Key Insights

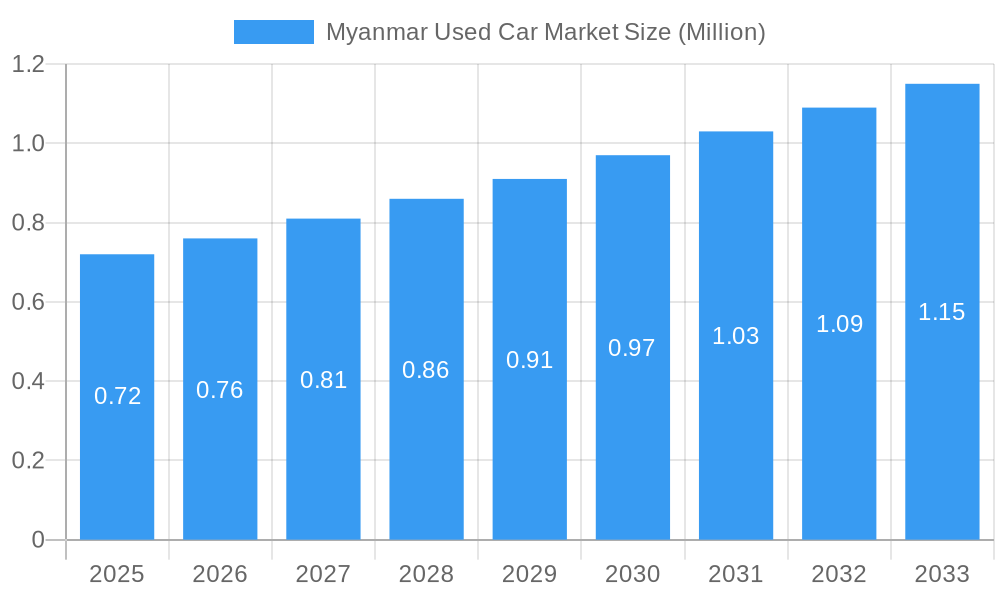

The Myanmar Used Car Market is poised for substantial growth, projected to reach an estimated market size of USD 0.72 million in 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 5.80% over the forecast period of 2025-2033. A key driver for this burgeoning market is the increasing demand for affordable and reliable transportation solutions among a growing middle class. As disposable incomes rise, more consumers are looking to own vehicles, and the used car segment offers a more accessible entry point compared to new vehicles. Furthermore, advancements in the organized used car dealership sector, alongside the continued presence of unorganized vendors, contribute to a dynamic marketplace catering to diverse consumer preferences and budgets. The prevalence of gasoline and diesel-powered vehicles is expected to dominate the fuel type segment in the near term, reflecting the current infrastructure and consumer preference in Myanmar.

Myanmar Used Car Market Market Size (In Million)

The market's trajectory will be further shaped by evolving trends in vehicle types. Sport Utility Vehicles (SUVs) and Sedans are anticipated to see significant demand, aligning with family needs and professional lifestyles. The increasing urbanization and the development of better road networks, even in developing economies like Myanmar, also encourage the adoption of versatile vehicle types. While the market benefits from these drivers, potential restraints such as import regulations, fluctuating foreign exchange rates, and the availability of financing options for used vehicles will need to be carefully navigated by stakeholders. The competitive landscape includes established players like Japan Auto Showroom and CarsDB, alongside local entities, all vying for market share. As the market matures, we can expect an increased focus on quality assurance, transparent pricing, and enhanced customer service to build trust and sustain growth.

Myanmar Used Car Market Company Market Share

Here's a detailed SEO-optimized report description for the Myanmar Used Car Market, incorporating high-ranking keywords, specific details, and adhering to your formatting requirements.

Myanmar Used Car Market Analysis: Growth Drivers, Trends, and Competitive Landscape (2019-2033)

This comprehensive report provides an in-depth analysis of the Myanmar Used Car Market, offering critical insights into its structure, trends, dominant segments, and competitive dynamics. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving second-hand car market in Myanmar. We delve into crucial industry developments, including significant regulatory changes and digital platform launches, providing actionable intelligence for used car dealers in Myanmar, automotive distributors, and potential investors. Our analysis encompasses used vehicle types, vendor types, and fuel types, offering a granular view of market penetration and growth opportunities.

Myanmar Used Car Market Market Structure & Competitive Dynamics

The Myanmar used car market exhibits a moderate level of concentration, with a blend of established organized used car vendors and a substantial unorganized sector. Key players like Japan Auto Showroom, CarsDB, Japan Partner Inc, Toyota Aye and Sons, SBT CO LTD, Capital Diamond Star Group Limited, Farmer Auto, and Prestige Automobiles Co Ltd are actively shaping the market landscape. The presence of organized players, such as Capital Diamond Star Group Limited, indicates a growing trend towards professionalization and standardized services. Innovation ecosystems are nascent but are gradually developing, particularly with the integration of digital platforms. Regulatory frameworks, such as the Myanmar used car import rules and regulations announced in March 2023, significantly influence market entry and operational costs, with customs duties ranging from 30-40%. Product substitutes, while limited in the immediate sense, include new vehicle purchases and alternative transportation modes. End-user trends lean towards affordability and accessibility, driving demand for used vehicles. Mergers and acquisitions (M&A) activities are currently low, but the potential for consolidation exists as the market matures. The overall market share distribution remains dynamic, influenced by pricing, availability, and consumer trust.

Myanmar Used Car Market Industry Trends & Insights

The Myanmar Used Car Market is poised for significant growth, driven by a confluence of economic, social, and technological factors. During the historical period (2019–2024), the market witnessed steady demand, a trend expected to accelerate in the forecast period (2025–2033). A key market growth driver is the increasing disposable income among the growing middle class, coupled with the inherent affordability of used cars in Myanmar compared to new vehicles. The automotive industry in Myanmar is also seeing a rise in vehicle ownership aspirations, with used cars serving as an accessible entry point. Technological disruptions are beginning to permeate the sector, most notably with the launch of digital platforms. For instance, Capital Diamond Star Group Limited's December 2021 initiative to establish a digital platform for used cars signifies a move towards greater transparency, convenience, and wider reach for buyers and sellers. This digital transformation is expected to improve market efficiency and customer experience, potentially increasing market penetration for organized vendors. Consumer preferences are evolving, with a greater emphasis on vehicle condition, service history, and reliable after-sales support, which organized players are better positioned to provide. Competitive dynamics are intensifying, with both local and international players vying for market share. The Myanmar automotive market's transition towards modernization and digital integration will be a defining trend. Furthermore, the government's revised used car import rules and regulations, including a 30-40% customs duty, aim to manage imports and potentially encourage domestic refurbishing and sales, impacting the overall market size and structure. The second-hand vehicle market is anticipated to experience a Compound Annual Growth Rate (CAGR) of approximately 7-9% over the forecast period, reflecting robust expansion potential.

Dominant Markets & Segments in Myanmar Used Car Market

The Myanmar Used Car Market is characterized by the dominance of specific segments driven by consumer needs and economic realities.

Vehicle Type Dominance:

- Sedans and Sport Utility Vehicles (SUVs) currently hold significant market share, catering to diverse needs ranging from daily commuting to family travel and the aspirational demands of a growing population. The affordability of used sedans makes them a staple for many households, while the increasing popularity of SUVs, driven by perceived utility and status, is also a strong segment.

- Hatchbacks represent a considerable portion of the market, particularly for urban commuters and younger demographics due to their fuel efficiency and compact size.

- Multi-Purpose Vehicles (MUVs) are gaining traction as families expand and the need for flexible seating and cargo space grows.

- The Electric Vehicle (EV) segment, while nascent, shows future potential but currently holds a minimal share in the used car market due to infrastructure and cost considerations.

Vendor Type Dominance:

- The Unorganized Vendor segment continues to hold a substantial market share, primarily due to its accessibility and often lower price points. This segment comprises individual sellers and smaller, informal dealerships that cater to a price-sensitive customer base.

- However, the Organized Vendor segment, including prominent names like Capital Diamond Star Group Limited, Japan Auto Showroom, and CarsDB, is experiencing significant growth. The increasing emphasis on trust, warranties, and professional services is gradually shifting consumer preference towards organized players, leading to an expanding market share in this category.

Fuel Type Dominance:

- Gasoline-powered vehicles dominate the Myanmar used car market. This is attributed to the historical prevalence of gasoline vehicles in imports and the established fueling infrastructure across the country.

- Diesel vehicles also command a significant share, particularly in commercial applications and larger vehicles like SUVs and trucks, due to their perceived durability and torque.

- Other Fuel Types, including CNG and LPG conversions, are present but constitute a smaller portion of the market.

- Electric fuel types are in their nascent stages and represent a very small fraction of the current used car market, with limited availability and charging infrastructure being key constraints.

Key drivers for the dominance of these segments include:

- Economic Accessibility: The lower cost of ownership for sedans, hatchbacks, and gasoline vehicles makes them highly desirable.

- Infrastructure: The widespread availability of gasoline and diesel fueling stations supports the dominance of these fuel types.

- Consumer Aspirations: The growing desire for personal mobility and versatile vehicles fuels the demand for SUVs and MUVs.

- Government Policies: Import regulations and duties indirectly influence which types of vehicles are more readily available and affordable in the used market.

Myanmar Used Car Market Product Innovations

Product innovations in the Myanmar used car market are largely centered on enhancing the buyer and seller experience. The integration of digital platforms by companies like Capital Diamond Star Group Limited is a significant innovation, offering online listings, virtual tours, and streamlined transaction processes. This improves market transparency and accessibility. Furthermore, there's a growing focus on providing certified pre-owned (CPO) programs by organized dealers, which involve rigorous inspections and extended warranties, offering competitive advantages by building consumer trust. The application of these innovations lies in reducing information asymmetry and improving the overall quality perception of used vehicles.

Report Segmentation & Scope

This report segments the Myanmar Used Car Market based on key differentiating factors to provide granular insights.

Vehicle Type Segmentation: The market is analyzed across Hatchback, Sedan, Sport Utility Vehicles (SUVs), and Multi-Purpose Vehicles (MUVs). Each segment's growth projections and market sizes are detailed, reflecting varying consumer demands and price points. Hatchbacks and Sedans are expected to maintain strong market share, while SUVs and MUVs show higher growth potential.

Vendor Type Segmentation: The analysis differentiates between Organized and Unorganized vendors. While the unorganized sector currently dominates in volume, the organized segment is projected for robust growth due to increasing demand for transparency and reliability.

Fuel Type Segmentation: The market is segmented into Gasoline, Diesel, Electric, and Other Fuel Types. Gasoline and Diesel vehicles are projected to maintain their dominance in the near to medium term, with Electric vehicles showing nascent but growing interest driven by future sustainability trends and potential government incentives.

Key Drivers of Myanmar Used Car Market Growth

Several key drivers are fueling the expansion of the Myanmar Used Car Market. The primary economic driver is the growing affordability of used vehicles, making car ownership accessible to a wider segment of the population. Rising disposable incomes and a burgeoning middle class are also significant contributors. Regulatory changes, while sometimes imposing duties, also aim to formalize the market, which can lead to increased confidence and structured growth. For instance, the government's announcement of used car import rules in March 2023, despite imposing customs duties, signifies a move towards regulation that can foster a more stable market in the long run. Technological advancements, particularly the adoption of digital platforms for sales and marketing, are enhancing market reach and efficiency, attracting more buyers and sellers.

Challenges in the Myanmar Used Car Market Sector

Despite its growth potential, the Myanmar Used Car Market faces several challenges. Regulatory hurdles, such as the 30-40% customs duty on used car imports, can impact pricing and availability, making vehicles less competitive. Supply chain issues, including logistical complexities and varying import quality, can affect the consistency and reliability of available stock. Furthermore, the prevalence of the unorganized sector can lead to concerns regarding vehicle condition, authenticity, and after-sales support, creating a trust deficit for some consumers. Intense competition among numerous small dealerships also puts pressure on margins, particularly for unorganized vendors.

Leading Players in the Myanmar Used Car Market Market

- Japan Auto Showroom

- CarsDB

- Japan Partner Inc

- Toyota Aye and Sons

- SBT CO LTD

- Capital Diamond Star Group Limited

- Farmer Auto

- Prestige Automobiles Co Ltd

Key Developments in Myanmar Used Car Market Sector

- March 2023: The government of Myanmar announced the used car Import Rules & Regulations in the country. The government imposed around 30-40% customs duty on used cars. This development aims to regulate the import of used vehicles, potentially impacting pricing, availability, and the competitive landscape by increasing operational costs for importers.

- December 2021: Capital Diamond Star Group Limited launched a digital platform for used cars in Myanmar. The company is one of the leading distributors of Ford Motor, Jaguar, and Land Rover Cars. This initiative signifies a move towards digitalization and modernization in the used car sector, enhancing transparency, accessibility, and customer experience for a broader audience.

Strategic Myanmar Used Car Market Market Outlook

The strategic outlook for the Myanmar Used Car Market is positive, characterized by sustained growth driven by increasing domestic demand and ongoing market formalization. Growth accelerators include the continued expansion of the middle class, a persistent preference for affordable transportation solutions, and the increasing adoption of digital technologies to streamline transactions. The formalization of the market through regulatory clarity and the rise of organized dealerships will likely attract more investment and build consumer confidence, paving the way for enhanced service offerings like certified pre-owned programs. Opportunities lie in leveraging digital platforms for wider reach, developing robust after-sales support, and catering to evolving consumer preferences for specific vehicle types and fuel efficiencies, positioning the market for a robust future.

Myanmar Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicles (SUVs)

- 1.4. Multi-Purpose Vehicles (MUVs)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types

Myanmar Used Car Market Segmentation By Geography

- 1. Myanmar

Myanmar Used Car Market Regional Market Share

Geographic Coverage of Myanmar Used Car Market

Myanmar Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Price of New Cars

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Rising Internet penetration and Online Digital Platforms to drive demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Myanmar Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicles (SUVs)

- 5.1.4. Multi-Purpose Vehicles (MUVs)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Myanmar

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Japan Auto Showroom

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CarsDB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Japan Partner Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toyota Aye and Sons

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SBT CO LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Capital Diamond Star Group Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Farmer Auto

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Prestige Automobiles Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Japan Auto Showroom

List of Figures

- Figure 1: Myanmar Used Car Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Myanmar Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: Myanmar Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Myanmar Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 3: Myanmar Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: Myanmar Used Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Myanmar Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Myanmar Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 7: Myanmar Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: Myanmar Used Car Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Myanmar Used Car Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Myanmar Used Car Market?

Key companies in the market include Japan Auto Showroom, CarsDB, Japan Partner Inc, Toyota Aye and Sons, SBT CO LTD, Capital Diamond Star Group Limited, Farmer Auto, Prestige Automobiles Co Ltd.

3. What are the main segments of the Myanmar Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Price of New Cars.

6. What are the notable trends driving market growth?

Rising Internet penetration and Online Digital Platforms to drive demand in the Market.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

March 2023: The government of Myanmar announced the used car Import Rules & Regulations in the country. The government imposed around 30-40% customs duty on used cars.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Myanmar Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Myanmar Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Myanmar Used Car Market?

To stay informed about further developments, trends, and reports in the Myanmar Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence