Key Insights

India's commercial vehicle (CV) market is set for significant expansion, fueled by robust economic growth and government initiatives prioritizing modernization and sustainability. The market is projected to reach $50.58 billion by 2024, with an anticipated Compound Annual Growth Rate (CAGR) of 5.24% through 2032. Key growth drivers include escalating infrastructure investment, the booming e-commerce sector’s demand for efficient logistics, and increased freight movement nationwide. Evolving regulations, particularly stricter emission standards and the promotion of sustainable transport, are acting as significant catalysts. The growing adoption of electric and hybrid powertrains, including Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs), marks a transformative shift towards cleaner mobility. Demand is strong in segments such as heavy-duty trucks and buses, bolstered by government fleet modernization and public transport upgrades.

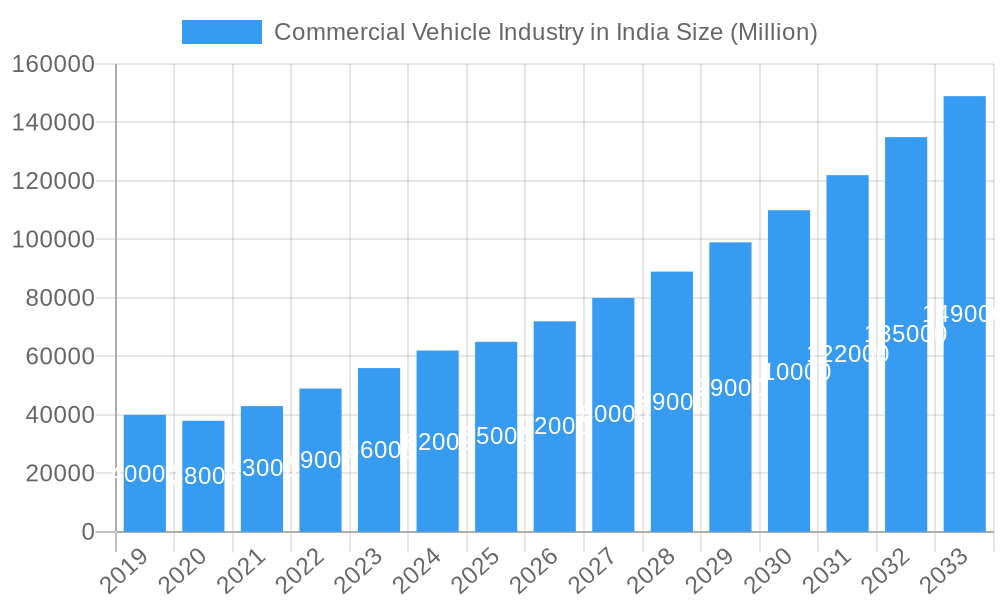

Commercial Vehicle Industry in India Market Size (In Billion)

While the outlook is positive, strategic considerations are essential. The upfront cost of electric and hybrid vehicles, along with nascent charging infrastructure, pose adoption challenges, especially in less developed areas. However, continuous technological progress, decreasing battery costs, and expanding charging networks are progressively alleviating these concerns. The competitive arena is vibrant, with key players like Tata Motors, Ashok Leyland, and Mahindra & Mahindra driving innovation in future-ready CVs. Global supply chain dynamics and raw material availability will also influence the industry's direction. As India strengthens its position as a manufacturing and logistics hub, the commercial vehicle sector will be instrumental in adapting to emerging technologies and evolving consumer needs, sustaining its growth trajectory.

Commercial Vehicle Industry in India Company Market Share

India Commercial Vehicle Industry: Market Analysis and Growth Forecast (2019-2033)

Unlock comprehensive insights into India's dynamic commercial vehicle market with our in-depth report. This definitive guide provides an exhaustive analysis of the Indian commercial vehicle industry, covering market structure, competitive dynamics, emerging trends, dominant segments, product innovations, and future outlook. Leveraging extensive data for the Study Period (2019–2033), with a Base Year of 2025, Estimated Year of 2025, Forecast Period (2025–2033), and Historical Period (2019–2024), this report is an indispensable resource for manufacturers, suppliers, investors, and policymakers seeking to navigate the evolving landscape of commercial vehicles in India. Discover key market drivers, challenges, leading players, and pivotal developments shaping the future of trucks and buses in India, including the accelerating adoption of electric commercial vehicles in India and hybrid commercial vehicles in India. Gain actionable intelligence on light commercial vehicles (LCVs) in India, heavy commercial vehicles (HCVs) in India, and the burgeoning commercial vehicle body types including buses in India, heavy-duty commercial trucks in India, light commercial pick-up trucks in India, and light commercial vans in India. Our analysis also delves into propulsion types, focusing on ICE (CNG, Diesel, Gasoline, LPG) and hybrid and electric vehicles (BEV, FCEV, HEV, PHEV).

Commercial Vehicle Industry in India Market Structure & Competitive Dynamics

The Indian commercial vehicle market is characterized by a moderate to high degree of concentration, with a few dominant players holding significant market share, particularly in the heavy-duty commercial trucks segment. Key companies like Tata Motors Limited, Ashok Leyland Limited, and VE Commercial Vehicles Limited consistently vie for leadership, while Mahindra & Mahindra Limited maintains a strong presence in the LCV segment. Daimler India Commercial Vehicles Pvt Ltd and SML Isuzu Limited are also significant contributors. The innovation ecosystem is rapidly evolving, driven by government initiatives like the National Electric Mobility Mission Plan and increasing R&D investments in sustainable technologies. Regulatory frameworks, including stricter emission norms (BS VI) and proposed safety standards, are reshaping product development and market entry strategies. Product substitutes, primarily from the unorganized sector and emerging shared mobility solutions, present a competitive challenge. End-user trends are shifting towards fuel efficiency, safety, and connectivity, with a growing demand for specialized vehicle applications. Merger and acquisition (M&A) activities, while not as frequent as in some mature markets, play a crucial role in consolidating market power and expanding technological capabilities. For instance, strategic alliances and technology sharing agreements are becoming more prevalent as companies seek to leverage each other's strengths. The market share of the top players hovers around 70-80% in their respective segments, indicating a concentrated market. M&A deal values in the recent past have seen investments in component suppliers and technology startups, with projected deal values in the range of INR 500 Million to INR 2 Billion in targeted acquisitions.

Commercial Vehicle Industry in India Industry Trends & Insights

The India commercial vehicle industry is experiencing robust growth, propelled by a confluence of macroeconomic factors and technological advancements. The Gross Domestic Product (GDP) growth of India, coupled with increasing urbanization and the expansion of e-commerce, are fundamental drivers for enhanced logistics and transportation demand. The government's focus on infrastructure development, including the development of national highways and expressways, significantly boosts the demand for heavy-duty commercial trucks and buses. The rising adoption of fleet modernization programs by logistics companies, aimed at improving operational efficiency and reducing downtime, further fuels market expansion. Technological disruptions, particularly the rapid advancements in electric commercial vehicles (BEV, HEV) and alternative fuels like CNG, are reshaping the industry. The push towards sustainable transportation, driven by environmental concerns and regulatory mandates, is leading to increased investments in R&D for cleaner propulsion systems. Consumer preferences are evolving, with a growing emphasis on Total Cost of Ownership (TCO), safety features, driver comfort, and telematics solutions for fleet management. Companies are investing in developing vehicles that offer better fuel economy, reduced emissions, and enhanced connectivity. The competitive dynamics are intensifying, with both established players and new entrants vying for market share. The Compound Annual Growth Rate (CAGR) for the overall commercial vehicle market in India is projected to be in the range of 7-9% over the forecast period. Market penetration of electric commercial vehicles, though currently low, is expected to witness substantial growth, reaching over 15-20% by 2030. The demand for light commercial pick-up trucks and light commercial vans is also on an upward trajectory due to the growth in last-mile delivery services and the burgeoning SME sector.

Dominant Markets & Segments in Commercial Vehicle Industry in India

The Indian commercial vehicle market exhibits distinct dominance across various segments, driven by economic policies, infrastructure development, and consumer demand.

Vehicle Body Type:

- Heavy-duty Commercial Trucks: This segment is the bedrock of the Indian commercial vehicle industry, dominating in terms of sales volume and revenue. The extensive road network development, coupled with the increasing movement of goods for manufacturing and consumption, fuels its growth. Key drivers include government initiatives like the Bharatmala Pariyojana, which aims to improve road infrastructure, and the burgeoning e-commerce sector requiring efficient long-haul transportation.

- Light Commercial Pick-up Trucks: This segment is experiencing rapid expansion, primarily driven by the growth of the SME sector, last-mile delivery services, and the increasing demand for small-scale logistics solutions. The ease of operation, maneuverability in urban areas, and lower acquisition costs make them a popular choice.

- Buses: The public transportation sector and intercity travel are significant demand generators for buses. Government investments in public transport infrastructure and the growing tourism industry contribute to the sustained demand for various types of buses, from intercity coaches to city buses.

- Light Commercial Vans: The e-commerce boom and the increasing need for specialized delivery vehicles for perishable goods and pharmaceuticals are propelling the growth of light commercial vans. Their versatility in catering to specific logistical needs is a key advantage.

Propulsion Type:

- ICE (Diesel, CNG): Diesel remains the dominant propulsion type for heavy-duty commercial vehicles due to its established infrastructure and historical performance. However, CNG is gaining significant traction, especially in urban areas, driven by environmental regulations and lower fuel costs, leading to its increasing penetration in the light commercial vehicles segment. Gasoline and LPG are primarily found in niche LCV applications.

- Hybrid and Electric Vehicles (BEV, HEV, PHEV): The electric commercial vehicle (BEV) segment, although nascent, is poised for exponential growth. Government incentives, falling battery costs, and the growing corporate focus on sustainability are key drivers. Hybrid electric vehicles (HEV) offer a transitional solution, combining internal combustion engines with electric powertrains for improved fuel efficiency and reduced emissions, especially in urban operations and for buses. While Fuel Cell Electric Vehicles (FCEV) are still in their early stages of development and demonstration in India, they represent a long-term potential for zero-emission heavy-duty transport. The dominance of ICE is gradually shifting, with EVs expected to capture a significant market share in the coming decade.

Commercial Vehicle Industry in India Product Innovations

The Indian commercial vehicle industry is witnessing a surge in product innovations focused on enhancing efficiency, safety, and sustainability. Manufacturers are actively developing vehicles equipped with advanced driver-assistance systems (ADAS) to improve road safety, and incorporating lightweight materials to boost fuel efficiency. The integration of telematics and connected vehicle technology is enabling real-time fleet management, predictive maintenance, and optimized route planning, offering significant competitive advantages. Furthermore, there's a strong push towards developing and deploying electric commercial vehicles (BEV) and hybrid commercial vehicles (HEV). Companies are investing in indigenous battery technology and charging infrastructure development. For instance, the introduction of new electric truck and bus models with improved range and faster charging capabilities is a key trend. The competitive advantage lies in offering cost-effective, reliable, and technologically advanced solutions that cater to the evolving demands of the Indian market, particularly in segments like light commercial pick-up trucks and last-mile delivery vans.

Report Segmentation & Scope

This comprehensive report segments the Indian commercial vehicle market into key categories to provide granular insights.

Vehicle Body Type:

- Buses: This segment encompasses various types of buses, including city buses, intercity coaches, school buses, and staff buses. The market size for buses is projected to grow at a CAGR of approximately 6-8%.

- Heavy-duty Commercial Trucks: This includes rigid trucks, tractor-trailers, and tippers with Gross Vehicle Weight (GVW) above 18.5 tonnes. This segment holds the largest market share and is expected to grow at a CAGR of 7-9%.

- Light Commercial Pick-up Trucks: This category covers pick-up trucks with GVW below 7.5 tonnes, catering to last-mile delivery and SME needs. Growth is projected at a CAGR of 8-10%.

- Light Commercial Vans: This includes panel vans, chassis-cab vans, and multi-purpose vans with GVW below 7.5 tonnes, crucial for urban logistics. Growth is estimated at a CAGR of 9-11%.

Propulsion Type:

- Hybrid and Electric Vehicles (BEV, FCEV, HEV, PHEV): This segment, while currently smaller, is the fastest-growing. The market size for BEVs is expected to experience a CAGR exceeding 30%, driven by policy support and technological advancements. HEVs offer a substantial growth opportunity as a transitional technology.

- ICE (CNG, Diesel, Gasoline, LPG): Diesel remains dominant in HCVs, with steady growth. CNG is rapidly gaining market share in LCVs and city buses, with a projected CAGR of 10-12%. Gasoline and LPG cater to niche applications.

Key Drivers of Commercial Vehicle Industry in India Growth

The Indian commercial vehicle industry is propelled by a robust set of growth drivers. Government initiatives like the National Logistics Policy and increased spending on infrastructure development, including highways and dedicated freight corridors, are significantly boosting demand for freight transportation. The burgeoning e-commerce sector and the increasing penetration of online retail are creating sustained demand for light commercial vehicles (LCVs) for last-mile delivery. Furthermore, the implementation of stricter emission norms, such as Bharat Stage VI (BS VI), is compelling fleet operators to upgrade their existing fleets, driving the demand for newer, more fuel-efficient, and technologically advanced vehicles. The growth of the manufacturing sector and the increasing need for efficient supply chains across various industries, from agriculture to construction, also contribute significantly to the overall market expansion. The rising disposable incomes and urbanization are also leading to increased passenger mobility, boosting the demand for buses.

Challenges in the Commercial Vehicle Industry in India Sector

Despite the strong growth trajectory, the commercial vehicle industry in India faces several significant challenges. The high cost of acquisition for electric commercial vehicles and the nascent state of charging infrastructure remain major deterrents to widespread adoption. Fluctuations in raw material prices, particularly steel and aluminum, can impact manufacturing costs and vehicle pricing. Stringent regulatory compliance, including evolving safety and emission standards, requires continuous investment in R&D and manufacturing upgrades, posing a challenge for smaller players. Intense competitive pressures among established manufacturers and the presence of an unorganized sector can lead to price wars and impact profitability. Additionally, the availability of skilled labor for the maintenance and repair of advanced vehicle technologies, especially electric powertrains, requires significant investment in training programs. Supply chain disruptions, as witnessed during global events, can also lead to production delays and increased lead times.

Leading Players in the Commercial Vehicle Industry in India Market

- Ashok Leyland Limited

- SML Isuzu Limited

- Daimler India Commercial Vehicles Pvt Ltd

- Tata Motors Limited

- Mahindra & Mahindra Limited

- Eicher Motors Ltd

- VE Commercial Vehicles Limited

- Asia Motor Works Limited

- Force Motors Ltd

- Volvo Buses India Private Limited

Key Developments in Commercial Vehicle Industry in India Sector

- August 2023: Eicher Trucks and Buses, a division of VE Commercial Vehicles Ltd, announced a partnership with Amazon to electrify the middle-mile and last-mile delivery processes for the e-commerce giant in India.

- August 2023: VE Commercial Vehicles Limited announced an order for 550 Intercity Buses from Vijayan Travels and VT, worth INR 5 billion. The order includes 500 Eicher Intercity 13.5m AC and non AC sleeper coaches and 50 Volvo 9600 luxury sleeper coaches.

- April 2023: Tata Elxsi signed a Memorandum of Understanding (MoU) with the Indian Institute of Technology, Guwahati (IIT-G) to jointly work on developing and commercializing state-of-the-art solutions for the electric mobility market.

Strategic Commercial Vehicle Industry in India Market Outlook

The strategic outlook for the Indian commercial vehicle industry is exceptionally promising, marked by significant growth accelerators and evolving market dynamics. The ongoing government focus on improving logistics efficiency and promoting sustainable transportation, coupled with the rapid expansion of the e-commerce and manufacturing sectors, will continue to drive robust demand across all vehicle segments. The accelerated adoption of electric and hybrid commercial vehicles presents a substantial strategic opportunity for manufacturers capable of offering advanced, cost-effective, and reliable solutions. Investments in indigenous technology development, charging infrastructure, and skilled workforce training will be critical for capitalizing on this shift. Partnerships and collaborations, both domestic and international, will play a pivotal role in technology transfer and market penetration. The industry is on the cusp of a transformative phase, driven by innovation and a commitment to a greener future, offering lucrative opportunities for stakeholders who can adapt to these changes.

Commercial Vehicle Industry in India Segmentation

-

1. Vehicle Body Type

- 1.1. Buses

- 1.2. Heavy-duty Commercial Trucks

- 1.3. Light Commercial Pick-up Trucks

- 1.4. Light Commercial Vans

-

2. Propulsion Type

-

2.1. Hybrid and Electric Vehicles

-

2.1.1. By Fuel Category

- 2.1.1.1. BEV

- 2.1.1.2. FCEV

- 2.1.1.3. HEV

- 2.1.1.4. PHEV

-

2.1.1. By Fuel Category

-

2.2. ICE

- 2.2.1. CNG

- 2.2.2. Diesel

- 2.2.3. Gasoline

- 2.2.4. LPG

-

2.1. Hybrid and Electric Vehicles

Commercial Vehicle Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Commercial Vehicle Industry in India Regional Market Share

Geographic Coverage of Commercial Vehicle Industry in India

Commercial Vehicle Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Travel and Tourism Industry is Driving the Car Rental Market

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Vehicle Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Body Type

- 5.1.1. Buses

- 5.1.2. Heavy-duty Commercial Trucks

- 5.1.3. Light Commercial Pick-up Trucks

- 5.1.4. Light Commercial Vans

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Hybrid and Electric Vehicles

- 5.2.1.1. By Fuel Category

- 5.2.1.1.1. BEV

- 5.2.1.1.2. FCEV

- 5.2.1.1.3. HEV

- 5.2.1.1.4. PHEV

- 5.2.1.1. By Fuel Category

- 5.2.2. ICE

- 5.2.2.1. CNG

- 5.2.2.2. Diesel

- 5.2.2.3. Gasoline

- 5.2.2.4. LPG

- 5.2.1. Hybrid and Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Body Type

- 6. North America Commercial Vehicle Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Body Type

- 6.1.1. Buses

- 6.1.2. Heavy-duty Commercial Trucks

- 6.1.3. Light Commercial Pick-up Trucks

- 6.1.4. Light Commercial Vans

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. Hybrid and Electric Vehicles

- 6.2.1.1. By Fuel Category

- 6.2.1.1.1. BEV

- 6.2.1.1.2. FCEV

- 6.2.1.1.3. HEV

- 6.2.1.1.4. PHEV

- 6.2.1.1. By Fuel Category

- 6.2.2. ICE

- 6.2.2.1. CNG

- 6.2.2.2. Diesel

- 6.2.2.3. Gasoline

- 6.2.2.4. LPG

- 6.2.1. Hybrid and Electric Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Body Type

- 7. South America Commercial Vehicle Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Body Type

- 7.1.1. Buses

- 7.1.2. Heavy-duty Commercial Trucks

- 7.1.3. Light Commercial Pick-up Trucks

- 7.1.4. Light Commercial Vans

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. Hybrid and Electric Vehicles

- 7.2.1.1. By Fuel Category

- 7.2.1.1.1. BEV

- 7.2.1.1.2. FCEV

- 7.2.1.1.3. HEV

- 7.2.1.1.4. PHEV

- 7.2.1.1. By Fuel Category

- 7.2.2. ICE

- 7.2.2.1. CNG

- 7.2.2.2. Diesel

- 7.2.2.3. Gasoline

- 7.2.2.4. LPG

- 7.2.1. Hybrid and Electric Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Body Type

- 8. Europe Commercial Vehicle Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Body Type

- 8.1.1. Buses

- 8.1.2. Heavy-duty Commercial Trucks

- 8.1.3. Light Commercial Pick-up Trucks

- 8.1.4. Light Commercial Vans

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. Hybrid and Electric Vehicles

- 8.2.1.1. By Fuel Category

- 8.2.1.1.1. BEV

- 8.2.1.1.2. FCEV

- 8.2.1.1.3. HEV

- 8.2.1.1.4. PHEV

- 8.2.1.1. By Fuel Category

- 8.2.2. ICE

- 8.2.2.1. CNG

- 8.2.2.2. Diesel

- 8.2.2.3. Gasoline

- 8.2.2.4. LPG

- 8.2.1. Hybrid and Electric Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Body Type

- 9. Middle East & Africa Commercial Vehicle Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Body Type

- 9.1.1. Buses

- 9.1.2. Heavy-duty Commercial Trucks

- 9.1.3. Light Commercial Pick-up Trucks

- 9.1.4. Light Commercial Vans

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. Hybrid and Electric Vehicles

- 9.2.1.1. By Fuel Category

- 9.2.1.1.1. BEV

- 9.2.1.1.2. FCEV

- 9.2.1.1.3. HEV

- 9.2.1.1.4. PHEV

- 9.2.1.1. By Fuel Category

- 9.2.2. ICE

- 9.2.2.1. CNG

- 9.2.2.2. Diesel

- 9.2.2.3. Gasoline

- 9.2.2.4. LPG

- 9.2.1. Hybrid and Electric Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Body Type

- 10. Asia Pacific Commercial Vehicle Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Body Type

- 10.1.1. Buses

- 10.1.2. Heavy-duty Commercial Trucks

- 10.1.3. Light Commercial Pick-up Trucks

- 10.1.4. Light Commercial Vans

- 10.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.2.1. Hybrid and Electric Vehicles

- 10.2.1.1. By Fuel Category

- 10.2.1.1.1. BEV

- 10.2.1.1.2. FCEV

- 10.2.1.1.3. HEV

- 10.2.1.1.4. PHEV

- 10.2.1.1. By Fuel Category

- 10.2.2. ICE

- 10.2.2.1. CNG

- 10.2.2.2. Diesel

- 10.2.2.3. Gasoline

- 10.2.2.4. LPG

- 10.2.1. Hybrid and Electric Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Body Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ashok Leyland Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SML Isuzu Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Daimler India Commercial Vehicles Pvt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tata Motors Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mahindra & Mahindra Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eicher Motors Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 VE Commercial Vehicles Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Asia Motor Works Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Force Motors Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Volvo Buses India Private Limite

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ashok Leyland Limited

List of Figures

- Figure 1: Global Commercial Vehicle Industry in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Commercial Vehicle Industry in India Revenue (billion), by Vehicle Body Type 2025 & 2033

- Figure 3: North America Commercial Vehicle Industry in India Revenue Share (%), by Vehicle Body Type 2025 & 2033

- Figure 4: North America Commercial Vehicle Industry in India Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 5: North America Commercial Vehicle Industry in India Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 6: North America Commercial Vehicle Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Commercial Vehicle Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Commercial Vehicle Industry in India Revenue (billion), by Vehicle Body Type 2025 & 2033

- Figure 9: South America Commercial Vehicle Industry in India Revenue Share (%), by Vehicle Body Type 2025 & 2033

- Figure 10: South America Commercial Vehicle Industry in India Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 11: South America Commercial Vehicle Industry in India Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 12: South America Commercial Vehicle Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Commercial Vehicle Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Commercial Vehicle Industry in India Revenue (billion), by Vehicle Body Type 2025 & 2033

- Figure 15: Europe Commercial Vehicle Industry in India Revenue Share (%), by Vehicle Body Type 2025 & 2033

- Figure 16: Europe Commercial Vehicle Industry in India Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 17: Europe Commercial Vehicle Industry in India Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 18: Europe Commercial Vehicle Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Commercial Vehicle Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Commercial Vehicle Industry in India Revenue (billion), by Vehicle Body Type 2025 & 2033

- Figure 21: Middle East & Africa Commercial Vehicle Industry in India Revenue Share (%), by Vehicle Body Type 2025 & 2033

- Figure 22: Middle East & Africa Commercial Vehicle Industry in India Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 23: Middle East & Africa Commercial Vehicle Industry in India Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 24: Middle East & Africa Commercial Vehicle Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Commercial Vehicle Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Commercial Vehicle Industry in India Revenue (billion), by Vehicle Body Type 2025 & 2033

- Figure 27: Asia Pacific Commercial Vehicle Industry in India Revenue Share (%), by Vehicle Body Type 2025 & 2033

- Figure 28: Asia Pacific Commercial Vehicle Industry in India Revenue (billion), by Propulsion Type 2025 & 2033

- Figure 29: Asia Pacific Commercial Vehicle Industry in India Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 30: Asia Pacific Commercial Vehicle Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Commercial Vehicle Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Vehicle Body Type 2020 & 2033

- Table 2: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 3: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Vehicle Body Type 2020 & 2033

- Table 5: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 6: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Vehicle Body Type 2020 & 2033

- Table 11: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 12: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Vehicle Body Type 2020 & 2033

- Table 17: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 18: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Vehicle Body Type 2020 & 2033

- Table 29: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 30: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Vehicle Body Type 2020 & 2033

- Table 38: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 39: Global Commercial Vehicle Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Commercial Vehicle Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Vehicle Industry in India?

The projected CAGR is approximately 5.24%.

2. Which companies are prominent players in the Commercial Vehicle Industry in India?

Key companies in the market include Ashok Leyland Limited, SML Isuzu Limited, Daimler India Commercial Vehicles Pvt Ltd, Tata Motors Limited, Mahindra & Mahindra Limited, Eicher Motors Ltd, VE Commercial Vehicles Limited, Asia Motor Works Limited, Force Motors Ltd, Volvo Buses India Private Limite.

3. What are the main segments of the Commercial Vehicle Industry in India?

The market segments include Vehicle Body Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 50.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Travel and Tourism Industry is Driving the Car Rental Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market.

8. Can you provide examples of recent developments in the market?

August 2023: Eicher Trucks and Buses, a division of VE Commercial Vehicles Ltd has announced a partnership with Amazon to electrify the middle-mile and last-mile delivery processes for the e-commerce giant in India.August 2023: Ve Commercial Vehicles Limited announced that it has received an order for 550 Intercity Buses from Vijayan Travels and VT, worth INR 5 billion. The order includes 500 Eicher Intercity 13.5m AC and non AC sleeper coaches and 50 Volvo 9600 luxury sleeper coaches.April 2023: Tata Elxsi signed a Memorandum of Understanding (MoU) with the Indian Institute of Technology, Guwahati (IIT-G) to jointly work on developing and commercializing state-of-the-art solutions for the electric mobility market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Vehicle Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Vehicle Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Vehicle Industry in India?

To stay informed about further developments, trends, and reports in the Commercial Vehicle Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence