Key Insights

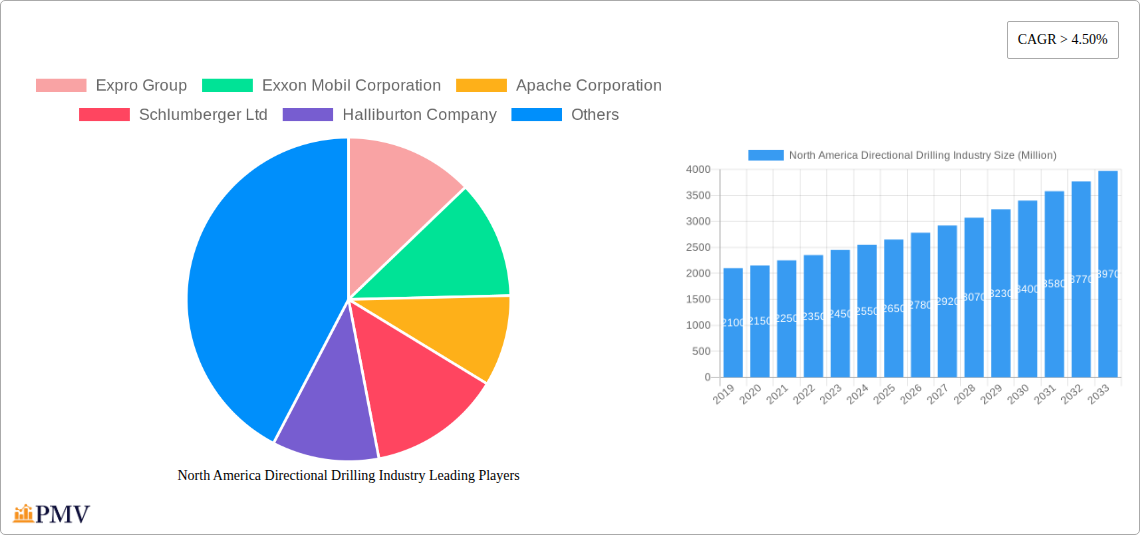

The North America Directional Drilling Market is projected for significant expansion, driven by escalating energy needs and the strategic necessity to access complex hydrocarbon reserves. The market size is estimated at USD 9.9 billion, with a projected Compound Annual Growth Rate (CAGR) of 4.48% from the base year 2024 through 2033. Key growth catalysts include enhanced oil recovery initiatives, the development of unconventional resources, and advancements in drilling technologies for precise wellbore placement. The adoption of sophisticated techniques like Rotary Steerable Systems (RSS) is notable for improving control, reducing drilling time, and lowering operational costs. Continuous exploration and production activities in onshore and offshore basins across the United States and Canada are bolstering demand for specialized directional drilling services. Leading companies are actively investing in R&D to meet evolving market requirements.

North America Directional Drilling Industry Market Size (In Billion)

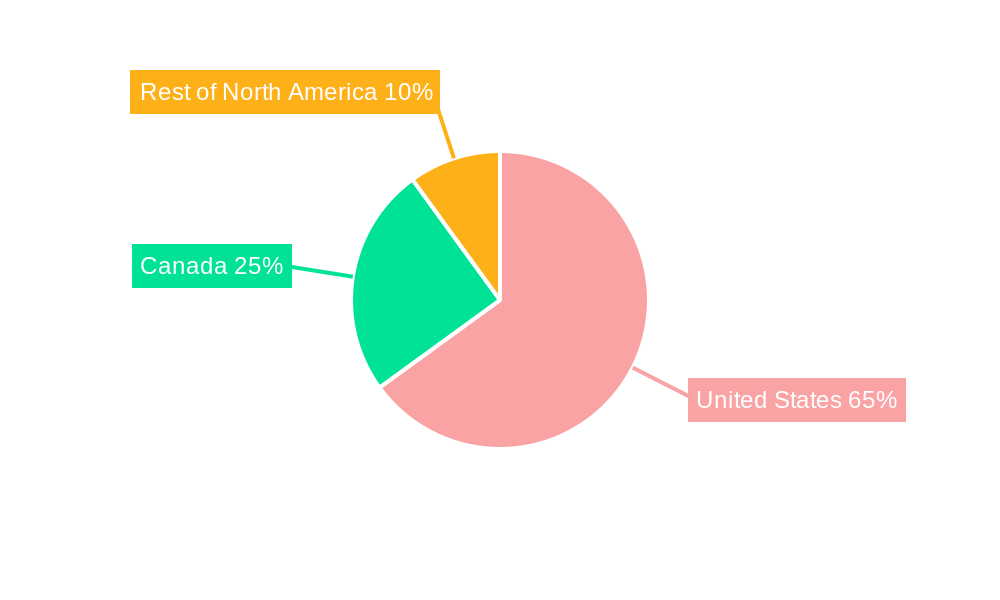

Market dynamics are shaped by robust competition, fostering innovation and operational excellence. While demand is strong, factors such as fluctuating crude oil prices and stringent environmental regulations may present challenges. However, the inherent efficiency gains and the necessity of accessing challenging geological formations through directional drilling are expected to largely offset these restraints. The market is segmented by deployment type (onshore and offshore) and technology (e.g., RSS). Geographically, the United States leads the market, followed by Canada, reflecting the mature yet growing oil and gas landscape of the region. The ongoing focus on production optimization and minimizing environmental impact through advanced drilling practices will be crucial for future market performance.

North America Directional Drilling Industry Company Market Share

This comprehensive report offers an in-depth analysis of the North America Directional Drilling Market, covering the period from 2019 to 2033. With a base year of 2024, the forecast period extends to 2033, providing granular insights into market dynamics, emerging trends, and competitive landscapes. The analysis includes detailed segmentation by onshore and offshore deployments, key technologies such as Rotary Steerable Systems (RSS), and major geographical markets including the United States, Canada, and the Rest of North America. This report is vital for service providers, operators, and stakeholders aiming to leverage opportunities within this critical sector.

North America Directional Drilling Industry Market Structure & Competitive Dynamics

The North America Directional Drilling Industry is characterized by a moderately concentrated market structure, with leading companies like Schlumberger Ltd, Halliburton Company, Baker Hughes Company, and Weatherford International PLC holding significant market shares, estimated to be upwards of 60% collectively in 2025. Innovation ecosystems are driven by continuous research and development in advanced drilling technologies, particularly in RSS, aimed at enhancing efficiency and reducing operational costs. Regulatory frameworks, especially concerning environmental impact and safety standards, play a crucial role in shaping market entry and operational practices. While product substitutes exist in traditional drilling methods, the superior precision and efficiency of directional drilling, especially for complex geological formations and in environmentally sensitive areas, limit their competitive impact. End-user trends, driven by the demand for unconventional oil and gas resources and the expansion of infrastructure projects, are steadily increasing the adoption of directional drilling services. Merger and acquisition (M&A) activities are strategically focused on consolidating market positions, acquiring new technologies, and expanding service portfolios. For instance, past M&A deals have ranged in value from tens of millions to over a billion USD, reflecting consolidation strategies among major players and service providers. Understanding these dynamics is paramount for navigating this competitive landscape effectively.

North America Directional Drilling Industry Industry Trends & Insights

The North America Directional Drilling Industry is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This expansion is primarily fueled by the escalating demand for oil and gas, driven by energy security concerns and economic development across the continent. Technological disruptions, particularly advancements in autonomous drilling systems, real-time data analytics, and improved downhole tools, are revolutionizing operational efficiency and cost-effectiveness. The increasing preference for horizontal directional drilling (HDD) techniques in both onshore and offshore environments, due to its minimal surface disturbance and ability to navigate complex terrains, is a significant consumer trend. Furthermore, the growing emphasis on accessing challenging reserves, including deep offshore deposits and shale formations, necessitates the adoption of sophisticated directional drilling capabilities. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a race to offer integrated service solutions. Market penetration is deepening as operators increasingly recognize the economic and environmental advantages of directional drilling over conventional methods for a wider array of projects. The shift towards cleaner energy sources is also indirectly benefiting directional drilling, as it is crucial for the exploration and production of natural gas, a transitional fuel. The market penetration for directional drilling services is estimated to reach over 70% for new well constructions in key regions by 2030.

Dominant Markets & Segments in North America Directional Drilling Industry

The United States dominates the North America Directional Drilling Industry, accounting for an estimated 75% of the total market value in 2025, primarily due to its vast shale oil and gas reserves and extensive exploration and production activities. Within the Location of Deployment segment, Onshore operations command the largest share, estimated at 85% in 2025, driven by the widespread application in shale plays and conventional oil and gas fields. The Service Type segment is heavily influenced by the dominance of Rotary Steerable Systems (RSS), which is projected to capture over 60% of the market by 2025, owing to their superior accuracy, speed, and efficiency in complex well trajectories compared to conventional methods.

Key Drivers of Dominance in the United States:

- Abundant Shale Reserves: The prolific nature of shale formations in regions like the Permian Basin, Eagle Ford, and Bakken necessitates advanced directional drilling techniques for efficient extraction.

- Technological Advancement: Significant investments in R&D by major service providers and operators have led to the development and widespread adoption of cutting-edge directional drilling technologies, particularly RSS.

- Economic Policies: Favorable government policies and incentives aimed at boosting domestic energy production have historically supported exploration and drilling activities.

- Infrastructure Development: The ongoing expansion and maintenance of oil and gas pipelines and related infrastructure often require directional drilling for crossings.

In Canada, the Onshore segment also leads, driven by oil sands extraction and conventional gas exploration. While RSS is increasingly adopted, Conventional directional drilling still holds a considerable share, particularly in mature fields. The Rest of North America segment, encompassing Mexico, shows emerging growth, with increasing adoption of directional drilling for both conventional and unconventional resources, albeit at a smaller scale compared to the US and Canada. The offshore segment, though smaller in overall market share (estimated 15% in 2025), is critical for deepwater exploration in the Gulf of Mexico and off the coast of Canada, where specialized directional drilling capabilities are essential.

North America Directional Drilling Industry Product Innovations

Product innovations in the North America Directional Drilling Industry are centered on enhancing drilling efficiency, accuracy, and safety. Advancements in real-time downhole sensing technologies, predictive analytics for wellbore stability, and the development of more robust and steerable drilling motors are key trends. The integration of artificial intelligence and machine learning into drilling optimization software is enabling operators to achieve faster penetration rates and reduce non-productive time. The development of automated directional steering systems and remote operational capabilities further streamlines processes and improves personnel safety. These innovations provide a significant competitive advantage by reducing operational costs, minimizing environmental impact, and enabling access to increasingly challenging reservoirs.

Report Segmentation & Scope

This report meticulously segments the North America Directional Drilling Industry across key dimensions to provide a comprehensive market overview.

- Location of Deployment: The market is analyzed for Onshore operations, encompassing the vast majority of drilling activities in shale plays and conventional fields, and Offshore operations, crucial for deepwater exploration and production.

- Service Type: The analysis differentiates between Rotary Steerable Systems (RSS), highlighting their growing dominance due to advanced capabilities, and Conventional directional drilling services, which remain relevant in various applications.

- Geography: The report provides detailed insights into the United States, the largest market, Canada, a significant player with unique operational demands, and the Rest of North America, encompassing emerging markets.

Each segment is analyzed for its market size, projected growth rates, and competitive dynamics, offering targeted intelligence for strategic decision-making.

Key Drivers of North America Directional Drilling Industry Growth

The growth of the North America Directional Drilling Industry is propelled by several key factors. The ongoing global demand for oil and natural gas necessitates efficient and precise extraction methods, making directional drilling indispensable. Technological advancements in drilling tools and software continue to enhance efficiency and reduce costs, driving wider adoption. Furthermore, the increasing focus on accessing unconventional resources, such as shale gas and tight oil, which require complex wellbore trajectories, provides a significant growth impetus. Stringent environmental regulations also favor directional drilling due to its ability to minimize surface footprint and enable precise well placement, thereby reducing environmental impact. The strategic importance of energy independence for North American nations further fuels investment in domestic exploration and production.

Challenges in the North America Directional Drilling Industry Sector

Despite its strong growth trajectory, the North America Directional Drilling Industry faces several challenges. Fluctuations in oil and gas prices can impact exploration and production budgets, consequently affecting demand for drilling services. Evolving regulatory landscapes, particularly concerning environmental protection and permitting processes, can introduce complexities and delays. Supply chain disruptions for specialized equipment and skilled labor shortages can also pose significant hurdles. Moreover, intense competition among service providers can lead to price pressures, impacting profit margins. The ongoing global transition towards renewable energy sources, while a long-term consideration, also presents a strategic challenge by potentially reducing the overall demand for fossil fuels in the distant future.

Leading Players in the North America Directional Drilling Industry Market

- Expro Group

- Exxon Mobil Corporation

- Apache Corporation

- Schlumberger Ltd

- Halliburton Company

- Chevron Corporation

- Weatherford International PLC

- Baker Hughes Company

- BP PLC

- Royal Dutch Shell PLC

Key Developments in North America Directional Drilling Industry Sector

- November 2021: Nabors Industries Ltd entered a contractual agreement with Chesapeake Energy Corporation, designating Nabors as the preferred drilling contractor for oil and gas projects in the United States. This strategic partnership is anticipated to facilitate Nabors' business expansion across the country.

- August 2021: Michels Canada demonstrated a significant advancement in trenchless construction within Canada by successfully completing a 3540-meter Horizontal Directional Drilling (HDD) crossing in Burlington, Ontario, beneath the Hidden Lake Golf Club. This installation is a vital component of Imperial's Waterdown to Finch Project, aimed at the proactive replacement of approximately 63 kilometers of the Sarnia Products Pipeline. The Hidden Lake HDD crossing now stands as the longest successful HDD installation ever recorded in Canada, surpassing the previous record of 2195 meters, also set by Michels Canada.

Strategic North America Directional Drilling Industry Market Outlook

The strategic outlook for the North America Directional Drilling Industry remains highly positive, driven by sustained energy demand and continuous technological innovation. Key growth accelerators include the ongoing development of deepwater reserves, the economic viability of unconventional resource extraction, and the increasing application of HDD for infrastructure projects and environmental remediation. The industry is poised for further consolidation, with strategic M&A activities likely to reshape the competitive landscape. Companies that invest in digitalization, automation, and sustainable drilling practices will be best positioned to capitalize on future opportunities. The ongoing evolution of energy policies and the potential for new discoveries will continue to influence market dynamics, making agility and technological leadership paramount for success.

North America Directional Drilling Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Service Type

- 2.1. Rotary Steerable Systems (RSS)

- 2.2. Conventional

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Directional Drilling Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Directional Drilling Industry Regional Market Share

Geographic Coverage of North America Directional Drilling Industry

North America Directional Drilling Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Offshore Segment Expected to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Directional Drilling Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Rotary Steerable Systems (RSS)

- 5.2.2. Conventional

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. United States North America Directional Drilling Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Rotary Steerable Systems (RSS)

- 6.2.2. Conventional

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Canada North America Directional Drilling Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Rotary Steerable Systems (RSS)

- 7.2.2. Conventional

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Rest of North America North America Directional Drilling Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Rotary Steerable Systems (RSS)

- 8.2.2. Conventional

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Expro Group

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Exxon Mobil Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Apache Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Schlumberger Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Halliburton Company

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Service Providers

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Chevron Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Weatherford International PLC

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Operators

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Baker Hughes Company

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 BP PLC

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Royal Dutch Shell PLC

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Expro Group

List of Figures

- Figure 1: North America Directional Drilling Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Directional Drilling Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Directional Drilling Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 2: North America Directional Drilling Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 3: North America Directional Drilling Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Directional Drilling Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Directional Drilling Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 6: North America Directional Drilling Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 7: North America Directional Drilling Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Directional Drilling Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Directional Drilling Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 10: North America Directional Drilling Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 11: North America Directional Drilling Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Directional Drilling Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Directional Drilling Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 14: North America Directional Drilling Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 15: North America Directional Drilling Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Directional Drilling Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Directional Drilling Industry?

The projected CAGR is approximately 4.48%.

2. Which companies are prominent players in the North America Directional Drilling Industry?

Key companies in the market include Expro Group, Exxon Mobil Corporation, Apache Corporation, Schlumberger Ltd, Halliburton Company, Service Providers, Chevron Corporation, Weatherford International PLC, Operators, Baker Hughes Company, BP PLC, Royal Dutch Shell PLC.

3. What are the main segments of the North America Directional Drilling Industry?

The market segments include Location of Deployment, Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Offshore Segment Expected to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

In November 2021, Nabors Industries Ltd came into a contractual agreement with Chesapeake Energy Corporation to choose Nabors as the preferred drilling contractor for the oil and gas projects in the United States. This agreement is likely to enable the company to expand its business portfolio across the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Directional Drilling Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Directional Drilling Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Directional Drilling Industry?

To stay informed about further developments, trends, and reports in the North America Directional Drilling Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence