Key Insights

India's Nuclear Power Plant Equipment Market is projected for substantial growth, fueled by the nation's commitment to energy security and increasing power demands. The market is estimated to reach $41.7 billion by 2024, with a projected Compound Annual Growth Rate (CAGR) of 2.89% through 2033. Government initiatives to expand nuclear energy capacity, diversify the energy mix from fossil fuels, and achieve cleaner energy targets are key drivers. This includes the development of new nuclear power projects, the enhancement of existing facilities, and the adoption of advanced reactor technologies. Demand for both critical island equipment, such as reactors and turbines, and essential auxiliary systems like cooling and safety apparatus, is expected to rise significantly. Nuclear power plays a crucial role in India's future energy strategy, offering considerable opportunities for global and domestic equipment suppliers.

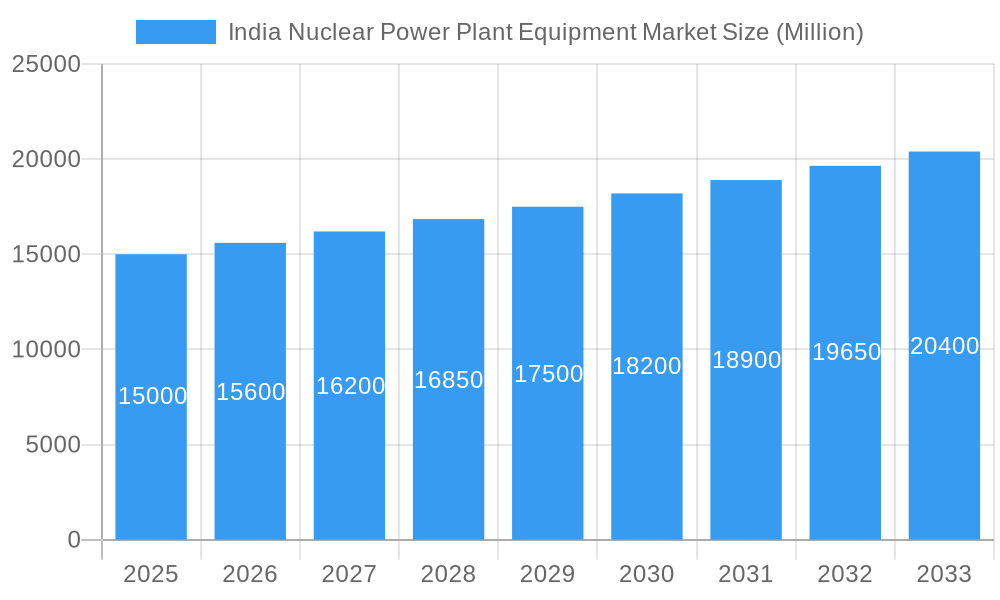

India Nuclear Power Plant Equipment Market Market Size (In Billion)

Market dynamics are further influenced by the emphasis on indigenous manufacturing and "Make in India" initiatives, promoting a self-sufficient ecosystem. Advancements in Pressurized Water Reactor (PWR) and Pressurized Heavy Water Reactor (PHWR) technologies, alongside exploration of other reactor designs, are shaping equipment specifications. However, stringent regulations, extended project timelines, and significant capital investment pose challenges. Despite these, the drive for sustainable energy solutions and continuous technological upgrades are expected to propel market expansion. Leading players such as Larsen & Toubro Ltd, Westinghouse Electric Company LLC, and Bharat Heavy Electricals Limited underscore the competitive and promising nature of this sector. India's focus on increasing nuclear capacity for power generation and strategic purposes guarantees sustained demand for specialized equipment.

India Nuclear Power Plant Equipment Market Company Market Share

This comprehensive report provides an in-depth analysis of the India Nuclear Power Plant Equipment Market, offering critical insights into market structure, trends, key segments, and future projections. Covering the period from 2019 to 2033, with 2024 as the base year, this report is an essential resource for stakeholders navigating the evolving landscape of India's nuclear energy sector. Utilizing advanced analytical methodologies, the report forecasts market growth and identifies pivotal drivers and challenges. The market is meticulously segmented by reactor type (Pressurized Water Reactor (PWR), Pressurized Heavy Water Reactor (PHWR), Other Reactor Types), equipment type (Island Equipment, Auxiliary Equipment), and carrier type (Research Reactor). The forecast period from 2024 to 2033 presents significant opportunities driven by government support and technological innovation.

India Nuclear Power Plant Equipment Market Market Structure & Competitive Dynamics

The India Nuclear Power Plant Equipment Market exhibits a moderately consolidated structure, with a few prominent global and domestic players holding significant market share. Key companies like Larsen & Toubro Ltd, Westinghouse Electric Company LLC, Dongfang Electric Corp Limited, Doosan Corporation, Bharat Heavy Electricals Limited, Hindustan Construction Company, Rosatom State Atomic Energy Corporation, and Mitsubishi Heavy Industries Ltd are actively involved in manufacturing and supplying a wide range of nuclear power plant equipment. Innovation plays a crucial role, with continuous research and development focused on enhancing safety, efficiency, and cost-effectiveness of nuclear technologies. The regulatory framework, governed by the Atomic Energy Regulatory Board (AERB) and the Department of Atomic Energy (DAE), is stringent, prioritizing safety and security. Product substitutes, while limited in the context of primary power generation, might include advanced renewable energy solutions in the long term. End-user trends indicate a growing preference for cleaner energy sources, driving sustained demand for nuclear power infrastructure. Mergers and acquisitions (M&A) activities, though not extensively documented publicly, are strategic maneuvers for companies to expand their product portfolios and geographical reach. For instance, strategic partnerships and collaborations are more prevalent than outright acquisitions, facilitating technology transfer and joint project development, further shaping the competitive dynamics and market share distribution within the India Nuclear Power Plant Equipment Market. The estimated market share of leading players is subject to project-specific contracts and technological advancements, but collectively, these entities are instrumental in shaping the market's competitive landscape.

India Nuclear Power Plant Equipment Market Industry Trends & Insights

The India Nuclear Power Plant Equipment Market is poised for substantial growth, fueled by India's ambitious energy security goals and its commitment to reducing carbon emissions. The India Nuclear Power Plant Equipment Market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This growth is primarily driven by the Indian government's proactive policies aimed at expanding its nuclear power generation capacity to meet rising energy demands and achieve energy independence. A significant trend is the increasing adoption of advanced reactor technologies, including Generation III and III+ reactors, which offer enhanced safety features and improved operational efficiency. The "Make in India" initiative further encourages domestic manufacturing of nuclear equipment, fostering innovation and creating opportunities for local enterprises. Furthermore, international collaborations and technology transfer agreements are playing a vital role in accelerating the development and deployment of new nuclear power projects. The rising cost of fossil fuels and the growing global emphasis on sustainable energy sources are also contributing to the resurgence of interest in nuclear power as a reliable and clean baseload energy option. Technological disruptions, such as advancements in small modular reactors (SMRs) and fusion energy research, while still in their nascent stages, hold the potential to reshape the future of nuclear power generation and the associated equipment market. Consumer preferences are gradually shifting towards cleaner energy solutions, with nuclear power recognized for its low carbon footprint and consistent energy supply, thereby bolstering the demand for India Nuclear Power Plant Equipment. The competitive dynamics are characterized by a blend of established global manufacturers and emerging domestic players, each vying for a share in this high-growth market. The India Nuclear Power Plant Equipment Market penetration is projected to increase significantly as more projects move from the planning to the execution phase. The government's commitment to achieving Net Zero emissions by 2070 further underscores the strategic importance of nuclear power in India's energy mix.

Dominant Markets & Segments in India Nuclear Power Plant Equipment Market

The India Nuclear Power Plant Equipment Market is significantly influenced by government policies, economic development, and the inherent characteristics of different reactor types and equipment. Within the Reactor Type segmentation, Pressurized Heavy Water Reactors (PHWRs) have historically dominated the Indian nuclear landscape due to India's indigenous technological capabilities and the availability of natural uranium. PHWRs are well-suited to India's fuel cycle and have been extensively deployed. However, there is a growing interest and planned expansion in Pressurized Water Reactors (PWRs), often through international collaborations, which offer higher power densities and potentially improved efficiency. Other Reactor Types, including Fast Breeder Reactors (FBRs) and advanced generation reactors, are also part of India's long-term nuclear vision, although their market penetration for commercial power generation is currently limited.

In terms of Carrier Type, Island Equipment constitutes the largest and most critical segment. This includes the nuclear steam supply system (NSSS), turbines, generators, and other core components directly involved in power generation within the reactor island. The high value and complex engineering involved in these systems make it a significant market driver. Auxiliary Equipment, while individual components might be of lower value, represents a substantial and continuous market due to its sheer volume and the ongoing maintenance and replacement needs of existing and new plants. This segment includes pumps, valves, heat exchangers, control systems, and safety equipment. Research Reactors, though smaller in scale and capacity, represent a niche but important segment, crucial for fuel cycle research, material science, and training, requiring specialized equipment.

Key drivers for dominance include:

- Economic Policies: Government incentives, subsidies, and long-term power purchase agreements play a crucial role in making nuclear power economically viable and driving investment in associated equipment.

- Infrastructure Development: The availability of land, water resources for cooling, and robust grid connectivity are essential for the establishment of nuclear power plants, influencing the scale and location of equipment demand.

- Technological Expertise: India's indigenous R&D capabilities in PHWR technology have historically given it a leading edge, while its growing openness to foreign collaboration is expanding its options in PWR technology.

- Safety Regulations: Strict adherence to global safety standards and the continuous upgrading of safety features in both reactor designs and associated equipment are paramount and influence purchasing decisions.

The dominance analysis reveals a strong focus on expanding the baseload power capacity, with PHWRs continuing to be a cornerstone, while PWRs are gaining traction for future projects. The demand for robust and reliable island and auxiliary equipment will remain consistently high, driven by both new construction and the operational lifecycle of existing plants. The India Nuclear Power Plant Equipment Market is thus characterized by a dynamic interplay of established indigenous capabilities and the strategic adoption of international advancements across its diverse segments.

India Nuclear Power Plant Equipment Market Product Innovations

Product innovations in the India Nuclear Power Plant Equipment Market are primarily focused on enhancing safety, improving operational efficiency, and reducing construction timelines and costs. This includes the development of advanced reactor designs with passive safety features, such as those in Generation III+ and IV reactors, which significantly minimize the risk of accidents. Innovations in fuel technology, such as accident-tolerant fuels, are also crucial for improving reactor performance and safety margins. Furthermore, the digitalization of control and instrumentation systems, incorporating artificial intelligence and machine learning, is leading to smarter, more responsive, and more reliable plant operations. The development of modular components and advanced manufacturing techniques, like additive manufacturing, is contributing to faster assembly and reduced on-site construction challenges, thereby offering a competitive advantage in a market seeking cost-effective and time-efficient solutions.

Report Segmentation & Scope

The India Nuclear Power Plant Equipment Market is segmented by Reactor Type and Carrier Type.

- Reactor Type: This segmentation includes Pressurized Water Reactor (PWR), Pressurized Heavy Water Reactor (PHWR), and Other Reactor Types such as Fast Breeder Reactors. The PWR segment is expected to witness robust growth due to international collaborations, while PHWRs will continue to be a significant contributor. Other reactor types represent the future growth potential of the market.

- Carrier Type: This segmentation comprises Island Equipment, Auxiliary Equipment, and Research Reactor equipment. Island Equipment, including the nuclear steam supply system and turbine-generator sets, will maintain its position as the largest segment by value. Auxiliary Equipment, covering a wide range of components like pumps, valves, and control systems, represents a stable and consistent demand. Research Reactors cater to specialized applications and are crucial for technological advancements and training. Growth projections and competitive dynamics will vary across these sub-segments based on ongoing and planned nuclear projects.

Key Drivers of India Nuclear Power Plant Equipment Market Growth

The India Nuclear Power Plant Equipment Market is propelled by several key drivers. Foremost is the Indian government's strong political will and policy support for expanding nuclear energy as a clean and reliable baseload power source. This is evident in ambitious targets for increasing installed nuclear capacity. Economic drivers include the growing demand for electricity due to industrialization and population growth, coupled with the desire to diversify the energy mix and reduce reliance on fossil fuels. Technological advancements in reactor safety and efficiency make nuclear power a more attractive option. Regulatory frameworks that are evolving to facilitate quicker project approvals and streamlined procurement processes are also crucial. The December 2022 announcement of in-principle approval for five new nuclear power plant locations signifies substantial future demand for equipment.

Challenges in the India Nuclear Power Plant Equipment Market Sector

Despite its growth potential, the India Nuclear Power Plant Equipment Market faces several challenges. Significant upfront capital investment for nuclear power projects remains a considerable barrier. The complex and lengthy regulatory approval processes, while improving, can still cause project delays. Public perception and safety concerns, though diminishing, require continuous management and transparent communication. Supply chain bottlenecks for specialized components and the need for highly skilled manpower for manufacturing, construction, and operation also pose challenges. Furthermore, geopolitical factors and the availability of uranium fuel can impact project timelines and costs. The March 2022 announcement of uranium imports highlights the reliance on external sources for certain fuel requirements, which can be subject to price volatility and supply disruptions.

Leading Players in the India Nuclear Power Plant Equipment Market Market

- Larsen & Toubro Ltd

- Westinghouse Electric Company LLC

- Dongfang Electric Corp Limited

- Doosan Corporation

- Bharat Heavy Electricals Limited

- Hindustan Construction Company

- Rosatom State Atomic Energy Corporation

- Mitsubishi Heavy Industries Ltd

Key Developments in India Nuclear Power Plant Equipment Market Sector

- December 2022: The Indian government announced that it, in principle, approved five new locations for building nuclear power plants in the future. This strategic decision is expected to significantly boost the demand for a wide array of nuclear power plant equipment in the coming years.

- March 2022: The Indian government announced that the country would import 100 tonnes of natural uranium and 133 units of fuel assemblies during 2022-2023. This is expected to lower the costs of nuclear energy generation, driving the demand and development of new power plants and equipment during the forecast period.

Strategic India Nuclear Power Plant Equipment Market Market Outlook

The India Nuclear Power Plant Equipment Market presents a robust and promising outlook, characterized by sustained growth and strategic opportunities. The government's unwavering commitment to expanding nuclear energy capacity, coupled with the increasing global imperative for decarbonization, positions India as a key growth market for nuclear power plant equipment. Investments in indigenous manufacturing capabilities under the "Make in India" initiative will foster technological self-reliance and create a competitive domestic supply chain. International collaborations for advanced reactor technologies and specialized components will continue to shape the market. The projected increase in nuclear power capacity will drive demand for a comprehensive range of equipment, from large reactor components to intricate control systems, offering significant opportunities for both established and emerging players. The strategic focus on safety, efficiency, and sustainability will guide future innovations and market development.

India Nuclear Power Plant Equipment Market Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Pressurized Heavy Water Reactor

- 1.3. Other Reactor Types

-

2. Carrier Type

- 2.1. Island Equipment

- 2.2. Auxiliary Equipment

- 2.3. Research Reactor

India Nuclear Power Plant Equipment Market Segmentation By Geography

- 1. India

India Nuclear Power Plant Equipment Market Regional Market Share

Geographic Coverage of India Nuclear Power Plant Equipment Market

India Nuclear Power Plant Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Pressurized Heavy Water Reactors to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Nuclear Power Plant Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Pressurized Heavy Water Reactor

- 5.1.3. Other Reactor Types

- 5.2. Market Analysis, Insights and Forecast - by Carrier Type

- 5.2.1. Island Equipment

- 5.2.2. Auxiliary Equipment

- 5.2.3. Research Reactor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Larsen & Toubro Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Westinghouse Electric Company LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dongfang Electric Corp Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Doosan Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bharat Heavy Electricals Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hindustan Construction Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rosatom State Atomiс Energy Corporation *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi Heavy Industries Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Larsen & Toubro Ltd

List of Figures

- Figure 1: India Nuclear Power Plant Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Nuclear Power Plant Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: India Nuclear Power Plant Equipment Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 2: India Nuclear Power Plant Equipment Market Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 3: India Nuclear Power Plant Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Nuclear Power Plant Equipment Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 5: India Nuclear Power Plant Equipment Market Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 6: India Nuclear Power Plant Equipment Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Nuclear Power Plant Equipment Market?

The projected CAGR is approximately 2.89%.

2. Which companies are prominent players in the India Nuclear Power Plant Equipment Market?

Key companies in the market include Larsen & Toubro Ltd, Westinghouse Electric Company LLC, Dongfang Electric Corp Limited, Doosan Corporation, Bharat Heavy Electricals Limited, Hindustan Construction Company, Rosatom State Atomiс Energy Corporation *List Not Exhaustive, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the India Nuclear Power Plant Equipment Market?

The market segments include Reactor Type, Carrier Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.7 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population.

6. What are the notable trends driving market growth?

Pressurized Heavy Water Reactors to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

In December 2022, the Indian government announced that it, in principle, approved five new locations for building nuclear power plants in the future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Nuclear Power Plant Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Nuclear Power Plant Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Nuclear Power Plant Equipment Market?

To stay informed about further developments, trends, and reports in the India Nuclear Power Plant Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence