Key Insights

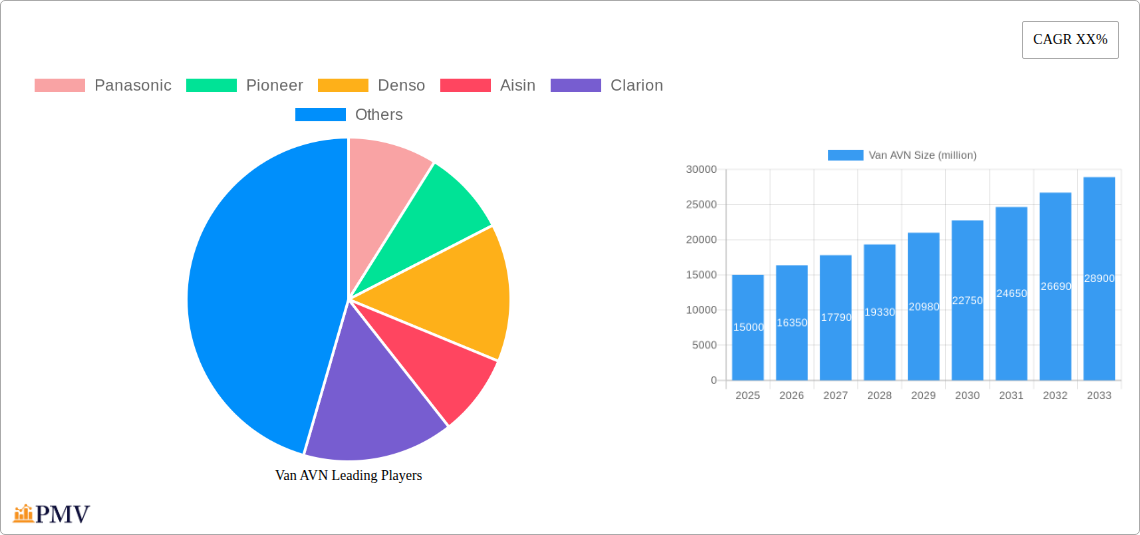

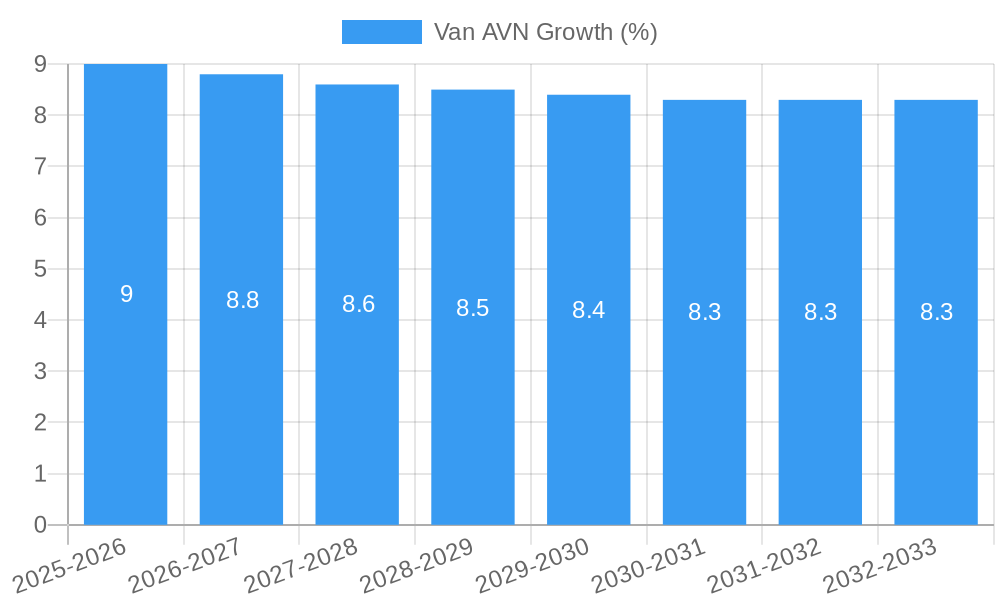

The Van AVN (Audio-Visual Navigation) market is experiencing robust growth, driven by increasing consumer demand for integrated in-car entertainment and navigation solutions. With a projected market size of approximately $15,000 million and a Compound Annual Growth Rate (CAGR) of around 9.5% between 2025 and 2033, the industry is poised for significant expansion. Key growth drivers include advancements in infotainment technology, the rising adoption of connected car features, and the increasing sophistication of navigation systems. The "More than 8 MT" application segment is expected to lead the market, reflecting the growing preference for larger, more immersive display screens in commercial and passenger vans. Navigation, as a core feature, will continue to dominate the types segment, although the integration of advanced AI and real-time traffic updates will further enhance its value proposition.

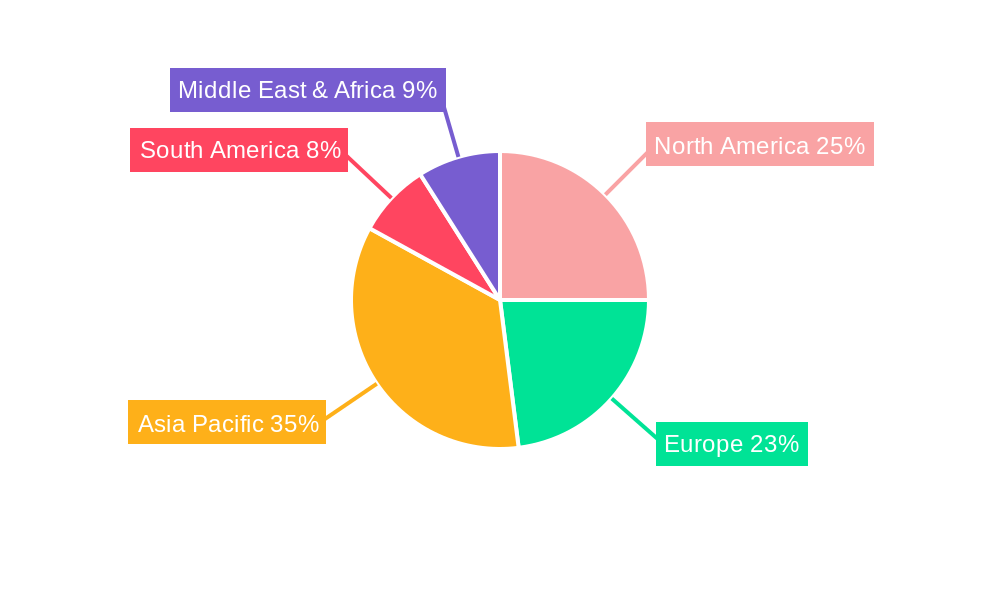

The market's expansion is also fueled by technological innovations such as enhanced user interfaces, smartphone integration capabilities (Apple CarPlay and Android Auto), and the incorporation of advanced driver-assistance systems (ADAS) linked to the AVN. However, certain restraints, including the high cost of advanced AVN systems and potential cybersecurity concerns, could temper growth. Geographically, the Asia Pacific region, particularly China and India, is anticipated to be a major growth engine due to the burgeoning automotive industry and increasing disposable incomes. North America and Europe will remain significant markets, driven by premium vehicle penetration and the early adoption of advanced automotive technologies. Companies like Panasonic, Pioneer, Denso, and Continental are actively shaping the market through product innovation and strategic partnerships.

This comprehensive report offers an in-depth analysis of the global Van AVN (Audio-Visual Navigation) market, providing critical insights for stakeholders navigating this dynamic sector. Covering the historical period of 2019–2024, base year 2025, and a forecast period of 2025–2033, this study delves into market structure, competitive landscapes, emerging trends, and growth projections across key applications and vehicle types. Gain an actionable understanding of van infotainment systems, commercial vehicle navigation, and automotive multimedia solutions to inform your strategic decisions.

Van AVN Market Structure & Competitive Dynamics

The Van AVN market exhibits a moderately concentrated structure, with key players actively investing in R&D to enhance their product offerings. The innovation ecosystem is characterized by collaborations between automotive OEMs and technology providers, fostering the development of integrated and advanced AVN solutions. Regulatory frameworks, while evolving, primarily focus on safety standards and data privacy, influencing product design and deployment. Product substitutes include standalone GPS devices and smartphone integration, though the seamless integration and advanced features of in-dash AVN systems continue to drive demand. End-user trends highlight a growing preference for intuitive interfaces, real-time traffic updates, and connectivity features in commercial and passenger vans. Mergers and acquisitions (M&A) activities, with estimated deal values in the hundreds of millions, are shaping the competitive landscape, enabling companies to expand their market reach and technological capabilities.

- Market Concentration: Moderate, with leading players holding significant market share.

- Innovation Ecosystem: Driven by partnerships between OEMs and tech firms, focusing on AI, IoT, and advanced connectivity.

- Regulatory Frameworks: Emphasize safety, cybersecurity, and data privacy.

- Product Substitutes: Standalone GPS, smartphone mirroring.

- End-User Trends: Demand for intuitive UI/UX, real-time data, and seamless connectivity.

- M&A Activities: Strategically important for market consolidation and technological advancement.

Van AVN Industry Trends & Insights

The Van AVN industry is poised for robust growth, propelled by several interconnected trends. The increasing adoption of connected vehicle technology and the rise of e-commerce, which fuels the demand for efficient logistics and delivery fleets, are significant market growth drivers. Technological disruptions, including the integration of artificial intelligence (AI) for voice commands and personalized user experiences, advancements in augmented reality (AR) for navigation, and the deployment of 5G connectivity for faster data processing and over-the-air (OTA) updates, are transforming the AVN landscape. Consumer preferences are shifting towards sophisticated infotainment systems that offer not only navigation but also entertainment, productivity tools, and enhanced safety features. The competitive dynamics are intensifying, with a focus on differentiating through user experience, software capabilities, and the integration of advanced driver-assistance systems (ADAS) functionalities. The market penetration of advanced AVN systems is steadily increasing across various van segments. The Compound Annual Growth Rate (CAGR) is projected to be substantial over the forecast period, driven by these evolving demands and technological advancements. The market is expected to witness a surge in demand for intelligent transportation systems (ITS) integrated within van AVN solutions.

Dominant Markets & Segments in Van AVN

The Van AVN market is experiencing dominance from specific regions and segments, driven by a confluence of economic policies, infrastructure development, and market adoption rates. North America and Europe currently lead in terms of market size and penetration, attributed to mature automotive markets, strong consumer spending power, and a higher propensity to adopt advanced vehicle technologies. The Asia-Pacific region, however, is emerging as a high-growth market, fueled by rapid industrialization, the expanding e-commerce sector, and government initiatives promoting smart mobility solutions.

Within the Application segmentation:

- More Than 8 MT (Metric Tons): This segment, encompassing heavy-duty commercial vans and trucks, represents a significant opportunity. Growth is driven by the need for robust fleet management solutions, real-time tracking for logistics optimization, and integrated safety features to comply with stringent commercial vehicle regulations. Economic policies supporting trade and logistics, along with investments in infrastructure, directly influence the demand for AVN in this segment.

- 3-8 MT: This mid-range segment, including light commercial vehicles and delivery vans, is also a strong performer. The proliferation of last-mile delivery services and the increasing emphasis on operational efficiency by businesses are key drivers. The ability of AVN systems to enhance driver productivity through optimized routing and reduced downtime is highly valued.

- Less Than 3 MT: This segment, comprising smaller passenger vans and utility vehicles, shows steady growth, influenced by the increasing demand for versatile personal and light commercial transportation. The integration of user-friendly infotainment and navigation features caters to both personal and professional needs.

Within the Types segmentation:

- Navigation: The Navigation type segment remains dominant, reflecting the fundamental need for efficient route planning, real-time traffic information, and destination guidance in van operations. Continued advancements in navigation technology, including predictive traffic analysis and AI-powered route optimization, further solidify its position.

- None Navigation: While currently a smaller segment, the None Navigation type is expected to see growth as manufacturers explore alternative functionalities for van-specific AVN units, potentially focusing on advanced telematics, driver behavior monitoring, or integrated entertainment systems tailored for long-haul journeys.

Van AVN Product Innovations

Product innovations in the Van AVN market are focused on enhancing user experience, safety, and operational efficiency. Key developments include the integration of advanced AI-powered voice assistants for hands-free control, sophisticated navigation systems with predictive traffic analysis and multi-stop route optimization, and larger, higher-resolution displays for improved visibility and interaction. Connectivity features, such as seamless smartphone integration (Apple CarPlay, Android Auto), Wi-Fi hotspots, and over-the-air (OTA) software updates, are becoming standard. Furthermore, the incorporation of telematics for fleet management, driver monitoring systems, and integration with ADAS features are providing competitive advantages to manufacturers.

Report Segmentation & Scope

This report meticulously segments the Van AVN market to provide granular analysis. The segmentation by Application includes:

- Less Than 3 MT: This segment, representing smaller vans and utility vehicles, is projected to witness a market size of approximately hundreds of millions by 2033. Competitive dynamics are characterized by a focus on user-friendly infotainment and basic navigation features.

- 3-8 MT: Covering mid-sized commercial vans, this segment is estimated to reach a market size of billions by 2033. Growth drivers include the demand for integrated fleet management and advanced navigation for logistics.

- More Than 8 MT: This segment, encompassing heavy-duty commercial vehicles, is projected to account for a significant market share, with an estimated market size in the hundreds of millions by 2033. Emphasis is placed on robust telematics, safety, and compliance.

The segmentation by Types includes:

- None Navigation: This segment, though smaller, is anticipated to grow, with a projected market size of hundreds of millions by 2033, focusing on advanced telematics and entertainment.

- Navigation: As the dominant segment, Navigation is expected to reach market sizes in the billions by 2033, driven by continuous innovation in routing and real-time data.

Key Drivers of Van AVN Growth

The growth of the Van AVN market is propelled by several key drivers. Technologically, the widespread adoption of connected car technologies, advancements in AI for enhanced user interaction, and the proliferation of 5G for seamless data connectivity are paramount. Economically, the burgeoning e-commerce sector and the resulting surge in last-mile delivery services are creating substantial demand for efficient logistics and fleet management solutions, which AVN systems directly support. Regulatory factors, such as increasing mandates for driver safety and fleet compliance, also encourage the integration of advanced AVN features. For instance, the need to monitor driver behavior and ensure adherence to driving hours directly benefits AVN systems with telematics capabilities.

Challenges in the Van AVN Sector

The Van AVN sector faces several challenges that could impede its growth trajectory. Regulatory hurdles, while often drivers of adoption, can also create complexities in terms of compliance with evolving safety and data privacy standards across different regions, potentially adding to development costs and timelines. Supply chain issues, particularly those related to semiconductor shortages and component availability, can disrupt production schedules and impact product availability, leading to increased lead times and higher costs. Competitive pressures from both established players and new entrants, especially those offering software-centric solutions, necessitate continuous innovation and price competitiveness. The initial cost of advanced AVN systems can also be a restraint for some smaller fleet operators, requiring a clear demonstration of ROI.

Leading Players in the Van AVN Market

- Panasonic

- Pioneer

- Denso

- Aisin

- Clarion

- Desay SV

- Kenwood

- Harman

- ADAYO

- Alpine

- Visteon

- Continental

- Bosch

- Hangsheng

- Coagent

Key Developments in Van AVN Sector

- 2023 November: Harman International launches new modular AVN platform for commercial vehicles, enhancing connectivity and data analytics.

- 2024 January: Continental AG announces strategic partnership with a leading AI firm to integrate advanced driver assistance features into its next-generation AVN systems.

- 2024 February: Visteon Corporation unveils its new cockpit electronics architecture designed for seamless integration of AVN and digital clusters in light commercial vehicles.

- 2024 March: Pioneer Corporation expands its commercial vehicle navigation offerings with enhanced real-time traffic and route planning capabilities.

- 2024 April: Desay SV Automotive introduces its latest intelligent cockpit solution featuring advanced voice recognition and personalized user profiles.

Strategic Van AVN Market Outlook

The future outlook for the Van AVN market is exceptionally promising, driven by the relentless pace of technological innovation and evolving commercial demands. Growth accelerators include the increasing integration of AI for predictive maintenance and driver coaching, the expansion of connected services for remote diagnostics and fleet management, and the development of more sophisticated AR navigation overlays for enhanced situational awareness. The burgeoning electric vehicle (EV) market for vans also presents a significant opportunity, as AVN systems will play a crucial role in battery management, charging station guidance, and optimizing range. Strategic opportunities lie in developing flexible and scalable AVN solutions that can be adapted to diverse van types and evolving user needs, thereby capturing market share in this expanding and critical sector.

Van AVN Segmentation

-

1. Application

- 1.1. 3-8 MT

- 1.2. More than 8 MT

- 1.3. Less than 3 MT

-

2. Types

- 2.1. Navigation

- 2.2. None Navigation

Van AVN Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Van AVN REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Van AVN Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. 3-8 MT

- 5.1.2. More than 8 MT

- 5.1.3. Less than 3 MT

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Navigation

- 5.2.2. None Navigation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Van AVN Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. 3-8 MT

- 6.1.2. More than 8 MT

- 6.1.3. Less than 3 MT

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Navigation

- 6.2.2. None Navigation

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Van AVN Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. 3-8 MT

- 7.1.2. More than 8 MT

- 7.1.3. Less than 3 MT

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Navigation

- 7.2.2. None Navigation

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Van AVN Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. 3-8 MT

- 8.1.2. More than 8 MT

- 8.1.3. Less than 3 MT

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Navigation

- 8.2.2. None Navigation

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Van AVN Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. 3-8 MT

- 9.1.2. More than 8 MT

- 9.1.3. Less than 3 MT

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Navigation

- 9.2.2. None Navigation

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Van AVN Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. 3-8 MT

- 10.1.2. More than 8 MT

- 10.1.3. Less than 3 MT

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Navigation

- 10.2.2. None Navigation

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Panasonic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pioneer

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Denso

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aisin

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Clarion

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Desay SV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kenwood

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Harman

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ADAYO

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Alpine

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Visteon

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Continental

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bosch

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hangsheng

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Coagent

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Panasonic

List of Figures

- Figure 1: Global Van AVN Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Van AVN Revenue (million), by Application 2024 & 2032

- Figure 3: North America Van AVN Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Van AVN Revenue (million), by Types 2024 & 2032

- Figure 5: North America Van AVN Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Van AVN Revenue (million), by Country 2024 & 2032

- Figure 7: North America Van AVN Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Van AVN Revenue (million), by Application 2024 & 2032

- Figure 9: South America Van AVN Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Van AVN Revenue (million), by Types 2024 & 2032

- Figure 11: South America Van AVN Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Van AVN Revenue (million), by Country 2024 & 2032

- Figure 13: South America Van AVN Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Van AVN Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Van AVN Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Van AVN Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Van AVN Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Van AVN Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Van AVN Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Van AVN Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Van AVN Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Van AVN Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Van AVN Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Van AVN Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Van AVN Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Van AVN Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Van AVN Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Van AVN Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Van AVN Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Van AVN Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Van AVN Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Van AVN Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Van AVN Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Van AVN Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Van AVN Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Van AVN Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Van AVN Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Van AVN Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Van AVN Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Van AVN Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Van AVN Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Van AVN Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Van AVN Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Van AVN Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Van AVN Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Van AVN Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Van AVN Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Van AVN Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Van AVN Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Van AVN Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Van AVN Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Van AVN Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Van AVN?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Van AVN?

Key companies in the market include Panasonic, Pioneer, Denso, Aisin, Clarion, Desay SV, Kenwood, Harman, ADAYO, Alpine, Visteon, Continental, Bosch, Hangsheng, Coagent.

3. What are the main segments of the Van AVN?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Van AVN," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Van AVN report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Van AVN?

To stay informed about further developments, trends, and reports in the Van AVN, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence