Key Insights

The global construction machinery attachment market is projected for significant growth, estimated at $6.41 billion in 2025 with a compound annual growth rate (CAGR) of 5.1% through 2033. This expansion is driven by escalating infrastructure investments worldwide, particularly in emerging Asia Pacific economies. Increased adoption of advanced construction equipment and rising demand for specialized attachments enhancing productivity, versatility, and efficiency are key market drivers. Urbanization and the subsequent need for new residential, commercial, and industrial buildings sustain demand for construction machinery and attachments. Technological advancements leading to more sophisticated, durable attachments for diverse applications (demolition, material handling, landscaping, mining) present substantial opportunities.

Construction Machinery Attachment Market Market Size (In Billion)

Market segmentation highlights emphasis on equipment types and sales channels. Buckets and grapplers are expected to lead due to their foundational role. The aftermarket segment is poised for growth as contractors seek cost-effective solutions and replacements, extending machinery fleet lifespans. Leading industry players are investing in R&D and strategic partnerships. However, high initial costs of advanced attachments and raw material price fluctuations pose restraints. Despite challenges, increased construction mechanization and the need for specialized tools for complex projects will sustain the market's upward trajectory.

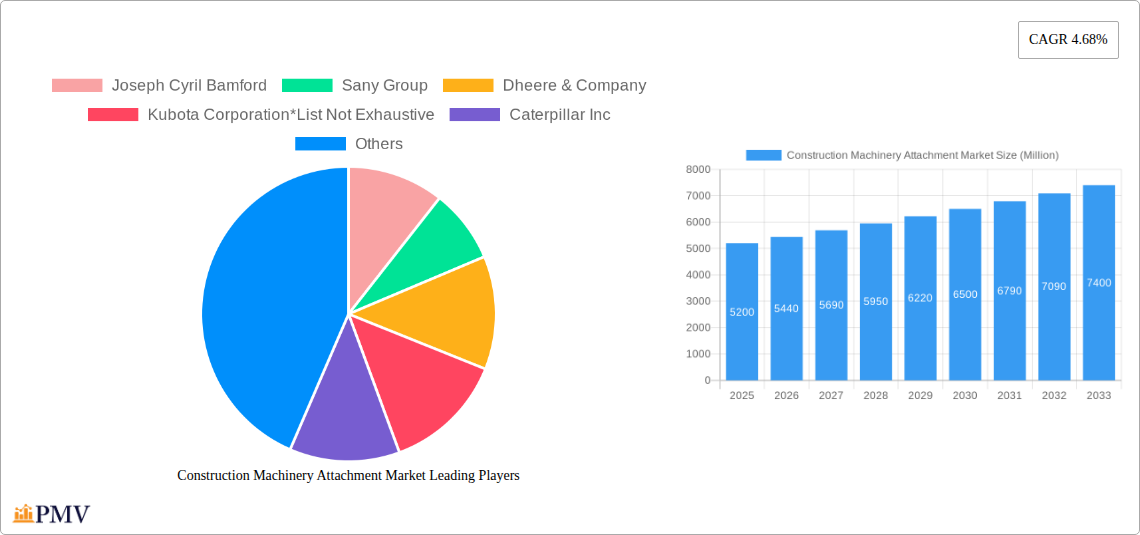

Construction Machinery Attachment Market Company Market Share

This comprehensive market research report offers in-depth analysis and actionable intelligence for industry stakeholders in the global Construction Machinery Attachment Market. Covering the historical period of 2019-2024, the base year of 2025, and a forecast period extending to 2033, this report is essential for understanding market dynamics, identifying growth opportunities, and navigating competitive landscapes.

The report examines key segments including Buckets, Grapplers, Hammers, and Other Equipment Types, and sales channels such as OEM and Aftermarket. It scrutinizes construction machinery attachment market trends, construction attachment market share, and the latest construction equipment innovations.

Construction Machinery Attachment Market Market Structure & Competitive Dynamics

The Construction Machinery Attachment Market is characterized by a moderately concentrated structure, with several large, established players like Caterpillar Inc, Komatsu Ltd, and Volvo Construction Equipment holding significant construction attachment market share. However, the presence of numerous regional and specialized manufacturers contributes to a dynamic competitive environment. Innovation plays a pivotal role, with companies continuously investing in R&D to develop high-performance construction attachments that enhance efficiency, versatility, and safety. The OEM attachment market is a key battleground, where manufacturers strive to integrate their attachments seamlessly with new machinery. Regulatory frameworks, particularly concerning safety and emissions, influence product development and market entry. Product substitutes, while limited for core functionalities, emerge in the form of multi-functional attachments or rental services. End-user trends, driven by demand for increased productivity and reduced operational costs, are pushing manufacturers towards lighter, more durable, and technologically advanced attachments. Mergers and acquisitions (M&A) activities are observed as companies seek to expand their product portfolios, geographic reach, and technological capabilities. Recent M&A deals in the broader construction equipment sector, valued in the hundreds of millions of dollars, signal consolidation and strategic realignments within the industry. The market penetration of advanced attachments is steadily increasing, driven by the growing need for specialized solutions in diverse construction applications.

Construction Machinery Attachment Market Industry Trends & Insights

The Construction Machinery Attachment Market is poised for substantial growth, fueled by robust global infrastructure development initiatives, increasing urbanization, and the continuous demand for enhanced operational efficiency in the construction sector. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. A key trend is the rising adoption of intelligent construction attachments equipped with advanced sensors and IoT capabilities, enabling real-time data monitoring, predictive maintenance, and improved operational control. This technological disruption allows for greater precision and productivity on job sites, directly impacting construction machinery productivity. Furthermore, the growing emphasis on sustainability is driving demand for eco-friendly construction attachments and those that promote fuel efficiency. The aftermarket construction attachment sales segment is experiencing a notable surge as contractors prioritize cost-effectiveness and seek to extend the lifespan of their existing machinery fleets. Consumer preferences are shifting towards versatile, multi-functional attachments that can perform a wider range of tasks, thereby reducing the need for specialized equipment. The competitive dynamics are intensifying, with established players expanding their product lines and new entrants focusing on niche markets and innovative solutions. The increasing complexity of construction projects, requiring specialized tools, further propels the demand for diverse attachment types. The market penetration of advanced attachments is expected to climb as more contractors recognize the long-term benefits of investing in high-quality, technologically superior solutions.

Dominant Markets & Segments in Construction Machinery Attachment Market

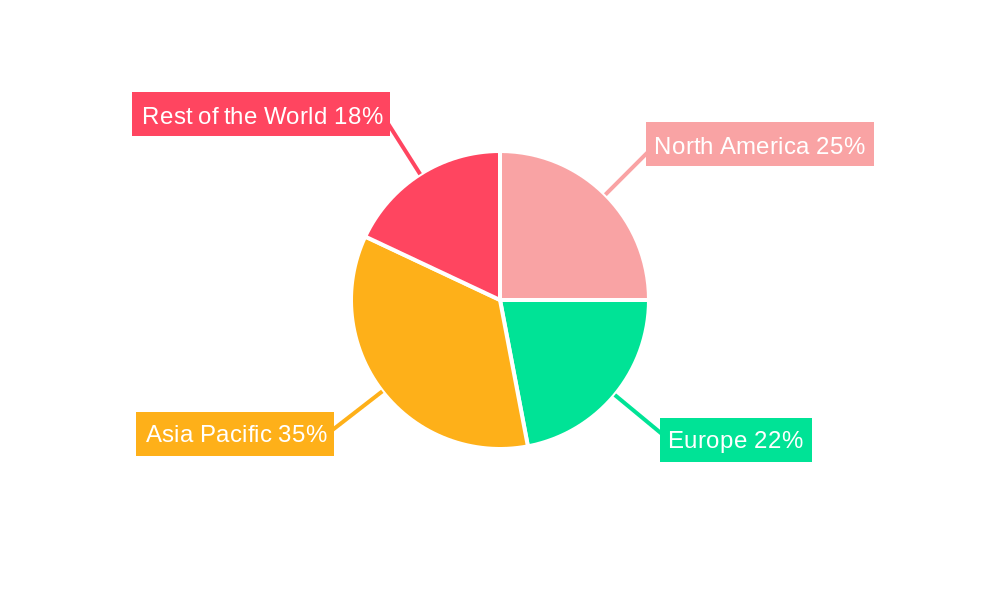

The Construction Machinery Attachment Market is segmented by Equipment Type into Buckets, Grapplers, Hammers, and Other Equipment Types, and by Sales Channel into OEM and Aftermarket. Geographically, North America and Europe currently dominate the market, driven by their mature construction industries and significant investments in infrastructure upgrades. However, the Asia-Pacific region is emerging as a high-growth market, propelled by rapid urbanization, government-led infrastructure projects, and increasing foreign direct investment in construction.

Equipment Type Dominance:

- Buckets: Constitute the largest segment due to their fundamental role in excavation, loading, and material handling across virtually all construction projects. Key drivers include the sheer volume of earthmoving and material transport required in large-scale infrastructure development and building construction.

- Other Equipment Types: This broad category, encompassing augers, breakers, compactors, forks, and hydraulic cutters, is experiencing rapid growth. This surge is attributed to the increasing demand for specialized attachments to handle diverse and complex construction tasks, from demolition to precise excavation. The need for greater project efficiency and reduced manual labor further propels the adoption of these versatile attachments.

Sales Channel Dominance:

- OEM: Remains a significant channel as manufacturers of construction machinery offer integrated attachment solutions, ensuring compatibility and optimal performance. This channel benefits from new machinery sales and the desire for factory-fitted, high-quality attachments.

- Aftermarket: This segment is witnessing robust growth. Factors contributing to its dominance include cost-effectiveness for contractors, a wide availability of replacement parts and specialized attachments for older models, and the ability to customize machinery with unique solutions not offered by OEMs. The increasing focus on extending the operational life of existing equipment is a major growth accelerator for the aftermarket. Economic policies encouraging machinery upgrades and extensions, coupled with the inherent cost savings in the aftermarket, solidify its leading position.

Construction Machinery Attachment Market Product Innovations

Product innovations in the Construction Machinery Attachment Market are largely focused on enhancing efficiency, durability, and versatility. The development of lighter yet stronger materials, such as advanced high-strength steel, allows for attachments that can handle greater loads with reduced fuel consumption. Smart attachments, incorporating GPS technology, sensors, and telematics, are gaining traction, enabling precise operation, remote monitoring, and automated functions. This technological advancement offers significant competitive advantages by improving job site safety and reducing operational errors. Furthermore, the trend towards modular and interchangeable attachments allows for quicker tool changes, minimizing downtime and maximizing equipment utilization, a crucial aspect for construction equipment efficiency.

Report Segmentation & Scope

This report segmentizes the Construction Machinery Attachment Market comprehensively. The Equipment Type segmentation includes Buckets, the most ubiquitous attachment for material handling and excavation; Grapplers, essential for demolition, scrap handling, and timber management; Hammers, vital for breaking concrete and rock; and Other Equipment Types, encompassing a wide array of specialized tools like augers, compactors, and hydraulic cutters. The Sales Channel segmentation covers OEM, where attachments are sold directly by machinery manufacturers or their authorized dealers, and Aftermarket, which includes independent distributors and repair services offering a broad range of new, used, and reconditioned attachments. Each segment's growth projections, market sizes, and competitive dynamics are meticulously analyzed.

Key Drivers of Construction Machinery Attachment Market Growth

Several factors are driving the growth of the Construction Machinery Attachment Market. The surge in global construction spending, particularly on infrastructure projects and residential and commercial development, directly translates to higher demand for construction machinery and, consequently, their attachments. Technological advancements, such as the integration of IoT and AI into attachments, are enhancing their functionality and efficiency, making them indispensable for modern construction. Furthermore, the increasing focus on project timelines and cost reduction necessitates the use of versatile and high-performance attachments. Government initiatives promoting infrastructure development and urbanization are also significant catalysts. For instance, the US Bipartisan Infrastructure Law is expected to fuel demand for various construction equipment and attachments across the nation. The growing need for specialized applications in sectors like mining and waste management further boosts the demand for niche attachment types.

Challenges in the Construction Machinery Attachment Market Sector

Despite the positive growth outlook, the Construction Machinery Attachment Market faces several challenges. Fluctuations in raw material prices, particularly steel, can impact manufacturing costs and profit margins. Stringent regulatory standards concerning safety and emissions in various regions can increase product development costs and market entry barriers. The competitive landscape is intense, with a large number of manufacturers vying for market share, leading to price pressures. Supply chain disruptions, as witnessed in recent years, can affect the availability of components and finished products, impacting delivery timelines. Moreover, the high initial investment cost for certain advanced attachments can be a deterrent for smaller construction companies, limiting their market penetration. The economic downturns in specific regions can also dampen overall construction activity, indirectly affecting the demand for attachments.

Leading Players in the Construction Machinery Attachment Market Market

- Joseph Cyril Bamford

- Sany Group

- Dheere & Company

- Kubota Corporation

- Caterpillar Inc

- Liebherr group

- Hyundai Construction Equipment

- Komatsu Ltd

- Volvo Construction Equipment

- Case Construction Equipments

Key Developments in Construction Machinery Attachment Market Sector

- September 2022: CASE rolls out its new range of OEM fitted 2D and 3D fitments for construction machinery including loaders and excavators. The new attachment offers better profile and allows better storage capacities.

- September 2022: Bobcat unveiled its new T86 compact track loader, S86 steer loader with more versatile attachments. Attachments are designed in order to increase product efficiency.

Strategic Construction Machinery Attachment Market Market Outlook

The future outlook for the Construction Machinery Attachment Market is highly promising, driven by ongoing technological advancements and a sustained global demand for construction services. The increasing adoption of smart and automated attachments will be a key growth accelerator, enabling greater precision and productivity. The growing focus on sustainable construction practices will further fuel the demand for energy-efficient and eco-friendly attachment solutions. Strategic opportunities lie in expanding into emerging markets with significant infrastructure development plans, such as those in Southeast Asia and Africa. Manufacturers who can offer a diverse range of specialized attachments, coupled with robust aftermarket support and competitive pricing, are well-positioned for success. The trend towards customization and value-added services will also play a crucial role in capturing market share and fostering customer loyalty in the evolving construction equipment attachments industry.

Construction Machinery Attachment Market Segmentation

-

1. Equipment Type

- 1.1. Buckets

- 1.2. Grapplers

- 1.3. Hammers

- 1.4. Other Equipment Types

-

2. Sales Channel

- 2.1. OEM

- 2.2. Aftermarket

Construction Machinery Attachment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

Construction Machinery Attachment Market Regional Market Share

Geographic Coverage of Construction Machinery Attachment Market

Construction Machinery Attachment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing infrastructural development Across the Region

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge

- 3.4. Market Trends

- 3.4.1. OEM to Gain Traction During Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Machinery Attachment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Buckets

- 5.1.2. Grapplers

- 5.1.3. Hammers

- 5.1.4. Other Equipment Types

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. North America Construction Machinery Attachment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6.1.1. Buckets

- 6.1.2. Grapplers

- 6.1.3. Hammers

- 6.1.4. Other Equipment Types

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. OEM

- 6.2.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7. Europe Construction Machinery Attachment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7.1.1. Buckets

- 7.1.2. Grapplers

- 7.1.3. Hammers

- 7.1.4. Other Equipment Types

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. OEM

- 7.2.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8. Asia Pacific Construction Machinery Attachment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8.1.1. Buckets

- 8.1.2. Grapplers

- 8.1.3. Hammers

- 8.1.4. Other Equipment Types

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. OEM

- 8.2.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9. Rest of the World Construction Machinery Attachment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9.1.1. Buckets

- 9.1.2. Grapplers

- 9.1.3. Hammers

- 9.1.4. Other Equipment Types

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel

- 9.2.1. OEM

- 9.2.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Joseph Cyril Bamford

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sany Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dheere & Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kubota Corporation*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Caterpillar Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Liebherr group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hyundai Construction Equipment

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Komatsu Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Volvo construction equipment

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Case Construction Equipments

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Joseph Cyril Bamford

List of Figures

- Figure 1: Global Construction Machinery Attachment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Construction Machinery Attachment Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 3: North America Construction Machinery Attachment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 4: North America Construction Machinery Attachment Market Revenue (billion), by Sales Channel 2025 & 2033

- Figure 5: North America Construction Machinery Attachment Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 6: North America Construction Machinery Attachment Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Construction Machinery Attachment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Construction Machinery Attachment Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 9: Europe Construction Machinery Attachment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 10: Europe Construction Machinery Attachment Market Revenue (billion), by Sales Channel 2025 & 2033

- Figure 11: Europe Construction Machinery Attachment Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 12: Europe Construction Machinery Attachment Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Construction Machinery Attachment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Construction Machinery Attachment Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 15: Asia Pacific Construction Machinery Attachment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 16: Asia Pacific Construction Machinery Attachment Market Revenue (billion), by Sales Channel 2025 & 2033

- Figure 17: Asia Pacific Construction Machinery Attachment Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 18: Asia Pacific Construction Machinery Attachment Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Construction Machinery Attachment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Construction Machinery Attachment Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 21: Rest of the World Construction Machinery Attachment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 22: Rest of the World Construction Machinery Attachment Market Revenue (billion), by Sales Channel 2025 & 2033

- Figure 23: Rest of the World Construction Machinery Attachment Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 24: Rest of the World Construction Machinery Attachment Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Construction Machinery Attachment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Machinery Attachment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 2: Global Construction Machinery Attachment Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 3: Global Construction Machinery Attachment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Construction Machinery Attachment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 5: Global Construction Machinery Attachment Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 6: Global Construction Machinery Attachment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Construction Machinery Attachment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 11: Global Construction Machinery Attachment Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 12: Global Construction Machinery Attachment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Construction Machinery Attachment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 18: Global Construction Machinery Attachment Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 19: Global Construction Machinery Attachment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: India Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: China Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Construction Machinery Attachment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 26: Global Construction Machinery Attachment Market Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 27: Global Construction Machinery Attachment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Mexico Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Arab Emirates Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Other Countries Construction Machinery Attachment Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Machinery Attachment Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Construction Machinery Attachment Market?

Key companies in the market include Joseph Cyril Bamford, Sany Group, Dheere & Company, Kubota Corporation*List Not Exhaustive, Caterpillar Inc, Liebherr group, Hyundai Construction Equipment, Komatsu Ltd, Volvo construction equipment, Case Construction Equipments.

3. What are the main segments of the Construction Machinery Attachment Market?

The market segments include Equipment Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.41 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing infrastructural development Across the Region.

6. What are the notable trends driving market growth?

OEM to Gain Traction During Forecast Period..

7. Are there any restraints impacting market growth?

Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge.

8. Can you provide examples of recent developments in the market?

In September 2022, CASE rolls out its new range of OEM fitted 2D and 3D fitments for construction machinery including loaders and excavators. The new attachment offers better profile and allows better storage capacities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Machinery Attachment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Machinery Attachment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Machinery Attachment Market?

To stay informed about further developments, trends, and reports in the Construction Machinery Attachment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence