Key Insights

The global Dry Type Transformer market is projected for significant expansion, forecasted to reach approximately 7.12 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 6.7%. This growth is fueled by the increasing demand for reliable and efficient power distribution solutions across industrial, commercial, and utility sectors. Key drivers include the integration of renewable energy, modernization of electrical infrastructure, and a focus on energy efficiency and safety. Dry type transformers, favored for their safety, environmental benefits, and reduced maintenance, are increasingly adopted in sensitive environments like hospitals, data centers, and urban areas. Technological advancements are further enhancing transformer performance, capacity, and design.

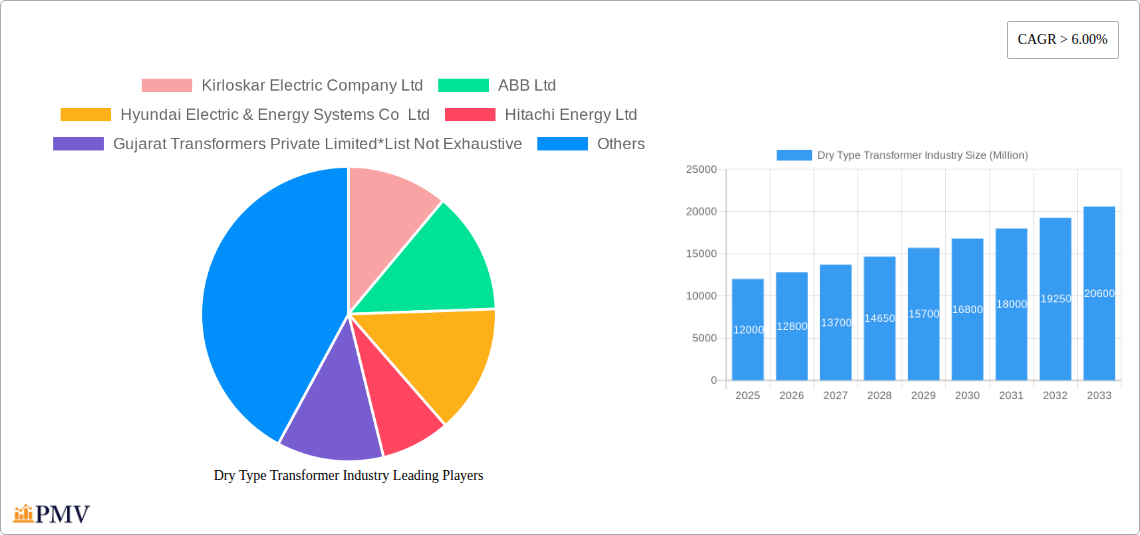

Dry Type Transformer Industry Market Size (In Billion)

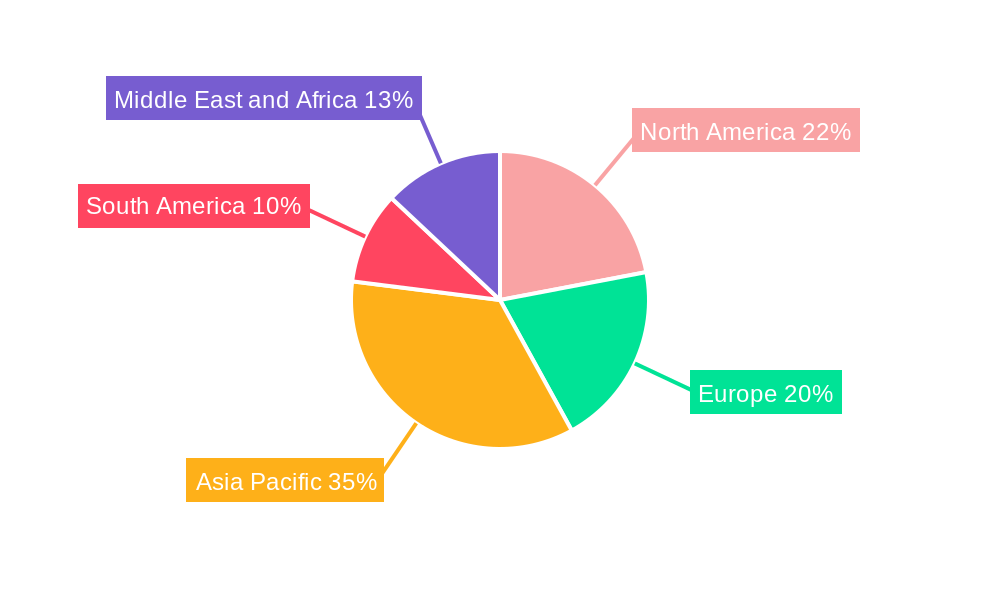

The market is segmented by voltage into Low Voltage and Medium Voltage, with Power Transformers and Distribution Transformers as primary product types. Three Phase transformers are dominant in residential and commercial applications, supported by global electrification efforts. The Asia Pacific region is expected to lead growth due to rapid industrialization, smart city initiatives, and infrastructure investments. North America and Europe offer significant opportunities for retrofitting and upgrading existing power systems. Leading companies like Siemens AG, ABB Ltd, and Hitachi Energy Ltd are innovating advanced dry type transformer solutions for a sustainable power grid. Potential challenges include the initial cost premium and raw material availability.

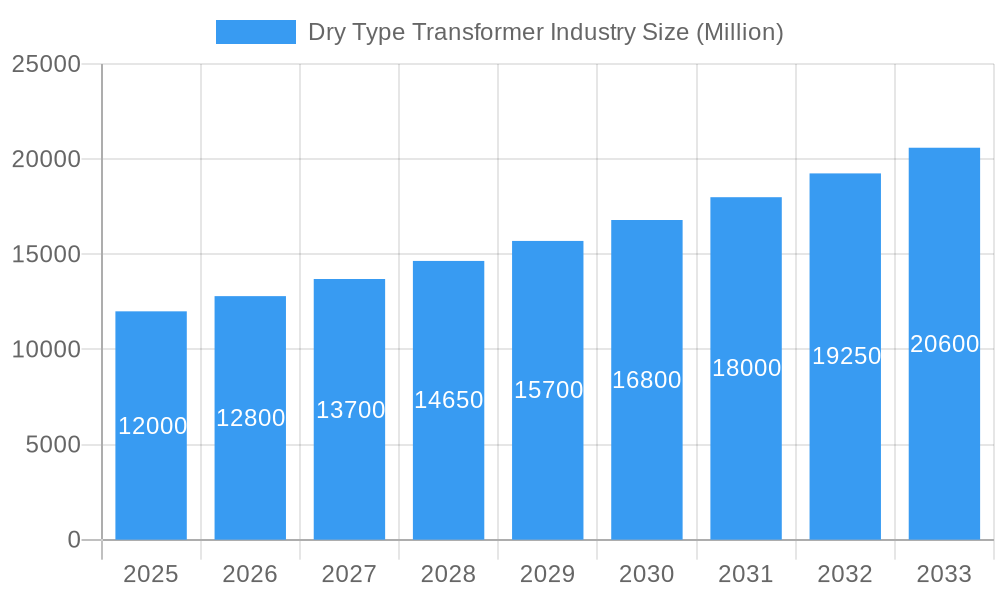

Dry Type Transformer Industry Company Market Share

This report provides an in-depth analysis of the Dry Type Transformer Industry, covering market size, trends, drivers, challenges, and the competitive landscape. The study period is from 2019 to 2033, with a base year of 2025. Key insights are offered for stakeholders navigating the evolving global dry transformer market. Explore the potential of low voltage dry type transformers, medium voltage dry type transformers, power transformers, and distribution transformers in single-phase and three-phase applications.

Dry Type Transformer Industry Market Structure & Competitive Dynamics

The Dry Type Transformer Industry exhibits a moderately concentrated market structure, with a significant presence of global players alongside regional specialists. Key companies such as Siemens AG, Hitachi Energy Ltd, ABB Ltd, and Schneider Electric SE hold substantial market share due to their extensive product portfolios, technological prowess, and established distribution networks. Innovation plays a pivotal role, with companies investing heavily in Research and Development to enhance efficiency, sustainability, and safety features of cast resin transformers and vacuum pressure impregnated (VPI) transformers. The regulatory landscape, particularly concerning environmental standards and grid modernization initiatives, shapes product development and market entry strategies. Product substitutes, primarily oil-filled transformers, continue to be a factor, but the advantages of dry-type transformers, such as fire safety and reduced environmental impact, are driving their adoption. End-user trends favoring decentralization, electrification, and renewable energy integration are creating new opportunities. Merger and Acquisition (M&A) activities, while not as rampant as in some other industrial sectors, are observed, particularly for companies looking to acquire specific technological capabilities or expand their geographic reach. For instance, acquisitions that bolster expertise in advanced insulation techniques or smart grid integration are highly valued. The market share of leading players is estimated to be around 60-70% combined, with M&A deal values often in the range of tens to hundreds of millions of dollars.

Dry Type Transformer Industry Industry Trends & Insights

The Dry Type Transformer Industry is experiencing robust growth, fueled by several interconnected trends and insights. A significant market growth driver is the global push towards enhanced grid resilience and the integration of renewable energy sources. Governments worldwide are investing heavily in upgrading electrical infrastructure, leading to increased demand for reliable and safe power distribution solutions. This creates a fertile ground for dry type transformers, which offer superior fire safety and environmental compliance compared to their oil-filled counterparts, a critical consideration in urban and environmentally sensitive areas. Technological disruptions are at the forefront, with advancements in insulation materials, cooling technologies, and intelligent monitoring systems transforming the dry transformer market. For example, the development of advanced cast resin insulation is enabling transformers to operate at higher temperatures and with greater efficiency. Furthermore, the integration of IoT and AI capabilities into transformers for predictive maintenance and real-time performance monitoring is becoming a key differentiator. Consumer preferences are shifting towards solutions that minimize environmental impact and operational costs. The inherent safety features of dry-type transformers, requiring less maintenance and posing a lower risk of environmental contamination, align perfectly with these preferences. Competitive dynamics are characterized by a race for innovation, cost optimization, and market penetration in emerging economies. The global dry type transformer market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025-2033). Market penetration of dry-type transformers is steadily increasing, particularly in sectors like industrial manufacturing, commercial buildings, and urban infrastructure, driven by stringent safety regulations and a growing awareness of their long-term economic benefits. The total market size is projected to reach over $20 billion by 2033.

Dominant Markets & Segments in Dry Type Transformer Industry

The Dry Type Transformer Industry showcases distinct dominance across various regions and segments.

Dominant Region: North America and Europe

- Key Drivers: Stringent environmental regulations, well-established industrial infrastructure, significant investments in grid modernization, and a high adoption rate for advanced technologies contribute to the dominance of North America and Europe. The focus on renewable energy integration and the upgrading of aging power grids further bolster demand for reliable medium voltage dry type transformers and power transformers. Economic policies supporting sustainable energy solutions and infrastructure development are critical accelerators in these regions.

- Detailed Dominance Analysis: These regions are leading in terms of market value and adoption of high-efficiency, environmentally friendly dry type distribution transformers. The presence of major manufacturing hubs and advanced research institutions fosters continuous innovation and the deployment of sophisticated dry-type transformer technologies.

Dominant Segment: Medium Voltage Dry Type Transformers

- Key Drivers: The widespread application of medium voltage transformers in industrial facilities, commercial complexes, and for utility power distribution makes this segment a significant contributor to the overall market. The need for safe and reliable power supply in these critical sectors drives the demand for medium voltage dry type transformers. Infrastructure development projects and industrial expansion are key economic drivers.

- Detailed Dominance Analysis: This segment accounts for a substantial portion of the dry transformer market due to its crucial role in the power transmission and distribution network. The ability of these transformers to handle higher voltage levels while maintaining safety standards makes them indispensable.

Dominant Segment: Three Phase Transformers

- Key Drivers: The majority of industrial and commercial applications require three-phase power for efficient operation of heavy machinery and electrical systems. This fundamental requirement fuels the dominance of three-phase dry type transformers. Growing industrialization and the increasing complexity of electrical loads are primary drivers.

- Detailed Dominance Analysis: Three-phase dry-type transformers are the workhorses of industrial power distribution. Their capacity to efficiently deliver power to multiple loads simultaneously makes them essential for manufacturing plants, data centers, and large commercial establishments.

Dominant Segment: Power Transformers

- Key Drivers: Power transformers are essential for stepping up or stepping down voltage levels in transmission and distribution networks. The continuous expansion and modernization of electrical grids globally necessitate a strong demand for reliable dry type power transformers, especially in locations where safety and environmental concerns are paramount. Significant government investments in energy infrastructure are key economic policies.

- Detailed Dominance Analysis: While distribution transformers cater to localized power needs, power transformers are critical for the backbone of the electrical grid. The trend towards decentralized power generation and smart grids further amplifies the need for advanced dry type power transformer solutions.

Dry Type Transformer Industry Product Innovations

The Dry Type Transformer Industry is witnessing significant product innovations aimed at enhancing performance, safety, and sustainability. Companies are developing transformers with improved cast resin insulation and VPI technologies, allowing for higher operating temperatures and increased power density. Innovations in cooling systems, such as forced air cooling and integrated fan designs, are improving efficiency and reducing physical footprints. The integration of smart grid functionalities, including advanced sensors and communication modules for real-time monitoring and predictive maintenance, is a key trend. These advancements offer competitive advantages by reducing operational costs, minimizing downtime, and improving grid reliability. Applications are expanding beyond traditional industrial and commercial uses to include renewable energy substations, data centers, and specialized urban installations where fire safety and environmental compliance are critical.

Report Segmentation & Scope

This report segments the Dry Type Transformer Industry across several key categories to provide a granular market view.

- Voltage: This segmentation covers Low Voltage Dry Type Transformers (typically up to 1,000V) and Medium Voltage Dry Type Transformers (ranging from 1,000V to 35kV). Low voltage transformers are crucial for final power distribution in commercial and residential buildings, while medium voltage transformers are essential for industrial applications and utility substations.

- Type: The report analyzes the Power Transformer segment, which handles high voltage transmission and distribution, and the Distribution Transformer segment, which steps down voltage for end-user consumption. Power transformers are characterized by higher ratings and are integral to the grid's backbone, whereas distribution transformers are deployed closer to the point of consumption.

- End Phase: This segmentation focuses on Single Phase Dry Type Transformers, primarily used in residential and light commercial applications, and Three Phase Dry Type Transformers, which are the standard for industrial, commercial, and utility operations due to their efficiency in powering larger equipment.

Each segment is analyzed for its market size, growth projections, and competitive dynamics within the broader dry transformer market.

Key Drivers of Dry Type Transformer Industry Growth

Several key factors are propelling the growth of the Dry Type Transformer Industry. The escalating global emphasis on grid modernization and the integration of renewable energy sources, such as solar and wind power, necessitates advanced and safe transformer solutions. Governments' commitment to decarbonization and sustainable energy policies actively promotes the adoption of environmentally friendly technologies like dry-type transformers, which eliminate the risk of oil leaks and associated environmental hazards. Technological advancements in insulation materials and cooling systems are enhancing the efficiency, reliability, and safety of these transformers, making them increasingly competitive against traditional oil-filled units. Furthermore, the growing trend of urbanization and industrialization in developing economies is creating substantial demand for reliable power distribution infrastructure, where dry-type transformers offer a superior safety profile for densely populated areas and critical industrial facilities.

Challenges in the Dry Type Transformer Industry Sector

Despite the promising growth trajectory, the Dry Type Transformer Industry faces certain challenges. One significant barrier is the higher initial cost of dry-type transformers compared to conventional oil-filled transformers, which can deter adoption in cost-sensitive markets or applications. While total cost of ownership is often lower due to reduced maintenance and safety expenditures, the upfront investment remains a hurdle. Regulatory frameworks, while generally supportive of dry-type technology, can sometimes be complex and vary significantly across regions, potentially creating compliance challenges for manufacturers and end-users. Supply chain disruptions, particularly concerning the availability of specialized raw materials and components, can impact production timelines and costs. Moreover, the established infrastructure and familiarity with oil-filled transformers in certain legacy applications present a competitive pressure, requiring ongoing efforts to educate the market on the benefits of dry-type alternatives.

Leading Players in the Dry Type Transformer Industry Market

- Kirloskar Electric Company Ltd

- ABB Ltd

- Hyundai Electric & Energy Systems Co Ltd

- Hitachi Energy Ltd

- Gujarat Transformers Private Limited

- Siemens AG

- Schneider Electric SE

- Eaton Corporation PLC

- Hammond Power Solutions Inc

- TBEA Co Ltd

Key Developments in Dry Type Transformer Industry Sector

- April 2022: Siemens Energy launched an innovative dry-type single-phase transformer for pole applications. Designed for the technological requirements of the American grid, the new cast-resin distribution transformer provides a reliable and sustainable alternative to oil-filled transformers.

- September 2022: Hitachi Energy launched a plug-and-play dry-type traction transformer with an integrated cooling system, designed to reduce CO2 emissions and total operating costs while increasing energy efficiency.

Strategic Dry Type Transformer Industry Market Outlook

The strategic outlook for the Dry Type Transformer Industry is exceptionally strong, driven by an accelerating global commitment to sustainable energy and resilient infrastructure. Growth accelerators include the ongoing transition to smart grids, the increasing adoption of electric vehicles and charging infrastructure, and the continuous expansion of data centers, all of which demand highly efficient and safe power distribution solutions. Investments in upgrading aging power grids and building new renewable energy facilities will continue to fuel demand for advanced medium voltage dry type transformers and power transformers. The inherent safety and environmental benefits of dry-type technology position it favorably in an era of heightened environmental consciousness and stricter regulations. Strategic opportunities lie in developing next-generation transformers with enhanced digital capabilities, improved energy efficiency, and innovative cooling solutions, catering to specialized industrial needs and contributing to a greener, more reliable global energy future. The market is poised for sustained expansion, with significant potential for both established players and emerging innovators.

Dry Type Transformer Industry Segmentation

-

1. Voltage

- 1.1. Low Voltage

- 1.2. Medium Voltage

-

2. Type

- 2.1. Power Transformer

- 2.2. Distribution Transformer

-

3. End Phase

- 3.1. Single Phase

- 3.2. Three Phase

Dry Type Transformer Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Dry Type Transformer Industry Regional Market Share

Geographic Coverage of Dry Type Transformer Industry

Dry Type Transformer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Power Demand4.; Substantial Investments And Efforts To Modernize The T&D Grid

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Distributed Energy Generation

- 3.4. Market Trends

- 3.4.1. Distribution Transformer to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dry Type Transformer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 5.1.1. Low Voltage

- 5.1.2. Medium Voltage

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Power Transformer

- 5.2.2. Distribution Transformer

- 5.3. Market Analysis, Insights and Forecast - by End Phase

- 5.3.1. Single Phase

- 5.3.2. Three Phase

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 6. North America Dry Type Transformer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 6.1.1. Low Voltage

- 6.1.2. Medium Voltage

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Power Transformer

- 6.2.2. Distribution Transformer

- 6.3. Market Analysis, Insights and Forecast - by End Phase

- 6.3.1. Single Phase

- 6.3.2. Three Phase

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 7. Europe Dry Type Transformer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 7.1.1. Low Voltage

- 7.1.2. Medium Voltage

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Power Transformer

- 7.2.2. Distribution Transformer

- 7.3. Market Analysis, Insights and Forecast - by End Phase

- 7.3.1. Single Phase

- 7.3.2. Three Phase

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 8. Asia Pacific Dry Type Transformer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 8.1.1. Low Voltage

- 8.1.2. Medium Voltage

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Power Transformer

- 8.2.2. Distribution Transformer

- 8.3. Market Analysis, Insights and Forecast - by End Phase

- 8.3.1. Single Phase

- 8.3.2. Three Phase

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 9. South America Dry Type Transformer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Voltage

- 9.1.1. Low Voltage

- 9.1.2. Medium Voltage

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Power Transformer

- 9.2.2. Distribution Transformer

- 9.3. Market Analysis, Insights and Forecast - by End Phase

- 9.3.1. Single Phase

- 9.3.2. Three Phase

- 9.1. Market Analysis, Insights and Forecast - by Voltage

- 10. Middle East and Africa Dry Type Transformer Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Voltage

- 10.1.1. Low Voltage

- 10.1.2. Medium Voltage

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Power Transformer

- 10.2.2. Distribution Transformer

- 10.3. Market Analysis, Insights and Forecast - by End Phase

- 10.3.1. Single Phase

- 10.3.2. Three Phase

- 10.1. Market Analysis, Insights and Forecast - by Voltage

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kirloskar Electric Company Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hyundai Electric & Energy Systems Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hitachi Energy Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gujarat Transformers Private Limited*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schneider Electric SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eaton Corporation PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hammond Power Solutions Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TBEA Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Kirloskar Electric Company Ltd

List of Figures

- Figure 1: Global Dry Type Transformer Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Dry Type Transformer Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Dry Type Transformer Industry Revenue (billion), by Voltage 2025 & 2033

- Figure 4: North America Dry Type Transformer Industry Volume (K Units), by Voltage 2025 & 2033

- Figure 5: North America Dry Type Transformer Industry Revenue Share (%), by Voltage 2025 & 2033

- Figure 6: North America Dry Type Transformer Industry Volume Share (%), by Voltage 2025 & 2033

- Figure 7: North America Dry Type Transformer Industry Revenue (billion), by Type 2025 & 2033

- Figure 8: North America Dry Type Transformer Industry Volume (K Units), by Type 2025 & 2033

- Figure 9: North America Dry Type Transformer Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Dry Type Transformer Industry Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Dry Type Transformer Industry Revenue (billion), by End Phase 2025 & 2033

- Figure 12: North America Dry Type Transformer Industry Volume (K Units), by End Phase 2025 & 2033

- Figure 13: North America Dry Type Transformer Industry Revenue Share (%), by End Phase 2025 & 2033

- Figure 14: North America Dry Type Transformer Industry Volume Share (%), by End Phase 2025 & 2033

- Figure 15: North America Dry Type Transformer Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Dry Type Transformer Industry Volume (K Units), by Country 2025 & 2033

- Figure 17: North America Dry Type Transformer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Dry Type Transformer Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Dry Type Transformer Industry Revenue (billion), by Voltage 2025 & 2033

- Figure 20: Europe Dry Type Transformer Industry Volume (K Units), by Voltage 2025 & 2033

- Figure 21: Europe Dry Type Transformer Industry Revenue Share (%), by Voltage 2025 & 2033

- Figure 22: Europe Dry Type Transformer Industry Volume Share (%), by Voltage 2025 & 2033

- Figure 23: Europe Dry Type Transformer Industry Revenue (billion), by Type 2025 & 2033

- Figure 24: Europe Dry Type Transformer Industry Volume (K Units), by Type 2025 & 2033

- Figure 25: Europe Dry Type Transformer Industry Revenue Share (%), by Type 2025 & 2033

- Figure 26: Europe Dry Type Transformer Industry Volume Share (%), by Type 2025 & 2033

- Figure 27: Europe Dry Type Transformer Industry Revenue (billion), by End Phase 2025 & 2033

- Figure 28: Europe Dry Type Transformer Industry Volume (K Units), by End Phase 2025 & 2033

- Figure 29: Europe Dry Type Transformer Industry Revenue Share (%), by End Phase 2025 & 2033

- Figure 30: Europe Dry Type Transformer Industry Volume Share (%), by End Phase 2025 & 2033

- Figure 31: Europe Dry Type Transformer Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Dry Type Transformer Industry Volume (K Units), by Country 2025 & 2033

- Figure 33: Europe Dry Type Transformer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Dry Type Transformer Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Dry Type Transformer Industry Revenue (billion), by Voltage 2025 & 2033

- Figure 36: Asia Pacific Dry Type Transformer Industry Volume (K Units), by Voltage 2025 & 2033

- Figure 37: Asia Pacific Dry Type Transformer Industry Revenue Share (%), by Voltage 2025 & 2033

- Figure 38: Asia Pacific Dry Type Transformer Industry Volume Share (%), by Voltage 2025 & 2033

- Figure 39: Asia Pacific Dry Type Transformer Industry Revenue (billion), by Type 2025 & 2033

- Figure 40: Asia Pacific Dry Type Transformer Industry Volume (K Units), by Type 2025 & 2033

- Figure 41: Asia Pacific Dry Type Transformer Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: Asia Pacific Dry Type Transformer Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: Asia Pacific Dry Type Transformer Industry Revenue (billion), by End Phase 2025 & 2033

- Figure 44: Asia Pacific Dry Type Transformer Industry Volume (K Units), by End Phase 2025 & 2033

- Figure 45: Asia Pacific Dry Type Transformer Industry Revenue Share (%), by End Phase 2025 & 2033

- Figure 46: Asia Pacific Dry Type Transformer Industry Volume Share (%), by End Phase 2025 & 2033

- Figure 47: Asia Pacific Dry Type Transformer Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Dry Type Transformer Industry Volume (K Units), by Country 2025 & 2033

- Figure 49: Asia Pacific Dry Type Transformer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Dry Type Transformer Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Dry Type Transformer Industry Revenue (billion), by Voltage 2025 & 2033

- Figure 52: South America Dry Type Transformer Industry Volume (K Units), by Voltage 2025 & 2033

- Figure 53: South America Dry Type Transformer Industry Revenue Share (%), by Voltage 2025 & 2033

- Figure 54: South America Dry Type Transformer Industry Volume Share (%), by Voltage 2025 & 2033

- Figure 55: South America Dry Type Transformer Industry Revenue (billion), by Type 2025 & 2033

- Figure 56: South America Dry Type Transformer Industry Volume (K Units), by Type 2025 & 2033

- Figure 57: South America Dry Type Transformer Industry Revenue Share (%), by Type 2025 & 2033

- Figure 58: South America Dry Type Transformer Industry Volume Share (%), by Type 2025 & 2033

- Figure 59: South America Dry Type Transformer Industry Revenue (billion), by End Phase 2025 & 2033

- Figure 60: South America Dry Type Transformer Industry Volume (K Units), by End Phase 2025 & 2033

- Figure 61: South America Dry Type Transformer Industry Revenue Share (%), by End Phase 2025 & 2033

- Figure 62: South America Dry Type Transformer Industry Volume Share (%), by End Phase 2025 & 2033

- Figure 63: South America Dry Type Transformer Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: South America Dry Type Transformer Industry Volume (K Units), by Country 2025 & 2033

- Figure 65: South America Dry Type Transformer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Dry Type Transformer Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Dry Type Transformer Industry Revenue (billion), by Voltage 2025 & 2033

- Figure 68: Middle East and Africa Dry Type Transformer Industry Volume (K Units), by Voltage 2025 & 2033

- Figure 69: Middle East and Africa Dry Type Transformer Industry Revenue Share (%), by Voltage 2025 & 2033

- Figure 70: Middle East and Africa Dry Type Transformer Industry Volume Share (%), by Voltage 2025 & 2033

- Figure 71: Middle East and Africa Dry Type Transformer Industry Revenue (billion), by Type 2025 & 2033

- Figure 72: Middle East and Africa Dry Type Transformer Industry Volume (K Units), by Type 2025 & 2033

- Figure 73: Middle East and Africa Dry Type Transformer Industry Revenue Share (%), by Type 2025 & 2033

- Figure 74: Middle East and Africa Dry Type Transformer Industry Volume Share (%), by Type 2025 & 2033

- Figure 75: Middle East and Africa Dry Type Transformer Industry Revenue (billion), by End Phase 2025 & 2033

- Figure 76: Middle East and Africa Dry Type Transformer Industry Volume (K Units), by End Phase 2025 & 2033

- Figure 77: Middle East and Africa Dry Type Transformer Industry Revenue Share (%), by End Phase 2025 & 2033

- Figure 78: Middle East and Africa Dry Type Transformer Industry Volume Share (%), by End Phase 2025 & 2033

- Figure 79: Middle East and Africa Dry Type Transformer Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: Middle East and Africa Dry Type Transformer Industry Volume (K Units), by Country 2025 & 2033

- Figure 81: Middle East and Africa Dry Type Transformer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Dry Type Transformer Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dry Type Transformer Industry Revenue billion Forecast, by Voltage 2020 & 2033

- Table 2: Global Dry Type Transformer Industry Volume K Units Forecast, by Voltage 2020 & 2033

- Table 3: Global Dry Type Transformer Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global Dry Type Transformer Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 5: Global Dry Type Transformer Industry Revenue billion Forecast, by End Phase 2020 & 2033

- Table 6: Global Dry Type Transformer Industry Volume K Units Forecast, by End Phase 2020 & 2033

- Table 7: Global Dry Type Transformer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Dry Type Transformer Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Global Dry Type Transformer Industry Revenue billion Forecast, by Voltage 2020 & 2033

- Table 10: Global Dry Type Transformer Industry Volume K Units Forecast, by Voltage 2020 & 2033

- Table 11: Global Dry Type Transformer Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Dry Type Transformer Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 13: Global Dry Type Transformer Industry Revenue billion Forecast, by End Phase 2020 & 2033

- Table 14: Global Dry Type Transformer Industry Volume K Units Forecast, by End Phase 2020 & 2033

- Table 15: Global Dry Type Transformer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Dry Type Transformer Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Global Dry Type Transformer Industry Revenue billion Forecast, by Voltage 2020 & 2033

- Table 18: Global Dry Type Transformer Industry Volume K Units Forecast, by Voltage 2020 & 2033

- Table 19: Global Dry Type Transformer Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Dry Type Transformer Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 21: Global Dry Type Transformer Industry Revenue billion Forecast, by End Phase 2020 & 2033

- Table 22: Global Dry Type Transformer Industry Volume K Units Forecast, by End Phase 2020 & 2033

- Table 23: Global Dry Type Transformer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Dry Type Transformer Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Global Dry Type Transformer Industry Revenue billion Forecast, by Voltage 2020 & 2033

- Table 26: Global Dry Type Transformer Industry Volume K Units Forecast, by Voltage 2020 & 2033

- Table 27: Global Dry Type Transformer Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Global Dry Type Transformer Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 29: Global Dry Type Transformer Industry Revenue billion Forecast, by End Phase 2020 & 2033

- Table 30: Global Dry Type Transformer Industry Volume K Units Forecast, by End Phase 2020 & 2033

- Table 31: Global Dry Type Transformer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global Dry Type Transformer Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Global Dry Type Transformer Industry Revenue billion Forecast, by Voltage 2020 & 2033

- Table 34: Global Dry Type Transformer Industry Volume K Units Forecast, by Voltage 2020 & 2033

- Table 35: Global Dry Type Transformer Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 36: Global Dry Type Transformer Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 37: Global Dry Type Transformer Industry Revenue billion Forecast, by End Phase 2020 & 2033

- Table 38: Global Dry Type Transformer Industry Volume K Units Forecast, by End Phase 2020 & 2033

- Table 39: Global Dry Type Transformer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global Dry Type Transformer Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Global Dry Type Transformer Industry Revenue billion Forecast, by Voltage 2020 & 2033

- Table 42: Global Dry Type Transformer Industry Volume K Units Forecast, by Voltage 2020 & 2033

- Table 43: Global Dry Type Transformer Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 44: Global Dry Type Transformer Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 45: Global Dry Type Transformer Industry Revenue billion Forecast, by End Phase 2020 & 2033

- Table 46: Global Dry Type Transformer Industry Volume K Units Forecast, by End Phase 2020 & 2033

- Table 47: Global Dry Type Transformer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Dry Type Transformer Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dry Type Transformer Industry?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the Dry Type Transformer Industry?

Key companies in the market include Kirloskar Electric Company Ltd, ABB Ltd, Hyundai Electric & Energy Systems Co Ltd, Hitachi Energy Ltd, Gujarat Transformers Private Limited*List Not Exhaustive, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, Hammond Power Solutions Inc, TBEA Co Ltd.

3. What are the main segments of the Dry Type Transformer Industry?

The market segments include Voltage, Type, End Phase.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.12 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Power Demand4.; Substantial Investments And Efforts To Modernize The T&D Grid.

6. What are the notable trends driving market growth?

Distribution Transformer to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Distributed Energy Generation.

8. Can you provide examples of recent developments in the market?

April 2022: Siemens Energy launched an innovative dry-type single-phase transformer for pole applications. Designed for the technological requirements of the American grid, the new cast-resin distribution transformer provides a reliable and sustainable alternative to oil-filled transformers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dry Type Transformer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dry Type Transformer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dry Type Transformer Industry?

To stay informed about further developments, trends, and reports in the Dry Type Transformer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence