Key Insights

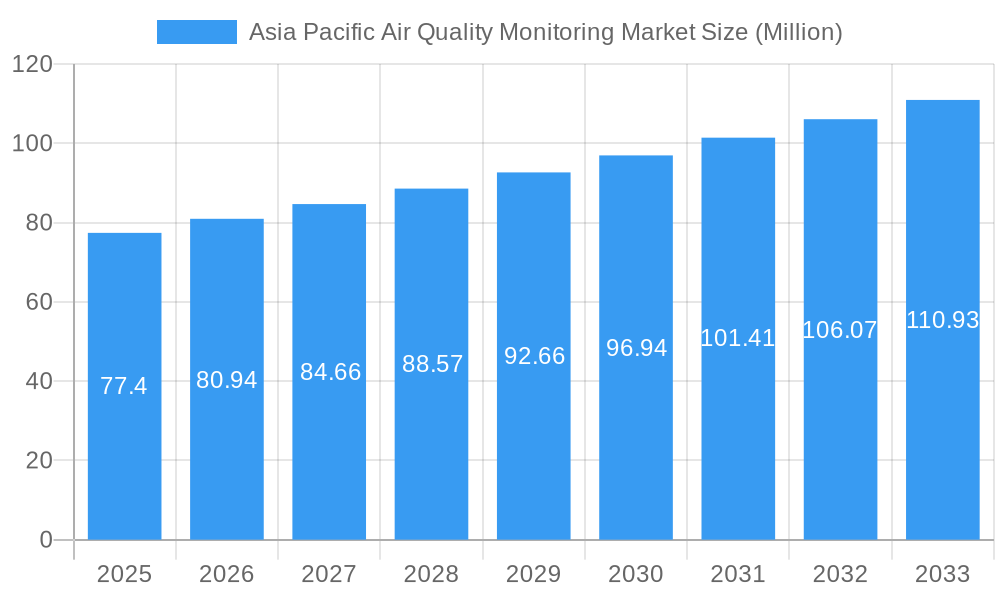

The Asia Pacific air quality monitoring market, valued at $77.40 million in 2025, is projected to experience robust growth, driven by increasing environmental concerns, stringent government regulations, and rising industrialization across the region. A Compound Annual Growth Rate (CAGR) of 4.55% from 2025 to 2033 indicates a significant market expansion. Key growth drivers include the escalating prevalence of respiratory illnesses linked to air pollution, coupled with government initiatives promoting cleaner air. The continuous sampling method is expected to dominate the market due to its real-time data provision crucial for effective pollution control. Chemical pollutants constitute a major segment, reflecting the high levels of industrial activity and vehicular emissions in the region. Major end-users include power generation and petrochemical industries, demanding sophisticated monitoring solutions for compliance and operational efficiency. China, India, and Japan are projected to be the largest national markets, fueled by rapid urbanization and industrial development. The market is highly competitive, with established players like Honeywell, Horiba, and Thermo Fisher Scientific vying for market share alongside regional and specialized companies. Growth is anticipated to be particularly strong in emerging economies within the Asia Pacific region, as these nations invest in infrastructure development and environmental protection measures. The market’s growth trajectory, however, may be impacted by factors such as the high initial investment costs of advanced monitoring equipment and the need for skilled personnel for installation and maintenance.

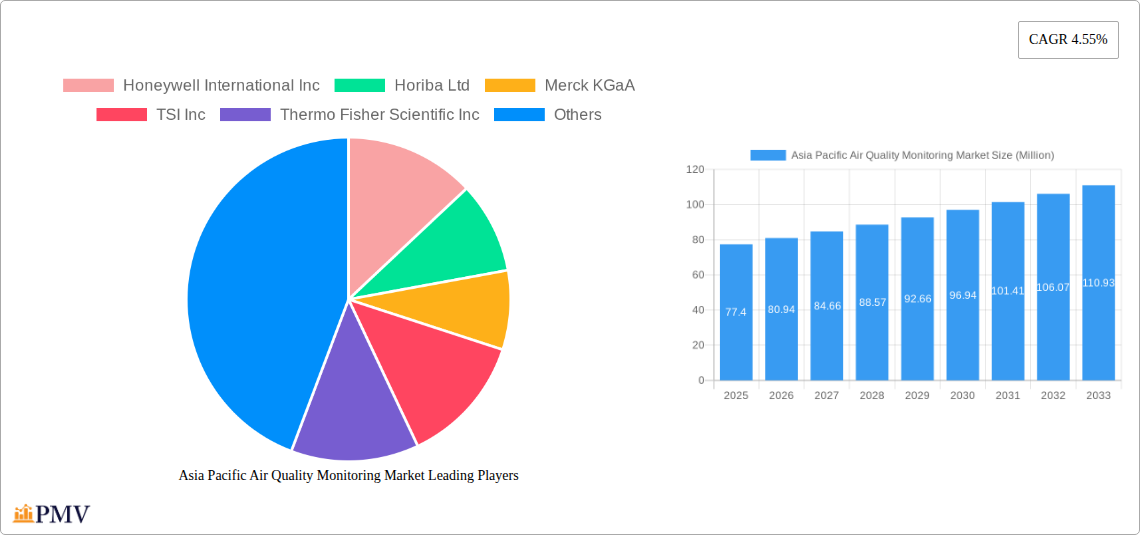

Asia Pacific Air Quality Monitoring Market Market Size (In Million)

The continuous growth in the Asia Pacific air quality monitoring market is largely attributable to the increasing awareness among governments and industries about the detrimental health and environmental impacts of air pollution. Technological advancements in monitoring equipment, offering enhanced accuracy, portability and data analytics capabilities, will further fuel market expansion. The increasing adoption of smart cities initiatives also promises to boost demand for integrated air quality monitoring systems. Furthermore, the development of more affordable and accessible monitoring technologies will broaden market penetration, especially in smaller cities and rural areas. Competition in the market is expected to intensify, with companies focusing on product innovation, strategic partnerships, and geographical expansion to gain a competitive edge. The market segmentation by pollutant type, sampling method, and end-user provides lucrative opportunities for specialized players to cater to niche demands.

Asia Pacific Air Quality Monitoring Market Company Market Share

Asia Pacific Air Quality Monitoring Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific Air Quality Monitoring Market, offering invaluable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is essential for understanding the market's current state and future trajectory. The study meticulously examines various market segments, including sampling methods, pollutant types, end-users, and product types, providing granular data and actionable strategies for informed decision-making.

Asia Pacific Air Quality Monitoring Market Market Structure & Competitive Dynamics

The Asia Pacific Air Quality Monitoring market exhibits a moderately consolidated structure, with several multinational corporations holding significant market share. Key players like Honeywell International Inc, Horiba Ltd, Merck KGaA, TSI Inc, Thermo Fisher Scientific Inc, and Emerson Electric Co., amongst others, compete fiercely, driving innovation and market penetration. The market concentration ratio (CR4) is estimated at xx%, indicating a presence of both larger players and smaller, specialized firms.

- Market Share: The top five players collectively hold an estimated xx% of the market share in 2025, with Honeywell International Inc. leading at an estimated xx%. Exact figures are detailed within the full report.

- Innovation Ecosystems: Significant investments are being made in R&D to develop advanced sensors, data analytics platforms, and IoT-enabled monitoring systems. Collaboration between technology providers and environmental agencies is also prevalent.

- Regulatory Frameworks: Governments across the Asia Pacific region are increasingly implementing stringent air quality regulations, driving demand for sophisticated monitoring solutions. These regulations vary across countries, creating a complex regulatory landscape.

- Product Substitutes: While technological advancements constantly shape the landscape, there are few direct substitutes for air quality monitoring systems. However, improvements in modelling and forecasting techniques may partly substitute the need for widespread monitoring in certain contexts.

- End-User Trends: Growing environmental consciousness, coupled with increasing urbanization and industrialization, is fuelling demand from diverse end-users, including government agencies, industrial facilities, and residential sectors.

- M&A Activities: Consolidation within the industry is anticipated with an estimated xx Million in M&A deal values recorded between 2019 and 2024. Further details on these transactions are provided in the complete report.

Asia Pacific Air Quality Monitoring Market Industry Trends & Insights

The Asia Pacific Air Quality Monitoring market is experiencing robust growth, driven by several key factors. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing air pollution levels across major cities, stringent government regulations, rising awareness about health risks associated with poor air quality, and the growing adoption of advanced monitoring technologies.

Technological disruptions, particularly the integration of IoT, AI, and big data analytics, are revolutionizing air quality monitoring. This enables real-time data acquisition, advanced predictive modelling, and enhanced decision-making for pollution control measures. Consumer preferences are shifting towards user-friendly, cost-effective, and data-driven solutions for both indoor and outdoor air quality monitoring. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a growing focus on value-added services. Market penetration rates for advanced monitoring technologies remain relatively low in many regions, offering significant growth potential.

Dominant Markets & Segments in Asia Pacific Air Quality Monitoring Market

Leading Region: China and India are leading the market due to rapid industrialization, high levels of air pollution, and substantial government investments in air quality improvement initiatives.

Dominant Segments:

- Sampling Method: Continuous monitoring systems dominate due to their ability to provide real-time data, though manual and intermittent methods retain niche applications.

- Pollutant Type: Chemical pollutants (PM2.5, PM10, NOx, SO2) are the primary focus, followed by physical pollutants like dust and biological pollutants like pollen and mold.

- End User: Government agencies are the largest end-user segment, followed by the industrial sector (power generation and petrochemicals). Residential and commercial sectors are showing rapid growth.

- Product Type: Outdoor monitors hold a larger market share compared to indoor monitors, driven by the need for comprehensive pollution monitoring across urban areas.

Key Drivers in Dominant Markets:

- China: Stringent environmental regulations, substantial government funding for air quality improvement, and rapid urbanization are driving market expansion.

- India: Growing environmental concerns, increasing public awareness, and government initiatives like the AI-AQMS v1.0 are stimulating market growth.

- Other Southeast Asian Countries: Rapid industrialization and urbanization are contributing to rising air pollution, creating increasing demand for monitoring solutions.

Asia Pacific Air Quality Monitoring Market Product Innovations

Recent product innovations focus on miniaturization, improved accuracy, wireless connectivity, and the integration of advanced analytics capabilities. New monitoring systems incorporate IoT technology, allowing for remote data access and real-time analysis. The market is witnessing the development of low-cost, portable devices catering to individual needs, alongside sophisticated multi-parameter systems designed for large-scale monitoring programs. This creates products suited to both individual and government needs.

Report Segmentation & Scope

This report segments the Asia Pacific Air Quality Monitoring Market based on sampling method (continuous, manual, intermittent), pollutant type (chemical, physical, biological), end-user (residential & commercial, power generation, petrochemicals, others), and product type (indoor, outdoor). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The report provides a comprehensive overview of the market across various countries in the Asia-Pacific region.

Key Drivers of Asia Pacific Air Quality Monitoring Market Growth

The Asia Pacific air quality monitoring market is propelled by several key drivers:

- Stringent Government Regulations: Governments across the region are enacting stricter emission norms and air quality standards, mandating the use of monitoring equipment.

- Rising Air Pollution Levels: Increasing urbanization, industrialization, and vehicular emissions are leading to alarming levels of air pollution, necessitating robust monitoring systems.

- Technological Advancements: The development of sophisticated, cost-effective, and user-friendly monitoring technologies is further driving market growth.

- Growing Awareness: Rising public awareness about the health impacts of air pollution is driving demand for reliable monitoring solutions and proactive mitigation strategies.

Challenges in the Asia Pacific Air Quality Monitoring Market Sector

The market faces certain challenges, including:

- High Initial Investment Costs: Setting up comprehensive air quality monitoring networks requires significant capital investment, particularly for developing economies.

- Data Management and Analysis: Effective data management and analysis of large datasets generated by monitoring systems pose significant challenges.

- Lack of Standardization: The lack of standardized protocols and reporting formats across different countries can hinder data comparison and effective policy-making.

- Maintenance & Calibration: Continuous monitoring systems necessitate regular maintenance and calibration, adding to operational costs.

Leading Players in the Asia Pacific Air Quality Monitoring Market Market

- Honeywell International Inc

- Horiba Ltd

- Merck KGaA

- TSI Inc

- Thermo Fisher Scientific Inc

- Aeroqual Limited

- Emerson Electric Co

- Siemens AG

- Agilent Technologies Inc

- 3M Co

- Teledyne Technologies Inc

Key Developments in Asia Pacific Air Quality Monitoring Market Sector

- January 2023: Launch of the Technology for Air Quality Monitoring System (AI-AQMS v1.0) in India, significantly enhancing monitoring capabilities.

- September 2022: The Asian Development Bank's launch of the Asia Clean Blue Skies Program (ACBSP) will boost investments in air quality projects across the region.

Strategic Asia Pacific Air Quality Monitoring Market Outlook

The Asia Pacific air quality monitoring market presents significant growth opportunities due to increasing government support, technological innovations, and rising public awareness. Strategic partnerships between technology providers, government agencies, and research institutions will be crucial in driving market expansion. Companies focusing on developing affordable, user-friendly, and data-driven solutions will be well-positioned to capitalize on the market's growth potential. Expansion into emerging markets and investment in R&D will also be key to success in this rapidly evolving landscape.

Asia Pacific Air Quality Monitoring Market Segmentation

-

1. Product Type

- 1.1. Indoor Monitor

- 1.2. Outdoor Monitor

-

2. Sampling Method

- 2.1. Continuous

- 2.2. Manual

- 2.3. Intermittent

-

3. Pollutant Type

- 3.1. Chemical Pollutants

- 3.2. Physical Pollutants

- 3.3. Biological Pollutants

-

4. End User

- 4.1. Residential and Commercial

- 4.2. Power Generation

- 4.3. Petrochemicals

- 4.4. Other End Users

-

5. Geography

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. Singapore

- 5.5. Rest of Asia-Pacific

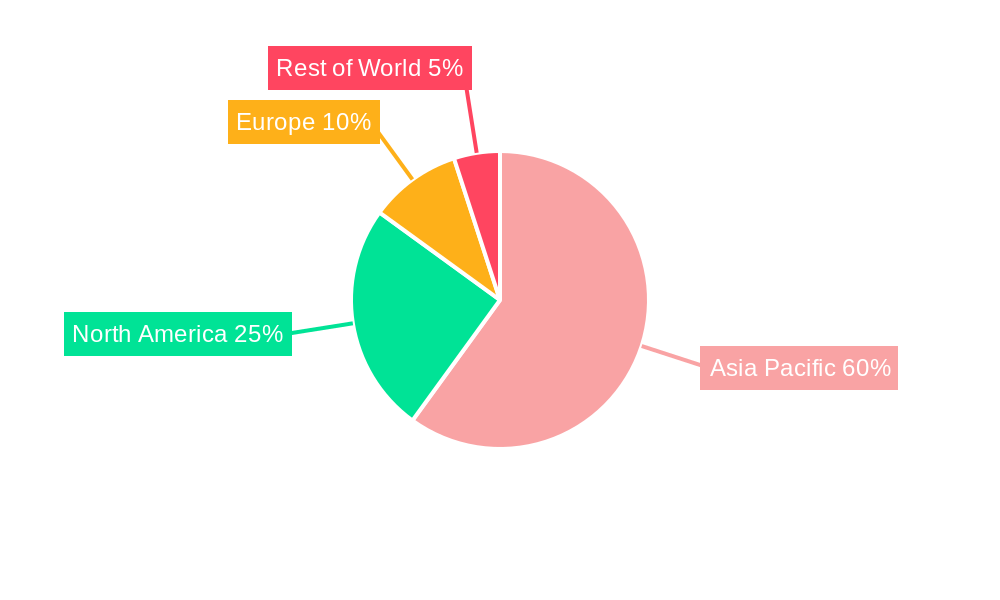

Asia Pacific Air Quality Monitoring Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Singapore

- 5. Rest of Asia Pacific

Asia Pacific Air Quality Monitoring Market Regional Market Share

Geographic Coverage of Asia Pacific Air Quality Monitoring Market

Asia Pacific Air Quality Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Awareness and Favorable Government Policies and Non-government Initiatives for Curbing Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; High Costs of Air Quality Monitoring Systems

- 3.4. Market Trends

- 3.4.1. Outdoor Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Indoor Monitor

- 5.1.2. Outdoor Monitor

- 5.2. Market Analysis, Insights and Forecast - by Sampling Method

- 5.2.1. Continuous

- 5.2.2. Manual

- 5.2.3. Intermittent

- 5.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 5.3.1. Chemical Pollutants

- 5.3.2. Physical Pollutants

- 5.3.3. Biological Pollutants

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Residential and Commercial

- 5.4.2. Power Generation

- 5.4.3. Petrochemicals

- 5.4.4. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Singapore

- 5.5.5. Rest of Asia-Pacific

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.6.2. India

- 5.6.3. Japan

- 5.6.4. Singapore

- 5.6.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia Pacific Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Indoor Monitor

- 6.1.2. Outdoor Monitor

- 6.2. Market Analysis, Insights and Forecast - by Sampling Method

- 6.2.1. Continuous

- 6.2.2. Manual

- 6.2.3. Intermittent

- 6.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 6.3.1. Chemical Pollutants

- 6.3.2. Physical Pollutants

- 6.3.3. Biological Pollutants

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Residential and Commercial

- 6.4.2. Power Generation

- 6.4.3. Petrochemicals

- 6.4.4. Other End Users

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. China

- 6.5.2. India

- 6.5.3. Japan

- 6.5.4. Singapore

- 6.5.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India Asia Pacific Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Indoor Monitor

- 7.1.2. Outdoor Monitor

- 7.2. Market Analysis, Insights and Forecast - by Sampling Method

- 7.2.1. Continuous

- 7.2.2. Manual

- 7.2.3. Intermittent

- 7.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 7.3.1. Chemical Pollutants

- 7.3.2. Physical Pollutants

- 7.3.3. Biological Pollutants

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Residential and Commercial

- 7.4.2. Power Generation

- 7.4.3. Petrochemicals

- 7.4.4. Other End Users

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. China

- 7.5.2. India

- 7.5.3. Japan

- 7.5.4. Singapore

- 7.5.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan Asia Pacific Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Indoor Monitor

- 8.1.2. Outdoor Monitor

- 8.2. Market Analysis, Insights and Forecast - by Sampling Method

- 8.2.1. Continuous

- 8.2.2. Manual

- 8.2.3. Intermittent

- 8.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 8.3.1. Chemical Pollutants

- 8.3.2. Physical Pollutants

- 8.3.3. Biological Pollutants

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Residential and Commercial

- 8.4.2. Power Generation

- 8.4.3. Petrochemicals

- 8.4.4. Other End Users

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. China

- 8.5.2. India

- 8.5.3. Japan

- 8.5.4. Singapore

- 8.5.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Singapore Asia Pacific Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Indoor Monitor

- 9.1.2. Outdoor Monitor

- 9.2. Market Analysis, Insights and Forecast - by Sampling Method

- 9.2.1. Continuous

- 9.2.2. Manual

- 9.2.3. Intermittent

- 9.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 9.3.1. Chemical Pollutants

- 9.3.2. Physical Pollutants

- 9.3.3. Biological Pollutants

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Residential and Commercial

- 9.4.2. Power Generation

- 9.4.3. Petrochemicals

- 9.4.4. Other End Users

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. China

- 9.5.2. India

- 9.5.3. Japan

- 9.5.4. Singapore

- 9.5.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Asia Pacific Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Indoor Monitor

- 10.1.2. Outdoor Monitor

- 10.2. Market Analysis, Insights and Forecast - by Sampling Method

- 10.2.1. Continuous

- 10.2.2. Manual

- 10.2.3. Intermittent

- 10.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 10.3.1. Chemical Pollutants

- 10.3.2. Physical Pollutants

- 10.3.3. Biological Pollutants

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Residential and Commercial

- 10.4.2. Power Generation

- 10.4.3. Petrochemicals

- 10.4.4. Other End Users

- 10.5. Market Analysis, Insights and Forecast - by Geography

- 10.5.1. China

- 10.5.2. India

- 10.5.3. Japan

- 10.5.4. Singapore

- 10.5.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Horiba Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TSI Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermo Fisher Scientific Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aeroqual Limited*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Emerson Electric Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siemens AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agilent Technologies Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 3M Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Teledyne Technologies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Asia Pacific Air Quality Monitoring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Air Quality Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Sampling Method 2020 & 2033

- Table 3: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Pollutant Type 2020 & 2033

- Table 4: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 5: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Sampling Method 2020 & 2033

- Table 9: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Pollutant Type 2020 & 2033

- Table 10: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 11: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Sampling Method 2020 & 2033

- Table 15: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Pollutant Type 2020 & 2033

- Table 16: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 17: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Sampling Method 2020 & 2033

- Table 21: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Pollutant Type 2020 & 2033

- Table 22: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 23: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Sampling Method 2020 & 2033

- Table 27: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Pollutant Type 2020 & 2033

- Table 28: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 29: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Sampling Method 2020 & 2033

- Table 33: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Pollutant Type 2020 & 2033

- Table 34: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 36: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Air Quality Monitoring Market?

The projected CAGR is approximately 4.55%.

2. Which companies are prominent players in the Asia Pacific Air Quality Monitoring Market?

Key companies in the market include Honeywell International Inc, Horiba Ltd, Merck KGaA, TSI Inc, Thermo Fisher Scientific Inc, Aeroqual Limited*List Not Exhaustive, Emerson Electric Co, Siemens AG, Agilent Technologies Inc, 3M Co, Teledyne Technologies Inc.

3. What are the main segments of the Asia Pacific Air Quality Monitoring Market?

The market segments include Product Type, Sampling Method, Pollutant Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 77.40 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Awareness and Favorable Government Policies and Non-government Initiatives for Curbing Air Pollution.

6. What are the notable trends driving market growth?

Outdoor Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Costs of Air Quality Monitoring Systems.

8. Can you provide examples of recent developments in the market?

Januaru 2023: The government of India launched the Technology for Air Quality Monitoring System (AI-AQMS v1.0) developed under MeitY-supported projects. The Centre for Development of Advanced Computing (C-DAC), Kolkata, in partnership with TeXMIN, ISM, Dhanbad under the ‘National program on Electronics and ICT applications in Agriculture and Environment (AgriEnIcs)’ has developed an outdoor air quality monitoring station to monitor environmental pollutants which includes parameters like PM 1.0, PM 2.5, PM 10.0, SO2, NO2, CO, O2, ambient temperature, relative humidity etc., for continuous air quality analysis of the environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Air Quality Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Air Quality Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Air Quality Monitoring Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Air Quality Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence