Key Insights

The Indian Smart Grid market is projected for substantial growth, with an estimated market size of $2,395.9 million in the base year 2024, and is expected to expand at a CAGR of 26.11%. This expansion is driven by the increasing demand for reliable power distribution and the government's commitment to modernizing energy infrastructure. Key growth catalysts include the adoption of Advanced Metering Infrastructure (AMI) for real-time monitoring and billing, efforts to minimize transmission and distribution (T&D) losses, and the integration of renewable energy sources requiring advanced grid management. The deployment of smart meters, smart substations, and grid automation technologies are pivotal to these advancements. Initiatives like the Smart Grid Mission and broader digitalization efforts within the power sector are fostering innovation and investment.

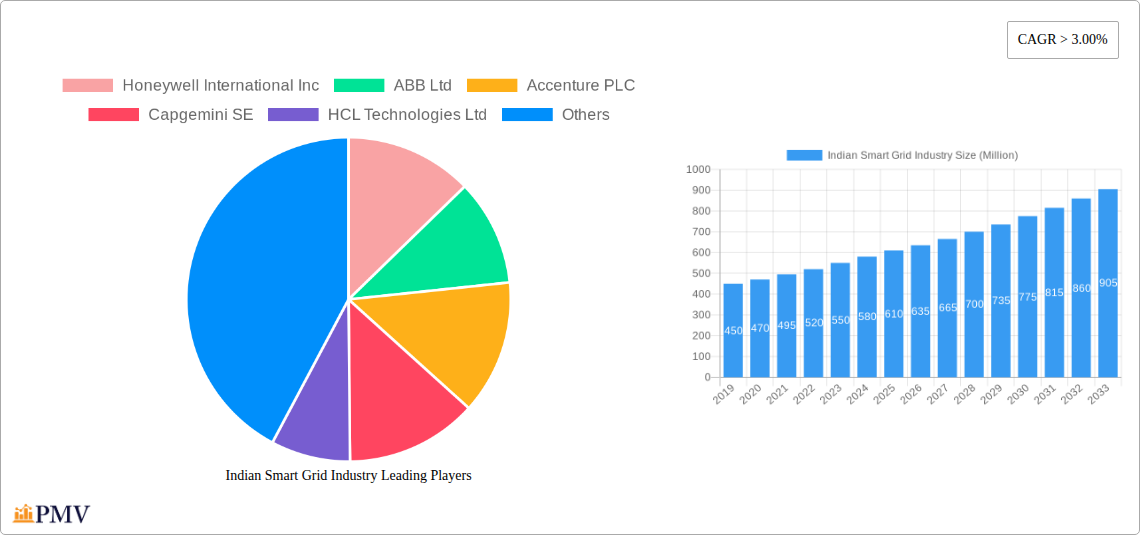

Indian Smart Grid Industry Market Size (In Billion)

Emerging trends such as the integration of 5G and IoT for enhanced data exchange and the application of AI and machine learning for predictive maintenance and demand-side management are further propelling the market. Challenges include significant initial capital investment, integration complexities with existing infrastructure, and the need for a skilled workforce. The Transmission, AMI, Communication Technology, and Other Technology Application Areas segments are all poised for significant development, with AMI and Communication Technology expected to lead. Key industry contributors include Honeywell, ABB, Accenture, Siemens, and General Electric, driving market evolution through strategic partnerships and technological innovation.

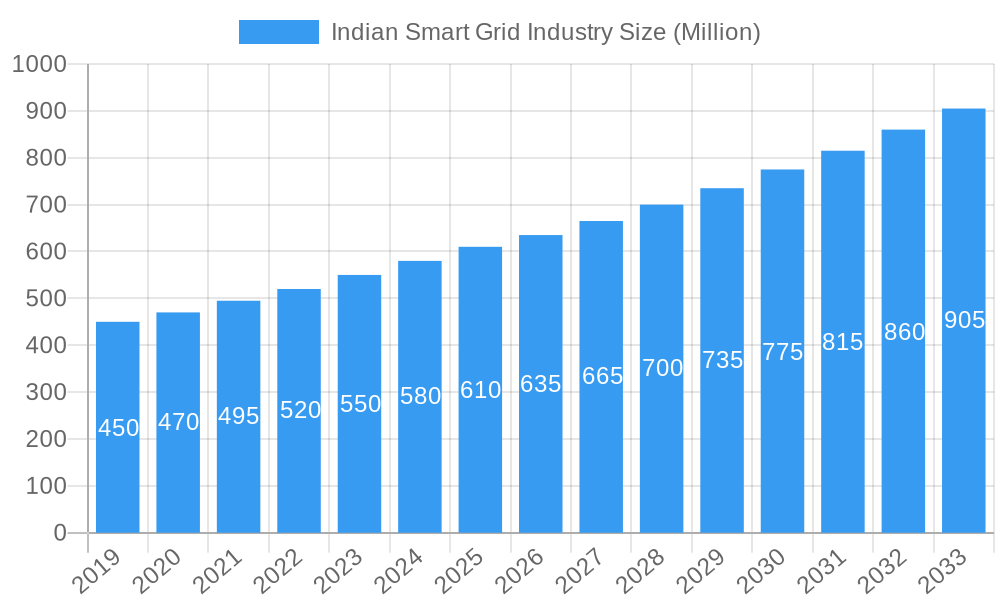

Indian Smart Grid Industry Company Market Share

Indian Smart Grid Industry Market Analysis & Future Outlook: 2019-2033

This comprehensive report delves into the dynamic Indian Smart Grid Industry, offering an in-depth analysis of market structure, competitive landscapes, and future projections. With a study period spanning from 2019 to 2033, featuring a base year of 2025, estimated year of 2025, and a forecast period from 2025 to 2033, alongside a historical period of 2019-2024, this report is your definitive guide to understanding the evolving smart energy infrastructure in India. We explore key segments including Transmission, Advanced Metering Infrastructure (AMI), Communication Technology, and Other Technology Application Areas, providing actionable insights for stakeholders.

Indian Smart Grid Industry Market Structure & Competitive Dynamics

The Indian Smart Grid Industry exhibits a moderately concentrated market structure, with key players investing heavily in innovation and technological advancement. Leading global and domestic companies are driving this evolution, focusing on enhancing grid efficiency and reliability through sophisticated technologies. The innovation ecosystem is fueled by government initiatives promoting digital transformation in the power sector, fostering collaborations between research institutions and industry giants. Regulatory frameworks are progressively evolving to support the deployment of smart grid solutions, encouraging investment and streamlining market entry. While direct product substitutes are limited, advancements in IoT, AI, and data analytics are transforming existing solutions and creating new functionalities. End-user trends indicate a growing demand for reliable power, real-time monitoring, and enhanced energy management capabilities, pushing utilities towards smart grid adoption. Mergers and acquisitions (M&A) activities, valued in the hundreds of Million range, are observed as companies seek to expand their market reach and technological portfolios. For instance, strategic acquisitions by companies like Siemens AG and Schneider Electric SE aim to consolidate their position in the burgeoning Indian market. Estimated market share figures for key players are meticulously detailed within the report, showcasing their dominance across various sub-segments. The competitive landscape is characterized by intense R&D efforts and a focus on delivering end-to-end smart grid solutions, from grid modernization to consumer-facing applications.

Indian Smart Grid Industry Industry Trends & Insights

The Indian Smart Grid Industry is poised for substantial growth, driven by a confluence of factors including the nation's increasing energy demand, the imperative for grid modernization, and supportive government policies. A projected Compound Annual Growth Rate (CAGR) of approximately 18-20% is anticipated over the forecast period. Key growth drivers include the government's push for 100% electrification, the need to reduce transmission and distribution (T&D) losses, and the integration of renewable energy sources, which necessitates a more intelligent and flexible grid. Technological disruptions are at the forefront, with the increasing adoption of Internet of Things (IoT) devices for real-time data collection and analysis, Artificial Intelligence (AI) for predictive maintenance and grid optimization, and advanced communication technologies like 5G for enhanced data transmission speeds. Consumer preferences are shifting towards greater control over their energy consumption, with demand for smart meters offering features like pre-paid payment options and detailed consumption insights. Competitive dynamics are characterized by strategic partnerships and increasing investments from both established players and new entrants. The market penetration of advanced smart grid technologies is steadily increasing, moving beyond pilot projects to large-scale deployments across urban and rural areas. The focus on cybersecurity is also becoming paramount, ensuring the integrity and resilience of the smart grid infrastructure against potential threats. Utility companies are increasingly embracing digital solutions to enhance operational efficiency, improve customer service, and manage the complexities of a modern, distributed energy landscape. The ongoing transformation of the power sector, coupled with significant government impetus, paints a robust picture for the future of smart grids in India.

Dominant Markets & Segments in Indian Smart Grid Industry

The Indian Smart Grid Industry is experiencing robust growth across multiple segments, with Advanced Metering Infrastructure (AMI) emerging as a particularly dominant and high-growth sector. This dominance is propelled by government mandates and ambitious projects aimed at replacing conventional meters with smart alternatives across millions of households.

Advanced Metering Infrastructure (AMI): This segment is a primary driver of market expansion.

- Key Drivers:

- Government Initiatives: Schemes like the National Smart Grid Mission (NSGM) and directives for reducing AT&C losses provide strong policy support.

- Discom Modernization: Power Distribution Companies (Discoms) are under pressure to improve efficiency and reduce revenue leakage, making AMI a critical investment.

- Consumer Benefits: Features like pre-paid metering, accurate billing, and real-time consumption data empower consumers.

- Tender Opportunities: Large-scale tenders for smart meter installation, such as those seen in Uttar Pradesh, indicate substantial market potential. For instance, tenders for approximately 2.85 crore smart meters highlight the sheer scale of AMI deployment.

- Key Drivers:

Transmission: While AMI leads in current deployment momentum, the Transmission segment is crucial for the overall smart grid ecosystem.

- Dominance Analysis: Investment in smart transmission technologies, including advanced sensors, real-time monitoring systems, and grid automation, is critical for enhancing the reliability and stability of the national power grid. Power Grid Corporation of India Limited plays a pivotal role in deploying these advanced solutions to manage the increasing flow of electricity from diverse generation sources. The integration of renewable energy necessitates a smarter, more agile transmission network.

Communication Technology: This segment acts as the backbone of the smart grid, enabling seamless data flow.

- Dominance Analysis: The rapid evolution of communication technologies, from cellular (4G, 5G) to fiber optics and wireless mesh networks, is vital for the successful operation of AMI and other smart grid applications. The adoption of advanced SIM cards (4G/5G) in smart meters, as announced by BEST for its 10.5 lakh consumers, exemplifies the growing importance of robust communication infrastructure.

Other Technology Application Areas: This encompasses a broad range of applications, including smart substations, grid analytics, demand-response management, and electric vehicle charging infrastructure integration.

- Dominance Analysis: These areas are gaining traction as utilities seek to optimize grid operations, improve asset management, and incorporate new energy paradigms. Investments in these segments are driven by the need for enhanced grid intelligence and the integration of distributed energy resources.

The market for smart grid solutions in India is characterized by significant growth potential across all these segments, with AMI currently experiencing the most rapid adoption due to its direct impact on operational efficiency and revenue management for Discoms.

Indian Smart Grid Industry Product Innovations

Product innovations in the Indian Smart Grid Industry are primarily focused on enhancing grid efficiency, reliability, and consumer engagement. Key advancements include the development of more sophisticated Advanced Metering Infrastructure (AMI) solutions, featuring enhanced security features and advanced communication capabilities like 4G and 5G integration for real-time data transmission. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into grid management systems is enabling predictive maintenance, anomaly detection, and optimized energy distribution. Furthermore, innovations in communication technology are facilitating seamless data exchange between grid components and consumers. Companies are also developing solutions for demand-side management, enabling consumers to actively participate in grid balancing and optimize their energy consumption. These innovations are driven by the need to address challenges such as T&D losses, integrate renewable energy sources, and provide a more resilient and sustainable power infrastructure.

Report Segmentation & Scope

This report meticulously segments the Indian Smart Grid Industry to provide granular insights into its various facets. The segmentation includes:

- Transmission: This segment analyzes the adoption of smart technologies in power transmission networks, focusing on grid modernization, asset management, and enhanced monitoring capabilities. Projections indicate a steady growth in the integration of advanced control systems and real-time data analytics to manage complex transmission flows.

- Advanced Metering Infrastructure (AMI): This core segment examines the market for smart meters and associated communication and data management systems. Growth projections are robust, driven by large-scale deployment initiatives and the increasing demand for accurate billing and consumer-centric energy management. Competitive dynamics are characterized by intense bidding processes for multi-crore meter installations.

- Communication Technology: This segment delves into the various communication protocols and technologies enabling smart grid operations, including cellular, fiber optics, and wireless networks. The forecast suggests continued investment in high-speed and secure communication infrastructure to support the ever-increasing data generated by smart grid devices.

- Other Technology Application Areas: This encompassing segment covers smart substations, grid analytics platforms, demand-response systems, and integrations for electric vehicles. Market sizes are projected to expand as utilities adopt a holistic approach to grid management and incorporate emerging energy solutions.

Key Drivers of Indian Smart Grid Industry Growth

The Indian Smart Grid Industry is propelled by a powerful set of drivers, ensuring its sustained expansion. Foremost among these is the Indian government's steadfast commitment to modernizing the nation's power infrastructure, exemplified by initiatives like the National Smart Grid Mission, which aims to create a more efficient, reliable, and sustainable electricity network. Secondly, the escalating demand for electricity, driven by economic growth and increasing urbanization, necessitates a smarter, more responsive grid capable of managing complex energy flows and integrating diverse generation sources. Thirdly, the imperative to reduce significant transmission and distribution (T&D) losses, which represent a substantial economic drain, is a critical catalyst for smart grid adoption. Finally, the growing integration of renewable energy sources, such as solar and wind power, demands a flexible and intelligent grid that can balance intermittent supply and maintain grid stability.

Challenges in the Indian Smart Grid Industry Sector

Despite its immense potential, the Indian Smart Grid Industry faces several significant challenges that temper its growth trajectory. A primary restraint is the complex and sometimes fragmented regulatory landscape, which can lead to delays in project implementation and hinder consistent policy implementation across different states. High upfront investment costs for smart grid technologies, coupled with the financial constraints faced by many state-owned power distribution companies (Discoms), present another substantial barrier. Furthermore, the existing infrastructure in many areas may require significant upgrades to support advanced smart grid functionalities, leading to additional capital expenditure. Cybersecurity concerns are also paramount; ensuring the resilience of the smart grid against potential cyber threats and data breaches requires robust security protocols and continuous investment in advanced security solutions. Lastly, the availability of skilled personnel capable of deploying, managing, and maintaining sophisticated smart grid systems remains a challenge, necessitating targeted training and development programs.

Leading Players in the Indian Smart Grid Industry Market

The Indian Smart Grid Industry is characterized by the presence of both global technology leaders and prominent domestic enterprises. Key players driving innovation and deployment in this sector include:

- Honeywell International Inc

- ABB Ltd

- Accenture PLC

- Capgemini SE

- HCL Technologies Ltd

- Siemens AG

- Cisco Systems Inc

- Schneider Electric SE

- General Electric Company

- Power Grid Corporation of India Limited

This list is not exhaustive, as numerous other companies are actively contributing to the growth and development of the Indian smart grid ecosystem.

Key Developments in Indian Smart Grid Industry Sector

- February 2023: The Brihanmumbai Electric Supply and Transport (BEST) announced its intention to begin installing smart meters for its 10.5 lakh power consumers from March 2023 onward. These advanced devices will be equipped with 4G and 5G SIM cards, offering consumers the convenience of pre-paid payment options. This development signals a significant push towards enhanced consumer engagement and advanced metering capabilities in a major metropolitan area.

- October 2022: A substantial tender process saw several Indian corporate giants, including the Adani Group, GMR Group, L&T, and IntelliSmart, submit bids for the installation of approximately 2.85 crore prepaid "smart meters" across Uttar Pradesh. This massive undertaking by four power distribution companies (Discoms) in the state highlights the aggressive pace of smart meter deployment aimed at improving efficiency and reducing losses on a large scale.

Strategic Indian Smart Grid Industry Market Outlook

The Strategic Indian Smart Grid Industry Market Outlook is exceptionally positive, driven by the confluence of strong government support, burgeoning energy demand, and rapid technological advancements. The ongoing focus on grid modernization, coupled with the ambitious targets for renewable energy integration, presents significant growth accelerators. Increased adoption of IoT, AI, and big data analytics will further enhance grid efficiency, reliability, and predictive capabilities. Strategic opportunities lie in the development of integrated energy management systems, smart substation automation, and robust cybersecurity solutions. Furthermore, the growing awareness and demand for energy efficiency and smart home solutions will create a dynamic consumer-driven market. The continuous evolution of communication technologies, particularly the rollout of 5G, will unlock new possibilities for real-time data exchange and control, solidifying India's position as a leading market for smart grid deployment and innovation. The substantial investments in AMI infrastructure are expected to lay a solid foundation for the widespread adoption of other smart grid applications, promising a future of a more resilient, sustainable, and intelligent power sector.

Indian Smart Grid Industry Segmentation

- 1. Transmission

- 2. Advanced Metering Infrastructure (AMI)

- 3. Communication Technology

- 4. Other Technology Application Areas

Indian Smart Grid Industry Segmentation By Geography

- 1. India

Indian Smart Grid Industry Regional Market Share

Geographic Coverage of Indian Smart Grid Industry

Indian Smart Grid Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Power Demand from the Commercial and Industrial Sectors

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Environmental and Safety Regulations

- 3.4. Market Trends

- 3.4.1. Advanced Metering Infrastructure (AMI) is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indian Smart Grid Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transmission

- 5.2. Market Analysis, Insights and Forecast - by Advanced Metering Infrastructure (AMI)

- 5.3. Market Analysis, Insights and Forecast - by Communication Technology

- 5.4. Market Analysis, Insights and Forecast - by Other Technology Application Areas

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Transmission

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Accenture PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Capgemini SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HCL Technologies Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cisco Systems Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schneider Electric SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Power Grid Corporation of India Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Indian Smart Grid Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Indian Smart Grid Industry Share (%) by Company 2025

List of Tables

- Table 1: Indian Smart Grid Industry Revenue million Forecast, by Transmission 2020 & 2033

- Table 2: Indian Smart Grid Industry Revenue million Forecast, by Advanced Metering Infrastructure (AMI) 2020 & 2033

- Table 3: Indian Smart Grid Industry Revenue million Forecast, by Communication Technology 2020 & 2033

- Table 4: Indian Smart Grid Industry Revenue million Forecast, by Other Technology Application Areas 2020 & 2033

- Table 5: Indian Smart Grid Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Indian Smart Grid Industry Revenue million Forecast, by Transmission 2020 & 2033

- Table 7: Indian Smart Grid Industry Revenue million Forecast, by Advanced Metering Infrastructure (AMI) 2020 & 2033

- Table 8: Indian Smart Grid Industry Revenue million Forecast, by Communication Technology 2020 & 2033

- Table 9: Indian Smart Grid Industry Revenue million Forecast, by Other Technology Application Areas 2020 & 2033

- Table 10: Indian Smart Grid Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indian Smart Grid Industry?

The projected CAGR is approximately 26.11%.

2. Which companies are prominent players in the Indian Smart Grid Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Accenture PLC, Capgemini SE, HCL Technologies Ltd, Siemens AG*List Not Exhaustive, Cisco Systems Inc, Schneider Electric SE, General Electric Company, Power Grid Corporation of India Limited.

3. What are the main segments of the Indian Smart Grid Industry?

The market segments include Transmission, Advanced Metering Infrastructure (AMI), Communication Technology, Other Technology Application Areas.

4. Can you provide details about the market size?

The market size is estimated to be USD 2395.9 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Power Demand from the Commercial and Industrial Sectors.

6. What are the notable trends driving market growth?

Advanced Metering Infrastructure (AMI) is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Stringent Environmental and Safety Regulations.

8. Can you provide examples of recent developments in the market?

February 2023: The Brihanmumbai Electric Supply and Transport (BEST) announced that the company is likely to start installing smart meters for its 10.5 lakh power consumers from March 2023 onward. These devices will be enabled with 4G and 5G SIM cards and will offer pre-paid payment options for consumers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indian Smart Grid Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indian Smart Grid Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indian Smart Grid Industry?

To stay informed about further developments, trends, and reports in the Indian Smart Grid Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence