Key Insights

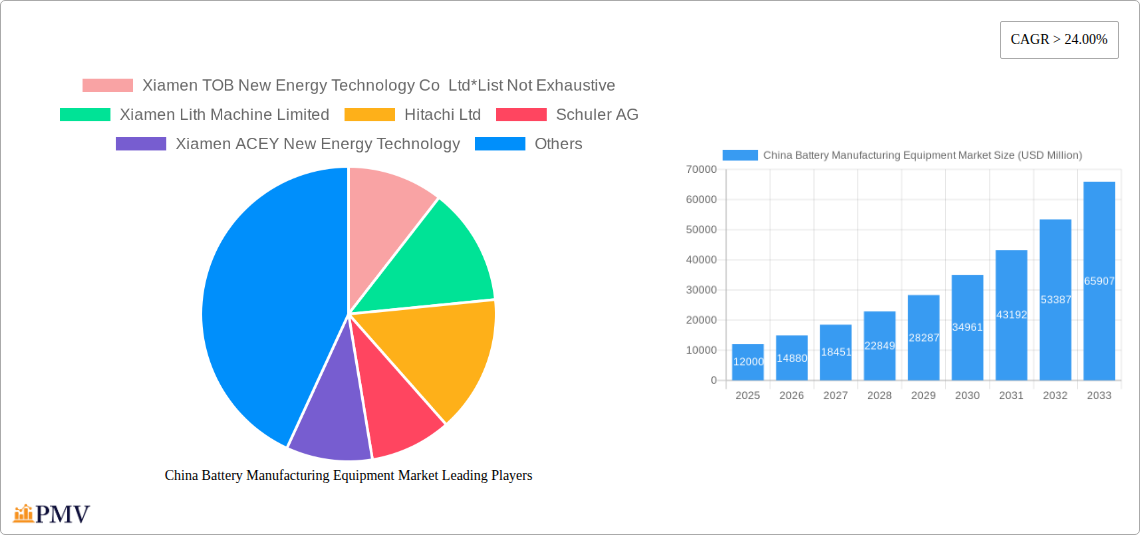

The China Battery Manufacturing Equipment Market is experiencing explosive growth, projected to reach a substantial USD 12,000 million in market size by 2025. This surge is underpinned by an impressive Compound Annual Growth Rate (CAGR) exceeding 24.00%, indicating a robust and sustained expansion trajectory. Key drivers fueling this remarkable ascent include the escalating global demand for electric vehicles (EVs) and the increasing adoption of renewable energy storage solutions. China, as a dominant player in both battery production and EV manufacturing, is at the forefront of this demand, necessitating advanced and efficient manufacturing capabilities. The market's dynamism is further shaped by significant trends such as the rapid technological advancements in battery chemistries, leading to a demand for sophisticated coating, drying, calendaring, and slitting machinery. Automation and intelligent manufacturing solutions are also becoming paramount, with companies investing heavily in electrode stacking, assembly, handling, and formation & testing machines to enhance production throughput and product quality.

China Battery Manufacturing Equipment Market Market Size (In Billion)

While the market is characterized by immense opportunities, certain restraints might influence its trajectory. These could include potential supply chain disruptions for critical raw materials, increasing regulatory compliances for environmental sustainability in manufacturing processes, and the intense competition among equipment manufacturers, which could impact profit margins. However, the sheer scale of investment in the battery sector, particularly driven by automotive manufacturers seeking to secure their battery supply chains, alongside industrial applications and other emerging end-users like consumer electronics and grid storage, is expected to largely overshadow these challenges. The market is segmented across various machine types, with Coating & Dryer, Calendaring, and Electrode Stacking machines being critical components for high-volume battery cell production. Xiamen TOB New Energy Technology Co. Ltd, Xiamen Lith Machine Limited, and Hitachi Ltd are among the prominent companies actively shaping this landscape through innovation and strategic expansions, with China being the dominant region for both manufacturing and consumption.

China Battery Manufacturing Equipment Market Company Market Share

This comprehensive report provides an in-depth analysis of the China Battery Manufacturing Equipment Market, examining the historical landscape (2019–2024) and forecasting future growth (2025–2033). With a base year of 2025 and an estimated year also set at 2025, this study offers critical insights into market dynamics, technological advancements, and the competitive strategies of key players shaping the electric vehicle (EV) battery and energy storage solutions industries. Explore the burgeoning demand for lithium-ion battery production equipment, gigafactory automation, and advanced battery manufacturing technologies within the world's largest battery market.

China Battery Manufacturing Equipment Market Market Structure & Competitive Dynamics

The China Battery Manufacturing Equipment Market is characterized by a dynamic and moderately concentrated landscape, with a blend of established global players and rapidly growing domestic enterprises. Innovation ecosystems are thriving, driven by substantial government support for the electric vehicle (EV) and renewable energy sectors. Regulatory frameworks, while supportive of growth, also impose stringent quality and safety standards, influencing equipment design and adoption. Product substitutes are limited, given the specialized nature of battery manufacturing, but efficiency gains in existing technologies can impact demand. End-user trends, particularly the exponential growth in automotive battery production, are the primary market accelerants. Mergers and acquisitions (M&A) activities are notable, with companies strategically acquiring capabilities or market share. For instance, recent M&A deals in the broader industrial automation sector, while not exclusively battery-focused, signal a trend towards consolidation and expansion valued in the hundreds of millions of USD. The market share for leading battery equipment manufacturers is estimated to be between 10-20% for the top few, indicating room for further growth and competitive jockeying.

China Battery Manufacturing Equipment Market Industry Trends & Insights

The China Battery Manufacturing Equipment Market is experiencing robust expansion, projected to grow at a significant Compound Annual Growth Rate (CAGR) of approximately 15-20% during the forecast period of 2025–2033. This surge is primarily fueled by the global transition towards electrification and the escalating demand for sustainable energy storage solutions. The Chinese government's ambitious New Energy Vehicle (NEV) policies, including substantial subsidies and mandates for EV adoption, have created an unparalleled demand for battery manufacturing capabilities. Technological disruptions are a constant feature, with continuous advancements in battery chemistry, leading to evolving equipment requirements for higher energy density, faster charging, and improved safety. The shift towards solid-state batteries and next-generation battery technologies is also beginning to influence R&D in manufacturing equipment. Consumer preferences are increasingly leaning towards EVs with longer ranges and faster charging times, placing immense pressure on battery manufacturers to scale up production efficiently and cost-effectively. This, in turn, drives demand for advanced, high-throughput battery manufacturing equipment. Competitive dynamics are intensifying, with both domestic and international players vying for market dominance. Chinese manufacturers, benefiting from local market knowledge and government support, are increasingly challenging established global players. The market penetration of automated and intelligent battery production lines is rising rapidly, as manufacturers seek to optimize yields, reduce labor costs, and enhance overall operational efficiency. Investments in battery recycling equipment are also gaining traction, reflecting a growing focus on circular economy principles within the battery value chain.

Dominant Markets & Segments in China Battery Manufacturing Equipment Market

Within the China Battery Manufacturing Equipment Market, the Automotive end-user segment overwhelmingly dominates, driven by the nation's position as the world's largest EV market. This segment's growth is directly correlated with the increasing production of electric vehicle batteries, necessitating advanced and high-volume manufacturing solutions. In terms of machine types, Coating & Dryer and Electrode Stacking machines are critical and command significant market share due to their foundational role in battery cell construction. The Assembly & Handling Machines segment is also vital, supporting the intricate processes of cell assembly and module creation.

Machine Type Dominance:

- Coating & Dryer: Essential for creating uniform electrode coatings, crucial for battery performance and lifespan. Economic policies promoting domestic production of high-quality battery components directly benefit this segment.

- Electrode Stacking: The precision and speed of stacking machines directly impact the energy density and safety of the battery cell. Advancements in automation and robotics are key drivers here.

- Assembly & Handling Machines: The increasing complexity of battery packs and modules requires sophisticated handling and assembly equipment. The growth of EV battery pack manufacturing is a primary driver.

- Formation & Testing Machines: As battery technology matures, the demand for sophisticated formation and testing equipment to ensure quality, safety, and performance is paramount.

End User Dominance:

- Automotive: The primary growth engine, fueled by government incentives, consumer demand for EVs, and the expansion of charging infrastructure. Investment in gigafactory expansions directly translates to demand for all types of battery manufacturing equipment.

- Industrial: While smaller than the automotive sector, industrial applications such as energy storage systems (ESS) for grid stabilization and backup power are experiencing significant growth, further contributing to the demand for battery manufacturing equipment.

China Battery Manufacturing Equipment Market Product Innovations

Product innovations in the China Battery Manufacturing Equipment Market are intensely focused on enhancing efficiency, precision, and safety. Manufacturers are developing advanced laser welding technologies for electrode tab connections, high-speed slitting machines for improved throughput, and intelligent coating systems for uniform and defect-free electrode application. Innovations in automated electrode stacking machines are crucial for achieving higher energy densities and consistent cell performance. Furthermore, the development of sophisticated formation and testing equipment with real-time monitoring capabilities is enabling manufacturers to identify and mitigate potential defects early in the production process, leading to higher yields and improved battery quality. These advancements provide a significant competitive advantage in a rapidly evolving market.

Report Segmentation & Scope

This report segmentations focus on the granular details of the China Battery Manufacturing Equipment Market. The Machine Type segmentation includes:

- Coating & Dryer: Essential for uniform electrode deposition, crucial for battery performance. This segment is projected to see significant growth driven by the demand for high-quality battery electrodes.

- Calendaring: Used to control electrode thickness and density, directly impacting cell performance.

- Slitting: Precision slitting is vital for efficient electrode handling and subsequent cell assembly.

- Mixing: The initial stage of electrode preparation, requiring precise material dispersion.

- Electrode Stacking: A critical step for battery cell formation, with advancements in automation driving growth.

- Assembly & Handling Machines: Covers the complex processes of cell and pack assembly, directly benefiting from the booming EV sector.

- Formation & Testing Machines: Crucial for quality control and performance validation of batteries.

The End User segmentation includes:

- Automotive: The largest and fastest-growing segment, driven by EV production.

- Industrial: Encompasses energy storage systems and other industrial applications.

- Other End Users: Includes consumer electronics and other niche battery applications. Growth projections for each segment vary based on the specific demands and adoption rates within their respective industries.

Key Drivers of China Battery Manufacturing Equipment Market Growth

The China Battery Manufacturing Equipment Market is propelled by several key drivers. Foremost is the exponential growth of the electric vehicle (EV) industry, fueled by government mandates, subsidies, and increasing consumer acceptance of EVs in China. The country's strong commitment to renewable energy targets also drives demand for energy storage systems (ESS), indirectly boosting the battery manufacturing equipment market. Technological advancements in battery chemistries, such as higher energy density and faster charging capabilities, necessitate continuous upgrades and investments in advanced manufacturing equipment. Furthermore, the "Made in China 2025" initiative and similar government policies prioritize the development of domestic high-tech manufacturing, including battery equipment, fostering innovation and local production.

Challenges in the China Battery Manufacturing Equipment Market Sector

Despite robust growth, the China Battery Manufacturing Equipment Market faces several challenges. Intense competition among domestic and international players can lead to price pressures and reduced profit margins. The rapidly evolving nature of battery technology necessitates continuous R&D investment to keep pace with new requirements, posing a financial burden. Supply chain disruptions, particularly for specialized components and raw materials, can impact production timelines and costs. Stringent environmental regulations and the increasing focus on sustainable manufacturing practices require significant investment in eco-friendly equipment and processes. Furthermore, the skilled labor shortage for operating and maintaining advanced battery manufacturing equipment can hinder optimal production efficiency.

Leading Players in the China Battery Manufacturing Equipment Market Market

- Xiamen TOB New Energy Technology Co Ltd

- Xiamen Lith Machine Limited

- Hitachi Ltd

- Schuler AG

- Xiamen ACEY New Energy Technology

- Durr AG

- Wuxi Lead Intelligent Equipment Co Ltd

- Andritz AG

- Xiamen Tmax Battery Equipments Limited

- Manz AG

Key Developments in China Battery Manufacturing Equipment Market Sector

- December 2022: Chinese car company GAC announced the construction of an electric car battery production facility in Guangzhou. With an investment of USD 1.561 billion, the factory is scheduled to begin operations in March 2024 with an annual production capacity of 6 GWh. This development signifies a substantial increase in demand for battery manufacturing equipment.

- November 2022: BYD announced further expansion of its battery production capacities in China with a new plant in Wenzhou, Zhejiang province. The factory is slated to have an annual capacity of 20 gigawatt-hours and commence production in 2024, indicating continued investment in large-scale battery manufacturing infrastructure.

Strategic China Battery Manufacturing Equipment Market Market Outlook

The strategic outlook for the China Battery Manufacturing Equipment Market remains exceptionally strong. The persistent global demand for electric vehicles and renewable energy storage solutions will continue to be the primary growth accelerator. Future opportunities lie in developing and supplying equipment for solid-state battery manufacturing, which promises higher energy density and improved safety, and in advanced battery recycling technologies to support a circular economy. Increased automation, artificial intelligence integration in production lines, and the development of smart factories will be crucial for maintaining competitiveness. Collaborative efforts between equipment manufacturers, battery producers, and research institutions will foster innovation and drive the market towards even greater efficiency and sustainability, solidifying China's position as a global leader in battery technology and manufacturing.

China Battery Manufacturing Equipment Market Segmentation

-

1. Machine Type

- 1.1. Coating & Dryer

- 1.2. Calendaring

- 1.3. Slitting

- 1.4. Mixing

- 1.5. Electrode Stacking

- 1.6. Assembly & Handling Machines

- 1.7. Formation & Testing Machines

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Other End Users

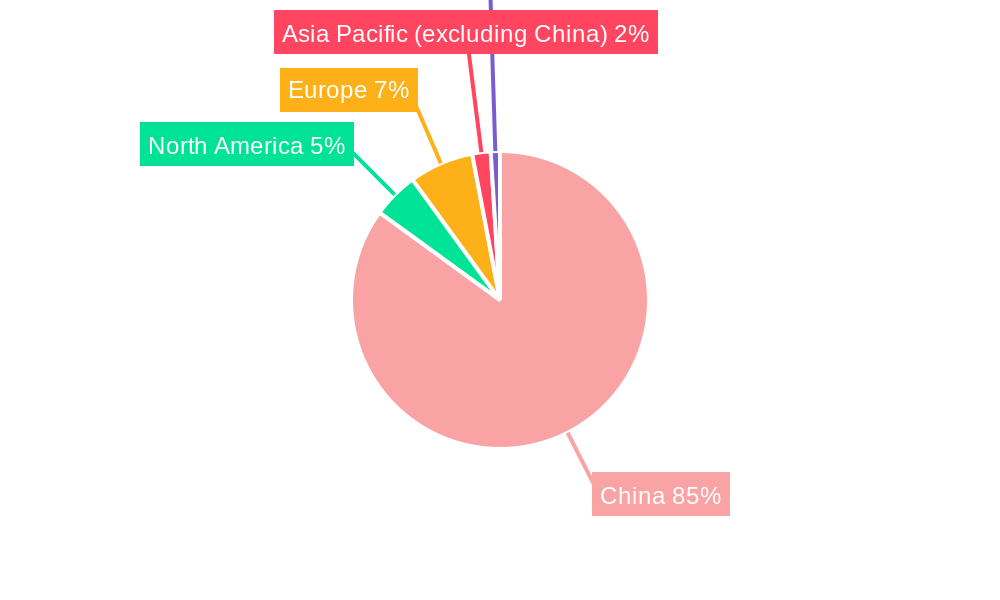

China Battery Manufacturing Equipment Market Segmentation By Geography

- 1. China

China Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of China Battery Manufacturing Equipment Market

China Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 24.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Coating & Dryer

- 5.1.2. Calendaring

- 5.1.3. Slitting

- 5.1.4. Mixing

- 5.1.5. Electrode Stacking

- 5.1.6. Assembly & Handling Machines

- 5.1.7. Formation & Testing Machines

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xiamen Lith Machine Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schuler AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Xiamen ACEY New Energy Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durr AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wuxi Lead Intelligent Equipment Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Andritz AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Xiamen Tmax Battery Equipments Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Manz AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive

List of Figures

- Figure 1: China Battery Manufacturing Equipment Market Revenue Breakdown (USD Million, %) by Product 2025 & 2033

- Figure 2: China Battery Manufacturing Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Machine Type 2020 & 2033

- Table 2: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 3: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by End User 2020 & 2033

- Table 4: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 5: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Region 2020 & 2033

- Table 6: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Machine Type 2020 & 2033

- Table 8: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 9: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by End User 2020 & 2033

- Table 10: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 11: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Country 2020 & 2033

- Table 12: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Battery Manufacturing Equipment Market?

The projected CAGR is approximately > 24.00%.

2. Which companies are prominent players in the China Battery Manufacturing Equipment Market?

Key companies in the market include Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive, Xiamen Lith Machine Limited, Hitachi Ltd, Schuler AG, Xiamen ACEY New Energy Technology, Durr AG, Wuxi Lead Intelligent Equipment Co Ltd, Andritz AG, Xiamen Tmax Battery Equipments Limited, Manz AG.

3. What are the main segments of the China Battery Manufacturing Equipment Market?

The market segments include Machine Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 12000 USD Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing.

8. Can you provide examples of recent developments in the market?

In December 2022, the Chinese car company GAC announced that they had started building a production facility for electric car batteries in Guangzhou. With a total investment of USD 1.561 billion, the new factory is scheduled to operate in March 2024 with an annual production capacity of 6 GWh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in USD Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the China Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence