Key Insights

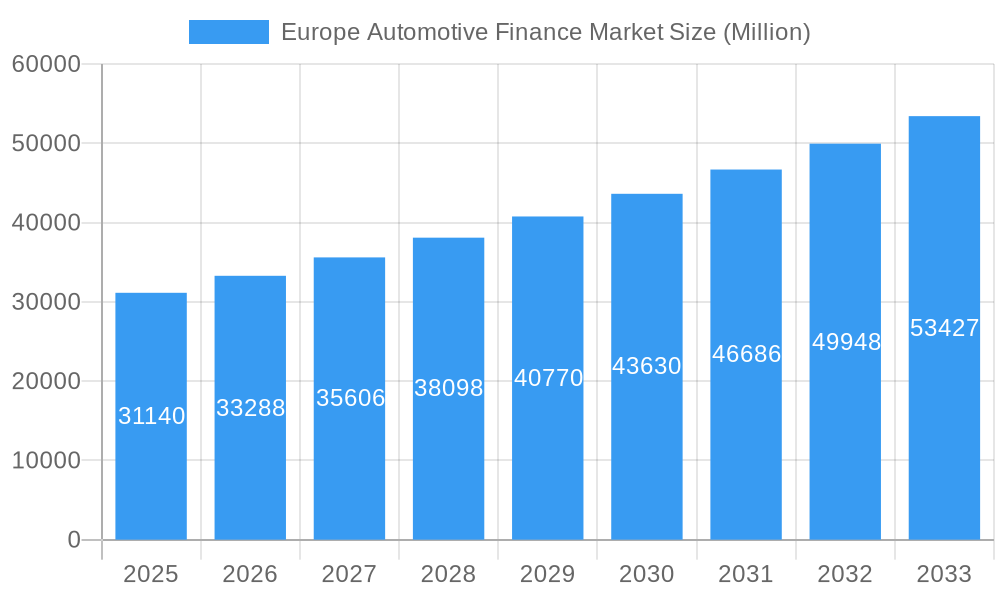

The European automotive finance market, valued at €31.14 billion in 2025, is projected to experience robust growth, driven by several key factors. The rising popularity of electric vehicles (EVs) is fueling demand for specialized financing options, including longer-term loans and battery lease programs. Furthermore, the increasing penetration of online platforms and digital lending solutions is streamlining the financing process, attracting a wider range of customers and boosting market expansion. Government incentives aimed at promoting sustainable transportation, such as subsidies for EV purchases, further contribute to market growth. However, economic fluctuations, particularly interest rate hikes and potential recessions, pose a significant challenge, potentially impacting consumer borrowing capacity and thus slowing market expansion. Competition among established financial institutions and the emergence of fintech companies is intensifying, necessitating innovative strategies and efficient risk management to maintain market share. The market's segmentation likely includes various loan types (e.g., consumer loans, lease financing, and commercial financing for dealerships), reflecting the diverse needs of car buyers and businesses.

Europe Automotive Finance Market Market Size (In Billion)

The forecast period (2025-2033) suggests a continued upward trajectory, with a Compound Annual Growth Rate (CAGR) of 6.73%. This growth is expected to be influenced by the evolving automotive landscape, incorporating factors like the rise of subscription models and the increasing complexity of vehicle technology, which requires more sophisticated financing solutions. The presence of major international and regional players such as Mitsubishi UFJ Lease & Finance, HSBC, HDFC Bank, and others indicates a competitive yet consolidated market structure. Regional variations within Europe will likely exist, with stronger growth in markets that exhibit higher EV adoption rates and supportive government policies. Understanding these dynamics is crucial for stakeholders to effectively navigate the market's complexities and capitalize on emerging opportunities.

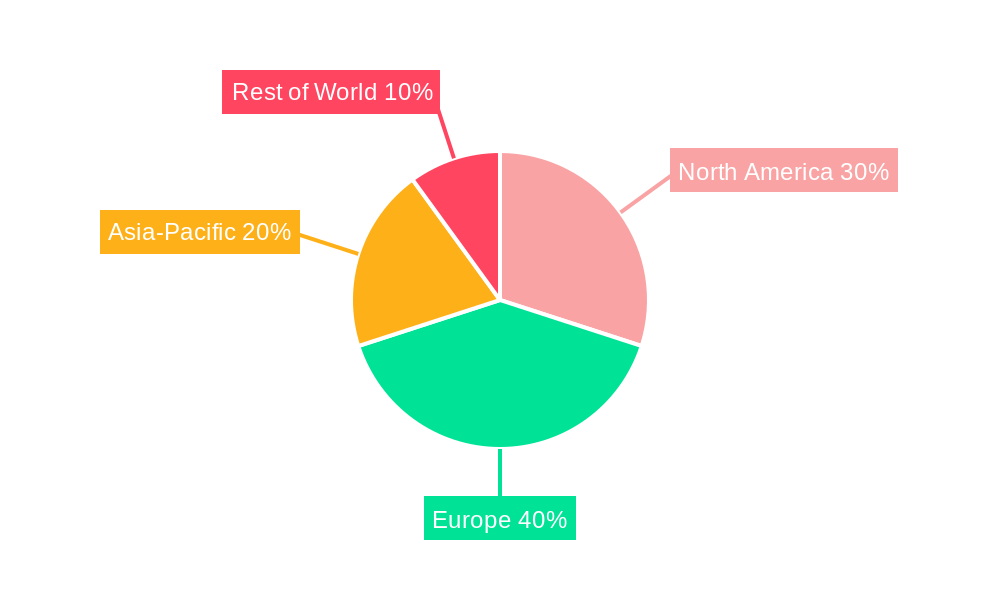

Europe Automotive Finance Market Company Market Share

This comprehensive report provides an in-depth analysis of the European automotive finance market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of historical trends and future market potential. The report covers key segments, leading players, and significant industry developments, empowering businesses to navigate the dynamic landscape of European automotive finance.

Europe Automotive Finance Market Market Structure & Competitive Dynamics

The European automotive finance market exhibits a moderately concentrated structure, with several major players vying for market share. The market's competitive dynamics are shaped by factors including innovation ecosystems, evolving regulatory frameworks, the emergence of product substitutes (like leasing and subscription models), evolving end-user preferences (towards EVs and flexible financing options), and ongoing mergers and acquisitions (M&A) activity.

Market Concentration: The top 10 players account for approximately xx% of the market share in 2025, indicating a moderately concentrated landscape. This is expected to slightly decrease to xx% by 2033 due to increased competition from fintechs and smaller players.

Innovation Ecosystems: Collaboration between traditional automotive financiers and fintech companies is fostering innovation in areas such as open banking, digital lending platforms, and personalized financing solutions.

Regulatory Frameworks: Stringent regulations regarding consumer protection, data privacy (GDPR), and responsible lending practices significantly influence market operations and competitive strategies.

Product Substitutes: The rise of car subscription services and leasing options presents a competitive challenge to traditional automotive financing models. The market penetration of these alternatives is estimated at xx% in 2025 and projected to reach xx% by 2033.

End-User Trends: The increasing adoption of electric vehicles (EVs) and the growing preference for flexible financing options are driving significant changes in market demand.

M&A Activities: The automotive finance sector has witnessed significant M&A activity in recent years, with deal values totaling approximately xx Million in 2024. These transactions often aim to expand market reach, enhance technological capabilities, and consolidate market positions. Examples include [Insert Specific M&A examples if available, with deal values].

Europe Automotive Finance Market Industry Trends & Insights

The European automotive finance market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). This growth is fueled by increasing vehicle sales, rising consumer demand for financing options, technological advancements in lending and risk assessment, and favorable economic conditions (in specific regions). However, economic downturns and shifts in consumer spending habits pose potential challenges. The market penetration of automotive finance is estimated at xx% in 2025, expected to increase to xx% by 2033. Technological disruptions, such as the adoption of AI and machine learning in credit scoring and fraud detection, are streamlining processes and improving efficiency.

Consumer preferences are shifting towards more flexible financing solutions, including shorter-term loans, balloon payments, and subscription models. The rise of electric vehicles (EVs) is also impacting the market, with specific financing products tailored to the unique characteristics of EVs gaining traction. Competitive dynamics are intensifying with the entry of new players, particularly fintech companies offering innovative digital solutions.

Dominant Markets & Segments in Europe Automotive Finance Market

Germany, the United Kingdom, and France represent the dominant markets within the European automotive finance sector. These countries boast robust automotive industries, well-developed financial infrastructures, and high consumer demand for vehicle financing.

Germany:

- Strong domestic automotive manufacturing base.

- Well-established financial institutions.

- High vehicle ownership rates.

United Kingdom:

- Large consumer market.

- Favorable regulatory environment for fintech innovation.

- Significant investments in infrastructure supporting the automotive sector.

France:

- Growing demand for vehicle financing, particularly for EVs.

- Government initiatives promoting sustainable transportation.

- Strong consumer confidence.

Europe Automotive Finance Market Product Innovations

Recent innovations in the European automotive finance market include the adoption of open banking technologies, the integration of AI-powered risk assessment tools, and the emergence of flexible financing solutions tailored to the needs of EV buyers. These innovations improve efficiency, enhance customer experiences, and enable more accurate risk assessment, leading to increased market penetration and customer acquisition. The development of mobile-first applications and digital onboarding processes also streamlines the borrowing process.

Report Segmentation & Scope

The report segments the European automotive finance market based on vehicle type (passenger cars, commercial vehicles), financing type (loans, leases), and end-user (individuals, businesses). Each segment's growth projections, market size (in Million), and competitive dynamics are analyzed in detail. For instance, the passenger car segment is expected to dominate in 2025 and beyond, driven by higher demand, while the commercial vehicle segment is anticipated to see a slower, yet steady growth. The leasing segment is growing rapidly due to its flexible nature and lower upfront cost.

Key Drivers of Europe Automotive Finance Market Growth

Key growth drivers include:

- Rising vehicle sales across Europe.

- Increasing adoption of EVs and the associated specialized financing options.

- Technological advancements improving efficiency and risk assessment.

- Government incentives promoting automotive purchases and sustainable transport.

Challenges in the Europe Automotive Finance Market Sector

Challenges include:

- Economic uncertainty and fluctuations in consumer spending.

- Rising interest rates impacting borrowing costs.

- Stringent regulatory requirements for compliance.

- Competition from new entrants and alternative financing models. The competition from fintech lenders, particularly, is driving down margins and requiring established players to adapt.

Leading Players in the Europe Automotive Finance Market Market

- Mitsubishi UFJ Lease & Finance Co Ltd

- HSBC Holdings PLC (HSBC Holdings PLC)

- HDFC Bank Limited

- Capital One Financial Corporation (Capital One Financial Corporation)

- Wells Fargo & Co (Wells Fargo & Co)

- Toyota Financial Services (Toyota Motor Corporation) (Toyota Financial Services)

- BNP Paribas SA (BNP Paribas SA)

- Volkswagen AG (Volkswagen AG)

- Mercedes-Benz Group AG (Mercedes-Benz Group AG)

- Standard Chartered PLC (Standard Chartered PLC)

- BMW AG (Alphera Financial Services) (BMW Group)

- Ford Motor Company (Ford Motor Company)

- Banco Santander SA (Banco Santander SA)

- Societe Generale Grou (Societe Generale Group)

Key Developments in Europe Automotive Finance Market Sector

March 2024: BMW's financial arm partnered with CRIF to introduce open banking services in the UK, streamlining auto financing and improving access to creditworthiness data. This enhances competition and potentially expands the market.

February 2024: The BPFI reported a 25.5% increase in Irish car loan values in Q3 2023 (reaching Euro 189 Million or USD 204 Million), driven by increased EV adoption. This highlights the growing demand for financing in the EV sector.

January 2024: Bumper secured USD 48 Million in Series B funding, expanding flexible payment options for car repairs. This signifies the increasing importance of fintech solutions in the automotive finance ecosystem.

Strategic Europe Automotive Finance Market Market Outlook

The European automotive finance market holds significant future potential, driven by ongoing technological advancements, evolving consumer preferences, and the increasing adoption of electric vehicles. Strategic opportunities exist for companies that can leverage data analytics, AI, and open banking technologies to offer personalized and seamless financing solutions. Further growth is anticipated through strategic partnerships, mergers, and acquisitions, enabling expansion into new markets and service offerings. Companies focused on sustainability and offering financing for EVs are particularly well-positioned for future success.

Europe Automotive Finance Market Segmentation

-

1. Type

- 1.1. New Vehicles

- 1.2. Used Vehicles

-

2. Source Type

- 2.1. Original Equipment Manufacturers (OEMs)

- 2.2. Banks

- 2.3. Credit Institutions

- 2.4. Non-banking Financial Institutions

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Europe Automotive Finance Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Automotive Finance Market Regional Market Share

Geographic Coverage of Europe Automotive Finance Market

Europe Automotive Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Electric Vehicles Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Electric Vehicles Fosters the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The Passenger Cars Market Segment to Witness Surging Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. New Vehicles

- 5.1.2. Used Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Source Type

- 5.2.1. Original Equipment Manufacturers (OEMs)

- 5.2.2. Banks

- 5.2.3. Credit Institutions

- 5.2.4. Non-banking Financial Institutions

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsubishi UFJ Lease & Finance Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HSBC Holdings PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HDFC Bank Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Capital One Financial Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wells Fargo & Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toyota Financial Services (Toyota Motor Corporation)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BNP Paribas SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Volkswagen AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mercedes-Benz Group AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Standard Chartered PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BMW AG (Alphera Financial Services)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ford Motor Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Banco Santander SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Societe Generale Grou

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi UFJ Lease & Finance Co Ltd

List of Figures

- Figure 1: Europe Automotive Finance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Finance Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Finance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Automotive Finance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Automotive Finance Market Revenue Million Forecast, by Source Type 2020 & 2033

- Table 4: Europe Automotive Finance Market Volume Billion Forecast, by Source Type 2020 & 2033

- Table 5: Europe Automotive Finance Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Europe Automotive Finance Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: Europe Automotive Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Automotive Finance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Europe Automotive Finance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Europe Automotive Finance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Europe Automotive Finance Market Revenue Million Forecast, by Source Type 2020 & 2033

- Table 12: Europe Automotive Finance Market Volume Billion Forecast, by Source Type 2020 & 2033

- Table 13: Europe Automotive Finance Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Europe Automotive Finance Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Europe Automotive Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Automotive Finance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: France Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Finance Market?

The projected CAGR is approximately 6.73%.

2. Which companies are prominent players in the Europe Automotive Finance Market?

Key companies in the market include Mitsubishi UFJ Lease & Finance Co Ltd, HSBC Holdings PLC, HDFC Bank Limited, Capital One Financial Corporation, Wells Fargo & Co, Toyota Financial Services (Toyota Motor Corporation), BNP Paribas SA, Volkswagen AG, Mercedes-Benz Group AG, Standard Chartered PLC, BMW AG (Alphera Financial Services), Ford Motor Company, Banco Santander SA, Societe Generale Grou.

3. What are the main segments of the Europe Automotive Finance Market?

The market segments include Type, Source Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Electric Vehicles Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

The Passenger Cars Market Segment to Witness Surging Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Adoption of Electric Vehicles Fosters the Growth of the Market.

8. Can you provide examples of recent developments in the market?

March 2024: BMW's financial arm partnered with CRIF to introduce open banking services in the United Kingdom, targeting prospective car buyers. The collaboration aims to streamline auto financing across all UK retailers, enhancing BMW's financial arm's access to crucial creditworthiness data.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Finance Market?

To stay informed about further developments, trends, and reports in the Europe Automotive Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence