Key Insights

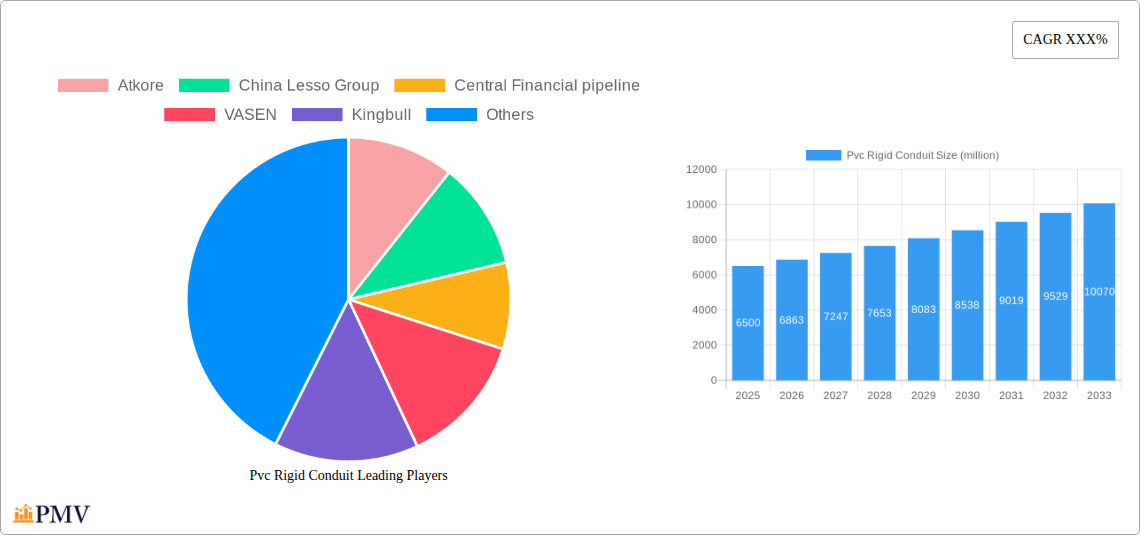

The global PVC rigid conduit market is projected to experience robust growth, reaching an estimated market size of approximately $6,500 million by 2025. This expansion is driven by escalating demand for durable and cost-effective electrical protection solutions across various sectors, including construction, infrastructure development, and industrial facilities. The market's growth trajectory is further propelled by increasing investments in smart city initiatives, renewable energy projects, and upgrading aging electrical infrastructure, all of which necessitate reliable conduit systems. Furthermore, the inherent advantages of PVC, such as its resistance to corrosion, chemicals, and moisture, coupled with its ease of installation and lower material costs compared to metal alternatives, are significant market catalysts. The market is segmented by application, with electrical and telecommunications applications dominating, and by type, with solid wall conduits holding a substantial share.

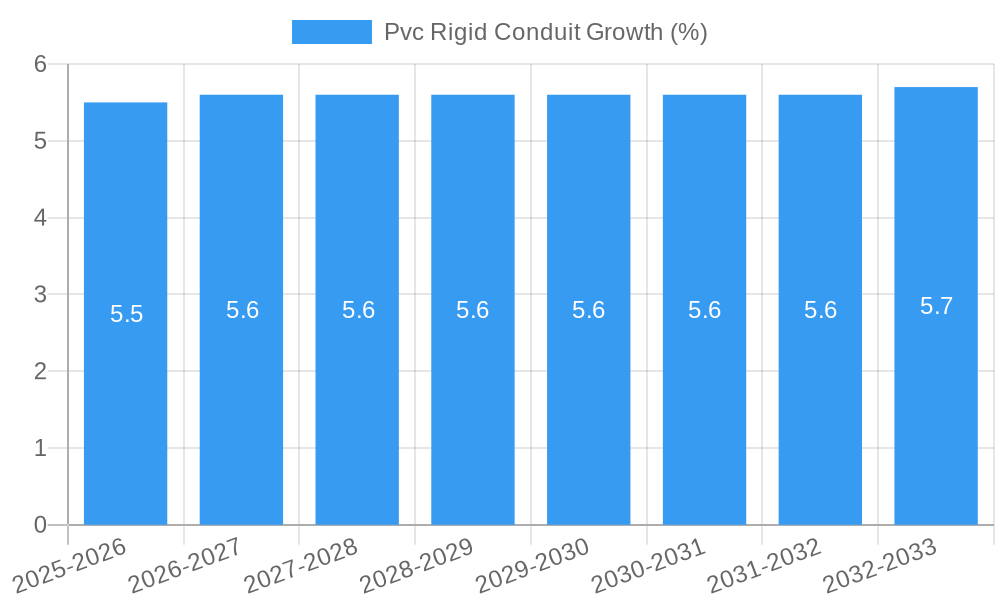

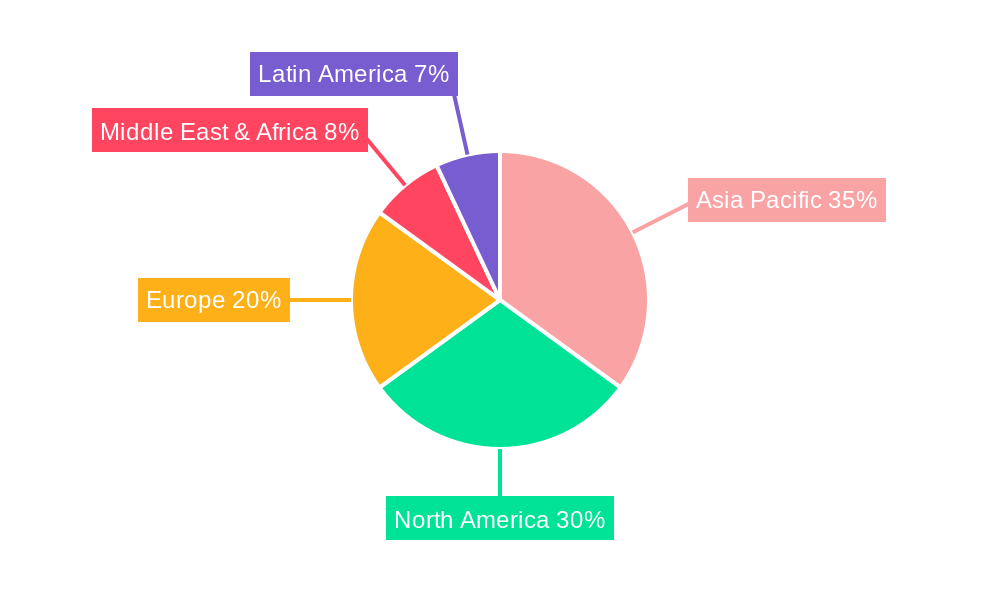

Looking ahead, the PVC rigid conduit market is anticipated to witness a Compound Annual Growth Rate (CAGR) of around 5.5% during the forecast period of 2025-2033. This sustained growth will be influenced by evolving building codes, an increasing focus on safety standards, and the continuous innovation in PVC formulations for enhanced performance and sustainability. Emerging economies, particularly in Asia-Pacific, are expected to be major growth engines due to rapid urbanization and substantial infrastructure spending. While the market benefits from strong demand drivers, potential restraints include the fluctuating prices of raw materials and increasing competition from alternative conduit materials. However, the inherent cost-effectiveness and proven reliability of PVC rigid conduits are expected to maintain their competitive edge, ensuring continued market dominance in the foreseeable future.

Here is the SEO-optimized, detailed report description for PVC Rigid Conduit, incorporating your specified keywords, structure, and content requirements:

PVC Rigid Conduit Market Structure & Competitive Dynamics

The global PVC rigid conduit market is characterized by a moderate to high level of competition, with a mix of established global manufacturers and a growing number of regional players. Market concentration varies by region, with North America and Asia Pacific exhibiting higher densities of key players like Atkore, JM Eagle, Southwire, AFC Cable Systems, CANTEX, IPEX USA LLC, and Eaton, alongside prominent Chinese firms such as China Lesso Group, Kingbull, Shanghai White Butterfly Pipe Technology Co., Ltd, RiFeng Group, Honyar, Ginde, and PERTP. Innovation ecosystems are driven by advancements in material science, manufacturing processes, and product durability, with a focus on meeting evolving electrical and construction standards. Regulatory frameworks, particularly electrical codes and safety standards across different countries, play a crucial role in shaping product development and market entry. Product substitutes, including metal conduits (EMT, IMC, RMC) and other non-metallic conduits (e.g., flexible PVC, HDPE), present a competitive challenge, necessitating continuous product differentiation and cost-effectiveness from PVC rigid conduit manufacturers. End-user trends are increasingly influenced by demand for sustainable building materials, enhanced safety features, and efficient installation solutions. Mergers and acquisitions (M&A) activity, while not as prevalent as in some other industrial sectors, are strategically employed to expand market reach, acquire new technologies, or consolidate market share. Projected M&A deal values are estimated to reach several hundred million dollars annually over the forecast period. Key metrics such as market share for leading companies and M&A deal values will be thoroughly analyzed, with estimated market share for the top 5 players reaching 40% of the global market by 2025.

PVC Rigid Conduit Industry Trends & Insights

The PVC rigid conduit industry is poised for significant growth, propelled by a confluence of factors including robust infrastructure development, increasing urbanization, and a rising demand for electrical safety and protection in residential, commercial, and industrial sectors. The market growth drivers are multifaceted, with substantial investments in new construction projects, particularly in emerging economies, acting as a primary catalyst. The escalating need for reliable and durable electrical systems in renewable energy installations, such as solar farms and wind power projects, further fuels demand for high-quality PVC rigid conduit. Technological disruptions are primarily centered around enhancing the physical properties of PVC, such as improved UV resistance, increased impact strength, and fire retardancy, making it a more viable alternative in challenging environments. Sustainability initiatives are also gaining traction, with manufacturers exploring eco-friendly PVC formulations and recycling programs to address environmental concerns. Consumer preferences are leaning towards cost-effective, easy-to-install, and long-lasting conduit solutions, where PVC rigid conduit excels. Competitive dynamics are intensifying, with players like Atkore, China Lesso Group, and JM Eagle vying for market dominance through product innovation, strategic partnerships, and aggressive market penetration strategies. The market penetration of PVC rigid conduit is projected to reach xx% by 2025, demonstrating its growing adoption. The compound annual growth rate (CAGR) for the global PVC rigid conduit market is estimated to be around 5.5% to 6.0% during the forecast period of 2025–2033. The market is also witnessing a trend towards specialized PVC rigid conduit products designed for specific applications, such as underground installations, corrosive environments, and high-temperature applications. The increasing adoption of smart grid technologies and the expansion of data centers also contribute to the sustained demand for reliable conduit systems. Furthermore, government incentives and regulations promoting electrical safety and energy efficiency indirectly boost the adoption of compliant conduit solutions, including PVC rigid conduit. The industry is also seeing a rise in demand for lighter yet equally robust conduit options, pushing manufacturers to invest in research and development for advanced PVC formulations. The growing preference for pre-fabricated conduit systems and accessories is another key trend shaping the competitive landscape, offering contractors enhanced installation efficiency and reduced labor costs. The global market size for PVC rigid conduit is projected to reach over $12,000 million by 2033, driven by these persistent industry trends.

Dominant Markets & Segments in PVC Rigid Conduit

The PVC rigid conduit market exhibits distinct regional dominance and segment leadership, driven by a combination of economic policies, infrastructure development, and specific application needs. Asia Pacific stands out as the leading region, primarily fueled by rapid industrialization, extensive urbanization, and substantial government investments in infrastructure projects across countries like China and India. The sheer scale of new construction, coupled with significant upgrades to existing electrical grids, creates an insatiable demand for reliable conduit solutions. Economic policies in these regions often prioritize domestic manufacturing and infrastructure development, creating a fertile ground for local and international PVC rigid conduit manufacturers.

In terms of Application, the Electrical and Electronics segment holds a dominant position. This is directly attributable to the ubiquitous need for safe and protected electrical wiring in virtually every building and infrastructure project. Key drivers include:

- Residential Construction Boom: Growing populations and rising disposable incomes in developing economies lead to an unprecedented demand for new housing units, all requiring extensive electrical installations.

- Commercial Building Expansion: The growth of retail spaces, office complexes, hotels, and healthcare facilities necessitates robust electrical infrastructure, where PVC rigid conduit is a preferred choice for its durability and cost-effectiveness.

- Industrial Facility Development: The expansion of manufacturing plants, chemical processing units, and other industrial facilities requires highly reliable conduit systems to protect sensitive electrical components from harsh environments.

- Infrastructure Projects: Power generation plants, substations, telecommunication networks, and transportation hubs (airports, railways) heavily rely on PVC rigid conduit for their electrical distribution and protection needs.

The Type segment showcasing dominant growth is Heavy-Duty PVC Rigid Conduit. This dominance is underpinned by its superior strength, impact resistance, and ability to withstand demanding environmental conditions, making it ideal for applications where durability and long-term performance are paramount. Key drivers include:

- Underground Installations: Its robustness makes it the conduit of choice for buried electrical lines, protecting them from soil pressure, moisture, and potential damage from excavation.

- Corrosive Environments: In industrial settings exposed to chemicals or salt spray, heavy-duty PVC rigid conduit offers excellent resistance, preventing degradation and ensuring system integrity.

- High-Traffic Areas: Buildings and public spaces with high foot traffic or the potential for physical impact benefit from the superior protection offered by heavier-duty conduits.

- Stringent Safety Standards: Regions with stricter electrical codes and safety regulations often mandate the use of more robust conduit types, favoring heavy-duty PVC rigid conduit.

North America also represents a significant market, characterized by a mature construction sector, ongoing infrastructure modernization, and a strong emphasis on electrical safety codes. Countries like the United States and Canada contribute substantially to market demand, driven by renovation projects and the continuous need for upgrades in power distribution and telecommunications.

PVC Rigid Conduit Product Innovations

Product innovations in the PVC rigid conduit market are focused on enhancing performance, sustainability, and ease of installation. Manufacturers are developing advanced PVC formulations offering improved UV resistance for outdoor applications, higher impact strength to withstand rough handling and environmental stresses, and enhanced fire-retardant properties for increased safety in sensitive areas. Innovations also include the development of specialized conduit types for extreme temperatures and corrosive environments, expanding the applicability of PVC rigid conduit. Furthermore, the integration of antimicrobial additives is being explored for healthcare and food processing facilities. The competitive advantage lies in offering solutions that not only meet but exceed existing industry standards, providing superior protection and longevity for electrical systems.

Report Segmentation & Scope

This comprehensive report segments the PVC rigid conduit market by Application and Type.

The Application segment encompasses key areas such as Electrical and Electronics, Residential Construction, Commercial Construction, Industrial Construction, and Infrastructure Projects. Each of these segments is analyzed for market size, growth projections, and the competitive landscape, with the Electrical and Electronics segment expected to maintain its leading position with a market size projected to exceed $6,000 million by 2025.

The Type segment is meticulously detailed, including Heavy-Duty PVC Rigid Conduit, Medium-Duty PVC Rigid Conduit, and Light-Duty PVC Rigid Conduit. Growth projections and market sizes are provided for each type, with heavy-duty variants projected for robust growth due to increasing demand for durability and protection in challenging environments, holding an estimated market share of over 45% by 2025.

Key Drivers of PVC Rigid Conduit Growth

The growth of the PVC rigid conduit market is propelled by several key drivers. Infrastructure development, particularly in emerging economies, is a primary engine, with significant government spending on power grids, transportation, and telecommunications. Urbanization further fuels demand as cities expand, necessitating extensive new building construction requiring reliable electrical protection. Technological advancements in PVC formulations enhance durability, safety, and environmental resistance, making PVC rigid conduit a more attractive option. Increasing awareness of electrical safety standards globally compels the adoption of compliant and robust conduit systems. Furthermore, government initiatives and policies promoting renewable energy installations and energy-efficient buildings indirectly support the demand for high-quality PVC rigid conduit.

Challenges in the PVC Rigid Conduit Sector

Despite robust growth, the PVC rigid conduit sector faces several challenges. Fluctuations in raw material prices, particularly for PVC resin, can impact profitability and pricing strategies. Stringent environmental regulations regarding plastic production and disposal, though often driving innovation towards sustainable solutions, can also add compliance costs. Competition from alternative conduit materials, such as metal conduits and other plastics, remains a persistent threat, requiring continuous product differentiation and cost-effectiveness. Supply chain disruptions, exacerbated by global events, can affect product availability and lead times. The installation labor cost factor, where alternative materials might offer quicker installation, also presents a competitive hurdle.

Leading Players in the PVC Rigid Conduit Market

- Atkore

- China Lesso Group

- Central Financial pipeline

- VASEN

- Kingbull

- Shanghai White Butterfly Pipe Technology Co., Ltd

- RiFeng Group

- Honyar

- Ginde

- PERTP

- AKAN

- JM Eagle

- Halex

- Southwire

- AFC Cable Systems

- CANTEX

- NPP

- AKG

- IPEX USA LLC

- Eaton

- Topaz Lighting Corp.

- American Fittings

- Bridgeport

- Segments

Key Developments in PVC Rigid Conduit Sector

- 2023/2024: Introduction of new fire-retardant PVC rigid conduit formulations by leading manufacturers to meet stricter building codes.

- 2023: Several key players, including Atkore and JM Eagle, announced strategic investments in expanding production capacities to meet rising global demand.

- 2022/2023: Increased focus on developing PVC rigid conduit with enhanced UV resistance for applications in solar energy infrastructure.

- 2021/2022: Emergence of more sustainable PVC formulations and recycling initiatives by companies like China Lesso Group.

- 2020/2021: M&A activities aimed at consolidating market share and expanding product portfolios in key regional markets.

Strategic PVC Rigid Conduit Market Outlook

The strategic outlook for the PVC rigid conduit market is highly positive, driven by ongoing global infrastructure development and the persistent demand for safe and reliable electrical systems. Growth accelerators include the expanding renewable energy sector, increased smart city initiatives, and the continuous need for upgrades in existing electrical networks. Companies that invest in product innovation, focusing on enhanced performance, sustainability, and cost-efficiency, will be well-positioned to capitalize on market opportunities. Strategic partnerships and geographic expansion into high-growth regions, particularly in Asia Pacific and developing economies, are crucial for sustained market leadership. The market presents significant potential for players offering specialized solutions that address niche application requirements and evolving regulatory landscapes.

Pvc Rigid Conduit Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Pvc Rigid Conduit Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Pvc Rigid Conduit REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pvc Rigid Conduit Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Pvc Rigid Conduit Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Pvc Rigid Conduit Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Pvc Rigid Conduit Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Pvc Rigid Conduit Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Pvc Rigid Conduit Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Atkore

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Lesso Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Central Financial pipeline

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 VASEN

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kingbull

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shanghai White Butterfly Pipe Technology Co. Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RiFeng Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Honyar

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ginde

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PERTP

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AKAN

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 JM Eagle

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Halex

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Southwire

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 AFC Cable Systems

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 CANTEX

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 NPP

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 AKG

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 IPEX USA LLC

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Eaton

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Topaz Lighting Corp.

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 American Fittings

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Bridgeport

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 Atkore

List of Figures

- Figure 1: Global Pvc Rigid Conduit Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: undefined Pvc Rigid Conduit Revenue (million), by Application 2024 & 2032

- Figure 3: undefined Pvc Rigid Conduit Revenue Share (%), by Application 2024 & 2032

- Figure 4: undefined Pvc Rigid Conduit Revenue (million), by Type 2024 & 2032

- Figure 5: undefined Pvc Rigid Conduit Revenue Share (%), by Type 2024 & 2032

- Figure 6: undefined Pvc Rigid Conduit Revenue (million), by Country 2024 & 2032

- Figure 7: undefined Pvc Rigid Conduit Revenue Share (%), by Country 2024 & 2032

- Figure 8: undefined Pvc Rigid Conduit Revenue (million), by Application 2024 & 2032

- Figure 9: undefined Pvc Rigid Conduit Revenue Share (%), by Application 2024 & 2032

- Figure 10: undefined Pvc Rigid Conduit Revenue (million), by Type 2024 & 2032

- Figure 11: undefined Pvc Rigid Conduit Revenue Share (%), by Type 2024 & 2032

- Figure 12: undefined Pvc Rigid Conduit Revenue (million), by Country 2024 & 2032

- Figure 13: undefined Pvc Rigid Conduit Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Pvc Rigid Conduit Revenue (million), by Application 2024 & 2032

- Figure 15: undefined Pvc Rigid Conduit Revenue Share (%), by Application 2024 & 2032

- Figure 16: undefined Pvc Rigid Conduit Revenue (million), by Type 2024 & 2032

- Figure 17: undefined Pvc Rigid Conduit Revenue Share (%), by Type 2024 & 2032

- Figure 18: undefined Pvc Rigid Conduit Revenue (million), by Country 2024 & 2032

- Figure 19: undefined Pvc Rigid Conduit Revenue Share (%), by Country 2024 & 2032

- Figure 20: undefined Pvc Rigid Conduit Revenue (million), by Application 2024 & 2032

- Figure 21: undefined Pvc Rigid Conduit Revenue Share (%), by Application 2024 & 2032

- Figure 22: undefined Pvc Rigid Conduit Revenue (million), by Type 2024 & 2032

- Figure 23: undefined Pvc Rigid Conduit Revenue Share (%), by Type 2024 & 2032

- Figure 24: undefined Pvc Rigid Conduit Revenue (million), by Country 2024 & 2032

- Figure 25: undefined Pvc Rigid Conduit Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Pvc Rigid Conduit Revenue (million), by Application 2024 & 2032

- Figure 27: undefined Pvc Rigid Conduit Revenue Share (%), by Application 2024 & 2032

- Figure 28: undefined Pvc Rigid Conduit Revenue (million), by Type 2024 & 2032

- Figure 29: undefined Pvc Rigid Conduit Revenue Share (%), by Type 2024 & 2032

- Figure 30: undefined Pvc Rigid Conduit Revenue (million), by Country 2024 & 2032

- Figure 31: undefined Pvc Rigid Conduit Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pvc Rigid Conduit Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Pvc Rigid Conduit Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Pvc Rigid Conduit Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Pvc Rigid Conduit Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Pvc Rigid Conduit Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Pvc Rigid Conduit Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Pvc Rigid Conduit Revenue million Forecast, by Country 2019 & 2032

- Table 8: Global Pvc Rigid Conduit Revenue million Forecast, by Application 2019 & 2032

- Table 9: Global Pvc Rigid Conduit Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Pvc Rigid Conduit Revenue million Forecast, by Country 2019 & 2032

- Table 11: Global Pvc Rigid Conduit Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Pvc Rigid Conduit Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Pvc Rigid Conduit Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Pvc Rigid Conduit Revenue million Forecast, by Application 2019 & 2032

- Table 15: Global Pvc Rigid Conduit Revenue million Forecast, by Type 2019 & 2032

- Table 16: Global Pvc Rigid Conduit Revenue million Forecast, by Country 2019 & 2032

- Table 17: Global Pvc Rigid Conduit Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Pvc Rigid Conduit Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Pvc Rigid Conduit Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pvc Rigid Conduit?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Pvc Rigid Conduit?

Key companies in the market include Atkore, China Lesso Group, Central Financial pipeline, VASEN, Kingbull, Shanghai White Butterfly Pipe Technology Co., Ltd, RiFeng Group, Honyar, Ginde, PERTP, AKAN, JM Eagle, Halex, Southwire, AFC Cable Systems, CANTEX, NPP, AKG, IPEX USA LLC, Eaton, Topaz Lighting Corp., American Fittings, Bridgeport.

3. What are the main segments of the Pvc Rigid Conduit?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pvc Rigid Conduit," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pvc Rigid Conduit report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pvc Rigid Conduit?

To stay informed about further developments, trends, and reports in the Pvc Rigid Conduit, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence