Key Insights

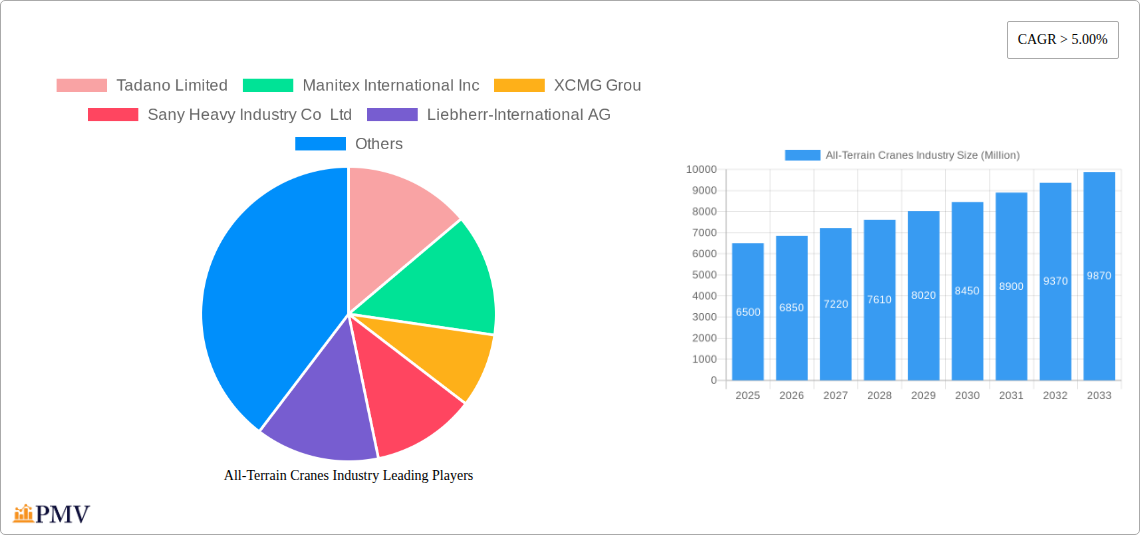

The global All-Terrain Cranes market is projected for significant expansion, expected to reach $18.32 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.65% through 2033. This growth is driven by substantial infrastructure development, including transportation networks, residential and commercial construction, and renewable energy installations. The demand for versatile, high-capacity lifting solutions is a key factor, as all-terrain cranes offer superior mobility and efficiency on challenging sites, making them vital for complex construction, industrial expansion, and utility maintenance.

All-Terrain Cranes Industry Market Size (In Billion)

Technological advancements are further enhancing the market with lighter, more powerful, and fuel-efficient crane designs, improving operational safety and reducing environmental impact.

All-Terrain Cranes Industry Company Market Share

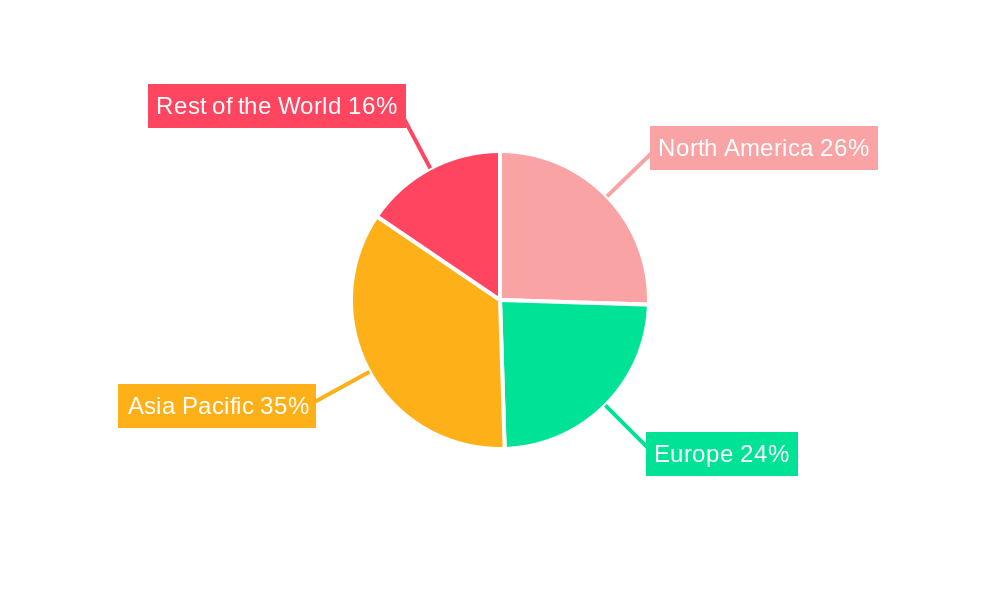

The market is segmented by capacity, with the "200-500 Tons" segment anticipated to lead in value due to its extensive use in mid-to-large scale construction projects. The "Construction" sector will remain the primary application, propelled by urbanization and ongoing building infrastructure needs. However, the "Industries" and "Utilities" segments are expected to experience considerable growth, reflecting increased industrial manufacturing and the global shift towards renewable energy infrastructure. Geographically, the Asia Pacific region, particularly China and India, is projected for the fastest growth due to massive infrastructure investment and a growing manufacturing base. North America and Europe will continue to be major markets, supported by infrastructure modernization and the presence of key innovators such as Tadano Limited, Liebherr-International AG, and Sany Heavy Industry Co Ltd.

This comprehensive All-Terrain Cranes Industry Market Report offers critical insights for stakeholders in this dynamic sector. Covering the historical period of 2019–2024, with 2025 as the base year and a forecast to 2033, the report utilizes meticulous data analysis to provide actionable intelligence on market structures, competitive landscapes, evolving trends, dominant segments, product innovations, growth drivers, challenges, and strategic outlooks for the all-terrain crane market, valued in billions. This report is essential for manufacturers, investors, equipment rental companies, construction firms, and utility providers seeking to understand and capitalize on opportunities in the robust global all-terrain crane market.

All-Terrain Cranes Industry Market Structure & Competitive Dynamics

The all-terrain crane market exhibits a moderately consolidated structure, characterized by a few global giants alongside a considerable number of regional and specialized players. Market concentration is influenced by the high capital expenditure required for manufacturing and the intricate technological expertise demanded. Innovation ecosystems thrive through continuous product development in lifting capacities, mobility, safety features, and emission compliance. Regulatory frameworks, encompassing safety standards and environmental regulations, significantly shape market entry and operational strategies. Product substitutes, while limited in direct replacement for the versatility of all-terrain cranes, might include specialized mobile cranes or tower cranes for specific applications. End-user trends favor cranes offering enhanced fuel efficiency, lower operational costs, and greater maneuverability. Mergers and acquisitions (M&A) play a crucial role in consolidating market share and expanding technological capabilities. For instance, in April 2022, Terex's acquisition of Steelweld aimed to bolster fabrication capabilities, demonstrating a strategic move to enhance production capacity and potentially influence market supply dynamics. The global all-terrain crane market size is projected to witness significant growth, with market share varying across leading manufacturers based on their product portfolios and geographical reach. M&A deal values are expected to continue reflecting strategic imperatives for growth and diversification within the heavy lifting equipment industry.

All-Terrain Cranes Industry Industry Trends & Insights

The all-terrain crane industry is experiencing robust growth, driven by several interconnected trends that are reshaping its operational landscape. A primary growth driver is the escalating global demand for infrastructure development, particularly in emerging economies. Massive government investments in transportation networks, renewable energy projects, and urban expansion necessitate powerful and versatile lifting solutions, positioning all-terrain cranes as indispensable assets. The ongoing surge in construction activities, from residential and commercial buildings to industrial complexes, directly fuels the demand for these machines. Technological advancements are another significant catalyst. Manufacturers are heavily investing in R&D to enhance crane efficiency, safety, and environmental performance. Innovations such as advanced telematics for remote monitoring and diagnostics, hybrid powertrains for reduced emissions and fuel consumption, and intelligent control systems for precise operation are gaining traction. This technological disruption is not only improving operational effectiveness but also addressing growing environmental concerns within the construction equipment market.

Consumer preferences are increasingly shifting towards cranes that offer a higher power-to-weight ratio, improved fuel economy, and reduced operational noise. The demand for cranes with greater lifting capacities, especially in the 200 - 500 Tons and More than 500 Tons segments, is on the rise to handle increasingly complex and heavy-duty projects. Furthermore, the trend towards electrification in various industries is subtly influencing the all-terrain crane market, with a growing interest in hybrid and electric-powered crane variants, although widespread adoption is still in its nascent stages. Competitive dynamics are intensifying, with companies focusing on product differentiation, expanding service networks, and offering comprehensive rental and maintenance solutions. The CAGR for the all-terrain crane market is projected to remain strong throughout the forecast period, indicating sustained expansion. Market penetration is deepening across various applications, underscoring the versatility and essential nature of all-terrain cranes. The focus on sustainability and digitalization will continue to be a key differentiator for market leaders.

Dominant Markets & Segments in All-Terrain Cranes Industry

The all-terrain crane industry demonstrates distinct dominance across geographical regions and specific market segments, driven by economic policies, infrastructure investment, and industrial activity. Asia-Pacific, particularly China, stands out as a dominant market for all-terrain cranes. This supremacy is fueled by aggressive government infrastructure spending, rapid industrialization, and a burgeoning construction sector. The region's economic policies actively support manufacturing and large-scale development projects, creating a consistent demand for high-capacity and versatile lifting equipment.

Within capacity types, the 200 - 500 Tons segment is a significant driver of market growth. This range offers a balance of lifting power and maneuverability, making it suitable for a wide array of applications in construction and industries.

- Key Drivers for Dominance:

- Economic Policies: Favorable government incentives for infrastructure development and construction projects.

- Infrastructure Investment: Sustained and substantial public and private investment in transportation, energy, and urban development.

- Industrial Growth: Expansion of manufacturing facilities, petrochemical plants, and other heavy industrial operations requiring significant lifting capabilities.

- Urbanization: Rapid growth of cities, leading to increased demand for skyscrapers, commercial complexes, and residential buildings.

In terms of applications, the Construction segment unequivocally leads the all-terrain crane market. The sheer volume and diversity of construction projects, ranging from residential buildings and commercial complexes to monumental infrastructure like bridges, tunnels, and airports, consistently require the deployment of all-terrain cranes. The ability of these cranes to navigate diverse terrains and adapt to various site conditions makes them indispensable on construction sites.

- Construction Segment Dominance Factors:

- Versatility: Ability to handle a wide range of lifting tasks on diverse construction sites.

- Mobility: Efficient travel between job sites and on-site maneuverability.

- Productivity: High lifting capacities and operational speeds that enhance project timelines.

- Investment: Continuous global investment in new construction and infrastructure upgrades.

The Industries segment also represents a substantial market share, encompassing sectors like oil and gas, mining, manufacturing, and power generation, all of which rely on all-terrain cranes for heavy lifting during plant construction, maintenance, and expansion. The Utilities sector, while a smaller segment, is growing in importance due to the increasing demand for renewable energy infrastructure (wind farms, solar power plants) and the maintenance of existing power grids, requiring specialized lifting for large components.

All-Terrain Cranes Industry Product Innovations

Product innovation in the all-terrain crane industry is primarily focused on enhancing lifting capabilities, improving operational efficiency, and ensuring stringent safety and environmental compliance. Manufacturers are continuously developing cranes with higher load capacities, longer boom lengths, and improved reach to tackle more complex and demanding projects. Technological advancements are leading to the integration of intelligent control systems, offering operators greater precision, stability, and safety features, thereby minimizing risks and optimizing lifting operations. Furthermore, there is a growing emphasis on fuel efficiency and reduced emissions, with the exploration of hybrid and alternative powertrains to meet environmental regulations and operational cost reduction demands. These innovations provide a significant competitive advantage by catering to the evolving needs of the construction and industrial sectors.

Report Segmentation & Scope

This comprehensive report segments the all-terrain cranes market based on crucial parameters to offer granular insights. The segmentation by Capacity Type includes:

- Less than 200 Tons: This segment caters to smaller-scale construction, utility work, and specialized industrial applications requiring moderate lifting power. Growth is driven by routine infrastructure maintenance and smaller commercial projects.

- 200 - 500 Tons: This is a significant and growing segment, ideal for mid-sized construction projects, industrial installations, and infrastructure development requiring substantial lifting capacity and good maneuverability. Market size is robust, with strong growth projections.

- More than 500 Tons: This segment comprises super-heavy lifting cranes essential for large-scale projects such as power plant construction, wind turbine installation, and complex industrial facilities. It represents a high-value market with specialized demand.

The segmentation by Application covers:

- Construction: The largest segment, encompassing all building and infrastructure development activities, driving consistent demand for all-terrain cranes due to their versatility.

- Industries: This segment includes oil & gas, mining, manufacturing, and heavy industrial sectors, requiring cranes for plant construction, maintenance, and expansion. Market size is considerable, with stable growth.

- Utilities: This segment, increasingly important, covers power generation (including renewables), transmission, and distribution, where cranes are needed for component installation and maintenance. Growth is accelerating due to energy infrastructure upgrades.

- Others: This residual category includes diverse applications such as heavy logistics, specialized lifting services, and disaster relief operations.

Key Drivers of All-Terrain Cranes Industry Growth

The growth of the all-terrain crane industry is propelled by a confluence of factors that underscore its essential role in modern economic development. A primary driver is the continuous global investment in infrastructure development, including roads, bridges, airports, and public transportation systems, which necessitates heavy lifting capabilities. Economic expansion and industrialization in emerging economies further fuel demand as manufacturing facilities, power plants, and large-scale industrial projects are undertaken. Technological advancements in crane design, such as enhanced safety features, improved fuel efficiency, and greater operational precision, are also critical growth accelerators. These innovations make all-terrain cranes more attractive and cost-effective for a wider range of applications. Regulatory support for infrastructure projects and environmental mandates that encourage the adoption of more efficient and eco-friendly equipment also contribute positively to market growth.

Challenges in the All-Terrain Cranes Industry Sector

Despite the promising growth trajectory, the all-terrain cranes industry faces several significant challenges that can impede its expansion. High capital investment for manufacturing and the substantial cost of acquiring new, advanced all-terrain cranes can be a barrier for smaller companies and rental businesses. Stringent safety regulations and environmental standards, while necessary, increase compliance costs and can lead to longer lead times for product development and deployment. Supply chain disruptions, particularly in the availability of critical components and raw materials, can impact production schedules and increase manufacturing costs. Intense competition among established players and new entrants, especially from emerging economies, can lead to price pressures and affect profit margins. Furthermore, the cyclical nature of the construction and industrial sectors means that downturns in these industries can directly translate into reduced demand for all-terrain cranes. The skilled labor shortage for operating and maintaining these complex machines also poses a persistent challenge.

Leading Players in the All-Terrain Cranes Industry Market

- Tadano Limited

- Manitex International Inc

- XCMG Group

- Sany Heavy Industry Co Ltd

- Liebherr-International AG

- Manitowoc

- Hitachi Sumitomo Heavy Industries Construction Cranes Co Ltd

- Zoomlion Heavy Industry Science and Technology Co Ltd

- Kobelco Cranes Co Ltd

- Terex Corporation

Key Developments in All-Terrain Cranes Industry Sector

- April 2022: Terex announced the acquisition of Steelweld, a manufacturer of heavy fabrications based in Northern Ireland. The purchase of Steelweld supports Materials Processing's growth strategy by increasing fabrication capabilities in Northern Ireland.

- Feb 2022: NORWALK announced its Series B investment in Viatec, Inc., a South Carolina-based manufacturer of plug-and-play electronic power take-off ("PTO") systems that support the electrification of utility fleets.

- Oct 2021: Manufacturer Manitowoc launched two new all-terrain cranes, the Grove GMK5120L and the Grove GMK5150XL, at the company's Wilhelmshaven facility in Northern Germany.

Strategic All-Terrain Cranes Industry Market Outlook

The strategic outlook for the all-terrain cranes industry is exceptionally positive, driven by sustained global demand for infrastructure, renewable energy projects, and industrial expansion. Growth accelerators include the increasing adoption of advanced technologies such as AI-powered diagnostics, telematics for fleet management, and the ongoing development of more fuel-efficient and environmentally friendly crane designs. Strategic opportunities lie in expanding market reach in developing economies, focusing on specialized lifting solutions for emerging sectors like offshore wind farms, and offering integrated services encompassing sales, rental, maintenance, and financing. The industry is poised for continued innovation, with a strong emphasis on smart manufacturing, product customization, and enhancing the overall user experience. Companies that invest in R&D, build robust distribution networks, and prioritize sustainability will be well-positioned to capture significant market share and achieve long-term success. The all-terrain crane market value is expected to see significant appreciation through strategic partnerships and product portfolio diversification.

All-Terrain Cranes Industry Segmentation

-

1. Capacity Type

- 1.1. Less than 200 Tons

- 1.2. 200 - 500 Tons

- 1.3. More than 500 Tons

-

2. Application

- 2.1. Construction

- 2.2. Industries

- 2.3. Utilities

- 2.4. Others

All-Terrain Cranes Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

All-Terrain Cranes Industry Regional Market Share

Geographic Coverage of All-Terrain Cranes Industry

All-Terrain Cranes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in demand for Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. High Cost Associated With Product

- 3.4. Market Trends

- 3.4.1. Construction is Driving the All -Terrain Crane Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global All-Terrain Cranes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity Type

- 5.1.1. Less than 200 Tons

- 5.1.2. 200 - 500 Tons

- 5.1.3. More than 500 Tons

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Construction

- 5.2.2. Industries

- 5.2.3. Utilities

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Capacity Type

- 6. North America All-Terrain Cranes Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity Type

- 6.1.1. Less than 200 Tons

- 6.1.2. 200 - 500 Tons

- 6.1.3. More than 500 Tons

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Construction

- 6.2.2. Industries

- 6.2.3. Utilities

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Capacity Type

- 7. Europe All-Terrain Cranes Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity Type

- 7.1.1. Less than 200 Tons

- 7.1.2. 200 - 500 Tons

- 7.1.3. More than 500 Tons

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Construction

- 7.2.2. Industries

- 7.2.3. Utilities

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Capacity Type

- 8. Asia Pacific All-Terrain Cranes Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity Type

- 8.1.1. Less than 200 Tons

- 8.1.2. 200 - 500 Tons

- 8.1.3. More than 500 Tons

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Construction

- 8.2.2. Industries

- 8.2.3. Utilities

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Capacity Type

- 9. Rest of the World All-Terrain Cranes Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capacity Type

- 9.1.1. Less than 200 Tons

- 9.1.2. 200 - 500 Tons

- 9.1.3. More than 500 Tons

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Construction

- 9.2.2. Industries

- 9.2.3. Utilities

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Capacity Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Tadano Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Manitex International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 XCMG Grou

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sany Heavy Industry Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Liebherr-International AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Manitowoc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hitachi Sumitomo Heavy Industries Construction Cranes Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Zoomlion Heavy Industry Science and Technology Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Kobelco Cranes Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Terex Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Tadano Limited

List of Figures

- Figure 1: Global All-Terrain Cranes Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America All-Terrain Cranes Industry Revenue (billion), by Capacity Type 2025 & 2033

- Figure 3: North America All-Terrain Cranes Industry Revenue Share (%), by Capacity Type 2025 & 2033

- Figure 4: North America All-Terrain Cranes Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America All-Terrain Cranes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America All-Terrain Cranes Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America All-Terrain Cranes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe All-Terrain Cranes Industry Revenue (billion), by Capacity Type 2025 & 2033

- Figure 9: Europe All-Terrain Cranes Industry Revenue Share (%), by Capacity Type 2025 & 2033

- Figure 10: Europe All-Terrain Cranes Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe All-Terrain Cranes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe All-Terrain Cranes Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe All-Terrain Cranes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific All-Terrain Cranes Industry Revenue (billion), by Capacity Type 2025 & 2033

- Figure 15: Asia Pacific All-Terrain Cranes Industry Revenue Share (%), by Capacity Type 2025 & 2033

- Figure 16: Asia Pacific All-Terrain Cranes Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific All-Terrain Cranes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific All-Terrain Cranes Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific All-Terrain Cranes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World All-Terrain Cranes Industry Revenue (billion), by Capacity Type 2025 & 2033

- Figure 21: Rest of the World All-Terrain Cranes Industry Revenue Share (%), by Capacity Type 2025 & 2033

- Figure 22: Rest of the World All-Terrain Cranes Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Rest of the World All-Terrain Cranes Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World All-Terrain Cranes Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World All-Terrain Cranes Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global All-Terrain Cranes Industry Revenue billion Forecast, by Capacity Type 2020 & 2033

- Table 2: Global All-Terrain Cranes Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global All-Terrain Cranes Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global All-Terrain Cranes Industry Revenue billion Forecast, by Capacity Type 2020 & 2033

- Table 5: Global All-Terrain Cranes Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global All-Terrain Cranes Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global All-Terrain Cranes Industry Revenue billion Forecast, by Capacity Type 2020 & 2033

- Table 11: Global All-Terrain Cranes Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global All-Terrain Cranes Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global All-Terrain Cranes Industry Revenue billion Forecast, by Capacity Type 2020 & 2033

- Table 18: Global All-Terrain Cranes Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global All-Terrain Cranes Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: India All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: China All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global All-Terrain Cranes Industry Revenue billion Forecast, by Capacity Type 2020 & 2033

- Table 26: Global All-Terrain Cranes Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Global All-Terrain Cranes Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Mexico All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Arab Emirates All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Other Countries All-Terrain Cranes Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the All-Terrain Cranes Industry?

The projected CAGR is approximately 5.65%.

2. Which companies are prominent players in the All-Terrain Cranes Industry?

Key companies in the market include Tadano Limited, Manitex International Inc, XCMG Grou, Sany Heavy Industry Co Ltd, Liebherr-International AG, Manitowoc, Hitachi Sumitomo Heavy Industries Construction Cranes Co Ltd, Zoomlion Heavy Industry Science and Technology Co Ltd, Kobelco Cranes Co Ltd, Terex Corporation.

3. What are the main segments of the All-Terrain Cranes Industry?

The market segments include Capacity Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.32 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in demand for Electric Vehicles.

6. What are the notable trends driving market growth?

Construction is Driving the All -Terrain Crane Market.

7. Are there any restraints impacting market growth?

High Cost Associated With Product.

8. Can you provide examples of recent developments in the market?

In April 2022, Terex announced the acquisition of Steelweld, a manufacturer of heavy fabrications based in Northern Ireland. The purchase of Steelweld supports Materials Processing's growth strategy by increasing fabrication capabilities in Northern Ireland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "All-Terrain Cranes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the All-Terrain Cranes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the All-Terrain Cranes Industry?

To stay informed about further developments, trends, and reports in the All-Terrain Cranes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence