Key Insights

The Indian LNG bunkering market is projected for significant expansion, reaching an estimated $12.6 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.3% anticipated between 2025 and 2033. This growth is propelled by supportive government policies, a burgeoning maritime sector, and a global shift towards cleaner marine fuels. Initiatives like "Make in India" and investments in coastal shipping infrastructure are fostering LNG bunkering adoption. Stricter international emission regulations are encouraging vessel owners to adopt cleaner alternatives like LNG, meeting the demands of an expanding fleet, particularly in tanker and container segments, for efficient and eco-friendly fueling solutions. Key players such as Indian Oil Corporation Ltd, Bharat Petroleum Corp Ltd, Adani Enterprises Ltd, Petronet LNG Ltd, and H-Energy Private Limited are strategically investing in essential infrastructure, including LNG terminals and bunkering facilities, to meet this rising market demand.

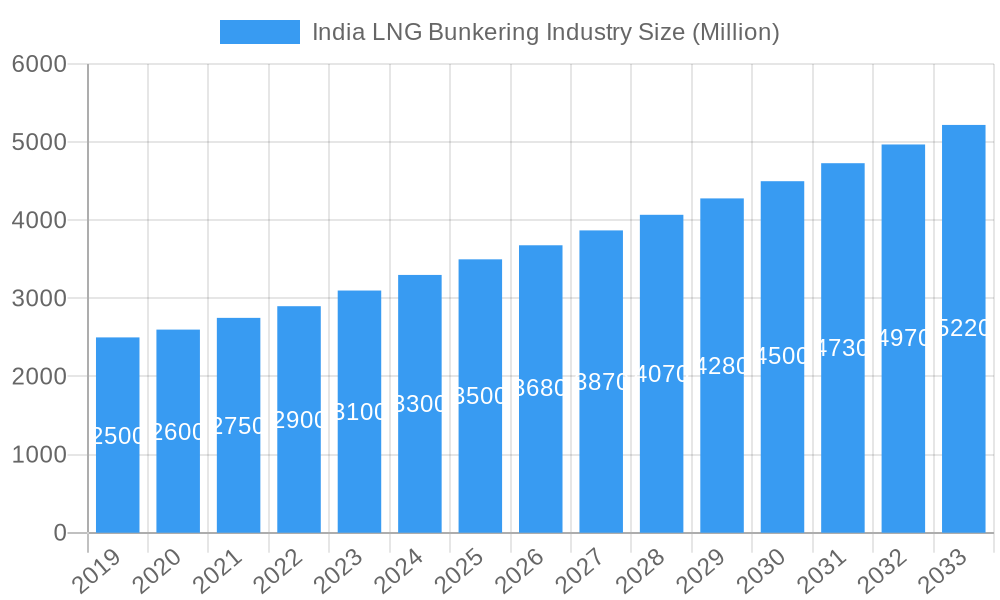

India LNG Bunkering Industry Market Size (In Billion)

The market's expansion is further fueled by the development of dedicated LNG bunkering infrastructure at major Indian ports, increased LNG supply via regasification terminals, and the growing prevalence of dual-fuel vessels. The "Atmanirbhar Bharat" vision also supports domestic LNG production and utilization. While market growth is robust, challenges such as the initial high investment cost for LNG-powered vessels and the need for widespread refueling infrastructure require strategic consideration. Nevertheless, the long-term environmental benefits and cost efficiencies of LNG, alongside global emission standard compliance, are expected to position it as a leading bunkering fuel in India. Integrating LNG bunkering into India's broader energy security and sustainability objectives is vital for realizing its full market potential.

India LNG Bunkering Industry Company Market Share

Discover detailed market insights and forecasts for the India LNG Bunkering Industry, optimized for search visibility.

India LNG Bunkering Industry Market Structure & Competitive Dynamics

The India LNG Bunkering Industry is characterized by a moderately concentrated market structure, with key players actively shaping its trajectory. Major stakeholders like Indian Oil Corporation Ltd, Bharat Petroleum Corp Ltd, Adani Enterprises Ltd, Petronet LNG Ltd, and H-Energy Private Limited are at the forefront, driving innovation and infrastructure development. The competitive landscape is evolving rapidly, influenced by government initiatives promoting cleaner fuel alternatives and stringent environmental regulations for maritime shipping. Innovation ecosystems are flourishing, with companies investing in LNG bunkering infrastructure, including port facilities and vessel conversions. Regulatory frameworks, while supportive of LNG adoption, are also becoming more comprehensive, dictating safety standards and operational procedures. Product substitutes, primarily traditional marine fuels like High Sulfur Fuel Oil (HSFO) and Low Sulfur Fuel Oil (LSFO), still hold a significant market share, but the long-term shift towards LNG is evident. End-user trends are heavily skewed towards the Tanker Fleet and Container Fleet, as these segments face increasing pressure to comply with global emissions standards. The Bulk and General Cargo Fleet and Ferries and OSV are also progressively integrating LNG. Merger and acquisition (M&A) activities are anticipated to increase as companies seek to consolidate market presence and leverage economies of scale, with projected M&A deal values in the range of hundreds of millions to billions of USD as the market matures. The market share distribution among the leading players is dynamic, with significant ongoing investments aimed at capturing a larger portion of this burgeoning sector.

India LNG Bunkering Industry Industry Trends & Insights

The India LNG Bunkering Industry is poised for remarkable expansion, driven by a confluence of factors including robust economic growth, increasing environmental consciousness, and supportive government policies. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15-20% during the forecast period of 2025-2033. This growth is primarily fueled by the global push for decarbonization in the shipping sector and India's strategic vision to become a global hub for cleaner maritime fuels. Technological disruptions are a significant trend, with advancements in LNG liquefaction, storage, and transfer technologies making bunkering more efficient and cost-effective. The development of small-scale LNG (SSLNG) infrastructure is a key enabler, allowing for more flexible and widespread bunkering operations across India's extensive coastline. Consumer preferences are shifting demonstrably towards LNG due to its lower sulfur oxide (SOx), nitrogen oxide (NOx), and particulate matter emissions compared to conventional marine fuels. This is further accelerated by the International Maritime Organization's (IMO) stringent emission regulations. Competitive dynamics are intensifying, with existing oil and gas majors, port authorities, and new energy companies vying for market share. Strategic partnerships and joint ventures are becoming common as companies collaborate to build necessary infrastructure and overcome initial investment hurdles. The market penetration of LNG as a marine fuel, while still nascent, is expected to accelerate significantly, driven by the economic viability of LNG-powered vessels and the increasing availability of LNG bunkering facilities. The shift is not merely a regulatory compliance measure but also an economic opportunity for shipping companies to reduce fuel costs and enhance their environmental credentials. The increasing number of LNG-powered new builds and conversions of existing vessels will further bolster demand for LNG bunkering services. The development of an integrated LNG supply chain, from import terminals to bunkering stations, is a critical ongoing insight shaping the industry's future.

Dominant Markets & Segments in India LNG Bunkering Industry

The Tanker Fleet segment is currently the most dominant in the India LNG Bunkering Industry, driven by the extensive global and coastal trade routes managed by Indian shipping companies. This dominance is underpinned by several key drivers, including the economic viability of LNG for long-haul voyages and the stringent emission control requirements imposed on tankers, particularly those operating in Emission Control Areas (ECAs). Indian Oil Corporation Ltd and Petronet LNG Ltd are actively developing bunkering infrastructure to cater to the high demand from this segment. The Container Fleet is rapidly emerging as a close second, with major shipping lines investing in LNG-powered container vessels to meet customer demand for sustainable logistics. The economic policies encouraging green shipping and the development of port-side infrastructure at major Indian ports like JNPT and Mundra are significant enablers for this segment's growth.

The Bulk and General Cargo Fleet represents a substantial future growth opportunity. While currently slower to adopt LNG due to the diverse nature of cargo and vessel types, increasing environmental awareness and the potential for long-term cost savings are driving interest. Government initiatives promoting domestic trade and the growth of India's industrial base will further boost this segment.

Ferries and OSV (Offshore Support Vessels) are also critical segments, particularly in coastal and inland waterways. The adoption of LNG in ferries is gaining traction due to cleaner operations in populated areas and reduced operational costs. The offshore sector, with its specialized vessels, is increasingly looking towards LNG for compliance and operational efficiency in environmentally sensitive offshore regions.

The Others segment encompasses smaller vessels, tugs, and specialized craft that are gradually incorporating LNG as fuel. The economic policies supporting the modernization of the Indian maritime sector, coupled with a growing awareness of the benefits of cleaner fuels, are expected to drive growth across all these segments. The infrastructure development at key bunkering hubs along India's coastline, supported by companies like Adani Enterprises Ltd and H-Energy Private Limited, is crucial for enabling the dominance and growth of these segments.

India LNG Bunkering Industry Product Innovations

Product innovations in the India LNG Bunkering Industry are centered around enhancing efficiency, safety, and accessibility. Developments include advanced LNG bunkering vessels designed for rapid and safe transfers, as well as modular onshore bunkering solutions that can be deployed flexibly at various ports. Companies are also innovating in terms of LNG fuel quality management and certification, ensuring compliance with international standards. The competitive advantage lies in offering integrated solutions that combine fuel supply with technical support and emissions monitoring, catering to the evolving needs of shipowners seeking cost-effective and environmentally friendly fuel options.

Report Segmentation & Scope

This report meticulously segments the India LNG Bunkering Industry to provide granular insights. The Tanker Fleet segment, encompassing both crude oil and product tankers, is analyzed for its substantial bunkering requirements and growth projections, with an estimated market size of billions of USD. The Container Fleet segment, crucial for global trade, is examined for its increasing adoption of LNG, with strong growth forecasts. The Bulk and General Cargo Fleet segment, representing a diverse range of vessels, is assessed for its emerging LNG demand. The Ferries and OSV segment, vital for regional and offshore operations, is detailed for its specific bunkering needs and future potential. The Others segment covers specialized vessels and smaller craft, offering a comprehensive view of market penetration. Each segment's growth projections, current market sizes, and competitive dynamics are thoroughly investigated.

Key Drivers of India LNG Bunkering Industry Growth

The India LNG Bunkering Industry's growth is propelled by several interconnected drivers. Government Policies are paramount, with initiatives like the National Green Hydrogen Mission and Sagarmala Programme actively promoting cleaner maritime fuels and infrastructure development. Environmental Regulations, particularly the IMO's 2020 sulfur cap and upcoming emissions targets, are compelling the industry to adopt LNG. Economic Factors, such as the price advantage of LNG over conventional fuels and the long-term cost savings for vessel operators, are significant motivators. Technological Advancements in LNG handling and storage, coupled with the increasing availability of LNG-powered vessels, are further accelerating adoption. The strategic location of India, with its extensive coastline and growing maritime trade, provides a natural advantage for the development of LNG bunkering hubs.

Challenges in the India LNG Bunkering Industry Sector

Despite its promising growth, the India LNG Bunkering Industry faces several challenges. High Initial Investment Costs for bunkering infrastructure and vessel conversions remain a significant barrier, requiring substantial capital outlay. LNG Supply Chain Infrastructure Gaps, including the availability of sufficient liquefaction plants and regasification terminals, can lead to supply disruptions. Regulatory Hurdles and Standardization for LNG bunkering operations across different ports can create complexities. Perceived Safety Concerns associated with handling LNG, although largely mitigated by modern technology, can still be a point of hesitation for some stakeholders. Availability of LNG-powered vessels and retrofitting challenges also pose restraints. The competitive pressure from established marine fuels, though diminishing, still influences market dynamics.

Leading Players in the India LNG Bunkering Industry Market

- Indian Oil Corporation Ltd

- Bharat Petroleum Corp Ltd

- Adani Enterprises Ltd

- Petronet LNG Ltd

- H-Energy Private Limited

Key Developments in India LNG Bunkering Industry Sector

- 2023 September: Petronet LNG Ltd announced plans to establish LNG bunkering facilities at multiple Indian ports, aiming to serve increasing demand from coastal vessels.

- 2023 August: H-Energy Private Limited signed a Memorandum of Understanding (MOU) with a leading shipping company to explore LNG bunkering solutions for their fleet.

- 2023 July: Indian Oil Corporation Ltd commenced LNG bunkering trials at a major Indian port, demonstrating its commitment to cleaner marine fuels.

- 2023 June: Adani Enterprises Ltd outlined its strategy to develop integrated LNG bunkering hubs, leveraging its port infrastructure.

- 2023 May: Bharat Petroleum Corp Ltd announced investments in expanding its LNG infrastructure to support the growing bunkering market.

- 2023 April: The Indian government released new guidelines for LNG bunkering operations to enhance safety and efficiency.

Strategic India LNG Bunkering Industry Market Outlook

The strategic outlook for the India LNG Bunkering Industry is exceptionally positive, fueled by India's ambition to become a global maritime leader and its commitment to sustainable energy. Growth accelerators include the expanding network of LNG import terminals, which will ensure a stable supply of fuel. The increasing global demand for cleaner shipping solutions will drive higher adoption rates for LNG-powered vessels. Strategic opportunities lie in developing advanced bunkering technologies, fostering public-private partnerships for infrastructure development, and creating a robust regulatory environment that encourages investment. The industry is projected to witness significant expansion, with companies that can offer reliable, cost-effective, and environmentally compliant LNG bunkering solutions poised for substantial market share gains. The focus will increasingly shift towards integrated energy solutions for the maritime sector.

India LNG Bunkering Industry Segmentation

-

1. End-User

- 1.1. Tanker Fleet

- 1.2. Container Fleet

- 1.3. Bulk and General Cargo Fleet

- 1.4. Ferries and OSV

- 1.5. Others

India LNG Bunkering Industry Segmentation By Geography

- 1. India

India LNG Bunkering Industry Regional Market Share

Geographic Coverage of India LNG Bunkering Industry

India LNG Bunkering Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Ferries and OSV Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India LNG Bunkering Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Tanker Fleet

- 5.1.2. Container Fleet

- 5.1.3. Bulk and General Cargo Fleet

- 5.1.4. Ferries and OSV

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Indian Oil Corporation Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bharat Petroleum Corp Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Adani Enterprises Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Petronet LNG Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 H-Energy Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Indian Oil Corporation Ltd

List of Figures

- Figure 1: India LNG Bunkering Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India LNG Bunkering Industry Share (%) by Company 2025

List of Tables

- Table 1: India LNG Bunkering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 2: India LNG Bunkering Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India LNG Bunkering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: India LNG Bunkering Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India LNG Bunkering Industry?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the India LNG Bunkering Industry?

Key companies in the market include Indian Oil Corporation Ltd, Bharat Petroleum Corp Ltd, Adani Enterprises Ltd, Petronet LNG Ltd, H-Energy Private Limited.

3. What are the main segments of the India LNG Bunkering Industry?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.6 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities.

6. What are the notable trends driving market growth?

Ferries and OSV Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Clean Power Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India LNG Bunkering Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India LNG Bunkering Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India LNG Bunkering Industry?

To stay informed about further developments, trends, and reports in the India LNG Bunkering Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence