Key Insights

The global Open Hole Logging Services Market is poised for robust growth, projected to reach a substantial market size of approximately $7,500 million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 2.00% throughout the forecast period of 2025-2033. This expansion is primarily fueled by the increasing demand for efficient and accurate subsurface data acquisition in oil and gas exploration and production activities. Key drivers include the need for optimized reservoir management, enhanced oil recovery techniques, and the exploration of unconventional reserves. Companies are investing in advanced logging technologies to improve wellbore integrity, identify hydrocarbon potential, and reduce operational risks, all contributing to the market's upward trajectory. The market is segmented into E-Line and Slickline services, each catering to distinct phases of wellbore evaluation and intervention. E-line services, offering real-time data transmission, are crucial for detailed formation evaluation and wellbore characterization. Slickline services, while simpler, are vital for various well intervention tasks like setting and retrieving tools, making both segments indispensable to the industry.

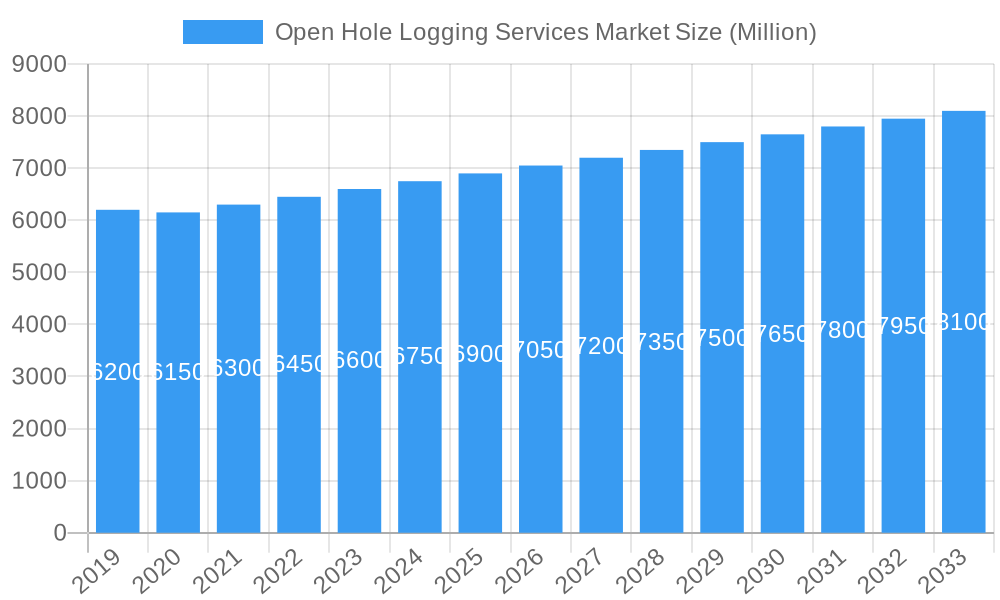

Open Hole Logging Services Market Market Size (In Billion)

The Open Hole Logging Services Market is experiencing significant trends such as the integration of artificial intelligence (AI) and machine learning (ML) for advanced data analysis and interpretation, leading to faster and more insightful decision-making. Furthermore, there's a growing emphasis on the development and deployment of specialized logging tools for complex geological formations and challenging environments, including deepwater and high-pressure/high-temperature (HPHT) wells. This technological innovation is crucial for unlocking new reserves and maximizing production from existing fields. However, the market also faces restraints, including the volatility of crude oil prices, which directly impacts exploration and production budgets, and the increasing regulatory scrutiny regarding environmental impact and safety standards. Geographically, North America is anticipated to lead the market share, driven by extensive shale gas and oil exploration activities, followed by the Middle East and Africa due to significant upstream investments. Asia Pacific and Europe are also expected to witness steady growth, propelled by ongoing exploration efforts and the need for enhanced production from mature fields.

Open Hole Logging Services Market Company Market Share

This comprehensive market research report delves into the dynamic Open Hole Logging Services Market, offering an in-depth analysis of its current landscape and future trajectory. Covering the study period 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report provides actionable insights for stakeholders seeking to understand and capitalize on market opportunities. Our analysis encompasses historical trends from 2019–2024, alongside detailed projections. The market is segmented by Wireline Type, including E-Line and Slickline. Key industry developments are thoroughly examined.

Open Hole Logging Services Market Market Structure & Competitive Dynamics

The Open Hole Logging Services Market exhibits a moderately concentrated structure, characterized by the significant presence of major international oilfield service providers alongside specialized regional players. Innovation ecosystems are driven by continuous advancements in sensor technology, data analytics, and downhole tool miniaturization, fostering a competitive environment. Regulatory frameworks, primarily concerning environmental impact and safety standards, play a crucial role in shaping market entry and operational practices. Product substitutes, such as advanced seismic imaging and reservoir simulation software, offer alternative methods for subsurface characterization, albeit often complementary rather than directly substitutive to logging. End-user trends are heavily influenced by fluctuating oil and gas prices, the increasing demand for unconventional resource exploration, and a growing emphasis on enhanced oil recovery (EOR) techniques. Mergers and acquisition (M&A) activities are anticipated to remain a key strategy for consolidating market share, expanding service portfolios, and acquiring cutting-edge technologies. For instance, strategic acquisitions in recent years have reshaped the competitive landscape, with deal values often reaching hundreds of millions of dollars, consolidating expertise and market reach.

Open Hole Logging Services Market Industry Trends & Insights

The Open Hole Logging Services Market is poised for robust growth, driven by a confluence of factors that underscore the indispensable role of subsurface data acquisition in the oil and gas industry. The increasing complexity of newly discovered hydrocarbon reserves, particularly in deepwater and unconventional plays, necessitates more sophisticated and accurate logging techniques to optimize exploration and production strategies. A key growth driver is the global energy demand, which, despite the ongoing energy transition, remains substantial, fueling exploration activities and subsequently, the demand for open hole logging services. Technological disruptions are at the forefront of market evolution. The integration of artificial intelligence (AI) and machine learning (ML) algorithms is revolutionizing data interpretation, enabling faster and more precise geological assessments and reservoir characterization. Advancements in E-Line logging technology, including high-resolution imaging tools and advanced formation evaluation sensors, are enhancing the accuracy of data collected in real-time, leading to improved decision-making during drilling operations. Similarly, Slickline services, while traditionally focused on simpler interventions, are witnessing innovation with the development of more sophisticated tools for production logging and wellbore integrity assessment.

Consumer preferences are increasingly geared towards integrated service solutions that combine logging with data analytics and reporting, offering a streamlined and cost-effective approach. This demand for holistic solutions is pushing service providers to expand their capabilities beyond raw data collection. The competitive dynamics within the market are characterized by intense rivalry, particularly among the top-tier players who compete on technological superiority, global reach, and comprehensive service offerings. However, niche players and regional specialists are also carving out significant market share by focusing on specific geological challenges or offering specialized logging techniques. The market penetration of advanced logging technologies is expected to increase as operators seek to maximize the efficiency and economic viability of their wells. The projected Compound Annual Growth Rate (CAGR) for the Open Hole Logging Services Market is anticipated to be in the range of 4.5% to 6.0% over the forecast period, a testament to the industry's resilience and ongoing importance. The global market size is estimated to reach approximately $15,000 Million by 2033.

Dominant Markets & Segments in Open Hole Logging Services Market

The North America region currently stands as the dominant force within the global Open Hole Logging Services Market, propelled by its extensive and mature oil and gas industry, particularly its leadership in unconventional resource development. The United States, with its vast shale plays like the Permian Basin, Bakken, and Marcellus, represents the single largest national market. Key drivers for this dominance include:

- Economic Policies: Favorable government policies promoting domestic energy production and investment in oil and gas infrastructure have been instrumental in sustaining high levels of exploration and drilling activity. Tax incentives and regulatory streamlining contribute to a conducive business environment.

- Infrastructure: The well-established network of pipelines, processing facilities, and transportation networks across North America facilitates efficient operations and the widespread deployment of logging services.

- Technological Adoption: North American operators are early adopters of advanced drilling and logging technologies, constantly pushing the boundaries of what is possible in subsurface characterization. This includes a strong demand for high-resolution data and real-time analytics.

- Unconventional Resource Expertise: Decades of experience in hydraulic fracturing and horizontal drilling have created a specialized knowledge base and a demand for logging services tailored to the unique challenges of shale reservoirs.

Within the Wireline Type segmentation, E-Line (Electric Line) logging services command the largest market share due to its superior data acquisition capabilities and versatility. E-line tools can deliver high-resolution measurements, advanced imaging, and real-time data transmission, making them indispensable for complex formation evaluation, wellbore imaging, and detailed reservoir characterization. This segment is crucial for understanding rock properties, fluid saturation, and identifying potential hydrocarbon zones with high precision.

Conversely, Slickline services represent a significant but generally smaller segment. Slickline operations are typically employed for less complex interventions, such as basic logging, wellbore cleanouts, and wireline fishing operations. While not as data-intensive as E-line, slickline services remain vital for cost-effective routine well maintenance and interventions. The demand for slickline is often driven by mature fields requiring ongoing production optimization and interventions. The global market value for open hole logging services is projected to be in the region of $12,500 Million in 2025, with North America accounting for approximately 40% of this value.

Open Hole Logging Services Market Product Innovations

Product innovations in the Open Hole Logging Services Market are primarily focused on enhancing data quality, improving operational efficiency, and reducing environmental impact. Advancements in sensor technology have led to the development of miniaturized tools capable of delivering higher resolution and more comprehensive formation evaluation data. The integration of advanced imaging techniques, such as acoustic and resistivity imaging, provides detailed insights into the micro-structure of the formation and the presence of fractures. Furthermore, the application of AI and machine learning in data interpretation is transforming raw logging data into actionable insights, enabling faster and more accurate reservoir characterization. These innovations offer competitive advantages by reducing drilling risks, optimizing well placement, and improving hydrocarbon recovery rates.

Report Segmentation & Scope

This report provides a granular analysis of the Open Hole Logging Services Market, segmented primarily by Wireline Type. The E-Line segment is projected to exhibit strong growth, driven by the increasing demand for advanced formation evaluation in complex geological settings. The market size for E-line is estimated to reach $7,500 Million by 2033, with a CAGR of approximately 5.5%. The competitive dynamics within this segment are characterized by a focus on technological sophistication and integrated data solutions.

The Slickline segment, while smaller in market size, is expected to maintain steady growth. Its market size is estimated to reach $5,000 Million by 2033, with a CAGR of around 4.0%. This segment's competitive landscape is influenced by cost-effectiveness and the reliability of routine intervention services. The scope of this report encompasses a detailed examination of market drivers, challenges, trends, and the competitive landscape for both segments across major global regions.

Key Drivers of Open Hole Logging Services Market Growth

The Open Hole Logging Services Market is propelled by several critical growth drivers. Technologically, the relentless pursuit of enhanced oil recovery (EOR) techniques and the need for detailed reservoir characterization in increasingly complex geological formations are paramount. The exploration and production of unconventional resources, such as shale gas and tight oil, necessitate sophisticated logging tools to accurately assess reservoir potential and optimize extraction methods. Economically, the global demand for energy remains a fundamental driver, influencing exploration budgets and consequently the demand for logging services. Fluctuations in oil prices directly impact investment in new drilling projects. Regulatory factors, such as stricter environmental regulations and safety standards, also drive the adoption of advanced logging technologies that improve operational efficiency and minimize risks, thereby contributing to market growth.

Challenges in the Open Hole Logging Services Market Sector

Despite the positive growth outlook, the Open Hole Logging Services Market faces several significant challenges. The inherent volatility of oil and gas prices can lead to unpredictable fluctuations in exploration and production (E&P) spending, directly impacting the demand for logging services. Geopolitical instability in key oil-producing regions can disrupt supply chains and operational activities. Furthermore, the increasing adoption of renewable energy sources presents a long-term challenge to the overall demand for fossil fuels, potentially impacting the sustained growth of the oilfield services sector. Intense competition among service providers can lead to price erosion, affecting profit margins, particularly for standardized services. The high capital investment required for advanced logging equipment and continuous research and development also poses a barrier to entry for smaller players.

Leading Players in the Open Hole Logging Services Market Market

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International Plc

- Nabors Industries Ltd

- China Oilfield Services Limited

- Superior Energy Services Inc

- OilServ

- RECON Petrotechnologies Ltd

- Pioneer Energy Services

Key Developments in Open Hole Logging Services Market Sector

- 2023 November: Halliburton Company launches its new suite of AI-powered reservoir characterization software, enhancing real-time data analysis for open hole logging.

- 2024 January: Schlumberger Limited announces a strategic partnership with a leading technology firm to develop next-generation downhole sensors for improved data acquisition.

- 2024 March: Weatherford International Plc expands its integrated logging and drilling services portfolio for unconventional plays in North America.

- 2024 May: Baker Hughes Company acquires a specialized provider of advanced formation evaluation tools, strengthening its technological offerings.

- 2024 July: China Oilfield Services Limited (COSL) secures a major contract for open hole logging services in the South China Sea, underscoring its growing international presence.

Strategic Open Hole Logging Services Market Market Outlook

The Open Hole Logging Services Market presents a strategic outlook characterized by a continued focus on technological innovation and service integration. The growing demand for data-driven decision-making in the oil and gas industry will fuel the adoption of advanced logging technologies, including AI-powered analytics and high-resolution imaging tools. Companies that can offer comprehensive, end-to-end solutions, from data acquisition to interpretation and reservoir modeling, will be best positioned for success. The increasing emphasis on sustainability and efficiency within the energy sector will also drive the development of more environmentally friendly logging practices and technologies. Strategic partnerships and acquisitions will remain crucial for expanding market reach, acquiring new technologies, and consolidating competitive advantages in this evolving market. The overall outlook suggests a market driven by precision, efficiency, and integrated solutions.

Open Hole Logging Services Market Segmentation

-

1. Wireline Type

- 1.1. E-Line

- 1.2. Slickline

Open Hole Logging Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Open Hole Logging Services Market Regional Market Share

Geographic Coverage of Open Hole Logging Services Market

Open Hole Logging Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing demand for natural gas and developing gas infrastructure4.; Increasing offshore oil and Gas Exploration Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Cleaner Alternatives

- 3.4. Market Trends

- 3.4.1. E-Line to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Open Hole Logging Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Wireline Type

- 5.1.1. E-Line

- 5.1.2. Slickline

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Wireline Type

- 6. North America Open Hole Logging Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Wireline Type

- 6.1.1. E-Line

- 6.1.2. Slickline

- 6.1. Market Analysis, Insights and Forecast - by Wireline Type

- 7. Europe Open Hole Logging Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Wireline Type

- 7.1.1. E-Line

- 7.1.2. Slickline

- 7.1. Market Analysis, Insights and Forecast - by Wireline Type

- 8. Asia Pacific Open Hole Logging Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Wireline Type

- 8.1.1. E-Line

- 8.1.2. Slickline

- 8.1. Market Analysis, Insights and Forecast - by Wireline Type

- 9. South America Open Hole Logging Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Wireline Type

- 9.1.1. E-Line

- 9.1.2. Slickline

- 9.1. Market Analysis, Insights and Forecast - by Wireline Type

- 10. Middle East and Africa Open Hole Logging Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Wireline Type

- 10.1.1. E-Line

- 10.1.2. Slickline

- 10.1. Market Analysis, Insights and Forecast - by Wireline Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Superior Energy Services Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Weatherford International Plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 OilServ

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Baker Hughes Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Oilfield Services Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Halliburton Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RECON Petrotechnologies Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schlumberger Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pioneer Energy Services*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nabors Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Superior Energy Services Inc

List of Figures

- Figure 1: Global Open Hole Logging Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Open Hole Logging Services Market Revenue (Million), by Wireline Type 2025 & 2033

- Figure 3: North America Open Hole Logging Services Market Revenue Share (%), by Wireline Type 2025 & 2033

- Figure 4: North America Open Hole Logging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Open Hole Logging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Open Hole Logging Services Market Revenue (Million), by Wireline Type 2025 & 2033

- Figure 7: Europe Open Hole Logging Services Market Revenue Share (%), by Wireline Type 2025 & 2033

- Figure 8: Europe Open Hole Logging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Open Hole Logging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Open Hole Logging Services Market Revenue (Million), by Wireline Type 2025 & 2033

- Figure 11: Asia Pacific Open Hole Logging Services Market Revenue Share (%), by Wireline Type 2025 & 2033

- Figure 12: Asia Pacific Open Hole Logging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Open Hole Logging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Open Hole Logging Services Market Revenue (Million), by Wireline Type 2025 & 2033

- Figure 15: South America Open Hole Logging Services Market Revenue Share (%), by Wireline Type 2025 & 2033

- Figure 16: South America Open Hole Logging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Open Hole Logging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Open Hole Logging Services Market Revenue (Million), by Wireline Type 2025 & 2033

- Figure 19: Middle East and Africa Open Hole Logging Services Market Revenue Share (%), by Wireline Type 2025 & 2033

- Figure 20: Middle East and Africa Open Hole Logging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Open Hole Logging Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Open Hole Logging Services Market Revenue Million Forecast, by Wireline Type 2020 & 2033

- Table 2: Global Open Hole Logging Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Open Hole Logging Services Market Revenue Million Forecast, by Wireline Type 2020 & 2033

- Table 4: Global Open Hole Logging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Open Hole Logging Services Market Revenue Million Forecast, by Wireline Type 2020 & 2033

- Table 6: Global Open Hole Logging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Open Hole Logging Services Market Revenue Million Forecast, by Wireline Type 2020 & 2033

- Table 8: Global Open Hole Logging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Open Hole Logging Services Market Revenue Million Forecast, by Wireline Type 2020 & 2033

- Table 10: Global Open Hole Logging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Open Hole Logging Services Market Revenue Million Forecast, by Wireline Type 2020 & 2033

- Table 12: Global Open Hole Logging Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Open Hole Logging Services Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Open Hole Logging Services Market?

Key companies in the market include Superior Energy Services Inc, Weatherford International Plc, OilServ, Baker Hughes Company, China Oilfield Services Limited, Halliburton Company, RECON Petrotechnologies Ltd, Schlumberger Limited, Pioneer Energy Services*List Not Exhaustive, Nabors Industries Ltd.

3. What are the main segments of the Open Hole Logging Services Market?

The market segments include Wireline Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing demand for natural gas and developing gas infrastructure4.; Increasing offshore oil and Gas Exploration Activities.

6. What are the notable trends driving market growth?

E-Line to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Adoption of Cleaner Alternatives.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Open Hole Logging Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Open Hole Logging Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Open Hole Logging Services Market?

To stay informed about further developments, trends, and reports in the Open Hole Logging Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence