Key Insights

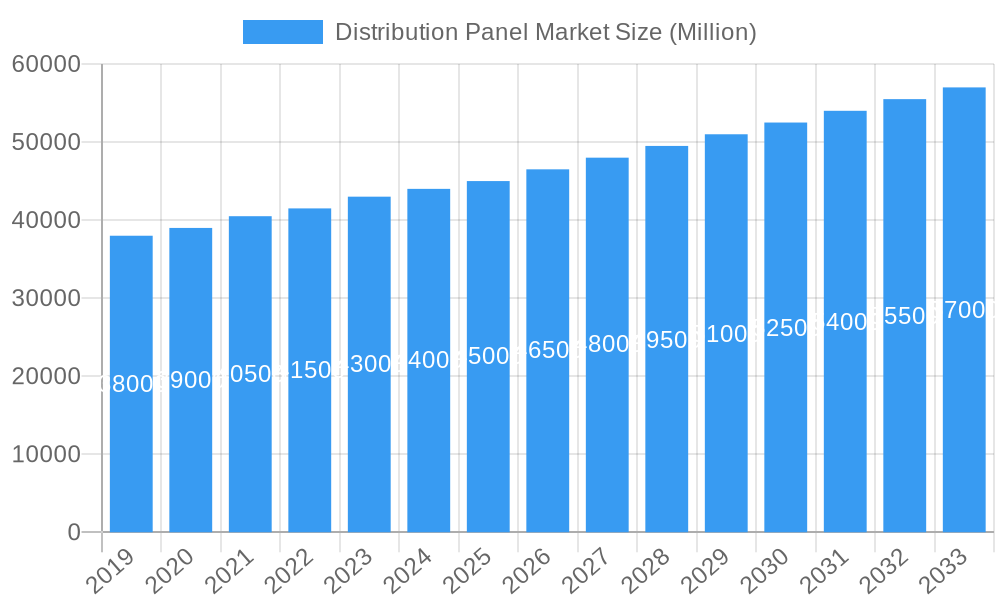

The global Distribution Panel Market is projected for substantial growth, expected to reach approximately $8 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.2% through 2033. This expansion is driven by the increasing demand for reliable electrical infrastructure. Key sectors fueling this growth include Power Utilities, driven by grid modernization and renewable energy integration, and the Commercial & Industrial (C&I) segment, spurred by industrialization and smart technology adoption. The Residential sector also contributes through new construction and smart home technology integration.

Distribution Panel Market Market Size (In Billion)

Market growth is further supported by a global focus on energy efficiency and sustainability, necessitating advanced distribution panels. The deployment of smart grids and IoT for energy management also boosts demand for intelligent panels with enhanced control features. Challenges include high initial investment costs and the presence of counterfeit products. However, strategic initiatives by leading manufacturers, focusing on innovation, partnerships, and expansion, are expected to mitigate these restraints. Regionally, Asia Pacific is anticipated to lead market growth due to rapid industrialization and infrastructure development, followed by North America and Europe, which prioritize grid modernization and smart technology.

Distribution Panel Market Company Market Share

This comprehensive market research report offers critical insights into the global distribution panel market from 2019 to 2033, with a base year of 2025. It analyzes market structure, trends, segments, innovations, drivers, challenges, leading players, and strategic outlook, providing a detailed forecast and identifying key opportunities.

Distribution Panel Market Market Structure & Competitive Dynamics

The distribution panel market exhibits a moderately concentrated structure, with a few dominant global players and a substantial number of regional and specialized manufacturers. Market concentration is influenced by technological expertise, established distribution networks, and economies of scale. Innovation ecosystems within this sector are driven by advancements in smart grid technologies, increasing demand for energy efficiency, and the integration of digital solutions for remote monitoring and control. Regulatory frameworks, including electrical safety standards, energy efficiency mandates, and smart grid initiatives, play a pivotal role in shaping market entry and product development. Product substitutes, while limited for core distribution functions, include advancements in integrated power management systems and decentralized energy solutions that may influence traditional panel designs. End-user trends are increasingly focused on intelligent, modular, and sustainable solutions. Merger and acquisition (M&A) activities are significant, driven by the desire for market expansion, technology acquisition, and portfolio diversification. For instance, strategic acquisitions in recent years have seen major players bolstering their offerings in areas like smart distribution and renewable energy integration, with M&A deal values often reaching hundreds of millions of dollars.

Distribution Panel Market Industry Trends & Insights

The distribution panel market is poised for robust growth, driven by a confluence of factors. The global CAGR for the distribution panel market is projected to be approximately 6.5% during the forecast period. This growth is fundamentally fueled by the increasing global demand for electricity, coupled with the imperative for modernized and resilient electrical infrastructure. The ongoing expansion of smart grids, a critical component of modern power management, necessitates advanced distribution panels capable of handling bidirectional power flow, real-time data analytics, and sophisticated control mechanisms. Furthermore, the escalating adoption of renewable energy sources such as solar and wind power presents a significant opportunity, as these intermittent sources require intelligent distribution panels to ensure grid stability and efficient energy management.

Technological disruptions are transforming the distribution panel market. The integration of IoT (Internet of Things) capabilities is enabling smarter, more connected distribution panels that offer predictive maintenance, remote diagnostics, and enhanced operational efficiency. The advent of AI and machine learning algorithms is further optimizing energy distribution, fault detection, and load balancing. Consumer preferences are shifting towards more energy-efficient, safe, and user-friendly distribution panel solutions. The residential sector, in particular, is witnessing a growing demand for smart home compatible panels that can seamlessly integrate with other smart devices and facilitate energy consumption monitoring. The commercial and industrial sectors are increasingly investing in advanced distribution panels to improve operational reliability, reduce energy costs, and comply with stringent energy efficiency regulations. Competitive dynamics within the market are characterized by fierce price competition for standard products, while differentiation is achieved through technological innovation, customization, and value-added services. Key players are focusing on developing intelligent, modular, and sustainable solutions to capture market share. The market penetration of advanced distribution panels with smart features is expected to accelerate significantly in the coming years, especially in developed economies.

Dominant Markets & Segments in Distribution Panel Market

Within the distribution panel market, several regions and end-user segments demonstrate significant dominance. Power Utilities represent a cornerstone of the market, driven by the fundamental need for reliable and efficient electricity distribution across vast networks. The relentless global demand for electricity, coupled with aging infrastructure requiring upgrades and modernization, propels consistent investment in distribution panels by power utilities. Economic policies supporting grid modernization, the integration of renewable energy sources, and the development of smart grid technologies are key drivers in this segment. Countries with extensive power grids and ambitious renewable energy targets, such as the United States, China, Germany, and India, are particularly dominant markets for power utility-focused distribution panels.

The Commercial and Industrial (C&I) segment is another major contributor to the distribution panel market's growth. This segment is characterized by a diverse range of applications, including manufacturing facilities, data centers, commercial buildings, and healthcare institutions. Key drivers in the C&I segment include the need for high-performance, reliable, and safe electrical distribution systems to support complex operations. Increased industrial automation, the proliferation of data centers demanding robust power management, and the ongoing construction of new commercial infrastructure are significant growth accelerators. Stricter safety regulations and a growing emphasis on energy efficiency and sustainability within businesses are further boosting demand for advanced distribution panel solutions. Emerging economies with rapidly industrializing sectors and significant infrastructure development projects are also key growth areas within this segment.

The Residential segment, while often smaller in terms of individual panel value compared to C&I, represents a substantial volume market. The increasing adoption of smart home technologies, electric vehicles (EVs) requiring dedicated charging infrastructure, and a general trend towards enhanced electrical safety and convenience are driving growth in this segment. Government initiatives promoting energy-efficient housing and smart building development also contribute to the demand for advanced residential distribution panels. The growing middle class in developing nations, coupled with rising disposable incomes, fuels new residential construction, further bolstering the demand for electrical components like distribution panels. The dominance in each of these segments is a testament to their critical role in the overall energy ecosystem, with ongoing investments ensuring a sustained demand for robust and intelligent distribution panel solutions.

Distribution Panel Market Product Innovations

Product innovations in the distribution panel market are increasingly focused on intelligence, connectivity, and sustainability. Manufacturers are integrating advanced digital technologies, such as IoT sensors and communication modules, enabling real-time monitoring, remote diagnostics, and predictive maintenance. These smart distribution panels enhance operational efficiency, reduce downtime, and improve overall grid reliability. Modular design concepts are gaining traction, allowing for greater flexibility and scalability in system configurations, catering to diverse end-user requirements. Furthermore, advancements in arc flash mitigation technologies and enhanced surge protection are providing superior safety features. The competitive advantage lies in offering solutions that not only meet stringent safety and performance standards but also deliver enhanced intelligence and user-friendliness, aligning with the growing demand for smart and sustainable electrical infrastructure.

Report Segmentation & Scope

This comprehensive report segments the distribution panel market by End-User into three primary categories: Power Utilities, Commercial and Industrial, and Residential.

Power Utilities: This segment focuses on distribution panels designed for the high-voltage and high-capacity demands of power generation, transmission, and distribution networks. Growth projections for this segment are robust, estimated at approximately 7.0% CAGR, driven by grid modernization and renewable energy integration. The market size for this segment is expected to reach over $15,000 Million by 2033, with competitive dynamics characterized by a focus on reliability, scalability, and advanced grid management capabilities.

Commercial and Industrial: This segment encompasses distribution panels for manufacturing plants, data centers, office buildings, retail spaces, and other commercial establishments. This segment is projected to grow at a CAGR of around 6.3%, with a market size anticipated to exceed $12,000 Million by 2033. Competitive dynamics revolve around customization, energy efficiency solutions, and robust safety features to meet diverse industrial and commercial needs.

Residential: This segment covers distribution panels for homes, apartments, and other residential units. Growth is estimated at approximately 5.8% CAGR, with a market size projected to surpass $8,000 Million by 2033. Key competitive factors include affordability, ease of installation, integration with smart home technologies, and adherence to evolving safety standards.

Key Drivers of Distribution Panel Market Growth

The distribution panel market is propelled by several interconnected growth drivers. Technological advancements are paramount, with the integration of smart grid technologies, IoT capabilities, and AI-driven analytics enhancing the functionality, efficiency, and reliability of distribution panels. Economic factors, including global infrastructure development, increasing urbanization, and the growing demand for electricity across all sectors, directly fuel the need for robust electrical distribution systems. Regulatory frameworks, such as mandates for energy efficiency, stringent electrical safety standards, and supportive policies for renewable energy integration, further stimulate market growth by driving demand for compliant and advanced solutions. The ongoing transition to renewable energy sources necessitates sophisticated distribution panels to manage intermittent power generation and ensure grid stability.

Challenges in the Distribution Panel Market Sector

Despite the positive growth trajectory, the distribution panel market faces several challenges. Intense price competition, particularly for standard and low-voltage distribution panels, can compress profit margins for manufacturers. Fluctuations in raw material prices, such as copper and aluminum, can impact production costs and supply chain stability. Evolving and increasingly stringent regulatory landscapes across different regions require continuous product adaptation and compliance, adding complexity and R&D costs. Supply chain disruptions, exacerbated by geopolitical events and logistical challenges, can lead to delays and increased costs for components. Furthermore, the adoption of advanced smart distribution panels may face resistance in regions with less developed digital infrastructure or a lack of skilled personnel for installation and maintenance. The estimated impact of these challenges could potentially slow the adoption rate of advanced technologies by 10-15% in certain markets.

Leading Players in the Distribution Panel Market Market

- ABB Ltd

- Alfanar Group

- Larsen & Toubro Limited

- Legrand SA

- Havells India Ltd

- Siemens AG

- Schneider Electric SE

- Eaton Corporation PLC

- Hager Group

Key Developments in Distribution Panel Market Sector

- 2023/04: Siemens AG launched its new generation of intelligent distribution boards, incorporating advanced digital features for enhanced monitoring and control.

- 2022/11: Schneider Electric SE announced strategic partnerships to accelerate the integration of its distribution panel solutions with smart grid technologies and renewable energy management systems.

- 2022/07: Eaton Corporation PLC acquired a specialized technology firm to bolster its offerings in arc flash detection and mitigation solutions for distribution panels.

- 2021/09: Legrand SA introduced a new range of modular distribution panels designed for increased flexibility and faster installation in commercial and residential applications.

- 2020/05: Larsen & Toubro Limited expanded its manufacturing capacity for high-voltage distribution panels to meet the growing demand from power utility projects in emerging markets.

Strategic Distribution Panel Market Market Outlook

The strategic outlook for the distribution panel market is highly optimistic, fueled by accelerating trends in digitalization, sustainability, and grid modernization. Growth accelerators include the continued expansion of smart cities, the electrification of transportation demanding robust charging infrastructure, and the increasing adoption of distributed energy resources. Manufacturers who focus on developing integrated solutions, offering enhanced cybersecurity features, and providing comprehensive after-sales support will be well-positioned for success. The market presents significant opportunities for innovation in areas such as AI-powered predictive maintenance, advanced energy management systems, and modular designs that cater to evolving building codes and energy efficiency standards. Strategic investments in R&D and a focus on building strong partnerships with utility companies and system integrators will be crucial for capitalizing on future market potential.

Distribution Panel Market Segmentation

-

1. End-User

- 1.1. Power Utilities

- 1.2. Commercial and Industrial

- 1.3. Residential

Distribution Panel Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Distribution Panel Market Regional Market Share

Geographic Coverage of Distribution Panel Market

Distribution Panel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Power Utilities Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Distribution Panel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Power Utilities

- 5.1.2. Commercial and Industrial

- 5.1.3. Residential

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. North America Distribution Panel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Power Utilities

- 6.1.2. Commercial and Industrial

- 6.1.3. Residential

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. Europe Distribution Panel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Power Utilities

- 7.1.2. Commercial and Industrial

- 7.1.3. Residential

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Asia Pacific Distribution Panel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Power Utilities

- 8.1.2. Commercial and Industrial

- 8.1.3. Residential

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. South America Distribution Panel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Power Utilities

- 9.1.2. Commercial and Industrial

- 9.1.3. Residential

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Middle East and Africa Distribution Panel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 10.1.1. Power Utilities

- 10.1.2. Commercial and Industrial

- 10.1.3. Residential

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alfanar Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Larsen & Toubro Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Legrand SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Havells India Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schneider Electric SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eaton Corporation PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hager Group*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global Distribution Panel Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Distribution Panel Market Revenue (billion), by End-User 2025 & 2033

- Figure 3: North America Distribution Panel Market Revenue Share (%), by End-User 2025 & 2033

- Figure 4: North America Distribution Panel Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Distribution Panel Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Distribution Panel Market Revenue (billion), by End-User 2025 & 2033

- Figure 7: Europe Distribution Panel Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: Europe Distribution Panel Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Distribution Panel Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Distribution Panel Market Revenue (billion), by End-User 2025 & 2033

- Figure 11: Asia Pacific Distribution Panel Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Asia Pacific Distribution Panel Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Distribution Panel Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Distribution Panel Market Revenue (billion), by End-User 2025 & 2033

- Figure 15: South America Distribution Panel Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: South America Distribution Panel Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Distribution Panel Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Distribution Panel Market Revenue (billion), by End-User 2025 & 2033

- Figure 19: Middle East and Africa Distribution Panel Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: Middle East and Africa Distribution Panel Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Distribution Panel Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Distribution Panel Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 2: Global Distribution Panel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Distribution Panel Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Global Distribution Panel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Distribution Panel Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Global Distribution Panel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Distribution Panel Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 8: Global Distribution Panel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Distribution Panel Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Global Distribution Panel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Distribution Panel Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Global Distribution Panel Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Distribution Panel Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Distribution Panel Market?

Key companies in the market include ABB Ltd, Alfanar Group, Larsen & Toubro Limited, Legrand SA, Havells India Ltd, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, Hager Group*List Not Exhaustive.

3. What are the main segments of the Distribution Panel Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Power Utilities Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Distribution Panel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Distribution Panel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Distribution Panel Market?

To stay informed about further developments, trends, and reports in the Distribution Panel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence