Key Insights

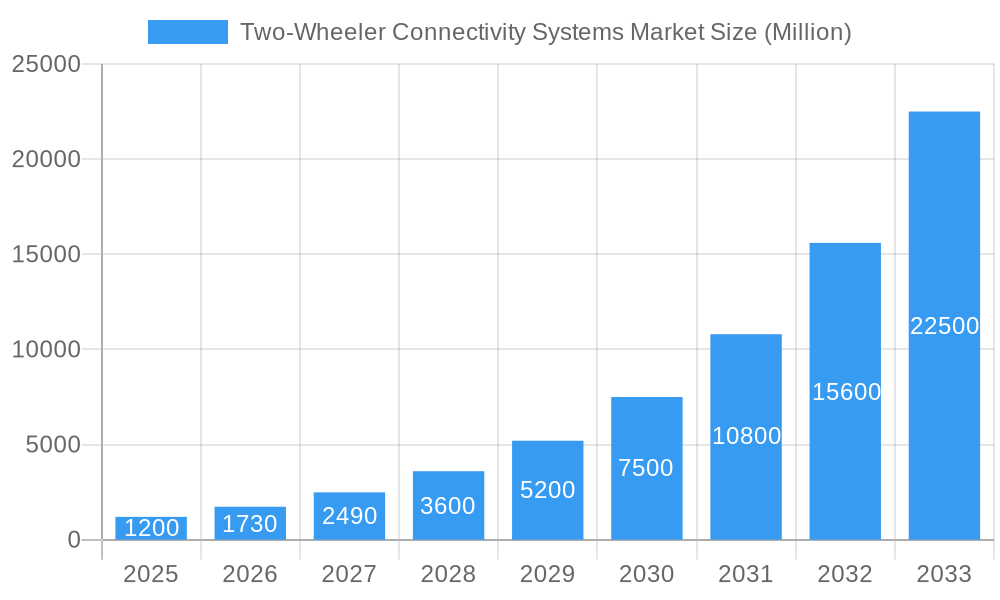

The global Two-Wheeler Connectivity Systems Market is poised for substantial expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 16.34%. The market size was valued at $6.27 billion in the base year 2025 and is expected to see significant growth. This surge is attributed to increasing demand for advanced safety features, enhanced rider experience via integrated infotainment systems, and improved vehicle management. The adoption of Vehicle-to-Everything (V2X) communication is a key trend, enabling two-wheelers to interact with their environment for better traffic management and accident prevention. The rise of electric two-wheelers further fuels the need for sophisticated connectivity solutions for battery monitoring, charging, and performance optimization. Manufacturers are focusing on developing smart features beyond basic telematics, including predictive maintenance, real-time navigation, and seamless smartphone integration.

Two-Wheeler Connectivity Systems Market Market Size (In Billion)

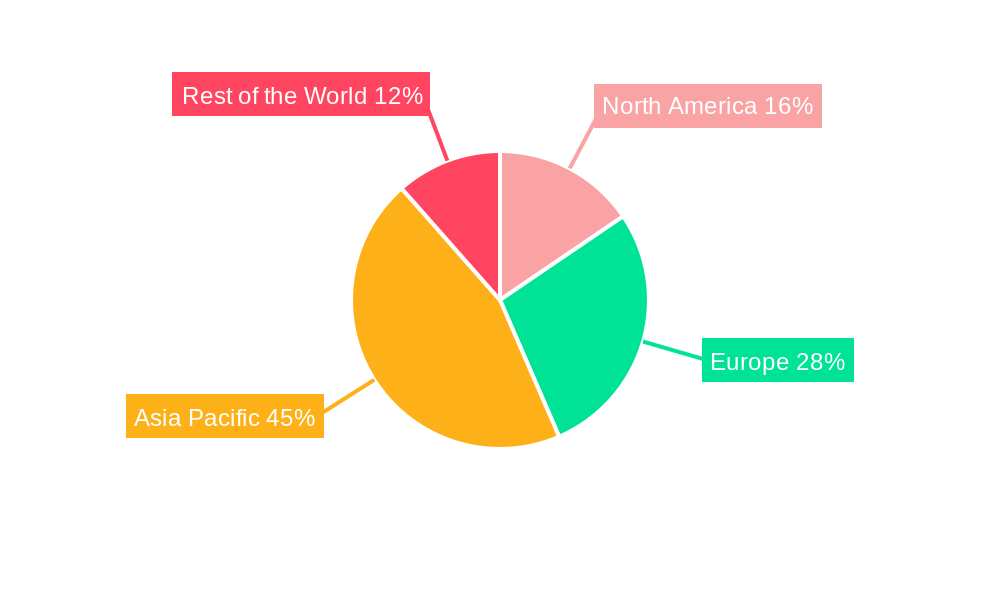

Challenges to market growth include the initial cost of advanced connectivity features and potential cybersecurity vulnerabilities. However, ongoing research and development, alongside robust security protocols, are actively addressing these concerns. The market is segmented by feature type, including Driver Assistance, Safety, Vehicle Management, and Infotainment. Both Internal Combustion Engine and Electric two-wheeler segments are adopting connectivity solutions, with V2X and Dedicated Short-Range Communication (DSRC) emerging as crucial network types. Geographically, Asia Pacific (particularly China and India) and Europe are expected to lead market growth due to a large two-wheeler population and stringent safety regulations.

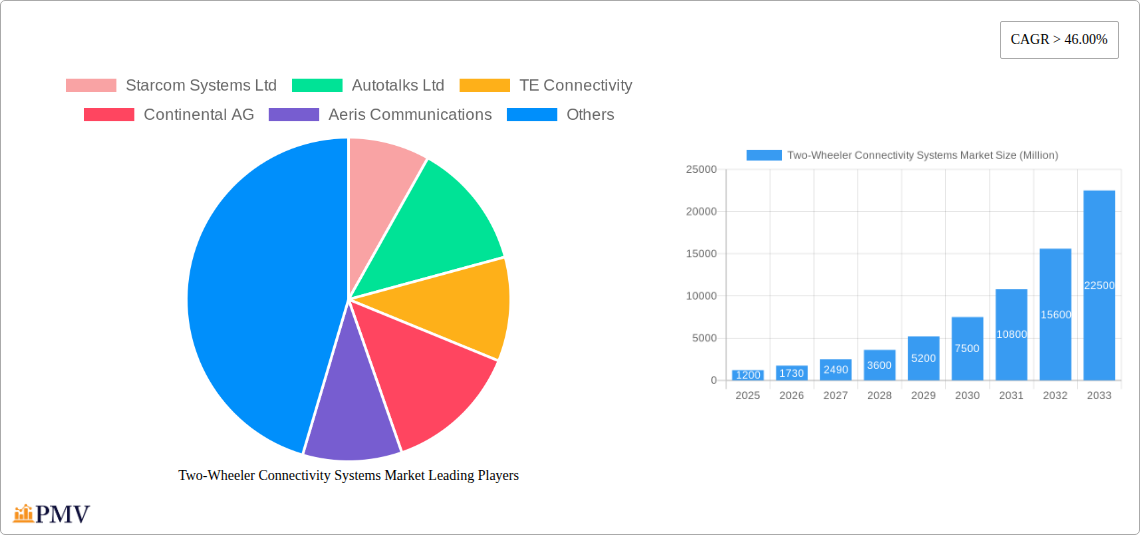

Two-Wheeler Connectivity Systems Market Company Market Share

Report Title: Two-Wheeler Connectivity Systems Market: Analysis, Trends, and Growth Forecast (2025–2033)

Report Overview:

This comprehensive report provides an in-depth analysis of the dynamic Two-Wheeler Connectivity Systems Market, offering actionable insights for industry stakeholders. We examine the evolving landscape of connected motorcycles and scooters, driven by advancements in V2X communication, DSRC, and integrated infotainment and safety features. The market is forecasted to reach US$ 6.27 billion by 2025, with a projected CAGR of 16.34% from 2025 to 2033. Our analysis covers market segmentation by feature type (driver assistance, vehicle management, infotainment, safety), powertrain type (internal combustion engine, electric), and network type. This report is essential for understanding the competitive dynamics, emerging trends, and future trajectory of the global two-wheeler connectivity market.

Two-Wheeler Connectivity Systems Market Structure & Competitive Dynamics

The Two-Wheeler Connectivity Systems Market is characterized by a moderate to high degree of fragmentation, with both established automotive giants and specialized technology providers vying for market share. Innovation ecosystems are rapidly developing, driven by strategic partnerships and increasing R&D investments by key players like Robert Bosch GmbH, Continental AG, and TE Connectivity. Regulatory frameworks are evolving to standardize communication protocols and enhance rider safety, influencing product development and market entry strategies. Product substitutes, while not directly replacing connectivity systems, include standalone navigation devices and aftermarket safety accessories; however, their integration within a comprehensive connectivity platform offers a superior value proposition. End-user trends indicate a growing demand for advanced features such as real-time diagnostics, remote vehicle management, and enhanced rider safety, pushing manufacturers to integrate sophisticated driver assistance and infotainment systems. Mergers and acquisitions (M&A) activities are on the rise as companies seek to expand their technological capabilities and market reach. For instance, M&A deals in the broader automotive connectivity space have averaged US$ XX Million annually over the past five years, a trend expected to accelerate within the two-wheeler segment. The market concentration is gradually shifting towards integrated solutions, with key players focusing on developing comprehensive platforms rather than individual components.

Two-Wheeler Connectivity Systems Market Industry Trends & Insights

The Two-Wheeler Connectivity Systems Market is experiencing a significant surge in growth, fueled by a confluence of technological advancements, evolving consumer preferences, and supportive industry developments. The increasing integration of smart features and the growing adoption of electric two-wheelers are primary growth drivers. Consumers are demanding enhanced safety, convenience, and entertainment options, propelling the adoption of infotainment systems, driver assistance features, and sophisticated vehicle management solutions. The global market is projected to witness a CAGR of XX.X% during the forecast period of 2025–2033, reaching an estimated value of US$ X,XXX Million by the end of this period. Historical data from 2019–2024 shows a steady upward trajectory, with market penetration of connected features steadily increasing across different price segments.

Technological disruptions are playing a pivotal role, with the widespread adoption of V2X communication and advancements in DSRC enabling seamless interaction between two-wheelers, infrastructure, and other vehicles. This not only enhances rider safety through collision avoidance and hazard warnings but also facilitates traffic management and efficient route planning. The development of reliable and cost-effective telematics solutions is further accelerating market growth.

Consumer preferences are rapidly shifting towards connected experiences, mirroring trends observed in the four-wheeler automotive sector. Riders are increasingly seeking features like smartphone integration, GPS navigation with real-time traffic updates, remote diagnostics, over-the-air (OTA) software updates, and personalized riding experiences. This demand is particularly pronounced among younger demographics and urban commuters.

Competitive dynamics within the market are intensifying, with companies like Starcom Systems Ltd, Autotalks Ltd, and TE Connectivity investing heavily in R&D to introduce innovative and integrated connectivity solutions. The emergence of new players and the strategic collaborations between technology providers and motorcycle manufacturers are reshaping the competitive landscape. The increasing focus on cybersecurity to protect sensitive rider data and vehicle systems is also a critical trend, driving innovation in secure connectivity protocols. The penetration of connected features in mid-range and premium two-wheelers is expected to grow substantially, while efforts are also being made to bring these technologies to more affordable segments. The ongoing evolution of 5G networks is anticipated to further boost the capabilities and adoption of advanced connectivity features in the coming years.

Dominant Markets & Segments in Two-Wheeler Connectivity Systems Market

The Two-Wheeler Connectivity Systems Market exhibits strong regional dominance, with Asia-Pacific leading the charge due to its massive two-wheeler sales volume and increasing consumer disposable income. Countries like India and China are at the forefront of adoption, driven by government initiatives promoting smart mobility and a growing awareness of advanced safety features. The market penetration of connected features in these regions is expected to see significant growth in the coming years.

Within feature types, Safety features are currently the dominant segment, encompassing technologies like anti-lock braking systems (ABS) with integrated connectivity, traction control, and emergency call (eCall) systems. This dominance is directly linked to stringent safety regulations and a heightened consumer focus on rider well-being. However, the Infotainment segment is rapidly gaining traction, with increasing demand for smartphone integration, GPS navigation, and entertainment options. Vehicle Management features, including remote diagnostics, theft tracking, and performance monitoring, are also crucial, especially for fleet operators and urban commuters. Driver Assistance systems, such as adaptive cruise control and blind-spot detection, are emerging as significant growth areas, mirroring trends in the automotive sector.

Considering powertrain type, the Electric segment is poised for exponential growth. The inherent technological sophistication and digital integration capabilities of electric two-wheelers make them ideal platforms for advanced connectivity solutions. This segment is expected to outpace the Internal Combustion Engine segment in terms of adoption of new connectivity features.

In terms of network type, Vehicle-to-everything (V2X) communication is emerging as the future standard, offering a wide range of applications from traffic management to enhanced safety. While Dedicated Short-Range Communication (DSRC) has been a foundational technology, the broader adoption of cellular-based V2X (C-V2X) solutions is anticipated to drive more comprehensive and scalable connectivity. Key drivers for dominance in these segments include:

- Economic Policies: Government incentives for electric vehicle adoption and smart city initiatives in Asia-Pacific are fostering rapid growth.

- Infrastructure Development: Expansion of 5G networks and smart road infrastructure is crucial for enabling advanced V2X functionalities.

- Consumer Awareness: Increasing rider awareness of safety benefits and the desire for a connected lifestyle are driving demand across all segments.

- Technological Advancements: Continuous innovation in sensors, processors, and communication modules makes sophisticated connectivity features more accessible and affordable.

The dominance analysis reveals a strong correlation between regulatory support, technological readiness, and consumer demand in shaping the leading markets and segments within the Two-Wheeler Connectivity Systems Market.

Two-Wheeler Connectivity Systems Market Product Innovations

Product innovations in the Two-Wheeler Connectivity Systems Market are focused on enhancing rider safety, convenience, and overall riding experience. Key developments include integrated driver assistance systems that leverage V2X technology for collision avoidance and predictive warnings, as well as advanced vehicle management platforms offering remote diagnostics and OTA updates. Manufacturers are embedding sophisticated infotainment systems with seamless smartphone connectivity and intuitive user interfaces. The shift towards electric powertrains is driving innovations in battery management systems with integrated connectivity for real-time monitoring and optimized charging. These advancements are crucial for maintaining competitive advantage and catering to the evolving demands of connected riders.

Report Segmentation & Scope

This report segments the Two-Wheeler Connectivity Systems Market based on critical parameters to provide a granular analysis. The Feature Type segment includes Driver Assistance, Safety, Vehicle Management, Infotainment, and Other Features, each with distinct growth trajectories and market penetrations. The Powertrain Type segmentation differentiates between Internal Combustion Engine and Electric vehicles, reflecting the diverging technological pathways and adoption rates. The Network Type segment analyzes the market based on Vehicle-to-everything (V2X) and Dedicated Short-Range Communication (DSRC) technologies, highlighting the evolving communication standards. The scope covers the global market, with detailed regional breakdowns and forecasts from 2019 to 2033, providing a comprehensive overview of market sizes, growth projections, and competitive dynamics within each segment.

Key Drivers of Two-Wheeler Connectivity Systems Market Growth

The Two-Wheeler Connectivity Systems Market is propelled by several key drivers. Technological advancements, particularly in V2X communication and IoT, enable enhanced safety features and data-driven services. Growing consumer demand for integrated infotainment and navigation systems, coupled with increasing awareness of the safety benefits offered by connected features, is a significant accelerator. Supportive government regulations and initiatives promoting smart mobility and rider safety are also crucial. Furthermore, the expanding electric vehicle segment provides a fertile ground for the integration of advanced connectivity solutions, creating a synergistic growth effect. The increasing affordability of these technologies is also making them accessible to a broader consumer base.

Challenges in the Two-Wheeler Connectivity Systems Market Sector

Despite robust growth, the Two-Wheeler Connectivity Systems Market faces several challenges. Regulatory hurdles, particularly the lack of standardized V2X protocols across different regions, can hinder widespread adoption. Cybersecurity concerns related to data privacy and potential hacking of vehicle systems pose a significant risk. The high cost of initial implementation and integration of sophisticated connectivity features can be a barrier, especially for entry-level two-wheelers. Supply chain disruptions and the limited availability of skilled labor for installation and maintenance also present challenges. Intense competition among established players and new entrants necessitates continuous innovation and aggressive pricing strategies, impacting profit margins.

Leading Players in the Two-Wheeler Connectivity Systems Market Market

- Starcom Systems Ltd

- Autotalks Ltd

- TE Connectivity

- Continental AG

- Aeris Communications

- Robert Bosch GmbH

- BMW Group

- KPIT Technologies Limited

- Fabricacion Componentes Motocicletas S

- Panasonic Corporation

Key Developments in Two-Wheeler Connectivity Systems Market Sector

- 2024: Autotalks Ltd partners with a leading motorcycle manufacturer to integrate advanced V2X chipsets for enhanced rider safety.

- 2023: Robert Bosch GmbH launches a new generation of connected motorcycle systems featuring predictive maintenance and OTA updates.

- 2023: TE Connectivity introduces innovative telematics modules designed for ruggedized two-wheeler environments.

- 2022: BMW Group showcases its latest connected ride concepts, emphasizing seamless integration of rider and vehicle.

- 2022: KPIT Technologies Limited expands its offerings in connected vehicle software solutions for two-wheelers.

- 2021: Panasonic Corporation develops compact and energy-efficient infotainment units for motorcycles.

- 2021: Continental AG announces advancements in its V2X technology for motorcycle applications.

- 2020: Starcom Systems Ltd enhances its fleet management solutions with advanced connectivity features for two-wheelers.

Strategic Two-Wheeler Connectivity Systems Market Market Outlook

The strategic outlook for the Two-Wheeler Connectivity Systems Market is highly promising, driven by the escalating demand for enhanced safety, convenience, and personalized rider experiences. The rapid electrification of two-wheelers presents a significant growth accelerator, as electric platforms are inherently more conducive to digital integration. Strategic opportunities lie in developing cost-effective, modular connectivity solutions that can be adapted across different vehicle segments. Furthermore, forging strong partnerships with technology providers, telecommunication companies, and regulatory bodies will be crucial for navigating the evolving landscape and capitalizing on the full potential of V2X communication and smart mobility initiatives. The future success hinges on delivering secure, reliable, and user-friendly connected experiences.

Two-Wheeler Connectivity Systems Market Segmentation

-

1. Feature Type

- 1.1. Driver Assistance

- 1.2. Safety

- 1.3. Vehicle Management

- 1.4. Infotainment

- 1.5. Other Features

-

2. Powertrain Type

- 2.1. Internal Combustion Engine

- 2.2. Electric

-

3. Network Type

- 3.1. Vehicle-to-everything (V2X)

- 3.2. Dedicated short-range communication (DSRC)

Two-Wheeler Connectivity Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. South Africa

- 4.3. United Arab Emirates

- 4.4. Other Countries

Two-Wheeler Connectivity Systems Market Regional Market Share

Geographic Coverage of Two-Wheeler Connectivity Systems Market

Two-Wheeler Connectivity Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sale of Electric Two-wheelers Poised to Boost Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Connectivity Infrastructure

- 3.4. Market Trends

- 3.4.1. Sale of Electric Two-wheelers Poised to Boost Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Feature Type

- 5.1.1. Driver Assistance

- 5.1.2. Safety

- 5.1.3. Vehicle Management

- 5.1.4. Infotainment

- 5.1.5. Other Features

- 5.2. Market Analysis, Insights and Forecast - by Powertrain Type

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Network Type

- 5.3.1. Vehicle-to-everything (V2X)

- 5.3.2. Dedicated short-range communication (DSRC)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Feature Type

- 6. North America Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Feature Type

- 6.1.1. Driver Assistance

- 6.1.2. Safety

- 6.1.3. Vehicle Management

- 6.1.4. Infotainment

- 6.1.5. Other Features

- 6.2. Market Analysis, Insights and Forecast - by Powertrain Type

- 6.2.1. Internal Combustion Engine

- 6.2.2. Electric

- 6.3. Market Analysis, Insights and Forecast - by Network Type

- 6.3.1. Vehicle-to-everything (V2X)

- 6.3.2. Dedicated short-range communication (DSRC)

- 6.1. Market Analysis, Insights and Forecast - by Feature Type

- 7. Europe Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Feature Type

- 7.1.1. Driver Assistance

- 7.1.2. Safety

- 7.1.3. Vehicle Management

- 7.1.4. Infotainment

- 7.1.5. Other Features

- 7.2. Market Analysis, Insights and Forecast - by Powertrain Type

- 7.2.1. Internal Combustion Engine

- 7.2.2. Electric

- 7.3. Market Analysis, Insights and Forecast - by Network Type

- 7.3.1. Vehicle-to-everything (V2X)

- 7.3.2. Dedicated short-range communication (DSRC)

- 7.1. Market Analysis, Insights and Forecast - by Feature Type

- 8. Asia Pacific Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Feature Type

- 8.1.1. Driver Assistance

- 8.1.2. Safety

- 8.1.3. Vehicle Management

- 8.1.4. Infotainment

- 8.1.5. Other Features

- 8.2. Market Analysis, Insights and Forecast - by Powertrain Type

- 8.2.1. Internal Combustion Engine

- 8.2.2. Electric

- 8.3. Market Analysis, Insights and Forecast - by Network Type

- 8.3.1. Vehicle-to-everything (V2X)

- 8.3.2. Dedicated short-range communication (DSRC)

- 8.1. Market Analysis, Insights and Forecast - by Feature Type

- 9. Rest of the World Two-Wheeler Connectivity Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Feature Type

- 9.1.1. Driver Assistance

- 9.1.2. Safety

- 9.1.3. Vehicle Management

- 9.1.4. Infotainment

- 9.1.5. Other Features

- 9.2. Market Analysis, Insights and Forecast - by Powertrain Type

- 9.2.1. Internal Combustion Engine

- 9.2.2. Electric

- 9.3. Market Analysis, Insights and Forecast - by Network Type

- 9.3.1. Vehicle-to-everything (V2X)

- 9.3.2. Dedicated short-range communication (DSRC)

- 9.1. Market Analysis, Insights and Forecast - by Feature Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Starcom Systems Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Autotalks Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 TE Connectivity

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Continental AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Aeris Communications

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Robert Bosch GmbH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BMW Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 KPIT Technologies Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Fabricacion Componentes Motocicletas S

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Panasonic Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Starcom Systems Ltd

List of Figures

- Figure 1: Global Two-Wheeler Connectivity Systems Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Two-Wheeler Connectivity Systems Market Revenue (billion), by Feature Type 2025 & 2033

- Figure 3: North America Two-Wheeler Connectivity Systems Market Revenue Share (%), by Feature Type 2025 & 2033

- Figure 4: North America Two-Wheeler Connectivity Systems Market Revenue (billion), by Powertrain Type 2025 & 2033

- Figure 5: North America Two-Wheeler Connectivity Systems Market Revenue Share (%), by Powertrain Type 2025 & 2033

- Figure 6: North America Two-Wheeler Connectivity Systems Market Revenue (billion), by Network Type 2025 & 2033

- Figure 7: North America Two-Wheeler Connectivity Systems Market Revenue Share (%), by Network Type 2025 & 2033

- Figure 8: North America Two-Wheeler Connectivity Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Two-Wheeler Connectivity Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Two-Wheeler Connectivity Systems Market Revenue (billion), by Feature Type 2025 & 2033

- Figure 11: Europe Two-Wheeler Connectivity Systems Market Revenue Share (%), by Feature Type 2025 & 2033

- Figure 12: Europe Two-Wheeler Connectivity Systems Market Revenue (billion), by Powertrain Type 2025 & 2033

- Figure 13: Europe Two-Wheeler Connectivity Systems Market Revenue Share (%), by Powertrain Type 2025 & 2033

- Figure 14: Europe Two-Wheeler Connectivity Systems Market Revenue (billion), by Network Type 2025 & 2033

- Figure 15: Europe Two-Wheeler Connectivity Systems Market Revenue Share (%), by Network Type 2025 & 2033

- Figure 16: Europe Two-Wheeler Connectivity Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Two-Wheeler Connectivity Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue (billion), by Feature Type 2025 & 2033

- Figure 19: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue Share (%), by Feature Type 2025 & 2033

- Figure 20: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue (billion), by Powertrain Type 2025 & 2033

- Figure 21: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue Share (%), by Powertrain Type 2025 & 2033

- Figure 22: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue (billion), by Network Type 2025 & 2033

- Figure 23: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue Share (%), by Network Type 2025 & 2033

- Figure 24: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Two-Wheeler Connectivity Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Two-Wheeler Connectivity Systems Market Revenue (billion), by Feature Type 2025 & 2033

- Figure 27: Rest of the World Two-Wheeler Connectivity Systems Market Revenue Share (%), by Feature Type 2025 & 2033

- Figure 28: Rest of the World Two-Wheeler Connectivity Systems Market Revenue (billion), by Powertrain Type 2025 & 2033

- Figure 29: Rest of the World Two-Wheeler Connectivity Systems Market Revenue Share (%), by Powertrain Type 2025 & 2033

- Figure 30: Rest of the World Two-Wheeler Connectivity Systems Market Revenue (billion), by Network Type 2025 & 2033

- Figure 31: Rest of the World Two-Wheeler Connectivity Systems Market Revenue Share (%), by Network Type 2025 & 2033

- Figure 32: Rest of the World Two-Wheeler Connectivity Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Two-Wheeler Connectivity Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Feature Type 2020 & 2033

- Table 2: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 3: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Network Type 2020 & 2033

- Table 4: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Feature Type 2020 & 2033

- Table 6: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 7: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Network Type 2020 & 2033

- Table 8: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Feature Type 2020 & 2033

- Table 13: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 14: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Network Type 2020 & 2033

- Table 15: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Feature Type 2020 & 2033

- Table 21: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 22: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Network Type 2020 & 2033

- Table 23: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: India Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: China Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: South Korea Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Feature Type 2020 & 2033

- Table 30: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 31: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Network Type 2020 & 2033

- Table 32: Global Two-Wheeler Connectivity Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 33: Brazil Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: South Africa Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: United Arab Emirates Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Other Countries Two-Wheeler Connectivity Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Two-Wheeler Connectivity Systems Market?

The projected CAGR is approximately 16.34%.

2. Which companies are prominent players in the Two-Wheeler Connectivity Systems Market?

Key companies in the market include Starcom Systems Ltd, Autotalks Ltd, TE Connectivity, Continental AG, Aeris Communications, Robert Bosch GmbH, BMW Group, KPIT Technologies Limited, Fabricacion Componentes Motocicletas S, Panasonic Corporation.

3. What are the main segments of the Two-Wheeler Connectivity Systems Market?

The market segments include Feature Type, Powertrain Type, Network Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Sale of Electric Two-wheelers Poised to Boost Market Growth.

6. What are the notable trends driving market growth?

Sale of Electric Two-wheelers Poised to Boost Market Growth.

7. Are there any restraints impacting market growth?

Lack of Connectivity Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Two-Wheeler Connectivity Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Two-Wheeler Connectivity Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Two-Wheeler Connectivity Systems Market?

To stay informed about further developments, trends, and reports in the Two-Wheeler Connectivity Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence