Key Insights

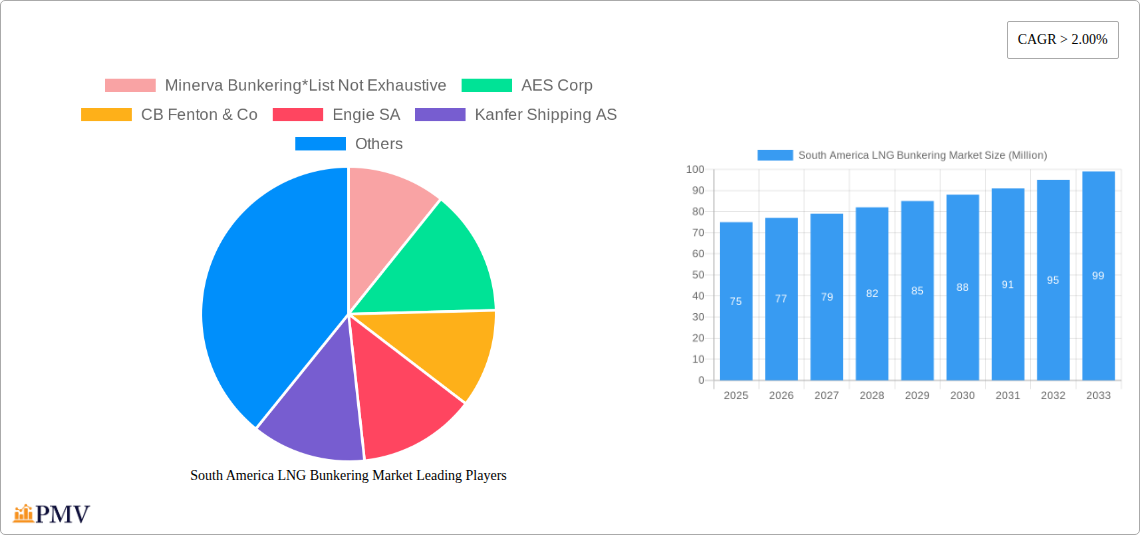

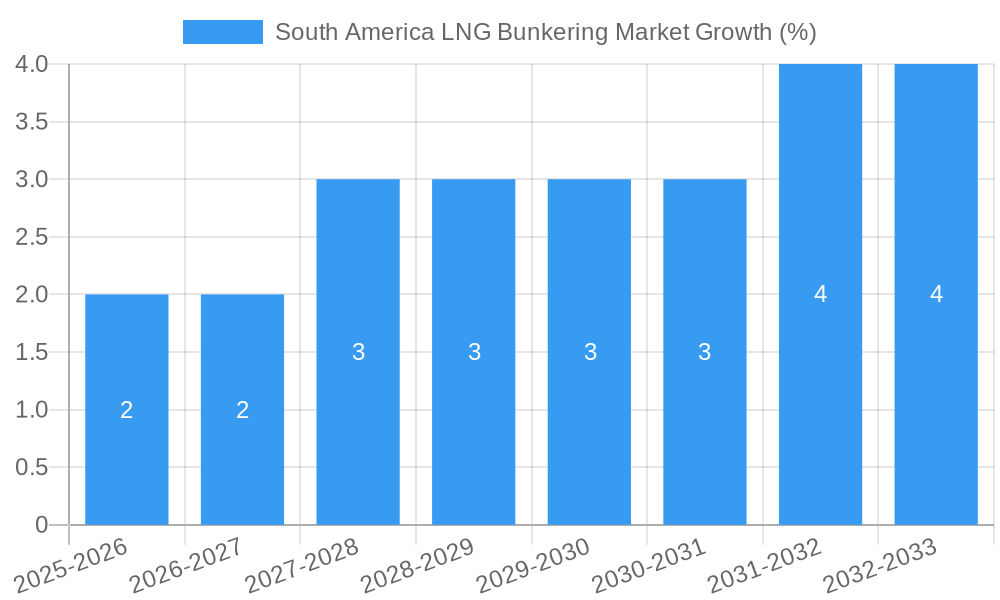

The South American LNG bunkering market, while currently relatively nascent compared to more established regions, exhibits strong growth potential fueled by several key factors. The expanding global demand for cleaner maritime fuels, coupled with stringent environmental regulations targeting sulfur emissions, is driving increased adoption of LNG as a marine fuel. Brazil and Argentina, the two largest economies in South America, are at the forefront of this transition, investing in LNG infrastructure development including bunkering facilities and promoting LNG as a viable alternative to traditional heavy fuel oil. While the exact market size in 2025 is not provided, considering a CAGR of >2.00% and a market size of XX million in an unspecified year, a reasonable estimation for the 2025 South American LNG bunkering market would be in the range of $50-100 million USD, depending on the base year of the XX value. This estimate accounts for the recent and projected growth in LNG adoption and the region's economic conditions. The presence of key players like Minerva Bunkering, AES Corp, and Engie SA further solidifies the market's growing momentum, indicating significant investment and confidence in the sector's future.

Growth within the South American market is projected to continue, driven by increasing governmental support for cleaner fuels, expanding port infrastructure to accommodate LNG bunkering, and the growing tanker, container, and bulk cargo fleets operating in the region. However, challenges remain, including the high initial capital investment required for LNG infrastructure development and the need for more widespread LNG supply chains to ensure reliable fuel availability. Furthermore, the relative cost competitiveness of LNG versus alternative fuels will continue to influence market penetration. Segment-wise, tanker fleets and container fleets are likely to be the earliest adopters, given their long-distance voyages and higher emission profiles. The forecast period of 2025-2033 suggests a significant growth trajectory, with a projected market value exceeding $150 million by 2033, given the compounded annual growth rate and regional expansion. The market's expansion will depend heavily on the successful implementation of supportive policies and the consistent development of LNG infrastructure throughout South America.

This in-depth report provides a comprehensive analysis of the South America LNG bunkering market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth trajectories. The study period is 2019-2033, with 2025 as the base and estimated year, and 2025-2033 as the forecast period. The historical period covered is 2019-2024.

South America LNG Bunkering Market Structure & Competitive Dynamics

This section analyzes the market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the South American LNG bunkering market. The market is characterized by a moderate level of concentration, with a few major players holding significant market share. However, the presence of numerous smaller players, particularly in specialized segments, indicates a dynamic and evolving competitive landscape. Innovation is driven by advancements in LNG storage and handling technologies, as well as the development of more efficient bunkering infrastructure. Regulatory frameworks vary across South American countries, influencing market access and operational costs. The emergence of alternative fuels presents a potential threat, although LNG's current cost-competitiveness and environmental benefits are significant factors.

- Market Share: Minerva Bunkering holds an estimated xx% market share in 2025, while AES Corp, Engie SA, and other players share the remaining xx%. Specific market share data is available in the full report.

- M&A Activity: The value of M&A deals in the South American LNG bunkering market reached approximately $xx Million in 2024, with several key transactions reshaping the competitive landscape. Detailed analysis of these deals, including their financial implications and strategic rationale, is included in the complete report.

- End-User Trends: The increasing adoption of LNG as a marine fuel, driven by stricter environmental regulations and a growing focus on sustainability, is a major factor driving market growth. The report further details the evolving preferences of different end-user segments.

South America LNG Bunkering Market Industry Trends & Insights

This section explores the key industry trends shaping the South American LNG bunkering market. Market growth is primarily driven by the increasing demand for cleaner marine fuels, supported by stringent environmental regulations implemented across various South American countries. Technological advancements, including the development of more efficient LNG bunkering vessels and improved storage technologies, are further accelerating market expansion. The CAGR for the South American LNG bunkering market is projected to be xx% during the forecast period (2025-2033), reflecting the market's robust growth potential. However, challenges remain, such as the need for substantial investments in bunkering infrastructure and the volatility of LNG prices, which can impact market penetration rates.

Dominant Markets & Segments in South America LNG Bunkering Market

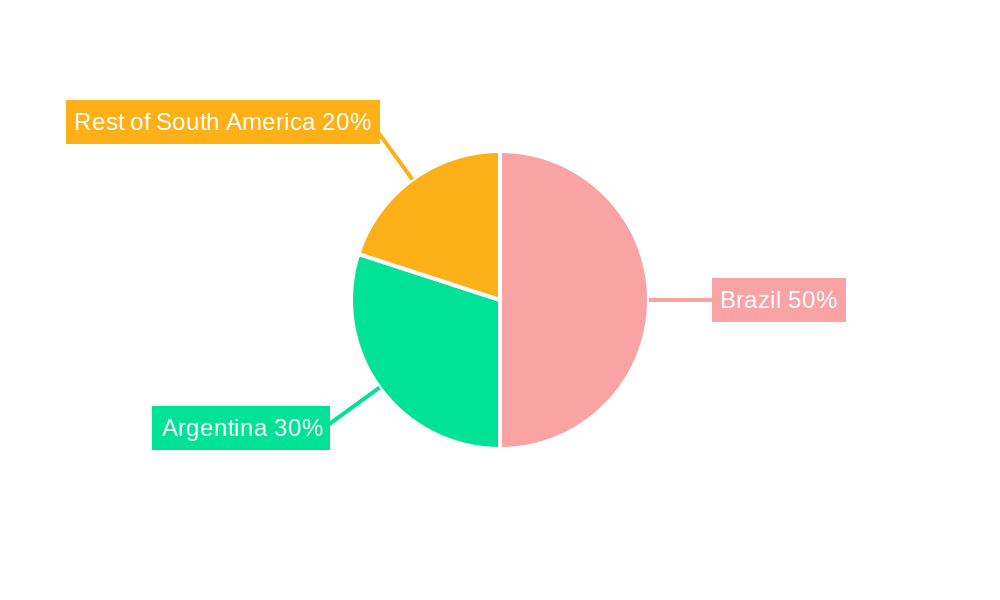

This section identifies the leading regions, countries, and segments within the South American LNG bunkering market. The detailed analysis reveals the significance of various factors influencing market dominance across different regions and segments, including economic policies, infrastructure availability, and regulatory frameworks.

- Tanker Fleet: This segment is currently the largest end-user of LNG bunkering services in South America, driven by the increasing size and frequency of LNG tanker operations in the region.

- Brazil: Brazil is projected as the dominant market due to its substantial shipping activity and supportive government policies towards cleaner maritime fuels. The growth drivers include:

- Significant investments in port infrastructure upgrades and expansion.

- Government initiatives aimed at promoting the use of LNG as a marine fuel.

- A large and expanding tanker fleet that demands efficient and reliable LNG bunkering services.

- Container Fleet and Bulk and General Cargo Fleet: These segments are exhibiting steady growth driven by rising international trade and the adoption of environmentally sustainable practices. The report provides a detailed breakdown of these segments.

- Ferries and OSV: This segment is gradually increasing its adoption of LNG bunkering. Further analysis is provided in the full report.

South America LNG Bunkering Market Product Innovations

Significant advancements in LNG bunkering technologies are transforming the market. Innovations include the development of more efficient and safer bunkering vessels, improved LNG storage systems, and optimized bunkering procedures to enhance operational efficiency and reduce environmental impact. These developments are leading to increased market penetration and greater acceptance of LNG as a marine fuel.

Report Segmentation & Scope

This report segments the South American LNG bunkering market by end-user: Tanker Fleet, Container Fleet, Bulk and General Cargo Fleet, Ferries and OSV, and Others. Each segment's growth projections, market sizes, and competitive dynamics are comprehensively analyzed, offering granular insights into the market's structure and future potential. The report provides detailed market size estimates for each segment in Million USD for the historical period, base year, and forecast period.

Key Drivers of South America LNG Bunkering Market Growth

The South American LNG bunkering market's growth is fueled by several key factors:

- Stringent Environmental Regulations: Increasingly strict emission regulations are driving the adoption of cleaner marine fuels, boosting LNG's appeal.

- Economic Growth: The continued economic expansion in several South American countries fuels maritime trade, thereby increasing demand for LNG bunkering services.

- Technological Advancements: Innovations in LNG bunkering technology, such as efficient bunkering vessels and improved storage, enhance market appeal.

Challenges in the South America LNG Bunkering Market Sector

Despite its immense potential, the South American LNG bunkering market faces several challenges:

- Infrastructure Limitations: The lack of sufficient LNG bunkering infrastructure in some regions hinders market growth.

- High Initial Investment Costs: The considerable initial investment required for LNG bunkering infrastructure can be a significant barrier to entry.

- Price Volatility of LNG: Fluctuations in LNG prices can impact the cost-competitiveness of LNG as a marine fuel.

Leading Players in the South America LNG Bunkering Market Market

- Minerva Bunkering

- AES Corp

- CB Fenton & Co

- Engie SA

- Kanfer Shipping AS

- Avenir LNG Ltd

Key Developments in South America LNG Bunkering Market Sector

- December 2022: CB Fenton & Kanfer Shipping signed an MOU to establish an LNG bunkering hub in Panama. This significantly strengthens the infrastructure for small-scale LNG distribution in the region.

- September 2022: YPF and Petronas signed a JSDA for an integrated LNG project in Argentina, boosting domestic LNG production and potentially increasing the availability of LNG for bunkering.

Strategic South America LNG Bunkering Market Outlook

The South American LNG bunkering market presents significant growth opportunities. Strategic investments in infrastructure development, coupled with ongoing technological advancements and supportive government policies, are expected to fuel market expansion in the coming years. The increasing awareness of environmental concerns among shipping companies and proactive government regulations will continue to drive the demand for LNG as a marine fuel, creating substantial growth potential for market players. The full report provides detailed strategic recommendations and forecasts, offering valuable guidance for businesses navigating this dynamic market.

South America LNG Bunkering Market Segmentation

-

1. End-User

- 1.1. Tanker Fleet

- 1.2. Container Fleet

- 1.3. Bulk and General Cargo Fleet

- 1.4. Ferries and OSV

- 1.5. Others

-

2. Geography

-

2.1. South America

- 2.1.1. Brazil

- 2.1.2. Argentina

- 2.1.3. Rest of South America

-

2.1. South America

South America LNG Bunkering Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

South America LNG Bunkering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies for Waste-to-Energy Plants4.; Increasing Investments in Waste-to-Energy Industries

- 3.3. Market Restrains

- 3.3.1. 4.; The Strict Regulation Imposed Against the Release of Harmful Gases When Trash is Burned

- 3.4. Market Trends

- 3.4.1. Increase in Maritime Activities is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Tanker Fleet

- 5.1.2. Container Fleet

- 5.1.3. Bulk and General Cargo Fleet

- 5.1.4. Ferries and OSV

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. South America

- 5.2.1.1. Brazil

- 5.2.1.2. Argentina

- 5.2.1.3. Rest of South America

- 5.2.1. South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Brazil South America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Minerva Bunkering*List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 AES Corp

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CB Fenton & Co

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Engie SA

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Kanfer Shipping AS

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Avenir LNG Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 Minerva Bunkering*List Not Exhaustive

List of Figures

- Figure 1: South America LNG Bunkering Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America LNG Bunkering Market Share (%) by Company 2024

List of Tables

- Table 1: South America LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 3: South America LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: South America LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South America LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of South America South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South America LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: South America LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: South America LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America LNG Bunkering Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the South America LNG Bunkering Market?

Key companies in the market include Minerva Bunkering*List Not Exhaustive, AES Corp, CB Fenton & Co, Engie SA, Kanfer Shipping AS, Avenir LNG Ltd.

3. What are the main segments of the South America LNG Bunkering Market?

The market segments include End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies for Waste-to-Energy Plants4.; Increasing Investments in Waste-to-Energy Industries.

6. What are the notable trends driving market growth?

Increase in Maritime Activities is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; The Strict Regulation Imposed Against the Release of Harmful Gases When Trash is Burned.

8. Can you provide examples of recent developments in the market?

In December 2022, CB Fenton, part of Ultramar (Chile), and Norwegian small-scale LNG sea transport and bunkering vessels developer Kanfer Shipping signed a Memorandum of Understanding to establish a hub for LNG bunkering and small-scale LNG distribution in/out of Panama.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America LNG Bunkering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America LNG Bunkering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America LNG Bunkering Market?

To stay informed about further developments, trends, and reports in the South America LNG Bunkering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence