Key Insights

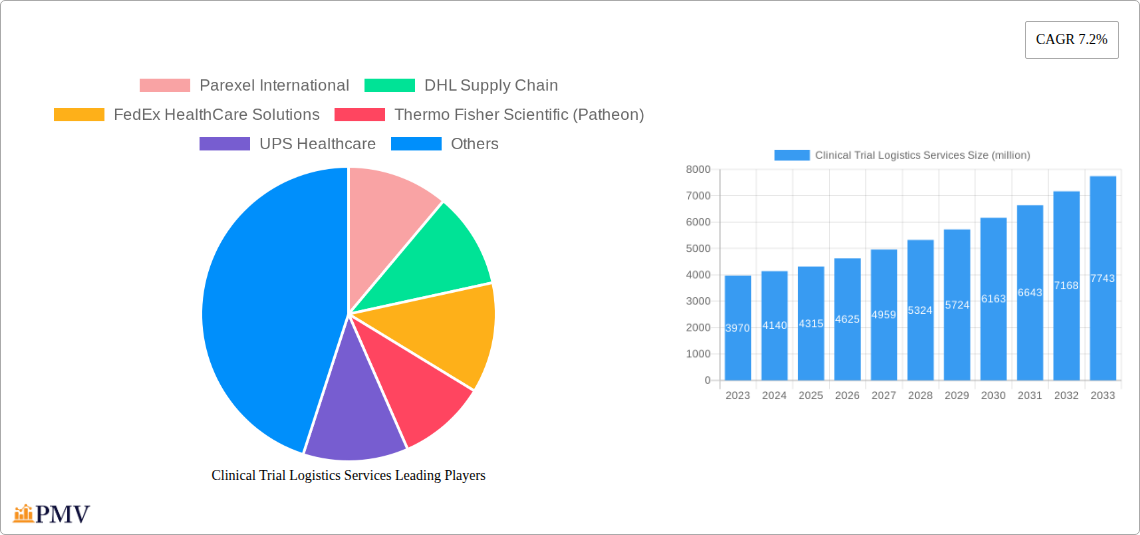

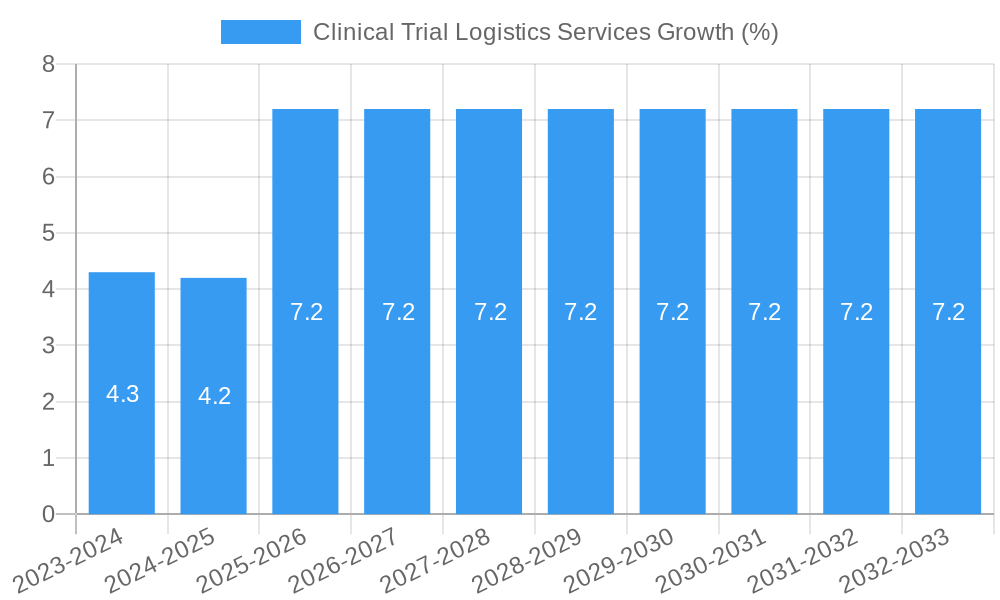

The global Clinical Trial Logistics Services market is projected for robust expansion, with a current market size of approximately $4,315 million. This growth is fueled by a significant Compound Annual Growth Rate (CAGR) of 7.2%, indicating a dynamic and evolving sector. Key drivers behind this upward trajectory include the increasing complexity of global clinical trials, a growing pipeline of biologic drugs requiring specialized handling, and the expanding reach of research into emerging economies. The escalating demand for temperature-controlled solutions, from room temperature storage to ultra-cold chain logistics, is paramount, driven by the inherent sensitivity of investigational medicinal products and advanced therapies. Furthermore, the rise of decentralized clinical trials (DCTs) necessitates sophisticated logistics networks capable of direct-to-patient delivery and home-based sample collection, further propelling market growth.

The market is segmented into distinct application types catering to the needs of both Large Enterprises and Small and Medium-sized Enterprises (SMEs). Within the types of storage, the demand for specialized cold chain and ultra-cold chain storage solutions is rapidly increasing, reflecting advancements in pharmaceutical research and development. While the market benefits from strong growth drivers, certain restraints, such as the high cost associated with specialized infrastructure and the stringent regulatory compliance required for clinical trial logistics, need to be carefully managed. Leading companies such as Parexel International, DHL Supply Chain, FedEx HealthCare Solutions, and Thermo Fisher Scientific (Patheon) are actively shaping this landscape through strategic investments in technology, infrastructure, and global network expansion, ensuring the efficient and secure transport and storage of vital clinical trial materials.

Detailed Report Description: Clinical Trial Logistics Services Market Analysis (2019-2033)

This comprehensive report delves into the dynamic clinical trial logistics services market, offering an in-depth analysis of its structure, competitive landscape, emerging trends, and future outlook. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report provides actionable insights for stakeholders seeking to navigate this rapidly evolving sector. The study period spans from 2019 to 2033, offering a long-term perspective on market evolution.

Clinical Trial Logistics Services Market Structure & Competitive Dynamics

The clinical trial logistics services market is characterized by a moderately concentrated structure, with key players investing heavily in innovation and global reach. Prominent companies such as Parexel International, DHL Supply Chain, FedEx HealthCare Solutions, Thermo Fisher Scientific (Patheon), UPS Healthcare, Marken, World Courier (AmerisourceBergen), Fisher Clinical Services, Catalent Pharma Solutions, PCI Pharma Services, Almac Group, and BioStorage Technologies hold significant market share. Recent M&A activities are reshaping the landscape, with deal values in the tens of millions, driven by the need for expanded service portfolios and geographical footprints. The innovation ecosystem thrives on the development of specialized solutions for temperature-controlled transport and real-time monitoring, directly addressing the stringent requirements of pharmaceutical and biotechnology companies. Regulatory frameworks, particularly GMP and GDP guidelines, form a critical barrier to entry and a crucial operational consideration. Product substitutes are limited due to the highly specialized nature of clinical trial logistics, but advancements in patient-centric trial models are influencing demand for decentralized logistics solutions. End-user trends point towards an increasing preference for integrated logistics partners capable of managing complex, multi-country trials.

Clinical Trial Logistics Services Industry Trends & Insights

The clinical trial logistics services industry is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 7.8% from 2025 to 2033. This expansion is fueled by several key market growth drivers, including the escalating complexity of global clinical trials, a burgeoning pipeline of biopharmaceutical drugs requiring specialized handling, and an increasing outsourcing trend among pharmaceutical companies. Technological disruptions are at the forefront, with the adoption of advanced tracking and monitoring systems, including IoT devices and blockchain technology, enhancing supply chain visibility and integrity. This allows for real-time temperature monitoring, deviation alerts, and enhanced security, crucial for high-value biological samples and investigational medicinal products. Consumer preferences are shifting towards more patient-centric and decentralized trial models, necessitating agile and localized logistics solutions that can deliver directly to patients' homes and collect biological samples with the same level of stringent control. Competitive dynamics are intensifying, pushing companies to differentiate through specialized services, such as ultra-cold chain logistics for advanced therapies, and to invest in sustainable logistics practices. The increasing prevalence of chronic diseases and the demand for novel therapies are significant underlying factors contributing to the sustained growth in demand for efficient and reliable clinical trial logistics services. The market penetration of advanced logistics solutions is steadily increasing as more research organizations recognize the critical role of robust supply chains in successful clinical trial outcomes.

Dominant Markets & Segments in Clinical Trial Logistics Services

Within the clinical trial logistics services market, the large enterprises segment commands a dominant share, accounting for over 75% of the market value. This dominance is driven by the sheer volume of complex, multi-site, and international clinical trials conducted by major pharmaceutical and biotechnology corporations. These enterprises have the resources and the need for comprehensive, end-to-end logistics solutions that can manage intricate supply chains. Economical policies favoring R&D investment and robust healthcare infrastructure in regions like North America and Europe contribute significantly to their market leadership.

Cold Chain Storage is the most dominant segment within the types of storage, representing approximately 50% of the market. This is attributed to the growing number of biologic drugs, vaccines, and cell and gene therapies that require strict temperature control throughout their lifecycle. The development and increasing utilization of advanced therapies, which are highly sensitive to temperature fluctuations, further solidify the importance of cold chain logistics.

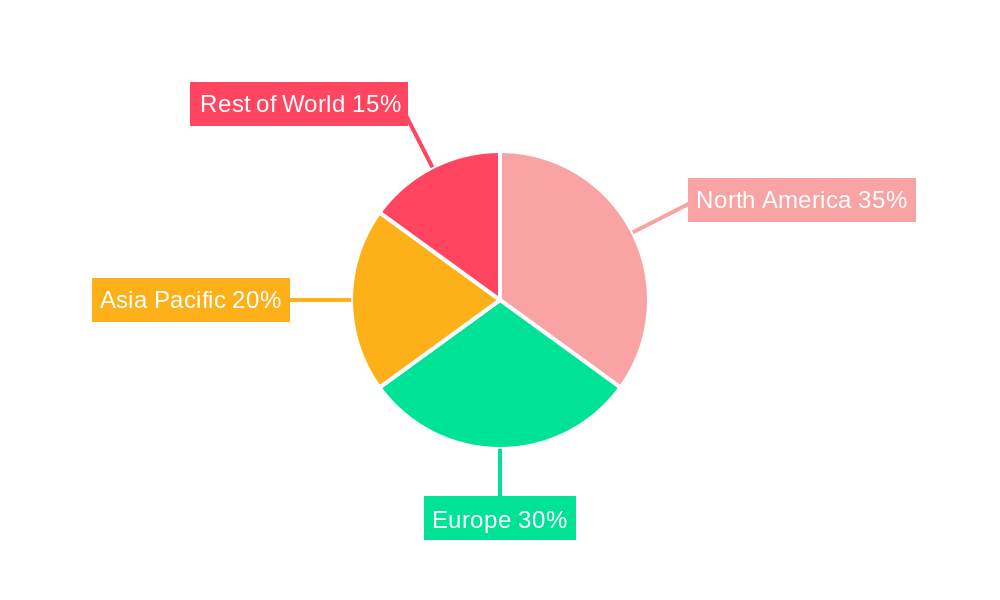

Geographically, North America remains the leading market, driven by a strong presence of pharmaceutical research and development companies, a well-established regulatory framework, and advanced healthcare infrastructure. The region's significant investment in new drug development and clinical trials directly translates into higher demand for specialized logistics services. Economic policies that encourage innovation and the presence of leading academic research institutions also bolster its dominance.

Key Drivers for Large Enterprises Dominance:

- High volume of complex, international clinical trials.

- Significant R&D expenditure.

- Need for integrated, end-to-end supply chain management.

- Stringent regulatory compliance requirements.

Key Drivers for Cold Chain Storage Dominance:

- Growing number of biologic and advanced therapy drugs.

- Increased sensitivity of investigational medicinal products to temperature.

- Demand for temperature-controlled shipping and storage solutions.

Key Drivers for North America's Dominance:

- Concentration of major pharmaceutical and biotech companies.

- High investment in R&D and clinical trials.

- Well-developed healthcare infrastructure and regulatory environment.

Clinical Trial Logistics Services Product Innovations

Product innovations in clinical trial logistics services are primarily focused on enhancing temperature control, real-time visibility, and supply chain efficiency. Companies are developing advanced packaging solutions, including phase-change materials and active temperature control systems, to maintain product integrity even in extreme conditions. The integration of IoT sensors and AI-powered analytics is revolutionizing real-time monitoring, providing unprecedented insights into shipment status, environmental conditions, and potential risks. These innovations offer competitive advantages by ensuring product quality, reducing waste, and improving patient safety, ultimately contributing to more successful and cost-effective clinical trials.

Report Segmentation & Scope

This report segments the clinical trial logistics services market across key applications and storage types. The Large Enterprises segment is projected to grow at a CAGR of approximately 7.5%, reaching a market size of over $50,000 million by 2033, driven by extensive R&D activities and global trial operations. The SMEs segment, while smaller, is anticipated to experience a higher growth rate of around 8.2%, as smaller biotech firms increasingly outsource their logistics needs to specialized providers.

Within storage types, Room Temperature Storage will continue to be a significant segment, with a projected market size of over $25,000 million. However, Cold Chain Storage is expected to witness the highest growth, with a CAGR of approximately 8.5%, driven by the proliferation of biologic drugs and advanced therapies. Ultra-Cold Chain Storage, though niche, will also experience substantial expansion due to its critical role in preserving highly sensitive biological materials, with an estimated market size of over $10,000 million by 2033.

Key Drivers of Clinical Trial Logistics Services Growth

The clinical trial logistics services market is propelled by several critical growth drivers. The escalating number of global clinical trials, driven by an aging global population and the increasing prevalence of chronic diseases, directly fuels demand. Technological advancements, particularly in real-time temperature monitoring and data analytics, are crucial for ensuring product integrity and compliance. Economic factors, such as increased R&D investment by pharmaceutical companies and government incentives for drug development, further bolster the market. Regulatory frameworks, while sometimes a challenge, also drive the need for specialized and compliant logistics services. The growing adoption of patient-centric trial designs, necessitating home delivery and sample pick-up services, is another significant accelerator.

Challenges in the Clinical Trial Logistics Services Sector

Despite robust growth, the clinical trial logistics services sector faces notable challenges. Stringent and evolving regulatory landscapes across different regions can lead to compliance complexities and delays. Supply chain disruptions, whether due to geopolitical events, natural disasters, or transportation issues, pose a significant risk to timely drug delivery and sample integrity. The high cost associated with specialized cold chain infrastructure and advanced monitoring technologies can be a barrier, particularly for smaller players. Intense competition also pressures margins, requiring continuous investment in innovation and operational efficiency. Furthermore, the need for highly trained personnel capable of handling specialized biological materials and adhering to strict protocols adds to operational complexities.

Leading Players in the Clinical Trial Logistics Services Market

- Parexel International

- DHL Supply Chain

- FedEx HealthCare Solutions

- Thermo Fisher Scientific (Patheon)

- UPS Healthcare

- Marken

- World Courier (AmerisourceBergen)

- Fisher Clinical Services

- Catalent Pharma Solutions

- PCI Pharma Services

- Almac Group

- BioStorage Technologies

Key Developments in Clinical Trial Logistics Services Sector

- 2023 Q4: Expansion of ultra-cold chain storage facilities by several key players to accommodate new cell and gene therapies.

- 2023 Q3: Increased adoption of blockchain technology for enhanced supply chain traceability and security in clinical trials.

- 2023 Q2: Launch of new integrated logistics platforms offering end-to-end solutions from site to patient.

- 2023 Q1: Strategic partnerships formed between logistics providers and innovative biotech startups to streamline decentralized trial logistics.

- 2022 Q4: Significant investments in sustainable logistics practices and green transportation solutions by major players.

- 2022 Q3: Introduction of advanced real-time temperature monitoring solutions with predictive analytics capabilities.

- 2022 Q2: Consolidation and M&A activities aimed at expanding service portfolios and geographical reach.

- 2022 Q1: Development of specialized logistics solutions for companion diagnostics and personalized medicine trials.

Strategic Clinical Trial Logistics Services Market Outlook

The strategic clinical trial logistics services market outlook is characterized by continued strong growth and increasing specialization. Growth accelerators include the rising demand for cell and gene therapies, the expansion of decentralized clinical trials, and the ongoing globalization of pharmaceutical R&D. Strategic opportunities lie in developing end-to-end integrated solutions, leveraging cutting-edge technologies like AI and IoT for enhanced supply chain management, and expanding services to emerging markets. Companies that focus on building robust, resilient, and patient-centric logistics networks will be best positioned to capitalize on the future potential of this vital sector. The ongoing investment in innovative therapies will continue to drive the need for sophisticated and reliable clinical trial logistics.

Clinical Trial Logistics Services Segmentation

-

1. Application

- 1.1. Large enterprises

- 1.2. SMEs

-

2. Types

- 2.1. Room Temperature Storage

- 2.2. Cold Chain Storage

- 2.3. Ultra-Cold Chain Storage

Clinical Trial Logistics Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Clinical Trial Logistics Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Clinical Trial Logistics Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large enterprises

- 5.1.2. SMEs

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Room Temperature Storage

- 5.2.2. Cold Chain Storage

- 5.2.3. Ultra-Cold Chain Storage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Clinical Trial Logistics Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large enterprises

- 6.1.2. SMEs

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Room Temperature Storage

- 6.2.2. Cold Chain Storage

- 6.2.3. Ultra-Cold Chain Storage

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Clinical Trial Logistics Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large enterprises

- 7.1.2. SMEs

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Room Temperature Storage

- 7.2.2. Cold Chain Storage

- 7.2.3. Ultra-Cold Chain Storage

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Clinical Trial Logistics Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large enterprises

- 8.1.2. SMEs

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Room Temperature Storage

- 8.2.2. Cold Chain Storage

- 8.2.3. Ultra-Cold Chain Storage

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Clinical Trial Logistics Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large enterprises

- 9.1.2. SMEs

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Room Temperature Storage

- 9.2.2. Cold Chain Storage

- 9.2.3. Ultra-Cold Chain Storage

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Clinical Trial Logistics Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large enterprises

- 10.1.2. SMEs

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Room Temperature Storage

- 10.2.2. Cold Chain Storage

- 10.2.3. Ultra-Cold Chain Storage

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Parexel International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL Supply Chain

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FedEx HealthCare Solutions

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thermo Fisher Scientific (Patheon)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 UPS Healthcare

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Marken

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 World Courier (AmerisourceBergen)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fisher Clinical Services

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Catalent Pharma Solutions

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PCI Pharma Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Almac Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BioStorage Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Parexel International

List of Figures

- Figure 1: Global Clinical Trial Logistics Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Clinical Trial Logistics Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Clinical Trial Logistics Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Clinical Trial Logistics Services Revenue (million), by Types 2024 & 2032

- Figure 5: North America Clinical Trial Logistics Services Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Clinical Trial Logistics Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Clinical Trial Logistics Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Clinical Trial Logistics Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Clinical Trial Logistics Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Clinical Trial Logistics Services Revenue (million), by Types 2024 & 2032

- Figure 11: South America Clinical Trial Logistics Services Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Clinical Trial Logistics Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Clinical Trial Logistics Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Clinical Trial Logistics Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Clinical Trial Logistics Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Clinical Trial Logistics Services Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Clinical Trial Logistics Services Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Clinical Trial Logistics Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Clinical Trial Logistics Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Clinical Trial Logistics Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Clinical Trial Logistics Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Clinical Trial Logistics Services Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Clinical Trial Logistics Services Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Clinical Trial Logistics Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Clinical Trial Logistics Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Clinical Trial Logistics Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Clinical Trial Logistics Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Clinical Trial Logistics Services Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Clinical Trial Logistics Services Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Clinical Trial Logistics Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Clinical Trial Logistics Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Clinical Trial Logistics Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Clinical Trial Logistics Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Clinical Trial Logistics Services Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Clinical Trial Logistics Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Clinical Trial Logistics Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Clinical Trial Logistics Services Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Clinical Trial Logistics Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Clinical Trial Logistics Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Clinical Trial Logistics Services Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Clinical Trial Logistics Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Clinical Trial Logistics Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Clinical Trial Logistics Services Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Clinical Trial Logistics Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Clinical Trial Logistics Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Clinical Trial Logistics Services Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Clinical Trial Logistics Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Clinical Trial Logistics Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Clinical Trial Logistics Services Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Clinical Trial Logistics Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Clinical Trial Logistics Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Clinical Trial Logistics Services?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Clinical Trial Logistics Services?

Key companies in the market include Parexel International, DHL Supply Chain, FedEx HealthCare Solutions, Thermo Fisher Scientific (Patheon), UPS Healthcare, Marken, World Courier (AmerisourceBergen), Fisher Clinical Services, Catalent Pharma Solutions, PCI Pharma Services, Almac Group, BioStorage Technologies.

3. What are the main segments of the Clinical Trial Logistics Services?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 4315 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Clinical Trial Logistics Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Clinical Trial Logistics Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Clinical Trial Logistics Services?

To stay informed about further developments, trends, and reports in the Clinical Trial Logistics Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence