Key Insights

The Indian automotive heat exchanger market is projected to reach USD 18.7 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 8.4% through 2033. This growth is propelled by the expanding Indian automotive sector, characterized by increased vehicle production and a rising demand for advanced vehicles. Evolving emission norms and fuel efficiency mandates are significant drivers, necessitating more sophisticated heat exchange systems for both internal combustion engine (ICE) and electric vehicles (EVs).

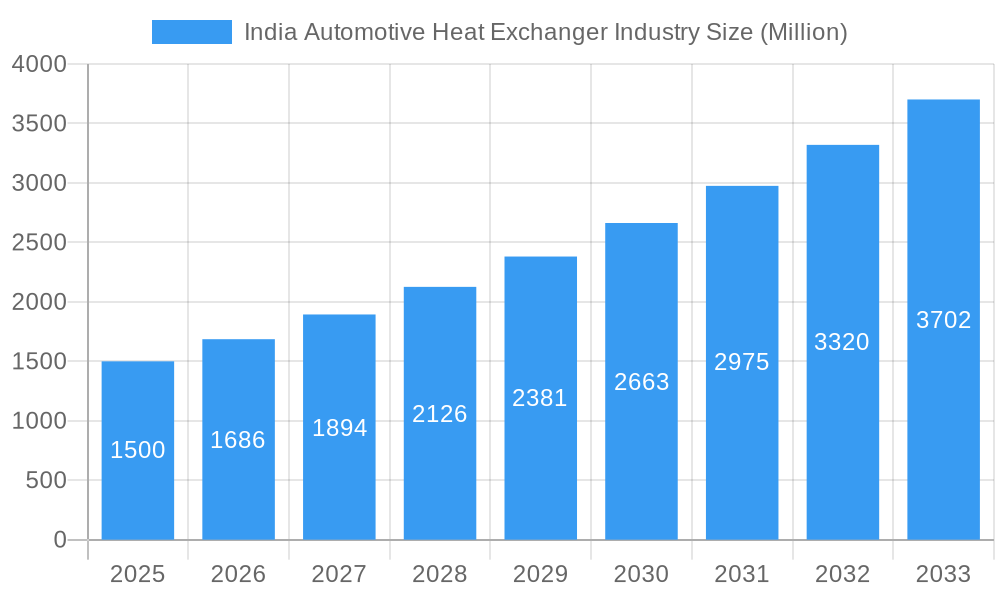

India Automotive Heat Exchanger Industry Market Size (In Billion)

Key market segments include radiators, oil coolers, intercoolers, and air conditioning/condenser units. The rapid adoption of EVs is fostering demand for specialized thermal management solutions, such as battery cooling systems and advanced electric powertrain thermal management. Design trends favor compact, lightweight, and highly efficient solutions like tube/fin, plate-bar, and extrusion fin technologies. Potential market challenges include raw material price fluctuations and the imperative for continuous innovation to meet regulatory and consumer demands.

India Automotive Heat Exchanger Industry Company Market Share

This comprehensive report offers detailed analysis and strategic insights into the dynamic India Automotive Heat Exchanger Industry from 2019 to 2033, with a base year of 2025. It serves as a vital resource for stakeholders navigating this evolving sector, highlighting robust expansion driven by vehicle production, stricter emission standards, and the growing EV segment.

India Automotive Heat Exchanger Industry Market Structure & Competitive Dynamics

The India Automotive Heat Exchanger Industry exhibits a moderately consolidated market structure, characterized by the presence of both global automotive giants and emerging domestic players. Innovation ecosystems are thriving, fueled by significant investments in Research & Development by leading companies such as Denso Corporation, Mahle Gmbh, and Valeo SA. Regulatory frameworks, particularly those related to emission standards and fuel efficiency, are increasingly shaping product development and market entry strategies. While direct product substitutes are limited in their core function, advancements in thermal management technologies and integrated cooling solutions present indirect competitive threats. End-user trends are shifting towards lightweight, high-efficiency heat exchangers, with a growing demand for integrated thermal management systems. Mergers & Acquisitions (M&A) activities are expected to remain strategic, focusing on expanding production capacities, acquiring advanced technologies, and strengthening market presence. For instance, the acquisition of Climetal S L by a major automotive component manufacturer could significantly alter regional market shares. The market share of key players like Nippon Light Metal and AKG Thermal Systems is continuously being re-evaluated based on their technological prowess and expansion plans.

- Market Concentration: Moderately consolidated, with a few key players holding significant market share.

- Innovation Ecosystems: Robust R&D activities focused on performance, efficiency, and sustainability.

- Regulatory Frameworks: Driven by stringent emission norms (e.g., BS VI) and CAFE standards.

- Product Substitutes: Limited direct substitutes, but integrated thermal management systems pose indirect competition.

- End-User Trends: Growing demand for lightweight, durable, and highly efficient heat exchangers.

- M&A Activities: Strategic acquisitions aimed at technology acquisition and market expansion.

India Automotive Heat Exchanger Industry Industry Trends & Insights

The India Automotive Heat Exchanger Industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period of 2025–2033. This upward trajectory is primarily propelled by the increasing passenger and commercial vehicle production volumes in India, a direct consequence of rising disposable incomes and an expanding middle class. Furthermore, the stringent implementation of Bharat Stage VI (BS VI) emission norms has significantly boosted the demand for advanced exhaust gas heat exchangers and highly efficient cooling systems, crucial for minimizing tailpipe emissions. The burgeoning electric vehicle (EV) segment represents a pivotal growth driver, necessitating sophisticated thermal management solutions for batteries, motors, and power electronics, thereby creating new market opportunities for specialized heat exchangers like advanced battery thermal management systems and electric oil coolers. Technological advancements, including the adoption of advanced materials like aluminum alloys for lighter and more corrosion-resistant components, and innovations in manufacturing processes such as brazing and welding techniques, are enhancing product performance and reducing production costs. Consumer preferences are increasingly leaning towards fuel-efficient vehicles, which directly correlates with the need for optimized engine cooling and thermal management systems. Competitive dynamics are characterized by a blend of global suppliers with established technological expertise and growing domestic manufacturers vying for market share through cost-effectiveness and localized supply chains. The penetration of advanced heat exchanger technologies, particularly in the premium and EV segments, is steadily increasing.

- Market Growth Drivers: Rising vehicle production, stringent emission regulations, rapid EV adoption.

- Technological Disruptions: Advancements in materials, manufacturing processes, and integrated thermal management.

- Consumer Preferences: Demand for fuel efficiency, performance, and sustainability.

- Competitive Dynamics: Intense competition between global and domestic players.

- Market Penetration: Increasing adoption of advanced heat exchangers, especially in the EV segment.

Dominant Markets & Segments in India Automotive Heat Exchanger Industry

The Indian automotive heat exchanger market exhibits significant dominance across several key segments. In terms of Application, Radiators continue to hold the largest market share, driven by the sheer volume of conventional internal combustion engine (ICE) vehicles on Indian roads. However, the Air Conditioning and Condenser segment is experiencing rapid growth, spurred by the increasing adoption of air conditioning as a standard feature across all vehicle segments and rising ambient temperatures. The Exhaust Gas Heat Exchanger segment is also gaining prominence due to the imperative to meet BS VI emission norms. In terms of Design, the Tube/Fin design remains the most prevalent due to its cost-effectiveness and proven reliability, particularly for radiators and intercoolers. Nevertheless, the Plate-Bar design is witnessing an upward trend, especially in high-performance applications and certain EV components, owing to its compact size and superior thermal efficiency. Looking at Vehicle types, the Conventional Vehicle (ICE) segment currently dominates the market in terms of volume. However, the Electric Vehicle (EV) segment, although nascent, is projected to be the fastest-growing segment, demanding specialized thermal management solutions for batteries, electric motors, and power electronics. Economic policies promoting automotive manufacturing and infrastructure development play a crucial role in driving the demand for heat exchangers across all vehicle types.

- Dominant Application: Radiators, followed by Air Conditioning and Condenser.

- Emerging Application: Exhaust Gas Heat Exchanger, driven by emission regulations.

- Dominant Design: Tube/Fin, due to cost-effectiveness and widespread use.

- Growing Design: Plate-Bar, for enhanced efficiency and compactness in premium applications.

- Dominant Vehicle Type: Conventional Vehicle (ICE), due to existing market size.

- Fastest Growing Vehicle Type: Electric Vehicle (EV), driven by rapid technological advancements and government support.

- Key Drivers of Dominance: Economic policies supporting manufacturing, consumer demand for comfort and performance, and environmental regulations.

India Automotive Heat Exchanger Industry Product Innovations

Product innovation in the India Automotive Heat Exchanger Industry is primarily focused on enhancing thermal efficiency, reducing weight, and improving durability. Key developments include the increased use of lightweight aluminum alloys, advanced brazing technologies for improved structural integrity and leak resistance, and the integration of heat exchangers into single, multi-functional modules for space optimization. For Electric Vehicles, innovations are centered around sophisticated battery thermal management systems, ensuring optimal operating temperatures for battery longevity and performance, and efficient cooling solutions for electric motors and power electronics. Competitive advantages are being gained through patented designs that offer superior heat dissipation and reduced parasitic losses. The market is also witnessing a surge in the development of compact and modular heat exchangers that can be seamlessly integrated into evolving vehicle architectures.

Report Segmentation & Scope

This report meticulously segments the India Automotive Heat Exchanger Industry based on critical parameters to provide granular insights. The segmentation encompasses Application, including Radiators, Oil Coolers, Intercoolers, Air Conditioning and Condenser, and Exhaust Gas Heat Exchanger. Each application segment is analyzed for its market size, growth projections, and competitive dynamics, with Radiators leading in volume and Air Conditioning and Condenser showing strong growth. The Design segmentation covers Tube/Fin, Plate-Bar, and Extrusion Fin, with Tube/Fin holding the largest share but Plate-Bar exhibiting substantial growth potential due to its efficiency benefits. Vehicle segmentation categorizes the market into Electric Vehicle and Conventional Vehicle (ICE), with the latter currently dominant but the former presenting the most significant future growth prospects.

- Application: Radiators, Oil Coolers, Intercoolers, Air Conditioning and Condenser, Exhaust Gas Heat Exchanger.

- Design: Tube/Fin, Plate-Bar, Extrusion Fin.

- Vehicle: Electric Vehicle, Conventional Vehicle (ICE).

Key Drivers of India Automotive Heat Exchanger Industry Growth

The India Automotive Heat Exchanger Industry's growth is underpinned by several powerful drivers. The robust expansion of India's automotive sector, driven by increasing per capita income and a growing young population, directly translates to higher demand for vehicles and consequently, heat exchangers. Stringent government regulations, such as the BS VI emission standards and Corporate Average Fuel Economy (CAFE) norms, are compelling manufacturers to adopt more efficient and advanced thermal management systems. The accelerated adoption of Electric Vehicles (EVs) in India, supported by government initiatives and subsidies, is creating a new and rapidly expanding market for specialized EV heat exchangers, particularly for battery thermal management. Technological advancements in materials science and manufacturing processes are enabling the development of lighter, more efficient, and cost-effective heat exchangers.

Challenges in the India Automotive Heat Exchanger Industry Sector

Despite the strong growth prospects, the India Automotive Heat Exchanger Industry faces several challenges. The volatile prices of raw materials, particularly aluminum and copper, can significantly impact production costs and profit margins. Intense competition from both domestic and international players can lead to price wars and pressure on profitability. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can affect production schedules and material availability. Moreover, the transition to EVs, while an opportunity, also presents a challenge as it requires significant investment in R&D for new technologies and retraining of the workforce. Evolving regulatory landscapes, though driving innovation, can also create compliance hurdles for smaller manufacturers.

- Raw Material Price Volatility: Fluctuations in aluminum and copper prices.

- Intense Competition: Price pressures and margin erosion.

- Supply Chain Vulnerabilities: Disruptions impacting production and availability.

- Technological Transition: Adapting to the shift towards EV thermal management.

- Regulatory Compliance: Meeting evolving emission and safety standards.

Leading Players in the India Automotive Heat Exchanger Industry Market

- Denso Corporation

- Nippon Light Metal

- AKG Thermal Systems

- Mahle Gmbh

- Climetal S L

- HRS Process Systems

- Valeo SA

- Modine Manufacturing

Key Developments in India Automotive Heat Exchanger Industry Sector

- 2023: Denso Corporation announces investment in advanced thermal management solutions for EVs.

- 2023: Valeo SA expands its manufacturing facility in India to cater to the growing EV market.

- 2022: Mahle Gmbh introduces a new generation of lightweight aluminum radiators for improved fuel efficiency.

- 2022: Nippon Light Metal focuses on developing specialized aluminum alloys for high-performance automotive heat exchangers.

- 2021: AKG Thermal Systems collaborates with Indian OEMs for localized development of intercoolers.

- 2021: HRS Process Systems strengthens its offerings in exhaust gas heat recovery systems for commercial vehicles.

Strategic India Automotive Heat Exchanger Industry Market Outlook

The strategic outlook for the India Automotive Heat Exchanger Industry is exceptionally positive, driven by the sustained growth in vehicle production and the transformative shift towards electric mobility. Key growth accelerators include the continued government support for the automotive and EV sectors, such as production-linked incentive schemes and favorable policy frameworks. The increasing demand for advanced driver-assistance systems (ADAS) and connected car technologies will also necessitate more sophisticated thermal management for integrated electronic components. Strategic opportunities lie in developing highly efficient and compact thermal management solutions tailored for the unique requirements of EVs, including battery packs, electric powertrains, and cabin climate control. Furthermore, a focus on sustainable manufacturing practices and the use of recyclable materials will be crucial for long-term success and competitive advantage in an increasingly environmentally conscious market. Localization of production and supply chains will also be a strategic imperative to enhance cost-competitiveness and reduce lead times.

India Automotive Heat Exchanger Industry Segmentation

-

1. Application

- 1.1. Radiators

- 1.2. Oil Coolers

- 1.3. Intercoolers

- 1.4. Air Conditioning and Condenser

- 1.5. Exhaust Gas Heat Exchanger

-

2. Design

- 2.1. Tube/Fin

- 2.2. Plate-Bar

- 2.3. Extrusion Fin

-

3. Vehicle

- 3.1. Electric Vehicle

- 3.2. Conventional Vehicle (ICE)

India Automotive Heat Exchanger Industry Segmentation By Geography

- 1. India

India Automotive Heat Exchanger Industry Regional Market Share

Geographic Coverage of India Automotive Heat Exchanger Industry

India Automotive Heat Exchanger Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns

- 3.3. Market Restrains

- 3.3.1. Shift towards Disposable Filters

- 3.4. Market Trends

- 3.4.1. Growing Vehicle Production and Aftermarket Demand Driving the Heat Exchanger Market in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automotive Heat Exchanger Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Radiators

- 5.1.2. Oil Coolers

- 5.1.3. Intercoolers

- 5.1.4. Air Conditioning and Condenser

- 5.1.5. Exhaust Gas Heat Exchanger

- 5.2. Market Analysis, Insights and Forecast - by Design

- 5.2.1. Tube/Fin

- 5.2.2. Plate-Bar

- 5.2.3. Extrusion Fin

- 5.3. Market Analysis, Insights and Forecast - by Vehicle

- 5.3.1. Electric Vehicle

- 5.3.2. Conventional Vehicle (ICE)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nippon Light Metal

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AKG Thermal Systems

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mahle Gmbh

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Climetal S L

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HRS Process Systems

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Valeo SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Modine Manufacturing

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: India Automotive Heat Exchanger Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Automotive Heat Exchanger Industry Share (%) by Company 2025

List of Tables

- Table 1: India Automotive Heat Exchanger Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: India Automotive Heat Exchanger Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 3: India Automotive Heat Exchanger Industry Revenue billion Forecast, by Vehicle 2020 & 2033

- Table 4: India Automotive Heat Exchanger Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: India Automotive Heat Exchanger Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: India Automotive Heat Exchanger Industry Revenue billion Forecast, by Design 2020 & 2033

- Table 7: India Automotive Heat Exchanger Industry Revenue billion Forecast, by Vehicle 2020 & 2033

- Table 8: India Automotive Heat Exchanger Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automotive Heat Exchanger Industry?

The projected CAGR is approximately 8.4%.

2. Which companies are prominent players in the India Automotive Heat Exchanger Industry?

Key companies in the market include Denso Corporation, Nippon Light Metal, AKG Thermal Systems, Mahle Gmbh, Climetal S L, HRS Process Systems, Valeo SA, Modine Manufacturing.

3. What are the main segments of the India Automotive Heat Exchanger Industry?

The market segments include Application, Design, Vehicle.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns.

6. What are the notable trends driving market growth?

Growing Vehicle Production and Aftermarket Demand Driving the Heat Exchanger Market in the Country.

7. Are there any restraints impacting market growth?

Shift towards Disposable Filters.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automotive Heat Exchanger Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automotive Heat Exchanger Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automotive Heat Exchanger Industry?

To stay informed about further developments, trends, and reports in the India Automotive Heat Exchanger Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence