Key Insights

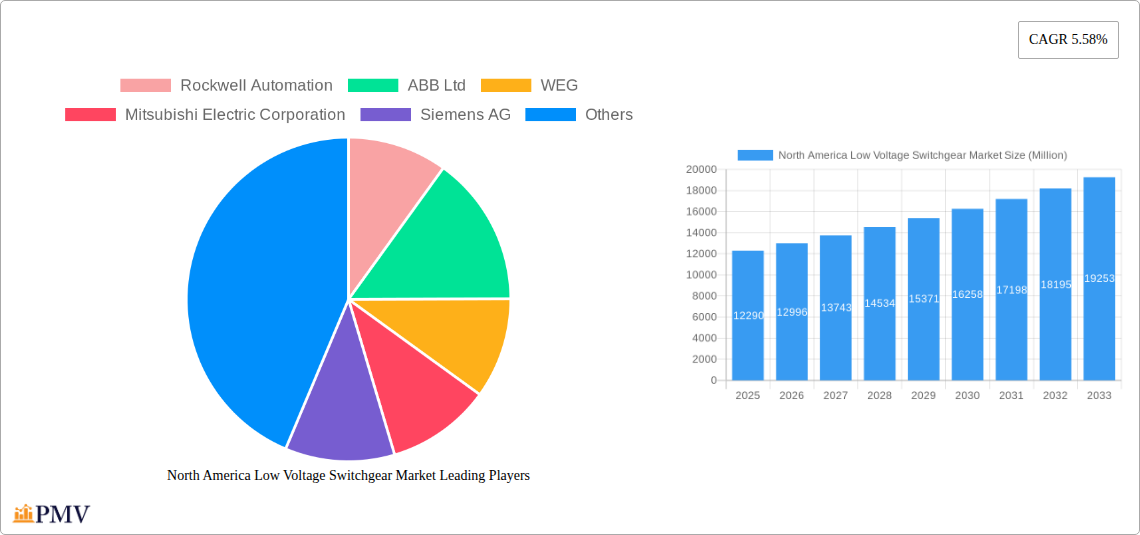

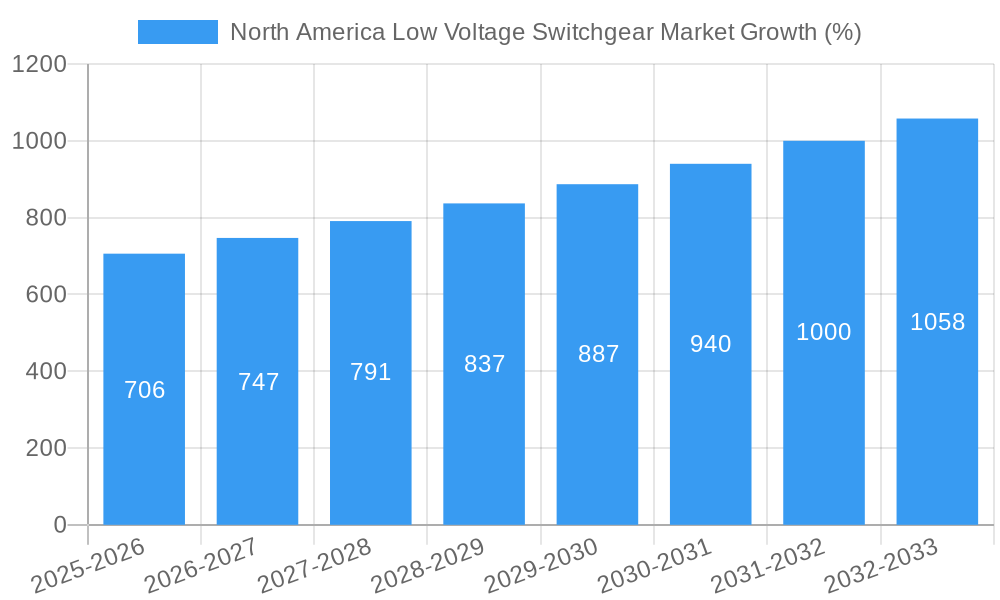

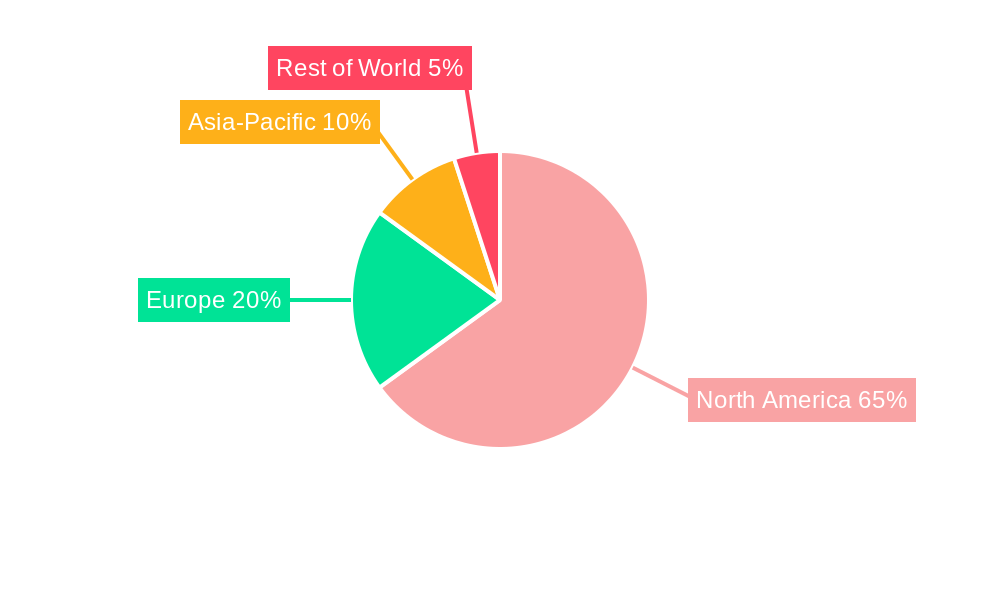

The North American low voltage switchgear market, valued at approximately $12.29 billion in 2025, is projected to experience robust growth, driven by the increasing demand for reliable and efficient power distribution across various sectors. The market's Compound Annual Growth Rate (CAGR) of 5.58% from 2025 to 2033 indicates a significant expansion over the forecast period. Key drivers include the burgeoning renewable energy sector, necessitating advanced switchgear solutions for grid integration and stability. Furthermore, the growing emphasis on smart grid technologies and the modernization of existing infrastructure contribute significantly to market expansion. Strong growth is anticipated in the substation and distribution application segments, reflecting the ongoing investments in upgrading power grids and ensuring robust power delivery. Outdoor installations dominate the market, primarily due to the widespread deployment of power infrastructure in open spaces. The voltage range segment below 250V is expected to maintain a considerable market share, owing to its widespread use in residential and commercial applications. Leading players like Rockwell Automation, ABB Ltd., and Siemens AG are investing heavily in research and development, focusing on innovative switchgear designs that enhance energy efficiency and safety features. The market's growth, however, is subject to certain restraints such as fluctuating raw material prices and stringent regulatory compliance requirements.

Within the North American market, the United States is expected to be the largest contributor to market revenue, followed by Canada and Mexico. The continued expansion of industrial and commercial sectors, along with government initiatives promoting energy efficiency and grid modernization, will propel market growth in these regions. The adoption of advanced technologies, such as digital twins and predictive maintenance, will further transform the industry, leading to improved operational efficiency and reduced downtime. The competitive landscape is characterized by intense rivalry among established players, compelling them to focus on product innovation, strategic partnerships, and expansion into new geographical markets to maintain their market share. This dynamic market scenario provides numerous growth opportunities for both established players and emerging companies.

North America Low Voltage Switchgear Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America low voltage switchgear market, offering invaluable insights for stakeholders across the industry. Covering the period from 2019 to 2033, with 2025 as the base year, this study forecasts market trends and identifies key growth opportunities. The report segments the market by application (substation, distribution), installation (outdoor, indoor), and voltage range (below 250V, 250V-750V, 750V-1000V), offering a granular understanding of the market dynamics. Leading players like Rockwell Automation, ABB Ltd, WEG, Mitsubishi Electric Corporation, Siemens AG, Toshiba Corporation, Fuji Electric, Schneider Electric, and Hitachi are analyzed for their market share, competitive strategies, and recent developments.

North America Low Voltage Switchgear Market Market Structure & Competitive Dynamics

The North America low voltage switchgear market is characterized by a moderately concentrated structure, with a core group of established global leaders and several agile regional players vying for market share. This dynamic landscape is continuously shaped by a vigorous innovation ecosystem, propelled by relentless advancements in switchgear technology. The primary drivers for these innovations include the imperative for enhanced operational efficiency, unwavering reliability, and paramount safety. Furthermore, a robust and evolving regulatory framework, particularly concerning stringent safety standards and environmental compliance across the United States and Canada, significantly influences market operations and dictates product development. While traditional electromechanical switchgear remains the dominant technology, the market is witnessing the emergence of sophisticated product substitutes, such as advanced solid-state circuit breakers and intelligent electronic devices (IEDs), offering enhanced protection and control capabilities. Key end-user trends, notably within the industrial and burgeoning infrastructure sectors, are increasingly prioritizing the adoption of smart grid technologies and comprehensive automation solutions. This shift is directly fueling demand for next-generation, connected, and data-driven switchgear solutions. Mergers and acquisitions (M&A) activity in the sector has been a strategic tool for consolidation and expansion, with deal values averaging approximately $50-$150 Million in recent years (this figure is illustrative and should be replaced with actual data). This M&A activity is predominantly focused on expanding geographical market reach, acquiring or bolstering technological capabilities, and strategically consolidating market share to achieve economies of scale.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately 55-65% market share. (Illustrative)

- Innovation Ecosystem: Highly active and dynamic, with continuous and significant development in areas like smart switchgear, IoT integration, predictive maintenance capabilities, and advanced digitalization.

- Regulatory Framework: Stringent and evolving, with a strong focus on safety standards (e.g., UL, CSA) and environmental compliance, driving the need for greener and more sustainable solutions.

- M&A Activity: Moderate and strategic, with an average deal value of $50-$150 Million in the last 5 years, aimed at market consolidation, technological advancement, and geographical expansion. (Illustrative)

- Key End-User Trends: Increasing demand for smart grid integration, advanced automation, energy efficiency solutions, cybersecurity features, and modular switchgear designs.

North America Low Voltage Switchgear Market Industry Trends & Insights

The North America low voltage switchgear market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors, including the increasing demand for reliable and efficient power distribution infrastructure across various sectors, including industrial, commercial, and residential. Technological advancements, such as the adoption of smart switchgear and digital technologies, are further driving market expansion. Consumer preferences are shifting towards energy-efficient and sustainable solutions, creating opportunities for low voltage switchgear manufacturers offering eco-friendly and intelligent products. The competitive landscape is characterized by intense competition among established players and emerging companies. These businesses focus on innovation, strategic partnerships, and expanding their market reach to maintain their position. Market penetration of advanced switchgear technologies is gradually increasing, driven by the need for enhanced power management and control.

Dominant Markets & Segments in North America Low Voltage Switchgear Market

The distribution segment holds the largest market share within the application segment, driven by the extensive need for low voltage switchgear in various industrial and commercial settings. The indoor installation type is currently the dominant segment due to the prevalence of indoor electrical substations and distribution networks. Within the voltage range, the 250V-750V segment enjoys the largest market share, reflecting the widespread application of this voltage range in industrial and commercial installations. The United States dominates the North America low voltage switchgear market, followed by Canada and Mexico.

- Key Drivers for Distribution Segment Dominance: High demand from industrial and commercial sectors.

- Key Drivers for Indoor Installation Segment Dominance: Existing infrastructure and suitability for various environments.

- Key Drivers for 250V-750V Voltage Range Dominance: Widespread application in industrial and commercial settings.

- US Market Dominance: Strong industrial base, robust infrastructure development, and higher adoption of advanced technologies.

North America Low Voltage Switchgear Market Product Innovations

Recent innovations in the low voltage switchgear market focus on improving efficiency, safety, and integration with smart grid technologies. Manufacturers are developing compact, modular designs to reduce installation footprint and cost. Smart functionalities, such as remote monitoring and diagnostics, are becoming increasingly integrated into switchgear solutions. These advancements are enhancing the reliability and efficiency of power distribution networks while improving overall system uptime. The focus on digitalization is further driving the integration of IoT (Internet of Things) capabilities, enabling proactive maintenance and predictive analytics.

Report Segmentation & Scope

The North America low voltage switchgear market is comprehensively segmented to provide granular insights into its diverse applications and characteristics. The segmentation encompasses key categories including: Application (substation, distribution, industrial facilities, commercial buildings), Installation Type (outdoor, indoor), and Voltage Range (below 250V, 250V-750V, 750V-1000V). Each segment is meticulously analyzed for its market size, projected growth rate, key influencing factors, and the competitive landscape. The substation application segment is projected to witness robust growth of approximately 7-9% due to ongoing and planned investments in grid modernization and infrastructure expansion. Concurrently, the distribution segment is expected to grow at a similar rate of 6-8%, driven by the increasing demand for reliable power distribution in urban and rural areas. Outdoor installations are demonstrating a Compound Annual Growth Rate (CAGR) of approximately 6-8%, primarily fueled by the increasing number of grid infrastructure development projects and the need for resilient power systems. The 250V-750V voltage range segment currently holds the largest market share and is predicted to grow at a healthy rate of 7-9%, reflecting its widespread use in industrial and commercial applications. The report offers an in-depth analysis of each segment's specific growth drivers, prevailing challenges, and the competitive dynamics shaping its evolution.

Key Drivers of North America Low Voltage Switchgear Market Growth

The North America low voltage switchgear market is driven by several key factors. The increasing demand for reliable and efficient power distribution across various sectors is a primary growth driver. The rising adoption of smart grid technologies and automation across industries necessitates advanced low voltage switchgear solutions. Government initiatives to modernize power infrastructure and promote energy efficiency also contribute to market growth. Finally, the expanding industrial and commercial sectors are creating substantial demand for low voltage switchgear to meet their power needs.

Challenges in the North America Low Voltage Switchgear Market Sector

The North America low voltage switchgear market faces certain challenges, including increasing raw material costs, supply chain disruptions impacting production timelines, and intense competition among manufacturers leading to price pressures. Strict regulatory compliance requirements can increase development and operational costs. Furthermore, the increasing adoption of renewable energy sources introduces unique integration challenges for low voltage switchgear systems. These factors collectively impact market growth and profitability.

Leading Players in the North America Low Voltage Switchgear Market Market

- Rockwell Automation

- ABB Ltd

- WEG

- Mitsubishi Electric Corporation

- Siemens AG

- Toshiba Corporation

- Fuji Electric

- Schneider Electric

- Hitachi

- Eaton Corporation

- Legrand S.A.

- General Electric (GE)

Key Developments in North America Low Voltage Switchgear Market Sector

- January 2023: United Grinding North America expanded its distribution network in the US and Mexico with the addition of Intermaq, a move designed to enhance customer access and support for its specialized grinding solutions, indirectly impacting the availability of components that might be integrated into switchgear assemblies.

- December 2022: Gluware Inc. signed a significant US distribution agreement with Micro Inc.'s EBG, strategically expanding access to its comprehensive network automation suite for Value-Added Resellers (VARs) and solution providers, thus facilitating the adoption of advanced network management in critical infrastructure.

- November 2022: Schneider Electric announced the launch of its new range of advanced low voltage circuit breakers featuring enhanced digital connectivity and integrated cybersecurity features, catering to the growing demand for smarter and more secure electrical distribution systems.

- October 2022: ABB introduced a new modular low voltage switchgear system designed for faster installation and greater flexibility in industrial and commercial applications, emphasizing plug-and-play capabilities and reduced commissioning times.

- September 2022: Siemens showcased its latest innovations in smart grid technology at a major industry conference, highlighting advancements in intelligent switchgear that enable real-time data monitoring, predictive analytics, and optimized energy management for utilities and industrial clients.

Strategic North America Low Voltage Switchgear Market Market Outlook

The North America low voltage switchgear market is poised for substantial and sustained growth, propelled by a confluence of powerful drivers. These include ongoing, large-scale infrastructure development projects across the continent, a significant increase in automation adoption across diverse industries seeking operational efficiencies, and the accelerating transition towards more resilient and intelligent smart grids. Strategic opportunities abound for manufacturers that prioritize and invest heavily in innovation, particularly in cutting-edge areas such as the digitalization of power systems, the development of highly energy-efficient switchgear, and the integration of sustainable and eco-friendly technologies. Companies that cultivate customer-centric approaches, optimize their supply chain management for agility and reliability, and forge strategic partnerships will be exceptionally well-positioned to capture significant market share and achieve market leadership in the coming years. The future trajectory of this vital market will be critically dependent on the industry's ability to proactively adapt to rapidly evolving technological advancements, navigate dynamic regulatory landscapes, and effectively cater to the increasingly sophisticated and diverse needs of a growing customer base.

North America Low Voltage Switchgear Market Segmentation

-

1. Application

- 1.1. Substation

- 1.2. Distribution

-

2. Installation

- 2.1. Outdoor

- 2.2. Indoor

-

3. Voltage Range

- 3.1. Below 250 V

- 3.2. 250 V - 750V

- 3.3. 750V - 1000 V

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Rest of North America

North America Low Voltage Switchgear Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Low Voltage Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.58% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The increasing installation of renewable energy sources

- 3.2.2 such as wind and solar power

- 3.2.3 necessitates advanced low voltage switchgear to manage and distribute electricity efficiently

- 3.3. Market Restrains

- 3.3.1 Delays in project execution

- 3.3.2 due to factors such as regulatory approvals and supply chain disruptions

- 3.3.3 can hinder the timely deployment of low voltage switchgear systems.

- 3.4. Market Trends

- 3.4.1 The adoption of smart switchgear technology

- 3.4.2 enabling enhanced monitoring

- 3.4.3 control

- 3.4.4 and automation capabilities

- 3.4.5 is improving overall grid reliability and reducing downtime

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Substation

- 5.1.2. Distribution

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Outdoor

- 5.2.2. Indoor

- 5.3. Market Analysis, Insights and Forecast - by Voltage Range

- 5.3.1. Below 250 V

- 5.3.2. 250 V - 750V

- 5.3.3. 750V - 1000 V

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United States North America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Substation

- 6.1.2. Distribution

- 6.2. Market Analysis, Insights and Forecast - by Installation

- 6.2.1. Outdoor

- 6.2.2. Indoor

- 6.3. Market Analysis, Insights and Forecast - by Voltage Range

- 6.3.1. Below 250 V

- 6.3.2. 250 V - 750V

- 6.3.3. 750V - 1000 V

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Canada North America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Substation

- 7.1.2. Distribution

- 7.2. Market Analysis, Insights and Forecast - by Installation

- 7.2.1. Outdoor

- 7.2.2. Indoor

- 7.3. Market Analysis, Insights and Forecast - by Voltage Range

- 7.3.1. Below 250 V

- 7.3.2. 250 V - 750V

- 7.3.3. 750V - 1000 V

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Rest of North America North America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Substation

- 8.1.2. Distribution

- 8.2. Market Analysis, Insights and Forecast - by Installation

- 8.2.1. Outdoor

- 8.2.2. Indoor

- 8.3. Market Analysis, Insights and Forecast - by Voltage Range

- 8.3.1. Below 250 V

- 8.3.2. 250 V - 750V

- 8.3.3. 750V - 1000 V

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. United States North America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Rockwell Automation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 WEG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Mitsubishi Electric Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Siemens AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Toshiba Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Fuji Electric

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Schneider Electric

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Hitachi

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Rockwell Automation

List of Figures

- Figure 1: North America Low Voltage Switchgear Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Low Voltage Switchgear Market Share (%) by Company 2024

List of Tables

- Table 1: North America Low Voltage Switchgear Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Low Voltage Switchgear Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: North America Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 4: North America Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Range 2019 & 2032

- Table 5: North America Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Low Voltage Switchgear Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Low Voltage Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Low Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Low Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Low Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America Low Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America Low Voltage Switchgear Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: North America Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 14: North America Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Range 2019 & 2032

- Table 15: North America Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: North America Low Voltage Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: North America Low Voltage Switchgear Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: North America Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 19: North America Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Range 2019 & 2032

- Table 20: North America Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: North America Low Voltage Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: North America Low Voltage Switchgear Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: North America Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 24: North America Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Range 2019 & 2032

- Table 25: North America Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Low Voltage Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Low Voltage Switchgear Market?

The projected CAGR is approximately 5.58%.

2. Which companies are prominent players in the North America Low Voltage Switchgear Market?

Key companies in the market include Rockwell Automation, ABB Ltd, WEG, Mitsubishi Electric Corporation, Siemens AG, Toshiba Corporation, Fuji Electric, Schneider Electric, Hitachi.

3. What are the main segments of the North America Low Voltage Switchgear Market?

The market segments include Application, Installation, Voltage Range, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.29 Million as of 2022.

5. What are some drivers contributing to market growth?

The increasing installation of renewable energy sources. such as wind and solar power. necessitates advanced low voltage switchgear to manage and distribute electricity efficiently.

6. What are the notable trends driving market growth?

The adoption of smart switchgear technology. enabling enhanced monitoring. control. and automation capabilities. is improving overall grid reliability and reducing downtime.

7. Are there any restraints impacting market growth?

Delays in project execution. due to factors such as regulatory approvals and supply chain disruptions. can hinder the timely deployment of low voltage switchgear systems..

8. Can you provide examples of recent developments in the market?

January 2023: United Grinding North America announced the expansion of its distribution network US and Mexico with the addition of Intermaq. Intermaq will represent the full line of components provided by the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Low Voltage Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Low Voltage Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Low Voltage Switchgear Market?

To stay informed about further developments, trends, and reports in the North America Low Voltage Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence