Key Insights

The Asia Pacific Non-Passenger Vehicle Market is projected to experience significant expansion, with an estimated market size of $4543.97 billion by 2025, growing at a Compound Annual Growth Rate (CAGR) of 5.66% from 2025 to 2033. Key growth drivers include substantial infrastructure development investments in China, India, and Southeast Asia, fueling demand for construction equipment. The agricultural sector's modernization and the mining industry's resurgence also contribute significantly, alongside robust demand for medium and heavy-duty trucks for logistics. The integration of telematics and ADAS in commercial vehicles is further enhancing market growth.

Asia Pacific Non Passenger Vehicle Market Market Size (In Million)

While the shift towards vehicle electrification is a notable long-term trend, initial cost of advanced technologies and the need for skilled labor present current challenges. However, manufacturers' strategic focus on product innovation, localized production, and expanded distribution networks is effectively addressing these hurdles. The Asia Pacific region's economic potential and diverse industrial base position it as a key market, with construction and agricultural machinery segments expected to lead growth. Major industry players are actively investing in the region, indicating a competitive and promising market outlook.

Asia Pacific Non Passenger Vehicle Market Company Market Share

This comprehensive report, Asia Pacific Non-Passenger Vehicle Market, offers in-depth insights into the commercial and specialized vehicle landscape across the region from 2019 to 2033, with 2025 as the base year. It analyzes key segments including Construction Equipment, Mining Equipment, Agricultural Machinery, Medium & Heavy Duty Trucks, and Others, and provides detailed geographical analysis of the Asia Pacific region, including China, Japan, India, South Korea, Australia, and the Rest of Asia-Pacific. Understand critical growth drivers, emerging trends, competitive strategies, and future opportunities within this expansive market.

Asia Pacific Non Passenger Vehicle Market Market Structure & Competitive Dynamics

The Asia Pacific non-passenger vehicle market exhibits a moderately consolidated structure, characterized by the presence of both global heavyweights and strong regional players. Market concentration varies across segments, with heavy-duty trucking and construction equipment showing higher consolidation due to significant capital investment requirements and established brand loyalty. Innovation ecosystems are thriving, driven by rapid technological advancements in automation, electrification, and advanced safety features. Regulatory frameworks, though evolving, are increasingly focused on emissions reduction and safety standards, influencing product development and market entry. Product substitutes exist, particularly in the construction and agricultural sectors, where rental and leasing models offer alternatives to outright purchase, impacting market penetration. End-user trends are shifting towards greater demand for fuel-efficient, technologically advanced, and sustainable vehicle solutions. Mergers & Acquisitions (M&A) activities are crucial for expanding market reach, acquiring new technologies, and gaining a competitive edge. For instance, significant M&A deals in the construction equipment segment have allowed key players to broaden their product portfolios and geographical presence. The overall market share is heavily influenced by the demand from infrastructure development and industrial expansion in key economies like China and India.

Asia Pacific Non Passenger Vehicle Market Industry Trends & Insights

The Asia Pacific non-passenger vehicle market is poised for robust growth, driven by several pivotal trends and insights. A significant growth driver is the ongoing massive infrastructure development projects across the region, particularly in emerging economies like India and Southeast Asian nations, fueling substantial demand for construction equipment and medium & heavy-duty trucks. The agricultural machinery segment is experiencing a surge in adoption of advanced technologies, including GPS-guided tractors and automated harvesters, to improve productivity and address labor shortages. Mining equipment demand is being propelled by the region's rich mineral resources and increasing global demand for raw materials, with a growing emphasis on safer and more efficient extraction methods. Technological disruptions are playing a transformative role, with the integration of IoT for fleet management and predictive maintenance becoming standard. Furthermore, the push towards electrification and alternative fuels is gaining momentum, especially in urban areas and for specific applications like last-mile delivery trucks, contributing to a lower overall CAGR for traditional combustion engine vehicles in certain sub-segments. Consumer preferences are increasingly leaning towards vehicles offering higher payload capacities, enhanced fuel efficiency, greater operational uptime, and advanced telematics for real-time monitoring. Competitive dynamics are intensifying, with manufacturers investing heavily in R&D to develop innovative solutions that cater to the specific needs of diverse Asia Pacific markets. The market penetration of advanced features is accelerating, as fleet operators recognize the long-term economic benefits of investing in modern, efficient machinery. The CAGR for the overall Asia Pacific non-passenger vehicle market is projected to be in the range of 6-8% during the forecast period, with specific segments like electric medium & heavy-duty trucks experiencing significantly higher growth rates.

Dominant Markets & Segments in Asia Pacific Non Passenger Vehicle Market

Within the Asia Pacific non-passenger vehicle market, China stands as the dominant geographical market, driven by its immense scale of infrastructure projects, robust manufacturing capabilities, and significant industrial output. Its dominance is further amplified by substantial investments in urbanization and transportation networks, directly translating into high demand for Construction Equipment and Medium & Heavy Duty Trucks.

China: The sheer volume of construction activities, from high-speed rail and airports to residential and commercial buildings, makes China the undisputed leader. The government's continued focus on economic stimulus and infrastructure upgrades ensures sustained demand. The Construction Equipment segment in China accounts for a considerable portion of the global market.

India: Emerging as a powerful growth engine, India's non-passenger vehicle market is rapidly expanding, propelled by government initiatives like "Make in India," substantial investments in infrastructure development (roads, railways, smart cities), and a burgeoning agricultural sector. The Medium & Heavy Duty Trucks segment is experiencing significant growth due to increased logistics and e-commerce activities. The Agricultural Machinery segment is also witnessing transformation with greater adoption of modern farming techniques and equipment to boost food production and farmer incomes.

South Korea and Japan: These developed markets showcase a mature demand for sophisticated and technologically advanced vehicles. While growth rates might be more moderate, the focus is on high-value equipment, specialized vehicles, and the adoption of sustainable technologies. Mining Equipment in these regions often involves highly specialized machinery for niche applications.

Rest of Asia-Pacific (Southeast Asia): Countries like Vietnam, Indonesia, and Thailand are experiencing significant infrastructure development, driving demand for construction and commercial vehicles. Economic growth and increasing urbanization are key factors supporting market expansion in this sub-region.

Vehicle Type Dominance:

- Construction Equipment: This segment consistently leads the market in terms of volume and value, owing to continuous urbanization, infrastructure projects, and real estate development across the Asia Pacific region.

- Medium & Heavy Duty Trucks: Fueling trade and logistics, this segment is experiencing robust growth, driven by the expansion of e-commerce, supply chain optimization, and increasing inter-city and cross-border trade.

- Agricultural Machinery: While perhaps smaller in overall market value compared to construction, this segment is critical for food security and rural economic development, witnessing increasing mechanization and technological integration in key agricultural economies.

- Mining Equipment: Demand in this segment is cyclical, influenced by global commodity prices and specific resource extraction projects in countries like Australia and parts of Southeast Asia.

- Others (Firetrucks, Ambulances, Recreational Boats): These are niche but essential segments, with demand driven by public safety investments, growing disposable incomes, and tourism development respectively.

Asia Pacific Non Passenger Vehicle Market Product Innovations

Product innovations in the Asia Pacific non-passenger vehicle market are heavily focused on enhancing efficiency, sustainability, and operator comfort. Manufacturers are increasingly integrating advanced telematics and IoT capabilities for real-time fleet management, predictive maintenance, and optimized route planning. The development of electric and hybrid powertrain options for trucks and construction equipment is a significant trend, driven by stringent emission regulations and corporate sustainability goals. Furthermore, advancements in autonomous driving technologies are beginning to appear in specialized mining and agricultural equipment, promising increased safety and productivity. New model launches, such as Manitowoc's Potain MCT 805, highlight a commitment to robust performance and compliance with international standards, catering to diverse lifting requirements in construction. Sany Bharat's launch of 22 new products exclusively designed for the Indian market exemplifies a strategic approach to localizing solutions and meeting specific customer needs for improved profitability.

Report Segmentation & Scope

This report segmentations offer a granular view of the Asia Pacific non-passenger vehicle market. The Vehicle Type segmentation includes Construction Equipment, which encompasses excavators, loaders, dozers, and more; Mining Equipment, covering haul trucks, loaders, and excavators specifically for mining operations; Agricultural Machinery, including tractors, harvesters, and other farm equipment; Medium & Heavy Duty Trucks, vital for logistics and transportation; and Others, comprising specialized vehicles like firetrucks, ambulances, and recreational boats. Geographically, the analysis covers the Asia Pacific region, with detailed insights into China, Japan, India, South Korea, Australia, and the Rest of Asia-Pacific. Each segment is analyzed for its market size, projected growth, and competitive landscape, providing a comprehensive understanding of market dynamics and investment opportunities across diverse applications and geographies.

Key Drivers of Asia Pacific Non Passenger Vehicle Market Growth

The growth of the Asia Pacific non-passenger vehicle market is primarily propelled by significant government investments in infrastructure development and urbanization across countries like China and India. The expanding manufacturing sector and increasing trade activities necessitate a robust fleet of medium & heavy-duty trucks for efficient logistics. In the agricultural sector, the drive for increased food production and modern farming practices fuels demand for advanced agricultural machinery. Technological advancements, including electrification and automation, are becoming key drivers as companies seek to improve operational efficiency, reduce emissions, and comply with stricter environmental regulations. Furthermore, growing foreign direct investment and the expansion of e-commerce platforms are creating sustained demand for commercial vehicles.

Challenges in the Asia Pacific Non Passenger Vehicle Market Sector

Despite robust growth, the Asia Pacific non-passenger vehicle market faces several challenges. Stringent and evolving emission regulations across different countries can increase manufacturing costs and necessitate significant R&D investments. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can impact production timelines and costs. Intense competition from both established global players and emerging local manufacturers leads to price pressures, potentially squeezing profit margins. Furthermore, the high initial capital investment required for advanced and specialized vehicles can be a barrier for smaller businesses and emerging markets within the region. Economic downturns and fluctuating commodity prices can also impact demand, particularly in the mining equipment segment.

Leading Players in the Asia Pacific Non Passenger Vehicle Market Market

- Kobelco Construction Machinery Co Ltd

- CNH Industrial N V

- Deere & Co

- JCB Limited

- Hino Motors

- Kubota Corporation

- Mahindra & Mahindra

- Isuzu Motors Limited

- Liebherr Group

- Hitachi Construction Machinery Co Ltd

- Volvo Construction Equipment

- AGCO Corporation

- Caterpillar Inc

- Hyundai Construction Equipment

- Escorts Group

- Iveco

Key Developments in Asia Pacific Non Passenger Vehicle Market Sector

- August, 2022: Volvo CE announced the development of its manufacturing facility in Bengaluru, India, into an export hub. This investment will enable Volvo Construction Equipment to produce medium-sized excavators for both the Indian market and export, enhancing their global manufacturing footprint.

- June, 2022: Cummins Inc. and Komatsu Corp. announced a new collaboration focused on developing zero-emissions mining haul trucks. Their initial efforts will concentrate on zero-emission power technologies, including hydrogen fuel cell solutions, specifically for large mining haul truck applications.

- April, 2022: Manitowoc launched the Potain MCT 805, manufactured at their Zhangjiagang, China factory. This new model offers strong performance, complies with international standards, and is available in 32 t and 40 t capacity configurations, with an 80 m jib and a height under hook of 84 m.

- May, 2022: Sany Bharat launched 22 new products during Excon 2022 in India. These machines are exclusively designed for the Indian market, incorporating insights into local customer requirements and market sentiments, aiming for enhanced profitability for users.

Strategic Asia Pacific Non Passenger Vehicle Market Market Outlook

The strategic outlook for the Asia Pacific non-passenger vehicle market is exceptionally positive, driven by sustained economic growth and ongoing infrastructure development. Key growth accelerators include the increasing adoption of electrification and alternative powertrains, which will open new market avenues and create demand for innovative solutions. The continued focus on smart city initiatives and sustainable development across the region will further boost the demand for advanced construction and specialized vehicles. Furthermore, the growing emphasis on precision agriculture and efficient logistics management will spur the adoption of technologically sophisticated machinery and heavy-duty trucks. Strategic opportunities lie in developing localized product offerings, leveraging digital technologies for enhanced customer service and aftermarket support, and focusing on sustainable manufacturing practices to align with global environmental objectives. The market is ripe for players who can offer integrated solutions, robust after-sales service, and innovative financing options to cater to the diverse needs of the Asia Pacific region.

Asia Pacific Non Passenger Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Construction Equipment

- 1.2. Mining Equipment

- 1.3. Agricultural Machinery

- 1.4. Medium & Heavy Duty Trucks

- 1.5. Others(Firetrucks, Ambulances, Recreational Boats)

-

2. Geography

-

2.1. Asia Pacific

- 2.1.1. China

- 2.1.2. Japan

- 2.1.3. India

- 2.1.4. South Korea

- 2.1.5. Australia

- 2.1.6. Rest of Asia-Pacific

-

2.1. Asia Pacific

Asia Pacific Non Passenger Vehicle Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. South Korea

- 1.5. Australia

- 1.6. Rest of Asia Pacific

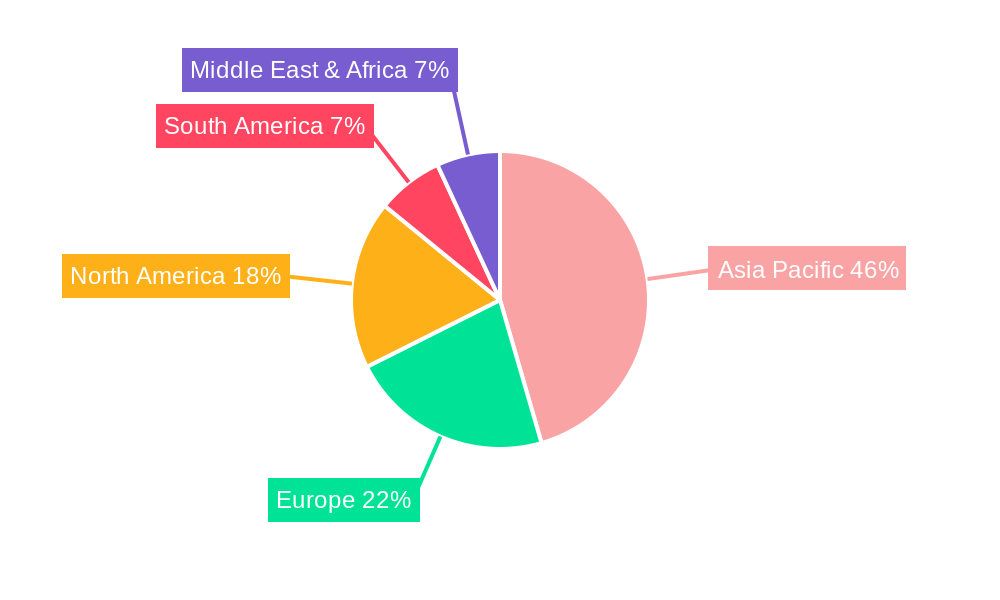

Asia Pacific Non Passenger Vehicle Market Regional Market Share

Geographic Coverage of Asia Pacific Non Passenger Vehicle Market

Asia Pacific Non Passenger Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Electric School Buses

- 3.3. Market Restrains

- 3.3.1. Uncertainty of The Global Pandemic

- 3.4. Market Trends

- 3.4.1. Rising Focus On Infrastructure Activities To Drive Demand In The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Non Passenger Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Construction Equipment

- 5.1.2. Mining Equipment

- 5.1.3. Agricultural Machinery

- 5.1.4. Medium & Heavy Duty Trucks

- 5.1.5. Others(Firetrucks, Ambulances, Recreational Boats)

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia Pacific

- 5.2.1.1. China

- 5.2.1.2. Japan

- 5.2.1.3. India

- 5.2.1.4. South Korea

- 5.2.1.5. Australia

- 5.2.1.6. Rest of Asia-Pacific

- 5.2.1. Asia Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kobelco Construction Machinery Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CNH Industrial N V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deere & Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JCB Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hino Motors

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kubota Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mahindra & Mahindra

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Isuzu Motors Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Liebherr Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hitachi Construction Machinery Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Volvo Construction Equipment

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 AGCO Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Caterpillar Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Hyundai Construction Equipment

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Escorts Group

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Ivec

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Kobelco Construction Machinery Co Ltd

List of Figures

- Figure 1: Asia Pacific Non Passenger Vehicle Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Non Passenger Vehicle Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Non Passenger Vehicle Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Asia Pacific Non Passenger Vehicle Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Asia Pacific Non Passenger Vehicle Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Non Passenger Vehicle Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: Asia Pacific Non Passenger Vehicle Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia Pacific Non Passenger Vehicle Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Non Passenger Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Non Passenger Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: India Asia Pacific Non Passenger Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Asia Pacific Non Passenger Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Non Passenger Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Asia Pacific Non Passenger Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Non Passenger Vehicle Market?

The projected CAGR is approximately 5.66%.

2. Which companies are prominent players in the Asia Pacific Non Passenger Vehicle Market?

Key companies in the market include Kobelco Construction Machinery Co Ltd, CNH Industrial N V, Deere & Co, JCB Limited, Hino Motors, Kubota Corporation, Mahindra & Mahindra, Isuzu Motors Limited, Liebherr Group, Hitachi Construction Machinery Co Ltd, Volvo Construction Equipment, AGCO Corporation, Caterpillar Inc, Hyundai Construction Equipment, Escorts Group, Ivec.

3. What are the main segments of the Asia Pacific Non Passenger Vehicle Market?

The market segments include Vehicle Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4543.97 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Electric School Buses.

6. What are the notable trends driving market growth?

Rising Focus On Infrastructure Activities To Drive Demand In The Market.

7. Are there any restraints impacting market growth?

Uncertainty of The Global Pandemic.

8. Can you provide examples of recent developments in the market?

August, 2022: Volvo CE announced to development of its manufacturing facility located in Bengaluru in India into an export hub. The company stated that this investment will allow Volvo Construction Equipment to produce medium-sized excavators at the plant. The company further stated that these machines will primarily be used in the Indian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Non Passenger Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Non Passenger Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Non Passenger Vehicle Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Non Passenger Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence