Key Insights

The North American automotive industry is poised for significant expansion, with a current market size of approximately $0.99 billion and a projected Compound Annual Growth Rate (CAGR) of 5.43% over the forecast period of 2025-2033. This robust growth is underpinned by several key drivers, including increasing consumer demand for technologically advanced vehicles, a notable shift towards electric and hybrid powertrains, and government initiatives promoting sustainable transportation solutions. The market is experiencing a dynamic evolution characterized by rapid innovation in autonomous driving, advanced driver-assistance systems (ADAS), and connected car technologies. Furthermore, the ongoing electrification trend, spurred by both consumer preference and stringent emission regulations, is a dominant force reshaping the automotive landscape, driving investments in charging infrastructure and battery technology.

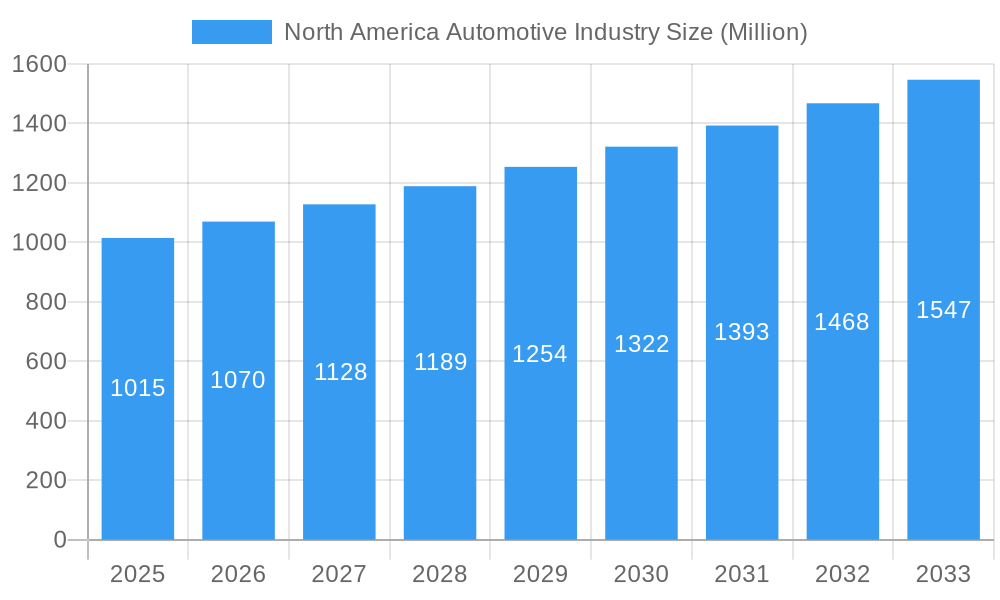

North America Automotive Industry Market Size (In Billion)

The North American automotive sector encompasses a diverse range of vehicle types, from passenger cars and light commercial vehicles to heavy-duty trucks and motorcycles, each segment exhibiting unique growth patterns and consumer behaviors. Geographically, the United States leads in market volume, followed by Canada and the rest of North America, with each region experiencing distinct influences from local economic conditions, regulatory frameworks, and consumer preferences. Despite the positive outlook, the industry faces certain restraints, such as supply chain disruptions, particularly concerning semiconductor availability, and the high initial cost associated with electric vehicle adoption for some consumer segments. Nevertheless, the sustained investment in research and development by major automotive players, coupled with a growing consumer awareness of environmental impacts, is expected to drive continued market penetration and innovation in the coming years.

North America Automotive Industry Company Market Share

This comprehensive report delivers an in-depth analysis of the North America Automotive Industry, covering historical trends, current market dynamics, and future projections. From passenger cars and commercial vehicles to two-wheelers and emerging electric vehicle (EV) technologies, this report provides critical insights for stakeholders navigating this dynamic sector. Our study spans the historical period of 2019-2024, with the base and estimated year of 2025, and forecasts market performance through 2033.

North America Automotive Industry Market Structure & Competitive Dynamics

The North America Automotive Industry exhibits a highly competitive market structure characterized by a mix of established global manufacturers and agile new entrants. Market concentration varies across segments, with the passenger car market demonstrating a more consolidated landscape compared to the fragmented commercial vehicle segment. Innovation ecosystems are robust, driven by significant investment in electric vehicle (EV) technology, autonomous driving, and sustainable manufacturing. Regulatory frameworks, particularly those concerning emissions standards and safety mandates, play a pivotal role in shaping industry practices and product development. The automotive aftermarket is a significant contributor, offering a stream of revenue for maintenance and repair services. Product substitutes are evolving, with advancements in public transportation and ride-sharing services offering alternatives to private vehicle ownership in urban areas. End-user trends highlight a growing demand for connectivity, advanced safety features, and environmentally friendly vehicles. Mergers and acquisitions (M&A) activity is a key feature, with companies strategically consolidating to enhance market share and secure technological advantages. For instance, Ford Motor Company's strategic partnerships and investments in EV startups reflect this trend. We estimate M&A deal values to reach xx Million during the forecast period. Key players like General Motors Company, Toyota Motor Corporation, and Volkswagen AG continuously strive to increase their market share, which is extensively analyzed within this report.

North America Automotive Industry Industry Trends & Insights

The North America Automotive Industry is experiencing a period of unprecedented transformation, propelled by a confluence of powerful growth drivers and disruptive technological advancements. The CAGR for the overall market is projected at xx% during the forecast period. A primary driver is the escalating consumer demand for electric vehicles (EVs), fueled by environmental consciousness, government incentives, and decreasing battery costs. EV market penetration is anticipated to reach xx% by 2033, a significant leap from current levels. Technological disruptions, including the widespread adoption of artificial intelligence (AI) in vehicle design and manufacturing, advanced driver-assistance systems (ADAS), and the burgeoning development of autonomous driving technology, are reshaping the automotive landscape. Consumer preferences are shifting towards smart, connected, and sustainable mobility solutions. The integration of sophisticated infotainment systems, over-the-air software updates, and personalized user experiences are becoming standard expectations. Furthermore, the industry is witnessing a paradigm shift towards mobility-as-a-service (MaaS) models, challenging traditional ownership paradigms. The competitive dynamics are intensifying, with traditional automakers facing stiff competition from tech giants and EV pure-plays like Tesla Inc.. The resilience of the automotive supply chain remains a critical consideration, with ongoing efforts to diversify and strengthen it to mitigate future disruptions. The increasing focus on vehicle electrification and the development of robust charging infrastructure are key trends shaping the industry's future. The demand for light commercial vehicles is also on the rise, driven by the e-commerce boom and last-mile delivery services.

Dominant Markets & Segments in North America Automotive Industry

The United States unequivocally dominates the North America Automotive Industry, driven by its robust economy, large consumer base, and advanced technological infrastructure. The passenger car segment within the United States consistently commands the largest market share, reflecting a strong consumer appetite for personal mobility. Key drivers for this dominance include favorable economic policies, extensive highway networks, and a high disposable income. The automotive manufacturing sector in the US, with major players like General Motors Company, Ford Motor Company, and Fiat Chrysler Automobiles NV, further solidifies its leading position.

United States:

- Key Drivers: Strong economic growth, high consumer spending power, extensive road infrastructure, and government support for advanced manufacturing and EV adoption. The growing demand for SUVs and pickup trucks, alongside the rapid expansion of the EV market, significantly contributes to its dominance.

- Dominance Analysis: The US market represents over xx% of the total North American automotive sales. Its leadership is further amplified by significant investments in R&D for autonomous driving technology and the establishment of comprehensive EV charging infrastructure.

Canada:

- Key Drivers: Government initiatives promoting EV incentives, a growing environmental consciousness among consumers, and a relatively stable economy. The presence of major automotive manufacturers and suppliers also plays a crucial role.

- Dominance Analysis: While smaller than the US, Canada's automotive market is a vital contributor, with a strong focus on sustainable mobility solutions. The market for commercial vehicles is also growing, supported by the country's extensive logistics and resource sectors.

Rest of North America:

- Key Drivers: Emerging markets within this region are showing increased potential for automotive growth, driven by rising disposable incomes and developing infrastructure. Government policies aimed at attracting foreign investment in the automotive sector are also noteworthy.

- Dominance Analysis: This segment, encompassing Mexico and other smaller markets, represents a growing but still developing automotive landscape. Mexico, in particular, is a significant hub for automotive manufacturing, serving both domestic and export markets. The demand for light commercial vehicles is a notable trend here.

Within Vehicle Types:

- Passenger Cars: This segment remains the largest contributor to overall market revenue, driven by sustained demand for personal transportation, evolving consumer preferences for comfort and technology, and a wide range of models available from manufacturers like Toyota Motor Corporation, Honda Motor Company Ltd, and Nissan Motor Co Ltd.

- Commercial Vehicles: This segment, encompassing Medium and Heavy Commercial Vehicles and Light Commercial Vehicles, is experiencing robust growth. The e-commerce boom and the increasing need for efficient logistics and last-mile delivery solutions are major catalysts for the light commercial vehicle market. The demand for specialized medium and heavy commercial vehicles is driven by construction, logistics, and industrial sectors.

- Two-Wheelers: While a smaller segment compared to passenger and commercial vehicles, the two-wheeler market holds steady, catering to urban mobility needs and offering an economical transportation alternative. Yamaha Motor Co Ltd and Harley-Davidson are key players in this segment, with evolving product portfolios to meet diverse consumer demands.

North America Automotive Industry Product Innovations

The North America Automotive Industry is witnessing an accelerated pace of product innovation, with a strong emphasis on electrification, connectivity, and advanced safety features. Key developments include the unveiling of production-ready electric vehicles (EVs) with extended range and faster charging capabilities, such as the vision previewed by Cadillac's Celestiq show car. The integration of artificial intelligence (AI) into vehicle systems for enhanced driver assistance and autonomous capabilities is a significant trend. Furthermore, manufacturers are investing in sustainable materials and advanced manufacturing processes to reduce environmental impact. The competitive advantage lies in offering innovative solutions that cater to evolving consumer demands for efficiency, safety, and a seamless digital experience, exemplified by Tesla Inc.'s continuous advancements in battery technology and software integration.

Report Segmentation & Scope

This report meticulously segments the North America Automotive Industry to provide granular insights into its diverse components. The scope encompasses:

Vehicle Type:

- Passenger Cars: This segment covers sedans, hatchbacks, SUVs, and other personal transport vehicles. Projections indicate continued strong demand driven by evolving consumer preferences for comfort, technology, and fuel efficiency. Market size is estimated at xx Million units in 2025, with projected growth to xx Million units by 2033.

- Commercial Vehicles: This includes Medium and Heavy Commercial Vehicles (trucks, buses) and Light Commercial Vehicles (vans, pickups). The growing e-commerce sector and logistics needs are fueling demand for LCVs, while infrastructure development drives demand for MHCVs. Market size for commercial vehicles is xx Million units in 2025, forecast to reach xx Million units by 2033.

- Two-Wheelers: This segment comprises motorcycles and scooters, serving urban mobility and recreational purposes. Growth is steady, with a focus on performance and efficiency. Market size is xx Million units in 2025, expected to reach xx Million units by 2033.

Geography:

- United States: The largest market, characterized by high consumer spending and a strong automotive manufacturing base. Expected to reach a market size of xx Million units by 2033.

- Canada: A significant market with growing EV adoption and government support. Expected to reach a market size of xx Million units by 2033.

- Rest of North America: Encompassing Mexico and other regions, this segment shows promising growth potential due to expanding economies and manufacturing capabilities. Expected to reach a market size of xx Million units by 2033.

Key Drivers of North America Automotive Industry Growth

The North America Automotive Industry's growth is propelled by several interconnected factors. Technological advancements, particularly in electric vehicle (EV) technology, including battery innovation and charging infrastructure development, are paramount. Government initiatives such as EV tax credits and stricter emission regulations are accelerating the transition to cleaner mobility. Economic factors, including rising disposable incomes and a stable job market, support consumer spending on vehicles. Furthermore, the increasing demand for connected car features, advanced safety systems, and the ongoing development of autonomous driving technology are significant growth accelerators. The expansion of the automotive aftermarket also contributes to overall industry growth through sales of parts, accessories, and maintenance services.

Challenges in the North America Automotive Industry Sector

Despite robust growth, the North America Automotive Industry faces significant challenges. Supply chain disruptions, particularly concerning semiconductor chips and raw materials for batteries, continue to pose a threat to production volumes. Regulatory hurdles related to evolving emissions standards and safety mandates require continuous adaptation and investment from manufacturers. The high cost of EV adoption for consumers, despite declining battery prices, remains a barrier. Intense competitive pressures from both traditional automakers and new market entrants necessitate constant innovation and cost optimization. The ongoing transition to electric vehicles requires substantial investments in retooling manufacturing plants and developing new supply chains, which can be financially taxing.

Leading Players in the North America Automotive Industry Market

- Fiat Chrysler Automobiles NV

- Nissan Motor Co Ltd

- General Motors Company

- Honda Motor Company Ltd

- Volkswagen AG

- Daimler AG

- Hyundai Motor Company

- BMW AG

- Tesla Inc.

- Groupe Renault

- Harley-Davidson

- Toyota Motor Corporation

- Yamaha Motor Co Ltd

- Ford Motor Company

Key Developments in North America Automotive Industry Sector

- July 2022: Cadillac unveiled the Celestiq show car, a vision of innovation that previews the brand's future handcrafted and all-electric flagship sedan. The Ultium-based electric show car previews some of the materials, innovative technologies, and hand-crafted attention to detail harnessed to express Cadillac's vision for the future.

- July 2022: Amazon began deploying its custom electric delivery vehicles from Rivian for package delivery, with the electric vehicles hitting the road in Baltimore, Chicago, Dallas, Kansas City, Nashville, Phoenix, San Diego, Seattle, and St. Louis, among other cities.

- January 2022: Tesla Inc. had a supply agreement with Talon Metals Corp., a subsidiary of Talon Nickel LLC, for the supply of nickel. This agreement will lead to the production of battery material from mine to battery cathode in order to make the electric vehicle battery more eco-friendly.

Strategic North America Automotive Industry Market Outlook

The strategic outlook for the North America Automotive Industry remains exceptionally positive, driven by the accelerating global shift towards electric mobility and the continuous innovation in automotive technology. Key growth accelerators include government incentives for EV adoption, ongoing investments in autonomous driving research and development, and the increasing consumer demand for connected and sustainable transportation solutions. Strategic opportunities lie in the expansion of charging infrastructure networks, the development of advanced battery technologies, and the integration of AI and IoT into vehicle ecosystems. Manufacturers that can effectively navigate supply chain complexities and adapt to evolving consumer preferences for digital services and personalized experiences will be well-positioned for significant growth and market leadership in the coming years. The focus on sustainable manufacturing practices will also become increasingly critical for long-term success.

North America Automotive Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

-

1.2. Commercial Vehicles

- 1.2.1. Medium and Heavy Commercial Vehicles

- 1.2.2. Light Commercial Vehicles

- 1.3. Two-Wheelers

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Automotive Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Automotive Industry Regional Market Share

Geographic Coverage of North America Automotive Industry

North America Automotive Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Travel and Tourism Industry is Driving the Car Rental Market

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 3.4. Market Trends

- 3.4.1. Rising Electric Mobility to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.1.2.1. Medium and Heavy Commercial Vehicles

- 5.1.2.2. Light Commercial Vehicles

- 5.1.3. Two-Wheelers

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. United States North America Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.1.2.1. Medium and Heavy Commercial Vehicles

- 6.1.2.2. Light Commercial Vehicles

- 6.1.3. Two-Wheelers

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Canada North America Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.1.2.1. Medium and Heavy Commercial Vehicles

- 7.1.2.2. Light Commercial Vehicles

- 7.1.3. Two-Wheelers

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Rest of North America North America Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.1.2.1. Medium and Heavy Commercial Vehicles

- 8.1.2.2. Light Commercial Vehicles

- 8.1.3. Two-Wheelers

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Fiat Chrysler Automobiles NV

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Nissan Motor Co Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 General Motors Company

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Honda Motor Company Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Volkswagen AG

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Daimler AG

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Hyundai Motor Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 BMW AG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Tesla Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Groupe Renault

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Harley-Davidson

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Toyota Motor Corporation

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Yamaha Motor Co Ltd*List Not Exhaustive

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Ford Motor Company

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.1 Fiat Chrysler Automobiles NV

List of Figures

- Figure 1: North America Automotive Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Automotive Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: North America Automotive Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: North America Automotive Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Automotive Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: North America Automotive Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: North America Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: North America Automotive Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: North America Automotive Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: North America Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: North America Automotive Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: North America Automotive Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Industry?

The projected CAGR is approximately 5.43%.

2. Which companies are prominent players in the North America Automotive Industry?

Key companies in the market include Fiat Chrysler Automobiles NV, Nissan Motor Co Ltd, General Motors Company, Honda Motor Company Ltd, Volkswagen AG, Daimler AG, Hyundai Motor Company, BMW AG, Tesla Inc, Groupe Renault, Harley-Davidson, Toyota Motor Corporation, Yamaha Motor Co Ltd*List Not Exhaustive, Ford Motor Company.

3. What are the main segments of the North America Automotive Industry?

The market segments include Vehicle Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Travel and Tourism Industry is Driving the Car Rental Market.

6. What are the notable trends driving market growth?

Rising Electric Mobility to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market.

8. Can you provide examples of recent developments in the market?

July 2022: Cadillac unveiled the Celestiq show car, a vision of innovation that previews the brand's future handcrafted and all-electric flagship sedan. The Ultium-based electric show car previews some of the materials, innovative technologies, and hand-crafted attention to detail harnessed to express Cadillac's vision for the future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Industry?

To stay informed about further developments, trends, and reports in the North America Automotive Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence