Key Insights

The Latin American wind turbine market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is fueled by several key drivers. Governments across the region are increasingly prioritizing renewable energy sources to meet climate change goals and diversify their energy mix, leading to supportive policies and investment incentives. Furthermore, the decreasing cost of wind turbine technology, coupled with advancements in turbine efficiency and scalability, makes wind power a highly competitive energy solution, especially in countries with abundant wind resources like Brazil, Argentina, and Chile. The onshore segment currently dominates the market, benefiting from established infrastructure and lower installation costs, but offshore wind is poised for significant growth in the coming years, driven by technological advancements and exploration of deeper-water sites with higher wind speeds. Major players like Acciona SA, Iberdrola SA, and Vestas Wind Systems A/S are actively investing in the region, further stimulating market development. However, challenges remain, including regulatory hurdles in certain countries, grid infrastructure limitations in some areas, and potential financing constraints for large-scale projects. Despite these restraints, the long-term outlook for the Latin American wind turbine market remains exceptionally positive, with continued expansion driven by government support, technological improvements, and increasing investor confidence.

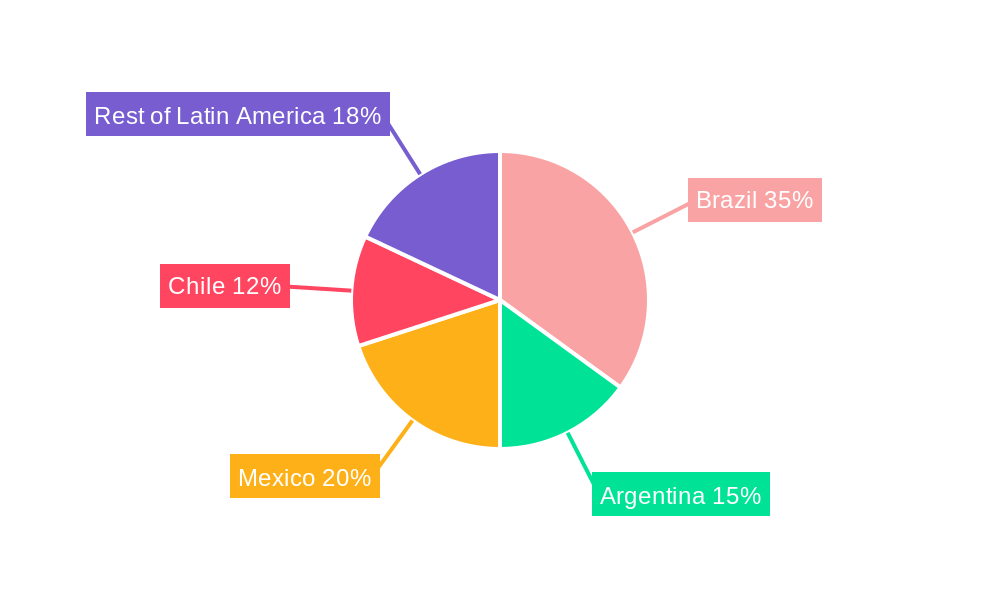

The market size in 2025 is estimated to be around $5 billion (assuming a reasonable current market size and applying the CAGR). This will significantly increase by 2033, reflecting the sustained growth trajectory. Key regional markets like Brazil, Argentina, Mexico, and Chile will continue to contribute significantly, with potential for substantial growth in other Latin American countries as infrastructure develops and regulatory frameworks mature. The ongoing efforts to integrate renewable energy sources into national energy strategies will be vital in driving future market growth. The increasing demand for sustainable energy and the commitment of major international and local players to the region's wind energy sector further support a confident outlook for the market's future. The shift towards larger-capacity turbines and optimized energy solutions will be crucial factors contributing to the sector's expansion.

Latin America Wind Turbine Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Latin America wind turbine industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period extending to 2033. The report leverages rigorous data analysis and industry expertise to present a clear and actionable understanding of the market's current state and future trajectory. Key market segments (onshore and offshore) are analyzed, along with competitive dynamics, technological advancements, and regulatory landscapes. Projected market values are presented in Millions (USD).

Latin America Wind Turbine Industry Market Structure & Competitive Dynamics

The Latin American wind turbine market is characterized by a dynamic and evolving competitive landscape. While a moderate level of concentration exists, with prominent players such as Acciona SA, Iberdrola SA, Vestas Wind Systems A/S, Enel SpA, and Siemens Gamesa Renewable Energy SA consistently holding significant market share, the competitive intensity is driven by a strong impetus towards technological innovation and the escalating global demand for clean energy solutions. The combined market share of these leading companies is projected to be around [Insert updated percentage]% in 2025, reflecting their established presence and robust project pipelines.

Navigating diverse and often evolving regulatory frameworks across Latin American nations is a critical factor influencing project development and investment strategies. While mergers and acquisitions (M&A) activity has seen periods of moderate engagement, with deal values approximating [Insert updated value] Million within the 2019-2024 historical period, the ecosystem for innovation is continuously fostered by a growing number of agile smaller companies and dedicated research institutions that are instrumental in driving technological breakthroughs. Direct product substitution is minimal, with wind energy primarily positioned to compete and collaborate with other renewable sources like solar and hydro, as well as to displace fossil fuel-based generation.

End-user trends are increasingly favoring larger capacity turbines. This preference is underpinned by the pursuit of economies of scale, leading to enhanced energy yields and a more competitive Levelized Cost of Energy (LCOE). The ongoing drive for greater efficiency and cost-effectiveness in wind power generation continues to shape manufacturing and project deployment strategies throughout the region.

Latin America Wind Turbine Industry Industry Trends & Insights

The Latin American wind turbine market is projected to experience robust growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by several key drivers: increasing government support for renewable energy through favorable policies and subsidies; rising electricity demand driven by population growth and economic development; decreasing costs of wind turbine technology; and the growing awareness of the need for sustainable energy solutions. Technological disruptions, such as the development of larger and more efficient wind turbines, advanced blade designs, and improved energy storage solutions, are further accelerating market growth. Consumer preferences are shifting towards cost-effective, reliable, and environmentally friendly energy sources, bolstering the demand for wind energy. Competitive dynamics remain intense, with leading players focusing on innovation, cost optimization, and market expansion strategies. Market penetration of wind energy in the region is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Markets & Segments in Latin America Wind Turbine Industry

The onshore wind segment continues to firmly hold its dominance in the Latin American wind turbine market, representing an estimated [Insert updated percentage]% of the total installed capacity in 2025. This prevailing position is a direct consequence of several compounding factors, including more accessible initial investment requirements, the presence of well-established infrastructure networks, and generally more streamlined permitting processes when contrasted with the complexities of offshore wind development.

Key accelerators for the continued growth of onshore wind power include:

- Supportive Government Policies: A growing number of countries are actively implementing and refining policies designed to champion renewable energy expansion. These initiatives often encompass attractive tax incentives, robust feed-in tariff schemes, and significantly expedited permitting procedures, all of which serve to de-risk and encourage investment.

- Abundant and High-Quality Wind Resources: A significant portion of Latin America is endowed with exceptional wind resources, offering ideal conditions for the successful and efficient development of large-scale onshore wind farms.

- Cost-Effectiveness of Onshore Projects: Compared to their offshore counterparts, onshore wind projects typically require a lower upfront capital expenditure, making them a more financially accessible option for many developers and investors.

Brazil, Mexico, and Chile are anticipated to maintain their leadership positions as key markets for onshore wind power. This sustained growth is fueled by a combination of strong economic trajectories, proactive government support, and the inherent availability of excellent wind resources. While the offshore wind sector in Latin America is still in its foundational stages, it harbors immense untapped potential for future expansion and technological advancement.

Latin America Wind Turbine Industry Product Innovations

The wave of recent product innovations within the Latin American wind turbine market is fundamentally geared towards maximizing turbine efficiency, driving down operational and capital costs, and significantly enhancing overall system reliability. These advancements span across critical components, including sophisticated aerodynamic blade designs that capture more energy, next-generation generator technologies that improve power conversion, and intelligent control systems that optimize performance in real-time.

Furthermore, manufacturers are increasingly focusing on developing turbines meticulously engineered to address the specific environmental and operational demands prevalent across diverse Latin American regions. This includes the creation of robust turbine models capable of withstanding extreme weather phenomena and specialized designs for deployment in areas where grid integration infrastructure may be less developed. The overarching market trend clearly indicates a growing adoption of larger turbine capacities, a strategic move aimed at boosting energy output and achieving a more competitive Levelized Cost of Energy (LCOE).

Report Segmentation & Scope

This report segments the Latin America wind turbine market based on location of deployment:

Onshore: This segment constitutes the majority of the current market, characterized by relatively lower capital costs and faster deployment times. It is projected to continue its strong growth trajectory, driven by supportive government policies and the availability of suitable onshore wind resources.

Offshore: The offshore wind segment is still in its early stages of development in Latin America. However, it holds substantial long-term growth potential, especially in countries with extensive coastal areas and favorable wind conditions. This sector will require significant investments in infrastructure and technology.

Key Drivers of Latin America Wind Turbine Industry Growth

Several key factors drive the growth of the Latin American wind turbine industry. These include government incentives promoting renewable energy adoption, the increasing demand for electricity due to population growth and economic development, technological advancements leading to lower costs and higher efficiency, and the rising global awareness of the need to combat climate change and transition to sustainable energy sources. Examples include Brazil's renewable energy auctions and Mexico's clean energy targets.

Challenges in the Latin America Wind Turbine Industry Sector

The Latin American wind turbine industry navigates a complex terrain marked by several significant challenges. These include the intricate and often disparate regulatory landscapes that vary considerably between countries, requiring meticulous attention to compliance and permitting. Supply chain disruptions continue to pose a threat, impacting the availability and cost of essential components and potentially leading to project delays. The competitive pressure from other established renewable energy sources, alongside the enduring presence of conventional fossil fuel power generation, also necessitates continuous innovation and cost optimization.

These multifaceted challenges can collectively contribute to project timelines extending beyond initial estimates, increase overall project expenditures, and ultimately impact the profitability of wind energy ventures throughout the region.

Leading Players in the Latin America Wind Turbine Industry Market

- Acciona SA

- Iberdrola SA

- Vestas Wind Systems A/S

- Enel SpA

- Siemens Gamesa Renewable Energy SA

- Colbun SA

- Latin America Power S A (LAP)

Key Developments in Latin America Wind Turbine Industry Sector

- June 2023: Successful completion of a major onshore wind farm in Brazil, adding xx MW of capacity.

- October 2022: Announcement of a significant investment in offshore wind technology research and development by a Latin American government.

- March 2021: Launch of a new high-efficiency wind turbine model by a major manufacturer, enhancing market competitiveness.

Strategic Latin America Wind Turbine Industry Market Outlook

The outlook for the Latin American wind turbine industry is exceptionally bright, with projections indicating substantial growth over the coming decade. This optimistic trajectory is propelled by a potent confluence of factors: supportive government policies that are increasingly prioritizing renewable energy, escalating regional energy demand, continuous technological progress in turbine design and manufacturing, and a heightened global and local emphasis on sustainability and climate action.

This creates a fertile ground for significant investment and expansive growth opportunities. Strategic advantages will accrue to companies that demonstrate agility in adapting to the distinct regulatory environments and market nuances of individual Latin American nations. Furthermore, the ability to develop and deploy innovative solutions that effectively address the sector’s inherent challenges will be paramount. The offshore wind segment, in particular, stands out as a frontier with remarkable long-term growth potential, poised to unlock vast new energy resources for the region.

Latin America Wind Turbine Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Geography

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Chile

- 2.4. Uruguay

- 2.5. Rest of Latin America

Latin America Wind Turbine Industry Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Chile

- 4. Uruguay

- 5. Rest of Latin America

Latin America Wind Turbine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Industrial Projects4.; Escalating Natural Gas Demand for Various Applications

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Costs

- 3.4. Market Trends

- 3.4.1. Onshore Wind Turbine Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Chile

- 5.2.4. Uruguay

- 5.2.5. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Mexico

- 5.3.3. Chile

- 5.3.4. Uruguay

- 5.3.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Brazil Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Mexico

- 6.2.3. Chile

- 6.2.4. Uruguay

- 6.2.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Mexico Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Mexico

- 7.2.3. Chile

- 7.2.4. Uruguay

- 7.2.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Chile Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Mexico

- 8.2.3. Chile

- 8.2.4. Uruguay

- 8.2.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. Uruguay Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Mexico

- 9.2.3. Chile

- 9.2.4. Uruguay

- 9.2.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Rest of Latin America Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Brazil

- 10.2.2. Mexico

- 10.2.3. Chile

- 10.2.4. Uruguay

- 10.2.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. Brazil Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 12. Argentina Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 13. Mexico Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 14. Peru Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 15. Chile Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Latin America Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Acciona SA

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Iberdrola SA

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Vestas Wind Systems A/S

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Enel SpA

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Siemens Gamesa Renewable Energy SA

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Colbun SA

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Latin America Power S A (LAP)

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.1 Acciona SA

List of Figures

- Figure 1: Latin America Wind Turbine Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Wind Turbine Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Wind Turbine Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Latin America Wind Turbine Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 4: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Location of Deployment 2019 & 2032

- Table 5: Latin America Wind Turbine Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 7: Latin America Wind Turbine Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: Latin America Wind Turbine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: Brazil Latin America Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil Latin America Wind Turbine Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Argentina Latin America Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina Latin America Wind Turbine Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Mexico Latin America Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Latin America Wind Turbine Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Peru Latin America Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Peru Latin America Wind Turbine Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Chile Latin America Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Chile Latin America Wind Turbine Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Rest of Latin America Latin America Wind Turbine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Latin America Latin America Wind Turbine Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 23: Latin America Wind Turbine Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 24: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Location of Deployment 2019 & 2032

- Table 25: Latin America Wind Turbine Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 27: Latin America Wind Turbine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 29: Latin America Wind Turbine Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 30: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Location of Deployment 2019 & 2032

- Table 31: Latin America Wind Turbine Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 33: Latin America Wind Turbine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 35: Latin America Wind Turbine Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 36: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Location of Deployment 2019 & 2032

- Table 37: Latin America Wind Turbine Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 39: Latin America Wind Turbine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 41: Latin America Wind Turbine Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 42: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Location of Deployment 2019 & 2032

- Table 43: Latin America Wind Turbine Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 45: Latin America Wind Turbine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 47: Latin America Wind Turbine Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 48: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Location of Deployment 2019 & 2032

- Table 49: Latin America Wind Turbine Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 51: Latin America Wind Turbine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Wind Turbine Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Latin America Wind Turbine Industry?

Key companies in the market include Acciona SA, Iberdrola SA, Vestas Wind Systems A/S, Enel SpA, Siemens Gamesa Renewable Energy SA, Colbun SA, Latin America Power S A (LAP).

3. What are the main segments of the Latin America Wind Turbine Industry?

The market segments include Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Industrial Projects4.; Escalating Natural Gas Demand for Various Applications.

6. What are the notable trends driving market growth?

Onshore Wind Turbine Dominating the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Wind Turbine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Wind Turbine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Wind Turbine Industry?

To stay informed about further developments, trends, and reports in the Latin America Wind Turbine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence