Key Insights

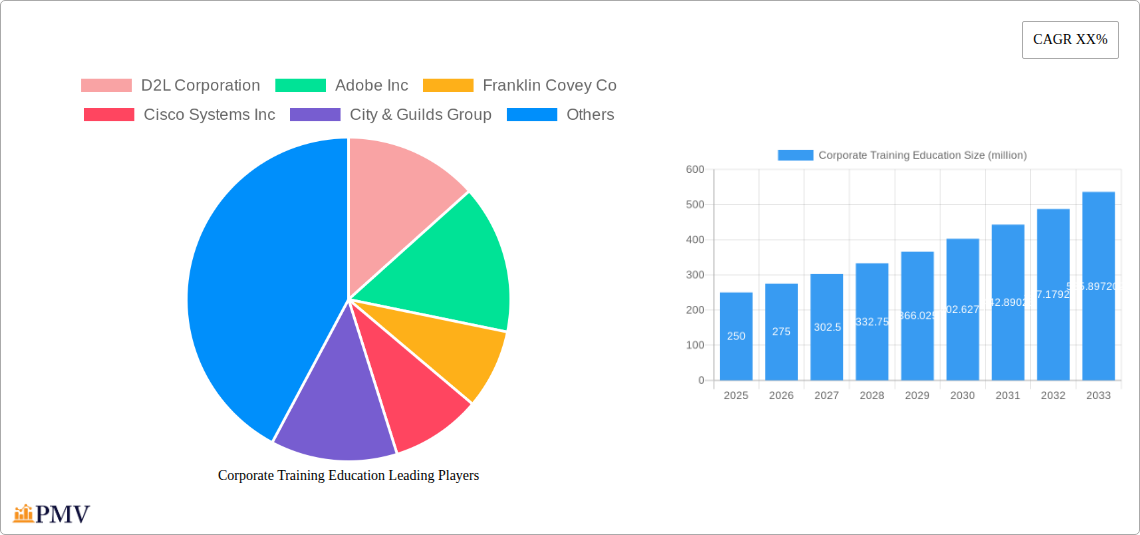

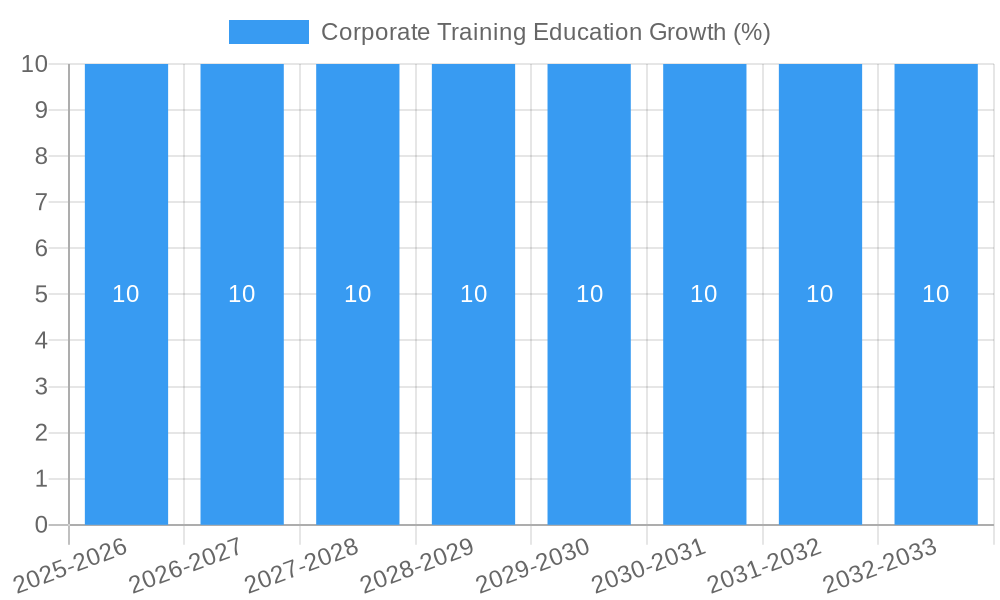

The global Corporate Training Education market is poised for significant expansion, projected to reach approximately USD 250 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 10% anticipated to persist through 2033. This growth is primarily fueled by the escalating need for continuous upskilling and reskilling of the workforce across diverse industries, driven by rapid technological advancements and evolving business landscapes. Organizations are increasingly recognizing the critical role of employee development in enhancing productivity, fostering innovation, and maintaining a competitive edge. Sectors such as Healthcare, Banking and Finance, and IT are leading the charge, investing heavily in training programs to equip their employees with the latest skills in areas like digital transformation, cybersecurity, and data analytics. The demand for both Virtual Training and Face-to-Face Training modalities is expected to rise, with virtual options gaining traction due to their flexibility and scalability, while in-person training remains crucial for complex skill development and team building.

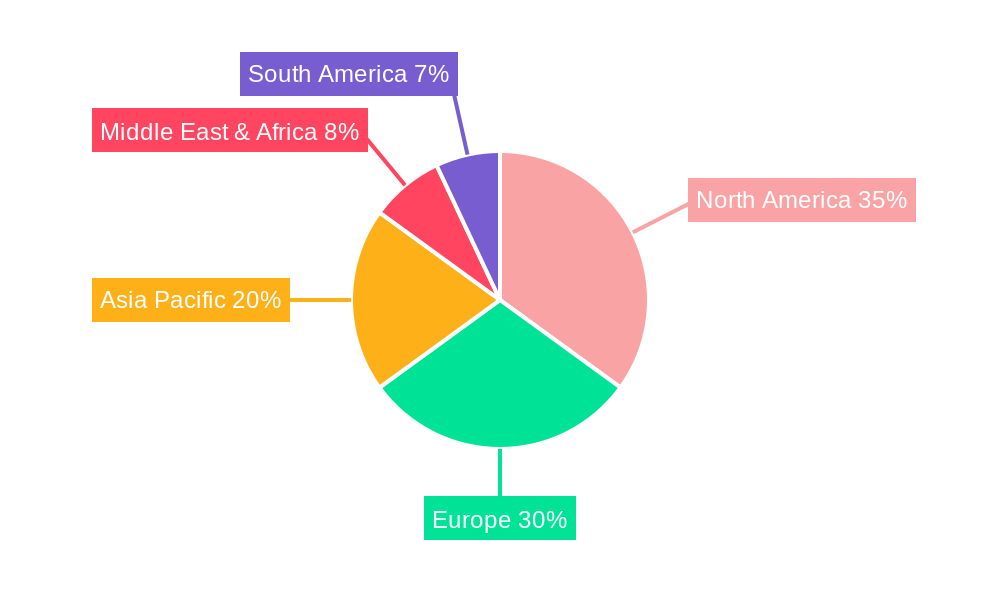

The market's trajectory is further shaped by several influential drivers, including the growing emphasis on compliance and regulatory training, the rising adoption of e-learning platforms, and the proactive strategies of companies to address skill gaps. Emerging trends such as personalized learning paths, AI-powered training solutions, and the integration of gamification are enhancing engagement and effectiveness. However, certain restraints, including budget constraints in smaller enterprises and resistance to adopting new training methodologies, could temper the growth in specific segments. Key players like D2L Corporation, Adobe Inc., and Skillsoft Ltd. are actively innovating and expanding their offerings to capture market share. Geographically, North America and Europe are expected to remain dominant regions due to their mature economies and high adoption rates of advanced training technologies, while Asia Pacific is projected to exhibit the fastest growth owing to its burgeoning economies and expanding corporate sector.

This in-depth report, "Corporate Training Education Market: Global Analysis & Strategic Forecast 2025-2033," offers a detailed examination of the corporate learning and development landscape. Covering a study period from 2019 to 2033, with a base year of 2025 and an estimated year also of 2025, this report leverages a robust forecast period of 2025–2033, building upon historical data from 2019–2024. The analysis provides actionable insights for industry stakeholders, investors, and decision-makers navigating the evolving corporate training education market. With a projected market size of several hundred million dollars, this report is essential for understanding current dynamics and future opportunities.

Corporate Training Education Market Structure & Competitive Dynamics

The corporate training education market exhibits a dynamic and evolving structure, characterized by moderate to high concentration among key players. Innovation plays a pivotal role, with companies continuously investing in R&D to develop cutting-edge learning solutions. Regulatory frameworks, while varying by region, generally support standardized quality and accessibility of training programs. Product substitutes, such as in-house developed training modules or free online resources, are present but often lack the specialized expertise, scalability, and accreditation offered by dedicated corporate training providers. End-user trends are shifting towards demand for personalized, flexible, and outcomes-driven learning experiences, necessitating a move away from one-size-fits-all approaches. Mergers and acquisitions (M&A) are a significant feature of the market, enabling consolidation of expertise, expansion of service offerings, and increased market share. For instance, recent M&A activities have seen deal values reaching tens of millions, as larger entities acquire specialized niche providers. Key companies actively shaping this landscape include D2L Corporation, Adobe Inc, Franklin Covey Co, Cisco Systems Inc, City & Guilds Group, GP Strategies Corp, Skillsoft Ltd, John Wiley & Sons Inc, NIIT Ltd, Wilson Learning Globally, Hult EF Corporate Education, Pasona Education, Lingoda, TrainingFolks, and Elearn2grow Limited. The competitive landscape is further intensified by players like Hult EF Corporate Education, known for its executive education programs, and Lingoda, a leading platform for language training, underscoring the diverse specializations within the broader market.

- Market Concentration: A blend of large, established players and agile, specialized providers.

- Innovation Ecosystem: Driven by advancements in EdTech, AI, and personalized learning platforms.

- Regulatory Frameworks: Ensuring quality standards and compliance across various industries.

- Product Substitutes: In-house training, open educational resources, and informal learning methods.

- End-User Trends: Growing demand for skill-based, micro-learning, and blended learning solutions.

- M&A Activities: Strategic acquisitions to broaden service portfolios and expand geographic reach, with reported deal values in the tens of millions.

Corporate Training Education Industry Trends & Insights

The corporate training education industry is experiencing robust growth, fueled by several interconnected trends. A primary growth driver is the accelerating pace of technological change, necessitating continuous upskilling and reskilling of the workforce to maintain competitive advantage. This includes the adoption of advanced technologies like artificial intelligence (AI) and machine learning (ML) to personalize learning paths, automate content delivery, and provide data-driven insights into employee development. The rise of remote and hybrid work models has also significantly boosted the demand for virtual training solutions, offering flexibility and accessibility to a global workforce. Consumer preferences are increasingly leaning towards on-demand, bite-sized learning modules (microlearning) that can be consumed at the learner's convenience, aligning with busy professional schedules. Gamification and immersive learning experiences, such as virtual reality (VR) and augmented reality (AR), are gaining traction, enhancing engagement and knowledge retention. The competitive dynamics are characterized by a push towards integrated learning platforms that offer a comprehensive suite of training solutions, from content creation to delivery and analytics. Companies are also focusing on developing specialized training programs that address specific industry skill gaps and compliance requirements. The overall market penetration of digital learning solutions is rapidly expanding, with a projected Compound Annual Growth Rate (CAGR) of approximately 10% over the forecast period. This growth is further propelled by organizations recognizing the strategic importance of investing in their human capital to drive innovation and productivity. The shift towards a skills-based economy means that continuous learning is no longer a perk but a necessity, leading to increased budget allocations for corporate training. The integration of learning into the workflow, facilitated by learning experience platforms (LXPs), is another key trend, making training more accessible and relevant. Furthermore, the increasing focus on soft skills, leadership development, and diversity and inclusion training is expanding the scope of corporate education beyond technical skills.

Dominant Markets & Segments in Corporate Training Education

The corporate training education market is characterized by distinct dominant regions and segments, each driven by specific economic policies, infrastructure development, and industry needs. The IT sector consistently emerges as a leading segment, fueled by the rapid evolution of technology, the constant demand for skilled professionals in areas like cybersecurity, cloud computing, and data science, and the significant investment companies make in upskilling their IT workforces. The Banking and Finance sector also holds a dominant position, driven by stringent regulatory compliance requirements, the need for continuous training in financial products and services, and the adoption of digital transformation initiatives.

- Leading Region: North America continues to lead due to substantial investments in R&D, a mature corporate training infrastructure, and a high concentration of technology and finance companies.

- Leading Segment by Application:

- IT: Driven by digital transformation, cybersecurity needs, and the demand for specialized tech skills. Key drivers include rapid technological advancements and the need for constant workforce adaptation.

- Banking and Finance: Fueled by regulatory compliance, digital banking adoption, and the need for financial literacy and risk management training. Economic policies promoting financial stability and innovation play a crucial role.

- Leading Segment by Type:

- Virtual Training: Dominates due to its scalability, cost-effectiveness, and flexibility, particularly in supporting remote and hybrid workforces. Global connectivity and advancements in video conferencing and learning management systems (LMS) are key infrastructure drivers.

- Face to Face Training: While still significant, its dominance is being challenged by virtual alternatives. It remains crucial for highly interactive workshops, team-building exercises, and specialized hands-on training.

The Manufacturing sector is also experiencing significant growth in corporate training, particularly in areas like Industry 4.0, automation, and advanced manufacturing techniques. Healthcare, driven by advancements in medical technology, evolving patient care practices, and regulatory compliance, is another rapidly expanding segment. The Hospitality sector, while recovering, is increasingly investing in customer service, digital guest experiences, and operational efficiency training. The "Others" category encompasses a wide array of industries, each with unique training needs, contributing to the overall market diversification. The dominance of virtual training is a testament to the global reach and accessibility it offers, allowing organizations to train employees across different geographies efficiently. The development of sophisticated learning platforms and the increasing comfort levels with online learning tools further solidify its position.

Corporate Training Education Product Innovations

Recent product innovations in corporate training education are centered on creating more engaging, personalized, and effective learning experiences. Companies are leveraging AI-powered adaptive learning platforms that tailor content and pace to individual learner needs, maximizing comprehension and skill acquisition. The integration of gamification elements, such as leaderboards, badges, and interactive challenges, is enhancing learner motivation and completion rates. Furthermore, there's a growing emphasis on immersive learning technologies like virtual reality (VR) for hands-on simulations in fields such as healthcare and manufacturing, and augmented reality (AR) for on-the-job performance support. The development of robust analytics dashboards provides detailed insights into learner progress, skill gaps, and training ROI, enabling organizations to refine their learning strategies. These innovations not only improve learning outcomes but also offer a significant competitive advantage by fostering a more skilled and agile workforce.

Report Segmentation & Scope

This report meticulously segments the corporate training education market across critical dimensions to provide a granular understanding of its dynamics.

- Application Segmentation: The market is analyzed by its application across key industries including Healthcare, Banking and Finance, Manufacturing, IT, Hospitality, and a broad "Others" category encompassing diverse sectors. Each application segment is projected to exhibit unique growth trajectories and market sizes, influenced by industry-specific demands for upskilling and reskilling.

- Type Segmentation: The report further divides the market by training delivery method into Virtual Training and Face to Face Training. Virtual training is expected to witness substantial growth due to its scalability and cost-effectiveness, while face-to-face training retains its importance for specific interactive and hands-on learning needs. Competitive dynamics within each delivery type are explored, highlighting the innovative approaches and market penetration strategies of key players.

Key Drivers of Corporate Training Education Growth

The corporate training education sector is propelled by a confluence of powerful growth drivers:

- Technological Advigilation: The rapid evolution of digital technologies, including AI, cloud computing, and automation, necessitates continuous workforce upskilling and reskilling.

- Skills Gap in Emerging Technologies: A persistent shortage of skilled professionals in areas like cybersecurity, data analytics, and AI creates a strong demand for specialized training.

- Digital Transformation Initiatives: Organizations across all sectors are investing heavily in digital transformation, requiring employees to acquire new digital competencies.

- Remote and Hybrid Work Models: The widespread adoption of flexible work arrangements has increased the demand for accessible and scalable virtual training solutions.

- Focus on Employee Development and Retention: Companies recognize that investing in employee growth is crucial for talent retention, engagement, and overall organizational success.

- Regulatory Compliance and Industry Standards: Many industries require ongoing training to meet evolving regulatory mandates and industry best practices, particularly in sectors like healthcare and finance.

Challenges in the Corporate Training Education Sector

Despite its robust growth, the corporate training education sector faces several significant challenges:

- Measuring ROI of Training Programs: Quantifying the direct return on investment for training initiatives can be complex, making it challenging to justify budget allocations.

- Keeping Pace with Rapid Technological Change: The fast-evolving technological landscape requires training content and delivery methods to be constantly updated, posing a logistical challenge.

- Learner Engagement and Motivation: Maintaining high levels of learner engagement and motivation, especially in virtual settings, remains a persistent hurdle.

- Integration with Existing Workflows: Seamlessly integrating learning into employees' daily workflows without disrupting productivity is crucial but difficult to achieve.

- Content Relevance and Personalization at Scale: Developing and delivering highly relevant and personalized content to a diverse workforce at scale is a significant undertaking.

- Cybersecurity Concerns for Online Platforms: Ensuring the security and privacy of sensitive employee data on online learning platforms is paramount.

Leading Players in the Corporate Training Education Market

The corporate training education market is shaped by a diverse set of leading players, each contributing to the industry's innovation and growth:

- D2L Corporation

- Adobe Inc

- Franklin Covey Co

- Cisco Systems Inc

- City & Guilds Group

- GP Strategies Corp

- Skillsoft Ltd

- John Wiley & Sons Inc

- NIIT Ltd

- Wilson Learning Globally

- Hult EF Corporate Education

- Pasona Education

- Lingoda

- TrainingFolks

- Elearn2grow Limited

Key Developments in Corporate Training Education Sector

- 2023: Skillsoft Ltd. launched its new AI-powered capability within the Percipio platform, offering personalized learning recommendations and content curation, significantly impacting learner engagement.

- 2023: Adobe Inc. expanded its digital learning solutions with enhanced collaboration features and new course offerings focused on creative and digital marketing skills.

- 2024: D2L Corporation announced strategic partnerships with several major universities to integrate its Brightspace platform for extended learning and executive education programs.

- 2024: Cisco Systems Inc. introduced an advanced cybersecurity training module leveraging virtual reality simulations for hands-on threat detection and response exercises.

- 2024: Hult EF Corporate Education launched a series of micro-credentials in sustainable business practices, responding to growing corporate demand for ESG expertise.

- 2025: City & Guilds Group unveiled a new digital assessment framework designed to provide real-time feedback on vocational skills, enhancing the credibility of certifications.

- 2025: GP Strategies Corp. acquired a specialized firm focusing on leadership development and change management, further strengthening its comprehensive service portfolio.

- 2025: John Wiley & Sons Inc. introduced an AI-driven analytics dashboard for its learning solutions, providing deeper insights into learner progress and course effectiveness.

Strategic Corporate Training Education Market Outlook

The strategic outlook for the corporate training education market remains exceptionally strong, characterized by sustained growth and significant opportunities for innovation. The increasing recognition of learning and development as a critical business enabler, rather than a cost center, is a key growth accelerator. Organizations are prioritizing investment in upskilling their workforce to adapt to evolving job roles and emerging technologies. The continued expansion of virtual learning technologies, coupled with the demand for personalized and microlearning experiences, presents a fertile ground for new product development and market penetration. Strategic opportunities lie in developing specialized training programs for high-demand sectors like AI, data science, and green skills, as well as in offering integrated learning platforms that provide end-to-end solutions from content delivery to performance analytics. Furthermore, partnerships and collaborations between EdTech providers, industry associations, and corporate entities will be crucial for developing relevant and impactful training initiatives that drive future workforce readiness and organizational success. The market is poised for continued expansion as companies worldwide invest in human capital as a strategic differentiator.

Corporate Training Education Segmentation

-

1. Application

- 1.1. Healthcare

- 1.2. Banking and Finance

- 1.3. Manufacturing

- 1.4. IT

- 1.5. Hospitality

- 1.6. Others

-

2. Types

- 2.1. Virtual Training

- 2.2. Face to Face Training

Corporate Training Education Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Corporate Training Education REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Corporate Training Education Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Healthcare

- 5.1.2. Banking and Finance

- 5.1.3. Manufacturing

- 5.1.4. IT

- 5.1.5. Hospitality

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Virtual Training

- 5.2.2. Face to Face Training

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Corporate Training Education Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Healthcare

- 6.1.2. Banking and Finance

- 6.1.3. Manufacturing

- 6.1.4. IT

- 6.1.5. Hospitality

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Virtual Training

- 6.2.2. Face to Face Training

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Corporate Training Education Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Healthcare

- 7.1.2. Banking and Finance

- 7.1.3. Manufacturing

- 7.1.4. IT

- 7.1.5. Hospitality

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Virtual Training

- 7.2.2. Face to Face Training

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Corporate Training Education Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Healthcare

- 8.1.2. Banking and Finance

- 8.1.3. Manufacturing

- 8.1.4. IT

- 8.1.5. Hospitality

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Virtual Training

- 8.2.2. Face to Face Training

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Corporate Training Education Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Healthcare

- 9.1.2. Banking and Finance

- 9.1.3. Manufacturing

- 9.1.4. IT

- 9.1.5. Hospitality

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Virtual Training

- 9.2.2. Face to Face Training

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Corporate Training Education Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Healthcare

- 10.1.2. Banking and Finance

- 10.1.3. Manufacturing

- 10.1.4. IT

- 10.1.5. Hospitality

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Virtual Training

- 10.2.2. Face to Face Training

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 D2L Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Adobe Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Franklin Covey Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cisco Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 City & Guilds Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GP Strategies Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Skillsoft Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 John Wiley & Sons Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NIIT Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wilson Learning Globally

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hult EF Corporate Education

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pasona Education

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Lingoda

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TrainingFolks

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Elearn2grow Limited

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 D2L Corporation

List of Figures

- Figure 1: Global Corporate Training Education Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Corporate Training Education Revenue (million), by Application 2024 & 2032

- Figure 3: North America Corporate Training Education Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Corporate Training Education Revenue (million), by Types 2024 & 2032

- Figure 5: North America Corporate Training Education Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Corporate Training Education Revenue (million), by Country 2024 & 2032

- Figure 7: North America Corporate Training Education Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Corporate Training Education Revenue (million), by Application 2024 & 2032

- Figure 9: South America Corporate Training Education Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Corporate Training Education Revenue (million), by Types 2024 & 2032

- Figure 11: South America Corporate Training Education Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Corporate Training Education Revenue (million), by Country 2024 & 2032

- Figure 13: South America Corporate Training Education Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Corporate Training Education Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Corporate Training Education Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Corporate Training Education Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Corporate Training Education Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Corporate Training Education Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Corporate Training Education Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Corporate Training Education Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Corporate Training Education Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Corporate Training Education Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Corporate Training Education Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Corporate Training Education Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Corporate Training Education Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Corporate Training Education Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Corporate Training Education Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Corporate Training Education Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Corporate Training Education Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Corporate Training Education Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Corporate Training Education Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Corporate Training Education Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Corporate Training Education Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Corporate Training Education Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Corporate Training Education Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Corporate Training Education Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Corporate Training Education Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Corporate Training Education Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Corporate Training Education Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Corporate Training Education Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Corporate Training Education Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Corporate Training Education Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Corporate Training Education Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Corporate Training Education Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Corporate Training Education Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Corporate Training Education Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Corporate Training Education Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Corporate Training Education Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Corporate Training Education Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Corporate Training Education Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Corporate Training Education Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Corporate Training Education?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Corporate Training Education?

Key companies in the market include D2L Corporation, Adobe Inc, Franklin Covey Co, Cisco Systems Inc, City & Guilds Group, GP Strategies Corp, Skillsoft Ltd, John Wiley & Sons Inc, NIIT Ltd, Wilson Learning Globally, Hult EF Corporate Education, Pasona Education, Lingoda, TrainingFolks, Elearn2grow Limited.

3. What are the main segments of the Corporate Training Education?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Corporate Training Education," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Corporate Training Education report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Corporate Training Education?

To stay informed about further developments, trends, and reports in the Corporate Training Education, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence