Key Insights

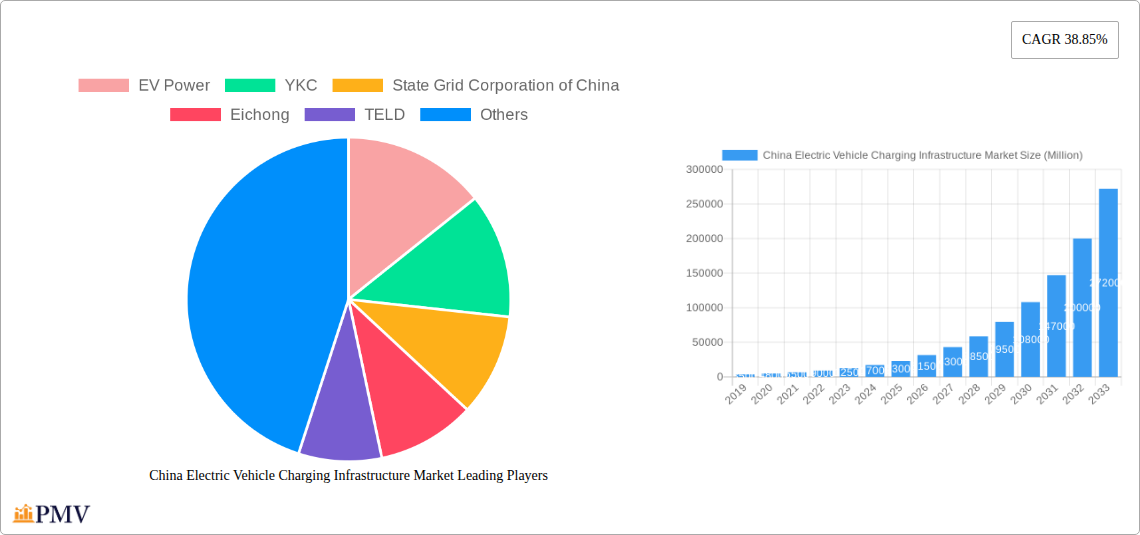

The China Electric Vehicle (EV) Charging Infrastructure Market is projected for substantial expansion, driven by a remarkable Compound Annual Growth Rate (CAGR) of 48.56%. This growth is underpinned by robust government policies, ambitious EV adoption targets, and significant investments in smart grid technologies and charging network development. Increasing consumer preference for EVs, influenced by environmental concerns and decreasing battery costs, further fuels demand for efficient charging solutions. The market is rapidly evolving, with a notable shift towards advanced, high-speed charging technologies.

China Electric Vehicle Charging Infrastructure Market Market Size (In Billion)

Market segmentation reveals strong demand for both AC and DC charging stations. AC charging is favored for residential and workplace installations, while DC fast charging is crucial for public networks and commercial fleets, addressing the need for rapid charging. Passenger vehicles currently lead the vehicle type segment, with significant growth anticipated from the electrification of commercial fleets. The infrastructure is transitioning from predominantly private installations to a more extensive public network, supported by key players. China represents the sole focus of this market, highlighting its leading position in the global EV charging sector. Prominent companies are actively driving innovation and strategic collaborations.

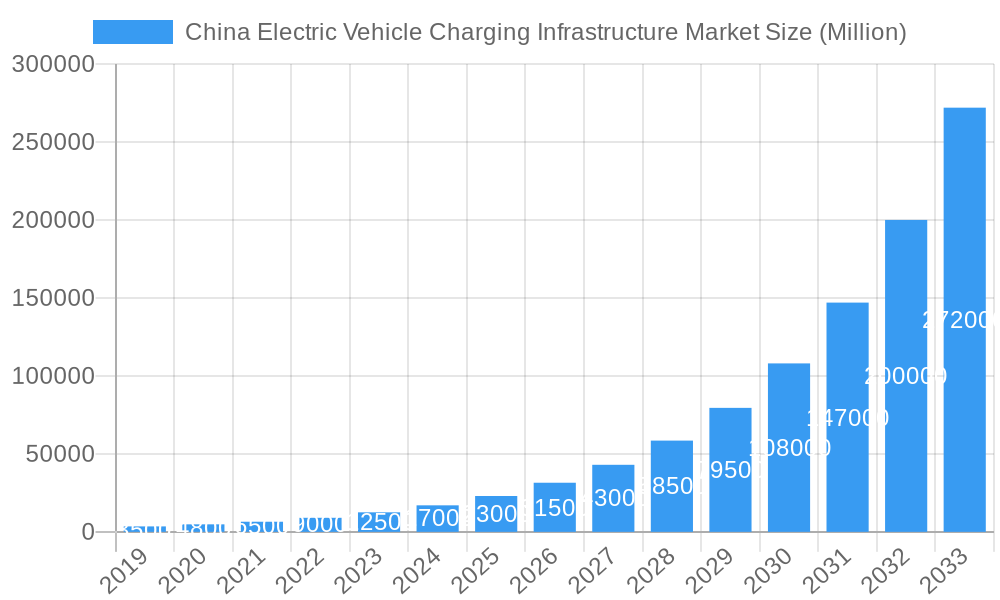

China Electric Vehicle Charging Infrastructure Market Company Market Share

This report delivers an in-depth analysis of the China Electric Vehicle Charging Infrastructure Market, encompassing market size, share, trends, drivers, challenges, and the competitive landscape from 2019 to 2033. With a base year of 2025 and a forecast period of 2025–2033, this study offers critical insights for stakeholders aiming to leverage the rapid growth of China's electric mobility sector. The analysis covers key segments including Charging Station Type (AC Charging, DC Charging), Vehicle Type (Passenger Vehicles, Commercial Vehicles), and User Application (Private Infrastructure, Public Infrastructure). Gain essential intelligence for the future of EV charging in the world's largest EV market, projected to reach a market size of 25.6 billion by 2033.

China Electric Vehicle Charging Infrastructure Market Market Structure & Competitive Dynamics

The China Electric Vehicle Charging Infrastructure Market is characterized by a dynamic and evolving market structure, exhibiting both concentrated elements and significant fragmentation. Leading players such as State Grid Corporation of China, TELD, and Eichong hold substantial market share, driven by their extensive network build-out and strong government support. However, a vibrant ecosystem of emerging companies and technology providers, including EV Power, YKC, TGood, Evking, Wancheng Wanchong, Starcharge, SAIC Motor, Potevio, Southern Power Grid, ShenZhen Carenergy Net, and Hooenergy, contributes to innovation and intense competition. M&A activities are on the rise as larger entities seek to consolidate their positions and gain access to new technologies and customer bases. For instance, PetroChina's acquisition of Potevio New Energy Co Ltd in September 2023 signifies strategic consolidation within the sector, aiming to bolster brand presence in the burgeoning EV charging market. Regulatory frameworks, such as government subsidies and mandates for charging infrastructure deployment, play a pivotal role in shaping market dynamics and influencing investment decisions. The increasing demand for reliable and accessible charging solutions, coupled with advancements in charging technology, continues to drive innovation and product development, creating a fertile ground for new market entrants and established players alike.

- Market Concentration: Moderate to high concentration among top players due to significant capital investment requirements and government-backed projects.

- Innovation Ecosystem: Flourishing, driven by startups and R&D investments in smart charging, V2G technology, and ultra-fast charging solutions.

- Regulatory Frameworks: Strong government influence through supportive policies, incentives, and standardization efforts.

- Product Substitutes: Limited direct substitutes, but grid capacity and reliability can act as indirect constraints.

- End-User Trends: Growing demand for convenience, speed, and integrated charging solutions, especially in urban areas and along major transportation routes.

- M&A Activities: Increasing, reflecting the drive for market consolidation and strategic expansion, with deal values projected to rise.

China Electric Vehicle Charging Infrastructure Market Industry Trends & Insights

The China Electric Vehicle Charging Infrastructure Market is experiencing unprecedented growth, propelled by a confluence of robust government initiatives, rapidly advancing electric vehicle adoption, and evolving consumer preferences. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 25% during the forecast period of 2025–2033, reaching an estimated market size of hundreds of billions of USD by 2033. This surge is primarily fueled by the nation's ambitious carbon neutrality goals and its strategic vision to lead the global EV revolution. Key industry trends include the rapid expansion of charging networks, both in urban centers and along critical expressways, driven by significant investments from both state-owned enterprises and private companies. The push for faster charging solutions, with an increasing deployment of DC fast chargers, is directly addressing range anxiety among EV owners and facilitating longer-distance travel. Furthermore, the integration of smart charging technologies, including demand-side management and vehicle-to-grid (V2G) capabilities, is becoming a critical differentiator, optimizing grid load and creating new revenue streams.

Consumer preferences are shifting towards more convenient and accessible charging options, leading to a rise in demand for charging infrastructure in residential complexes, workplaces, and public parking facilities. The proliferation of electric vehicles, particularly passenger cars, is a fundamental market driver, directly translating into an increased need for charging points. The government's commitment to developing a comprehensive charging ecosystem, as evidenced by initiatives to install charging stations across highways, further solidifies the market's growth trajectory. Technological disruptions, such as advancements in battery technology and charging efficiency, are also playing a significant role. Companies are investing heavily in research and development to offer more reliable, scalable, and cost-effective charging solutions. The competitive landscape is intense, with established players like State Grid Corporation of China and TELD fiercely competing with innovative startups and international brands like Audi, which is expanding its premium charging services. This dynamic environment fosters continuous innovation and market expansion. The estimated market penetration of EV charging infrastructure is set to reach over 80% of EV owners by 2030, highlighting the critical role of charging facilities in sustaining the EV ecosystem. The market penetration of DC charging stations is growing at a faster pace than AC charging stations due to the demand for rapid charging. The passenger vehicles segment is expected to continue dominating the market, accounting for over 70% of the total charging demand. Public infrastructure deployment is seeing significant acceleration, driven by government mandates and the need to support widespread EV adoption. Private infrastructure, particularly in residential and commercial settings, is also witnessing substantial growth as individuals and businesses invest in dedicated charging solutions. The market is poised for sustained high growth, driven by supportive policies, technological advancements, and a burgeoning EV market.

Dominant Markets & Segments in China Electric Vehicle Charging Infrastructure Market

The China Electric Vehicle Charging Infrastructure Market exhibits distinct dominance across various regions and segments, shaped by economic policies, infrastructure development, and consumer behavior. Geographically, major metropolitan areas and economically developed coastal regions, including Beijing, Shanghai, Guangzhou, and Shenzhen, represent the most dominant markets. These regions boast higher concentrations of EV ownership, robust economic activity, and a more developed urban infrastructure, leading to a higher density of charging stations.

Charging Station Type:

- Direct Current (DC) Charging Station: This segment is experiencing the most rapid growth and is poised for continued dominance. Driven by the demand for faster charging times, especially for long-distance travel and commercial vehicle fleets, DC charging stations are becoming indispensable. Key drivers include government mandates for highway charging networks and the increasing adoption of EVs with larger battery capacities. The convenience of rapid charging for consumers and the operational efficiency for fleet operators solidify its leading position.

- Alternating Current (AC) Charging Station: While AC charging stations remain crucial for residential and workplace charging due to their lower cost and suitability for overnight charging, their growth is tempered by the faster expansion of DC charging infrastructure to meet immediate needs.

Vehicle Type:

- Passenger Vehicles: This segment overwhelmingly dominates the China Electric Vehicle Charging Infrastructure Market. The sheer volume of passenger EVs on the road, coupled with government incentives and increasing consumer acceptance, makes them the primary driver of charging demand. The expansion of public and private charging infrastructure is largely tailored to the needs of passenger car owners.

- Commercial Vehicles: While currently a smaller segment, commercial vehicles, including buses and logistics trucks, represent a significant growth opportunity. The demand for charging infrastructure for commercial fleets is driven by operational efficiency needs and the increasing electrification of public transport and delivery services.

User Application:

- Public Infrastructure: This segment is a critical pillar of growth and dominance. The government's commitment to building a widespread and accessible public charging network, particularly along expressways and in urban public spaces, is a major catalyst. Initiatives like the identification of reserved parking spots for EV charging stations underscore the focus on public accessibility. The scale of investment and the strategic importance of ensuring ubiquitous charging access for all EV users make public infrastructure a dominant segment.

- Private Infrastructure: This segment, encompassing charging solutions for residential buildings, apartment complexes, and corporate campuses, is also experiencing substantial growth. As EV ownership becomes more mainstream, the demand for convenient, dedicated charging at home and work is rising.

Key Drivers for Dominance:

- Government Policies and Subsidies: Proactive policies, financial incentives, and charging infrastructure targets significantly influence the growth and adoption of specific segments.

- Urbanization and Population Density: High population density in major cities drives the need for widespread public and private charging solutions.

- Economic Development and Disposable Income: Higher economic development correlates with increased EV adoption and the capacity to invest in charging infrastructure.

- Technological Advancements: The development and deployment of faster and more efficient charging technologies, particularly DC fast charging, are shaping segment dominance.

- Infrastructure Investment: Significant investments in grid upgrades and charging station deployment are crucial for supporting the growth of dominant segments.

China Electric Vehicle Charging Infrastructure Market Product Innovations

Product innovations in the China Electric Vehicle Charging Infrastructure Market are primarily focused on enhancing charging speed, efficiency, intelligence, and user experience. The development of ultra-fast DC charging stations capable of providing hundreds of kilometers of range in just minutes is a significant trend, addressing range anxiety and facilitating rapid fleet turnover. Smart charging solutions are integrating advanced algorithms for load balancing, grid optimization, and predictive maintenance, enabling seamless integration with renewable energy sources. V2G (Vehicle-to-Grid) technology is emerging as a key innovation, allowing EVs to not only draw power from the grid but also feed it back, offering grid stabilization services and potential revenue streams for EV owners. User-friendly mobile applications and contactless payment systems are improving accessibility and convenience.

Report Segmentation & Scope

This comprehensive report segments the China Electric Vehicle Charging Infrastructure Market into key categories to provide granular insights.

Charging Station Type: The market is analyzed across Alternating Current (AC) Charging Stations and Direct Current (DC) Charging Stations. AC charging, typically found in homes and workplaces, offers slower charging speeds suitable for extended parking periods. DC charging, characterized by faster charging capabilities, is crucial for public charging and rapid top-ups.

Vehicle Type: The segmentation includes Passenger Vehicles and Commercial Vehicles. Passenger vehicles constitute the largest segment due to widespread EV adoption. Commercial vehicles, including buses and logistics fleets, represent a rapidly growing segment with unique charging infrastructure needs.

User Application: The market is further segmented into Private Infrastructure and Public Infrastructure. Private infrastructure encompasses charging solutions installed at residences, workplaces, and private parking facilities. Public infrastructure includes charging stations located in public parking areas, along highways, and in commercial hubs, designed for general EV user access. Each segment is analyzed for market size, growth projections, and competitive dynamics.

Key Drivers of China Electric Vehicle Charging Infrastructure Market Growth

The China Electric Vehicle Charging Infrastructure Market is propelled by a robust set of drivers, ensuring sustained expansion.

- Government Support and Policy Mandates: China's ambitious electrification targets, coupled with substantial subsidies and supportive regulations for charging infrastructure deployment, are primary growth accelerators.

- Rapid Growth in Electric Vehicle Sales: The surging demand for new energy vehicles (NEVs), driven by consumer preference and government incentives, directly fuels the need for charging solutions.

- Technological Advancements: Innovations in battery technology, charging speeds (e.g., ultra-fast charging), and smart grid integration enhance the attractiveness and practicality of EVs.

- Urbanization and Infrastructure Development: The continuous expansion of urban areas and the focus on developing comprehensive charging networks along major transportation routes are critical for market growth.

- Environmental Concerns and Sustainability Goals: China's commitment to reducing carbon emissions and promoting a sustainable transportation ecosystem strongly underpins the growth of the EV charging market.

Challenges in the China Electric Vehicle Charging Infrastructure Market Sector

Despite its rapid growth, the China Electric Vehicle Charging Infrastructure Market faces several challenges that require strategic navigation.

- Grid Capacity and Stability: Rapid deployment of charging infrastructure can strain existing power grids, necessitating significant upgrades and smart grid management solutions.

- Standardization and Interoperability: Ensuring seamless interoperability between different charging equipment manufacturers and charging network operators remains an ongoing challenge.

- High Initial Investment Costs: The substantial capital required for building and maintaining charging infrastructure can be a barrier, especially for smaller players.

- Site Selection and Permitting: Identifying optimal locations and navigating complex permitting processes for charging station installation can cause delays.

- User Experience and Charging Reliability: Ensuring consistent charging reliability and a positive user experience across a diverse network of charging stations is crucial for sustained adoption.

Leading Players in the China Electric Vehicle Charging Infrastructure Market Market

- EV Power

- YKC

- State Grid Corporation of China

- Eichong

- TELD

- TGood

- Evking

- Wancheng Wanchong

- Starcharge

- SAIC Motor

- Potevio

- Southern Power Grid

- ShenZhen Carenergy Net

- Hooenergy

- Winland

Key Developments in China Electric Vehicle Charging Infrastructure Market Sector

- September 2023: PetroChina announced its acquisition of EV charging firm Potevio New Energy Co Ltd, signaling strategic consolidation and a push to establish a strong brand presence in China's EV charging market. By the end of 2021, Potevio operated an estimated 50,000 charging points across more than 50 Chinese cities.

- June 2023: The Chinese government reaffirmed its commitment to expanding charging facilities along expressways for new energy vehicles (NEVs). Authorities reported the successful installation of 18,590 charging stations across highways and identified 27,000 parking spots for future EV charging station installations.

- November 2022: Audi launched its premium charging stations in China as part of its "Vorsprung 2030 China Strategy." By the end of 2022, 20 stations were installed in major cities like Beijing, Shanghai, Guangzhou, and Shenzhen, with plans for further expansion into more cities and locations.

Strategic China Electric Vehicle Charging Infrastructure Market Market Outlook

The strategic outlook for the China Electric Vehicle Charging Infrastructure Market is exceptionally positive, driven by strong governmental commitment and rapid EV adoption. Future growth accelerators include the widespread deployment of smart charging and V2G technologies, which will not only enhance grid efficiency but also create new revenue opportunities. The ongoing expansion of ultra-fast charging networks along major transportation arteries and in urban centers will further boost EV convenience. Strategic opportunities lie in the development of integrated mobility solutions, combining charging with parking and other vehicle services. Continued investment in R&D for more efficient and cost-effective charging hardware and software, alongside strategic partnerships and M&A activities, will be crucial for maintaining a competitive edge. The market is poised for continued robust growth, solidifying China's position as a global leader in electric mobility.

China Electric Vehicle Charging Infrastructure Market Segmentation

-

1. Charging Station Type

- 1.1. Alternating Current (AC) Charging Station

- 1.2. Direct Current (DC) Charging Station

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Vehicles

-

3. User Application

- 3.1. Private Infrastructure

- 3.2. Public Infrastructure

China Electric Vehicle Charging Infrastructure Market Segmentation By Geography

- 1. China

China Electric Vehicle Charging Infrastructure Market Regional Market Share

Geographic Coverage of China Electric Vehicle Charging Infrastructure Market

China Electric Vehicle Charging Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 48.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Government Initiatives to Support the Growth of Electric Vehicle Charging Infrastructure

- 3.3. Market Restrains

- 3.3.1. Supply Shortages in Building Electric Vehicle Charging Stations

- 3.4. Market Trends

- 3.4.1. Public Charging Stations are Expected to Gain Prominent Share in the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Electric Vehicle Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Charging Station Type

- 5.1.1. Alternating Current (AC) Charging Station

- 5.1.2. Direct Current (DC) Charging Station

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by User Application

- 5.3.1. Private Infrastructure

- 5.3.2. Public Infrastructure

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Charging Station Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EV Power

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 YKC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 State Grid Corporation of China

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eichong

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TELD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TGood

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Evking

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wancheng Wanchong

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Starcharge

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SAIC Motor

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Potevio

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Southern Power Grid

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 ShenZhen Carenergy Net

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Hooenergy

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Winland

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 EV Power

List of Figures

- Figure 1: China Electric Vehicle Charging Infrastructure Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Electric Vehicle Charging Infrastructure Market Share (%) by Company 2025

List of Tables

- Table 1: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by Charging Station Type 2020 & 2033

- Table 2: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by User Application 2020 & 2033

- Table 4: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by Charging Station Type 2020 & 2033

- Table 6: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by User Application 2020 & 2033

- Table 8: China Electric Vehicle Charging Infrastructure Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Electric Vehicle Charging Infrastructure Market?

The projected CAGR is approximately 48.56%.

2. Which companies are prominent players in the China Electric Vehicle Charging Infrastructure Market?

Key companies in the market include EV Power, YKC, State Grid Corporation of China, Eichong, TELD, TGood, Evking, Wancheng Wanchong, Starcharge, SAIC Motor, Potevio, Southern Power Grid, ShenZhen Carenergy Net, Hooenergy, Winland.

3. What are the main segments of the China Electric Vehicle Charging Infrastructure Market?

The market segments include Charging Station Type, Vehicle Type, User Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Favorable Government Initiatives to Support the Growth of Electric Vehicle Charging Infrastructure.

6. What are the notable trends driving market growth?

Public Charging Stations are Expected to Gain Prominent Share in the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Supply Shortages in Building Electric Vehicle Charging Stations.

8. Can you provide examples of recent developments in the market?

September 2023: PetroChina, a leading oil and gas company based out of China, announced its acquisition of an electric vehicle (EV) charging firm, Potevio New Energy Co Ltd. It is to establish its brand presence in the electric vehicle charging market across China. It was estimated that by the end of 2021, Potevio operated 50,000 charging points in more than 50 Chinese cities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Electric Vehicle Charging Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Electric Vehicle Charging Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Electric Vehicle Charging Infrastructure Market?

To stay informed about further developments, trends, and reports in the China Electric Vehicle Charging Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence