Key Insights

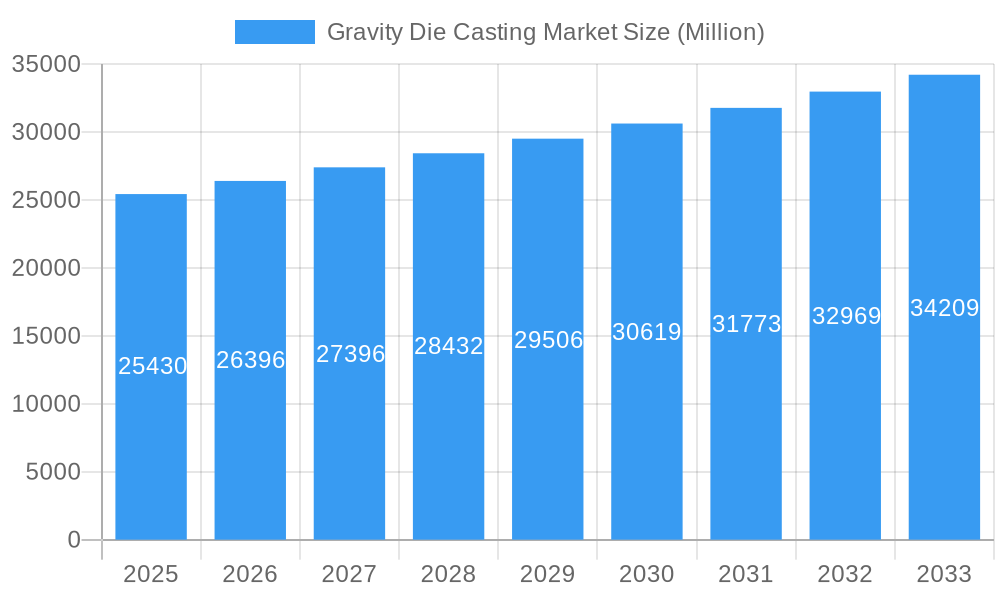

The global Gravity Die Casting Market is poised for steady expansion, with a projected market size of USD 25.43 billion in 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 3.79% over the forecast period of 2025-2033. The market's momentum is primarily driven by the escalating demand from the Automotive sector, where gravity die casting is extensively used for producing lightweight and intricate components like engine blocks, cylinder heads, and transmission housings. The increasing adoption of electric vehicles (EVs), which often require specialized casting solutions for battery enclosures and motor components, further fuels this segment. The Electrical and Electronics industry also contributes significantly, leveraging gravity die casting for components requiring high precision and thermal conductivity. Industrial applications, encompassing machinery, aerospace, and defense, represent another key growth avenue, benefiting from the durability and cost-effectiveness offered by gravity die cast parts. The underlying raw materials, Aluminum and Zinc, are readily available and offer excellent castability, making them the preferred choices for numerous applications.

Gravity Die Casting Market Market Size (In Billion)

The market's trajectory is further shaped by emerging trends such as the increasing use of advanced alloys to enhance component performance and the growing emphasis on sustainable manufacturing practices, including recyclability of cast materials. Innovations in casting technology, leading to improved surface finish and tighter tolerances, are also contributing to market growth. However, certain restraints, such as the initial capital investment required for high-end gravity die casting equipment and the availability of alternative manufacturing processes like high-pressure die casting for certain applications, could moderate the pace of growth. Geographically, the Asia Pacific region, led by China and India, is expected to emerge as a dominant force due to its robust manufacturing base and burgeoning automotive and electronics industries. Europe, with its established automotive sector and stringent quality standards, and North America, driven by technological advancements and the aerospace industry, will also play crucial roles in the market's evolution.

Gravity Die Casting Market Company Market Share

This in-depth report provides a detailed analysis of the global Gravity Die Casting Market, offering critical insights into its current landscape and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025, this report delves into market structure, key trends, dominant segments, product innovations, and the competitive dynamics shaping the industry. Leveraging high-ranking keywords such as "gravity die casting," "aluminum die casting," "zinc die casting," "automotive die casting," "industrial die casting," and "e-mobility casting," this analysis is designed to be highly visible and engaging for industry professionals, investors, and decision-makers.

Gravity Die Casting Market Market Structure & Competitive Dynamics

The Gravity Die Casting Market exhibits a moderate to high level of concentration, with a mix of established global players and specialized regional manufacturers. Innovation plays a crucial role, driven by advancements in metallurgy, automation, and process optimization for complex geometries. Regulatory frameworks, particularly concerning environmental impact and safety standards, influence manufacturing practices and material choices. Product substitutes, such as sand casting and investment casting, are present but often lack the precision and efficiency of gravity die casting for specific applications. End-user trends, particularly the growing demand for lightweight components in the automotive sector and sophisticated parts for electrical and electronics, are significant drivers. Mergers and acquisitions (M&A) are observed as companies seek to expand their product portfolios, geographic reach, and technological capabilities. For instance, the merger of component manufacturing companies under Rico Industries in May 2023 signals consolidation and enhanced design and manufacturing capabilities for die-casting auto parts. The market share for leading players is dynamic, influenced by their investment in advanced machinery and their ability to cater to evolving industry demands. M&A deal values are often substantial, reflecting the strategic importance of acquiring or merging with entities possessing specialized expertise or significant market presence.

Gravity Die Casting Market Industry Trends & Insights

The Gravity Die Casting Market is experiencing robust growth, propelled by several key trends. The automotive industry remains a primary consumer, with the increasing production of electric vehicles (EVs) driving demand for lightweight, high-strength aluminum and zinc alloy components for battery enclosures, motor housings, and structural parts. This trend is further amplified by stringent emission regulations globally, pushing automakers to adopt lighter materials. The electrical and electronics sector also contributes significantly, with gravity die casting employed for intricate components in consumer electronics, telecommunications equipment, and power distribution systems. The inherent precision and cost-effectiveness of the process make it ideal for these applications.

Technological disruptions are revolutionizing the market. The advent of giga casting, as evidenced by Ryobi Limited's order for an ultra-large die casting machine from UBE Machinery Corporation in September 2023, signals a paradigm shift towards larger, more integrated components, especially for electric vehicles. This innovation allows for fewer assembly steps, reduced weight, and improved structural integrity. Furthermore, advancements in automation and robotics are enhancing efficiency, consistency, and safety in gravity die casting operations. The integration of Industry 4.0 principles, including data analytics and IoT, is optimizing process control and predictive maintenance.

Consumer preferences are increasingly focused on sustainable and durable products, which gravity die casting can help achieve through the use of recyclable materials like aluminum and zinc. The demand for complex geometries and high-performance castings is also rising, pushing manufacturers to invest in advanced tooling and process simulation software. The competitive dynamics are characterized by a strong emphasis on quality, cost competitiveness, and the ability to deliver customized solutions. Companies are investing heavily in research and development to refine their casting processes and develop new alloys. The overall market penetration is steadily increasing, with a projected Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period, driven by these converging factors.

Dominant Markets & Segments in Gravity Die Casting Market

The Gravity Die Casting Market is significantly influenced by its key application and raw material segments, with Automotive emerging as the dominant application.

Application: Automotive

- Dominance: The automotive sector accounts for the largest share of the gravity die casting market, estimated to be over 60% in 2025. This dominance is fueled by the continuous demand for lightweight components to improve fuel efficiency and enhance EV range. The production of engines, transmissions, chassis parts, and increasingly, specialized components for electric powertrains, all rely heavily on gravity die casting for its precision, strength, and cost-effectiveness.

- Key Drivers:

- E-mobility Transition: The rapid growth of electric vehicles necessitates lighter and more robust components for battery packs, electric motors, and power electronics.

- Lightweighting Initiatives: Global regulations and consumer demand for fuel efficiency drive automakers to replace heavier materials with aluminum and zinc alloys.

- Cost Efficiency: Gravity die casting offers a cost-effective solution for high-volume production of complex automotive parts.

- Advancements in Alloy Development: The availability of high-strength, lightweight alloys specifically designed for automotive applications.

Raw Material: Aluminum

- Dominance: Aluminum alloys represent the most widely used raw material in gravity die casting, holding an estimated market share of over 75% in 2025. Its excellent strength-to-weight ratio, corrosion resistance, and recyclability make it an ideal choice for a vast array of applications, particularly in the automotive and electrical industries.

- Key Drivers:

- Lightweight Properties: Crucial for meeting fuel efficiency and EV range targets in the automotive sector.

- Corrosion Resistance: Enhances the longevity of components used in various environments.

- Recyclability: Aligns with increasing global sustainability initiatives and reduces manufacturing costs.

- Thermal Conductivity: Beneficial for components in electrical and electronic applications.

Application: Electrical and Electronics

- While smaller than the automotive sector, the electrical and electronics segment is a significant and growing contributor to the gravity die casting market. This segment utilizes gravity die casting for producing intricate casings, heat sinks, connectors, and other components where precision and good thermal management are critical. The demand is driven by advancements in consumer electronics, telecommunications infrastructure, and the growing need for efficient power management solutions. Market penetration is expected to grow at a CAGR of approximately 5.0%.

Application: Industrial Applications

- This segment encompasses a broad range of uses, including machinery components, pumps, valves, and hardware. Gravity die casting provides durable and precise parts for various industrial machines and equipment, benefiting from the process’s ability to produce complex shapes and maintain tight tolerances. Growth in this segment is linked to overall industrial production and infrastructure development.

Application: Other Applications

- This residual category includes diverse applications such as aerospace components, defense equipment, consumer goods, and architectural elements. While individually smaller, the collective demand from these sectors adds to the overall market size and diversification.

Raw Material: Zinc

- Zinc alloys are also a significant raw material, particularly for applications requiring excellent castability, high strength, and a good surface finish. They are commonly used for smaller, intricate parts, decorative items, and components in the automotive (e.g., door handles, grilles) and consumer goods sectors. The market share for zinc is approximately 20% in 2025, with steady growth expected due to its specific advantages in certain applications.

Gravity Die Casting Market Product Innovations

Product innovations in the gravity die casting market are primarily driven by the pursuit of enhanced material properties, improved manufacturing efficiency, and the creation of more complex, integrated components. Advances in aluminum and zinc alloy formulations are yielding castings with superior strength-to-weight ratios and higher temperature resistance, crucial for demanding automotive and industrial applications, including those in e-mobility. The integration of advanced simulation software allows for the design and optimization of complex geometries that were previously unfeasible, providing a significant competitive advantage. Furthermore, the development of automated tooling and intelligent process control systems is leading to increased precision, reduced defect rates, and faster production cycles.

Report Segmentation & Scope

The Gravity Die Casting Market is meticulously segmented to provide a granular understanding of its dynamics.

- Application: Automotive: This segment focuses on components for internal combustion engines, electric motors, transmissions, chassis, and other automotive systems, valued at approximately $12 Billion in 2025. Growth is driven by EV adoption and lightweighting mandates.

- Application: Electrical and Electronics: This segment covers components for consumer electronics, telecommunications, power distribution, and industrial automation, with an estimated market size of $5 Billion in 2025 and projected growth of 5.0% CAGR.

- Application: Industrial Applications: This segment includes parts for machinery, pumps, valves, hydraulics, and other industrial equipment, valued at approximately $3 Billion in 2025. Growth is linked to global industrial output.

- Application: Other Applications: This segment encompasses aerospace, defense, consumer goods, and architectural applications, with an estimated market size of $1 Billion in 2025.

- Raw Material: Aluminum: This segment analyzes the market share and demand for aluminum alloys, estimated at over $17 Billion in 2025, driven by its lightweight and strong properties.

- Raw Material: Zinc: This segment focuses on the market for zinc alloys, estimated at approximately $4 Billion in 2025, valued for its excellent castability and surface finish.

Key Drivers of Gravity Die Casting Market Growth

The gravity die casting market's expansion is propelled by several critical factors. The accelerating shift towards electric vehicles is a primary driver, demanding lightweight and robust components for battery systems, motor housings, and structural elements. Stringent global emission standards further incentivize the adoption of lightweight materials like aluminum, which gravity die casting excels at processing. Technological advancements in automation, robotics, and material science are enhancing precision, efficiency, and the ability to produce increasingly complex geometries. The growing demand for durable and aesthetically appealing consumer goods and infrastructure development projects also contribute to the market's upward trajectory.

Challenges in the Gravity Die Casting Market Sector

Despite its growth, the gravity die casting market faces several challenges. Fluctuating raw material prices, particularly for aluminum, can impact profitability and pricing strategies. Intensifying competition from other casting methods and manufacturers necessitates continuous innovation and cost optimization. Environmental regulations concerning energy consumption and waste management require ongoing investment in sustainable practices. Furthermore, the shortage of skilled labor in specialized manufacturing roles can hinder production capacity and operational efficiency. Supply chain disruptions, as experienced globally, can also impact the availability of critical raw materials and equipment.

Leading Players in the Gravity Die Casting Market Market

- Harrison Castings

- Georg Fischer Limited

- Endurance Group

- CIE Automotive

- MAN Group (Alucast)

- Hitachi Metals

- Esko Die Casting

- Minda Corporation

- Zollern GmbH

- Rockman Industries

Key Developments in Gravity Die Casting Market Sector

- September 2023: Ryobi Limited announced an order for an ultra-large die casting machine from UBE Machinery Corporation for giga casting, signaling a move towards larger, integrated components for prototypes by March 2025.

- May 2023: Rico Industries, India announced a scheme of amalgamation for merging component manufacturing companies to enhance design and production of die-casting auto parts for various propulsion engines.

- January 2023: GF Casting Solutions opened a new machining centre in Europe, featuring an automated iron casting moulding line and a 5-axis machining centre, enabling full-package supply of ready-to-mount cast components, particularly for commercial and off-highway vehicles.

- September 2022: DGS Druckguss Systeme s.r.o. began operations at its Frdlant facility, manufacturing aluminum and magnesium alloy die castings for the automotive sector, with plans for a second phase of expansion within two to three years.

- May 2022: KS HUAYU AluTech GmbH (Rheinmetall AG & HASCO joint venture) showcased advanced aluminum cast parts for e-mobility and lightweight structural components at Euroguss 2022.

Strategic Gravity Die Casting Market Market Outlook

The strategic outlook for the Gravity Die Casting Market remains highly positive, driven by ongoing global trends and technological advancements. The sustained growth of the electric vehicle sector will continue to be a significant catalyst, demanding innovative lightweight casting solutions. Expansion into emerging economies with growing automotive and industrial manufacturing bases presents substantial opportunities. Furthermore, the increasing focus on sustainability and circular economy principles will favor gravity die casting due to the high recyclability of aluminum and zinc. Strategic investments in automation, advanced materials, and smart manufacturing technologies will be crucial for players to maintain a competitive edge and capitalize on the evolving market landscape.

Gravity Die Casting Market Segmentation

-

1. Application

- 1.1. Automotive

- 1.2. Electrical and Electronics

- 1.3. Industrial Applications

- 1.4. Other Appplications

-

2. Raw Material

- 2.1. Aluminum

- 2.2. Zinc

Gravity Die Casting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Germany

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East

Gravity Die Casting Market Regional Market Share

Geographic Coverage of Gravity Die Casting Market

Gravity Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Automotive Industry to Drive Demand in the Gravity Die Casting Market

- 3.3. Market Restrains

- 3.3.1. High Processing Cost May Hamper Market Expansion

- 3.4. Market Trends

- 3.4.1. Automotive Industry is Expected Capture Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gravity Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automotive

- 5.1.2. Electrical and Electronics

- 5.1.3. Industrial Applications

- 5.1.4. Other Appplications

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Aluminum

- 5.2.2. Zinc

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Gravity Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automotive

- 6.1.2. Electrical and Electronics

- 6.1.3. Industrial Applications

- 6.1.4. Other Appplications

- 6.2. Market Analysis, Insights and Forecast - by Raw Material

- 6.2.1. Aluminum

- 6.2.2. Zinc

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Gravity Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automotive

- 7.1.2. Electrical and Electronics

- 7.1.3. Industrial Applications

- 7.1.4. Other Appplications

- 7.2. Market Analysis, Insights and Forecast - by Raw Material

- 7.2.1. Aluminum

- 7.2.2. Zinc

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Gravity Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automotive

- 8.1.2. Electrical and Electronics

- 8.1.3. Industrial Applications

- 8.1.4. Other Appplications

- 8.2. Market Analysis, Insights and Forecast - by Raw Material

- 8.2.1. Aluminum

- 8.2.2. Zinc

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Gravity Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automotive

- 9.1.2. Electrical and Electronics

- 9.1.3. Industrial Applications

- 9.1.4. Other Appplications

- 9.2. Market Analysis, Insights and Forecast - by Raw Material

- 9.2.1. Aluminum

- 9.2.2. Zinc

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Harrison Castings

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Georg Fischer Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Endurance Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 CIE Automotive*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 MAN Group (Alucast

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hitachi Metals

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Esko Die Casting

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Minda Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Zollern GmbH

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rockman Industries

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Harrison Castings

List of Figures

- Figure 1: Global Gravity Die Casting Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Gravity Die Casting Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Gravity Die Casting Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Gravity Die Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 5: North America Gravity Die Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 6: North America Gravity Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Gravity Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Gravity Die Casting Market Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Gravity Die Casting Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Gravity Die Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 11: Europe Gravity Die Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 12: Europe Gravity Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Gravity Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Gravity Die Casting Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Gravity Die Casting Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Gravity Die Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 17: Asia Pacific Gravity Die Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 18: Asia Pacific Gravity Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Gravity Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Gravity Die Casting Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Rest of the World Gravity Die Casting Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Rest of the World Gravity Die Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 23: Rest of the World Gravity Die Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 24: Rest of the World Gravity Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Gravity Die Casting Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gravity Die Casting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Gravity Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 3: Global Gravity Die Casting Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Gravity Die Casting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Gravity Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 6: Global Gravity Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Gravity Die Casting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Gravity Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 12: Global Gravity Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Germany Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Gravity Die Casting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Gravity Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 21: Global Gravity Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Gravity Die Casting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Global Gravity Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 30: Global Gravity Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: South America Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Middle East Gravity Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gravity Die Casting Market?

The projected CAGR is approximately 3.79%.

2. Which companies are prominent players in the Gravity Die Casting Market?

Key companies in the market include Harrison Castings, Georg Fischer Limited, Endurance Group, CIE Automotive*List Not Exhaustive, MAN Group (Alucast, Hitachi Metals, Esko Die Casting, Minda Corporation, Zollern GmbH, Rockman Industries.

3. What are the main segments of the Gravity Die Casting Market?

The market segments include Application, Raw Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Automotive Industry to Drive Demand in the Gravity Die Casting Market.

6. What are the notable trends driving market growth?

Automotive Industry is Expected Capture Major Market Share.

7. Are there any restraints impacting market growth?

High Processing Cost May Hamper Market Expansion.

8. Can you provide examples of recent developments in the market?

September 2023, Ryobi Limited announced that it has placed an order with UBE Machinery Corporation, Ltd., an industrial machinery making subsidiary of UBE Corporation, for an ultra-large die casting machine for giga casting. Ryobi will install the die casting machine at its Kikugawa Plant (Kikugawa City, Shizuoka Prefecture) and start making prototypes of ultra-large die-cast products around March 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gravity Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gravity Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gravity Die Casting Market?

To stay informed about further developments, trends, and reports in the Gravity Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence