Key Insights

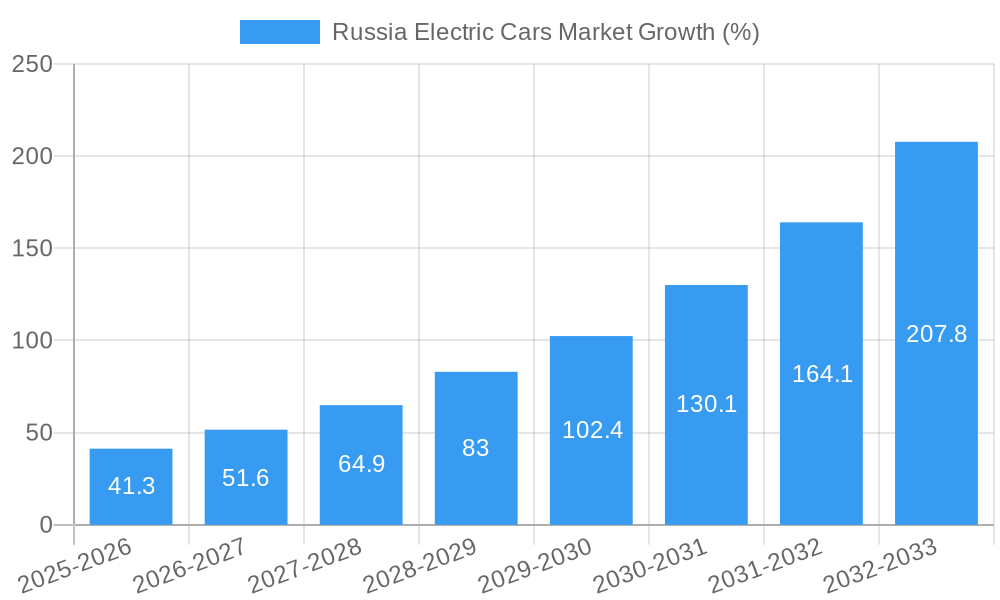

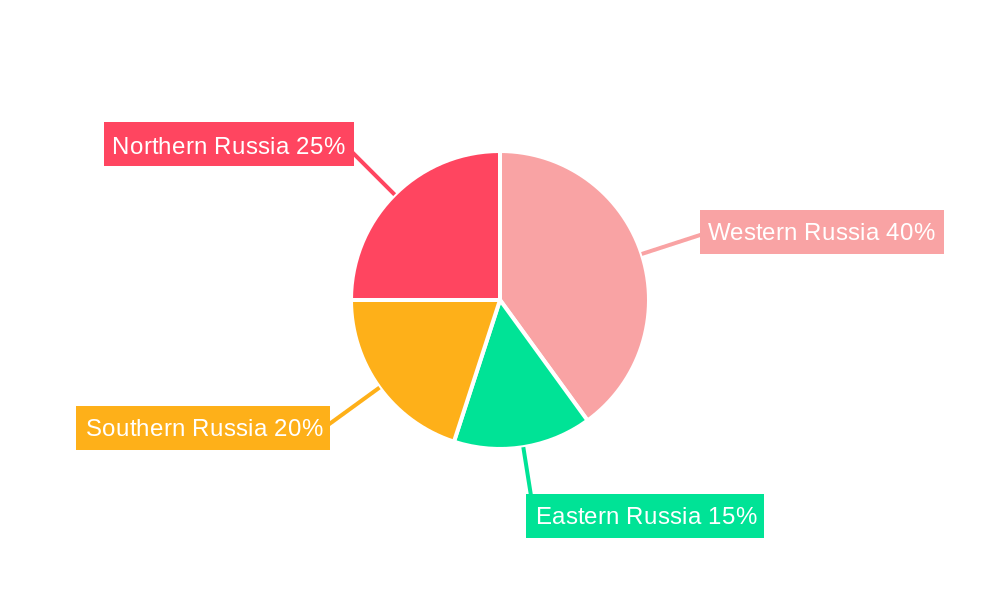

The Russia Electric Cars Market is poised for significant growth, exhibiting a robust Compound Annual Growth Rate (CAGR) of 27.65% from 2025 to 2033. This expansion is fueled by several key factors. Government initiatives promoting electric vehicle adoption, including subsidies and tax breaks, are playing a crucial role. Increasing environmental concerns among consumers and a growing awareness of the benefits of sustainable transportation are driving demand. Furthermore, advancements in battery technology, leading to increased range and reduced charging times, are making electric cars more attractive to a wider consumer base. The market is segmented by fuel category (BEV, HEV, PHEV) and vehicle configuration (passenger cars), with BEVs anticipated to dominate due to their zero-emission profile and growing technological advancements. Major players like Volkswagen, Hyundai, Tesla, Toyota, Great Wall Motor, and Chery are actively competing in this rapidly evolving market, introducing new models and expanding their infrastructure to support charging needs. The regional variations within Russia, encompassing Western, Eastern, Southern, and Northern regions, present diverse market opportunities, with Western Russia likely exhibiting higher initial adoption rates due to greater economic development and infrastructure.

However, challenges remain. The relatively high initial cost of electric vehicles compared to conventional vehicles, coupled with limited charging infrastructure outside of major cities, particularly in Eastern and Southern Russia, could hinder widespread adoption. Furthermore, fluctuating oil prices and the potential impact on government subsidies could influence market dynamics. Despite these constraints, the long-term outlook for the Russia Electric Cars Market remains positive, driven by a combination of supportive government policies, technological advancements, and evolving consumer preferences. The market is expected to witness substantial expansion, with BEVs projected to capture a significant market share in the coming years. The ongoing development of charging infrastructure and the continued introduction of more affordable electric vehicle models will be critical in accelerating market growth across all regions of Russia.

Russia Electric Cars Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia electric cars market, offering crucial insights for industry stakeholders, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth potential. The study incorporates detailed segmentation by fuel category (BEV, HEV, PHEV) and vehicle configuration (Passenger Cars), providing granular data for strategic decision-making. Key players such as Volkswagen AG, Hyundai Motor Company, Tesla Inc, Toyota Motor Corporation, Great Wall Motor Company Ltd (GWM), and Chery Automobile Co Ltd are analyzed, highlighting their market share, strategies, and recent developments. The report projects a market value of xx Million by 2033, presenting a compelling overview of opportunities and challenges within the rapidly evolving Russian electric vehicle sector.

Russia Electric Cars Market Structure & Competitive Dynamics

The Russia electric car market exhibits a moderately concentrated structure, with a few dominant players and several emerging entrants. Innovation ecosystems are still developing, hampered by regulatory uncertainties and infrastructure limitations. The regulatory framework, while aiming to promote electric vehicle adoption, is subject to ongoing revisions, impacting investment decisions. Product substitutes, primarily internal combustion engine (ICE) vehicles, remain highly competitive, particularly in the lower price segments. End-user trends point towards growing demand for electric vehicles, driven by environmental concerns and government incentives. However, affordability remains a significant barrier for widespread adoption. Mergers and acquisitions (M&A) activity has been relatively limited in recent years, with deal values totaling an estimated xx Million during the historical period (2019-2024). Market share data indicates that Volkswagen AG, Hyundai Motor Company, and Tesla Inc. hold the largest shares, but the precise figures vary across segments. Future M&A activity is anticipated to increase as established automakers and technology companies seek to consolidate their positions in the market.

- Market Concentration: Moderately concentrated, with a few dominant players and several niche players.

- Innovation Ecosystem: Developing, constrained by regulatory and infrastructural factors.

- Regulatory Framework: Evolving and subject to change, impacting investment certainty.

- Product Substitutes: ICE vehicles maintain strong competition, especially in the budget segment.

- End-User Trends: Growing demand driven by environmental awareness and government support, but affordability remains a challenge.

- M&A Activity: Relatively limited historically, with predicted increased activity in the forecast period.

Russia Electric Cars Market Industry Trends & Insights

The Russia electric cars market is projected to experience significant growth over the forecast period (2025-2033). Driven by government policies promoting electric mobility, technological advancements in battery technology and charging infrastructure are further accelerating the market's expansion. Consumer preferences are shifting towards electric vehicles, particularly among environmentally conscious younger demographics. However, challenges remain including the high initial cost of electric vehicles, limited charging infrastructure, and range anxiety. The Compound Annual Growth Rate (CAGR) is estimated at xx% during the forecast period, with market penetration projected to reach xx% by 2033. Competitive dynamics are intensifying, with established automakers facing competition from new entrants, particularly in the BEV segment. Technological disruptions, such as advancements in solid-state battery technology and autonomous driving features, are poised to further reshape the market landscape.

Dominant Markets & Segments in Russia Electric Cars Market

While precise regional market share data remains limited, the Moscow and St. Petersburg metropolitan areas are projected to constitute the largest segments of Russia's burgeoning electric car market. Currently, passenger cars dominate the vehicle configuration landscape, although light commercial vehicles (LCVs) are poised for substantial growth in the coming years, driven by increasing fleet electrification initiatives within the logistics and commercial sectors. This shift is expected to contribute significantly to the overall market value.

- Key Drivers for BEV Dominance: Government incentives, including subsidies and tax breaks, are actively stimulating consumer adoption of Battery Electric Vehicles (BEVs). Simultaneously, heightened environmental awareness and continuous technological advancements in battery technology, leading to improved range and reduced charging times, are further bolstering BEV market share.

- Key Drivers for Passenger Car Dominance: The larger consumer base for passenger vehicles, coupled with relatively more established charging infrastructure and a wider selection of available models, currently maintains passenger car dominance. However, the LCV segment’s growth trajectory indicates a potential shift in the market's composition.

- Regional Dominance: Moscow and St. Petersburg's projected leadership stems from their higher purchasing power and comparatively better-developed charging infrastructure compared to other regions. Continued investment in charging networks outside these major cities will be critical to expanding EV adoption nationwide.

The dominance of BEVs is anticipated to strengthen further, fueled by ongoing government support and the sustained decrease in battery production costs. Strategic infrastructure development, encompassing the expansion of charging station networks and the implementation of supportive policies, will be instrumental in shaping the future dominance of specific regions and vehicle segments. Proactive economic policies focused on reducing import tariffs for EVs and providing attractive tax benefits would significantly accelerate this market transformation.

Russia Electric Cars Market Product Innovations

Recent product innovations focus on improving battery range, enhancing charging speed, and integrating advanced driver-assistance systems (ADAS). Manufacturers are also emphasizing design aesthetics and user experience to enhance market appeal. Competition is driving continuous improvements in battery technology, leading to a reduction in costs and an increase in energy density. This technological trend is well aligned with consumer demand for longer ranges and faster charging times. The market fit is strong for EVs offering better value propositions and addressing consumer concerns regarding range and charging convenience.

Report Segmentation & Scope

This report segments the Russia electric cars market by:

Fuel Category: Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs). BEVs are projected to demonstrate the most rapid growth rate, while HEVs are expected to maintain a substantial market share in the near term due to their established presence. PHEVs are anticipated to experience steady growth, appealing to consumers seeking a balance between fuel efficiency and practicality. Each fuel category presents unique competitive dynamics and growth trajectories that are analyzed in detail within the report.

Vehicle Configuration: Passenger Cars currently constitute the primary focus, representing the majority of the market. However, light commercial vehicle (LCV) growth is projected to be significant in the long term, with this segment predicted to achieve substantial value growth by 2033. This sector's less mature status presents a considerable untapped potential, particularly with the increasing adoption of electric fleets by logistics and commercial businesses.

Key Drivers of Russia Electric Cars Market Growth

Several key factors are propelling the expansion of the Russia electric cars market:

- Government Incentives: Government-led initiatives such as subsidies and tax breaks are proving highly effective in incentivizing consumer adoption of electric vehicles.

- Technological Advancements: Significant strides in battery technology and charging infrastructure are enhancing the practicality and convenience of electric vehicles, addressing previous range anxiety and charging time concerns.

- Environmental Concerns: A rising awareness of climate change and the environmental impact of traditional combustion engine vehicles is driving increased demand for sustainable transportation alternatives.

- Falling Battery Costs: The ongoing reduction in battery production costs is making electric vehicles increasingly price-competitive with internal combustion engine (ICE) vehicles, further accelerating market adoption.

Challenges in the Russia Electric Cars Market Sector

Several factors hinder the growth of the Russia electric cars market:

- High Initial Purchase Prices: EVs remain significantly more expensive than comparable ICE vehicles.

- Limited Charging Infrastructure: The availability of public charging stations, especially outside major cities, is limited, causing range anxiety among consumers.

- Range Anxiety: Concerns about the driving range of EVs, particularly in the context of the vast distances in Russia, remain a significant barrier.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of components for EV manufacturing.

Leading Players in the Russia Electric Cars Market Market

- Volkswagen AG

- Hyundai Motor Company

- Tesla Inc

- Toyota Motor Corporation

- Great Wall Motor Company Ltd (GWM)

- Chery Automobile Co Ltd

Key Developments in Russia Electric Cars Market Sector

While specific developments directly impacting the Russian market are limited in publicly available information, global trends strongly influence the sector. Recent global events highlight the dynamism and ongoing investment within the broader electric vehicle sector:

- November 2023: Hyundai Motor's Genesis division launched a new showroom in New York, signifying its expansion into a key global market and its continued investment in the luxury electric vehicle sector. While not directly affecting Russia, it reflects the broader industry trends and competitive landscape influencing EV development globally.

- November 2023: Tesla's acquisition of US-based SiILion battery highlights the importance of battery technology advancements. Access to improved battery technology globally can potentially translate into lower costs and enhanced competitiveness for electric cars in Russia.

- November 2023: Volkswagen's launch of the new Nivus in Argentina showcases the company's continued investment in vehicle development and its global market strategy. This indirectly reflects Volkswagen's ongoing presence and commitment to the broader automotive sector, setting a benchmark for future innovations and potentially influencing the Russian market.

Strategic Russia Electric Cars Market Outlook

The Russia electric cars market holds significant future potential. Continued government support, technological advancements, and decreasing battery prices are poised to accelerate market growth. Strategic opportunities exist for companies focusing on battery technology, charging infrastructure development, and innovative vehicle designs tailored to the Russian market's unique conditions and demands. The market's trajectory hinges heavily on overcoming infrastructural challenges and addressing affordability concerns. Collaboration between the government, industry players, and consumers will be critical for realizing the full potential of this dynamic market.

Russia Electric Cars Market Segmentation

-

1. Vehicle Configuration

-

1.1. Passenger Cars

- 1.1.1. Hatchback

- 1.1.2. Multi-purpose Vehicle

- 1.1.3. Sedan

- 1.1.4. Sports Utility Vehicle

-

1.1. Passenger Cars

-

2. Fuel Category

- 2.1. BEV

- 2.2. HEV

- 2.3. PHEV

Russia Electric Cars Market Segmentation By Geography

- 1. Russia

Russia Electric Cars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 27.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Setting Up EV Charging Stations Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Electric Cars Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Passenger Cars

- 5.1.1.1. Hatchback

- 5.1.1.2. Multi-purpose Vehicle

- 5.1.1.3. Sedan

- 5.1.1.4. Sports Utility Vehicle

- 5.1.1. Passenger Cars

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. HEV

- 5.2.3. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. Western Russia Russia Electric Cars Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Electric Cars Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Electric Cars Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Electric Cars Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Volkswagen A

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hyundai Motor Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tesla Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Toyota Motor Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Great Wall Motor Company Ltd (GWM)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Chery Automobile Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Volkswagen A

List of Figures

- Figure 1: Russia Electric Cars Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Electric Cars Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Electric Cars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Electric Cars Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 3: Russia Electric Cars Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 4: Russia Electric Cars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Electric Cars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russia Electric Cars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russia Electric Cars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russia Electric Cars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russia Electric Cars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russia Electric Cars Market Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 11: Russia Electric Cars Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 12: Russia Electric Cars Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Electric Cars Market?

The projected CAGR is approximately 27.65%.

2. Which companies are prominent players in the Russia Electric Cars Market?

Key companies in the market include Volkswagen A, Hyundai Motor Company, Tesla Inc, Toyota Motor Corporation, Great Wall Motor Company Ltd (GWM), Chery Automobile Co Ltd.

3. What are the main segments of the Russia Electric Cars Market?

The market segments include Vehicle Configuration, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Cost of Setting Up EV Charging Stations Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

November 2023: Hyundai Motor's Genesis division has opened a new showroom in New York, the United States.November 2023: Tesla has acquired US-based start-up SiILion battery (Battery manufacturer) to excel the battery production in US.November 2023: In Argentina, Volkswagen debuted the brand-new Nivus. Both the Comfortline and Highline models of the VW Nivus will be offered in Argentina. They both come equipped with a 1.0-liter TSi three-cylinder engine that generates 116 horsepower and 200 Nm of torque and is coupled to a six-speed automated transmission.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Electric Cars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Electric Cars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Electric Cars Market?

To stay informed about further developments, trends, and reports in the Russia Electric Cars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence