 5.2.3. UPS

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United Kingdom Europe Industrial Traction Battery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Lithium-ion Battery

- 6.1.2. Lead-acid Battery

- 6.1.3. Other Te

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Forklift

- 6.2.2. Telecom

- 6.2.3. UPS

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Germany Europe Industrial Traction Battery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Lithium-ion Battery

- 7.1.2. Lead-acid Battery

- 7.1.3. Other Te

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Forklift

- 7.2.2. Telecom

- 7.2.3. UPS

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. France Europe Industrial Traction Battery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Lithium-ion Battery

- 8.1.2. Lead-acid Battery

- 8.1.3. Other Te

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Forklift

- 8.2.2. Telecom

- 8.2.3. UPS

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of Europe Europe Industrial Traction Battery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Lithium-ion Battery

- 9.1.2. Lead-acid Battery

- 9.1.3. Other Te

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Forklift

- 9.2.2. Telecom

- 9.2.3. UPS

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Robert Bosch GmbH*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Saft Groupe SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Exide Industries Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 East Penn Manufacturing Company Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 GS Yuasa Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 C&D Technologies Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Panasonic Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Robert Bosch GmbH*List Not Exhaustive

List of Figures

- Figure 1: Europe Industrial Traction Battery Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Industrial Traction Battery Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Industrial Traction Battery Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 2: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Europe Industrial Traction Battery Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Europe Industrial Traction Battery Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe Industrial Traction Battery Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 8: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 9: Europe Industrial Traction Battery Industry Revenue million Forecast, by Application 2020 & 2033

- Table 10: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Europe Industrial Traction Battery Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Europe Industrial Traction Battery Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 14: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 15: Europe Industrial Traction Battery Industry Revenue million Forecast, by Application 2020 & 2033

- Table 16: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 17: Europe Industrial Traction Battery Industry Revenue million Forecast, by Country 2020 & 2033

- Table 18: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Europe Industrial Traction Battery Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 20: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 21: Europe Industrial Traction Battery Industry Revenue million Forecast, by Application 2020 & 2033

- Table 22: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Europe Industrial Traction Battery Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe Industrial Traction Battery Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 26: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 27: Europe Industrial Traction Battery Industry Revenue million Forecast, by Application 2020 & 2033

- Table 28: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Europe Industrial Traction Battery Industry Revenue million Forecast, by Country 2020 & 2033

- Table 30: Europe Industrial Traction Battery Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Industrial Traction Battery Industry?

The projected CAGR is approximately 21.25%.

2. Which companies are prominent players in the Europe Industrial Traction Battery Industry?

Key companies in the market include Robert Bosch GmbH*List Not Exhaustive, Saft Groupe SA, Exide Industries Ltd, East Penn Manufacturing Company Inc, GS Yuasa Corporation, C&D Technologies Pvt Ltd, Panasonic Corporation.

3. What are the main segments of the Europe Industrial Traction Battery Industry?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 22359.9 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Lithium-ion Battery Prices4.; Rising Renewable Energy Integration Worldwide.

6. What are the notable trends driving market growth?

Lithium-ion Battery (LIB) Technology to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; Uncertainty in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

September 2022: Vianode, a company owned by Elkem, Hydro, and Altor, announced an investment of USD 195 million in its first industrial-scale plant for sustainable battery materials at Heroya in Norway. The investment is an important step towards establishing a complete battery value chain in Norway for the European market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Industrial Traction Battery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Industrial Traction Battery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Industrial Traction Battery Industry?

To stay informed about further developments, trends, and reports in the Europe Industrial Traction Battery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence