Key Insights

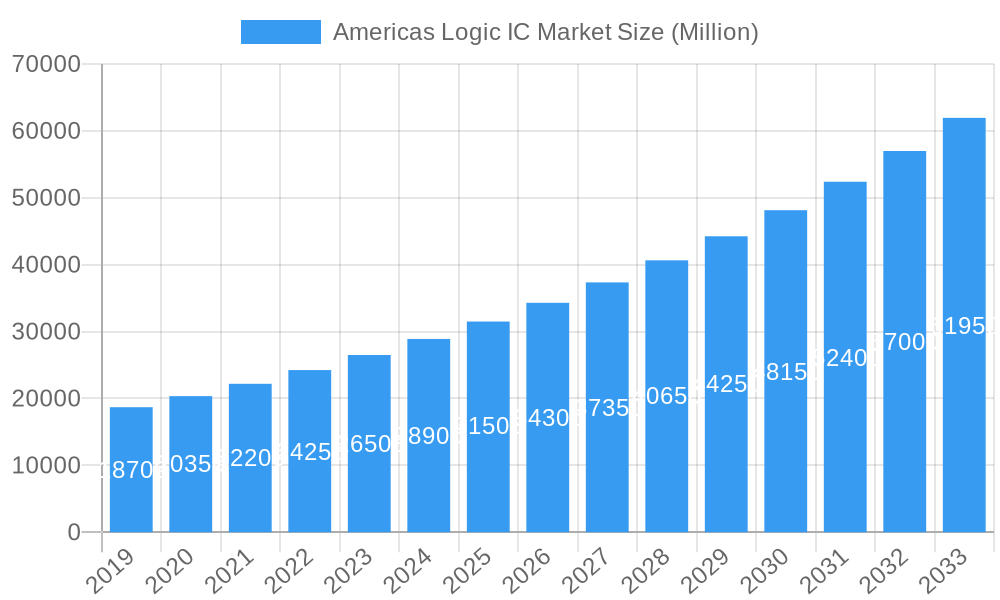

The Americas Logic IC Market is projected for significant expansion, expected to reach a market size of 151.4 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 7.5% from the base year 2025 through 2033. This growth is underpinned by robust demand in Consumer Electronics and IT & Telecommunications, propelled by advancements in smartphones, smart home devices, and computing infrastructure. The automotive sector's increasing need for ADAS, infotainment, and EV integration, alongside the manufacturing and automation industries' adoption of Industry 4.0, are key market accelerators.

Americas Logic IC Market Market Size (In Billion)

Market expansion is fueled by continuous semiconductor innovation, yielding smaller, more powerful, and energy-efficient logic ICs. Miniaturization and device complexity drive demand for ASICs and ASSPs. Challenges include high R&D costs and regulatory hurdles. Geopolitical factors and supply chain vulnerabilities may pose risks, though major players in the Americas, such as Intel Corporation, Texas Instruments, and Broadcom Inc., offer stability. The market is characterized by intense competition and a focus on technological advancement.

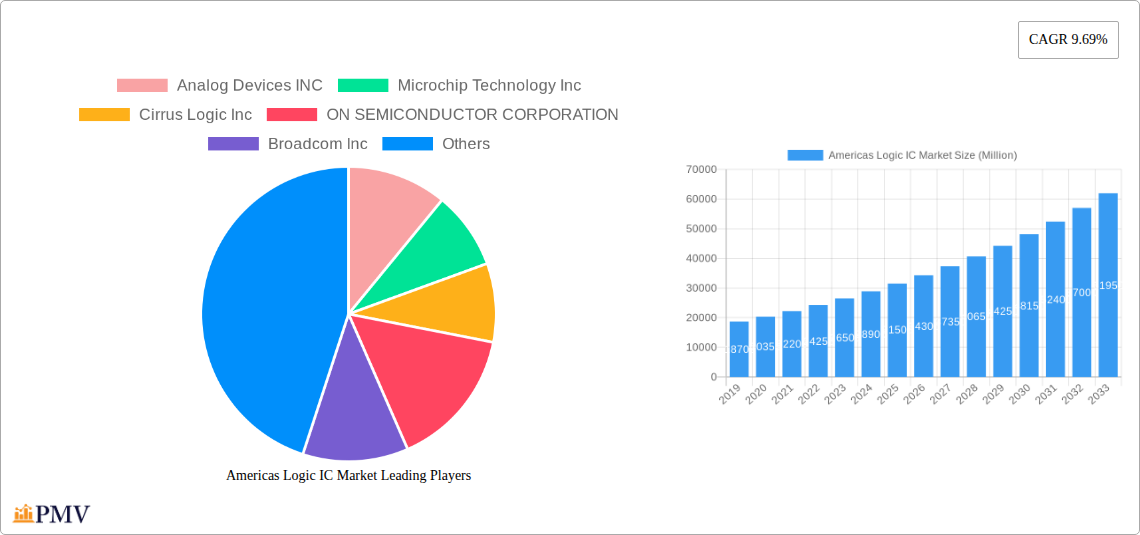

Americas Logic IC Market Company Market Share

Americas Logic IC Market: Comprehensive Growth Analysis & Forecast (2019–2033)

This in-depth report provides a definitive analysis of the Americas Logic Integrated Circuit (IC) market, offering strategic insights and actionable intelligence for stakeholders. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base and estimated year of 2025, this study delves into market dynamics, key players, industry trends, and future outlook. We meticulously examine segments including Logic Standard, MOS Special Purpose Logic, ASIC, ASSP, PLD, and applications spanning Consumer Electronics, Automotive, IT & Telecommunications, and Manufacturing and Automation. Uncover critical information on market concentration, technological advancements, regulatory impacts, and competitive landscapes to navigate this evolving semiconductor sector.

Americas Logic IC Market Market Structure & Competitive Dynamics

The Americas Logic IC market is characterized by a moderately concentrated structure, with key players like Texas Instruments Incorporated, Intel Corporation, and Analog Devices INC holding significant market shares. Innovation ecosystems are vibrant, driven by continuous R&D investments in advanced logic technologies. Regulatory frameworks, particularly those influenced by government initiatives like the CHIPS Act, are shaping domestic production and supply chain strategies. Product substitutes exist, but the specialized nature of advanced logic ICs limits direct competition for many high-performance applications. End-user trends highlight a growing demand for intelligent, power-efficient solutions across all sectors. Mergers and acquisitions (M&A) activities, while not always high in volume, often involve substantial deal values as companies seek to consolidate market position and acquire cutting-edge intellectual property. For instance, the strategic acquisition of a smaller ASIC design firm by a major player can significantly bolster their custom logic capabilities. The market share distribution reflects a blend of established giants and specialized niche providers, creating a dynamic competitive environment.

Americas Logic IC Market Industry Trends & Insights

The Americas Logic IC market is experiencing robust growth, propelled by an insatiable demand for advanced processing power and intelligent functionalities across a multitude of applications. The ongoing digital transformation, coupled with the proliferation of the Internet of Things (IoT), Artificial Intelligence (AI), and 5G technology, acts as a primary growth catalyst, driving the need for sophisticated Logic ICs. The Automotive sector, with its increasing integration of autonomous driving features, advanced infotainment systems, and electric vehicle powertrains, is a significant consumer of high-performance logic solutions, contributing substantially to market penetration. Similarly, the IT & Telecommunications industry's relentless pursuit of faster data processing, enhanced network infrastructure, and cloud computing capabilities fuels demand for specialized logic ICs. The Consumer Electronics segment continues to innovate with smart home devices, wearables, and advanced gaming consoles, all of which rely heavily on diverse logic IC portfolios. Manufacturing and Automation is also witnessing a surge in adoption of smart factory solutions, industrial IoT, and robotics, necessitating intelligent control and processing capabilities offered by logic ICs.

Technological disruptions, such as the advancement in FinFET and Gate-All-Around (GAA) transistor technologies, are enabling the development of smaller, more power-efficient, and higher-performance logic ICs, thus pushing the boundaries of what's possible. This trend is crucial for meeting the ever-increasing performance demands of modern applications. Consumer preferences are increasingly leaning towards devices that offer enhanced functionality, seamless connectivity, and energy efficiency, directly influencing the design and development of logic ICs. The competitive dynamics within the market are intense, with companies focusing on product differentiation through technological innovation, strategic partnerships, and cost-effective manufacturing. The overall Compound Annual Growth Rate (CAGR) for the Americas Logic IC market is projected to be robust, reflecting these strong underlying trends and the critical role of logic ICs in powering the digital economy. The market is witnessing a steady increase in market penetration as more devices and systems integrate logic ICs for enhanced intelligence and control.

Dominant Markets & Segments in Americas Logic IC Market

The Americas Logic IC market exhibits distinct dominance across various segments, driven by specific economic policies, infrastructure developments, and application-specific demands.

Leading Application: Consumer Electronics and Automotive currently represent the most dominant application segments.

- Consumer Electronics: Driven by the continuous innovation in smartphones, smart home devices, wearables, and advanced gaming consoles, this segment demands a wide array of logic ICs, from general-purpose logic to highly specialized application-specific integrated circuits (ASICs). The economic policies that encourage technological adoption and disposable income for tech gadgets directly fuel this dominance.

- Automotive: The rapid evolution of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and in-car infotainment systems has made this a critical growth engine. Government incentives for EV adoption and stringent safety regulations necessitate a significant influx of sophisticated logic ICs for control, sensing, and processing. Infrastructure development in charging networks further supports this trend.

Dominant Product Type: ASIC and ASSP hold significant sway.

- ASIC (Application-Specific Integrated Circuit): For highly customized functionalities, particularly in advanced automotive systems and high-performance computing, ASICs are indispensable. Their ability to provide optimized performance, power efficiency, and reduced form factor makes them preferred choices for unique application requirements.

- ASSP (Application-Specific Standard Product): These are pre-designed chips for specific functions, offering a balance between customization and cost-effectiveness. They are widely adopted in consumer electronics and communication devices due to their ready availability and performance characteristics.

Dominant Type: MOS Special Purpose Logic is a key driver.

- MOS Special Purpose Logic: This category encompasses advanced logic functions designed for specific, high-performance tasks, often utilizing cutting-edge MOS technologies. Their dominance is linked to the increasing complexity of modern electronics and the need for specialized processing capabilities in areas like AI acceleration and data analytics.

Key Drivers of Dominance:

- Technological Advancement: Continuous innovation in semiconductor manufacturing processes and chip architecture.

- Economic Policies: Government initiatives like the CHIPS Act, fostering domestic production and R&D.

- Consumer Demand: Growing consumer appetite for smarter, more connected, and feature-rich devices.

- Industry-Specific Regulations: Mandates for safety, efficiency, and connectivity in sectors like automotive and telecommunications.

- Infrastructure Development: Investments in digital infrastructure, 5G networks, and smart city initiatives.

Americas Logic IC Market Product Innovations

Product innovation in the Americas Logic IC market is intensely focused on enhancing performance, reducing power consumption, and increasing integration density. Key developments include the miniaturization of transistors through advanced fabrication processes, leading to smaller and more powerful logic ICs. There's a significant push towards heterogeneous integration, where different types of logic, memory, and I/O functions are combined onto a single package to improve efficiency and reduce latency. Innovations in AI-specific logic accelerators and edge computing solutions are also prominent, enabling sophisticated processing closer to the data source. These advancements are critical for meeting the evolving demands of applications in autonomous systems, smart devices, and high-performance computing.

Report Segmentation & Scope

This report segments the Americas Logic IC market across several key dimensions to provide a granular view of market dynamics and growth opportunities. The segmentation includes:

Type:

- Logic Standard: This segment encompasses general-purpose logic gates and flip-flops. Growth is driven by broad adoption across various electronic devices.

- MOS Special Purpose Logic: This category includes advanced logic ICs designed for specific, high-performance tasks, leveraging Metal-Oxide-Semiconductor technology. This segment is expected to witness significant growth due to increasing demand for AI and IoT applications.

Product Type:

- ASIC: Custom-designed chips offering tailored performance and functionality. Growth is strong in specialized applications like automotive and advanced computing.

- ASSP: Standardized chips designed for specific application categories, providing a balance of performance and cost. This segment is expected to maintain steady growth.

- PLD (Programmable Logic Device): Devices that can be programmed by the user after manufacturing. Their flexibility makes them valuable for prototyping and niche applications.

Application:

- Consumer Electronics: Driven by smart devices, wearables, and home entertainment systems.

- Automotive: Fueled by EVs, ADAS, and infotainment systems.

- IT & Telecommunications: Supported by 5G deployment, cloud computing, and data centers.

- Manufacturing and Automation: Driven by smart factory initiatives and robotics.

- Other: Encompassing segments like industrial controls, medical devices, and aerospace.

Key Drivers of Americas Logic IC Market Growth

The Americas Logic IC market's growth is propelled by several converging factors. The accelerating pace of digital transformation across all industries necessitates more sophisticated processing and control capabilities, directly increasing demand for logic ICs. The proliferation of the Internet of Things (IoT) and the expansion of 5G networks are creating new frontiers for connectivity and data processing, requiring advanced logic solutions. Furthermore, government initiatives, such as the CHIPS Act in the United States, are actively promoting domestic semiconductor manufacturing and innovation, which is expected to bolster market growth. The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) across various applications, from consumer devices to industrial automation, is a significant driver, demanding specialized and high-performance logic ICs for computation and inference. The continuous innovation in end-user industries like automotive, with the rise of EVs and autonomous driving, further fuels the demand for advanced logic integrated circuits.

Challenges in the Americas Logic IC Market Sector

Despite its robust growth trajectory, the Americas Logic IC market faces several significant challenges. Supply chain disruptions, exacerbated by geopolitical tensions and natural disasters, can lead to production delays and increased costs. The intense global competition, particularly from Asian manufacturers, puts pressure on pricing and market share. Navigating complex and evolving regulatory landscapes, including export controls and trade policies, can create uncertainties and hinder market access for certain technologies and regions. Furthermore, the escalating costs associated with advanced research and development, coupled with the high capital expenditure required for cutting-edge semiconductor fabrication facilities, present a substantial barrier to entry and expansion for smaller players. Talent acquisition and retention of skilled engineers and researchers in a highly specialized field also pose ongoing challenges.

Leading Players in the Americas Logic IC Market Market

- Analog Devices INC

- Microchip Technology Inc

- Cirrus Logic Inc

- ON SEMICONDUCTOR CORPORATION

- Broadcom Inc

- Integrated Silicon Solution Inc ( ISSI)

- Advanced Micro Devices Inc

- Texas Instruments Incorporated

- Bourns Inc

- Intel Corporation

Key Developments in Americas Logic IC Market Sector

- October 2022: The Biden administration issued new export controls, significantly impacting the flow of certain semiconductor chips and related technologies to China. This move is designed to slow Beijing's technological and military advancements and is expected to reshape global semiconductor supply chains, potentially influencing demand for Logic ICs in the Americas as companies re-evaluate sourcing and production strategies.

- September 2022: The US Department of Commerce unveiled its strategy for implementing USD 50 billion from the bipartisan CHIPS Act of 2022. This landmark legislation aims to reduce reliance on Asian manufacturers and revitalize the domestic semiconductor industry.

- Approximately USD 28 billion in CHIPS incentives will be directed towards establishing domestic production facilities for logic and memory chips, directly boosting manufacturing capacity within the Americas.

- The Department is actively seeking proposals for the expansion or construction of facilities involved in packaging, assembly, fabrication, and testing of critical semiconductor components, aiming to strengthen the overall supplier ecosystem.

- An investment of USD 11 billion is allocated to the Chips R&D program, focusing on a National Advanced Packaging Manufacturing Program, a National Semiconductor Technology Center, and NIST metrology R&D programs. This initiative is poised to create a robust innovation network for the semiconductor ecosystem in the United States of America.

Strategic Americas Logic IC Market Market Outlook

The strategic outlook for the Americas Logic IC market is exceptionally bright, driven by sustained innovation and supportive policy environments. The continued digital transformation, coupled with the pervasive adoption of AI, IoT, and advanced connectivity, presents a fertile ground for growth. Government investments through initiatives like the CHIPS Act are set to catalyze domestic manufacturing capabilities and foster groundbreaking research, creating a more resilient and competitive landscape. Strategic opportunities lie in developing specialized logic solutions for emerging sectors such as autonomous vehicles, smart cities, and advanced healthcare technologies. Companies that focus on high-performance computing, energy-efficient designs, and secure embedded logic will be well-positioned to capitalize on future market potential, ensuring a robust and dynamic expansion trajectory for the Americas Logic IC market.

Americas Logic IC Market Segmentation

-

1. Type

- 1.1. Logic Standard

- 1.2. MOS Special Purpose Logic

-

2. Product Type

- 2.1. ASIC

- 2.2. ASSP

- 2.3. PLD

-

3. Application

- 3.1. Consumer Electronics

- 3.2. Automotive

- 3.3. IT & Telecommunications

- 3.4. Manufacturing and Automation

- 3.5. Other En

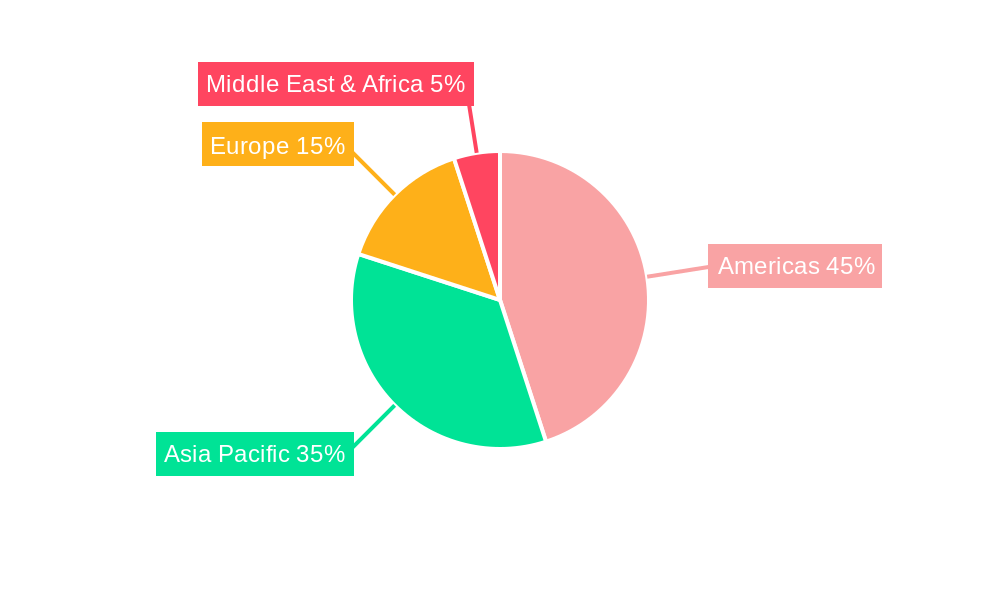

Americas Logic IC Market Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Brazil

- 1.5. Argentina

- 1.6. Chile

- 1.7. Colombia

- 1.8. Peru

Americas Logic IC Market Regional Market Share

Geographic Coverage of Americas Logic IC Market

Americas Logic IC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Focus on Integration of Devices; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Lack of Skilled Radiation Professionals

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Logic IC in Automotive Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Americas Logic IC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Logic Standard

- 5.1.2. MOS Special Purpose Logic

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. ASIC

- 5.2.2. ASSP

- 5.2.3. PLD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Consumer Electronics

- 5.3.2. Automotive

- 5.3.3. IT & Telecommunications

- 5.3.4. Manufacturing and Automation

- 5.3.5. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Americas

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Analog Devices INC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Microchip Technology Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cirrus Logic Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ON SEMICONDUCTOR CORPORATION

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Broadcom Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Integrated Silicon Solution Inc ( ISSI)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Advanced Micro Devices Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Texas Instruments Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bourns Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intel Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Analog Devices INC

List of Figures

- Figure 1: Americas Logic IC Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Americas Logic IC Market Share (%) by Company 2025

List of Tables

- Table 1: Americas Logic IC Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Americas Logic IC Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Americas Logic IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Americas Logic IC Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Americas Logic IC Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Americas Logic IC Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Americas Logic IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Americas Logic IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Brazil Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Argentina Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Chile Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Colombia Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Peru Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Americas Logic IC Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Americas Logic IC Market?

Key companies in the market include Analog Devices INC, Microchip Technology Inc, Cirrus Logic Inc, ON SEMICONDUCTOR CORPORATION, Broadcom Inc, Integrated Silicon Solution Inc ( ISSI), Advanced Micro Devices Inc, Texas Instruments Incorporated, Bourns Inc, Intel Corporation.

3. What are the main segments of the Americas Logic IC Market?

The market segments include Type, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Focus on Integration of Devices; Rising Capital Spending by Fabs to Increase Production Capacities.

6. What are the notable trends driving market growth?

Growing Adoption of Logic IC in Automotive Industries.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Lack of Skilled Radiation Professionals.

8. Can you provide examples of recent developments in the market?

October 2022: The Biden administration issued a new set of export controls. As per the new set of regulations, the US would be cutting China off from certain semiconductor chips made anywhere in the world with US equipment to slow down Beijing's technological and military advances. Such regulations are expected to further influence the demand for Logic ICs in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Americas Logic IC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Americas Logic IC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Americas Logic IC Market?

To stay informed about further developments, trends, and reports in the Americas Logic IC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence