Key Insights

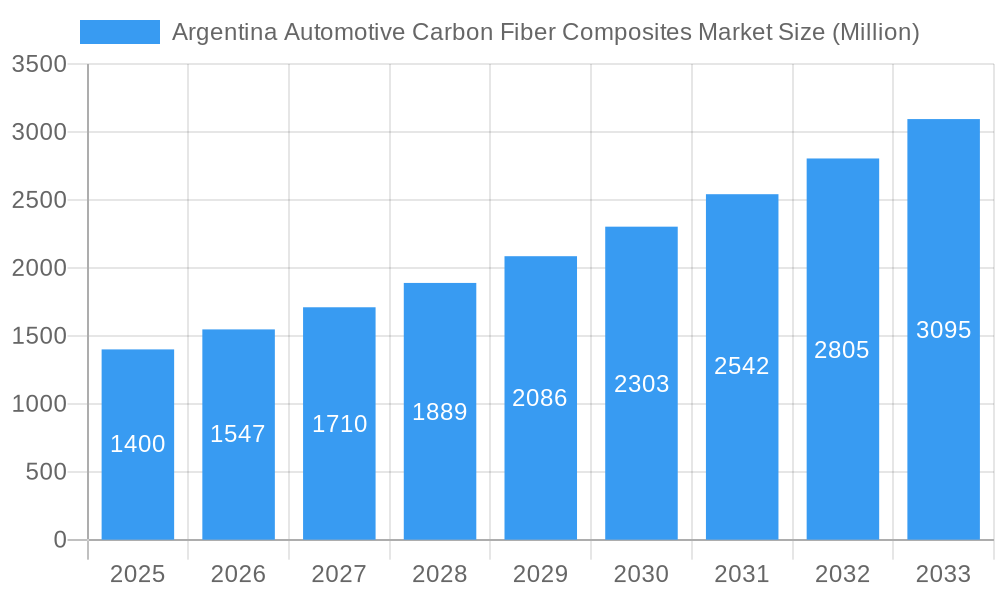

The Argentina Automotive Carbon Fiber Composites market, valued at $1.40 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.5% from 2025 to 2033. This expansion is driven by the increasing demand for lightweight vehicles to enhance fuel efficiency and reduce emissions, aligning with global sustainability initiatives. The automotive industry's focus on improving vehicle performance and safety also contributes significantly to market growth. Within the Argentinian market, the structural assembly segment currently holds the largest market share, followed by powertrain components. This is attributable to the growing adoption of carbon fiber in chassis and body parts for weight reduction and improved crashworthiness. The increasing use of carbon fiber composites in interior and exterior automotive components, such as dashboards and body panels, is also fueling market expansion. Key players such as Teijin Ltd, Toray Industries Inc, and Solvay S are actively investing in research and development to improve the performance and cost-effectiveness of carbon fiber composites, further bolstering market growth. However, the high initial cost of carbon fiber materials and the complex manufacturing processes involved present challenges to market penetration. Despite these restraints, the long-term outlook for the Argentina Automotive Carbon Fiber Composites market remains positive, driven by continuous technological advancements and increasing government support for sustainable transportation solutions. Growth will likely be further fueled by collaborations between automotive manufacturers and composite material suppliers to overcome the cost barrier and accelerate adoption.

Argentina Automotive Carbon Fiber Composites Market Market Size (In Billion)

The growth trajectory is expected to be influenced by several factors. Government regulations promoting fuel efficiency and emission reduction will incentivize the wider adoption of lightweight materials like carbon fiber. Furthermore, advancements in manufacturing techniques are expected to decrease production costs, making carbon fiber composites more competitive. Increased investments in research and development by major players will continue to lead to the development of new, higher-performance materials. Regional economic conditions and the overall growth of the Argentinan automotive sector will also play a crucial role in shaping the market's trajectory. Competition amongst key players is anticipated to intensify, prompting innovation and further cost reductions. Analyzing these interconnected factors reveals a dynamic and promising market poised for significant growth in the coming years.

Argentina Automotive Carbon Fiber Composites Market Company Market Share

Argentina Automotive Carbon Fiber Composites Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Argentina Automotive Carbon Fiber Composites Market, offering invaluable insights for industry stakeholders, investors, and researchers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report presents a robust overview of market trends, competitive dynamics, and future growth potential. The report meticulously examines market segmentation by application type (Structural Assembly, Power-train Components, Interior, Exterior, Other Application Types), providing detailed analysis and projections for each segment. The market size in Million is estimated at XX Million for the base year 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX% during the forecast period.

Argentina Automotive Carbon Fiber Composites Market Market Structure & Competitive Dynamics

The Argentina automotive carbon fiber composites market exhibits a moderately concentrated structure, with key players like Teijin Ltd, A&P Technology Inc, Toray Industries Inc, Solvay S.A., Mitsubishi Chemical Carbon Fiber and Composites Inc, Hexcel Corporation, SGL Carbon SE, and DowAksa USA LLC holding significant market share. Market concentration is influenced by factors such as technological advancements, economies of scale, and regulatory frameworks. The innovative ecosystem is relatively nascent but growing, driven by government initiatives promoting lightweight vehicle manufacturing and the adoption of sustainable materials.

The regulatory landscape is characterized by evolving environmental regulations pushing for lighter, more fuel-efficient vehicles, creating opportunities for carbon fiber composites. Product substitutes, such as aluminum and high-strength steel, present competitive pressure, albeit carbon fiber's superior strength-to-weight ratio offers a significant advantage. End-user trends favoring enhanced vehicle performance, safety, and fuel efficiency bolster market growth.

Mergers and acquisitions (M&A) activity within the sector remains moderate. While precise M&A deal values are unavailable for the Argentinian market specifically (data is xx Million), global M&A trends indicate a focus on strengthening supply chains and expanding product portfolios. Market share data for individual companies in Argentina is currently unavailable (xx%). However, the global market shares of the aforementioned key players provide a benchmark for understanding their potential influence within the Argentinian market.

Argentina Automotive Carbon Fiber Composites Market Industry Trends & Insights

The Argentina automotive carbon fiber composites market is experiencing robust growth, driven by several key factors. Increasing demand for lightweight vehicles to improve fuel economy and reduce emissions is a primary driver. Technological advancements in carbon fiber production, resulting in lower costs and improved performance characteristics, further stimulate market expansion. Consumer preferences are shifting toward vehicles with enhanced aesthetics, safety, and performance, fueling the adoption of carbon fiber composites in various automotive applications.

The market is witnessing significant technological disruptions, with innovations in resin systems, manufacturing processes (like the UBC bitumen-to-carbon-fiber process), and design optimization improving the overall competitiveness of carbon fiber components. The competitive dynamics are characterized by intense competition among established players and emerging companies, leading to continuous product development and price optimization. The estimated market size in 2025 is projected at xx Million, with a compound annual growth rate (CAGR) of xx% expected during the forecast period. Market penetration is still relatively low compared to developed markets, presenting significant future growth potential.

Dominant Markets & Segments in Argentina Automotive Carbon Fiber Composites Market

While precise regional dominance within Argentina is unavailable (data is xx), the structural assembly segment is expected to hold the largest market share within the Argentinian automotive carbon fiber composites market. This is driven by the increasing demand for lightweight yet strong components in vehicle bodies.

- Key Drivers for Structural Assembly Segment Dominance:

- Growing demand for fuel-efficient vehicles.

- Stringent emission regulations.

- Increasing adoption of electric vehicles (EVs).

- Advancements in manufacturing techniques reducing production costs.

The other segments (Power-train Components, Interior, Exterior, Other Application Types) are anticipated to witness significant growth in the coming years, driven by the factors listed above, as well as increasing adoption of carbon fiber components in various vehicle parts to improve performance, aesthetics, and safety. Further research is needed to determine the exact market share of each segment in Argentina.

Argentina Automotive Carbon Fiber Composites Market Product Innovations

Recent advancements in carbon fiber composites include the development of novel resin systems that enhance durability and reduce manufacturing costs. Furthermore, innovations in fiber architectures and processing techniques have enabled the creation of lighter and stronger components suitable for diverse applications in the automotive sector. These innovations directly address the needs of the automotive industry by delivering enhanced performance, lighter weight, and improved cost-effectiveness. The market fit is strong, driven by the ongoing demand for lighter and more fuel-efficient vehicles.

Report Segmentation & Scope

This report segments the Argentina automotive carbon fiber composites market primarily by application type:

Structural Assembly: This segment encompasses the use of carbon fiber composites in vehicle chassis, body panels, and other structural components. Growth is projected to be robust due to the increasing demand for lightweight and high-strength materials in automotive design. Competitive dynamics are driven by advancements in manufacturing technologies and material properties.

Power-train Components: Carbon fiber composites find application in engine parts, transmission components, and other powertrain elements. This segment's growth is linked to improvements in material performance and the development of hybrid and electric vehicle powertrains. The market is characterized by a combination of established players and new entrants.

Interior: Interior applications include dashboards, seats, and other interior trim components. Growth is influenced by consumer demand for enhanced vehicle aesthetics and ergonomics, along with technological advancements in material processing. Competitive intensity is moderate, with a focus on aesthetics and functional design.

Exterior: This encompasses exterior body panels, bumpers, and other exterior parts. Growth is driven by similar factors to the interior segment, with a strong emphasis on lightweighting and improved aerodynamics. The competitive landscape is similar to the interior segment.

Other Application Types: This encompasses various other automotive applications where carbon fiber composites offer advantages. The segment’s growth is contingent upon the introduction of novel applications and corresponding technological advancements. The competitive environment reflects the diversity of niche applications.

Key Drivers of Argentina Automotive Carbon Fiber Composites Market Growth

The growth of the Argentina automotive carbon fiber composites market is driven by several factors: the increasing demand for lightweight vehicles to enhance fuel efficiency and reduce emissions; stringent government regulations promoting the adoption of sustainable materials; and the technological advancements in carbon fiber production, leading to lower costs and improved performance. The rising popularity of electric vehicles (EVs) further boosts the demand for lightweight carbon fiber components, contributing significantly to the market’s expansion.

Challenges in the Argentina Automotive Carbon Fiber Composites Market Sector

Challenges facing the Argentinian market include the relatively high cost of carbon fiber composites compared to traditional materials, potentially hindering wider adoption. Supply chain disruptions and volatility in raw material prices pose additional risks, impacting overall market stability. Moreover, the lack of extensive local manufacturing capabilities can limit the growth and competitiveness of this market. The overall impact of these challenges is expected to be a slower market growth rate than in other regions.

Leading Players in the Argentina Automotive Carbon Fiber Composites Market Market

- Teijin Ltd

- A&P Technology Inc

- Toray Industries Inc

- Solvay S.A.

- Mitsubishi Chemical Carbon Fiber and Composites Inc

- Hexcel Corporation

- SGL Carbon SE

- DowAksa USA LLC

Key Developments in Argentina Automotive Carbon Fiber Composites Market Sector

June 2023: Engineers at the University of British Columbia (UBC) pioneered a method to transform bitumen into carbon fiber, potentially revolutionizing lightweight composite material production for EVs. This could significantly impact the Argentinian market in the long term, offering a more sustainable and potentially cost-effective source of carbon fiber.

May 2022: Solvay launched SolvaLite 714 Prepregs, advanced composite materials designed for rapid curing and extended outlife, suitable for producing automotive parts like body panels. This development directly impacts the availability of high-performance materials within the Argentinian market, potentially influencing the adoption of carbon fiber composites by local manufacturers.

Strategic Argentina Automotive Carbon Fiber Composites Market Market Outlook

The Argentina automotive carbon fiber composites market holds substantial growth potential, driven by favorable government regulations, the growing popularity of EVs, and technological advancements continually improving the cost-effectiveness and performance of carbon fiber composites. Strategic opportunities exist for companies focusing on localization of manufacturing, collaboration with local automotive manufacturers, and developing innovative applications tailored to the specific needs of the Argentinian automotive industry. The market is poised for significant expansion as these trends continue to shape the automotive landscape.

Argentina Automotive Carbon Fiber Composites Market Segmentation

-

1. Application Type

- 1.1. Structural Assembly

- 1.2. Power-train Components

- 1.3. Interior

- 1.4. Exterior

- 1.5. Other Application Types

Argentina Automotive Carbon Fiber Composites Market Segmentation By Geography

- 1. Argentina

Argentina Automotive Carbon Fiber Composites Market Regional Market Share

Geographic Coverage of Argentina Automotive Carbon Fiber Composites Market

Argentina Automotive Carbon Fiber Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Weight Reduction and Performance Is Likely To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Carbon Fiber Is Anticipated To Restrict The Market Growth

- 3.4. Market Trends

- 3.4.1. Structural Components Dominating The Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Automotive Carbon Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Structural Assembly

- 5.1.2. Power-train Components

- 5.1.3. Interior

- 5.1.4. Exterior

- 5.1.5. Other Application Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Teijin Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 A&P Technology Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Toray Industries Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Solvay S

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Chemical Carbon Fiber and Composites Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hexcel Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SGL Carbon SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DowAksa USA LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Teijin Ltd

List of Figures

- Figure 1: Argentina Automotive Carbon Fiber Composites Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Argentina Automotive Carbon Fiber Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Argentina Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: Argentina Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Argentina Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Argentina Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Automotive Carbon Fiber Composites Market?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the Argentina Automotive Carbon Fiber Composites Market?

Key companies in the market include Teijin Ltd, A&P Technology Inc, Toray Industries Inc, Solvay S, Mitsubishi Chemical Carbon Fiber and Composites Inc, Hexcel Corporation, SGL Carbon SE, DowAksa USA LLC.

3. What are the main segments of the Argentina Automotive Carbon Fiber Composites Market?

The market segments include Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Weight Reduction and Performance Is Likely To Drive The Market Growth.

6. What are the notable trends driving market growth?

Structural Components Dominating The Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Carbon Fiber Is Anticipated To Restrict The Market Growth.

8. Can you provide examples of recent developments in the market?

In June 2023, Engineers at the University of British Columbia (UBC) in Canada have pioneered a unique process that transforms bitumen into carbon fiber through an innovative spinning method. This breakthrough development holds significant potential for revolutionizing the production of lightweight composite materials, particularly for electric vehicles (EVs).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Automotive Carbon Fiber Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Automotive Carbon Fiber Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Automotive Carbon Fiber Composites Market?

To stay informed about further developments, trends, and reports in the Argentina Automotive Carbon Fiber Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence