Key Insights

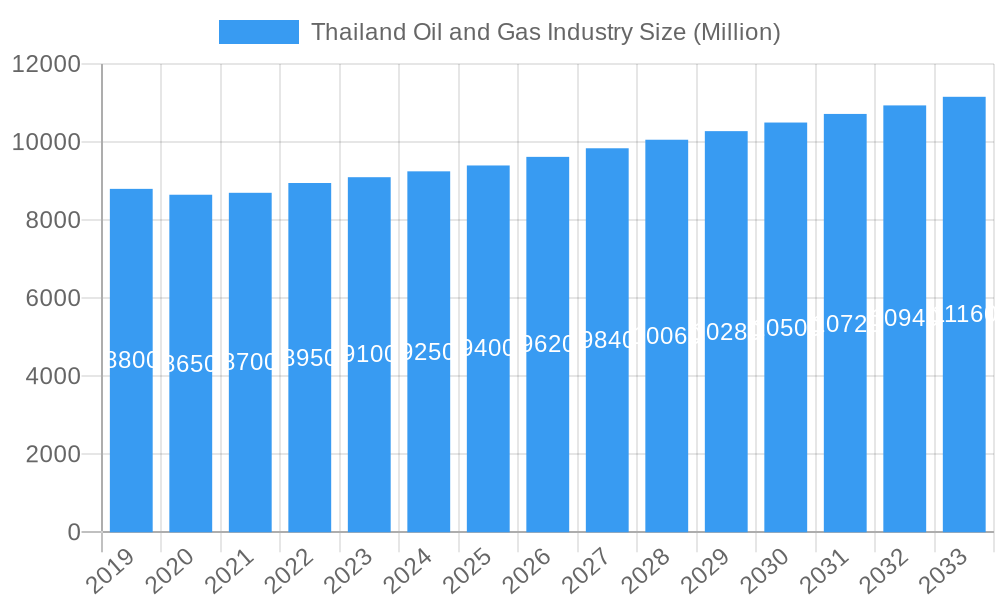

The Thailand oil and gas industry is projected for robust growth, with an estimated market size of $17.5 billion by 2024. The sector is expected to experience a Compound Annual Growth Rate (CAGR) of 4.2% through 2033. This expansion is fueled by significant domestic energy demand driven by Thailand's ongoing economic development, industrialization, and a burgeoning transportation sector. Governmental emphasis on energy security and diversification, alongside continued investment in exploration and production (E&P), are key contributors. Growth drivers include rising consumption of refined petroleum products, natural gas utilization in power generation and industrial processes, and an increase in upstream activities to meet these demands. Thailand's strategic Southeast Asian location also positions it as a potential hub for regional energy trade and downstream processing.

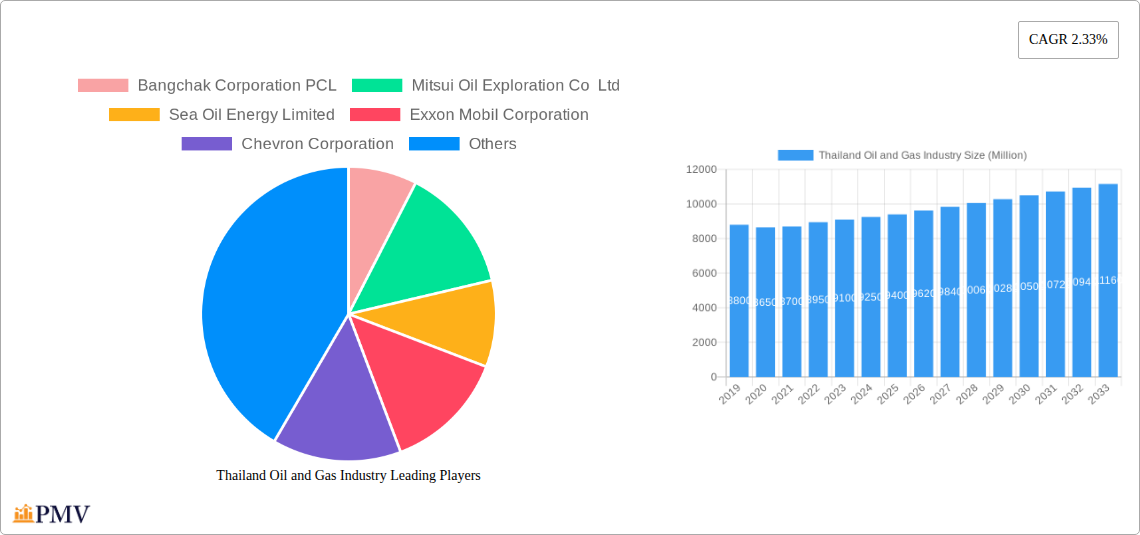

Thailand Oil and Gas Industry Market Size (In Billion)

While the outlook is generally positive, the industry faces potential restraints including global crude oil price volatility, geopolitical supply chain disruptions, and stringent environmental regulations aimed at carbon emission reduction. The global shift towards renewable energy presents a competitive challenge to traditional oil and gas markets. Nevertheless, oil and gas remain crucial for baseload power, industrial feedstock, and transportation fuels in the short to medium term. The upstream segment is focusing on enhancing production from existing fields and new exploration, while midstream and downstream sectors prioritize efficient refining, distribution, and petrochemical production. Key industry players like PTT Public Company Limited, Bangchak Corporation PCL, and Exxon Mobil Corporation are investing in technological advancements and sustainable practices to navigate these challenges and leverage market opportunities.

Thailand Oil and Gas Industry Company Market Share

Thailand Oil and Gas Industry: Market Dynamics and Future Outlook (2019–2033)

This comprehensive report offers an in-depth analysis of the Thailand oil and gas sector, providing critical insights into market structure, competitive landscape, emerging trends, and future projections. Covering the study period 2019–2033, with a base year of 2024 and a forecast period from 2024–2033, this report is an essential resource for stakeholders seeking to understand Thailand's energy landscape. It examines the upstream, midstream, and downstream segments, identifying key growth drivers, technological innovations, and challenges shaping the sector.

This detailed market research report on the Thai energy market provides granular analysis of oil and gas market size, market share, and market trends. Explore Thailand oil and gas exploration and production (E&P), oil and gas refining, the petrochemical market, and LNG import/export dynamics. The report presents a 2024 market value estimate, projected to reach billions by 2033, with a compelling CAGR of 4.2%. Understand the impact of energy security initiatives, regulatory reforms, and sustainable energy solutions on the industry's trajectory.

This report is invaluable for oil and gas companies, energy investors, government agencies, research institutions, and other stakeholders seeking to capitalize on opportunities within the dynamic Thailand energy market.

Thailand Oil and Gas Industry Market Structure & Competitive Dynamics

The Thailand oil and gas industry exhibits a moderately concentrated market structure, characterized by the presence of both large state-owned enterprises and multinational corporations. Key players like PTT Public Company Limited, Bangchak Corporation PCL, PTT Exploration and Production Public Company Limited (PTTEP), Chevron Corporation, and Exxon Mobil Corporation dominate significant market shares across various segments. Innovation ecosystems are driven by strategic investments in advanced exploration technologies, refinery upgrades, and the burgeoning petrochemical sector. Regulatory frameworks, overseen by the Ministry of Energy and relevant governmental bodies, significantly influence operational strategies and investment decisions. The threat of product substitutes, particularly from renewable energy sources, is a growing consideration, pushing the industry towards diversification and efficiency. End-user trends are increasingly favoring cleaner fuel options and specialized petrochemical products. Mergers and acquisitions (M&A) activities, while subject to stringent regulatory approvals, are pivotal for consolidating market power and expanding operational footprints. The total M&A deal value in the sector over the historical period is estimated at over 15,000 Million USD, reflecting strategic consolidations and asset acquisitions.

Thailand Oil and Gas Industry Industry Trends & Insights

The Thailand oil and gas industry is experiencing robust growth, primarily fueled by increasing domestic energy demand and strategic government initiatives aimed at enhancing energy security. The upstream segment is witnessing renewed exploration efforts, particularly in offshore blocks, spurred by discoveries and the government's competitive bidding rounds. For instance, the recent award of Blocks G1/65 and G3/65 to PTTEP in June 2023 signifies ongoing investment in exploration. The midstream sector is crucial for the efficient transportation and storage of crude oil and natural gas, with ongoing investments in pipeline infrastructure and LNG regasification terminals to support Thailand's growing import needs. May 2023 saw PTT planning to import up to 6 million tonnes of LNG, underscoring the rising demand and the critical role of liquefied natural gas in the energy mix. In the downstream sector, the refining and petrochemical industries are undergoing modernization and expansion to meet the demand for high-value products and to comply with stricter environmental regulations. Technological disruptions, including the adoption of digital technologies for enhanced operational efficiency, predictive maintenance, and improved safety, are becoming commonplace. Consumer preferences are subtly shifting, with a growing interest in cleaner fuels and energy-efficient products, prompting investments in biofuels and lower-emission fuel alternatives. Competitive dynamics are characterized by strategic partnerships, joint ventures, and a focus on cost optimization to maintain profitability amidst fluctuating global energy prices. The market penetration of advanced technologies is steadily increasing, contributing to a higher CAGR of approximately 4.5% projected for the forecast period.

Dominant Markets & Segments in Thailand Oil and Gas Industry

The downstream segment currently holds dominant market influence within the Thailand oil and gas industry. This dominance is primarily driven by the nation's substantial refining capacity and the thriving petrochemical sector, which serves both domestic and export markets. The presence of major refining hubs and integrated petrochemical complexes, operated by entities like PTT Global Chemical and Bangchak Corporation, ensures significant revenue generation and employment. Key drivers for this dominance include supportive government economic policies that encourage value-added manufacturing and the development of downstream industries. The infrastructure supporting the downstream segment, including extensive port facilities for import/export and sophisticated distribution networks, is well-established.

The upstream segment, while experiencing renewed activity, is still characterized by mature fields and a reliance on exploration success for significant growth. However, the recent awarding of Production Sharing Contracts (PSCs) for offshore blocks G1/65 and G3/65 to PTTEP in June 2023 highlights a strategic push to boost domestic production and bolster energy security, indicating potential for future growth and increased market share. Economic policies promoting domestic E&P are crucial here.

The midstream segment, encompassing pipelines, storage, and transportation, plays a vital supporting role. Its growth is intrinsically linked to the expansion of both upstream production and downstream demand. The increasing reliance on imported Liquefied Natural Gas (LNG), as exemplified by PTT's planned imports of up to 6 million tonnes in May 2023, necessitates continuous investment and expansion of LNG terminals and associated infrastructure. Regulatory frameworks that facilitate efficient logistics and infrastructure development are paramount for this segment's contribution to the overall market.

Thailand Oil and Gas Industry Product Innovations

Recent product innovations in the Thailand oil and gas industry are focused on enhancing efficiency, sustainability, and value creation. Advancements in refining technologies are leading to the production of cleaner fuels with lower sulfur content, meeting evolving environmental standards. In the petrochemical sector, there is a growing emphasis on developing specialty chemicals and advanced polymers for high-demand applications in industries like automotive and electronics. Innovations in upstream exploration and production are centered on utilizing digital technologies, such as AI and machine learning, for seismic data interpretation and reservoir management, leading to more efficient resource extraction. The development of biofuels and bio-based chemicals represents a significant trend, aligning with the nation's push towards a greener economy. These innovations provide a competitive advantage by meeting specific market needs and contributing to a more sustainable energy future.

Report Segmentation & Scope

This report meticulously segments the Thailand oil and gas industry into its core components: Upstream, Midstream, and Downstream.

- Upstream: This segment encompasses all activities related to the exploration, development, and production of crude oil and natural gas. Projections indicate a moderate growth trajectory, driven by new bidding rounds and technological advancements in exploration. The estimated market size for the upstream segment is expected to reach 8,000 Million USD by 2025.

- Midstream: This segment focuses on the transportation, storage, and processing of crude oil and natural gas. The growing demand for LNG and the need for robust pipeline networks are key drivers. Market size is estimated at 5,000 Million USD for 2025, with significant potential for expansion.

- Downstream: This segment includes refining, marketing, and the petrochemical industry. It is the largest segment, driven by refining capacity and the demand for petroleum products and petrochemical derivatives. Estimated market size for 2025 is 12,000 Million USD, with strong growth anticipated due to industrial expansion.

Key Drivers of Thailand Oil and Gas Industry Growth

Several factors are propelling the growth of the Thailand oil and gas industry:

- Rising Energy Demand: Consistent economic growth and industrial expansion are driving an increased demand for energy across all sectors, from transportation to manufacturing.

- Government Support and Energy Security: Strategic government policies aimed at enhancing energy security, including promoting domestic production and diversifying import sources (e.g., LNG), are crucial catalysts.

- Technological Advancements: Investment in advanced exploration and production technologies, as well as modernization of refining and petrochemical facilities, is boosting efficiency and output.

- Petrochemical Industry Expansion: The robust growth of Thailand's petrochemical sector, driven by demand for value-added products, directly fuels the downstream oil and gas market.

- Strategic Investments: Significant investments by both domestic and international players in exploration, infrastructure development, and capacity expansion are vital for sustained growth.

Challenges in the Thailand Oil and Gas Industry Sector

Despite the positive outlook, the Thailand oil and gas industry faces several challenges:

- Price Volatility: Fluctuations in global crude oil and natural gas prices can impact profitability and investment decisions, creating market uncertainty.

- Aging Infrastructure: Some existing infrastructure requires modernization and upgrades to meet current efficiency and safety standards, demanding substantial capital expenditure.

- Environmental Regulations: Increasingly stringent environmental regulations and the global push towards decarbonization necessitate significant investment in cleaner technologies and sustainable practices.

- Geopolitical Factors: Global geopolitical events can disrupt supply chains and influence energy prices, posing risks to market stability.

- Competition from Renewables: The growing competitiveness of renewable energy sources presents a long-term challenge, requiring the industry to adapt and integrate with emerging energy solutions.

Leading Players in the Thailand Oil and Gas Industry Market

- Bangchak Corporation PCL

- Mitsui Oil Exploration Co Ltd

- Sea Oil Energy Limited

- Exxon Mobil Corporation

- Chevron Corporation

- Pan Orient Energy (Siam) Ltd

- TotalEnergies SE

- Royal Dutch Shell PLC

- MedcoEnergi

- PTT Public Company Limited

Key Developments in Thailand Oil and Gas Industry Sector

- June 2023: PTT Exploration and Production Public Company Limited (PTTEP) and Domestic Production Asset Group signed Production Sharing Contracts (PSCs) for Block G1/65 and Block G3/65 with the Minister of Energy. PTTEP was awarded the two offshore blocks in the 24th Thailand Petroleum Bidding Round. This development is significant for boosting domestic exploration and production capabilities.

- May 2023: PTT, Thailand's largest oil and gas conglomerate, planned to import up to 6 million tonnes of liquefied natural gas (LNG) this year due to a surge in demand nationwide. This highlights the growing importance of LNG in meeting Thailand's energy needs and the expansion of midstream infrastructure.

- May 2022: PTT Exploration and Production Public Company Limited (PTTEP), responsible for developing the business in petroleum exploration, development, and production to support Thailand's energy security nations, decided to shift all of its equity crude production from its Oman location project to domestic Thai refineries rather than trading the barrels in the international market. This strategic move strengthens domestic refining capacity and enhances energy self-sufficiency.

Strategic Thailand Oil and Gas Industry Market Outlook

The strategic outlook for the Thailand oil and gas industry is characterized by a strong emphasis on energy security, technological advancement, and adaptation to global sustainability trends. The government's commitment to diversifying energy sources and enhancing domestic production, as seen with the recent PSC awards, will continue to drive upstream activities. The increasing reliance on LNG underscores the vital role of midstream infrastructure development and investment in regasification terminals. Downstream, the focus will be on modernizing refineries to produce cleaner fuels and expanding petrochemical capacities to meet growing demand for specialized products. Strategic opportunities lie in the integration of renewable energy sources, the development of biofuels, and the adoption of digital technologies for operational efficiency and cost optimization. By embracing these strategic imperatives, the industry is poised for sustained growth and resilience in the evolving global energy landscape, aiming for a market value exceeding 25,000 Million USD by 2033.

Thailand Oil and Gas Industry Segmentation

- 1. Upstream

- 2. Midstream

- 3. Downstream

Thailand Oil and Gas Industry Segmentation By Geography

- 1. Thailand

Thailand Oil and Gas Industry Regional Market Share

Geographic Coverage of Thailand Oil and Gas Industry

Thailand Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding the Asia's Largest Downstream Sector4.; Energy Transition from Coal to Natural Gas

- 3.3. Market Restrains

- 3.3.1. Government Policies to Shift Towards Cleaner Fuels

- 3.4. Market Trends

- 3.4.1. Downstream Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bangchak Corporation PCL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsui Oil Exploration Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sea Oil Energy Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Exxon Mobil Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chevron Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pan Orient Energy (Siam) Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TotalEnergies SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal Dutch Shell PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MedcoEnergi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PTT Public Company Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bangchak Corporation PCL

List of Figures

- Figure 1: Thailand Oil and Gas Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Thailand Oil and Gas Industry Share (%) by Company 2025

List of Tables

- Table 1: Thailand Oil and Gas Industry Revenue billion Forecast, by Upstream 2020 & 2033

- Table 2: Thailand Oil and Gas Industry Volume Thousand Forecast, by Upstream 2020 & 2033

- Table 3: Thailand Oil and Gas Industry Revenue billion Forecast, by Midstream 2020 & 2033

- Table 4: Thailand Oil and Gas Industry Volume Thousand Forecast, by Midstream 2020 & 2033

- Table 5: Thailand Oil and Gas Industry Revenue billion Forecast, by Downstream 2020 & 2033

- Table 6: Thailand Oil and Gas Industry Volume Thousand Forecast, by Downstream 2020 & 2033

- Table 7: Thailand Oil and Gas Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Thailand Oil and Gas Industry Volume Thousand Forecast, by Region 2020 & 2033

- Table 9: Thailand Oil and Gas Industry Revenue billion Forecast, by Upstream 2020 & 2033

- Table 10: Thailand Oil and Gas Industry Volume Thousand Forecast, by Upstream 2020 & 2033

- Table 11: Thailand Oil and Gas Industry Revenue billion Forecast, by Midstream 2020 & 2033

- Table 12: Thailand Oil and Gas Industry Volume Thousand Forecast, by Midstream 2020 & 2033

- Table 13: Thailand Oil and Gas Industry Revenue billion Forecast, by Downstream 2020 & 2033

- Table 14: Thailand Oil and Gas Industry Volume Thousand Forecast, by Downstream 2020 & 2033

- Table 15: Thailand Oil and Gas Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Thailand Oil and Gas Industry Volume Thousand Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Oil and Gas Industry?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Thailand Oil and Gas Industry?

Key companies in the market include Bangchak Corporation PCL, Mitsui Oil Exploration Co Ltd, Sea Oil Energy Limited, Exxon Mobil Corporation, Chevron Corporation, Pan Orient Energy (Siam) Ltd, TotalEnergies SE, Royal Dutch Shell PLC, MedcoEnergi, PTT Public Company Limited.

3. What are the main segments of the Thailand Oil and Gas Industry?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Expanding the Asia's Largest Downstream Sector4.; Energy Transition from Coal to Natural Gas.

6. What are the notable trends driving market growth?

Downstream Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Government Policies to Shift Towards Cleaner Fuels.

8. Can you provide examples of recent developments in the market?

June 2023: PTT Exploration and Production Public Company Limited (PTTEP) and Domestic Production Asset Group signed Production Sharing Contracts (PSCs) for Block G1/65 and Block G3/65 with the Minister of Energy. PTTEP was awarded the two offshore blocks in the 24th Thailand Petroleum Bidding Round.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Thailand Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence