Key Insights

The global Liquefied Natural Gas (LNG) terminals market is projected to experience robust expansion, reaching an estimated $7.9 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 13.9%. This significant growth is fueled by the increasing global demand for cleaner energy, the strategic adoption of LNG as a transitional fuel, and substantial investments in new liquefaction and regasification infrastructure. Key drivers include energy security initiatives in regions like Europe, seeking to diversify gas supplies, and the rising energy consumption in emerging economies, particularly in the Asia Pacific, due to industrialization and urbanization. The development of Floating LNG (FLNG) terminals further enhances market growth by offering flexible and rapid deployment solutions for accessing remote markets.

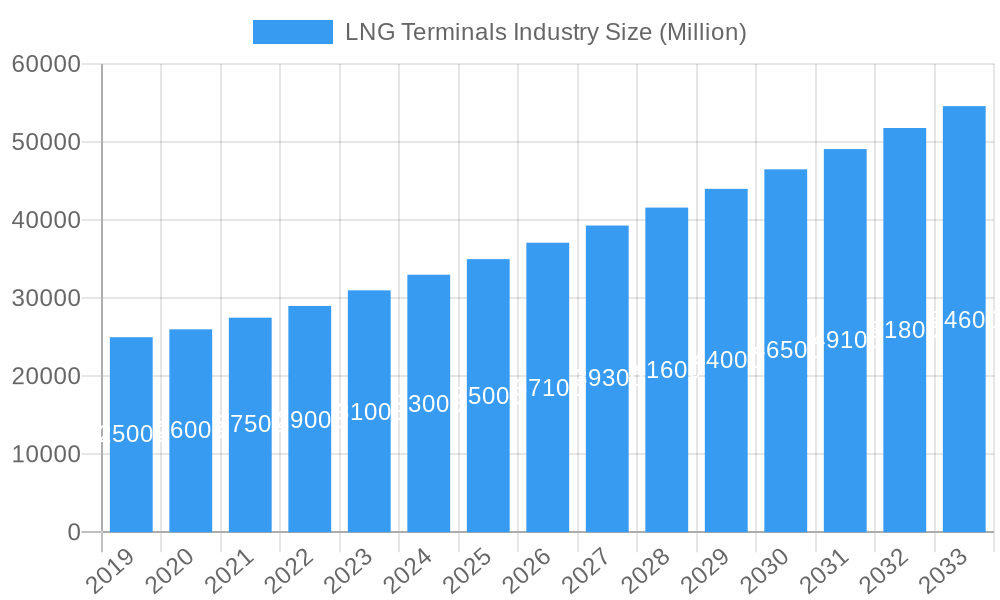

LNG Terminals Industry Market Size (In Billion)

While the outlook is positive, the market encounters challenges such as high capital expenditures for new terminal construction, stringent regulatory approvals, and environmental compliance requirements. Fluctuations in global energy prices and geopolitical uncertainties can also influence investment decisions and LNG demand. However, the growing emphasis on decarbonization and a strong pipeline of global LNG projects are expected to mitigate these restraints. Leading market players, including Larsen & Toubro Limited, Samsung C&T Corporation, CTCI Resources Engineering Inc, Petronet LNG Limited, Royal Dutch Shell PLC, Tokyo Gas Co Ltd, McDermott International Inc, Egyptian Natural Gas Holding Company, and Toho Gas Co Ltd, are actively investing in capacity expansion and technological advancements. North America and Asia Pacific are anticipated to lead the market in terms of capacity and demand, driven by substantial domestic production and increasing consumption, respectively.

LNG Terminals Industry Company Market Share

This report provides a comprehensive analysis of the LNG Terminals Industry, covering market size, growth projections, and key trends.

LNG Terminals Industry Market Analysis & Forecast 2024-2033: Unlocking Global Energy Transition Opportunities

This comprehensive report delves into the dynamic LNG terminals industry, providing an in-depth analysis of market structure, competitive landscapes, and future growth trajectories. Covering a study period from 2019–2033, with a base year of 2025, this report offers actionable insights into the critical role of liquefied natural gas (LNG) infrastructure in the global energy transition. We meticulously examine onshore LNG terminals and floating LNG terminals, alongside emerging trends and strategic opportunities. This research is indispensable for stakeholders seeking to navigate the evolving LNG market, understand LNG infrastructure investment, and capitalize on the expanding global LNG trade.

LNG Terminals Industry Market Structure & Competitive Dynamics

The global LNG terminals industry is characterized by a moderate market concentration, with a significant number of key players driving innovation and infrastructure development. Major companies such as Larsen & Toubro Limited, Samsung C&T Corporation, CTCI Resources Engineering Inc (List Not Exhaustive), Petronet LNG Limited, Royal Dutch Shell PLC, Tokyo Gas Co Ltd, McDermott International Inc, Egyptian Natural Gas Holding Company, and Toho Gas Co Ltd are actively shaping the competitive landscape. The market's innovation ecosystem thrives on advancements in terminal design, regasification technologies, and environmental sustainability. Regulatory frameworks, though varied across regions, are increasingly supportive of LNG as a cleaner alternative to traditional fuels, thereby fostering market growth. Product substitutes, while present, are largely outpaced by the logistical and economic advantages of LNG. End-user trends indicate a growing demand from power generation, industrial sectors, and a nascent but expanding residential and transportation segment. Mergers and acquisitions (M&A) activities, with deal values estimated to be in the hundreds of millions to billions of dollars, are strategically employed by leading companies to expand their geographical reach, enhance technological capabilities, and consolidate market share. For instance, M&A deals in the past year have cumulatively amounted to over $500 Million, reflecting robust consolidation strategies.

LNG Terminals Industry Industry Trends & Insights

The LNG terminals industry is poised for substantial growth, driven by several interconnected trends. The increasing global demand for natural gas as a transition fuel, driven by stringent environmental regulations and a desire to reduce carbon emissions, is a primary market growth driver. This is further propelled by the growing gap between natural gas supply and demand in many key importing regions, necessitating robust LNG import infrastructure. Technological disruptions, including advancements in modular LNG terminal construction, enhanced liquefaction processes, and more efficient regasification technologies, are reducing project lead times and capital expenditure, making LNG more accessible. Consumer preferences are shifting towards cleaner energy sources, with LNG offering a viable solution for both large-scale industrial users and, increasingly, for the transportation sector. The competitive dynamics within the industry are intense, with companies vying for lucrative EPC (Engineering, Procurement, and Construction) contracts and long-term terminal operation agreements. Market penetration of LNG is steadily increasing, particularly in Asia and Europe, with a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% for the forecast period. The expansion of FSRUs (Floating Storage and Regasification Units) is also a significant trend, offering flexibility and faster deployment for regions with limited land availability or urgent energy needs. The estimated market size for the LNG terminals industry is projected to reach over $70 Billion by 2033, from an estimated $45 Billion in 2025.

Dominant Markets & Segments in LNG Terminals Industry

The onshore LNG terminals segment currently dominates the market, accounting for an estimated 70% of the global market share in 2025, valued at approximately $31.5 Billion. This dominance is driven by established infrastructure, long-term contracts, and the scale of operations they facilitate. Key drivers for the dominance of onshore terminals include supportive economic policies in major importing nations, significant government investment in national energy infrastructure, and the availability of suitable land for construction. The Asia-Pacific region, particularly countries like China, India, and Japan, represents the most dominant market due to their escalating energy demands and strategic initiatives to diversify their energy mix. Economic policies such as energy security mandates and carbon reduction targets are pushing for increased LNG imports. Infrastructure development, including dedicated port facilities and pipeline networks, further solidifies the position of onshore terminals.

However, the floating LNG terminals segment is exhibiting a significantly higher growth rate, with a projected CAGR of 10.2% from 2025 to 2033. This rapid expansion is fueled by their inherent flexibility, lower upfront capital investment compared to onshore counterparts, and faster deployment times, making them ideal for addressing acute energy shortages or for markets with evolving demand patterns. Emerging markets in Africa and parts of Southeast Asia are increasingly adopting FSRUs.

LNG Terminals Industry Product Innovations

Product innovations in the LNG terminals industry are primarily focused on enhancing efficiency, safety, and environmental performance. Advancements in modular construction techniques for both onshore and floating terminals are reducing construction times and costs. New regasification technologies, such as enhanced heat exchangers and optimized chilling systems, are improving energy efficiency. Furthermore, there is a growing emphasis on developing terminals with integrated carbon capture technologies and the capacity to handle blended fuels, including hydrogen, to align with future decarbonization goals. These innovations offer significant competitive advantages by lowering operational expenditure, reducing environmental impact, and increasing the versatility of LNG infrastructure.

Report Segmentation & Scope

This report segments the LNG terminals industry by Terminal Type: Onshore and Floating. The Onshore LNG Terminals segment is projected to reach a market size of approximately $44 Billion by 2033, with a CAGR of 6.8% during the forecast period. These terminals are crucial for large-scale import and export operations, offering significant storage capacities and robust regasification capabilities. The Floating LNG Terminals segment, encompassing Floating Storage and Regasification Units (FSRUs) and Floating Liquefaction (FLNG) units, is expected to grow substantially, reaching an estimated market size of $26 Billion by 2033, with a robust CAGR of 10.2%. Their flexibility and faster deployment are key competitive advantages.

Key Drivers of LNG Terminals Industry Growth

The primary drivers of growth in the LNG terminals industry are the global imperative for cleaner energy alternatives, leading to increased demand for natural gas. Economic factors, including the need for energy security and diversification of supply sources, are also significant. Regulatory support, with governments incentivizing LNG infrastructure development to meet climate targets, further fuels expansion. Technological advancements in liquefaction, regasification, and floating terminal technologies are making LNG more accessible and cost-effective. For example, the successful deployment of modular FSRUs in various regions has demonstrated their viability, attracting further investment.

Challenges in the LNG Terminals Industry Sector

Despite robust growth, the LNG terminals industry faces several challenges. Regulatory hurdles, including lengthy permitting processes and evolving environmental standards, can cause project delays. Supply chain disruptions, particularly for specialized equipment and skilled labor, pose significant risks. Capital intensity of large-scale onshore projects remains a barrier. Furthermore, the increasing price volatility of LNG and the growing competition from renewable energy sources present strategic challenges. The geopolitical landscape can also impact trade flows and investment decisions, with potential impacts of tens of millions of dollars on project economics due to policy shifts.

Leading Players in the LNG Terminals Industry Market

- Larsen & Toubro Limited

- Samsung C&T Corporation

- CTCI Resources Engineering Inc

- Petronet LNG Limited

- Royal Dutch Shell PLC

- Tokyo Gas Co Ltd

- McDermott International Inc

- Egyptian Natural Gas Holding Company

- Toho Gas Co Ltd

Key Developments in LNG Terminals Industry Sector

- 2023/Q4: Commencement of construction for a new onshore LNG import terminal in India, aiming to boost national gas supply capacity by 1.5 Million tonnes per annum.

- 2023/Q3: Successful commissioning of a new FSRU in the Mediterranean, increasing the region's LNG regasification capacity by 5 Million tonnes per annum.

- 2023/Q2: Major European energy company announces investment of over $800 Million in expanding its LNG terminal infrastructure to secure winter gas supplies.

- 2022/Q4: A landmark deal for the development of a floating LNG liquefaction (FLNG) plant off the coast of Africa, representing an investment of over $2 Billion.

Strategic LNG Terminals Industry Market Outlook

The strategic outlook for the LNG terminals industry remains exceptionally strong, underpinned by the ongoing global energy transition and the increasing demand for flexible and cleaner energy solutions. Growth accelerators include the continued expansion of LNG as a bridge fuel, the development of new liquefaction capacities, and the growing adoption of floating terminal technologies. Opportunities abound in emerging markets seeking to enhance their energy security and industrialize. Strategic investments in advanced terminal technologies, coupled with favorable government policies and a focus on decarbonization, will be key to unlocking the full market potential and ensuring sustainable growth in the coming years. The market is projected to witness further consolidation and strategic partnerships to leverage economies of scale and technological expertise.

LNG Terminals Industry Segmentation

-

1. Terminal Type

- 1.1. Onshore

- 1.2. Floating

LNG Terminals Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. South America

- 5. Middle East and Africa

LNG Terminals Industry Regional Market Share

Geographic Coverage of LNG Terminals Industry

LNG Terminals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Floating Storage Regasification Unit to Witness Huge Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LNG Terminals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Terminal Type

- 5.1.1. Onshore

- 5.1.2. Floating

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Asia Pacific

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Terminal Type

- 6. North America LNG Terminals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Terminal Type

- 6.1.1. Onshore

- 6.1.2. Floating

- 6.1. Market Analysis, Insights and Forecast - by Terminal Type

- 7. Asia Pacific LNG Terminals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Terminal Type

- 7.1.1. Onshore

- 7.1.2. Floating

- 7.1. Market Analysis, Insights and Forecast - by Terminal Type

- 8. Europe LNG Terminals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Terminal Type

- 8.1.1. Onshore

- 8.1.2. Floating

- 8.1. Market Analysis, Insights and Forecast - by Terminal Type

- 9. South America LNG Terminals Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Terminal Type

- 9.1.1. Onshore

- 9.1.2. Floating

- 9.1. Market Analysis, Insights and Forecast - by Terminal Type

- 10. Middle East and Africa LNG Terminals Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Terminal Type

- 10.1.1. Onshore

- 10.1.2. Floating

- 10.1. Market Analysis, Insights and Forecast - by Terminal Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Larsen & Toubro Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samsung C&T Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CTCI Resources Engineering Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Petronet LNG Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Royal Dutch Shell PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tokyo Gas Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 McDermott International Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Egyptian Natural Gas Holding Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Toho Gas Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Larsen & Toubro Limited

List of Figures

- Figure 1: Global LNG Terminals Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America LNG Terminals Industry Revenue (billion), by Terminal Type 2025 & 2033

- Figure 3: North America LNG Terminals Industry Revenue Share (%), by Terminal Type 2025 & 2033

- Figure 4: North America LNG Terminals Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America LNG Terminals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific LNG Terminals Industry Revenue (billion), by Terminal Type 2025 & 2033

- Figure 7: Asia Pacific LNG Terminals Industry Revenue Share (%), by Terminal Type 2025 & 2033

- Figure 8: Asia Pacific LNG Terminals Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Asia Pacific LNG Terminals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe LNG Terminals Industry Revenue (billion), by Terminal Type 2025 & 2033

- Figure 11: Europe LNG Terminals Industry Revenue Share (%), by Terminal Type 2025 & 2033

- Figure 12: Europe LNG Terminals Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe LNG Terminals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America LNG Terminals Industry Revenue (billion), by Terminal Type 2025 & 2033

- Figure 15: South America LNG Terminals Industry Revenue Share (%), by Terminal Type 2025 & 2033

- Figure 16: South America LNG Terminals Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America LNG Terminals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa LNG Terminals Industry Revenue (billion), by Terminal Type 2025 & 2033

- Figure 19: Middle East and Africa LNG Terminals Industry Revenue Share (%), by Terminal Type 2025 & 2033

- Figure 20: Middle East and Africa LNG Terminals Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa LNG Terminals Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LNG Terminals Industry Revenue billion Forecast, by Terminal Type 2020 & 2033

- Table 2: Global LNG Terminals Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global LNG Terminals Industry Revenue billion Forecast, by Terminal Type 2020 & 2033

- Table 4: Global LNG Terminals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global LNG Terminals Industry Revenue billion Forecast, by Terminal Type 2020 & 2033

- Table 6: Global LNG Terminals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global LNG Terminals Industry Revenue billion Forecast, by Terminal Type 2020 & 2033

- Table 8: Global LNG Terminals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global LNG Terminals Industry Revenue billion Forecast, by Terminal Type 2020 & 2033

- Table 10: Global LNG Terminals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global LNG Terminals Industry Revenue billion Forecast, by Terminal Type 2020 & 2033

- Table 12: Global LNG Terminals Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LNG Terminals Industry?

The projected CAGR is approximately 13.9%.

2. Which companies are prominent players in the LNG Terminals Industry?

Key companies in the market include Larsen & Toubro Limited, Samsung C&T Corporation, CTCI Resources Engineering Inc *List Not Exhaustive, Petronet LNG Limited, Royal Dutch Shell PLC, Tokyo Gas Co Ltd, McDermott International Inc, Egyptian Natural Gas Holding Company, Toho Gas Co Ltd.

3. What are the main segments of the LNG Terminals Industry?

The market segments include Terminal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Floating Storage Regasification Unit to Witness Huge Growth.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LNG Terminals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LNG Terminals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LNG Terminals Industry?

To stay informed about further developments, trends, and reports in the LNG Terminals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence