Key Insights

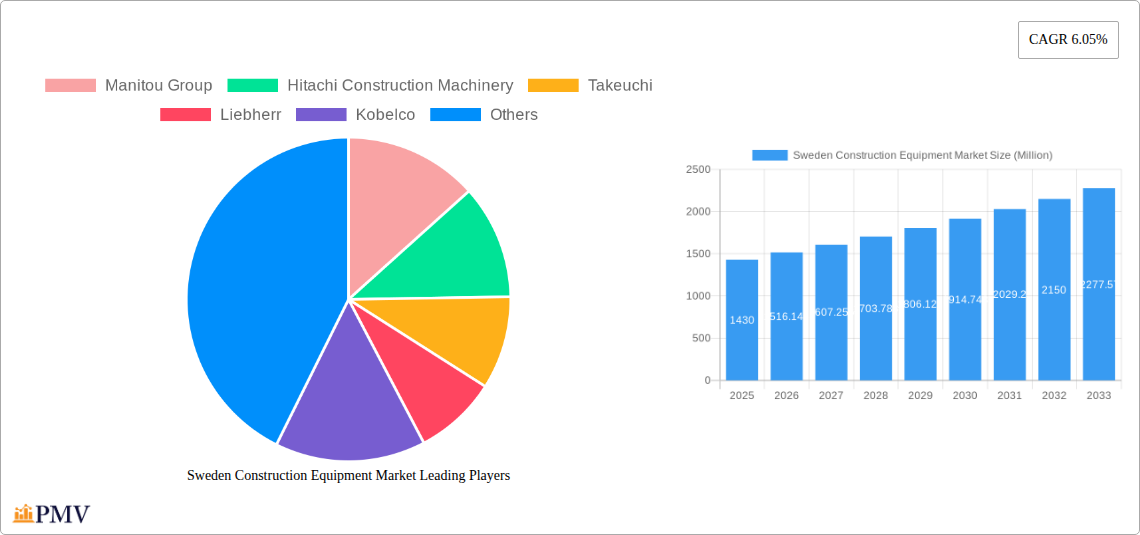

The Sweden Construction Equipment Market, valued at $1.43 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.05% from 2025 to 2033. This expansion is fueled by several key factors. Government initiatives focused on infrastructure development, including road construction and building projects, are significantly boosting demand for earthmoving, road construction, and material handling equipment. Furthermore, Sweden's commitment to sustainable construction practices is leading to increased adoption of electric/hybrid drive types within the construction equipment sector. This trend, while still nascent, is expected to gain significant momentum over the forecast period, contributing substantially to market growth. The increasing urbanization and ongoing residential and commercial construction projects further amplify the demand for diverse equipment types, including bulldozers, asphalt pavers, articulated boom lifts, concrete pump trucks, and dumpers. Competition within the market is fierce, with major players like Caterpillar, Volvo Construction Equipment, Hitachi Construction Machinery, and Liebherr vying for market share through technological advancements and strategic partnerships.

Sweden Construction Equipment Market Market Size (In Billion)

However, the market's growth trajectory is not without challenges. Fluctuations in raw material prices, particularly steel and other metals, pose a significant threat, impacting equipment production costs and potentially hindering affordability. Furthermore, stringent environmental regulations and a growing focus on reducing carbon emissions might necessitate significant investments in cleaner technologies, potentially affecting short-term profitability for some market players. Despite these restraints, the long-term outlook remains positive, underpinned by consistent government investments in infrastructure and a burgeoning construction industry within Sweden. The market segmentation, featuring varied equipment and drive types, presents significant opportunities for specialized players catering to niche demands. The market's continued growth is anticipated to be driven by both the volume of projects and increasing sophistication of equipment utilized in construction activities.

Sweden Construction Equipment Market Company Market Share

Sweden Construction Equipment Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Sweden construction equipment market, covering the period 2019-2033. It offers invaluable insights into market size, segmentation, competitive dynamics, key players, and future growth projections. The report is essential for industry professionals, investors, and stakeholders seeking a deep understanding of this dynamic sector. The report utilizes data from 2019-2024 as the historical period, 2025 as the base and estimated year, and 2025-2033 as the forecast period.

Sweden Construction Equipment Market Structure & Competitive Dynamics

The Swedish construction equipment market exhibits a moderately concentrated structure, with several multinational players holding significant market share. The market is characterized by intense competition, driven by innovation, technological advancements, and evolving customer preferences. Volvo Construction Equipment, given its Swedish origin, holds a substantial market share. However, other global giants like Caterpillar, Komatsu, and Hitachi Construction Machinery also compete fiercely. The regulatory framework in Sweden influences market dynamics, particularly concerning environmental regulations and safety standards. The market also witnesses ongoing M&A activities, albeit at a moderate pace, contributing to shifts in market share and competitive landscape. Deal values for recent M&As in this sector average approximately xx Million.

- Market Concentration: Moderately concentrated, with a few dominant players. Volvo Construction Equipment holds a significant market share.

- Innovation Ecosystem: Active collaboration between OEMs, research institutions, and startups drives technological advancements in construction equipment.

- Regulatory Framework: Stringent environmental regulations and safety standards influence product development and market entry.

- Product Substitutes: Limited direct substitutes exist, but efficiency gains through technology and alternative drive types present indirect competition.

- End-User Trends: Increasing demand for sustainable and efficient construction equipment.

- M&A Activities: Moderate level of M&A activity, primarily focusing on technology acquisition and strategic partnerships. Estimated M&A deal value in the last 5 years: xx Million.

Sweden Construction Equipment Market Industry Trends & Insights

The Swedish construction equipment market is expected to experience steady growth during the forecast period (2025-2033). Several factors are driving this expansion, including sustained infrastructure development projects, increasing urbanization, and government initiatives to modernize the construction sector. Technological advancements, such as the adoption of electric and hybrid equipment, are also shaping market trends. The market has a projected CAGR of xx% during 2025-2033. The increasing focus on sustainable construction practices is driving the adoption of electric and hybrid equipment, although the market penetration of these technologies remains relatively low (currently estimated at xx%). Competitive dynamics involve continuous product innovation and service offerings to gain a competitive edge.

Dominant Markets & Segments in Sweden Construction Equipment Market

The Swedish construction equipment market displays strong growth across diverse segments.

By Equipment Type:

- Earthmoving Equipment: Holds the largest market share due to consistent demand from infrastructure projects and mining activities. Market size in 2025 is estimated to be xx Million.

- Other Earthmoving Equipment (Bulldozers, etc.): Shows steady growth driven by infrastructure projects and large-scale construction activities. 2025 market size is projected at xx Million.

- Road Construction Equipment: Significant demand due to ongoing road maintenance and expansion projects. 2025 market size is projected at xx Million.

- Asphalt Pavers: Market growth aligns with road construction projects and paving activities. 2025 market size is projected at xx Million.

- Material Handling Equipment: Steady growth driven by logistics and material handling needs in construction sites. 2025 market size is projected at xx Million.

- Other Material Handling Equipment (Articulated Boom Lifts, etc.): This segment exhibits moderate growth. 2025 market size is predicted at xx Million.

- Other Construction Equipment (Concrete Pump Trucks, Dumpers, Tippers, etc.): This diverse category shows consistent growth, linked to overall construction activity. 2025 market size is predicted at xx Million.

By Drive Type:

- Hydraulic: Currently dominates the market, though this share is likely to decrease in the coming years due to increasing environmental concerns.

- Electric/Hybrid: Experiencing rapid growth but still accounts for a relatively small percentage of the overall market. Growing demand for sustainable construction practices is driving this segment's expansion. This segment is projected to achieve xx% market penetration by 2033.

Key Drivers for this dominance are: consistent government spending on infrastructure, a robust construction sector, and the ongoing modernization of the country's infrastructure.

Sweden Construction Equipment Market Product Innovations

Recent innovations in the Swedish construction equipment market center on enhancing efficiency, sustainability, and operator safety. Electric and hybrid models are gaining traction, and advancements in telematics and automation are improving equipment management and productivity. These innovations cater to the increasing demand for environmentally friendly and technologically advanced construction equipment, aligning with the overall industry trend towards sustainability and reduced environmental impact.

Report Segmentation & Scope

This report segments the Sweden construction equipment market by equipment type (earthmoving, road construction, material handling, and other) and drive type (hydraulic, electric/hybrid). Each segment's growth projections, market sizes (in Millions), and competitive dynamics are analyzed in detail. The report provides insights into the current market status and future growth potential for each segment. Market sizes for each segment are projected for 2025 and beyond. Competitive analysis includes market share, key players, and their strategies.

Key Drivers of Sweden Construction Equipment Market Growth

The Swedish construction equipment market's growth is primarily driven by several key factors:

- Government Infrastructure Spending: Significant investments in infrastructure projects fuel demand for construction equipment.

- Urbanization and Construction Boom: Rapid urbanization and ongoing construction projects increase demand for diverse equipment.

- Technological Advancements: Innovations like electric and hybrid models enhance efficiency and sustainability.

- Growing Focus on Sustainability: Demand for environmentally friendly equipment is increasing, driving growth in the electric/hybrid segment.

Challenges in the Sweden Construction Equipment Market Sector

The Swedish construction equipment market faces several challenges:

- Fluctuations in Raw Material Prices: Price volatility in steel and other raw materials impacts production costs and equipment pricing.

- Supply Chain Disruptions: Global supply chain disruptions can affect equipment availability and delivery times.

- Stringent Environmental Regulations: Compliance with environmental standards adds to the cost of production and operation.

- Economic Downturns: Economic slowdowns can reduce construction activity and negatively impact equipment sales.

Leading Players in the Sweden Construction Equipment Market Market

Key Developments in Sweden Construction Equipment Market Sector

- August 2023: Volvo Construction Equipment launched updated Volvo Service Contracts, enhancing customer support and maximizing equipment uptime.

- June 2023: Volvo CE relocated its global headquarters to Eskilstuna, Sweden, fostering collaboration and innovation.

- February 2023: Hitachi Construction Machinery announced an 8% price increase for its equipment globally, impacting the Swedish market.

- November 2022: Volvo Construction Equipment partnered with Skanska for a Stockholm urban development project, deploying its electric excavator.

Strategic Sweden Construction Equipment Market Outlook

The Swedish construction equipment market is poised for continued growth, driven by government initiatives, technological advancements, and a focus on sustainable practices. Strategic opportunities exist for companies focusing on electric and hybrid equipment, innovative service solutions, and digitalization. The market's future potential is significant, particularly for companies adapting to evolving customer demands and regulatory changes. Growth will be driven by infrastructure projects, urban development, and a growing focus on sustainability.

Sweden Construction Equipment Market Segmentation

-

1. Equipment Type

-

1.1. Earthmoving Equipment

- 1.1.1. Excavators

- 1.1.2. Backhoe Loaders

- 1.1.3. Motor Graders

- 1.1.4. Other Earthmoving Equipment (Bull Dozers, etc.)

-

1.2. Road Construction Equipment

- 1.2.1. Road Rollers

- 1.2.2. Asphalt Pavers

-

1.3. Material Handling Equipment

- 1.3.1. Cranes

- 1.3.2. Forklift & Telescopic Handlers

- 1.3.3. Other Ma

- 1.4. Other Co

-

1.1. Earthmoving Equipment

-

2. Drive Type

- 2.1. Hydraulic

- 2.2. Electric/Hybrid

Sweden Construction Equipment Market Segmentation By Geography

- 1. Sweden

Sweden Construction Equipment Market Regional Market Share

Geographic Coverage of Sweden Construction Equipment Market

Sweden Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Government Spending on Construction

- 3.2.2 Infrastructure

- 3.2.3 and Mining Sector

- 3.3. Market Restrains

- 3.3.1. High Cost of Replacement and Maintenance

- 3.4. Market Trends

- 3.4.1 Increasing Government Spending on Construction

- 3.4.2 Infrastructure

- 3.4.3 and Mining Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Earthmoving Equipment

- 5.1.1.1. Excavators

- 5.1.1.2. Backhoe Loaders

- 5.1.1.3. Motor Graders

- 5.1.1.4. Other Earthmoving Equipment (Bull Dozers, etc.)

- 5.1.2. Road Construction Equipment

- 5.1.2.1. Road Rollers

- 5.1.2.2. Asphalt Pavers

- 5.1.3. Material Handling Equipment

- 5.1.3.1. Cranes

- 5.1.3.2. Forklift & Telescopic Handlers

- 5.1.3.3. Other Ma

- 5.1.4. Other Co

- 5.1.1. Earthmoving Equipment

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Hydraulic

- 5.2.2. Electric/Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Manitou Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hitachi Construction Machinery

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeuchi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Liebherr

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kobelco

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JCB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Volvo Construction Equipment

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kubota

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hyundai Construction Equipment

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Komatsu

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yanmar

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Konecrane

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Caterpillar

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Manitou Group

List of Figures

- Figure 1: Sweden Construction Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Sweden Construction Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Sweden Construction Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 2: Sweden Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 3: Sweden Construction Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Sweden Construction Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 5: Sweden Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 6: Sweden Construction Equipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Construction Equipment Market?

The projected CAGR is approximately 6.05%.

2. Which companies are prominent players in the Sweden Construction Equipment Market?

Key companies in the market include Manitou Group, Hitachi Construction Machinery, Takeuchi, Liebherr, Kobelco, JCB, Volvo Construction Equipment, Kubota, Hyundai Construction Equipment, Komatsu, Yanmar, Konecrane, Caterpillar.

3. What are the main segments of the Sweden Construction Equipment Market?

The market segments include Equipment Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Spending on Construction. Infrastructure. and Mining Sector.

6. What are the notable trends driving market growth?

Increasing Government Spending on Construction. Infrastructure. and Mining Sector.

7. Are there any restraints impacting market growth?

High Cost of Replacement and Maintenance.

8. Can you provide examples of recent developments in the market?

August 2023: Volvo Construction Equipment, a Sweden-based manufacturer of construction equipment, unveiled an updated range of Volvo Service Contracts as a pivotal part of its post-sales division. These contracts are a rebranding of the previous Customer Services Agreements and offer valuable solutions for customers in managing the repair and maintenance needs of their Volvo machinery. The newly introduced service agreements consist of three tiers: the Blue Contract, which covers preventive maintenance and servicing, and the Gold Contract, which encompasses comprehensive machine repairs and preventive maintenance to maximize equipment uptime.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Construction Equipment Market?

To stay informed about further developments, trends, and reports in the Sweden Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence