Key Insights

The Microchannel Heat Exchanger Industry is poised for robust expansion, projected to reach a substantial market size of $18.08 billion by 2025. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 9.34%, indicating a dynamic and evolving market landscape. The primary impetus for this surge is the increasing demand for highly efficient, compact, and lightweight heat exchange solutions across a multitude of industries. In the oil and gas sector, the need for enhanced thermal management in exploration, refining, and processing operations is a significant driver. Similarly, the power generation industry is actively seeking advanced heat exchangers to improve energy efficiency and reduce emissions, particularly with the growing integration of renewable energy sources. The chemical industry also benefits immensely from microchannel technology due to its superior performance in demanding process conditions and its ability to minimize footprint and material usage. Furthermore, the food and beverages sector is increasingly adopting these technologies for their hygienic designs and precise temperature control capabilities, crucial for product quality and safety.

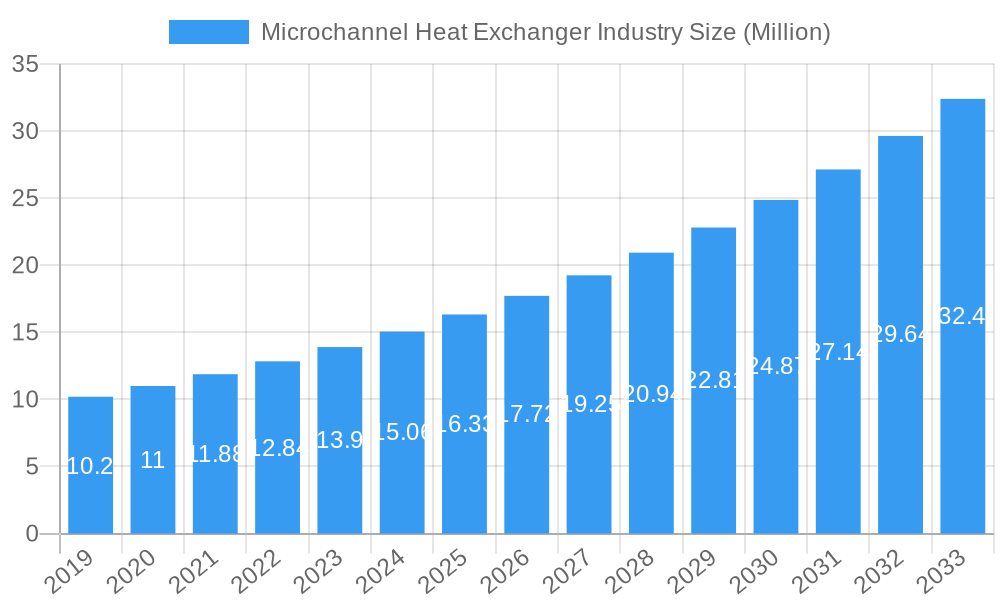

Microchannel Heat Exchanger Industry Market Size (In Million)

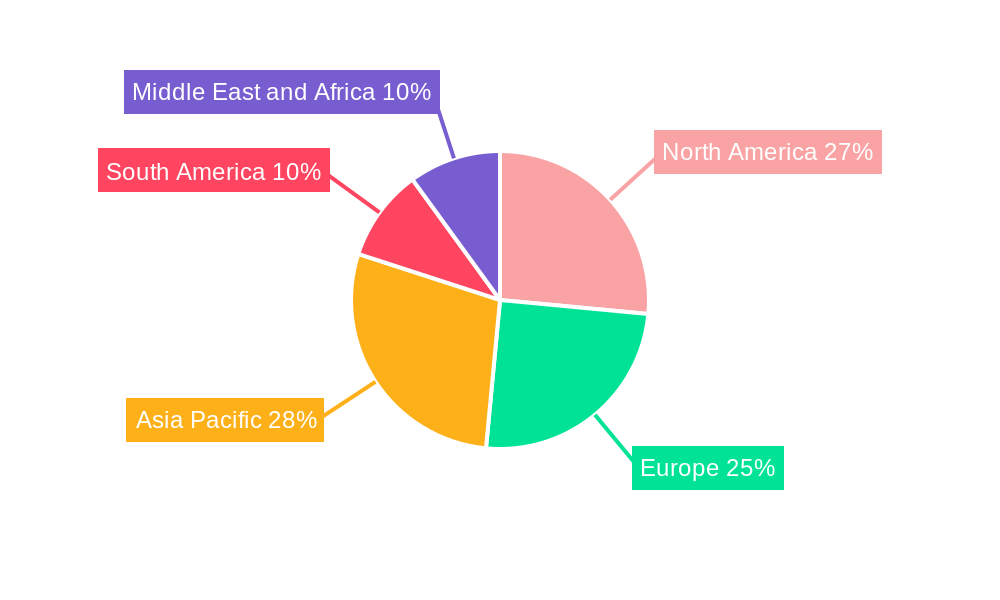

The market is characterized by a clear segmentation based on construction type, with Shell and Tube and Plate Frame heat exchangers holding significant shares, alongside emerging "Other Construction Types" that leverage innovative designs. Geographically, North America, Europe, and Asia Pacific are anticipated to be the dominant regions, driven by strong industrial bases and significant investments in technological upgrades. The Asia Pacific region, in particular, is expected to witness accelerated growth due to rapid industrialization and increasing adoption of advanced manufacturing processes. However, the industry faces certain restraints, including the high initial cost of some microchannel technologies and the need for specialized maintenance expertise. Despite these challenges, the persistent trend towards miniaturization, improved energy efficiency, and environmental sustainability across all end-user segments will continue to fuel innovation and drive market penetration for microchannel heat exchangers. Key players like Alfa Laval AB, Danfoss AS, and Thermax Limited are actively investing in research and development to expand their product portfolios and capitalize on these burgeoning opportunities.

Microchannel Heat Exchanger Industry Company Market Share

This in-depth report provides a detailed analysis of the Microchannel Heat Exchanger industry, offering critical insights for stakeholders aiming to navigate this dynamic and rapidly evolving market. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study meticulously examines market structure, competitive landscape, industry trends, dominant segments, product innovations, key drivers, challenges, and future outlook. Utilizing high-ranking keywords such as "microchannel heat exchanger," "plate heat exchanger," "oil and gas," "power generation," "chemical industry," "food and beverage," and "renewable energy," this report is optimized for maximum search visibility and engagement within the industry. We have incorporated specific company names like Danfoss AS, Thermax Limited, Kelvion Holding GmbH, Mersen SA, Barriquand Technologies Thermiques SAS, SPX Flow Inc, General Electric Company, Hisaka Works Ltd, and Alfa Laval AB, noting that this list is not exhaustive and represents approximately 64% market ranking/share analysis. All monetary values are presented in Millions.

Microchannel Heat Exchanger Industry Market Structure & Competitive Dynamics

The Microchannel Heat Exchanger industry exhibits a moderately concentrated market structure, with a few key global players holding significant market share. Innovation plays a crucial role, driving advancements in efficiency, size reduction, and material science. The ecosystem is characterized by continuous R&D investment, collaboration with research institutions, and a focus on developing sustainable and energy-efficient solutions. Regulatory frameworks, particularly concerning environmental impact and energy efficiency standards, are shaping product development and market entry strategies. Product substitutes, such as traditional heat exchangers, remain a factor, but the unique advantages of microchannel technology, including higher heat transfer coefficients and compact designs, are steadily eroding their market share. End-user trends are heavily influenced by the demand for energy efficiency across sectors like oil and gas, power generation, and chemical processing. Mergers and acquisitions (M&A) activities are observed as companies seek to expand their technological capabilities, market reach, and product portfolios. For instance, strategic acquisitions in the range of XX to XXX Million have been noted, aimed at consolidating market positions and integrating advanced microchannel technologies.

Microchannel Heat Exchanger Industry Industry Trends & Insights

The Microchannel Heat Exchanger industry is experiencing robust growth, driven by increasing global demand for energy efficiency and sustainability. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is estimated at XX%, a testament to the technology's growing adoption. This expansion is fueled by several critical trends:

- Energy Efficiency Mandates: Governments worldwide are implementing stricter energy efficiency regulations, pushing industries to adopt advanced heat transfer solutions like microchannel heat exchangers, which offer superior performance and reduced energy consumption compared to conventional counterparts. The oil and gas industry, in particular, is a major adopter due to its large-scale energy demands and the need for optimized processing.

- Technological Advancements: Ongoing innovation in materials science, manufacturing techniques (such as advanced brazing and welding), and design optimization is leading to lighter, more durable, and highly efficient microchannel heat exchangers. Developments in computational fluid dynamics (CFD) and thermal analysis are enabling the design of customized solutions for specific applications, further enhancing their market penetration.

- Compact and Lightweight Designs: The inherent advantage of microchannel technology in offering a significantly smaller footprint and lower weight compared to traditional heat exchangers is highly attractive for applications where space and weight are critical constraints, such as in the automotive sector (HVAC systems) and in compact industrial processes.

- Growth in Renewable Energy Sectors: The burgeoning renewable energy sector, including fuel cells and advanced battery cooling systems, presents a significant growth avenue. Microchannel heat exchangers are proving ideal for managing thermal loads in these high-performance systems, contributing to their reliability and efficiency.

- Focus on Sustainability and Environmental Concerns: The drive towards reducing greenhouse gas emissions and minimizing environmental impact is a major catalyst. Microchannel heat exchangers contribute to this by enabling more efficient energy utilization and reducing the need for refrigerants in certain applications.

- Diversification of End-Use Industries: Beyond traditional sectors, the adoption of microchannel heat exchangers is expanding into emerging applications within the electronics cooling, medical devices, and aerospace industries, showcasing the versatility and adaptability of this technology.

The market penetration of microchannel heat exchangers is steadily increasing, projected to reach XX% by 2033, reflecting the growing recognition of their economic and environmental benefits. Consumer preferences are increasingly aligning with sustainable and cost-effective solutions, directly benefiting manufacturers of advanced heat transfer technologies.

Dominant Markets & Segments in Microchannel Heat Exchanger Industry

The Microchannel Heat Exchanger industry is segmented by Construction Type (Shell and Tube, Plate Frame, Other Construction Types) and End User (Oil and Gas Industry, Power Generation, Chemical, Food and Beverages, Other End Users).

Dominant End User Segment: Oil and Gas Industry The Oil and Gas Industry stands as a primary driver of demand for microchannel heat exchangers. The inherent need for highly efficient and robust heat transfer solutions in upstream, midstream, and downstream operations makes this segment particularly significant.

- Key Drivers:

- Energy Efficiency Demands: The sector's vast energy consumption necessitates solutions that minimize operational costs and environmental impact.

- Process Intensification: Microchannel technology enables more compact and efficient processing units, crucial for offshore platforms and remote locations.

- Harsh Environment Operations: The durability and reliability of microchannel heat exchangers are vital for withstanding the challenging conditions in oil and gas exploration and production.

- Strict Environmental Regulations: Increasing pressure to reduce emissions and improve operational sustainability pushes for adoption of advanced technologies.

- Global Energy Demand: Continued global reliance on oil and gas ensures sustained investment in infrastructure and processing capabilities.

- Dominance Analysis: The large-scale applications in refining, petrochemical processing, and gas treatment, coupled with the continuous need for equipment upgrades and maintenance, solidify the oil and gas sector's dominance. Investments in new refineries and enhanced oil recovery projects further bolster demand. The market size for microchannel heat exchangers within this segment is estimated to be XX Billion in 2025, with a projected CAGR of XX% during the forecast period.

- Key Drivers:

Dominant Construction Type: Plate Frame While Shell and Tube remains a prevalent construction type, the Plate Frame segment, and specifically its microchannel variants, are gaining significant traction due to their superior heat transfer efficiency and compact design.

- Key Drivers:

- High Thermal Performance: Plate frame microchannel designs offer significantly higher heat transfer coefficients, leading to more compact and cost-effective solutions.

- Flexibility and Modularity: These designs allow for easy scaling and adaptation to specific process requirements.

- Lower Fouling Tendencies: In certain applications, plate designs can offer advantages in reducing fouling compared to tube-based systems.

- Cost-Effectiveness: Despite initial investment, the increased efficiency and smaller footprint often lead to lower overall lifecycle costs.

- Dominance Analysis: The widespread adoption in industries like food and beverage, HVAC, and chemical processing, where space and efficiency are paramount, contributes to the dominance of plate frame microchannel heat exchangers. Their suitability for liquid-to-liquid and gas-to-liquid applications makes them versatile. The market share of plate frame microchannel heat exchangers is estimated to be XX% of the total market in 2025.

- Key Drivers:

Other Dominant Segments:

- Power Generation: The need for efficient cooling and heating in power plants, including renewable energy facilities, drives demand.

- Chemical Industry: Process optimization, energy recovery, and stringent safety standards favor the adoption of microchannel technology.

- Food and Beverages: Hygienic designs, efficient processing, and energy savings are key drivers for microchannel heat exchangers in this sector.

Microchannel Heat Exchanger Industry Product Innovations

Product innovations in the Microchannel Heat Exchanger industry are rapidly enhancing performance and expanding application scope. Key advancements include the development of new materials resistant to corrosion and high temperatures, and improved manufacturing techniques for greater precision and cost-effectiveness. Novel designs are focusing on maximizing heat transfer surface area within minimal volumes, leading to unprecedented thermal efficiency. For instance, the introduction of all-stainless steel brazed plate heat exchangers is improving durability and hygiene for food and beverage applications. Furthermore, specialized microchannel designs tailored for emerging sectors like fuel cells and advanced battery thermal management are gaining prominence, offering critical solutions for next-generation energy technologies. These innovations are not only improving existing applications but also opening doors to entirely new markets and functionalities.

Report Segmentation & Scope

This report meticulously segments the Microchannel Heat Exchanger industry by Construction Type and End User.

- Construction Type: The report analyzes Shell and Tube, Plate Frame, and Other Construction Types segments. Each sub-segment's market size, growth projections, and competitive dynamics are detailed, with Plate Frame microchannel heat exchangers expected to exhibit a CAGR of XX% during the forecast period, driven by their superior efficiency and compact nature.

- End User: The analysis covers key end-use sectors including the Oil and Gas Industry, Power Generation, Chemical, and Food and Beverages, alongside a category for Other End Users. The Oil and Gas Industry is projected to account for the largest market share, with an estimated XX Billion market value in 2025, showcasing consistent growth due to its critical role in global energy infrastructure.

Key Drivers of Microchannel Heat Exchanger Industry Growth

The growth of the Microchannel Heat Exchanger industry is propelled by a confluence of technological, economic, and regulatory factors.

- Technological Advancement: Continuous innovation in design, materials, and manufacturing processes leads to higher efficiency, smaller footprints, and enhanced durability. This includes advancements in brazing and welding techniques, and the development of novel geometries.

- Energy Efficiency Mandates: Increasing global pressure to reduce energy consumption and carbon emissions, driven by environmental concerns and government policies, necessitates the adoption of high-performance heat exchangers.

- Growth in Key End-Use Industries: Expansion in sectors like oil and gas, power generation, chemical processing, and the burgeoning renewable energy sector (e.g., fuel cells) directly fuels the demand for advanced heat transfer solutions.

- Miniaturization Trend: The demand for compact and lightweight equipment across various industries, from automotive to electronics cooling, favors microchannel technology's inherent advantages.

- Cost-Effectiveness: While initial costs can be higher, the long-term operational savings through improved energy efficiency and reduced maintenance often make microchannel heat exchangers a more economical choice.

Challenges in the Microchannel Heat Exchanger Industry Sector

Despite its strong growth trajectory, the Microchannel Heat Exchanger industry faces certain challenges.

- High Initial Manufacturing Costs: The complex manufacturing processes and specialized equipment required for microchannel heat exchangers can lead to higher upfront investment compared to conventional technologies, posing a barrier for some smaller enterprises.

- Material Limitations and Corrosion: While advancements are ongoing, ensuring long-term durability and resistance to aggressive media in certain extreme applications remains an area of focus.

- Scalability for Very Large Applications: While excellent for process intensification, scaling microchannel technology to exceptionally large-scale industrial processes might present engineering complexities and cost considerations.

- Supply Chain Complexity: Sourcing specialized raw materials and maintaining consistent quality across intricate manufacturing steps can create supply chain vulnerabilities.

- Awareness and Education: Educating potential end-users about the specific benefits and applications of microchannel heat exchangers, especially in comparison to established technologies, is an ongoing effort.

Leading Players in the Microchannel Heat Exchanger Industry Market

- Alfa Laval AB

- Danfoss AS

- GEA Group AG

- Kelvion Holding GmbH

- Mersen SA

- SPX Flow Inc

- Thermax Limited

- Barriquand Technologies Thermiques SAS

- Hisaka Works Ltd

- General Electric Company

Key Developments in Microchannel Heat Exchanger Industry Sector

- September 2023: APV, a part of SPX FLOW’s suite of process solutions, introduced the new Plate Heat Exchanger FastFrame. The product has improved usability and durability, which is expected to save time and money for food and beverage operators.

- April 2023: Researchers in India developed a PV-powered earth-to-air heat exchanger to provide space heating and cooling in buildings. According to them, the proposed system may generate an annual energy gain of 8116.7 kWh.

- March 2023: Alfa Laval launched AlfaNova GL50. The company claims the product is the first heat exchanger explicitly developed for fuel cell systems.

Strategic Microchannel Heat Exchanger Industry Market Outlook

The future outlook for the Microchannel Heat Exchanger industry is exceptionally bright, driven by an accelerating global emphasis on sustainability and energy efficiency. Strategic opportunities lie in the continuous innovation of materials and manufacturing, leading to further cost reductions and performance enhancements. The expansion into emerging sectors like electric vehicle thermal management, advanced cooling for data centers, and hydrogen energy systems presents significant growth accelerators. Collaboration between technology providers and end-users will be crucial for developing bespoke solutions that address specific industry challenges. Furthermore, the growing demand for process intensification and miniaturization across diverse applications will continue to propel market expansion. Investments in research and development focused on creating more environmentally friendly and high-performance heat exchangers will solidify the industry's pivotal role in achieving global energy and environmental goals.

Microchannel Heat Exchanger Industry Segmentation

-

1. Construction Type

- 1.1. Shell and Tube

- 1.2. Plate Frame

- 1.3. Other Construction Types

-

2. End User

- 2.1. Oil and Gas Industry

- 2.2. Power Generation

- 2.3. Chemical

- 2.4. Food and Beverages

- 2.5. Other End Users

Microchannel Heat Exchanger Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. NORDIC

- 2.6. Italy

- 2.7. Spain

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Thailand

- 3.6. Indonesia

- 3.7. Malaysia

- 3.8. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Qatar

- 5.4. Nigeria

- 5.5. South Africa

- 5.6. Egypt

- 5.7. Rest of the Middle East and Africa

Microchannel Heat Exchanger Industry Regional Market Share

Geographic Coverage of Microchannel Heat Exchanger Industry

Microchannel Heat Exchanger Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Power Generation Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Microchannel Heat Exchanger Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Construction Type

- 5.1.1. Shell and Tube

- 5.1.2. Plate Frame

- 5.1.3. Other Construction Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Oil and Gas Industry

- 5.2.2. Power Generation

- 5.2.3. Chemical

- 5.2.4. Food and Beverages

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Construction Type

- 6. North America Microchannel Heat Exchanger Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Construction Type

- 6.1.1. Shell and Tube

- 6.1.2. Plate Frame

- 6.1.3. Other Construction Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Oil and Gas Industry

- 6.2.2. Power Generation

- 6.2.3. Chemical

- 6.2.4. Food and Beverages

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Construction Type

- 7. Europe Microchannel Heat Exchanger Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Construction Type

- 7.1.1. Shell and Tube

- 7.1.2. Plate Frame

- 7.1.3. Other Construction Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Oil and Gas Industry

- 7.2.2. Power Generation

- 7.2.3. Chemical

- 7.2.4. Food and Beverages

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Construction Type

- 8. Asia Pacific Microchannel Heat Exchanger Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Construction Type

- 8.1.1. Shell and Tube

- 8.1.2. Plate Frame

- 8.1.3. Other Construction Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Oil and Gas Industry

- 8.2.2. Power Generation

- 8.2.3. Chemical

- 8.2.4. Food and Beverages

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Construction Type

- 9. South America Microchannel Heat Exchanger Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Construction Type

- 9.1.1. Shell and Tube

- 9.1.2. Plate Frame

- 9.1.3. Other Construction Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Oil and Gas Industry

- 9.2.2. Power Generation

- 9.2.3. Chemical

- 9.2.4. Food and Beverages

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Construction Type

- 10. Middle East and Africa Microchannel Heat Exchanger Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Construction Type

- 10.1.1. Shell and Tube

- 10.1.2. Plate Frame

- 10.1.3. Other Construction Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Oil and Gas Industry

- 10.2.2. Power Generation

- 10.2.3. Chemical

- 10.2.4. Food and Beverages

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Construction Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Danfoss AS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thermax Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kelvion Holding GmbH*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysi

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mersen SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Barriquand Technologies Thermiques SAS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SPX Flow Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 General Electric Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hisaka Works Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alfa Laval AB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Danfoss AS

List of Figures

- Figure 1: Global Microchannel Heat Exchanger Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Microchannel Heat Exchanger Industry Revenue (Million), by Construction Type 2025 & 2033

- Figure 3: North America Microchannel Heat Exchanger Industry Revenue Share (%), by Construction Type 2025 & 2033

- Figure 4: North America Microchannel Heat Exchanger Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Microchannel Heat Exchanger Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Microchannel Heat Exchanger Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Microchannel Heat Exchanger Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Microchannel Heat Exchanger Industry Revenue (Million), by Construction Type 2025 & 2033

- Figure 9: Europe Microchannel Heat Exchanger Industry Revenue Share (%), by Construction Type 2025 & 2033

- Figure 10: Europe Microchannel Heat Exchanger Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Microchannel Heat Exchanger Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Microchannel Heat Exchanger Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Microchannel Heat Exchanger Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Microchannel Heat Exchanger Industry Revenue (Million), by Construction Type 2025 & 2033

- Figure 15: Asia Pacific Microchannel Heat Exchanger Industry Revenue Share (%), by Construction Type 2025 & 2033

- Figure 16: Asia Pacific Microchannel Heat Exchanger Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Microchannel Heat Exchanger Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Microchannel Heat Exchanger Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Microchannel Heat Exchanger Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Microchannel Heat Exchanger Industry Revenue (Million), by Construction Type 2025 & 2033

- Figure 21: South America Microchannel Heat Exchanger Industry Revenue Share (%), by Construction Type 2025 & 2033

- Figure 22: South America Microchannel Heat Exchanger Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: South America Microchannel Heat Exchanger Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: South America Microchannel Heat Exchanger Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Microchannel Heat Exchanger Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Microchannel Heat Exchanger Industry Revenue (Million), by Construction Type 2025 & 2033

- Figure 27: Middle East and Africa Microchannel Heat Exchanger Industry Revenue Share (%), by Construction Type 2025 & 2033

- Figure 28: Middle East and Africa Microchannel Heat Exchanger Industry Revenue (Million), by End User 2025 & 2033

- Figure 29: Middle East and Africa Microchannel Heat Exchanger Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa Microchannel Heat Exchanger Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Microchannel Heat Exchanger Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 2: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 5: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 12: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 13: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Germany Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: NORDIC Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 23: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 24: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: India Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: China Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Australia Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Thailand Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 34: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Brazil Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Argentina Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Colombia Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 41: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Microchannel Heat Exchanger Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: United Arab Emirates Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Saudi Arabia Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Qatar Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Nigeria Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: South Africa Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Egypt Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Rest of the Middle East and Africa Microchannel Heat Exchanger Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Microchannel Heat Exchanger Industry?

The projected CAGR is approximately 9.34%.

2. Which companies are prominent players in the Microchannel Heat Exchanger Industry?

Key companies in the market include Danfoss AS, Thermax Limited, Kelvion Holding GmbH*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysi, Mersen SA, Barriquand Technologies Thermiques SAS, SPX Flow Inc, General Electric Company, Hisaka Works Ltd, Alfa Laval AB.

3. What are the main segments of the Microchannel Heat Exchanger Industry?

The market segments include Construction Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.08 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants.

6. What are the notable trends driving market growth?

Power Generation Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

September 2023: APV, a part of SPX FLOW’s suite of process solutions, introduced the new Plate Heat Exchanger FastFrame. The product has improved usability and durability, which is expected to save time and money for food and beverage operators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Microchannel Heat Exchanger Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Microchannel Heat Exchanger Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Microchannel Heat Exchanger Industry?

To stay informed about further developments, trends, and reports in the Microchannel Heat Exchanger Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence