Key Insights

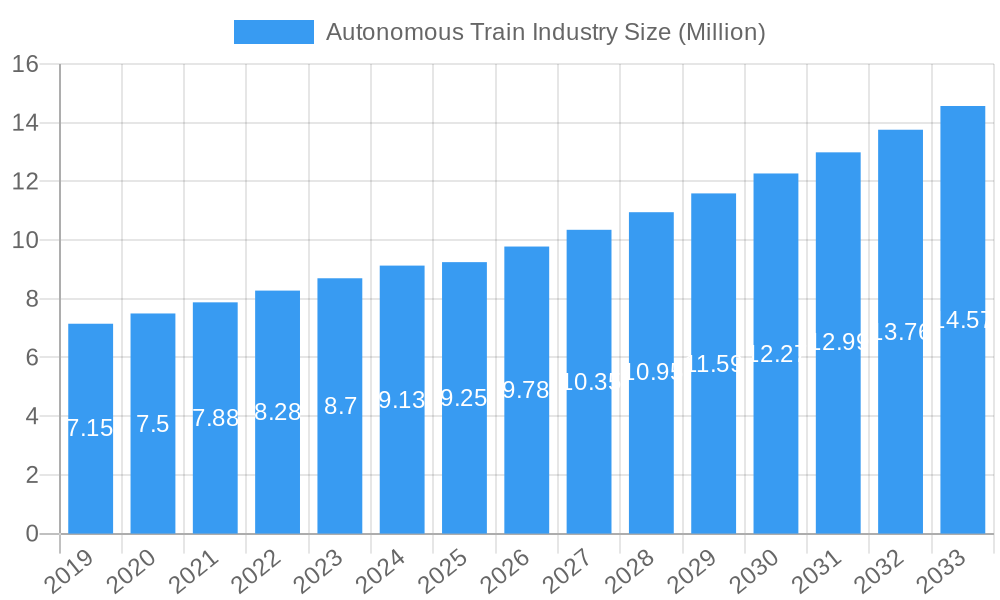

The global Autonomous Train Industry is poised for significant expansion, with a projected market size of USD 9.25 billion in 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 5.78% through 2033. This sustained growth is primarily fueled by the escalating demand for enhanced operational efficiency, reduced labor costs, and improved safety standards across passenger and freight rail services. Advancements in automation technologies, including Communications-Based Train Control (CBTC), European Rail Traffic Management System (ERTMS), Automatic Train Control (ATC), and Positive Train Control (PTC), are pivotal in enabling higher levels of autonomy, ranging from Grade of Automation (GoA) 1 to GoA 4. The industry's trajectory is further bolstered by substantial investments in railway infrastructure upgrades and the development of sophisticated AI and sensor technologies that facilitate driverless operations. Key players like Siemens AG, Alstom SA, and CRRC Corporation Limited are at the forefront, investing heavily in research and development to bring these advanced solutions to market, catering to a diverse range of train types, including metros, monorails, light rail, and high-speed trains.

Autonomous Train Industry Market Size (In Million)

While the market presents substantial opportunities, certain factors could influence its growth trajectory. Regulatory hurdles and the need for stringent safety certifications for fully autonomous systems may present challenges. Public perception and acceptance of driverless trains, alongside the considerable upfront investment required for implementing advanced automation infrastructure, also represent potential restraints. Nevertheless, the compelling benefits of autonomous trains – including increased capacity, optimized scheduling, and minimized human error – are expected to outweigh these concerns. Emerging trends such as predictive maintenance, enhanced passenger experience through personalized services, and the integration of autonomous trains with smart city initiatives are set to redefine urban and intercity mobility. The Asia Pacific region, driven by rapid urbanization and extensive infrastructure development, is anticipated to be a leading market, followed closely by Europe and North America, which are actively modernizing their existing rail networks.

Autonomous Train Industry Company Market Share

This comprehensive Autonomous Train Industry report offers an in-depth analysis of the global market, providing critical insights for stakeholders from 2019 to 2033. Leveraging data from the base year 2025 and a robust forecast period from 2025 to 2033, this report delves into market dynamics, technological advancements, and the competitive landscape of driverless train technology. With a focus on GoA 4 autonomous trains, CBTC systems, and high-speed rail automation, this research is essential for understanding the future of railway automation. The report meticulously examines key market segments including Automation Grade (GoA 1, GoA 2, GoA 3, GoA 4), Application (Passenger, Freight), Technology (CBTC, ERTMS, ATC, PTC), and Train Type (Metro/Monorail, Light Rail, High-speed Rail), forecasting a significant CAGR in the autonomous metro market. Discover how leading companies like Siemens AG, Alstom SA, CRRC Corporation Limited, and Kawasaki Heavy Industries are shaping the future of rail transport.

Autonomous Train Industry Market Structure & Competitive Dynamics

The Autonomous Train Industry market structure is characterized by a dynamic interplay of established railway giants and emerging technology providers. Market concentration is moderate, with a few key players holding significant market share in advanced automation solutions. The innovation ecosystem thrives on collaborations between train manufacturers, signaling solution providers, and software developers, fostering rapid advancements in GoA 4 technology and communications-based train control (CBTC). Regulatory frameworks are evolving, with governments worldwide pushing for safer and more efficient rail operations, driving the adoption of ERTMS and PTC systems. Product substitutes are limited in the context of full automation, but incremental upgrades to existing systems offer near-term competition. End-user trends indicate a strong demand for increased capacity, reduced operational costs, and enhanced passenger safety, fueling the growth of driverless train systems. Merger and acquisition (M&A) activities are strategic, often aimed at acquiring specialized expertise in AI, sensor technology, and cybersecurity for autonomous rail. For instance, M&A deals valued in the hundreds of millions to billions are anticipated as companies consolidate their positions in the autonomous metro and high-speed rail sectors.

- Market Share: Leading companies are estimated to hold combined market shares exceeding 60% in specific technology segments like CBTC.

- M&A Deal Values: Anticipated M&A deal values are projected to reach between USD 500 Million and USD 2 Billion per major acquisition, focusing on critical technologies and intellectual property.

- Innovation Ecosystem: Driven by an estimated USD 5 Billion annual investment in R&D across the sector.

- Regulatory Landscape: Increasing adoption of international standards for train control systems is a key differentiator.

- End-User Demands: Focus on operational efficiency, passenger safety, and capacity expansion, contributing to a projected USD 10 Billion market value by 2025.

Autonomous Train Industry Industry Trends & Insights

The Autonomous Train Industry is experiencing unprecedented growth, propelled by a confluence of technological advancements, economic imperatives, and increasing global urbanization. The primary market growth driver is the relentless pursuit of enhanced operational efficiency and safety in rail transport. Governments and railway operators are investing heavily in driverless train technology to reduce labor costs, minimize human error, and optimize train frequency, particularly in congested urban areas. Technological disruptions, such as advancements in Artificial Intelligence (AI), machine learning, sensor fusion, and high-speed communication networks, are enabling higher levels of automation, pushing towards the GoA 4 standard. Consumer preferences are increasingly leaning towards reliable, punctual, and safe public transportation, a need that fully automated trains are ideally positioned to meet. The competitive dynamics are intense, with traditional rail manufacturers like Siemens AG and Alstom SA vying for dominance against emerging players and technology integrators. The market penetration of autonomous train solutions is rapidly increasing, with significant investments being made in new lines and the retrofitting of existing infrastructure. The autonomous metro market is leading this transformation, followed by light rail and increasingly, high-speed rail. The projected CAGR for the autonomous train market is estimated at a robust 15% over the forecast period, indicating substantial expansion. The demand for CBTC and ERTMS compliant systems is a significant trend, driving innovation in integrated operational and safety management.

- Market Growth Drivers: Efficiency gains, safety enhancements, cost reduction, and increased capacity.

- Technological Disruptions: AI-powered decision-making, advanced sensor suites, and secure communication protocols.

- Consumer Preferences: Demand for punctuality, reliability, and enhanced passenger experience.

- Competitive Dynamics: Intense competition among established players and new entrants, focusing on technology leadership and deployment capabilities.

- Market Penetration: Expected to reach 30% of new rail system deployments by 2030.

- CAGR: Estimated at 15% from 2025 to 2033.

- Market Value: Projected to exceed USD 50 Billion by 2033.

Dominant Markets & Segments in Autonomous Train Industry

The Autonomous Train Industry is witnessing robust growth across various regions and segments, with specific markets and applications taking the lead. Asia-Pacific, particularly China, is the dominant region due to extensive investments in urban rail expansion and the early adoption of advanced driverless train technology. Countries like Japan, South Korea, and Singapore are also at the forefront, showcasing advanced autonomous metro operations. The Automation Grade GoA 4 segment is the primary focus for new deployments, signifying the industry's commitment to fully automated operations, driven by the need for maximum efficiency and safety. In terms of application, the Passenger segment, specifically Metro/Monorail systems, is the largest and fastest-growing. This is attributed to increasing urbanization and the critical need for efficient mass transit solutions in densely populated cities. The Technology segment is dominated by Communications-Based Train Control (CBTC), which enables high-capacity operations in urban environments, followed by European Rail Traffic Management System (ERTMS) for interoperability and safety on mainline railways. The Train Type segment sees Metro/Monorail leading, with significant growth also in Light Rail modernization projects. High-speed rail automation, while still in its nascent stages, is expected to experience substantial development in the latter half of the forecast period, driven by demand for faster intercity travel.

- Dominant Region: Asia-Pacific, with an estimated 40% market share.

- Leading Country: China, with over 100 active autonomous or semi-autonomous metro lines.

- Dominant Automation Grade: GoA 4, accounting for approximately 50% of new projects.

- Leading Application: Passenger transport, contributing over 85% of the market revenue.

- Dominant Technology: CBTC, with an estimated 60% adoption rate in urban rail.

- Leading Train Type: Metro/Monorail, representing 70% of autonomous deployments.

- Key Drivers:

- Economic Policies: Government subsidies and infrastructure development initiatives.

- Urbanization: Rapid growth of metropolitan areas requiring advanced transit solutions.

- Safety Regulations: Stringent requirements driving automation adoption.

- Technological Advancements: Maturation of AI and sensor technologies.

- Emerging Trends: Increasing focus on freight automation and the integration of predictive maintenance using AI.

Autonomous Train Industry Product Innovations

Product innovations in the Autonomous Train Industry are primarily focused on enhancing safety, efficiency, and passenger experience. Key developments include advanced AI algorithms for obstacle detection and collision avoidance, sophisticated sensor fusion technologies for precise train localization, and robust cybersecurity measures to protect critical operational data. These innovations are driving the evolution of driverless train systems towards higher automation grades, particularly GoA 4. Companies are developing integrated digital platforms that enable real-time monitoring, remote diagnostics, and predictive maintenance, significantly reducing downtime and operational costs. The application of 5G technology is also a critical innovation, facilitating ultra-reliable, low-latency communication essential for seamless CBTC and autonomous operations. Competitive advantages are being gained through the development of modular and scalable autonomous train solutions that can be adapted to various rail types, from metros to high-speed lines.

Report Segmentation & Scope

This report segments the Autonomous Train Industry market comprehensively, providing detailed analysis across key dimensions. The Automation Grade segmentation includes GoA 1, GoA 2, GoA 3, and GoA 4, with a strong emphasis on the rapid growth of GoA 4 deployments. The Application segmentation covers Passenger and Freight services, with the Passenger segment dominating current market share. The Technology segmentation analyzes the adoption of CBTC, ERTMS, ATC, and PTC systems, highlighting the prominence of CBTC in urban transit and ERTMS in mainline rail. The Train Type segmentation details the market for Metro/Monorail, Light Rail, and High-speed Rail systems, with Metro/Monorail systems leading in autonomous implementations. The scope encompasses the global market, with specific regional and country-level analysis, and projects market sizes and growth rates for each segment through 2033.

Key Drivers of Autonomous Train Industry Growth

The growth of the Autonomous Train Industry is propelled by several interconnected factors. Firstly, the drive for enhanced operational efficiency and significant cost reductions in train operations, including labor and energy consumption, is a primary economic driver. Secondly, safety regulations are becoming increasingly stringent, pushing operators towards driverless train technology to minimize human error and prevent accidents. Thirdly, technological advancements in AI, machine learning, sensor technology, and communication systems have reached a maturity level that enables reliable and safe autonomous operations. Finally, the growing global demand for efficient and sustainable public transportation solutions, driven by urbanization and environmental concerns, creates a substantial market opportunity for automated rail systems.

Challenges in the Autonomous Train Industry Sector

Despite its promising outlook, the Autonomous Train Industry faces several challenges. Regulatory hurdles remain significant, as certification processes for fully autonomous systems are complex and time-consuming, varying across different jurisdictions. Cybersecurity threats are a major concern, as increased connectivity of train systems makes them vulnerable to attacks, potentially leading to system failures or data breaches. High initial investment costs for implementing autonomous technology and upgrading existing infrastructure can be a barrier for some operators. Public perception and acceptance of driverless trains, while improving, still require careful management and robust safety demonstrations. Furthermore, the integration of new autonomous systems with legacy infrastructure presents considerable technical challenges.

Leading Players in the Autonomous Train Industry Market

- Kawasaki Heavy Industries

- CRRC Corporation Limited

- Construcciones y Auxiliar de Ferrocarriles (CAF)

- Thales Group

- Siemens AG

- Alstom SA

- Hitachi Rail STS (Ansaldo STS)

- Ingeteam Corporation S

- Wabtec Corporation

- Mitsubishi Heavy Industries Ltd

Key Developments in Autonomous Train Industry Sector

- June 2022: The German Aerospace Centre (DLR) and TU Berlin, in collaboration with Alstom, are developing technical solutions to gradually digitize rail passenger transport in Germany, exploring automation in regional transport via the European Train Control System (ETCS).

- September 2021: Mitsubishi Heavy Industries Engineering, in partnership with Keolis, successfully began operations of the Dubai Metro, a fully automated driverless rail system, managed by Keolis-MHI Rail Management Operation LLC (Keolis-MHI).

- August 2021: Siemens Mobility secured a contract to design, install, and commission the first Communications-Based Train Control (CBTC) technology for Malaysia and Singapore cross-border link trains. The company also announced plans to deliver a CBTC system for a Brazilian metro line in May 2021.

- July 2021: Ningbo Rail Transit Group and CRRC developed the first smart metro train for Ningbo Metro Line 5, capable of fully autonomous operation, including running, return, inspection, and repair, significantly boosting operating efficiency.

- May 2021: Kawasaki Heavy Industries launched new remote track monitoring services in North America, utilizing information and communications technology to improve trackside efficiency and address irregularities for enhanced train and passenger safety.

Strategic Autonomous Train Industry Market Outlook

The strategic outlook for the Autonomous Train Industry is exceptionally strong, driven by the global imperative for more efficient, sustainable, and safer transportation. Key growth accelerators include the ongoing smart city initiatives worldwide, which prioritize advanced public transit solutions, and the increasing adoption of digital twin technologies for optimizing rail operations. Furthermore, the integration of AI and big data analytics for predictive maintenance and dynamic route optimization will unlock new revenue streams and operational efficiencies. Investments in autonomous technologies are expected to accelerate, particularly in the high-speed rail and freight transport segments, opening up significant market potential. Companies that focus on developing interoperable, secure, and scalable autonomous systems will be well-positioned to capitalize on future market opportunities and secure long-term growth. The projected market expansion indicates a transformative era for railway automation.

Autonomous Train Industry Segmentation

-

1. Automation Grade

- 1.1. GoA 1

- 1.2. GoA 2

- 1.3. GoA 3

- 1.4. GoA 4

-

2. Application

- 2.1. Passenger

- 2.2. Freight

-

3. Technology

- 3.1. CBTC

- 3.2. ERTMS

- 3.3. ATC

- 3.4. PTC

-

4. Train Type

- 4.1. Metro/Monorail

- 4.2. Light Rail

- 4.3. High-speed Rail

Autonomous Train Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Autonomous Train Industry Regional Market Share

Geographic Coverage of Autonomous Train Industry

Autonomous Train Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Focus On Safety

- 3.3. Market Restrains

- 3.3.1. High Initial Investment

- 3.4. Market Trends

- 3.4.1. Metro/Monorail Dominating the Global Autonomous Train Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autonomous Train Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Automation Grade

- 5.1.1. GoA 1

- 5.1.2. GoA 2

- 5.1.3. GoA 3

- 5.1.4. GoA 4

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Passenger

- 5.2.2. Freight

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. CBTC

- 5.3.2. ERTMS

- 5.3.3. ATC

- 5.3.4. PTC

- 5.4. Market Analysis, Insights and Forecast - by Train Type

- 5.4.1. Metro/Monorail

- 5.4.2. Light Rail

- 5.4.3. High-speed Rail

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Automation Grade

- 6. North America Autonomous Train Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Automation Grade

- 6.1.1. GoA 1

- 6.1.2. GoA 2

- 6.1.3. GoA 3

- 6.1.4. GoA 4

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Passenger

- 6.2.2. Freight

- 6.3. Market Analysis, Insights and Forecast - by Technology

- 6.3.1. CBTC

- 6.3.2. ERTMS

- 6.3.3. ATC

- 6.3.4. PTC

- 6.4. Market Analysis, Insights and Forecast - by Train Type

- 6.4.1. Metro/Monorail

- 6.4.2. Light Rail

- 6.4.3. High-speed Rail

- 6.1. Market Analysis, Insights and Forecast - by Automation Grade

- 7. Europe Autonomous Train Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Automation Grade

- 7.1.1. GoA 1

- 7.1.2. GoA 2

- 7.1.3. GoA 3

- 7.1.4. GoA 4

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Passenger

- 7.2.2. Freight

- 7.3. Market Analysis, Insights and Forecast - by Technology

- 7.3.1. CBTC

- 7.3.2. ERTMS

- 7.3.3. ATC

- 7.3.4. PTC

- 7.4. Market Analysis, Insights and Forecast - by Train Type

- 7.4.1. Metro/Monorail

- 7.4.2. Light Rail

- 7.4.3. High-speed Rail

- 7.1. Market Analysis, Insights and Forecast - by Automation Grade

- 8. Asia Pacific Autonomous Train Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Automation Grade

- 8.1.1. GoA 1

- 8.1.2. GoA 2

- 8.1.3. GoA 3

- 8.1.4. GoA 4

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Passenger

- 8.2.2. Freight

- 8.3. Market Analysis, Insights and Forecast - by Technology

- 8.3.1. CBTC

- 8.3.2. ERTMS

- 8.3.3. ATC

- 8.3.4. PTC

- 8.4. Market Analysis, Insights and Forecast - by Train Type

- 8.4.1. Metro/Monorail

- 8.4.2. Light Rail

- 8.4.3. High-speed Rail

- 8.1. Market Analysis, Insights and Forecast - by Automation Grade

- 9. Rest of the World Autonomous Train Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Automation Grade

- 9.1.1. GoA 1

- 9.1.2. GoA 2

- 9.1.3. GoA 3

- 9.1.4. GoA 4

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Passenger

- 9.2.2. Freight

- 9.3. Market Analysis, Insights and Forecast - by Technology

- 9.3.1. CBTC

- 9.3.2. ERTMS

- 9.3.3. ATC

- 9.3.4. PTC

- 9.4. Market Analysis, Insights and Forecast - by Train Type

- 9.4.1. Metro/Monorail

- 9.4.2. Light Rail

- 9.4.3. High-speed Rail

- 9.1. Market Analysis, Insights and Forecast - by Automation Grade

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kawasaki Heavy Industries

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CRRC Corporation Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Construcciones y Auxiliar de Ferrocarriles (CAF)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Thales Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Alstom SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hitachi Rail STS (Ansaldo STS)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Ingeteam Corporation S

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wabtec Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mitsubishi Heavy Industries Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Kawasaki Heavy Industries

List of Figures

- Figure 1: Global Autonomous Train Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Autonomous Train Industry Revenue (Million), by Automation Grade 2025 & 2033

- Figure 3: North America Autonomous Train Industry Revenue Share (%), by Automation Grade 2025 & 2033

- Figure 4: North America Autonomous Train Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Autonomous Train Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Autonomous Train Industry Revenue (Million), by Technology 2025 & 2033

- Figure 7: North America Autonomous Train Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 8: North America Autonomous Train Industry Revenue (Million), by Train Type 2025 & 2033

- Figure 9: North America Autonomous Train Industry Revenue Share (%), by Train Type 2025 & 2033

- Figure 10: North America Autonomous Train Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Autonomous Train Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Autonomous Train Industry Revenue (Million), by Automation Grade 2025 & 2033

- Figure 13: Europe Autonomous Train Industry Revenue Share (%), by Automation Grade 2025 & 2033

- Figure 14: Europe Autonomous Train Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Autonomous Train Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Autonomous Train Industry Revenue (Million), by Technology 2025 & 2033

- Figure 17: Europe Autonomous Train Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Europe Autonomous Train Industry Revenue (Million), by Train Type 2025 & 2033

- Figure 19: Europe Autonomous Train Industry Revenue Share (%), by Train Type 2025 & 2033

- Figure 20: Europe Autonomous Train Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Autonomous Train Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Autonomous Train Industry Revenue (Million), by Automation Grade 2025 & 2033

- Figure 23: Asia Pacific Autonomous Train Industry Revenue Share (%), by Automation Grade 2025 & 2033

- Figure 24: Asia Pacific Autonomous Train Industry Revenue (Million), by Application 2025 & 2033

- Figure 25: Asia Pacific Autonomous Train Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: Asia Pacific Autonomous Train Industry Revenue (Million), by Technology 2025 & 2033

- Figure 27: Asia Pacific Autonomous Train Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Asia Pacific Autonomous Train Industry Revenue (Million), by Train Type 2025 & 2033

- Figure 29: Asia Pacific Autonomous Train Industry Revenue Share (%), by Train Type 2025 & 2033

- Figure 30: Asia Pacific Autonomous Train Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Autonomous Train Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Autonomous Train Industry Revenue (Million), by Automation Grade 2025 & 2033

- Figure 33: Rest of the World Autonomous Train Industry Revenue Share (%), by Automation Grade 2025 & 2033

- Figure 34: Rest of the World Autonomous Train Industry Revenue (Million), by Application 2025 & 2033

- Figure 35: Rest of the World Autonomous Train Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: Rest of the World Autonomous Train Industry Revenue (Million), by Technology 2025 & 2033

- Figure 37: Rest of the World Autonomous Train Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Rest of the World Autonomous Train Industry Revenue (Million), by Train Type 2025 & 2033

- Figure 39: Rest of the World Autonomous Train Industry Revenue Share (%), by Train Type 2025 & 2033

- Figure 40: Rest of the World Autonomous Train Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Autonomous Train Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Autonomous Train Industry Revenue Million Forecast, by Automation Grade 2020 & 2033

- Table 2: Global Autonomous Train Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Autonomous Train Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Global Autonomous Train Industry Revenue Million Forecast, by Train Type 2020 & 2033

- Table 5: Global Autonomous Train Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Autonomous Train Industry Revenue Million Forecast, by Automation Grade 2020 & 2033

- Table 7: Global Autonomous Train Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Autonomous Train Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 9: Global Autonomous Train Industry Revenue Million Forecast, by Train Type 2020 & 2033

- Table 10: Global Autonomous Train Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Autonomous Train Industry Revenue Million Forecast, by Automation Grade 2020 & 2033

- Table 12: Global Autonomous Train Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Autonomous Train Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global Autonomous Train Industry Revenue Million Forecast, by Train Type 2020 & 2033

- Table 15: Global Autonomous Train Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Autonomous Train Industry Revenue Million Forecast, by Automation Grade 2020 & 2033

- Table 17: Global Autonomous Train Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Autonomous Train Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 19: Global Autonomous Train Industry Revenue Million Forecast, by Train Type 2020 & 2033

- Table 20: Global Autonomous Train Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Autonomous Train Industry Revenue Million Forecast, by Automation Grade 2020 & 2033

- Table 22: Global Autonomous Train Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Autonomous Train Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 24: Global Autonomous Train Industry Revenue Million Forecast, by Train Type 2020 & 2033

- Table 25: Global Autonomous Train Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autonomous Train Industry?

The projected CAGR is approximately 5.78%.

2. Which companies are prominent players in the Autonomous Train Industry?

Key companies in the market include Kawasaki Heavy Industries, CRRC Corporation Limited, Construcciones y Auxiliar de Ferrocarriles (CAF), Thales Group, Siemens AG, Alstom SA, Hitachi Rail STS (Ansaldo STS), Ingeteam Corporation S, Wabtec Corporation, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Autonomous Train Industry?

The market segments include Automation Grade, Application, Technology, Train Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Focus On Safety.

6. What are the notable trends driving market growth?

Metro/Monorail Dominating the Global Autonomous Train Market.

7. Are there any restraints impacting market growth?

High Initial Investment.

8. Can you provide examples of recent developments in the market?

June 2022: The German Aerospace Centre (DLR) and the TU Berlin, Alstom, is developing technical solutions to gradually digitize rail passenger transport in Germany. The project will explore the possibilities of automation in regional transport via the European Train Control System (ETCS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autonomous Train Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autonomous Train Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autonomous Train Industry?

To stay informed about further developments, trends, and reports in the Autonomous Train Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence