Key Insights

The global Excitation Systems market is projected to reach over USD 5,500 million by 2033, expanding at a CAGR of 4.3% from 2025 to 2033. This growth is driven by the increasing demand for reliable and efficient power generation across renewable energy, industrial machinery, and utilities. The integration of advanced technologies such as brushless excitation systems and digital controls enhances power quality and reduces operational costs. Key market drivers include the modernization of existing power infrastructure, investments in new power plants, particularly in emerging economies, and the adoption of smart grid technologies. The expansion of renewable energy sources also necessitates precise synchronization, fueling demand for advanced excitation systems.

Excitation Systems Industry Market Size (In Billion)

The market is segmented by type into static and brushless systems, and by application into synchronous generators and synchronous motors. Brushless systems are gaining popularity due to their lower maintenance and increased durability, while static systems remain a robust choice. Geographically, the Asia Pacific region is expected to dominate market growth, propelled by rapid industrialization and government initiatives for power generation expansion. North America and Europe will remain significant markets, focusing on grid upgrades and energy efficiency. Challenges such as high initial costs and the need for skilled personnel may influence market expansion, but the overall trend towards electrification and grid stability ensures a positive outlook.

Excitation Systems Industry Company Market Share

This comprehensive report analyzes the global Excitation Systems market, providing insights into market structure, competitive dynamics, trends, and future projections from 2019 to 2033, with a base year of 2025. It examines static and brushless excitation systems, synchronous generator and motor excitation, and offers intelligence on power generation, renewable energy, and industrial motor excitation solutions. The report covers market size: 3.38 billion.

Excitation Systems Industry Market Structure & Competitive Dynamics

The Excitation Systems Industry exhibits a moderately consolidated market structure, with leading players such as ABB Ltd, Siemens AG, and KONČAR - Electronics and Informatics Inc., among others, holding significant market share. Innovation ecosystems are vibrant, driven by advancements in digital control, predictive maintenance, and integration with smart grid technologies. Regulatory frameworks play a crucial role, particularly concerning grid stability and energy efficiency standards, influencing product development and adoption. Product substitutes are limited for core excitation functionalities, but energy management systems and advanced control algorithms can augment or optimize existing solutions. End-user trends point towards increasing demand for reliable, efficient, and digitally enabled excitation systems in both new installations and retrofitting projects for power plants and industrial facilities. Mergers and acquisitions (M&A) activities, with deal values reaching hundreds of millions, are observed as companies seek to expand their product portfolios and geographical reach. Key players are investing heavily in R&D to develop next-generation excitation solutions that enhance operational performance and reduce downtime, contributing to an estimated market share shift of approximately 10-15% over the forecast period for innovative solutions.

Excitation Systems Industry Industry Trends & Insights

The Excitation Systems Industry is poised for substantial growth, driven by escalating global demand for electricity, the expansion of renewable energy sources requiring robust grid integration, and the ongoing modernization of aging power infrastructure. The increasing adoption of synchronous generators in power plants, from conventional thermal and hydro to increasingly vital renewable sources like wind and solar farms utilizing synchronous generators, directly fuels the demand for advanced excitation systems. Similarly, the proliferation of synchronous motors in heavy industries, including manufacturing, mining, and oil & gas, further propels market expansion. Technological disruptions are centered on the digitalization of excitation systems, enabling remote monitoring, predictive diagnostics, and enhanced control capabilities. This shift towards smart excitation solutions is a major market growth driver, with an estimated Compound Annual Growth Rate (CAGR) of 5-7% projected over the forecast period. Consumer preferences are leaning towards solutions that offer improved energy efficiency, reduced operational costs, enhanced reliability, and seamless integration with wider plant automation and SCADA systems. Competitive dynamics are characterized by a strong emphasis on technological innovation, customer service, and the ability to offer comprehensive solutions, including after-sales support and retrofitting services. Market penetration of digital excitation technologies is expected to rise significantly, reaching an estimated 70-80% of new installations by 2033. The development of advanced algorithms for voltage and frequency regulation, coupled with enhanced fault ride-through capabilities, are key differentiating factors for market leaders.

Dominant Markets & Segments in Excitation Systems Industry

The Excitation Systems Industry sees significant dominance from regions with substantial installed bases of power generation and heavy industrial capacity, particularly North America, Europe, and Asia Pacific. Within these regions, countries like the United States, Germany, China, and India are key markets due to ongoing investments in power infrastructure upgrades, grid modernization, and industrial expansion.

Static Excitation Systems: This segment is expected to maintain a dominant position due to its proven reliability, cost-effectiveness, and suitability for a wide range of synchronous generator applications. Key drivers include the ongoing replacement of older, less efficient systems and the increasing demand for static exciters in new medium-to-large scale power generation projects, especially in emerging economies. Economic policies promoting energy security and industrial development in these regions further bolster its market share. The estimated market share for static excitation systems is approximately 60-70% of the total market value.

Brushless Excitation Systems: While historically dominant in certain applications, brushless systems continue to be a strong contender, particularly in applications where maintenance is a critical concern. Their inherent advantage of eliminating brush wear and commutator maintenance appeals to sectors with challenging operating environments. The growing preference for higher reliability in critical infrastructure, such as nuclear and large-scale hydropower plants, supports the continued demand for this segment.

Application: Synchronous Generators: This segment represents the largest share of the Excitation Systems Industry due to the widespread use of synchronous generators across all forms of power generation. The expansion of renewable energy sources, which often employ synchronous generators for grid connectivity, is a major growth accelerator. Government initiatives promoting renewable energy adoption and the need to maintain grid stability are paramount drivers. The market size for excitation systems for synchronous generators is projected to reach over $5 Billion by 2033.

Application: Synchronous Motors: The increasing electrification of industrial processes and the growing demand for energy-efficient motor technologies in sectors like manufacturing, mining, and petrochemicals are driving the growth of this segment. The development of advanced variable speed drives integrated with excitation control further enhances the appeal of synchronous motors and their associated excitation systems. Infrastructure development and industrial automation projects are key economic policy drivers for this segment.

Excitation Systems Industry Product Innovations

Product innovations in the Excitation Systems Industry are increasingly focused on enhancing digital control, improving efficiency, and enabling predictive maintenance. Advancements in power electronics have led to more compact and robust static excitation systems with faster response times and higher precision in voltage and frequency regulation. Smart functionalities, including integrated diagnostic tools and remote monitoring capabilities, are becoming standard, allowing operators to anticipate and address potential issues before they lead to downtime. The competitive advantage lies in offering integrated solutions that contribute to overall grid stability, energy savings, and reduced operational expenditures for power generation facilities and industrial users of synchronous generators and synchronous motors.

Report Segmentation & Scope

This report segments the Excitation Systems Industry by Type and Application.

Type: Static Excitation Systems: This segment encompasses a broad range of solid-state exciters, including digital and analog variants, used for controlling the magnetic field of synchronous machines. These systems are favored for their precision, rapid response, and adaptability to complex grid requirements. Market growth is projected at a steady CAGR, driven by their widespread application in new power plant constructions and upgrades.

Type: Brushless Excitation Systems: This segment focuses on systems that eliminate the need for physical brushes, thereby reducing maintenance requirements and enhancing reliability. They are particularly prevalent in large-scale generators where brush wear can be a significant operational concern. Projected growth reflects their continued importance in critical power generation applications.

Application: Synchronous Generators: This segment analyzes the market for excitation systems designed to control the output of synchronous generators used in power plants of all types, including thermal, hydro, nuclear, and renewable energy facilities. The expansion of global power generation capacity is the primary driver of growth here.

Application: Synchronous Motors: This segment examines the market for excitation systems tailored for synchronous motors, widely utilized in industrial applications requiring high torque, constant speed, and energy efficiency. Growth is influenced by industrial automation trends and the demand for efficient industrial machinery.

Key Drivers of Excitation Systems Industry Growth

Several key factors are driving the growth of the Excitation Systems Industry. Technologically, the demand for enhanced grid stability and the integration of renewable energy sources necessitate advanced excitation control systems capable of rapid response and precise regulation. Economically, increasing global energy consumption and ongoing investments in power infrastructure modernization and expansion, particularly in developing regions, are significant drivers. Regulatory factors, such as mandates for energy efficiency and grid code compliance, also encourage the adoption of modern, high-performance excitation solutions. Furthermore, the growing trend of digitalization and the implementation of Industry 4.0 principles in power generation and heavy industries are creating opportunities for smart, connected excitation systems.

Challenges in the Excitation Systems Industry Sector

Despite robust growth prospects, the Excitation Systems Industry faces several challenges. Regulatory hurdles, particularly evolving grid interconnection standards and stringent environmental regulations, can impact product development timelines and costs. Supply chain issues, including the availability of critical components and geopolitical uncertainties, can lead to increased lead times and price volatility. Intense competitive pressures from established players and emerging regional manufacturers can affect profit margins. Additionally, the high initial investment cost for advanced digital excitation systems can be a barrier for some end-users, especially in cost-sensitive markets or for smaller-scale operations. The need for skilled personnel for installation, operation, and maintenance of complex digital systems also presents a challenge.

Leading Players in the Excitation Systems Industry Market

- ABB Ltd

- Siemens AG

- KONČAR - Electronics and Informatics Inc.

- Amtech Power Ltd

- Voith Group

- VEO Oy

- Basler Electric Co

- General Electric Company

- TENEL SRO

- Andritz AG

Key Developments in Excitation Systems Industry Sector

- November 2020: ABB secured a significant contract to supply excitation systems and speed regulation for four generator units at the Governador José Richa hydropower plant. This initiative, aimed at enhancing Copel's (Companhia Paranaense de Energia) operational data visibility through predictive diagnostics, underscores the growing importance of intelligent excitation solutions.

- May 2020: ANDRITZ signed a contract with Companhia Hidrelétrica do São Francisco (CHESF) for the comprehensive modernization and digitalization of the Sobradinho hydropower plant. The scope included the supply of excitation systems, alongside other critical components, highlighting the trend towards integrated, digitalized power plant solutions.

Strategic Excitation Systems Industry Market Outlook

The strategic outlook for the Excitation Systems Industry is highly positive, driven by the accelerating global transition towards cleaner energy and the imperative for robust, efficient, and digitally integrated power systems. The increasing complexity of modern grids, with a higher penetration of intermittent renewable sources, will continue to drive demand for advanced excitation systems that ensure grid stability and seamless operation. Strategic opportunities lie in developing intelligent, self-optimizing excitation solutions that leverage AI and machine learning for predictive maintenance and enhanced performance. Furthermore, the growing emphasis on asset longevity and operational efficiency will fuel demand for retrofitting and upgrading existing power generation facilities with state-of-the-art excitation technology. Companies that can offer comprehensive lifecycle support, including advanced diagnostics and remote management services, are well-positioned for significant growth.

Excitation Systems Industry Segmentation

-

1. Type

- 1.1. Static

- 1.2. Brushless

-

2. Application

- 2.1. Synchronous Generators

- 2.2. Synchronous Motors

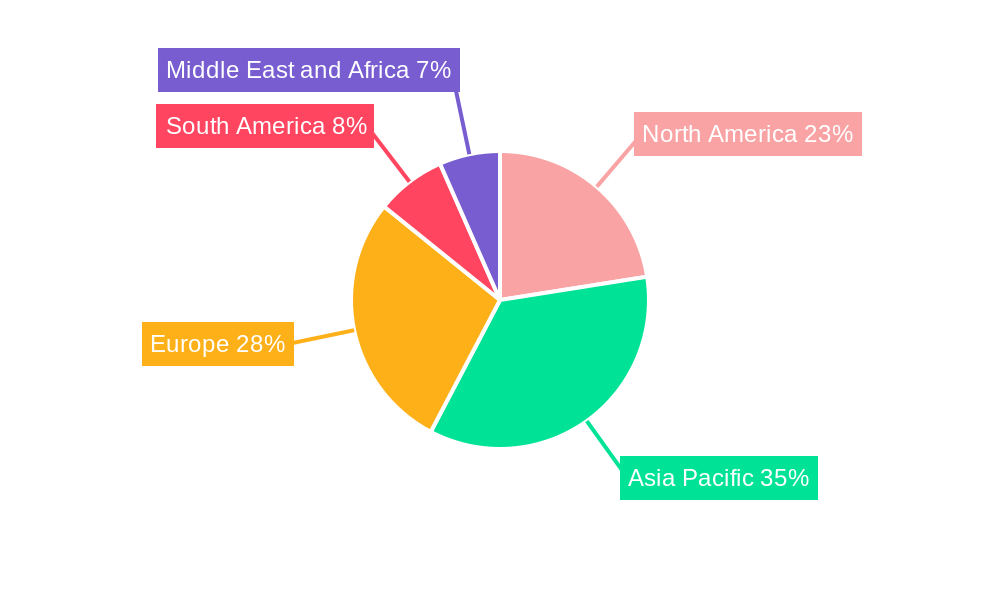

Excitation Systems Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. South America

- 5. Middle East and Africa

Excitation Systems Industry Regional Market Share

Geographic Coverage of Excitation Systems Industry

Excitation Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth of Utility-Scale Renewable Energy Plants4.; Rural Electrification Plans Worlwide

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Share of Distributed and Off-Grid Power Generation

- 3.4. Market Trends

- 3.4.1. The Brushless Type Segment is Expected to Record a Faster Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Excitation Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static

- 5.1.2. Brushless

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Synchronous Generators

- 5.2.2. Synchronous Motors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Excitation Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Static

- 6.1.2. Brushless

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Synchronous Generators

- 6.2.2. Synchronous Motors

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Excitation Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Static

- 7.1.2. Brushless

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Synchronous Generators

- 7.2.2. Synchronous Motors

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Excitation Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Static

- 8.1.2. Brushless

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Synchronous Generators

- 8.2.2. Synchronous Motors

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Excitation Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Static

- 9.1.2. Brushless

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Synchronous Generators

- 9.2.2. Synchronous Motors

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Excitation Systems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Static

- 10.1.2. Brushless

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Synchronous Generators

- 10.2.2. Synchronous Motors

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Siemens AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 KONČAR - Electronics and Informatics Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amtech Power Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Voith Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 VEO Oy

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Basler Electric Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 General Electric Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TENEL SRO

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Andritz AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global Excitation Systems Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Excitation Systems Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Excitation Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Excitation Systems Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Excitation Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Excitation Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Excitation Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific Excitation Systems Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Asia Pacific Excitation Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Asia Pacific Excitation Systems Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Asia Pacific Excitation Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Excitation Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Excitation Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Excitation Systems Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Excitation Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Excitation Systems Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Europe Excitation Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Excitation Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Excitation Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Excitation Systems Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Excitation Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Excitation Systems Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Excitation Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Excitation Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Excitation Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Excitation Systems Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Excitation Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Excitation Systems Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Excitation Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Excitation Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Excitation Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Excitation Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Excitation Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Excitation Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Excitation Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Excitation Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Excitation Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Excitation Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Excitation Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Excitation Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Excitation Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Excitation Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Excitation Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Excitation Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Excitation Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Excitation Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Excitation Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Excitation Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Excitation Systems Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Excitation Systems Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Excitation Systems Industry?

Key companies in the market include ABB Ltd, Siemens AG, KONČAR - Electronics and Informatics Inc *List Not Exhaustive, Amtech Power Ltd, Voith Group, VEO Oy, Basler Electric Co, General Electric Company, TENEL SRO, Andritz AG.

3. What are the main segments of the Excitation Systems Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.38 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth of Utility-Scale Renewable Energy Plants4.; Rural Electrification Plans Worlwide.

6. What are the notable trends driving market growth?

The Brushless Type Segment is Expected to Record a Faster Growth Rate.

7. Are there any restraints impacting market growth?

4.; Increasing Share of Distributed and Off-Grid Power Generation.

8. Can you provide examples of recent developments in the market?

In November 2020, ABB won a contract to provide excitation systems and speed regulation for four generator units at the Governador José Richa hydropower plant on the Iguazu River. The solution helped Copel (Companhia Paranaense de Energia) enhance the visibility of its operational data using predictive diagnostics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Excitation Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Excitation Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Excitation Systems Industry?

To stay informed about further developments, trends, and reports in the Excitation Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence