Key Insights

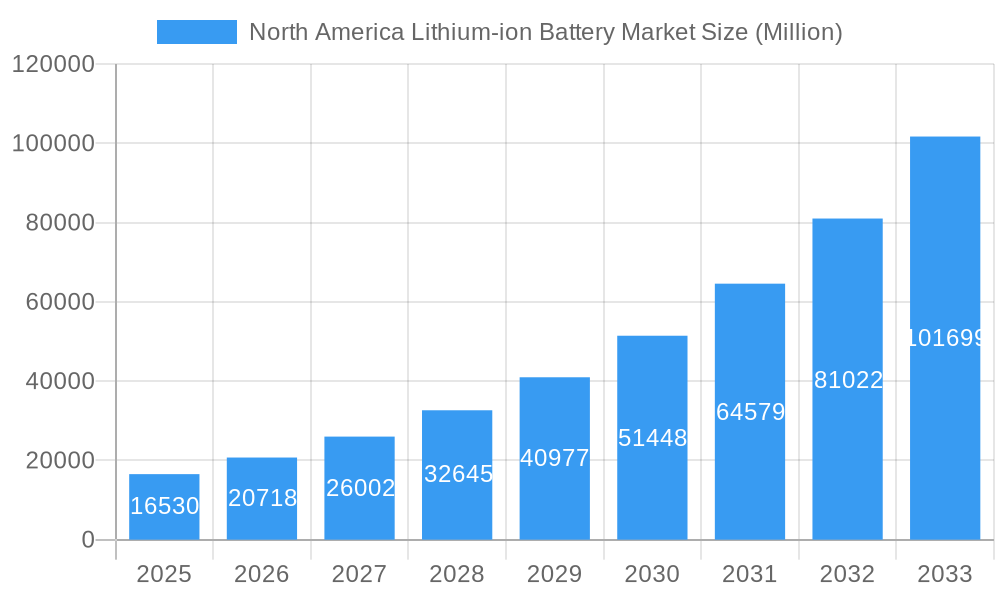

The North America Lithium-ion Battery Market is poised for remarkable expansion, projected to reach an estimated $16.53 billion in 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 25.35%. This robust growth trajectory is fueled by escalating demand across key applications, most notably consumer electronics and the rapidly evolving automotive sector. The increasing adoption of electric vehicles (EVs) in North America is a primary catalyst, creating a substantial need for high-performance lithium-ion batteries. Furthermore, industrial applications, including energy storage systems and grid stabilization, are also contributing significantly to market expansion as the region prioritizes renewable energy integration and grid modernization. The "Other" application segment is expected to encompass emerging uses and innovative technologies, further bolstering the overall market size.

North America Lithium-ion Battery Market Market Size (In Billion)

The competitive landscape of the North American lithium-ion battery market is characterized by the presence of established global leaders and emerging innovators. Key players such as EnerSys, Contemporary Amperex Technology Co. Limited (CATL), Samsung SDI Co. Ltd., LG Chem Ltd., and Tesla Inc. are actively investing in research, development, and manufacturing capacity to meet the surging demand. Companies like Clarios, BYD Company Ltd., Duracell Inc., VARTA AG, Panasonic Corporation, and Sony Corporation are also significant contributors, each bringing unique strengths and market focus. While the market demonstrates immense potential, it faces certain restraints, including fluctuations in raw material prices, increasing regulatory scrutiny regarding battery recycling and disposal, and the ongoing challenge of scaling production to meet exponential demand. Nevertheless, the strong momentum in EV adoption and the broader push towards electrification are expected to overshadow these challenges, paving the way for sustained and dynamic growth in the North American lithium-ion battery market through 2033.

North America Lithium-ion Battery Market Company Market Share

North America Lithium-ion Battery Market: Comprehensive Report & Analysis (2019-2033)

This in-depth report provides a detailed analysis of the North America Lithium-ion Battery Market, offering critical insights for stakeholders navigating this rapidly evolving sector. Covering the historical period of 2019-2024, the base year of 2025, and a comprehensive forecast period extending to 2033, this study dissects market dynamics, key players, technological advancements, and growth opportunities. With an estimated market size of $XX Million in 2025, the North America lithium-ion battery market is poised for significant expansion driven by the surging demand for electric vehicles (EVs), consumer electronics, and industrial applications. Our analysis utilizes high-ranking SEO keywords such as "lithium-ion battery market North America," "EV battery market," "battery manufacturing North America," "battery technology," "energy storage solutions," and "sustainable battery production" to ensure maximum visibility and engagement for industry professionals.

North America Lithium-ion Battery Market Market Structure & Competitive Dynamics

The North America lithium-ion battery market is characterized by a dynamic and increasingly concentrated competitive landscape. Key players are investing heavily in research and development, expanding manufacturing capacities, and forging strategic partnerships to secure a dominant market share. Innovation ecosystems are thriving, driven by advancements in battery chemistry, energy density, and charging speeds. Regulatory frameworks are evolving to support domestic production and sustainable practices, influencing investment decisions and market entry barriers. Product substitutes, such as solid-state batteries and alternative energy storage technologies, are emerging but are yet to significantly disrupt the dominant lithium-ion market share. End-user trends, particularly the rapid adoption of electric vehicles and the increasing demand for portable power solutions in consumer electronics, are reshaping product development and market penetration strategies. Mergers and acquisitions (M&A) activities are prevalent as larger companies aim to consolidate their positions, acquire new technologies, and expand their geographical reach. Notable M&A deal values are anticipated to rise as the market matures.

- Market Concentration: Moderate to high, with a few dominant players holding significant market share.

- Innovation Ecosystems: Flourishing, with substantial R&D investment in next-generation battery technologies.

- Regulatory Frameworks: Supportive of domestic manufacturing and sustainability initiatives, impacting import/export dynamics.

- Product Substitutes: Emerging technologies like solid-state batteries are under development but currently represent a minor market share.

- End-User Trends: Strong demand from the automotive (EVs) and consumer electronics sectors are primary market drivers.

- M&A Activities: Expected to increase as companies seek consolidation and technological acquisition.

North America Lithium-ion Battery Market Industry Trends & Insights

The North America lithium-ion battery market is experiencing robust growth, projected to achieve a significant Compound Annual Growth Rate (CAGR) of XX% over the forecast period (2025-2033). This expansion is fueled by a confluence of factors, including escalating government incentives for electric vehicle adoption, falling battery costs, and a growing consumer awareness of environmental sustainability. Technological disruptions are at the forefront, with continuous advancements in battery chemistries such as Nickel-Manganese-Cobalt (NMC), Lithium Iron Phosphate (LFP), and the exploration of solid-state battery technologies promising higher energy density, enhanced safety, and faster charging capabilities. Consumer preferences are increasingly leaning towards longer-range electric vehicles and more powerful, longer-lasting portable electronic devices. The competitive dynamics within the industry are intensifying, with both established global manufacturers and emerging North American players vying for market dominance. The increasing market penetration of electric vehicles, coupled with the expansion of charging infrastructure, is creating a virtuous cycle of demand for lithium-ion batteries. Furthermore, the growing emphasis on domestic battery production and supply chain resilience is driving substantial investments in gigafactories and raw material sourcing within North America. The development of advanced battery management systems (BMS) and sophisticated recycling processes are also key trends shaping the industry.

Dominant Markets & Segments in North America Lithium-ion Battery Market

The North America lithium-ion battery market is predominantly driven by the Automotive application segment, which accounts for the largest market share. This dominance is underpinned by the rapid electrification of the automotive industry across the United States, Canada, and Mexico, spurred by ambitious government targets for EV adoption and a substantial increase in the availability of electric vehicle models.

Leading Region/Country: While the entire North American region is significant, the United States currently holds the largest market share due to its extensive EV market, robust manufacturing base, and substantial government investments in battery production and research. Canada and Mexico are also exhibiting strong growth trajectories.

Dominant Application Segment: Automotive

- Key Drivers:

- Government Policies & Incentives: Federal and state/provincial tax credits, subsidies, and mandates for zero-emission vehicle sales.

- Infrastructure Development: Expansion of charging networks across major urban and highway corridors.

- Consumer Demand: Growing consumer preference for EVs due to environmental concerns, lower running costs, and improved vehicle performance.

- Automaker Commitments: Significant investments by major automakers in developing and producing electric vehicles.

- Detailed Dominance Analysis: The automotive sector's reliance on high-capacity, reliable lithium-ion batteries for powering electric vehicles is the primary growth engine. The increasing production volumes of EVs translate directly into substantial demand for battery cells and packs. The ongoing transition from internal combustion engine (ICE) vehicles to EVs is expected to sustain this dominance for the foreseeable future.

- Key Drivers:

Consumer Electronics: This segment remains a significant contributor, driven by the ubiquitous demand for smartphones, laptops, tablets, wearables, and other portable electronic devices. However, its growth rate is generally lower compared to the automotive sector.

- Key Drivers:

- Technological Advancements: Miniaturization and increased energy density of batteries for smaller, more powerful devices.

- Consumer Gadget Popularity: Continuous innovation and release of new consumer electronics.

- Market Position: Second largest segment, with stable and consistent demand.

- Key Drivers:

Industrial Applications: This segment encompasses energy storage systems (ESS) for grid stabilization, renewable energy integration, backup power for data centers and telecommunications, and power tools.

- Key Drivers:

- Renewable Energy Integration: Demand for ESS to manage the intermittency of solar and wind power.

- Grid Modernization: Need for improved grid reliability and resilience.

- Industrial Automation: Increasing use of battery-powered equipment in manufacturing and logistics.

- Growth Potential: High growth potential, particularly in grid-scale energy storage and backup power solutions.

- Key Drivers:

Other Applications: This broad category includes electric bikes, scooters, medical devices, and specialized military applications, each contributing to the overall market.

- Drivers: Niche but growing demand across various specialized sectors.

North America Lithium-ion Battery Market Product Innovations

Product innovations in the North America lithium-ion battery market are focused on enhancing energy density, improving safety, reducing charging times, and extending battery lifespan. Key advancements include the development of new cathode and anode materials, improved electrolyte formulations, and novel battery cell designs. For example, the rise of Lithium Iron Phosphate (LFP) batteries offers enhanced safety and lower cost, making them increasingly popular for electric vehicles and energy storage systems. The ongoing research into solid-state battery technology promises breakthroughs in safety and performance, with the potential to revolutionize the market. These innovations provide competitive advantages by enabling manufacturers to offer products that meet the evolving demands of consumers and industries for higher performance, greater sustainability, and improved cost-effectiveness.

Report Segmentation & Scope

This report segments the North America Lithium-ion Battery Market by Application, providing a detailed analysis of each category. The scope encompasses the United States, Canada, and Mexico.

- Consumer Electronics: This segment covers batteries used in smartphones, laptops, tablets, wearables, gaming consoles, and other personal electronic devices. Growth is driven by the continuous innovation in consumer gadgets and the demand for longer battery life.

- Automotive: This is a dominant segment, including batteries for battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs). Significant growth is projected due to the accelerating adoption of EVs and supportive government policies.

- Industrial: This segment includes batteries for energy storage systems (ESS) for grid applications, backup power solutions for data centers and telecommunications, industrial machinery, and electric forklifts. The expansion of renewable energy sources and the need for grid stability are key growth drivers.

- Other Applications: This broad segment comprises batteries for electric bikes and scooters, medical devices, power tools, drones, and specialized military applications, each contributing to niche market growth.

Key Drivers of North America Lithium-ion Battery Market Growth

The North America lithium-ion battery market is propelled by several interconnected drivers:

- Technological Advancements: Continuous improvements in battery energy density, charging speed, and safety are making lithium-ion batteries more attractive across various applications. Innovations in materials science and manufacturing processes are crucial.

- Government Support and Regulations: Favorable government policies, including tax incentives for EV purchases, subsidies for battery manufacturing, and stringent emissions standards, are significantly stimulating demand for lithium-ion batteries, especially in the automotive sector.

- Growing Demand for Electric Vehicles (EVs): The rapidly expanding EV market is the single largest growth driver, with increasing consumer acceptance and a wider range of EV models available.

- Energy Storage Solutions: The integration of renewable energy sources like solar and wind power necessitates robust energy storage solutions, driving the demand for large-scale lithium-ion battery systems.

- Sustainability and Environmental Concerns: A growing global emphasis on reducing carbon footprints and promoting clean energy is accelerating the transition to electric mobility and renewable energy storage, which heavily rely on lithium-ion battery technology.

Challenges in the North America Lithium-ion Battery Market Sector

Despite its robust growth, the North America lithium-ion battery market faces several challenges:

- Raw Material Supply Chain Volatility: Dependence on certain critical minerals like lithium, cobalt, and nickel, which are subject to geopolitical risks, price fluctuations, and supply chain disruptions, poses a significant challenge.

- High Initial Costs: While decreasing, the initial cost of lithium-ion batteries, particularly for large-scale applications like EVs and grid storage, can still be a barrier to widespread adoption.

- Recycling and Disposal Issues: The effective and environmentally sound recycling of spent lithium-ion batteries is an ongoing challenge. Developing scalable and economically viable recycling processes is critical for sustainability.

- Manufacturing Capacity Expansion: Meeting the soaring demand requires substantial investment in building and expanding gigafactories and related infrastructure, which can be capital-intensive and time-consuming.

- Technological Obsolescence: Rapid advancements in battery technology can lead to faster obsolescence of existing products, requiring continuous investment in research and development.

Leading Players in the North America Lithium-ion Battery Market Market

- EnerSys

- Contemporary Amperex Technology Co Limited

- Samsung SDI Co Ltd

- LG Chem Ltd

- Tesla Inc

- Clarios (Formerly Johnson Controls International PLC)

- BYD Company Ltd

- Duracell Inc

- VARTA AG

- Panasonic Corporation

- Sony Corporation

Key Developments in North America Lithium-ion Battery Market Sector

- February 2023: Ascend Elements, a United States-based battery recycling and engineered materials company, announced a basic agreement with Honda Motor Co. Ltd to collaborate on stable procurement of recycled lithium-ion battery materials for Honda electric vehicles in North America, which is expected to reduce the carbon footprint of electric vehicles.

- January 2023: United States battery manufacturer Yoshino Technology announced the development of solid-state lithium-ion batteries with outputs ranging from 330 W to 4,000 W designed for home backup, off-grid applications, and powering small industrial machinery. The system can be used in combination with solar panels. The 4,000 W power station has a peak power of 6000 W and 2,611 Wh capacity. A 600 W solar panel can fully recharge in 5.5 hours.

Strategic North America Lithium-ion Battery Market Market Outlook

The strategic outlook for the North America lithium-ion battery market is exceptionally promising, driven by a confluence of supportive government policies, accelerating technological innovation, and robust demand from key sectors. The ongoing transition to electric mobility is a primary growth accelerator, with substantial investments in EV manufacturing and charging infrastructure creating a sustained demand for high-performance batteries. Furthermore, the increasing focus on energy independence and grid modernization is fueling the growth of energy storage solutions, positioning lithium-ion batteries as a critical component in the clean energy transition. The emphasis on developing a resilient domestic supply chain, including raw material sourcing and advanced manufacturing capabilities, presents significant investment opportunities and strategic advantages for companies operating within the region. The continuous evolution of battery chemistries and the exploration of next-generation technologies, such as solid-state batteries, will further enhance the market's potential, offering improved safety, efficiency, and sustainability. Stakeholders who can adapt to these trends, innovate effectively, and navigate the evolving regulatory landscape are poised for substantial growth and success in this dynamic market.

North America Lithium-ion Battery Market Segmentation

-

1. Application

- 1.1. Consumer Electronics

- 1.2. Automotive

- 1.3. Industri

- 1.4. Other Ap

North America Lithium-ion Battery Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Lithium-ion Battery Market Regional Market Share

Geographic Coverage of North America Lithium-ion Battery Market

North America Lithium-ion Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Lithium-Ion Battery Prices4.; Increasing Adoption Of Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. 4.; Safety Concerns Related To Lithium-Ion Battery

- 3.4. Market Trends

- 3.4.1. Automotive Batteries Expected to be the Fastest-growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Lithium-ion Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Consumer Electronics

- 5.1.2. Automotive

- 5.1.3. Industri

- 5.1.4. Other Ap

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United States North America Lithium-ion Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Consumer Electronics

- 6.1.2. Automotive

- 6.1.3. Industri

- 6.1.4. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Canada North America Lithium-ion Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Consumer Electronics

- 7.1.2. Automotive

- 7.1.3. Industri

- 7.1.4. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Rest of North America North America Lithium-ion Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Consumer Electronics

- 8.1.2. Automotive

- 8.1.3. Industri

- 8.1.4. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 EnerSys

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Contemporary Amperex Technology Co Limited

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Samsung SDI Co Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 LG Chem Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Tesla Inc *List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Clarios (Formerly Johnson Controls International PLC)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 BYD Company Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Duracell Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 VARTA AG

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Panasonic Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Sony Corporation

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 EnerSys

List of Figures

- Figure 1: North America Lithium-ion Battery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Lithium-ion Battery Market Share (%) by Company 2025

List of Tables

- Table 1: North America Lithium-ion Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: North America Lithium-ion Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 3: North America Lithium-ion Battery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Lithium-ion Battery Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: North America Lithium-ion Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: North America Lithium-ion Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 7: North America Lithium-ion Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: North America Lithium-ion Battery Market Volume K Units Forecast, by Country 2020 & 2033

- Table 9: North America Lithium-ion Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: North America Lithium-ion Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 11: North America Lithium-ion Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Lithium-ion Battery Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: North America Lithium-ion Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: North America Lithium-ion Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 15: North America Lithium-ion Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Lithium-ion Battery Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Lithium-ion Battery Market?

The projected CAGR is approximately 25.35%.

2. Which companies are prominent players in the North America Lithium-ion Battery Market?

Key companies in the market include EnerSys, Contemporary Amperex Technology Co Limited, Samsung SDI Co Ltd, LG Chem Ltd, Tesla Inc *List Not Exhaustive, Clarios (Formerly Johnson Controls International PLC), BYD Company Ltd, Duracell Inc, VARTA AG, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the North America Lithium-ion Battery Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.53 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Lithium-Ion Battery Prices4.; Increasing Adoption Of Electric Vehicles.

6. What are the notable trends driving market growth?

Automotive Batteries Expected to be the Fastest-growing Segment.

7. Are there any restraints impacting market growth?

4.; Safety Concerns Related To Lithium-Ion Battery.

8. Can you provide examples of recent developments in the market?

February 2023: Ascend Elements, a United States-based battery recycling and engineered materials company announced a basic agreement with Honda Motor Co. Ltd to collaborate on stable procurement of recycled lithium-ion battery materials for Honda electric vehicles in North America, which is expected to reduce the carbon footprint of electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Lithium-ion Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Lithium-ion Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Lithium-ion Battery Market?

To stay informed about further developments, trends, and reports in the North America Lithium-ion Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence