Key Insights

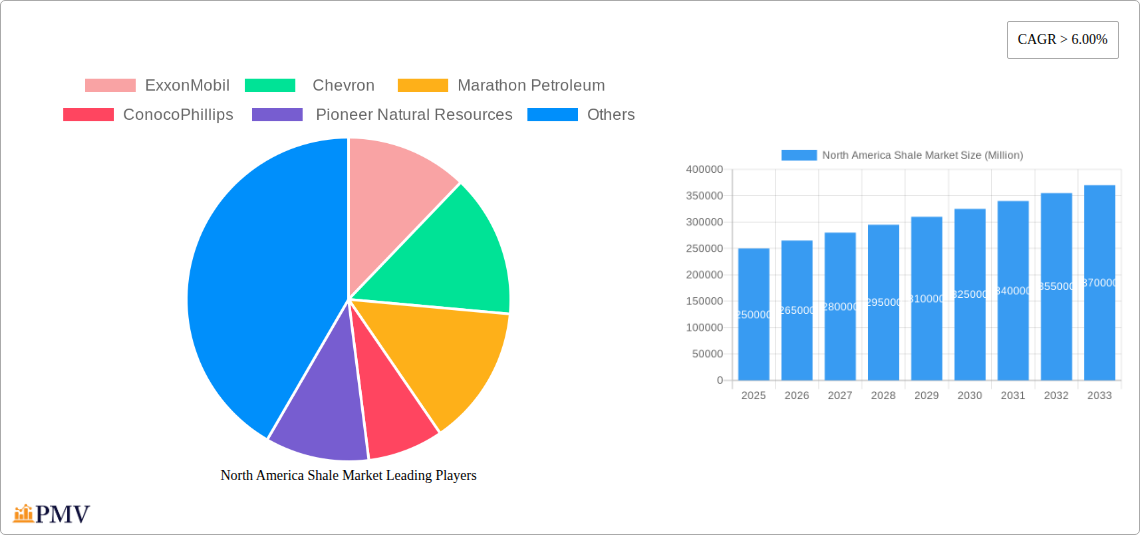

The North American shale market is projected for significant expansion, with an estimated market size of $88.6 billion in 2024. This sector is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.9% through 2032. This growth is driven by advancements in extraction technologies, increasing global energy requirements for natural gas and crude oil, and established regional infrastructure. Key players like ExxonMobil, Chevron, and ConocoPhillips are spearheading innovation and operational efficiency. The United States, particularly the Permian Basin, will remain a dominant force in production and consumption, with Canada also playing a significant role.

North America Shale Market Market Size (In Billion)

Key trends influencing the competitive landscape include enhanced efficiency, cost optimization, and the adoption of digital technologies. Challenges such as crude oil price volatility, environmental considerations, and decarbonization pressures are being addressed through industry adaptability and R&D investments. The market is segmented by production, consumption, trade, and pricing, all indicating robust sustained demand. Continued development of existing and new shale plays will solidify the North American shale market's vital contribution to the global energy supply.

North America Shale Market Company Market Share

North America Shale Market: Comprehensive Forecast (2019–2033) – Production, Consumption, Imports, Exports, Pricing & Industry Dynamics

This in-depth report delivers a detailed analysis of the North America Shale Market, providing critical insights into production, consumption, import/export dynamics, price trends, and key industry developments. Spanning the historical period from 2019 to 2024, with a base and estimated year of 2025, and a robust forecast period extending to 2033, this report is an essential resource for stakeholders seeking to understand market evolution and identify growth opportunities in the North American oil and gas sector, specifically focusing on shale oil and gas production. Our analysis leverages advanced methodologies to offer precise market valuations and volume estimations in millions.

North America Shale Market Market Structure & Competitive Dynamics

The North America Shale Market is characterized by a moderately concentrated structure, with several major players dominating production and exploration activities. Key companies such as ExxonMobil, Chevron, Marathon Petroleum, ConocoPhillips, and Pioneer Natural Resources hold significant market shares. Innovation ecosystems are driven by advancements in horizontal drilling and hydraulic fracturing (fracking) technologies, continually enhancing extraction efficiency and accessing previously uneconomical reserves. Regulatory frameworks, particularly concerning environmental impact and land use, play a crucial role in shaping market entry and operational strategies. Product substitutes, primarily traditional crude oil sources and increasingly renewable energy alternatives, exert some pressure, though the cost-effectiveness and scale of shale production maintain its competitive edge. End-user trends are largely dictated by global energy demand, refining capacities, and petrochemical feedstock requirements. Mergers and acquisitions (M&A) activities are observed as companies seek to consolidate assets, achieve economies of scale, and secure market positions. For instance, significant M&A deals exceeding $10,000 Million have been recorded historically, reflecting strategic consolidations. The market share of the top 5 players is estimated to be around 60-70%, showcasing a degree of market concentration.

North America Shale Market Industry Trends & Insights

The North America Shale Market is experiencing dynamic shifts driven by a confluence of technological advancements, evolving global energy policies, and persistent demand for hydrocarbons. The CAGR for the North American shale oil and gas market is projected to be approximately 3.5% during the forecast period. Key growth drivers include the continuous refinement of extraction techniques, leading to improved well productivity and reduced operational costs, making shale resources increasingly competitive against conventional oil. Technological disruptions, such as enhanced oil recovery (EOR) methods adapted for shale formations and innovations in water management for hydraulic fracturing, are critical in sustaining production levels. Consumer preferences, while increasingly leaning towards cleaner energy sources, are still significantly influenced by the need for reliable and affordable energy for transportation, industrial processes, and power generation, where shale plays a vital role. Competitive dynamics are intense, with companies constantly vying for prime acreage, technological superiority, and cost leadership. The market penetration of shale oil and gas in the global energy mix has been substantial over the past decade. Furthermore, government incentives and favorable regulatory environments in certain regions within North America have further bolstered exploration and production activities. Geopolitical factors also significantly influence price volatility and investment decisions within the sector. The increasing demand for natural gas as a cleaner transition fuel is also a significant accelerator for shale gas production.

Dominant Markets & Segments in North America Shale Market

The North America Shale Market is dominated by the United States, which accounts for over 80% of the total regional production and consumption. Within the U.S., the Permian Basin remains the most prolific shale play, contributing the largest share to both Production Analysis and Consumption Analysis.

- Production Analysis: Key drivers for dominance in regions like the Permian Basin include vast proven reserves, advanced infrastructure for extraction and transportation, and a favorable regulatory environment for oil and gas exploration. The estimated production volume in 2025 is projected to reach 15,000 Million barrels of oil equivalent.

- Consumption Analysis: The significant refining capacity and robust industrial base in the U.S. drive high consumption. Petrochemical industries are also major consumers of shale-derived natural gas. The estimated consumption volume in 2025 is expected to be around 12,000 Million barrels of oil equivalent.

- Import Market Analysis (Value & Volume): While North America is a net exporter, specific refined products or specialized crude grades might be imported. The estimated import value in 2025 is anticipated to be around $5,000 Million, with volumes around 200 Million barrels. Key drivers for imports include regional supply-demand imbalances and specialized product needs.

- Export Market Analysis (Value & Volume): The North America Shale Market is a significant global exporter, particularly of crude oil and Liquefied Natural Gas (LNG). The estimated export value in 2025 is projected at $80,000 Million, with volumes around 3,500 Million barrels of oil equivalent. Growth in LNG exports is a major trend, driven by international demand for cleaner energy sources.

- Price Trend Analysis: Price trends are influenced by global crude oil benchmarks (WTI, Brent), domestic supply dynamics, OPEC+ decisions, and geopolitical events. The average price of WTI crude is projected to range between $75-$85 per barrel in 2025.

North America Shale Market Product Innovations

Product innovations in the North America Shale Market are primarily focused on enhancing extraction efficiency, reducing environmental impact, and improving the quality of extracted hydrocarbons. Advancements in horizontal drilling and multi-stage hydraulic fracturing technologies continue to unlock previously inaccessible reserves, boosting well productivity. Innovations in drilling fluid formulations, proppant technologies, and water recycling techniques are crucial for sustainability and cost reduction. Furthermore, research into capturing and utilizing associated natural gas is gaining traction, addressing environmental concerns and creating value from byproducts. These innovations provide a competitive advantage by lowering extraction costs and improving operational safety.

Report Segmentation & Scope

This report segments the North America Shale Market by Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. The Production Analysis segment is expected to witness a CAGR of 3.8%, reaching an estimated 18,000 Million barrels by 2033. Consumption Analysis is projected to grow at a CAGR of 3.2%, reaching 14,000 Million barrels by 2033. The Import Market is analyzed for value and volume, with projections indicating a stable to slightly growing trend. The Export Market is a significant growth area, particularly for LNG, with a projected CAGR of 4.5%, reaching volumes of 5,000 Million barrels by 2033. The Price Trend Analysis provides outlooks for key benchmarks like WTI.

Key Drivers of North America Shale Market Growth

Several key factors are driving the growth of the North America Shale Market. Technological advancements in drilling and hydraulic fracturing techniques have significantly improved extraction efficiency and reduced costs, making shale economically viable. The vast, proven reserves of shale oil and gas in North America provide a substantial resource base for sustained production. Furthermore, a generally favorable regulatory environment in key producing regions, coupled with robust demand from both domestic and international markets for energy and petrochemical feedstocks, acts as a significant growth accelerator. The increasing global demand for natural gas as a transition fuel further bolsters the growth of shale gas production.

Challenges in the North America Shale Market Sector

Despite robust growth, the North America Shale Market faces several challenges. Stringent environmental regulations concerning water usage, methane emissions, and land reclamation can increase operational costs and complexity. Supply chain disruptions and the availability of specialized equipment and skilled labor can impact project timelines and profitability. Volatility in global crude oil prices creates uncertainty for investment decisions and can affect the economic viability of new projects. Additionally, growing public and investor pressure for decarbonization and sustainable energy practices poses a long-term challenge to the fossil fuel industry.

Leading Players in the North America Shale Market Market

- ExxonMobil

- Chevron

- Marathon Petroleum

- ConocoPhillips

- Pioneer Natural Resources

Key Developments in North America Shale Market Sector

- 2023/Q4: Major players continue to invest in efficiency improvements and cost reduction strategies to maintain profitability amid price fluctuations.

- 2024/Q1: Increased focus on methane emission reduction technologies and carbon capture initiatives by leading companies.

- 2024/Q2: Acquisitions and consolidations continue as companies seek to optimize acreage and production portfolios.

- 2024/Q3: Growing investment in LNG export infrastructure to meet rising international demand.

- 2024/Q4: Companies are exploring advanced drilling techniques to maximize recovery rates from existing shale plays.

Strategic North America Shale Market Market Outlook

The strategic outlook for the North America Shale Market remains positive, driven by sustained global energy demand and the region's significant resource base. Growth accelerators include ongoing technological innovation, which continues to enhance extraction efficiency and reduce environmental footprints. The increasing global demand for natural gas as a cleaner transition fuel presents a significant opportunity for shale gas producers. Furthermore, strategic investments in infrastructure, particularly for LNG exports, will solidify North America's position as a key global energy supplier. Companies that can effectively manage regulatory complexities, maintain cost competitiveness, and adapt to evolving environmental standards are poised for continued success.

North America Shale Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Shale Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Shale Market Regional Market Share

Geographic Coverage of North America Shale Market

North America Shale Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of Offshore Operations 4.; Demand Coming for Unconventional Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; Demand for Renewable Energy

- 3.4. Market Trends

- 3.4.1. Shale Gas to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Shale Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Shale Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Canada North America Shale Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Rest of North America North America Shale Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 ExxonMobil

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Chevron

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Marathon Petroleum

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 ConocoPhillips

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Pioneer Natural Resources

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.1 ExxonMobil

List of Figures

- Figure 1: North America Shale Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Shale Market Share (%) by Company 2025

List of Tables

- Table 1: North America Shale Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Shale Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Shale Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Shale Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Shale Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Shale Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: North America Shale Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Shale Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Shale Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Shale Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Shale Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Shale Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Shale Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: North America Shale Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 15: North America Shale Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: North America Shale Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: North America Shale Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: North America Shale Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: North America Shale Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 20: North America Shale Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 21: North America Shale Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: North America Shale Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: North America Shale Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: North America Shale Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Shale Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the North America Shale Market?

Key companies in the market include ExxonMobil, Chevron , Marathon Petroleum , ConocoPhillips , Pioneer Natural Resources.

3. What are the main segments of the North America Shale Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.6 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of Offshore Operations 4.; Demand Coming for Unconventional Energy Sources.

6. What are the notable trends driving market growth?

Shale Gas to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Demand for Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Shale Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Shale Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Shale Market?

To stay informed about further developments, trends, and reports in the North America Shale Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence