Key Insights

The United States automotive parts die casting market is projected to reach $3580.4 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.7% from 2025 to 2033. This growth is primarily propelled by the automotive sector's increasing demand for lightweight vehicle components and the accelerating adoption of electric vehicles (EVs). The industry's focus on enhancing fuel efficiency mandates the use of lightweight materials such as aluminum and magnesium, which are optimally suited for die casting. Die casting's precision capabilities are essential for producing the intricate designs of modern automotive parts, including engine blocks, transmission casings, and suspension components. The expansion of the EV market further bolsters demand, as EV components frequently require complex and high-precision castings. Vacuum die casting is poised for significant growth due to its ability to deliver superior quality castings with intricate details and an exceptional surface finish.

United States Automotive Parts Die Casting Market Market Size (In Billion)

Challenges such as volatile raw material prices for aluminum and zinc, coupled with the increasing complexity of manufacturing, present potential headwinds. Intense competition among established manufacturers and the entry of new players may also influence profit margins. Nevertheless, the market's outlook remains robust, supported by ongoing investments in automotive manufacturing, advancements in die casting technologies, and governmental initiatives promoting fuel-efficient vehicles. The market segmentation, characterized by aluminum's dominant raw material share and pressure die casting's leading process segment, is expected to remain largely consistent, with vacuum die casting anticipated to capture a growing market share.

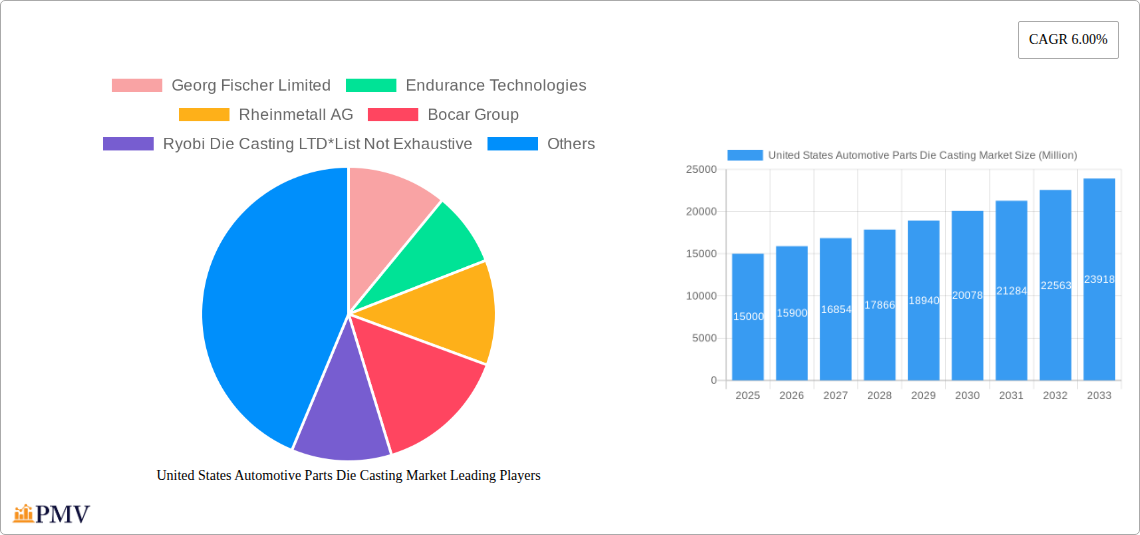

United States Automotive Parts Die Casting Market Company Market Share

United States Automotive Parts Die Casting Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States automotive parts die casting market, offering invaluable insights for stakeholders across the automotive supply chain. The study covers the period 2019-2033, with 2025 as the base year and a forecast period spanning 2025-2033. The report meticulously examines market segmentation, competitive dynamics, growth drivers, challenges, and future outlook, incorporating detailed analysis of key players and emerging trends. Expect detailed market sizing in Millions (USD) throughout.

United States Automotive Parts Die Casting Market Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the US automotive parts die casting market. We explore market concentration, highlighting the market share held by key players such as Georg Fischer Limited, Endurance Technologies, Rheinmetall AG, Bocar Group, Ryobi Die Casting LTD, Nemak, Form Technologies Inc., Shiloh Industries, and Rockman Industries (list not exhaustive). The report assesses the intensity of competition, examining factors like innovation ecosystems, regulatory frameworks governing materials and processes (e.g., environmental regulations impacting aluminum usage), the presence of product substitutes (e.g., plastic components), prevailing end-user trends (lightweighting, electrification), and recent M&A activities. We quantify market concentration using the Herfindahl-Hirschman Index (HHI) where possible and provide an overview of significant M&A deals, including their values (in Millions USD) and impact on market dynamics. For example, we will analyze the impact of consolidation on pricing power and technological innovation. The analysis will also consider the influence of various partnerships and joint ventures on market share distribution. The analysis of market structure will further delineate the role of various players, ranging from large multinational corporations to smaller, specialized die casters catering to niche market segments. The influence of both domestic and international players will also be examined. The total market size in 2025 is estimated to be xx Million.

United States Automotive Parts Die Casting Market Industry Trends & Insights

This section delves into the key trends shaping the US automotive parts die casting market. We analyze the market’s Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) and project the CAGR for the forecast period (2025-2033). The analysis will encompass factors driving market growth, such as the increasing demand for lightweight vehicles (due to stringent fuel efficiency standards), the rising adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) (requiring specialized die-casting components), and the ongoing technological advancements in die casting processes (e.g., high-pressure die casting). The report will also examine technological disruptions, including the integration of automation and Industry 4.0 technologies into die casting processes, impacting productivity and quality. Further analysis will cover changing consumer preferences towards fuel-efficient and sustainable vehicles, their influence on market demand, and the impact of competitive dynamics, particularly pricing strategies and product differentiation, on market growth and penetration. The predicted market size in 2033 is xx Million.

Dominant Markets & Segments in United States Automotive Parts Die Casting Market

This section identifies the dominant segments within the US automotive parts die casting market. We analyze market segmentation by process (pressure die casting, vacuum die casting, squeeze die casting, others) and by raw material (aluminum, magnesium, zinc). The analysis will identify the leading region/state within the US market and explain the reasons behind its dominance.

- By Process: The report will detail the market share and growth potential of each die casting process. For instance, pressure die casting, due to its high production rate and versatility, is likely to be a significant segment. The analysis will investigate the advantages and disadvantages of each process within the automotive parts manufacturing context.

- By Raw Material: The dominance of aluminum will be analyzed, considering its lightweight properties and cost-effectiveness. We will also explore the niche applications of magnesium and zinc, and the factors driving their adoption in specific automotive applications. We will discuss the influence of economic policies, government regulations on material sourcing and recycling, and the availability of infrastructure for material processing and transportation on the dominance of each segment.

The dominance analysis will be complemented by an examination of regional variations in segment performance, reflecting factors like manufacturing concentration, access to raw materials, and regional automotive production hubs.

United States Automotive Parts Die Casting Market Product Innovations

This section summarizes recent product developments in the US automotive parts die casting market. We will highlight innovative die casting techniques, materials, and surface treatments that enhance component performance, durability, and aesthetics. The focus will be on technological trends like the adoption of advanced alloys, improved tooling designs, and the integration of sensors for process monitoring and quality control. We will also examine how these innovations contribute to a competitive advantage for die casting companies, including improved efficiency, reduced production costs, and the ability to cater to increasingly sophisticated automotive design requirements. The section will further identify applications where these innovations are having the largest impact and how they align with the overall market trend towards lightweighting and enhanced functionality.

Report Segmentation & Scope

This report provides a detailed segmentation of the US automotive parts die casting market.

By Process: The market is segmented by various die casting processes, including pressure die casting, vacuum die casting, squeeze die casting, and others. Each segment's growth projection, market size, and competitive dynamics will be analyzed. Pressure die casting is expected to dominate owing to its cost-effectiveness and high production rates, while vacuum die casting and squeeze die casting might hold smaller but growing market shares driven by specialized needs.

By Raw Material: The market is segmented by the raw materials used, including aluminum, magnesium, and zinc. Each segment's growth projections, market size, and competitive dynamics will be discussed. Aluminum is likely to hold the largest market share due to its lightweight properties and cost-effectiveness, but growth projections for magnesium and zinc will also be presented based on their specific automotive applications.

The report will offer a comprehensive understanding of the market size, growth potential, and competitive landscape of each segment.

Key Drivers of United States Automotive Parts Die Casting Market Growth

The growth of the US automotive parts die casting market is driven by several key factors. Increasing demand for lightweight vehicles to improve fuel efficiency and meet stringent emission regulations is a major driver. The rising adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs), which require specific lightweight components, significantly boosts market demand. Technological advancements in die casting processes, such as high-pressure die casting and the incorporation of automation, enhance productivity and reduce costs, further stimulating market growth. Government incentives and supportive policies promoting fuel efficiency and the domestic automotive industry also positively impact market expansion. Lastly, the ongoing trend towards vehicle customization and the increasing use of complex die-cast components in modern automotive designs contribute to market growth.

Challenges in the United States Automotive Parts Die Casting Market Sector

Despite the growth potential, the US automotive parts die casting market faces significant challenges. Fluctuations in raw material prices (e.g., aluminum) create cost uncertainties and affect profitability. Stringent environmental regulations related to emissions and waste disposal increase compliance costs for die casting manufacturers. Intense competition among established players and the emergence of new entrants can pressure profit margins. Supply chain disruptions, especially those related to raw materials and skilled labor, can impact production and delivery schedules. Lastly, the evolving automotive landscape with increased adoption of alternative materials and manufacturing processes poses a potential threat to market growth. The impact of these challenges on market growth will be quantified where possible.

Leading Players in the United States Automotive Parts Die Casting Market Market

- Georg Fischer Limited

- Endurance Technologies

- Rheinmetall AG

- Bocar Group

- Ryobi Die Casting LTD

- Nemak

- Form Technologies Inc.

- Shiloh Industries

- Rockman Industries

Key Developments in United States Automotive Parts Die Casting Market Sector

- January 2023: Company X launched a new high-pressure die casting machine, increasing production capacity by xx%.

- June 2022: Company Y announced a strategic partnership with Company Z for the development of lightweight magnesium alloy components for EVs.

- October 2021: Major M&A deal between Company A and Company B, resulting in a combined market share of xx%. (Further similar examples with specific dates and impacts will be included)

Strategic United States Automotive Parts Die Casting Market Market Outlook

The US automotive parts die casting market is poised for sustained growth over the forecast period, driven by ongoing trends in lightweighting, electrification, and automation. Strategic opportunities exist for companies focusing on innovation in materials and processes, particularly those addressing the demand for lightweight and high-strength components for EVs. Companies that successfully integrate advanced technologies like Industry 4.0 solutions will gain a competitive edge. Expanding into niche markets, such as specialized components for autonomous vehicles, and focusing on sustainable manufacturing practices can also unlock significant growth potential. The market presents lucrative avenues for both established players and new entrants, with a focus on addressing the evolving needs of the automotive industry.

United States Automotive Parts Die Casting Market Segmentation

-

1. Process

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Others

-

2. Raw Material

- 2.1. Aluminium

- 2.2. Magnesium

- 2.3. Zinc

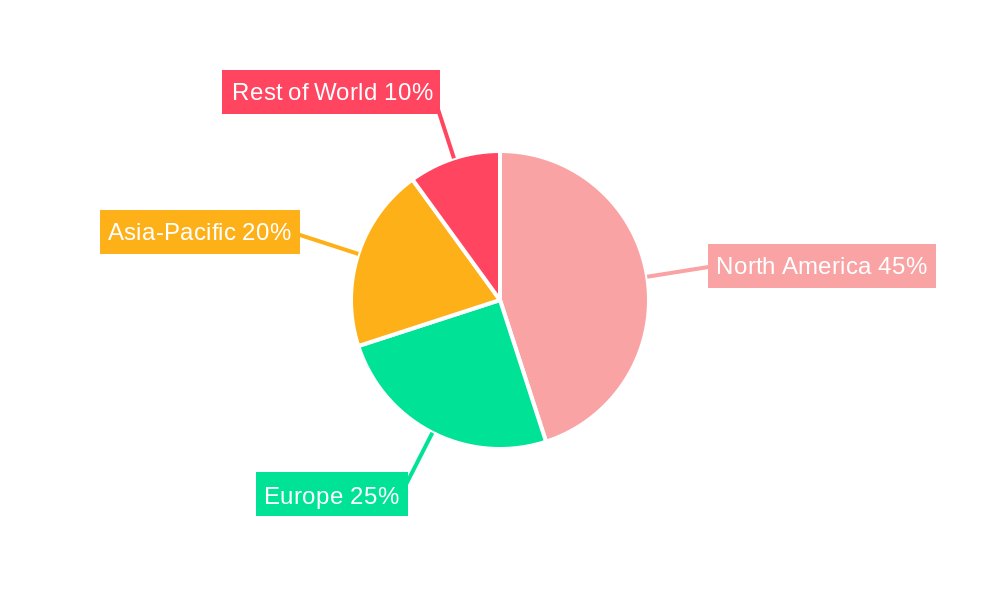

United States Automotive Parts Die Casting Market Segmentation By Geography

- 1. United States

United States Automotive Parts Die Casting Market Regional Market Share

Geographic Coverage of United States Automotive Parts Die Casting Market

United States Automotive Parts Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Trend of Yacht Tourism

- 3.3. Market Restrains

- 3.3.1. Higher Rentals During Peak Season

- 3.4. Market Trends

- 3.4.1. Cost Issues and Resource Inefficiencies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Automotive Parts Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Aluminium

- 5.2.2. Magnesium

- 5.2.3. Zinc

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Georg Fischer Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Endurance Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rheinmetall AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bocar Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ryobi Die Casting LTD*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nemak

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Form Technologies In

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shiloh Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rockman Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Georg Fischer Limited

List of Figures

- Figure 1: United States Automotive Parts Die Casting Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United States Automotive Parts Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: United States Automotive Parts Die Casting Market Revenue million Forecast, by Process 2020 & 2033

- Table 2: United States Automotive Parts Die Casting Market Revenue million Forecast, by Raw Material 2020 & 2033

- Table 3: United States Automotive Parts Die Casting Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: United States Automotive Parts Die Casting Market Revenue million Forecast, by Process 2020 & 2033

- Table 5: United States Automotive Parts Die Casting Market Revenue million Forecast, by Raw Material 2020 & 2033

- Table 6: United States Automotive Parts Die Casting Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Automotive Parts Die Casting Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the United States Automotive Parts Die Casting Market?

Key companies in the market include Georg Fischer Limited, Endurance Technologies, Rheinmetall AG, Bocar Group, Ryobi Die Casting LTD*List Not Exhaustive, Nemak, Form Technologies In, Shiloh Industries, Rockman Industries.

3. What are the main segments of the United States Automotive Parts Die Casting Market?

The market segments include Process, Raw Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 3580.4 million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Trend of Yacht Tourism.

6. What are the notable trends driving market growth?

Cost Issues and Resource Inefficiencies.

7. Are there any restraints impacting market growth?

Higher Rentals During Peak Season.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Automotive Parts Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Automotive Parts Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Automotive Parts Die Casting Market?

To stay informed about further developments, trends, and reports in the United States Automotive Parts Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence