Key Insights

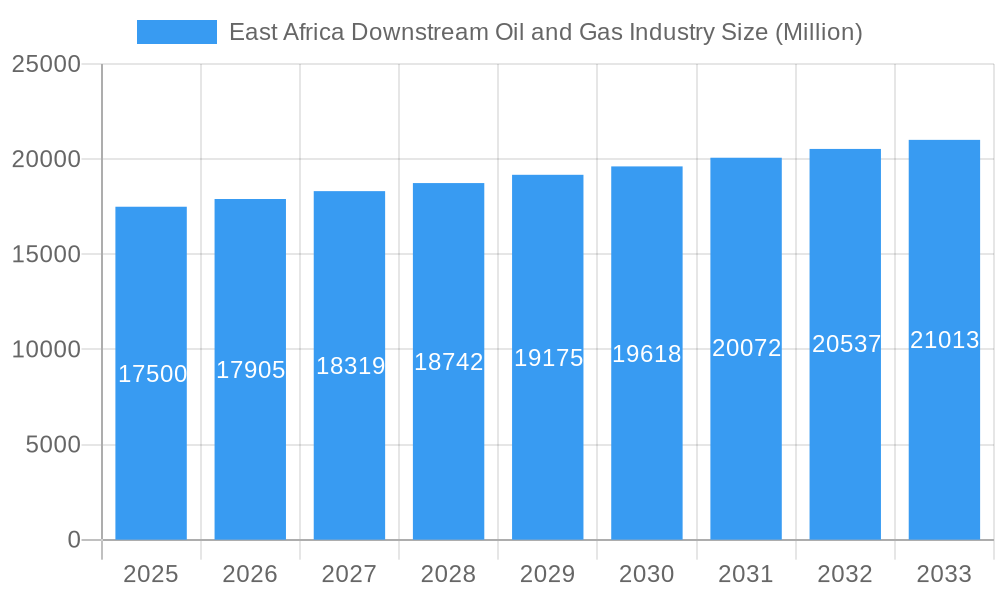

The East African downstream oil and gas sector is set for robust expansion, with a projected market size of 88.2 million by 2025. This growth is driven by a Compound Annual Growth Rate (CAGR) of 2.62%, fueled by escalating demand for refined petroleum products and petrochemicals. Key catalysts include a burgeoning refining sector focused on domestic consumption and import substitution, alongside an expanding petrochemical industry essential for manufacturing plastics, fertilizers, and other vital materials. Significant infrastructure investments in pipelines, storage, and retail networks further support this upward trend. Emerging economies like Mozambique, South Sudan, and Kenya lead this development, propelled by population growth, urbanization, and industrialization, which collectively drive demand for fuels, lubricants, and petrochemical derivatives.

East Africa Downstream Oil and Gas Industry Market Size (In Million)

The region's downstream landscape features a blend of established multinational corporations and dynamic local enterprises. Prominent players such as Sudan National Petroleum Corporation, China National Petroleum Corporation, Petrogal SA, Royal Dutch Shell PLC, and Eni SpA are integral to refining, distribution, and retail. Local companies, including Kenya Petroleum Refineries Ltd (KPRL), Total Energies Marketing Kenya, Shell Kenya, National Oil Corporation of Kenya (NOCK), and Oil Libya (Tamoil), significantly shape the market. While regulatory uncertainties, infrastructure gaps, and volatile global crude oil prices present potential challenges, the sustained demand for energy and petrochemicals, coupled with strategic investments, ensures a promising future for the East African downstream oil and gas industry.

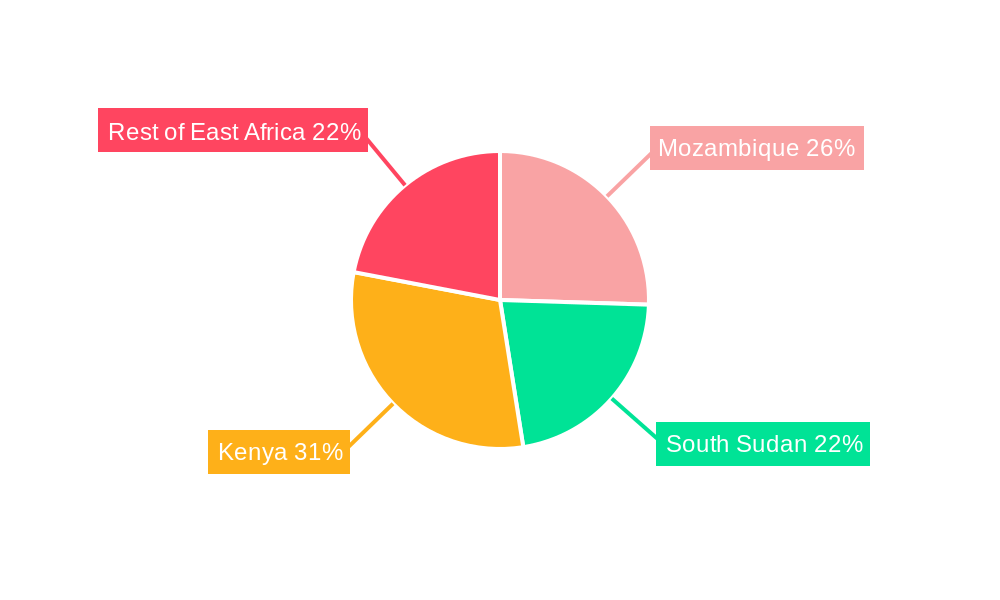

East Africa Downstream Oil and Gas Industry Company Market Share

This report provides an in-depth analysis of the East Africa Downstream Oil and Gas Industry, detailing market size, growth forecasts, and key trends.

East Africa Downstream Oil and Gas Industry Market Structure & Competitive Dynamics

The East Africa Downstream Oil and Gas Industry exhibits a dynamic market structure, characterized by evolving competitive landscapes and significant investment activities. Market concentration varies across different segments and geographies within the region. Key players, including Sudan National Petroleum Corporation, China National Petroleum Corporation, Petrogal SA, Royal Dutch Shell PLC, Eni SpA, Kenya Petroleum Refineries Ltd (KPRL), Total Energies Marketing Kenya, Shell Kenya, National Oil Corporation of Kenya (NOCK), and Oil Libya (Tamoil), actively shape the industry's competitive intensity. Innovation ecosystems are burgeoning, driven by the need for enhanced refining efficiency, the development of specialized petrochemical products, and the adoption of advanced technologies. Regulatory frameworks are becoming more sophisticated, influencing investment decisions and operational standards across countries like Mozambique, South Sudan, and Kenya. The presence of product substitutes, such as renewable energy sources, presents a growing challenge, while end-user trends increasingly favor cleaner and more sustainable fuel options. Mergers and acquisitions (M&A) are a significant facet of market consolidation. For instance, the Savannah Energy acquisition of producing oil fields in South Sudan from Petronas, valued at USD 1.25 Billion, underscores robust M&A activity. While specific market share data for each company is detailed within the full report, these strategic moves significantly alter the competitive equilibrium and market share distribution.

East Africa Downstream Oil and Gas Industry Industry Trends & Insights

The East Africa Downstream Oil and Gas Industry is on a trajectory of significant growth and transformation, driven by a confluence of powerful factors. A primary market growth driver is the increasing demand for refined petroleum products, including gasoline, diesel, and jet fuel, fueled by expanding populations, urbanization, and economic development across key East African nations. This surge in demand is particularly pronounced in countries like Kenya and Mozambique, where infrastructure development and industrialization are accelerating. Technological disruptions are playing a pivotal role in modernizing refining operations and petrochemical production. Investments in advanced refining technologies are enhancing efficiency, reducing operational costs, and enabling the production of higher-value products. Furthermore, the exploration and adoption of digital solutions, such as AI-powered predictive maintenance and IoT-enabled supply chain management, are improving operational resilience and optimizing resource allocation. Consumer preferences are evolving, with a growing awareness and demand for cleaner fuels and environmentally friendly petrochemical derivatives. This trend is prompting industry players to invest in cleaner fuel technologies and explore sustainable alternatives. The competitive dynamics within the industry are intensifying, with established international energy companies and growing national oil corporations vying for market dominance. Strategic partnerships and joint ventures are becoming increasingly common as companies seek to leverage complementary strengths and mitigate risks. The CAGR (Compound Annual Growth Rate) for the East Africa Downstream Oil and Gas Industry is projected to be robust, estimated at 6.5% over the forecast period. Market penetration of advanced refining technologies is expected to rise, contributing to improved product quality and environmental compliance. The ongoing liberalization of downstream markets in some East African countries is also creating new opportunities for both domestic and international investors, further stimulating competition and innovation.

Dominant Markets & Segments in East Africa Downstream Oil and Gas Industry

Within the East African Downstream Oil and Gas Industry, distinct markets and segments are exhibiting pronounced dominance. Mozambique is emerging as a significant hub for downstream activities, driven by its substantial natural gas reserves and ongoing investments in liquefied natural gas (LNG) infrastructure, which has spillover effects on associated downstream industries like petrochemicals. The country's strategic coastal location facilitates both import and export capabilities for refined products and petrochemicals. South Sudan, despite its historical challenges, holds substantial crude oil production capacity, which directly influences the demand and potential for domestic refining and petrochemical ventures. The acquisition of producing oil fields by Savannah Energy in South Sudan highlights the strategic importance of its upstream resources for downstream development. Kenya stands out as a leading market with a well-established refining capacity through Kenya Petroleum Refineries Ltd (KPRL) and a robust network of fuel distribution and marketing companies like Total Energies Marketing Kenya and Shell Kenya. The country's significant consumption base and its role as a regional trade hub contribute to its dominance in the downstream sector. The Rest of East Africa, encompassing countries like Tanzania and Uganda, presents nascent but rapidly growing downstream opportunities, driven by increasing energy demand and ongoing infrastructure projects, including planned refinery expansions and pipeline developments.

- Refineries: Kenya, with KPRL, currently holds a prominent position. However, planned expansions and new refinery projects in other East African nations signal a shift in dominance towards countries with growing domestic crude production or strategic import capabilities.

- Petrochemicals Plants: While currently less developed compared to refining, Mozambique's LNG development is a significant catalyst for future petrochemical growth, particularly for fertilizers and other gas-derived chemicals. South Sudan's oil potential also offers future prospects for petrochemical integration.

- Geography: Mozambique and Kenya are leading the charge due to their existing infrastructure and investment landscapes. South Sudan's dominance is intrinsically linked to its upstream oil production, while other nations are rapidly gaining traction.

Economic policies that encourage foreign direct investment, such as tax incentives and streamlined regulatory processes, are crucial drivers of dominance in these segments. Infrastructure development, including port facilities, pipelines, and transportation networks, is paramount for efficient downstream operations and market access.

East Africa Downstream Oil and Gas Industry Product Innovations

Product innovations in the East Africa Downstream Oil and Gas Industry are increasingly focused on enhancing product quality and environmental performance. This includes the development of cleaner-burning fuels with lower sulfur content, meeting stricter emissions standards and catering to growing environmental consciousness. Advancements in refining processes are enabling the production of specialized petrochemicals, such as polymers and industrial chemicals, to support local manufacturing and reduce import reliance. The competitive advantage of these innovations lies in their ability to meet evolving market demands, improve operational efficiency, and adhere to international sustainability benchmarks.

Report Segmentation & Scope

This report provides a comprehensive analysis of the East Africa Downstream Oil and Gas Industry, segmented by key areas to offer granular insights.

- Refineries: This segment covers the current refining capacity, planned expansions, and technological advancements in existing and new refinery facilities across the region. Projections for capacity growth and market sizes for refined products are detailed.

- Petrochemicals Plants: This section delves into the current state of petrochemical production, focusing on key chemical outputs and the potential for expansion driven by feedstock availability and downstream market demand. Growth projections and market sizes for petrochemical derivatives are included.

- Geography: The analysis is segmented by Mozambique, South Sudan, Kenya, and the Rest of East Africa. Each geographical segment is assessed for its unique market dynamics, investment opportunities, regulatory landscape, and competitive intensity, with specific market size and growth projections.

Key Drivers of East Africa Downstream Oil and Gas Industry Growth

Several key factors are propelling the growth of the East Africa Downstream Oil and Gas Industry.

- Economic Development and Population Growth: Rising populations and expanding economies across East Africa are leading to a significant increase in demand for refined fuels and petrochemical products, driving market expansion.

- Infrastructure Investment: Government and private sector investments in critical infrastructure, including pipelines, transportation networks, and port facilities, are crucial for improving the efficiency of the downstream value chain.

- Technological Advancements: The adoption of modern refining technologies and digital solutions is enhancing operational efficiency, reducing costs, and enabling the production of higher-quality products, thereby supporting industry growth.

- Government Policies and Incentives: Favorable regulatory frameworks, fiscal incentives, and a commitment to attracting foreign direct investment are vital for stimulating new projects and expanding existing operations within the downstream sector.

Challenges in the East Africa Downstream Oil and Gas Industry Sector

The East Africa Downstream Oil and Gas Industry faces several significant challenges that could impede its growth trajectory.

- Infrastructure Deficiencies: Inadequate transportation networks, port congestion, and a lack of adequate storage facilities in certain regions can lead to logistical bottlenecks and increased operational costs.

- Regulatory Uncertainty and Bureaucracy: Complex and sometimes inconsistent regulatory environments, coupled with bureaucratic hurdles, can deter investment and slow down project approvals.

- Volatile Commodity Prices: Fluctuations in global crude oil prices can impact refining margins and the profitability of downstream operations, creating financial risks for market players.

- Competition from Renewable Energy: The increasing global and regional focus on renewable energy sources presents a long-term challenge, potentially impacting the demand for fossil fuel-based products.

- Financing and Investment Risks: Securing adequate funding for large-scale downstream projects can be challenging, particularly in emerging markets, due to perceived political and economic risks.

Leading Players in the East Africa Downstream Oil and Gas Industry Market

- Sudan National Petroleum Corporation

- China National Petroleum Corporation

- Petrogal SA

- Royal Dutch Shell PLC

- Eni SpA

- Kenya Petroleum Refineries Ltd (KPRL)

- Total Energies Marketing Kenya

- Shell Kenya

- National Oil Corporation of Kenya (NOCK)

- Oil Libya (Tamoil)

Key Developments in East Africa Downstream Oil and Gas Industry Sector

- December 2022: Savannah Energy declared the acquisition of producing oil fields in South Sudan from Malaysian state oil and gas company Petronas, with an investment valued at USD 1.25 Billion. This strategic acquisition aims to bolster production and potentially integrate with future downstream refining and petrochemical projects. The other partners involved in this development include the international energy company, the China National Petroleum Corporation, India's flagship energy major, the Oil and Natural Gas Corporation, and South Sudan's national oil and gas company, Nilepet. This deal signifies a major consolidation and investment trend in the region.

Strategic East Africa Downstream Oil and Gas Industry Market Outlook

The strategic outlook for the East Africa Downstream Oil and Gas Industry is one of considerable promise, underpinned by accelerating economic growth and a rising energy demand. Future market potential is significant, particularly in countries with developing refining capacities and burgeoning petrochemical sectors, such as Mozambique and Kenya. Strategic opportunities lie in leveraging indigenous crude oil and natural gas resources for value addition, thereby reducing import dependence and fostering local industrialization. Investments in cleaner fuel technologies, petrochemical diversification, and digital transformation will be crucial growth accelerators. Furthermore, regional cooperation and favorable government policies that de-risk investments and streamline regulatory processes will be instrumental in unlocking the full potential of this dynamic market, ensuring sustained growth and enhanced competitiveness.

East Africa Downstream Oil and Gas Industry Segmentation

- 1. Refineries

- 2. Petrochemicals Plants

-

3. Geography

- 3.1. Mozambique

- 3.2. South Sudan

- 3.3. Kenya

- 3.4. Rest of East Africa

East Africa Downstream Oil and Gas Industry Segmentation By Geography

- 1. Mozambique

- 2. South Sudan

- 3. Kenya

- 4. Rest of East Africa

East Africa Downstream Oil and Gas Industry Regional Market Share

Geographic Coverage of East Africa Downstream Oil and Gas Industry

East Africa Downstream Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Electricity Demand4.; Rsing Investments in the Coal Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Installation of Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Refinery Capacity to Witness growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. East Africa Downstream Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Mozambique

- 5.3.2. South Sudan

- 5.3.3. Kenya

- 5.3.4. Rest of East Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mozambique

- 5.4.2. South Sudan

- 5.4.3. Kenya

- 5.4.4. Rest of East Africa

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Mozambique East Africa Downstream Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Refineries

- 6.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Mozambique

- 6.3.2. South Sudan

- 6.3.3. Kenya

- 6.3.4. Rest of East Africa

- 6.1. Market Analysis, Insights and Forecast - by Refineries

- 7. South Sudan East Africa Downstream Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Refineries

- 7.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Mozambique

- 7.3.2. South Sudan

- 7.3.3. Kenya

- 7.3.4. Rest of East Africa

- 7.1. Market Analysis, Insights and Forecast - by Refineries

- 8. Kenya East Africa Downstream Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Refineries

- 8.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Mozambique

- 8.3.2. South Sudan

- 8.3.3. Kenya

- 8.3.4. Rest of East Africa

- 8.1. Market Analysis, Insights and Forecast - by Refineries

- 9. Rest of East Africa East Africa Downstream Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Refineries

- 9.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Mozambique

- 9.3.2. South Sudan

- 9.3.3. Kenya

- 9.3.4. Rest of East Africa

- 9.1. Market Analysis, Insights and Forecast - by Refineries

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Sudan National Petroleum Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 China National Petroleum Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Petrogal SA*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Royal Dutch Shell PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Eni SpA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kenya Petroleum Refineries Ltd (KPRL)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Total Energies Marketing Kenya

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Shell Kenya

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 National Oil Corporation of Kenya (NOCK)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Oil Libya (Tamoil)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Sudan National Petroleum Corporation

List of Figures

- Figure 1: East Africa Downstream Oil and Gas Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: East Africa Downstream Oil and Gas Industry Share (%) by Company 2025

List of Tables

- Table 1: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Refineries 2020 & 2033

- Table 2: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Refineries 2020 & 2033

- Table 3: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Petrochemicals Plants 2020 & 2033

- Table 4: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Petrochemicals Plants 2020 & 2033

- Table 5: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 6: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 7: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Region 2020 & 2033

- Table 8: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Region 2020 & 2033

- Table 9: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Refineries 2020 & 2033

- Table 10: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Refineries 2020 & 2033

- Table 11: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Petrochemicals Plants 2020 & 2033

- Table 12: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Petrochemicals Plants 2020 & 2033

- Table 13: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 14: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 15: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Country 2020 & 2033

- Table 17: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Refineries 2020 & 2033

- Table 18: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Refineries 2020 & 2033

- Table 19: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Petrochemicals Plants 2020 & 2033

- Table 20: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Petrochemicals Plants 2020 & 2033

- Table 21: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 22: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 23: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Country 2020 & 2033

- Table 25: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Refineries 2020 & 2033

- Table 26: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Refineries 2020 & 2033

- Table 27: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Petrochemicals Plants 2020 & 2033

- Table 28: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Petrochemicals Plants 2020 & 2033

- Table 29: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 30: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 31: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 32: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Country 2020 & 2033

- Table 33: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Refineries 2020 & 2033

- Table 34: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Refineries 2020 & 2033

- Table 35: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Petrochemicals Plants 2020 & 2033

- Table 36: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Petrochemicals Plants 2020 & 2033

- Table 37: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 38: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 39: East Africa Downstream Oil and Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 40: East Africa Downstream Oil and Gas Industry Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the East Africa Downstream Oil and Gas Industry?

The projected CAGR is approximately 2.62%.

2. Which companies are prominent players in the East Africa Downstream Oil and Gas Industry?

Key companies in the market include Sudan National Petroleum Corporation, China National Petroleum Corporation, Petrogal SA*List Not Exhaustive, Royal Dutch Shell PLC, Eni SpA, Kenya Petroleum Refineries Ltd (KPRL) , Total Energies Marketing Kenya , Shell Kenya , National Oil Corporation of Kenya (NOCK) , Oil Libya (Tamoil).

3. What are the main segments of the East Africa Downstream Oil and Gas Industry?

The market segments include Refineries, Petrochemicals Plants, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.2 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Demand4.; Rsing Investments in the Coal Industry.

6. What are the notable trends driving market growth?

Refinery Capacity to Witness growth.

7. Are there any restraints impacting market growth?

4.; Increasing Installation of Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

In December 2022, Savannah Energy declared the acquisition of producing oil fields in South Sudan from Malaysian state oil and gas company Petronas. The investment is valued at USD 1.25 billion. The other partners include the international energy company, the China National Petroleum Corporation, India's flagship energy major, the Oil and Natural Gas Corporation, and South Sudan's national oil and gas company, Nilepet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "East Africa Downstream Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the East Africa Downstream Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the East Africa Downstream Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the East Africa Downstream Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence