Key Insights

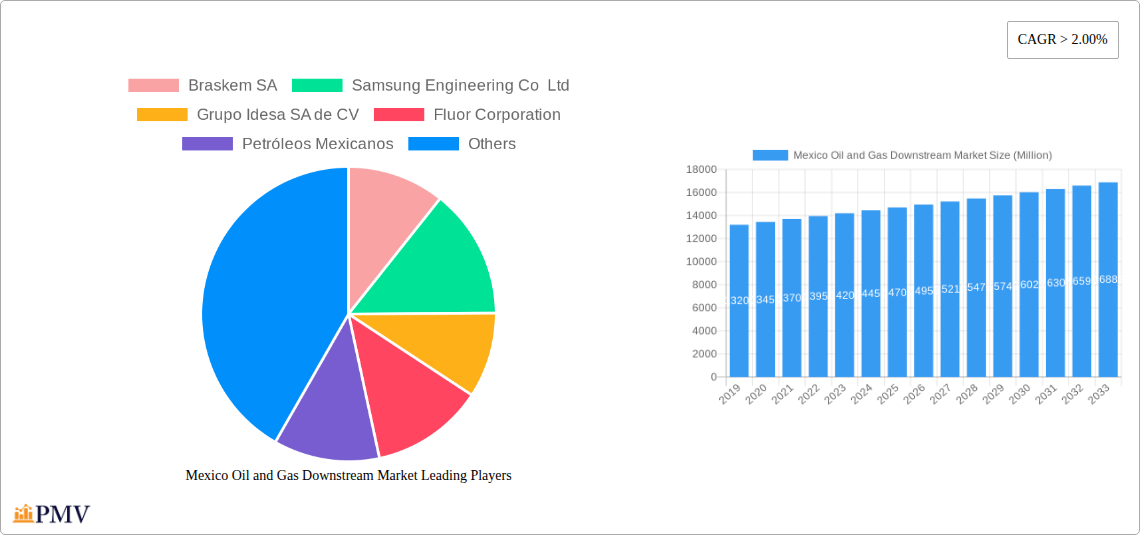

The Mexico Oil and Gas Downstream Market is projected to experience robust growth, reaching an estimated market size of $15.5 billion by 2025. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 2.35% from the base year 2025 to 2033. Key growth catalysts include strong demand from the petrochemical sector, propelled by increasing consumption of plastics and synthetic fibers. Modernization and debottlenecking initiatives in existing refineries further enhance operational efficiency and output, supporting market expansion. The downstream segment, crucial for value addition from crude oil and natural gas into fuels and feedstocks, demonstrates market resilience through adaptation to evolving energy landscapes and technological advancements.

Mexico Oil and Gas Downstream Market Market Size (In Billion)

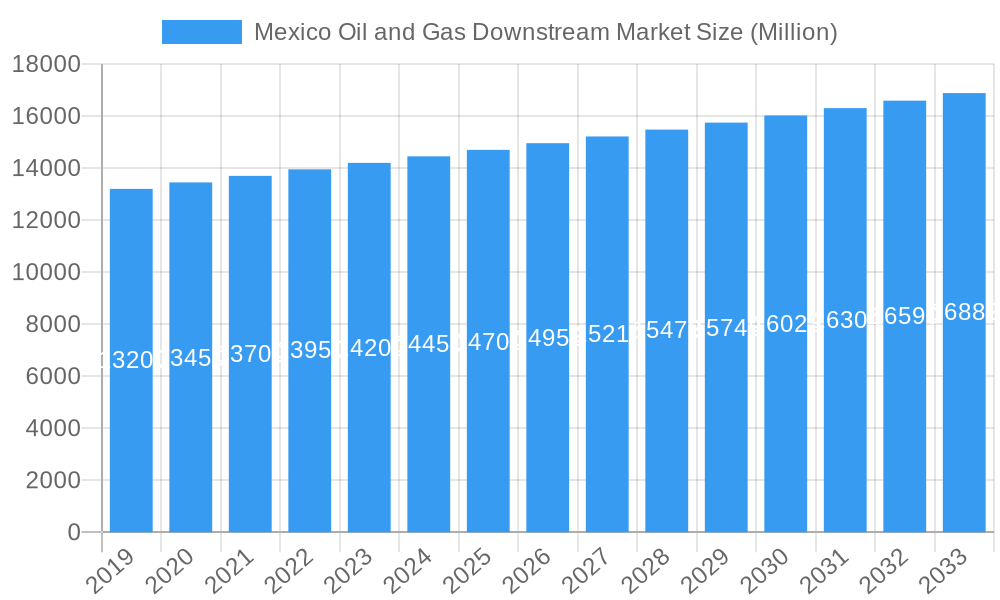

The market is strategically segmented into Refineries and Petrochemicals Plants, with Petrochemicals Plants expected to be a significant growth driver, influenced by Mexico's expanding manufacturing base and consumer demand for petrochemical-derived goods. Major industry players include Braskem SA, Samsung Engineering Co Ltd, Grupo Idesa SA de CV, Fluor Corporation, and Petróleos Mexicanos, who are actively investing in projects to increase refining capacity and petrochemical production. While aging infrastructure and potential regulatory shifts present challenges, increasing domestic consumption of refined products and petrochemical intermediates, alongside government initiatives for energy self-sufficiency, create a favorable outlook. Mexico's economic development and its strategic position in the North American energy supply chain underscore the market's significant potential.

Mexico Oil and Gas Downstream Market Company Market Share

Mexico Oil and Gas Downstream Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides an exhaustive analysis of the Mexico Oil and Gas Downstream Market, offering critical insights into its structure, industry trends, dominant segments, product innovations, and future outlook. Spanning the historical period of 2019-2024 and a forecast period of 2025-2033, with 2025 serving as the base and estimated year, this research is essential for stakeholders seeking to capitalize on the evolving Mexican energy landscape. We delve into the intricacies of Mexican oil and gas refining, petrochemical production in Mexico, downstream energy investments Mexico, Pemex downstream strategy, energy transition Mexico downstream, and the reliability and sustainability of Mexican refineries.

Mexico Oil and Gas Downstream Market Market Structure & Competitive Dynamics

The Mexico Oil and Gas Downstream Market exhibits a moderate to high market concentration, largely dominated by the national oil company, Petróleos Mexicanos (Pemex). Pemex holds a significant market share across refining and petrochemical production, influencing pricing and supply dynamics. However, the market is witnessing increased participation from international players and domestic conglomerates, fostering a more competitive environment. The innovation ecosystem is progressively maturing, driven by a focus on operational efficiency, environmental compliance, and the development of higher-value petrochemical products. Regulatory frameworks, while evolving, continue to shape investment decisions and operational standards. Challenges include the availability of crude oil feedstock, refinery upgrade costs, and the need for advanced petrochemical technologies. Product substitutes, primarily from imported refined products and petrochemicals, present a competitive pressure. End-user trends are leaning towards greater demand for cleaner fuels and specialized chemical derivatives. Mergers and acquisitions (M&A) activities are anticipated to increase as companies seek to consolidate their market positions, expand their product portfolios, and access new technologies. For instance, potential M&A deal values in the refining sector could range from several hundred million to over a billion dollars, driven by the need for modernization.

Mexico Oil and Gas Downstream Market Industry Trends & Insights

The Mexico Oil and Gas Downstream Market is poised for significant transformation, propelled by a confluence of factors including rising domestic demand for refined fuels and petrochemicals, government initiatives aimed at energy self-sufficiency, and the global push towards energy transition. The Compound Annual Growth Rate (CAGR) for the downstream sector is projected to be around 4.5% during the forecast period. Key market growth drivers include the increasing consumption of gasoline and diesel due to a growing automotive sector and industrial activity. Furthermore, investments in petrochemical plant expansions in Mexico are crucial for meeting the escalating demand for plastics, fertilizers, and other chemical derivatives essential for manufacturing and agriculture. Technological disruptions are playing a pivotal role, with a growing emphasis on adopting advanced refining processes to maximize yield, reduce emissions, and improve product quality. The deployment of digital technologies for predictive maintenance in refineries and enhanced operational efficiency is becoming a strategic imperative. Consumer preferences are shifting towards cleaner energy solutions, influencing the demand for ultra-low-sulfur diesel (ULSD) and higher-octane gasoline formulations. Competitive dynamics are intensifying, with both state-owned entities and private companies vying for market share. Foreign direct investment in Mexican downstream oil and gas is a critical trend, bringing in capital, technology, and expertise. The market penetration of advanced downstream products is expected to rise as domestic production capabilities improve and international trade policies evolve. The reliability and sustainability of Mexican refineries are paramount for ensuring energy security and attracting further investment.

Dominant Markets & Segments in Mexico Oil and Gas Downstream Market

Within the Mexico Oil and Gas Downstream Market, the Refineries segment currently holds a dominant position, driven by the fundamental need for domestic fuel production. Mexico's geographical location and its large population necessitate a robust refining capacity to meet its energy demands. Key drivers for this dominance include:

- Government Policy and Energy Security: A national imperative to reduce reliance on imported refined products fuels sustained investment and operational focus on refineries.

- Infrastructure Development: Continued investment in existing refinery upgrades and the development of new facilities, such as the Olmeca refinery, are critical to enhancing processing capacity and efficiency.

- Economic Growth: Industrial expansion and a growing automotive fleet directly translate to increased demand for refined fuels like gasoline and diesel.

- Feedstock Availability: Proximity to domestic crude oil sources provides a strategic advantage for the refining sector.

The Petrochemicals Plants segment is rapidly emerging as a crucial growth engine, with significant potential for expansion. This segment's increasing importance is driven by:

- Value Addition and Diversification: Petrochemicals offer higher profit margins and a broader product portfolio compared to basic refining, enabling diversification for energy companies.

- Growing Demand for Derivatives: The expanding manufacturing sector in Mexico, particularly in automotive, packaging, and construction, creates substantial demand for petrochemical products like polyethylene, polypropylene, and PVC.

- Import Substitution: Developing a strong domestic petrochemical industry can reduce Mexico's dependence on imported chemicals, enhancing trade balance.

- Integration with Refining: Synergies between refining and petrochemical operations, where refinery by-products can serve as feedstock for petrochemical plants, offer significant cost advantages and operational efficiencies.

The Olmeca refinery, with its projected capacity of 340,000 barrels per day, is a testament to the strategic importance placed on expanding refining capabilities to ensure energy security and support economic activities. Similarly, investments in petrochemical facilities by companies like Braskem SA and Grupo Idesa SA de CV underscore the segment's growing influence and the pursuit of advanced petrochemical production in Mexico.

Mexico Oil and Gas Downstream Market Product Innovations

Product innovations in the Mexico Oil and Gas Downstream Market are increasingly focused on enhancing product quality, environmental performance, and market responsiveness. Refiners are investing in technologies to produce ultra-low-sulfur diesel (ULSD) and cleaner gasoline formulations that meet stringent environmental regulations. In the petrochemical sphere, innovations are geared towards developing specialized polymers with improved properties for applications in automotive, construction, and consumer goods. There's also a growing interest in producing higher-value chemical intermediates and specialty chemicals, moving beyond basic commodity products. The competitive advantage of these innovations lies in their ability to command premium pricing, meet evolving market demands, and adhere to sustainability mandates, thereby solidifying market position and opening new revenue streams for companies like Samsung Engineering Co Ltd and Fluor Corporation in their project execution.

Report Segmentation & Scope

This report segments the Mexico Oil and Gas Downstream Market into two primary categories: Refineries and Petrochemicals Plants.

The Refineries segment encompasses all activities related to the processing of crude oil into various refined products such as gasoline, diesel, jet fuel, and lubricants. Projections indicate steady growth driven by ongoing modernization efforts and the commissioning of new capacities. The market size for this segment is estimated to reach approximately $25,000 million by 2033. Competitive dynamics are shaped by the operational efficiency and technological capabilities of key players.

The Petrochemicals Plants segment focuses on the production of a wide range of chemical products derived from oil and natural gas, including olefins, aromatics, polymers, and fertilizers. This segment is expected to witness robust growth, outpacing refining in terms of expansion due to increasing industrial demand and value addition. Market size for petrochemicals is projected to reach around $18,000 million by 2033. Key competitive factors include feedstock integration, technological advancements, and the ability to cater to specialized market needs.

Key Drivers of Mexico Oil and Gas Downstream Market Growth

The growth of the Mexico Oil and Gas Downstream Market is propelled by several interconnected factors:

- Energy Security Mandate: A strong governmental drive to enhance domestic energy self-sufficiency and reduce import dependency stimulates investment in both refining and petrochemical capacities.

- Growing Domestic Demand: An expanding economy, a growing middle class, and increased industrial activity are fueling a consistent rise in the demand for refined fuels and petrochemical derivatives.

- Infrastructure Modernization: Significant investments are being channeled into upgrading existing refineries and constructing new, more efficient facilities, such as the Olmeca refinery, to boost processing capabilities.

- Value Addition in Petrochemicals: The push to move up the value chain by producing higher-margin petrochemical products for domestic consumption and export is a key growth accelerator.

- Technological Advancements: Adoption of new refining and petrochemical technologies promises to improve efficiency, reduce environmental impact, and enhance product quality.

Challenges in the Mexico Oil and Gas Downstream Market Sector

Despite strong growth prospects, the Mexico Oil and Gas Downstream Market faces several significant challenges:

- Aging Infrastructure and Maintenance: Many existing refineries require substantial investment for modernization and improved operational reliability, leading to potential disruptions and higher maintenance costs.

- Regulatory Uncertainty and Policy Shifts: Fluctuations in government policies related to the energy sector can create an unpredictable investment climate and impact project viability.

- Feedstock Volatility and Availability: Securing a consistent and cost-effective supply of crude oil and natural gas feedstock is crucial for downstream operations.

- Environmental Compliance Costs: Meeting increasingly stringent environmental regulations for emissions and waste management necessitates significant capital expenditure and operational adjustments.

- Competition from Imports: While domestic production is prioritized, competition from imported refined products and petrochemicals continues to exert pressure on market prices and margins.

- Skilled Workforce Development: A shortage of skilled labor for operating and maintaining complex downstream facilities can hinder expansion and efficiency initiatives.

Leading Players in the Mexico Oil and Gas Downstream Market Market

- Petróleos Mexicanos

- Braskem SA

- Samsung Engineering Co Ltd

- Grupo Idesa SA de CV

- Fluor Corporation

Key Developments in Mexico Oil and Gas Downstream Market Sector

- December 2022: The Ecopetrol Group announced its investment plan for the energy transition. Out of the total share of investment, 7% will be invested in downstream activities. The investments will emphasize maintaining the reliability, availability, and sustainability of the Barrancabermeja and Cartagena refineries' operations to consolidate energy security, energy transition, and decarbonization of Mexico.

- December 2022: Mexican NOC Pemex is set to begin production at the country's eighth refinery in mid-2023. Once completed, the Olmeca refinery will have an installed capacity of 340,000 barrels per day (BPD) and produce 170,000 barrels of petrol and 120,000 barrels of ultra-low-sulfur diesel.

Strategic Mexico Oil and Gas Downstream Market Market Outlook

The strategic outlook for the Mexico Oil and Gas Downstream Market is overwhelmingly positive, driven by a confluence of factors that position it for robust growth and expansion. The Mexican government's commitment to achieving energy self-sufficiency is a primary growth accelerator, translating into sustained investment in both refining capacity and petrochemical production. The development of new facilities like the Olmeca refinery, coupled with upgrades to existing infrastructure, will significantly enhance the nation's ability to process crude oil and meet domestic demand for refined fuels. Simultaneously, the burgeoning petrochemical sector offers immense potential for value addition, diversification, and import substitution, aligning with broader industrial development goals. Strategic opportunities lie in leveraging technological advancements to improve operational efficiency, reduce environmental footprints, and produce higher-value specialty chemicals. Companies that can navigate regulatory landscapes effectively and secure stable feedstock supplies will be well-positioned to capitalize on the increasing demand for both cleaner fuels and essential petrochemical products, ensuring long-term market success and contributing to Mexico's economic stability.

Mexico Oil and Gas Downstream Market Segmentation

- 1. Refineries

- 2. Petrochemicals Plants

Mexico Oil and Gas Downstream Market Segmentation By Geography

- 1. Mexico

Mexico Oil and Gas Downstream Market Regional Market Share

Geographic Coverage of Mexico Oil and Gas Downstream Market

Mexico Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Refineries Segment to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Oil and Gas Downstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Braskem SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung Engineering Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Grupo Idesa SA de CV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fluor Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petróleos Mexicanos

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Braskem SA

List of Figures

- Figure 1: Mexico Oil and Gas Downstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Oil and Gas Downstream Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Oil and Gas Downstream Market Revenue billion Forecast, by Refineries 2020 & 2033

- Table 2: Mexico Oil and Gas Downstream Market Volume Million Forecast, by Refineries 2020 & 2033

- Table 3: Mexico Oil and Gas Downstream Market Revenue billion Forecast, by Petrochemicals Plants 2020 & 2033

- Table 4: Mexico Oil and Gas Downstream Market Volume Million Forecast, by Petrochemicals Plants 2020 & 2033

- Table 5: Mexico Oil and Gas Downstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Mexico Oil and Gas Downstream Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Mexico Oil and Gas Downstream Market Revenue billion Forecast, by Refineries 2020 & 2033

- Table 8: Mexico Oil and Gas Downstream Market Volume Million Forecast, by Refineries 2020 & 2033

- Table 9: Mexico Oil and Gas Downstream Market Revenue billion Forecast, by Petrochemicals Plants 2020 & 2033

- Table 10: Mexico Oil and Gas Downstream Market Volume Million Forecast, by Petrochemicals Plants 2020 & 2033

- Table 11: Mexico Oil and Gas Downstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Mexico Oil and Gas Downstream Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Oil and Gas Downstream Market?

The projected CAGR is approximately 2.35%.

2. Which companies are prominent players in the Mexico Oil and Gas Downstream Market?

Key companies in the market include Braskem SA, Samsung Engineering Co Ltd, Grupo Idesa SA de CV, Fluor Corporation, Petróleos Mexicanos.

3. What are the main segments of the Mexico Oil and Gas Downstream Market?

The market segments include Refineries, Petrochemicals Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.21 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities.

6. What are the notable trends driving market growth?

Refineries Segment to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Clean Power Sources.

8. Can you provide examples of recent developments in the market?

In December 2022, the Ecopetrol Group announced its investment plan for the energy transition. Out of the total share of investment, 7% will be invested in downstream activities. The investments will emphasize maintaining the reliability, availability, and sustainability of the Barrancabermeja and Cartagena refineries' operations to consolidate energy security, energy transition, and decarbonization of Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Mexico Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence