Key Insights

The South America portable generator market is forecast for substantial growth, projected to reach $720 million by 2033, with a CAGR of 9.2% from the base year 2024. This expansion is driven by increasing demand for reliable backup power amid severe weather, the need for mobile power in industrial operations, and consistent commercial power requirements for businesses and construction. Residential adoption is also rising due to awareness of outage risks and convenience for outdoor activities and emergency preparedness.

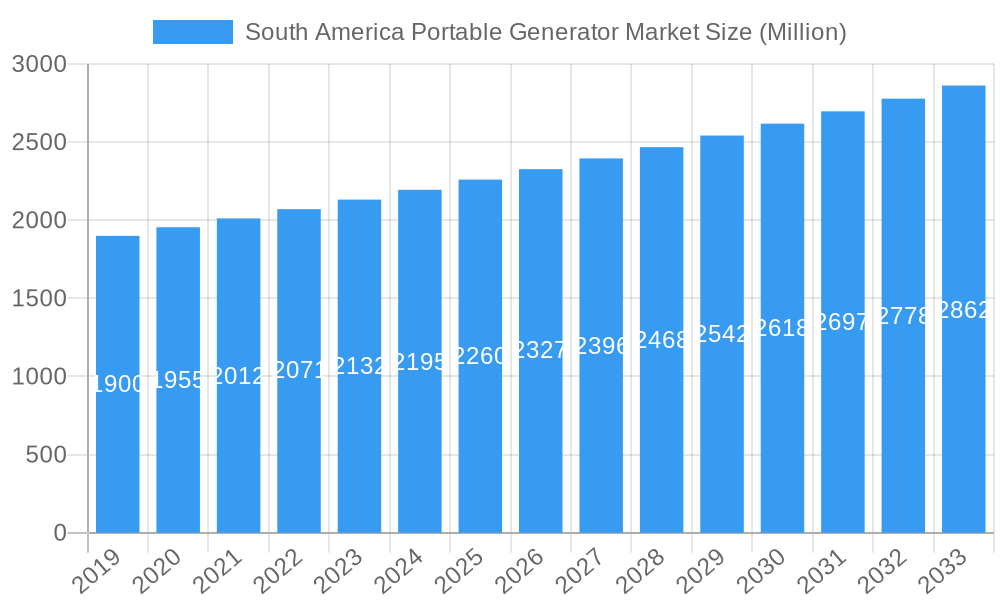

South America Portable Generator Market Market Size (In Million)

Segmentation by power rating shows strong demand for units below 5 kW and 5-10 kW. Gas-powered generators lead due to cost-effectiveness, while diesel is vital for heavy industrial use. Brazil is anticipated to be the largest market, followed by Argentina and Chile. The "Rest of South America" is expected to contribute significantly, driven by urbanization and electricity access needs. Key industry players include Caterpillar Inc., Briggs & Stratton Corporation, and Generac Holdings Inc.

South America Portable Generator Market Company Market Share

This market research report offers an in-depth analysis of the South America portable generator market from 2019 to 2033, with 2024 as the base year. It covers market dynamics, segmentation by power rating, fuel type, and end-user, alongside a detailed geographical analysis focusing on Brazil, Argentina, Chile, and the rest of the region. This report provides critical insights for stakeholders seeking to understand and leverage the growing South America portable generator market.

South America Portable Generator Market Market Structure & Competitive Dynamics

The South America portable generator market is characterized by a moderately concentrated structure, with a few key global players holding significant market share. Innovation plays a crucial role, with companies investing in research and development to enhance fuel efficiency, reduce emissions, and introduce smart features. Regulatory frameworks, though evolving, are becoming more stringent regarding noise pollution and emissions standards, influencing product development and market entry strategies. Product substitutes, such as uninterruptible power supplies (UPS) and centralized grid improvements, pose a minor threat but are often complementary solutions rather than direct replacements for portable generators. End-user trends indicate a growing preference for user-friendly, low-maintenance, and eco-friendlier generator options. Mergers and acquisitions (M&A) activities, while not as frequent as in more mature markets, are strategically important for consolidating market presence and expanding product portfolios. For instance, the acquisition of smaller regional players by larger entities can significantly alter market share distribution, with recent M&A deals valued in the tens of millions of US dollars impacting the competitive landscape. The competitive intensity is driven by factors such as price, product performance, brand reputation, and aftermarket support.

South America Portable Generator Market Industry Trends & Insights

The South America portable generator market is experiencing robust growth, driven by a confluence of factors. A primary growth driver is the increasing frequency and severity of natural disasters, including floods, hurricanes, and droughts, across the continent, necessitating reliable backup power solutions for residential, commercial, and industrial operations. Furthermore, intermittent power supply and aging grid infrastructure in several South American nations fuel a consistent demand for portable generators as essential backup power sources. Technological disruptions are shaping the market, with a notable trend towards the development of more fuel-efficient, quieter, and environmentally friendly generators. The advent of inverter technology has significantly improved power quality, making portable generators suitable for sensitive electronics, thus expanding their applicability in the commercial and residential sectors. Consumer preferences are shifting towards dual-fuel models offering flexibility and cost savings, as exemplified by the May 2022 launch of Generac Power Systems Inc.'s Powermate 7500 Watt and 4500 Watt Duel Fuel Portable Generators, capable of operating on either gasoline or LP gas. The growing awareness of the environmental impact of traditional fossil fuels is also spurring interest in alternative fuel options and hybrid generator technologies. The residential sector is a significant contributor to market growth, driven by an increasing adoption of portable generators for home backup power, outdoor recreational activities, and powering remote locations. The commercial segment, encompassing small businesses, construction sites, and event organizers, relies heavily on portable generators for uninterrupted operations. The industrial sector utilizes portable generators for critical backup power in manufacturing plants, data centers, and emergency services. The market penetration of portable generators is steadily increasing, particularly in regions with less developed power grids. The compound annual growth rate (CAGR) for the South America portable generator market is estimated to be approximately 5.8% during the forecast period of 2025-2033, underscoring a healthy expansion trajectory.

Dominant Markets & Segments in South America Portable Generator Market

Brazil stands out as the dominant market within South America for portable generators, driven by its large population, significant industrial base, and susceptibility to power outages due to its vast geography and diverse climate. Government initiatives aimed at improving energy infrastructure and promoting disaster preparedness further bolster demand. The "Rest of South America" segment, encompassing countries like Colombia, Peru, and Ecuador, is also exhibiting substantial growth, fueled by economic development and increased adoption of backup power solutions in both urban and rural areas.

Power Rating:

- Below 5 kW: This segment holds a significant market share due to its affordability, portability, and suitability for residential use, powering essential appliances during outages and for recreational purposes. Economic policies promoting lower-cost energy solutions and the growing middle class in several South American nations contribute to its dominance.

- 5-10 kW: This segment is crucial for small to medium-sized commercial enterprises and larger residential needs, offering a balance between power output and portability. Infrastructure development projects requiring temporary power solutions are key drivers.

- Above 10 kW: While a smaller segment in terms of unit volume, this category is vital for industrial applications and large-scale commercial operations where continuous and high-power backup is essential. Increased industrial investments and the need for uninterrupted manufacturing processes are key growth factors.

Fuel Type:

- Gas: Gasoline-powered generators remain the most popular due to their widespread availability, ease of use, and initial lower cost. Consumer preferences for readily accessible fuel sources and the established distribution networks for gasoline contribute to its dominance.

- Diesel: Diesel generators are favored in industrial and heavy-duty commercial applications for their durability, fuel efficiency, and higher power output, although their higher initial cost and emissions concerns are factors. The growing mining and agricultural sectors in some South American countries are key drivers for this segment.

- Other Fuel Types (e.g., Propane, Dual Fuel): The "Other Fuel Types" segment is experiencing rapid growth, particularly dual-fuel models. These offer greater flexibility and can be more cost-effective and environmentally friendly in certain scenarios. Increased consumer awareness and product innovation, such as the dual-fuel generators launched by Generac, are driving this expansion.

End-user:

- Residential: The residential sector is a major driver of market growth, fueled by the increasing need for backup power due to grid instability, rising adoption of smart homes, and the growing popularity of outdoor activities. Economic stability and disposable income directly impact this segment.

- Commercial: This segment, including retail stores, offices, and small businesses, relies on portable generators to minimize downtime and revenue loss during power outages. The growth of the small business sector and the need for business continuity are key factors.

- Industrial: While representing a smaller volume of sales, the industrial segment commands a higher value due to the demand for powerful and robust generators for manufacturing plants, construction sites, and critical infrastructure. Infrastructure development and industrial expansion are significant drivers.

Geography:

- Brazil: As mentioned, Brazil dominates due to its economic scale, population, and infrastructure challenges.

- Argentina: Argentina's market is driven by its agricultural sector and its vulnerability to energy price fluctuations, creating demand for cost-effective power solutions.

- Chile: Chile's mining industry and its susceptibility to seismic activity make portable generators essential for various operations.

- Rest of South America: This encompasses a diverse range of countries, each with unique drivers such as resource extraction, tourism, and agricultural development, all contributing to the overall growth of the portable generator market.

South America Portable Generator Market Product Innovations

Product innovation in the South America portable generator market is focused on enhancing user experience, sustainability, and connectivity. Manufacturers are prioritizing the development of quieter, more fuel-efficient inverter generators that provide clean power, ideal for sensitive electronics. The integration of smart features, such as remote monitoring and control capabilities via mobile applications, is gaining traction, particularly in the commercial and premium residential segments. The introduction of dual-fuel and tri-fuel options provides consumers with greater fuel flexibility and cost-optimization opportunities. For instance, the recent launch of dual-fuel models by Generac Power Systems Inc. addresses consumer demand for versatile and reliable backup power. These innovations aim to differentiate products, cater to evolving consumer preferences for convenience and environmental consciousness, and gain a competitive edge in the dynamic market.

Report Segmentation & Scope

This report comprehensively segments the South America portable generator market across key categories. The Power Rating segment is divided into Below 5 kW, 5-10 kW, and Above 10 kW, each projected to experience steady growth driven by specific end-user needs, from basic residential backup to robust industrial power requirements. The Fuel Type segment includes Gas, Diesel, and Other Fuel Types (such as propane and dual-fuel), with the "Other Fuel Types" category expected to witness the highest growth rate due to increasing demand for flexibility and efficiency. The End-user segmentation covers Industrial, Commercial, and Residential sectors, with the Residential segment anticipated to dominate in terms of unit volume and the Commercial segment to show strong growth driven by business continuity needs. Geographically, the market is analyzed across Brazil, Argentina, Chile, and the Rest of South America, with Brazil leading in market size and the Rest of South America exhibiting significant growth potential due to emerging economies and infrastructure development.

Key Drivers of South America Portable Generator Market Growth

The South America portable generator market is propelled by several key drivers. Firstly, the increasing unreliability of existing power grids in various regions necessitates dependable backup power solutions for both households and businesses. Secondly, the growing frequency of extreme weather events and natural disasters across the continent underscores the critical need for portable generators in emergency preparedness. Thirdly, the expanding industrial and construction sectors, particularly in developing economies, require portable power for their operations. Fourthly, technological advancements leading to more fuel-efficient, quieter, and environmentally friendly generators are attracting a wider consumer base. Finally, the rising disposable income in certain segments of the population is enabling greater adoption of portable generators for both essential backup and convenience.

Challenges in the South America Portable Generator Market Sector

Despite its growth potential, the South America portable generator market faces several challenges. Regulatory hurdles related to emissions standards and noise pollution can increase manufacturing costs and complexity. Fluctuations in fuel prices, particularly for gasoline and diesel, can impact operational costs and consumer purchasing decisions. Supply chain disruptions, exacerbated by global economic conditions and logistical complexities within South America, can affect product availability and lead times. Intense price competition among manufacturers and distributors can squeeze profit margins. Furthermore, the growing availability of renewable energy alternatives and energy storage solutions presents a long-term competitive challenge.

Leading Players in the South America Portable Generator Market Market

- Briggs & Stratton Corporation

- Atlas Copco AB

- Caterpillar Inc.

- Kohler Power Systems

- Generac Holdings Inc.

Key Developments in South America Portable Generator Market Sector

- May 2022: Generac Power Systems Inc. launched two portable dual fuel gas generators, named the Powermate 7500 Watt Duel Fuel Portable Generator and the Powermate 4500 Watt Duel Fuel Portable Generator. Both models operate either on gasoline or LP gas.

Strategic South America Portable Generator Market Market Outlook

The strategic outlook for the South America portable generator market is highly positive, driven by continued demand for reliable power solutions. Growth accelerators include the increasing adoption of smart technology for enhanced convenience and monitoring, alongside a growing emphasis on eco-friendly and dual-fuel options. Expanding product portfolios to cater to diverse power needs and price points will be crucial. Strategic partnerships with local distributors and retailers will be vital for market penetration and customer service. Investments in innovation, particularly in areas of fuel efficiency and emission reduction, will solidify competitive positioning. The market is poised for sustained expansion as South American economies develop and the need for robust and accessible power solutions intensifies.

South America Portable Generator Market Segmentation

-

1. Power Rating

- 1.1. Below 5 kW

- 1.2. 5-10 kW

- 1.3. Above 10 kW

-

2. Fuel Type

- 2.1. Gas

- 2.2. Diesel

- 2.3. Other Fuel Types

-

3. End-user

- 3.1. Industrial

- 3.2. Commercial

- 3.3. Residential

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Chile

- 4.4. Rest of South America

South America Portable Generator Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Chile

- 4. Rest of South America

South America Portable Generator Market Regional Market Share

Geographic Coverage of South America Portable Generator Market

South America Portable Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Power

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Battery Storage Systems and other Cleaner Sources of Standby Power

- 3.4. Market Trends

- 3.4.1. Residential Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 5.1.1. Below 5 kW

- 5.1.2. 5-10 kW

- 5.1.3. Above 10 kW

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gas

- 5.2.2. Diesel

- 5.2.3. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Industrial

- 5.3.2. Commercial

- 5.3.3. Residential

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Chile

- 5.4.4. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Chile

- 5.5.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 6. Brazil South America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 6.1.1. Below 5 kW

- 6.1.2. 5-10 kW

- 6.1.3. Above 10 kW

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Gas

- 6.2.2. Diesel

- 6.2.3. Other Fuel Types

- 6.3. Market Analysis, Insights and Forecast - by End-user

- 6.3.1. Industrial

- 6.3.2. Commercial

- 6.3.3. Residential

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Chile

- 6.4.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 7. Argentina South America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 7.1.1. Below 5 kW

- 7.1.2. 5-10 kW

- 7.1.3. Above 10 kW

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Gas

- 7.2.2. Diesel

- 7.2.3. Other Fuel Types

- 7.3. Market Analysis, Insights and Forecast - by End-user

- 7.3.1. Industrial

- 7.3.2. Commercial

- 7.3.3. Residential

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Chile

- 7.4.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 8. Chile South America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 8.1.1. Below 5 kW

- 8.1.2. 5-10 kW

- 8.1.3. Above 10 kW

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Gas

- 8.2.2. Diesel

- 8.2.3. Other Fuel Types

- 8.3. Market Analysis, Insights and Forecast - by End-user

- 8.3.1. Industrial

- 8.3.2. Commercial

- 8.3.3. Residential

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Chile

- 8.4.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 9. Rest of South America South America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Power Rating

- 9.1.1. Below 5 kW

- 9.1.2. 5-10 kW

- 9.1.3. Above 10 kW

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Gas

- 9.2.2. Diesel

- 9.2.3. Other Fuel Types

- 9.3. Market Analysis, Insights and Forecast - by End-user

- 9.3.1. Industrial

- 9.3.2. Commercial

- 9.3.3. Residential

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Brazil

- 9.4.2. Argentina

- 9.4.3. Chile

- 9.4.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Power Rating

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Briggs & Stratton Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Atlas Copco AB*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Caterpillar Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kohler Power Systems

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Generac Holdings Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 Briggs & Stratton Corporation

List of Figures

- Figure 1: South America Portable Generator Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America Portable Generator Market Share (%) by Company 2025

List of Tables

- Table 1: South America Portable Generator Market Revenue million Forecast, by Power Rating 2020 & 2033

- Table 2: South America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 3: South America Portable Generator Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 4: South America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 5: South America Portable Generator Market Revenue million Forecast, by End-user 2020 & 2033

- Table 6: South America Portable Generator Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 7: South America Portable Generator Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: South America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: South America Portable Generator Market Revenue million Forecast, by Region 2020 & 2033

- Table 10: South America Portable Generator Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: South America Portable Generator Market Revenue million Forecast, by Power Rating 2020 & 2033

- Table 12: South America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 13: South America Portable Generator Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 14: South America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 15: South America Portable Generator Market Revenue million Forecast, by End-user 2020 & 2033

- Table 16: South America Portable Generator Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 17: South America Portable Generator Market Revenue million Forecast, by Geography 2020 & 2033

- Table 18: South America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: South America Portable Generator Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: South America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: South America Portable Generator Market Revenue million Forecast, by Power Rating 2020 & 2033

- Table 22: South America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 23: South America Portable Generator Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 24: South America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 25: South America Portable Generator Market Revenue million Forecast, by End-user 2020 & 2033

- Table 26: South America Portable Generator Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 27: South America Portable Generator Market Revenue million Forecast, by Geography 2020 & 2033

- Table 28: South America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: South America Portable Generator Market Revenue million Forecast, by Country 2020 & 2033

- Table 30: South America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: South America Portable Generator Market Revenue million Forecast, by Power Rating 2020 & 2033

- Table 32: South America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 33: South America Portable Generator Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 34: South America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 35: South America Portable Generator Market Revenue million Forecast, by End-user 2020 & 2033

- Table 36: South America Portable Generator Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 37: South America Portable Generator Market Revenue million Forecast, by Geography 2020 & 2033

- Table 38: South America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: South America Portable Generator Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: South America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: South America Portable Generator Market Revenue million Forecast, by Power Rating 2020 & 2033

- Table 42: South America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 43: South America Portable Generator Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 44: South America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 45: South America Portable Generator Market Revenue million Forecast, by End-user 2020 & 2033

- Table 46: South America Portable Generator Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 47: South America Portable Generator Market Revenue million Forecast, by Geography 2020 & 2033

- Table 48: South America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: South America Portable Generator Market Revenue million Forecast, by Country 2020 & 2033

- Table 50: South America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Portable Generator Market?

The projected CAGR is approximately 9.2%.

2. Which companies are prominent players in the South America Portable Generator Market?

Key companies in the market include Briggs & Stratton Corporation, Atlas Copco AB*List Not Exhaustive, Caterpillar Inc, Kohler Power Systems, Generac Holdings Inc.

3. What are the main segments of the South America Portable Generator Market?

The market segments include Power Rating, Fuel Type, End-user, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 720 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Power.

6. What are the notable trends driving market growth?

Residential Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Demand for Battery Storage Systems and other Cleaner Sources of Standby Power.

8. Can you provide examples of recent developments in the market?

May 2022: Generac Power Systems Inc. launched two portable dual fuel gas generators, named the Powermate 7500 Watt Duel Fuel Portable Generator and the Powermate 4500 Watt Duel Fuel Portable Generator. Both models operate either on gasoline or LP gas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Portable Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Portable Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Portable Generator Market?

To stay informed about further developments, trends, and reports in the South America Portable Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence