Key Insights

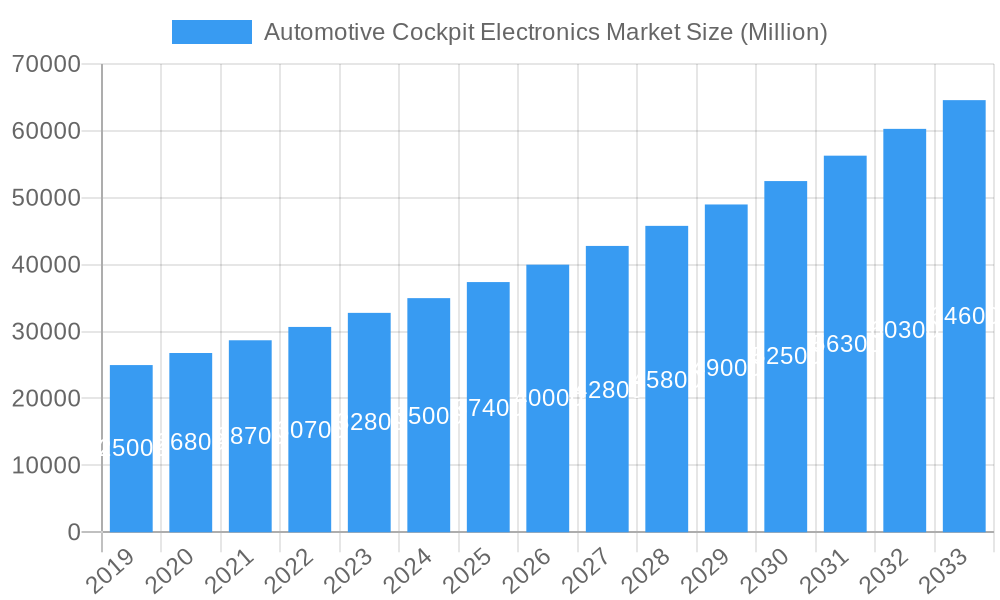

The global Automotive Cockpit Electronics Market is poised for robust expansion, projected to reach a significant market size by 2033. Driven by a substantial Compound Annual Growth Rate (CAGR) of 8.50%, the market is set to witness substantial value creation, estimated in the millions. This growth is primarily fueled by escalating consumer demand for advanced in-vehicle technologies, enhanced safety features, and seamless connectivity. The increasing integration of digital displays, sophisticated infotainment systems, and intuitive navigation solutions is transforming the automotive cockpit into a personalized and interactive space. Furthermore, the growing adoption of autonomous driving technologies and the subsequent need for advanced driver-assistance systems (ADAS) integrated into the cockpit are significant growth catalysts. Government regulations pushing for improved vehicle safety and emission standards also indirectly contribute to the adoption of more advanced cockpit electronics that enable better monitoring and control.

Automotive Cockpit Electronics Market Market Size (In Billion)

The market's trajectory is further shaped by a dynamic interplay of trends and restraints. Key trends include the rise of augmented reality (AR) head-up displays (HUDs) that project critical information onto the windshield, the proliferation of personalized infotainment experiences tailored to individual user preferences, and the increasing importance of telematics for vehicle diagnostics, remote services, and fleet management. The segment of Instrument Clusters is also experiencing a significant shift towards digital and reconfigurable displays. However, challenges such as the high cost of advanced technologies, cybersecurity concerns related to connected vehicle systems, and the complexity of software integration pose potential restraints to market growth. Nevertheless, strategic collaborations between automotive manufacturers and technology providers, coupled with continuous innovation, are expected to mitigate these challenges and propel the market forward across various vehicle types, including passenger cars and commercial vehicles.

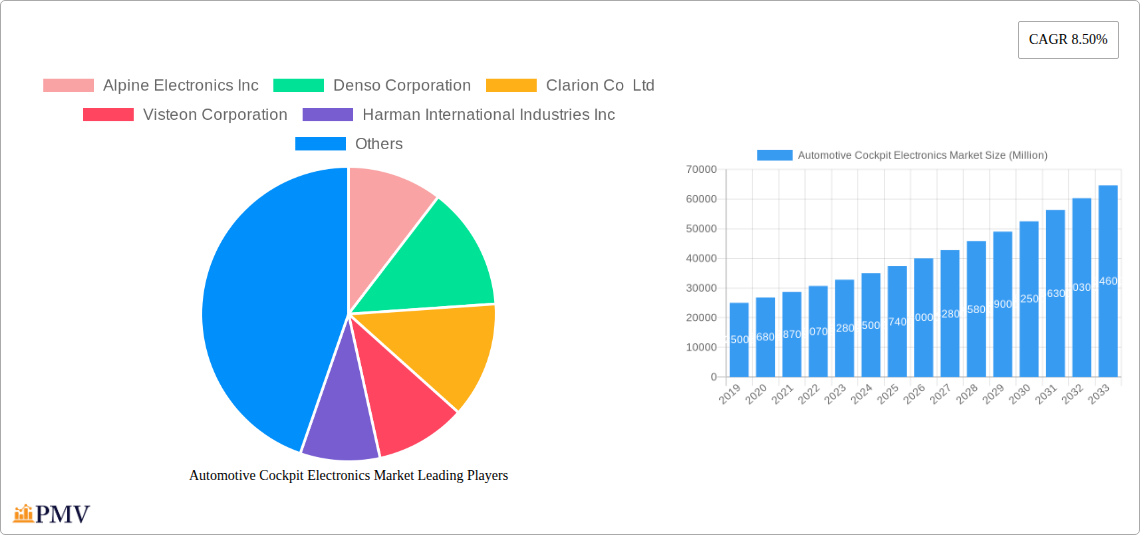

Automotive Cockpit Electronics Market Company Market Share

Automotive Cockpit Electronics Market Report: Unveiling the Future of In-Car Technology

Dive deep into the dynamic Automotive Cockpit Electronics Market with this comprehensive report. Covering the study period from 2019 to 2033, with a base year of 2025, this analysis provides unparalleled insights into the market's structure, trends, and future trajectory. We forecast the market to reach an estimated value of XX Million by 2025, driven by rapid advancements in in-car technology and evolving consumer expectations. This report is your definitive guide to understanding the competitive landscape, key growth drivers, and dominant segments shaping the future of automotive interiors.

Automotive Cockpit Electronics Market Market Structure & Competitive Dynamics

The Automotive Cockpit Electronics Market exhibits a moderately consolidated structure, characterized by the presence of both established Tier-1 suppliers and emerging technology players. Innovation ecosystems are thriving, fueled by substantial R&D investments in areas like augmented reality, advanced driver-assistance systems (ADAS) integration, and personalized user interfaces. Regulatory frameworks, particularly concerning data privacy and cybersecurity, are increasingly influencing product development and market entry strategies. Product substitutes, while not directly replacing cockpit electronics, can influence feature adoption based on cost-effectiveness and perceived value. End-user trends are strongly oriented towards enhanced connectivity, intuitive user experience, and seamless integration of digital lifestyles within the vehicle. Major M&A activities are anticipated as companies seek to acquire critical technologies or expand their market reach. For instance, a hypothetical M&A deal involving a leading infotainment provider acquiring an AR display specialist could be valued at XX Million, significantly altering the competitive landscape.

- Market Concentration: Moderate to high, with key players holding significant market share.

- Innovation Ecosystems: Robust, driven by collaboration between automakers, tech companies, and research institutions.

- Regulatory Frameworks: Evolving, with a focus on data security, privacy, and safety standards.

- Product Substitutes: Indirect, influencing feature prioritization.

- End-User Trends: High demand for connectivity, personalization, and intuitive interfaces.

- M&A Activities: Expected to increase as companies consolidate technology portfolios.

Automotive Cockpit Electronics Market Industry Trends & Insights

The Automotive Cockpit Electronics Market is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is primarily driven by the increasing demand for sophisticated in-car experiences, the integration of advanced digital technologies, and the proliferation of electric and autonomous vehicles. The shift towards software-defined vehicles necessitates more powerful and integrated cockpit solutions, encompassing advanced infotainment systems, sophisticated instrument clusters, and immersive head-up displays (HUDs). Consumer preferences are increasingly aligning with a "smart home on wheels" concept, where seamless connectivity, personalized settings, and access to a wide array of digital services are paramount. Technological disruptions, such as the miniaturization of components, advancements in display technology (OLED, micro-LED), and the rise of AI-powered voice assistants, are continuously reshaping the market. For example, the increasing adoption of Level 3 and Level 4 autonomous driving features will demand more advanced and integrated cockpit systems capable of presenting critical information and alerts to drivers in an intuitive manner. The penetration of premium features into mass-market vehicles is also accelerating, making advanced cockpit electronics more accessible to a wider consumer base. The competitive dynamics are intensifying, with traditional automotive suppliers facing increasing competition from tech giants and specialized electronics manufacturers, leading to strategic partnerships and co-development initiatives. Furthermore, the growing emphasis on over-the-air (OTA) updates is enabling continuous improvement and feature enhancement of cockpit electronics post-purchase, adding significant value for consumers and creating new revenue streams for manufacturers. The market penetration of advanced driver-assistance systems (ADAS) directly correlates with the demand for sophisticated cockpit displays that can effectively communicate ADAS functionalities and alerts to the driver.

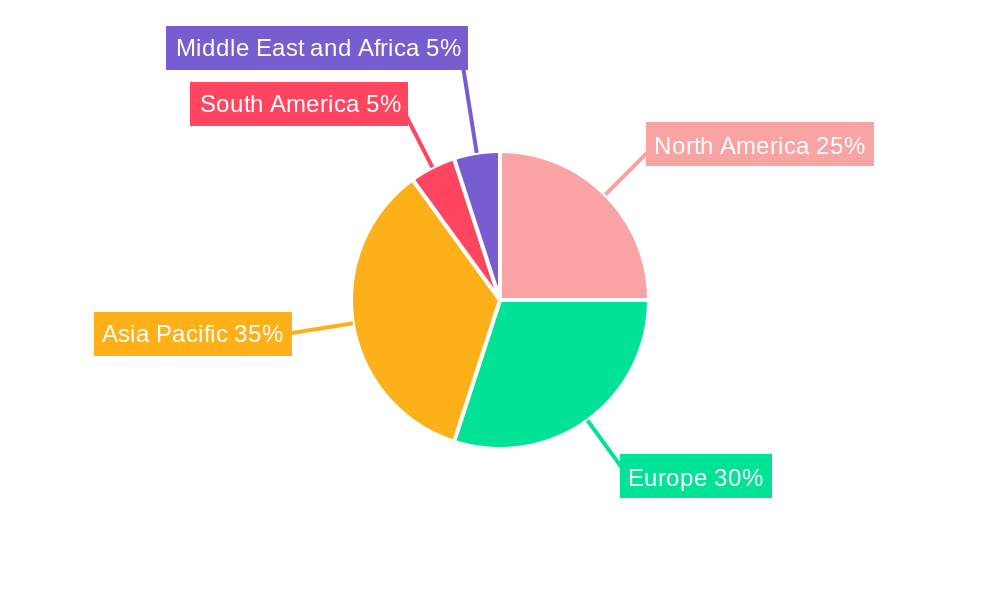

Dominant Markets & Segments in Automotive Cockpit Electronics Market

The Automotive Cockpit Electronics Market is currently dominated by Passenger Cars, which represent the largest segment due to their higher production volumes and a strong consumer appetite for advanced in-car technology. Geographically, North America and Europe are leading regions, driven by stringent safety regulations, high disposable incomes, and early adoption of automotive innovations. Within the Product segment, Infotainment and Navigation systems hold a commanding market share, reflecting their central role in enhancing the driving experience through entertainment, connectivity, and real-time traffic information. The Instrument Cluster segment is also witnessing significant growth, transitioning from traditional analog gauges to fully digital and customizable displays offering a wealth of vehicle information.

- Dominant Vehicle Type: Passenger Cars.

- Key Drivers: Higher production volumes, strong consumer demand for advanced features, and the integration of premium technologies.

- Dominant Product Segment: Infotainment and Navigation.

- Key Drivers: Increasing connectivity needs, demand for in-car entertainment, seamless smartphone integration (Apple CarPlay, Android Auto), and advanced navigation functionalities.

- Leading Geographical Regions: North America and Europe.

- Key Drivers (North America): High consumer spending power, early adoption of automotive technologies, and robust demand for connected car services.

- Key Drivers (Europe): Strict safety and emissions regulations pushing for advanced vehicle technology, strong presence of premium vehicle manufacturers, and growing consumer interest in digital in-car experiences.

- Emerging Trends in Segments: The Head-up Display (HUD) segment is experiencing substantial growth, with augmented reality HUDs becoming a key differentiator, offering drivers enhanced situational awareness and a more immersive experience. The Telematics segment is also gaining traction as connected car services become more prevalent, enabling features like remote diagnostics, emergency calls, and fleet management.

Automotive Cockpit Electronics Market Product Innovations

Product innovation in the Automotive Cockpit Electronics Market is primarily focused on enhancing user experience, safety, and connectivity. Advancements in display technologies, such as higher resolution, improved brightness, and flexible screen designs, are enabling more immersive and intuitive interfaces. The integration of artificial intelligence (AI) for voice control and personalized recommendations is transforming how drivers interact with their vehicles. Augmented reality HUDs are emerging as a key innovation, overlaying critical driving information onto the real world view, thereby improving safety and reducing driver distraction. Software-defined architectures are allowing for more modular and upgradable cockpit systems, facilitating over-the-air updates and personalization.

Report Segmentation & Scope

This report meticulously segments the Automotive Cockpit Electronics Market by Product and Vehicle Type.

Product Segmentation:

- Head-up Display: This segment includes advanced HUDs, augmented reality HUDs, and traditional HUDs, offering drivers crucial information without diverting their attention from the road. Growth projections indicate a significant CAGR, driven by increasing safety features and premium vehicle integration.

- Information Display: This encompasses digital instrument clusters, center console displays, and other secondary screens, providing comprehensive vehicle diagnostics, infotainment, and navigation data.

- Infotainment and Navigation: This dominant segment covers in-car entertainment systems, GPS navigation, smartphone integration (Apple CarPlay, Android Auto), and connectivity features. It is expected to maintain strong market share and consistent growth.

- Instrument Cluster: This segment focuses on the evolution from analog to fully digital and customizable instrument clusters, offering enhanced information display and personalization options.

- Telematics: This segment includes connected car services, V2X communication modules, and remote diagnostics systems, enabling advanced functionalities and data transmission.

- Other Products: This category encompasses a range of specialized cockpit electronics, such as driver monitoring systems, advanced audio components, and interior lighting controls.

Vehicle Type Segmentation:

- Passenger Cars: This segment, comprising sedans, SUVs, hatchbacks, and more, is the largest contributor to the market due to its high sales volumes and demand for advanced features.

- Commercial Vehicles: This segment includes trucks, buses, and vans, where cockpit electronics are increasingly being adopted for enhanced driver comfort, safety, and fleet management capabilities.

Key Drivers of Automotive Cockpit Electronics Market Growth

The Automotive Cockpit Electronics Market growth is propelled by several key factors. The escalating demand for enhanced in-car user experience, driven by consumer expectations for seamless connectivity and advanced digital features, is a primary driver. Technological advancements in display technology, artificial intelligence, and connectivity solutions are enabling the development of more sophisticated and integrated cockpit systems. The increasing penetration of electric vehicles (EVs) and the growing adoption of advanced driver-assistance systems (ADAS) necessitate more advanced cockpit displays for managing and communicating critical information. Government regulations and safety standards are also pushing automakers to incorporate advanced cockpit electronics to improve driver awareness and vehicle safety. Furthermore, the trend towards personalized and connected car experiences, akin to smart devices, is fueling innovation and adoption of these technologies.

Challenges in the Automotive Cockpit Electronics Market Sector

Despite the strong growth trajectory, the Automotive Cockpit Electronics Market faces several challenges. The escalating complexity and cost of integrated cockpit systems can pose a barrier to adoption, particularly for entry-level vehicles. Supply chain disruptions, as witnessed in recent years, can impact the availability of critical components and lead to production delays. Cybersecurity threats and data privacy concerns are becoming increasingly significant, requiring robust security measures and compliance with evolving regulations. Intense competition among established players and new entrants, coupled with rapid technological obsolescence, puts pressure on profit margins and necessitates continuous investment in R&D. The integration of disparate systems and software, along with ensuring seamless user experience across various hardware platforms, also presents significant engineering challenges.

Leading Players in the Automotive Cockpit Electronics Market Market

- Alpine Electronics Inc

- Denso Corporation

- Clarion Co Ltd

- Visteon Corporation

- Harman International Industries Inc

- Nippon-Seiki Co Ltd

- Garmin Ltd

- Continental AG

- Tomtom International B

- Magneti Marelli SPA

- Yazaki Corporation

- Panasonic Corporation

Key Developments in Automotive Cockpit Electronics Market Sector

- July 2022: Skoda EnyaqEV Camper is making its way to enter the United States market. Skoda Enyaq iV 80 FestEValcamper edition includes a highly practical yet compact camping setup that is entirely accommodated inside its boot. The model is equipped with a heads-up display with augmented reality, which can also come as an advantage on long road trips.

- May 2022: Hyundai Mobis launched a world-first adjustable display technology for an integrated automotive cockpit system with an ultra-large moveable curve display.

Strategic Automotive Cockpit Electronics Market Market Outlook

The Automotive Cockpit Electronics Market is poised for sustained growth, driven by an accelerating pace of innovation and evolving consumer demands for integrated, personalized, and intelligent in-car experiences. Strategic opportunities lie in the continued development of AI-powered interfaces, augmented reality displays, and seamless integration of vehicle systems with the broader digital ecosystem. The rise of autonomous driving and connected mobility will further amplify the need for sophisticated cockpit electronics that can provide comprehensive information and enhance driver situational awareness. Companies that can effectively navigate the complex technological landscape, address cybersecurity concerns, and deliver intuitive user experiences will be well-positioned to capture significant market share. The trend towards software-defined vehicles presents a substantial opportunity for recurring revenue through over-the-air updates and subscription-based services, redefining the aftermarket and long-term value proposition of automotive cockpit electronics.

Automotive Cockpit Electronics Market Segmentation

-

1. Product

- 1.1. Head-up Display

- 1.2. Information Display

- 1.3. Infotainment and Navigation

- 1.4. Instrument Cluster

- 1.5. Telematics

- 1.6. Other Products

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

Automotive Cockpit Electronics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Automotive Cockpit Electronics Market Regional Market Share

Geographic Coverage of Automotive Cockpit Electronics Market

Automotive Cockpit Electronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Connected Cars; Advancements in Human-Machine Interface (HMI) Technologies

- 3.3. Market Restrains

- 3.3.1. Rapid Technological Advancements

- 3.4. Market Trends

- 3.4.1. Increasing Customer Preference for In-Dash Navigation System

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Cockpit Electronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Head-up Display

- 5.1.2. Information Display

- 5.1.3. Infotainment and Navigation

- 5.1.4. Instrument Cluster

- 5.1.5. Telematics

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Automotive Cockpit Electronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Head-up Display

- 6.1.2. Information Display

- 6.1.3. Infotainment and Navigation

- 6.1.4. Instrument Cluster

- 6.1.5. Telematics

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Automotive Cockpit Electronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Head-up Display

- 7.1.2. Information Display

- 7.1.3. Infotainment and Navigation

- 7.1.4. Instrument Cluster

- 7.1.5. Telematics

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Automotive Cockpit Electronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Head-up Display

- 8.1.2. Information Display

- 8.1.3. Infotainment and Navigation

- 8.1.4. Instrument Cluster

- 8.1.5. Telematics

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South America Automotive Cockpit Electronics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Head-up Display

- 9.1.2. Information Display

- 9.1.3. Infotainment and Navigation

- 9.1.4. Instrument Cluster

- 9.1.5. Telematics

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East and Africa Automotive Cockpit Electronics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Head-up Display

- 10.1.2. Information Display

- 10.1.3. Infotainment and Navigation

- 10.1.4. Instrument Cluster

- 10.1.5. Telematics

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Cars

- 10.2.2. Commercial Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Alpine Electronics Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Denso Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Clarion Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Visteon Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Harman International Industries Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nippon-Seiki Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Garmin Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Continental AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tomtom International B

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Magneti Marelli SPA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Yazaki Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Panasonic Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Alpine Electronics Inc

List of Figures

- Figure 1: Global Automotive Cockpit Electronics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Cockpit Electronics Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Automotive Cockpit Electronics Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Automotive Cockpit Electronics Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Cockpit Electronics Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Cockpit Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Automotive Cockpit Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Cockpit Electronics Market Revenue (Million), by Product 2025 & 2033

- Figure 9: Europe Automotive Cockpit Electronics Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Automotive Cockpit Electronics Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive Cockpit Electronics Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive Cockpit Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Automotive Cockpit Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Cockpit Electronics Market Revenue (Million), by Product 2025 & 2033

- Figure 15: Asia Pacific Automotive Cockpit Electronics Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Automotive Cockpit Electronics Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Automotive Cockpit Electronics Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Automotive Cockpit Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Cockpit Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Automotive Cockpit Electronics Market Revenue (Million), by Product 2025 & 2033

- Figure 21: South America Automotive Cockpit Electronics Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: South America Automotive Cockpit Electronics Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: South America Automotive Cockpit Electronics Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: South America Automotive Cockpit Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Automotive Cockpit Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Automotive Cockpit Electronics Market Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East and Africa Automotive Cockpit Electronics Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Automotive Cockpit Electronics Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Middle East and Africa Automotive Cockpit Electronics Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Middle East and Africa Automotive Cockpit Electronics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Automotive Cockpit Electronics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Russia Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 19: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: India Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 27: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 28: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 33: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 34: Global Automotive Cockpit Electronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: United Arab Emirates Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Saudi Arabia Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Automotive Cockpit Electronics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Cockpit Electronics Market?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the Automotive Cockpit Electronics Market?

Key companies in the market include Alpine Electronics Inc, Denso Corporation, Clarion Co Ltd, Visteon Corporation, Harman International Industries Inc, Nippon-Seiki Co Ltd, Garmin Ltd, Continental AG, Tomtom International B, Magneti Marelli SPA, Yazaki Corporation, Panasonic Corporation.

3. What are the main segments of the Automotive Cockpit Electronics Market?

The market segments include Product, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Connected Cars; Advancements in Human-Machine Interface (HMI) Technologies.

6. What are the notable trends driving market growth?

Increasing Customer Preference for In-Dash Navigation System.

7. Are there any restraints impacting market growth?

Rapid Technological Advancements.

8. Can you provide examples of recent developments in the market?

July 2022: Skoda EnyaqEV Camper is making its way to enter the United States market. Skoda Enyaq iV 80 FestEValcamper edition includes a highly practical yet compact camping setup that is entirely accommodated inside its boot. The model is equipped with a heads-up display with augmented reality, which can also come as an advantage on long road trips.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Cockpit Electronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Cockpit Electronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Cockpit Electronics Market?

To stay informed about further developments, trends, and reports in the Automotive Cockpit Electronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence