Key Insights

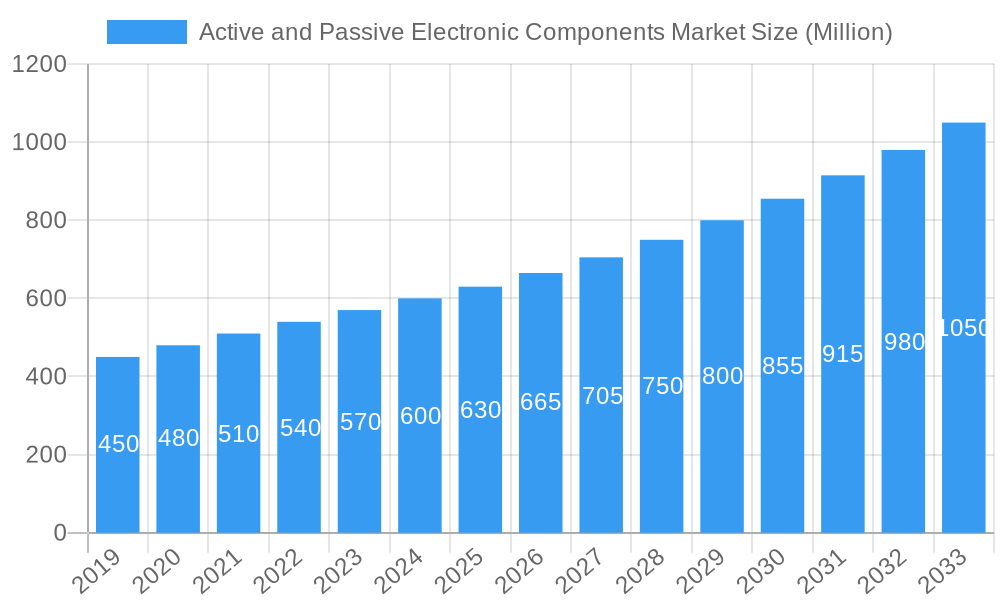

The global market for Active and Passive Electronic Components is poised for substantial expansion, projected to reach a market size of approximately $0.70 billion. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 8.79% throughout the forecast period of 2025-2033. This upward trajectory is primarily fueled by the relentless demand across diverse end-user industries. The automotive sector, in particular, is a significant contributor, driven by the increasing integration of advanced electronics for safety, infotainment, and electric vehicle (EV) powertrains. Similarly, the burgeoning consumer electronics and computing market, with its continuous innovation in smartphones, wearables, and high-performance computing devices, creates a sustained demand for sophisticated components. The medical industry's growing reliance on sophisticated diagnostic and therapeutic equipment, coupled with the expansion of industrial automation and smart manufacturing, further amplifies this growth. Communication technologies, from 5G deployment to the Internet of Things (IoT), also represent a critical driver, necessitating a vast array of high-performance active and passive components.

Active and Passive Electronic Components Market Market Size (In Million)

The market's dynamic nature is characterized by several key trends, including the miniaturization of components to enable more compact and powerful devices, and the increasing emphasis on energy efficiency to meet environmental regulations and consumer expectations. The rise of advanced packaging technologies, such as System-in-Package (SiP) and wafer-level packaging, is also playing a crucial role in enhancing component performance and reducing form factors. While the market exhibits strong growth potential, certain restraints warrant consideration. Supply chain complexities, particularly in the sourcing of raw materials and managing geopolitical risks, can impact production and lead times. Moreover, the escalating cost of research and development for cutting-edge components, along with the need for continuous technological upgrades, presents financial challenges for some players. Nevertheless, the strategic importance of electronic components across all modern industries ensures a resilient and growing market. The market segments are diverse, encompassing both active components like transistors, diodes, and integrated circuits, and passive components such as capacitors, inductors, and resistors, serving a wide spectrum of applications.

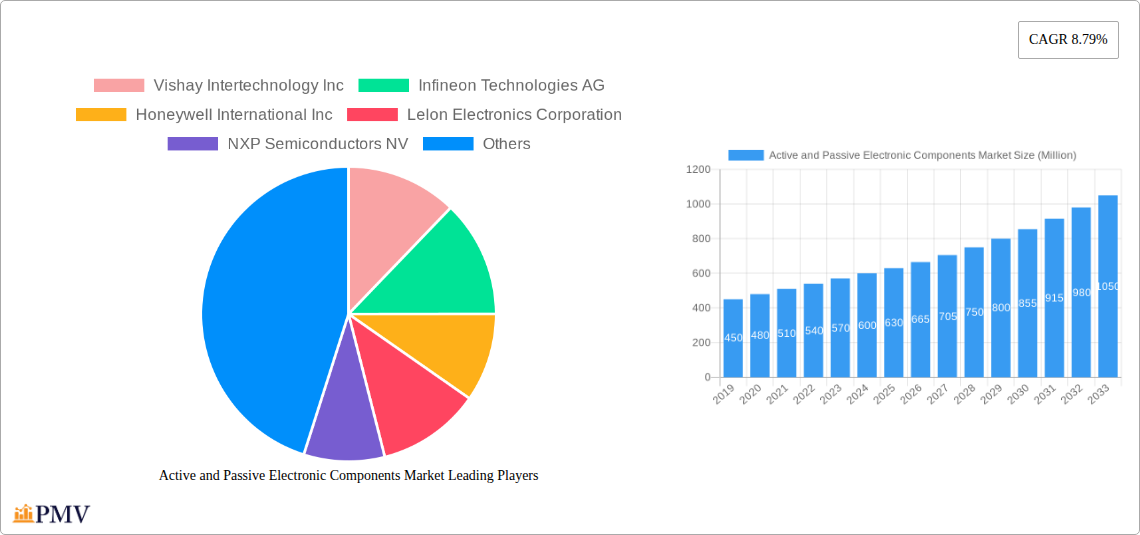

Active and Passive Electronic Components Market Company Market Share

Here is a detailed, SEO-optimized report description for the Active and Passive Electronic Components Market, designed to boost search visibility and engage industry professionals.

Unlock comprehensive insights into the dynamic global Active and Passive Electronic Components Market with this definitive research report. Covering the period from 2019 to 2033, with a base year of 2025 and an extensive forecast period of 2025–2033, this study delves deep into market drivers, trends, segmentation, competitive landscapes, and future outlook. Essential for stakeholders seeking to capitalize on the burgeoning demand for semiconductors, advanced circuitry, and critical electronic building blocks.

Active and Passive Electronic Components Market Market Structure & Competitive Dynamics

The global Active and Passive Electronic Components Market is characterized by a moderately concentrated structure, driven by significant R&D investments and economies of scale. Innovation ecosystems thrive, fueled by continuous technological advancements in miniaturization, performance enhancement, and power efficiency across both active and passive components. Regulatory frameworks, particularly those concerning environmental standards and supply chain security, play a crucial role in shaping market entry and operational strategies. Product substitutes, while present, often offer trade-offs in performance, reliability, or cost, limiting widespread displacement of core components. End-user trends, such as the rapid adoption of 5G technology, the proliferation of the Internet of Things (IoT), and advancements in electric vehicles (EVs), are major growth accelerators. Mergers & Acquisition (M&A) activities are a constant feature, with companies consolidating to expand portfolios, gain market share, and secure intellectual property. For instance, acquisitions in the semiconductor space often involve multi-million dollar valuations, indicative of the strategic importance of these players. Market share shifts are dynamic, influenced by product launches, geopolitical factors, and the ability of companies to navigate supply chain complexities.

Active and Passive Electronic Components Market Industry Trends & Insights

The Active and Passive Electronic Components Market is experiencing robust growth, propelled by an escalating demand for advanced electronics across diverse end-user industries. The Compound Annual Growth Rate (CAGR) is projected to remain strong throughout the forecast period, driven by key market growth drivers such as the burgeoning automotive sector, particularly with the surge in electric vehicles and advanced driver-assistance systems (ADAS), and the ever-expanding consumer electronics and computing segments, including smart devices, gaming consoles, and high-performance computing. Technological disruptions, such as the continuous evolution of integrated circuits (ICs) with higher functionality and reduced power consumption, alongside the development of novel capacitor and resistor technologies for demanding applications, are reshaping the market landscape. Consumer preferences are increasingly shifting towards smarter, more connected, and energy-efficient devices, directly influencing the types and specifications of components required. Competitive dynamics are intense, with leading players focusing on strategic partnerships, vertical integration, and localized manufacturing to mitigate supply chain risks and enhance customer proximity. Market penetration is deepening in emerging economies as digitalization accelerates and industrial automation takes hold. The need for high-reliability components in critical sectors like medical devices and industrial automation further solidifies market demand.

Dominant Markets & Segments in Active and Passive Electronic Components Market

The Automotive end-user industry is emerging as a dominant market for active and passive electronic components. The escalating demand for electric vehicles (EVs), advanced driver-assistance systems (ADAS), in-car infotainment, and connectivity solutions necessitates a significant volume of sophisticated components. Key drivers for this dominance include stringent government regulations on emissions and safety, substantial investments in automotive R&D, and consumer inclination towards technologically advanced vehicles.

- Component Dominance: Within the component segmentation, Active Components hold a significant share.

- Integrated Circuits (ICs): Microcontrollers, power management ICs, sensors, and memory chips are indispensable for modern automotive electronics, driving substantial market value.

- Transistors and Diodes: Crucial for power conversion, signal processing, and protection circuits in various automotive systems.

- Passive Components:

- Capacitors: High-capacitance MLCCs (Multi-Layer Ceramic Capacitors) are critical for energy storage, filtering, and decoupling in power electronics and battery management systems.

- Resistors: Essential for current limiting, voltage division, and sensing across numerous automotive applications.

The Consumer Electronics and Computing sector also represents a substantial market, driven by the relentless innovation in smartphones, laptops, wearables, smart home devices, and gaming. The ongoing digital transformation and the demand for enhanced performance, portability, and connectivity continue to fuel the consumption of active and passive electronic components in this segment.

- Component Dominance:

- Integrated Circuits (ICs): Processors, graphics chips, memory, and connectivity ICs are at the core of computing and consumer electronics.

- Capacitors: Essential for power supply filtering, signal integrity, and miniaturization in compact consumer devices.

Active and Passive Electronic Components Market Product Innovations

Product innovation in the Active and Passive Electronic Components Market is primarily focused on enhancing performance, miniaturization, and power efficiency. Advancements in materials science are leading to novel capacitor dielectrics with higher capacitance density and improved temperature stability, as well as resistors with tighter tolerances and higher power handling capabilities. In active components, the integration of complex functionalities into smaller ICs, such as AI-enabled processors and advanced power management units, is a key trend. These innovations are driven by the demand for smarter, more connected, and energy-efficient devices across all end-user industries, providing competitive advantages through improved device performance and reduced form factors.

Report Segmentation & Scope

This report provides a comprehensive analysis of the Active and Passive Electronic Components Market, segmented by component type and end-user industry. The Component segmentation includes: Active Components, encompassing Transistors, Diodes, Integrated Circuits (ICs), Amplifiers, and Vacuum Tubes, and Passive Components, covering Capacitors, Inductors, and Resistors. The End-user Industry segmentation analyzes the market across Automotive, Consumer Electronics and Computing, Medical, Industrial, Communications, and Other End-user Industries. Each segment is analyzed for its market size, growth projections, and competitive dynamics.

Key Drivers of Active and Passive Electronic Components Market Growth

The growth of the Active and Passive Electronic Components Market is primarily driven by several key factors. The rapid digital transformation across all sectors fuels demand for sophisticated electronic systems. The exponential growth of the Internet of Things (IoT) necessitates a vast array of sensors, microcontrollers, and passive components for connected devices. The ongoing 5G network rollout requires advanced RF components and high-performance ICs. Furthermore, the increasing adoption of electric vehicles (EVs) and advancements in automotive electronics represent a significant growth accelerator. Technological advancements in miniaturization and power efficiency enable the development of smaller, more capable electronic devices.

Challenges in the Active and Passive Electronic Components Market Sector

Despite robust growth, the Active and Passive Electronic Components Market faces several challenges. Supply chain disruptions, exacerbated by geopolitical tensions and natural disasters, can lead to component shortages and price volatility, impacting production timelines and costs. Increasing regulatory complexities, particularly concerning environmental compliance and material sourcing, add to operational overheads. Intense price competition among manufacturers, especially for commoditized components, can squeeze profit margins. The high capital expenditure required for advanced manufacturing facilities also presents a barrier to entry for new players. Furthermore, the rapid pace of technological change necessitates continuous and substantial investment in R&D to remain competitive.

Leading Players in the Active and Passive Electronic Components Market Market

- Vishay Intertechnology Inc

- Infineon Technologies AG

- Honeywell International Inc

- Lelon Electronics Corporation

- NXP Semiconductors NV

- KEMET Corporation (Yageo Corporation)

- Toshiba Corp

- Texas Instruments Inc

- AVX Corporation (Kyocera Corp)

- YAGEO Corporation

- TE Connectivity Ltd

- Taiyo Yuden Co Ltd

- TDK Corporation

- Murata Manufacturing Co Ltd

- Panasonic Corporation

- Eaton Corporation

Key Developments in Active and Passive Electronic Components Market Sector

- January 2023: Infineon Technologies AG launched its MOTIX family, catering to automotive and commercial motor control applications. The release of the MOTIX 3-phase gate driver IC 6ED2742S01Q, a 160 V silicon-on-insulator (SOI) gate driver in a QFN-32 package with an integrated power management unit (PMU), enhances product offerings for battery-powered industrial BLDC motor control drives, including robotics, drones, cordless power tools, and light electric vehicles.

- November 2022: YAGEO introduced the HCV X7R MLCCs, designed to meet the stringent requirements of industrial applications. Featuring a capacitance of 47uF and a rated voltage of 100 volts, these MLCCs are available in case sizes ranging from 0402 to 1210. YAGEO's strategic expansion with a new facility in 2023 aims to bolster its position as a competitive provider of HCV MLCCs by addressing rising demand and increasing manufacturing capacity.

Strategic Active and Passive Electronic Components Market Market Outlook

The strategic outlook for the Active and Passive Electronic Components Market is highly positive, driven by sustained innovation and expanding end-user applications. The continued proliferation of IoT devices, the transition to electric mobility, the advancements in artificial intelligence and machine learning, and the build-out of next-generation communication infrastructure (beyond 5G) will serve as significant growth accelerators. Companies that focus on developing highly integrated, power-efficient, and application-specific components, while simultaneously strengthening their supply chain resilience and investing in sustainable manufacturing practices, are poised for substantial market penetration and long-term success in this dynamic and indispensable industry. Strategic alliances and focused R&D will be crucial for capturing market share in emerging high-growth sub-segments.

Active and Passive Electronic Components Market Segmentation

-

1. Component

-

1.1. Active Components

- 1.1.1. Transistors

- 1.1.2. Diode

- 1.1.3. Integrated Circuits (ICs)

- 1.1.4. Amplifiers

- 1.1.5. Vacuum Tubes

-

1.2. Passive Components

- 1.2.1. Capacitors

- 1.2.2. Inductors

- 1.2.3. Resistors

-

1.1. Active Components

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Consumer Electronics and Computing

- 2.3. Medical

- 2.4. Industrial

- 2.5. Communications

- 2.6. Other End-user Industries

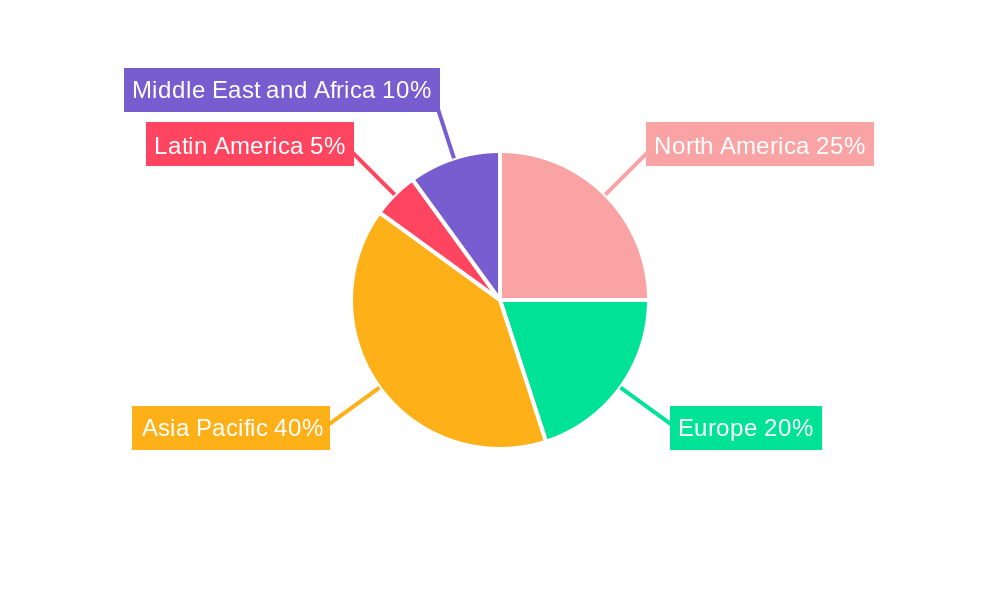

Active and Passive Electronic Components Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Active and Passive Electronic Components Market Regional Market Share

Geographic Coverage of Active and Passive Electronic Components Market

Active and Passive Electronic Components Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Preference For Miniaturized Designs; Growing Number of Computing

- 3.2.2 Communications

- 3.2.3 and Consumer Electronics; Increasing Adoption of 5G Technology

- 3.3. Market Restrains

- 3.3.1. Rising Metal Prices Impacting Component Production Costs

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of 5G Technology is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Active Components

- 5.1.1.1. Transistors

- 5.1.1.2. Diode

- 5.1.1.3. Integrated Circuits (ICs)

- 5.1.1.4. Amplifiers

- 5.1.1.5. Vacuum Tubes

- 5.1.2. Passive Components

- 5.1.2.1. Capacitors

- 5.1.2.2. Inductors

- 5.1.2.3. Resistors

- 5.1.1. Active Components

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Consumer Electronics and Computing

- 5.2.3. Medical

- 5.2.4. Industrial

- 5.2.5. Communications

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Active Components

- 6.1.1.1. Transistors

- 6.1.1.2. Diode

- 6.1.1.3. Integrated Circuits (ICs)

- 6.1.1.4. Amplifiers

- 6.1.1.5. Vacuum Tubes

- 6.1.2. Passive Components

- 6.1.2.1. Capacitors

- 6.1.2.2. Inductors

- 6.1.2.3. Resistors

- 6.1.1. Active Components

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Consumer Electronics and Computing

- 6.2.3. Medical

- 6.2.4. Industrial

- 6.2.5. Communications

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Active Components

- 7.1.1.1. Transistors

- 7.1.1.2. Diode

- 7.1.1.3. Integrated Circuits (ICs)

- 7.1.1.4. Amplifiers

- 7.1.1.5. Vacuum Tubes

- 7.1.2. Passive Components

- 7.1.2.1. Capacitors

- 7.1.2.2. Inductors

- 7.1.2.3. Resistors

- 7.1.1. Active Components

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Consumer Electronics and Computing

- 7.2.3. Medical

- 7.2.4. Industrial

- 7.2.5. Communications

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Active Components

- 8.1.1.1. Transistors

- 8.1.1.2. Diode

- 8.1.1.3. Integrated Circuits (ICs)

- 8.1.1.4. Amplifiers

- 8.1.1.5. Vacuum Tubes

- 8.1.2. Passive Components

- 8.1.2.1. Capacitors

- 8.1.2.2. Inductors

- 8.1.2.3. Resistors

- 8.1.1. Active Components

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Consumer Electronics and Computing

- 8.2.3. Medical

- 8.2.4. Industrial

- 8.2.5. Communications

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Active Components

- 9.1.1.1. Transistors

- 9.1.1.2. Diode

- 9.1.1.3. Integrated Circuits (ICs)

- 9.1.1.4. Amplifiers

- 9.1.1.5. Vacuum Tubes

- 9.1.2. Passive Components

- 9.1.2.1. Capacitors

- 9.1.2.2. Inductors

- 9.1.2.3. Resistors

- 9.1.1. Active Components

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Consumer Electronics and Computing

- 9.2.3. Medical

- 9.2.4. Industrial

- 9.2.5. Communications

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Active Components

- 10.1.1.1. Transistors

- 10.1.1.2. Diode

- 10.1.1.3. Integrated Circuits (ICs)

- 10.1.1.4. Amplifiers

- 10.1.1.5. Vacuum Tubes

- 10.1.2. Passive Components

- 10.1.2.1. Capacitors

- 10.1.2.2. Inductors

- 10.1.2.3. Resistors

- 10.1.1. Active Components

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Consumer Electronics and Computing

- 10.2.3. Medical

- 10.2.4. Industrial

- 10.2.5. Communications

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vishay Intertechnology Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Infineon Technologies AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lelon Electronics Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NXP Semiconductors NV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 KEMET Corporation (Yageo Corporation)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Toshiba Corp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Texas Instruments Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AVX Corporation (Kyocera Corp)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 YAGEO Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TE Connectivity Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Taiyo Yuden Co Ltd*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TDK Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Murata Manufacturing Co Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Panasonic Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Eaton Corporation

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Global Active and Passive Electronic Components Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Active and Passive Electronic Components Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Active and Passive Electronic Components Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Active and Passive Electronic Components Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Active and Passive Electronic Components Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Active and Passive Electronic Components Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Active and Passive Electronic Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Active and Passive Electronic Components Market Revenue (Million), by Component 2025 & 2033

- Figure 9: Europe Active and Passive Electronic Components Market Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Active and Passive Electronic Components Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Active and Passive Electronic Components Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Active and Passive Electronic Components Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Active and Passive Electronic Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Active and Passive Electronic Components Market Revenue (Million), by Component 2025 & 2033

- Figure 15: Asia Pacific Active and Passive Electronic Components Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Active and Passive Electronic Components Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Active and Passive Electronic Components Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Active and Passive Electronic Components Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Active and Passive Electronic Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Active and Passive Electronic Components Market Revenue (Million), by Component 2025 & 2033

- Figure 21: Latin America Active and Passive Electronic Components Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Latin America Active and Passive Electronic Components Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Active and Passive Electronic Components Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Active and Passive Electronic Components Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Active and Passive Electronic Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Active and Passive Electronic Components Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Middle East and Africa Active and Passive Electronic Components Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East and Africa Active and Passive Electronic Components Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Active and Passive Electronic Components Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Active and Passive Electronic Components Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Active and Passive Electronic Components Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Active and Passive Electronic Components Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Global Active and Passive Electronic Components Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Component 2020 & 2033

- Table 8: Global Active and Passive Electronic Components Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Component 2020 & 2033

- Table 11: Global Active and Passive Electronic Components Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global Active and Passive Electronic Components Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Component 2020 & 2033

- Table 17: Global Active and Passive Electronic Components Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Active and Passive Electronic Components Market?

The projected CAGR is approximately 8.79%.

2. Which companies are prominent players in the Active and Passive Electronic Components Market?

Key companies in the market include Vishay Intertechnology Inc, Infineon Technologies AG, Honeywell International Inc, Lelon Electronics Corporation, NXP Semiconductors NV, KEMET Corporation (Yageo Corporation), Toshiba Corp, Texas Instruments Inc, AVX Corporation (Kyocera Corp), YAGEO Corporation, TE Connectivity Ltd, Taiyo Yuden Co Ltd*List Not Exhaustive, TDK Corporation, Murata Manufacturing Co Ltd, Panasonic Corporation, Eaton Corporation.

3. What are the main segments of the Active and Passive Electronic Components Market?

The market segments include Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Preference For Miniaturized Designs; Growing Number of Computing. Communications. and Consumer Electronics; Increasing Adoption of 5G Technology.

6. What are the notable trends driving market growth?

Increasing Adoption of 5G Technology is Driving the Market.

7. Are there any restraints impacting market growth?

Rising Metal Prices Impacting Component Production Costs.

8. Can you provide examples of recent developments in the market?

January 2023: Infineon Technologies AG's MOTIX family for automotive and commercial motor control applications provides a wide range of products with different levels of integration. Infineon releases the MOTIX 3-phase gate driver IC 6ED2742S01Q to broaden its product line. The 160 V silicon-on-insulator (SOI) gate driver comes in a QFN-32 package with a thermally efficient exposed power pad and has an integrated power management unit (PMU). Because of this, the simple-to-integrate device is perfect for battery-powered industrial BLDC motor control drives, such as those used in robotics, drones, cordless power tools, and light electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Active and Passive Electronic Components Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Active and Passive Electronic Components Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Active and Passive Electronic Components Market?

To stay informed about further developments, trends, and reports in the Active and Passive Electronic Components Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence