Key Insights

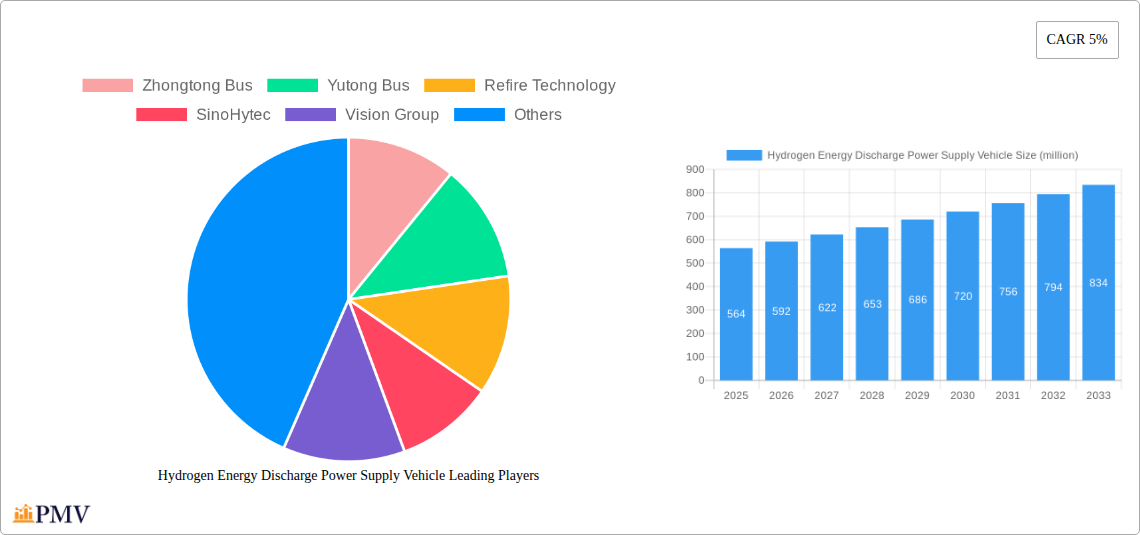

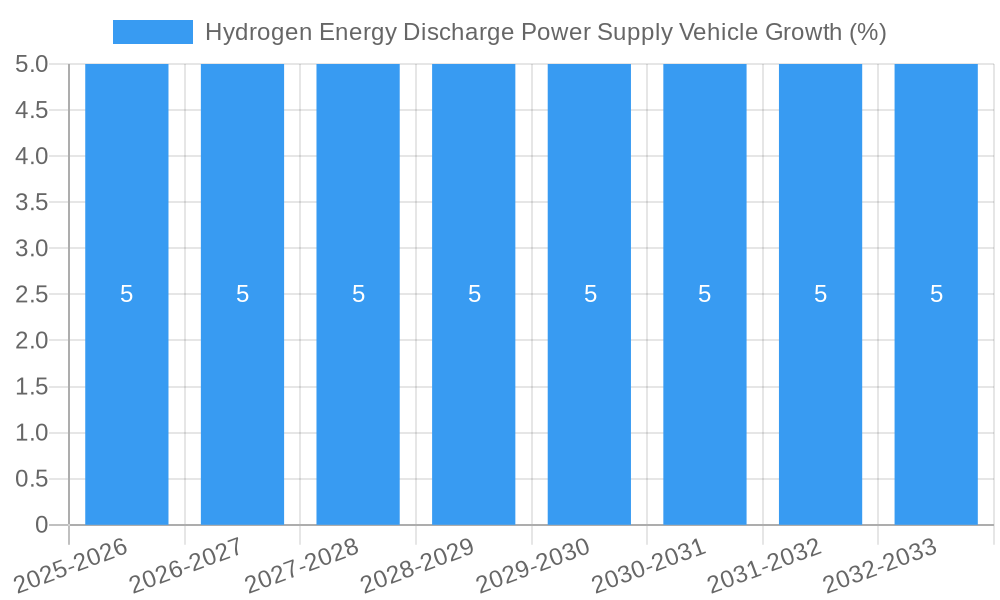

The Hydrogen Energy Discharge Power Supply Vehicle market is poised for significant expansion, projected to reach \$564 million by 2025 with a robust Compound Annual Growth Rate (CAGR) of 5%. This upward trajectory is propelled by a confluence of factors, primarily driven by the global imperative to decarbonize transportation and the increasing adoption of hydrogen fuel cell technology. The inherent advantages of hydrogen, such as zero tailpipe emissions and rapid refueling times, make it an attractive alternative to traditional internal combustion engines and even battery-electric vehicles for certain applications. Key applications within this burgeoning market include specialized vehicles for remote power generation, mobile charging stations for electric fleets, and emergency response units requiring on-demand, clean power. The development of advanced hydrogen storage solutions and the expanding hydrogen refueling infrastructure are critical enablers, further stimulating market growth.

Several emerging trends are shaping the Hydrogen Energy Discharge Power Supply Vehicle landscape. The integration of these vehicles into smart grid systems for grid stabilization and peak shaving is gaining traction, offering a flexible and mobile power source. Furthermore, advancements in fuel cell efficiency and durability are reducing operational costs, making hydrogen-powered solutions more economically viable. The involvement of major automotive manufacturers and dedicated fuel cell technology companies, such as Yutong Bus, Toyota, and Ballard Power Systems, underscores the growing industry commitment and investment in this sector. However, the market faces certain restraints, including the high initial cost of hydrogen fuel cell systems and the nascent stage of hydrogen production and distribution infrastructure in many regions. Overcoming these challenges through policy support, technological innovation, and strategic partnerships will be crucial for unlocking the full potential of this dynamic market.

Absolutely! Here's an SEO-optimized, detailed report description for the Hydrogen Energy Discharge Power Supply Vehicle market, incorporating your requirements and keywords.

This in-depth report provides a detailed analysis of the global Hydrogen Energy Discharge Power Supply Vehicle market, a rapidly evolving sector within the green hydrogen economy. Covering the study period 2019–2033, with a base year of 2025, an estimated year of 2025, and a forecast period from 2025 to 2033, this report offers critical insights for stakeholders seeking to capitalize on the burgeoning demand for sustainable transportation solutions. We delve into market structure, competitive dynamics, emerging trends, dominant segments, product innovations, and strategic outlooks, providing actionable intelligence for manufacturers, investors, and policymakers. Keywords: hydrogen fuel cell vehicles, hydrogen electric vehicles, fuel cell electric vehicles (FCEVs), green hydrogen infrastructure, zero-emission vehicles, hydrogen mobility, sustainable logistics, commercial vehicle electrification, industrial hydrogen applications, renewable energy storage.

Hydrogen Energy Discharge Power Supply Vehicle Market Structure & Competitive Dynamics

The Hydrogen Energy Discharge Power Supply Vehicle market exhibits a dynamic and evolving competitive landscape. Market concentration is currently moderate, with a significant presence of established automotive manufacturers and emerging technology providers. Innovation ecosystems are thriving, fueled by substantial investments in research and development for advanced fuel cell stacks, hydrogen storage systems, and efficient power management solutions. Regulatory frameworks are increasingly supportive, with governments worldwide enacting policies to promote zero-emission transportation and build out essential hydrogen refueling infrastructure. Product substitutes, primarily battery electric vehicles (BEVs), present a competitive challenge, yet the unique advantages of hydrogen, such as longer range and faster refueling times for heavy-duty applications, are carving out distinct market niches. End-user trends favor operational efficiency, reduced carbon footprints, and compliance with stringent environmental regulations, particularly within commercial and industrial sectors. Mergers and acquisitions (M&A) activity is on the rise as companies seek to secure market share, acquire critical technologies, and expand their geographical reach. For instance, recent M&A deals in the broader fuel cell industry have reached values exceeding $500 million, indicating strong investor confidence. Key players are actively forming strategic alliances and partnerships to accelerate technology deployment and market penetration.

Hydrogen Energy Discharge Power Supply Vehicle Industry Trends & Insights

The Hydrogen Energy Discharge Power Supply Vehicle industry is poised for robust growth, driven by a confluence of technological advancements, supportive government policies, and increasing environmental consciousness. The compound annual growth rate (CAGR) is projected to be in the range of 15% to 20% over the forecast period. Market penetration is steadily increasing, especially in regions with ambitious decarbonization targets and existing hydrogen infrastructure. A significant growth driver is the advancement in fuel cell technology, leading to improved efficiency, durability, and reduced cost. Companies like Ballard Power Systems and Plug Power are at the forefront of these innovations. The development of more compact and cost-effective hydrogen storage solutions is also crucial for widespread adoption.

The electrification of commercial fleets, including trucks, buses, and trains, represents a primary application area where hydrogen offers distinct advantages over battery-electric solutions, particularly for long-haul routes requiring extended operational uptime and rapid refueling. Zhongtong Bus and Yutong Bus are actively developing and deploying hydrogen fuel cell buses. Refire Technology is a key player in providing fuel cell systems for commercial vehicles.

Technological disruptions are also emerging from advancements in hydrogen production, such as electrolysis powered by renewable energy sources, further enhancing the sustainability credentials of hydrogen fuel cell vehicles. SinoHytec is a prominent Chinese company contributing to this segment.

Consumer preferences are shifting towards zero-emission mobility, and while BEVs currently dominate the passenger vehicle segment, FCEVs are gaining traction for their ability to meet the demands of commercial operations. Toyota and Hyundai Motor are continuing their investments in FCEV development for passenger and commercial applications. Vision Group is also exploring opportunities in this space.

Competitive dynamics are intensifying, with traditional automotive giants and specialized hydrogen technology firms vying for market leadership. Nikola Corporation, despite facing past challenges, remains a notable entity in the hydrogen truck sector. The global market is moving towards a future where hydrogen energy discharge power supply vehicles play a pivotal role in decarbonizing transportation. The market size is estimated to reach over $150 billion by 2033.

Dominant Markets & Segments in Hydrogen Energy Discharge Power Supply Vehicle

The Hydrogen Energy Discharge Power Supply Vehicle market is experiencing significant growth, with particular dominance observed in specific regions and application segments.

Application: Commercial Vehicles

- Key Drivers:

- Government Mandates & Incentives: Strong policy support for zero-emission transportation in key markets, including tax credits, subsidies for vehicle purchase, and funding for hydrogen refueling infrastructure.

- Operational Efficiency: The ability of hydrogen fuel cell vehicles to offer longer range, faster refueling times, and higher payload capacities compared to battery-electric alternatives makes them ideal for long-haul trucking, public transportation, and logistics.

- Decarbonization Goals: Ambitious corporate sustainability targets and industry-wide commitments to reduce greenhouse gas emissions are driving the adoption of hydrogen-powered fleets.

- Infrastructure Development: Growing investment in hydrogen refueling stations, particularly in strategic transport corridors, is reducing range anxiety and facilitating wider adoption.

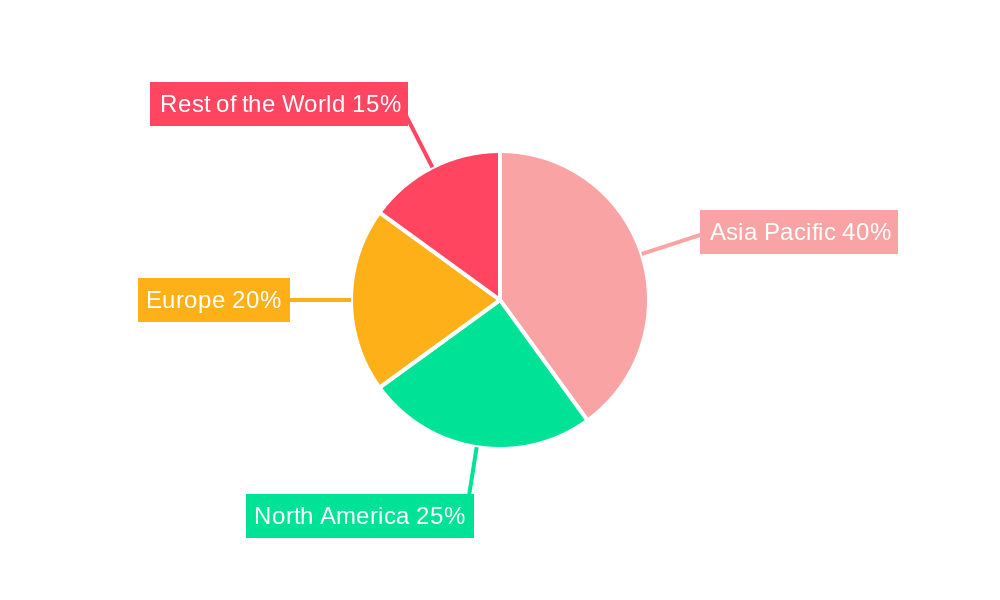

Region: Asia Pacific

- Dominance Analysis: Asia Pacific, led by China, is emerging as the dominant region in the hydrogen energy discharge power supply vehicle market. This leadership is attributed to a combination of factors:

- Proactive Government Policies: China's national policies have consistently prioritized the development of the hydrogen energy sector, including substantial subsidies for fuel cell vehicles and infrastructure, and ambitious targets for fleet deployment.

- Manufacturing Prowess: The region boasts a strong manufacturing base for automotive components and fuel cell systems, enabling efficient production and cost reduction. Companies like SinoHytec are at the forefront of this growth.

- Large Market Demand: The sheer size of the commercial vehicle market in Asia Pacific, coupled with growing environmental concerns, creates a substantial demand for sustainable transportation solutions.

- Infrastructure Investment: Significant investments are being made in building out a comprehensive hydrogen refueling network across major cities and transportation routes.

Type: Fuel Cell Electric Buses

- Dominance Analysis: Within the Hydrogen Energy Discharge Power Supply Vehicle landscape, fuel cell electric buses represent a leading segment.

- Public Transit Initiatives: Many cities globally are actively investing in electrifying their public bus fleets to reduce air pollution and achieve climate goals. Hydrogen offers a compelling solution for urban bus routes, providing zero tailpipe emissions and quick refueling during operational cycles.

- Extended Range & Refueling Speed: Unlike battery-electric buses which may require extensive charging times or frequent stops, fuel cell buses can achieve longer ranges and be refueled in minutes, minimizing service disruptions. Companies like Zhongtong Bus and Yutong Bus are key players in this segment, deploying these vehicles in numerous urban areas.

- Technological Maturity: Fuel cell technology for buses has reached a relatively mature stage, with proven reliability and performance in real-world applications.

The convergence of supportive policies, industrial capacity, and specific application demands in commercial vehicles and buses, particularly in the Asia Pacific region, solidifies their dominance in the Hydrogen Energy Discharge Power Supply Vehicle market.

Hydrogen Energy Discharge Power Supply Vehicle Product Innovations

Recent product innovations in Hydrogen Energy Discharge Power Supply Vehicles are focused on enhancing performance, durability, and cost-effectiveness. Advancements in fuel cell stack technology, such as increased power density and longer lifespan, are crucial. Companies are also innovating in integrated powertrain systems, optimizing energy management between the fuel cell and battery, and improving hydrogen storage solutions for greater safety and volumetric efficiency. These developments are making hydrogen vehicles more competitive for a wider range of applications, particularly in the heavy-duty sector. The integration of these vehicles with smart grid technologies and renewable hydrogen production methods is also a key trend.

Report Segmentation & Scope

This report segments the Hydrogen Energy Discharge Power Supply Vehicle market by Application and Type.

Application: The market is segmented into Commercial Vehicles (trucks, buses, vans) and potentially Other Applications (e.g., material handling equipment). Commercial vehicles are expected to dominate, with a projected market size of over $120 billion by 2033.

Type: The market is further segmented into Fuel Cell Electric Buses, Fuel Cell Electric Trucks, and other emerging types of hydrogen-powered vehicles. Fuel cell electric buses are anticipated to see significant growth, reaching an estimated $30 billion by 2033, driven by public transportation initiatives and zero-emission mandates. Fuel cell electric trucks are also poised for substantial expansion, representing a larger potential market as long-haul trucking decarbonizes.

Key Drivers of Hydrogen Energy Discharge Power Supply Vehicle Growth

The growth of the Hydrogen Energy Discharge Power Supply Vehicle market is propelled by several key factors. Foremost is the global imperative to reduce greenhouse gas emissions and combat climate change, leading governments and industries to pursue zero-emission transportation solutions. Supportive regulatory frameworks, including subsidies, tax incentives, and emission standards, are accelerating adoption. Technological advancements in fuel cell efficiency, durability, and cost reduction are making hydrogen vehicles more viable. The development of a robust hydrogen refueling infrastructure, driven by public and private investment, is crucial for alleviating range anxiety and facilitating widespread use. Furthermore, the increasing demand for sustainable logistics and cleaner public transportation, particularly in the commercial vehicle sector, is a significant catalyst for growth.

Challenges in the Hydrogen Energy Discharge Power Supply Vehicle Sector

Despite the promising outlook, the Hydrogen Energy Discharge Power Supply Vehicle sector faces several challenges. The high upfront cost of hydrogen vehicles and fuel cell systems remains a barrier to widespread adoption, although costs are decreasing. The limited availability and distribution of hydrogen refueling infrastructure in many regions pose a significant constraint. The production of "green" hydrogen, derived from renewable energy sources, needs to scale up to ensure the environmental benefits of these vehicles are fully realized. Supply chain complexities for critical components and the need for specialized maintenance expertise also present hurdles. Furthermore, competition from rapidly advancing battery electric vehicle technology, particularly in the passenger car segment, requires hydrogen vehicles to focus on their unique strengths in heavy-duty applications.

Leading Players in the Hydrogen Energy Discharge Power Supply Vehicle Market

- Zhongtong Bus

- Yutong Bus

- Refire Technology

- SinoHytec

- Vision Group

- Toyota

- Hyundai Motor

- Plug Power

- Ballard Power Systems

- Nikola Corporation

Key Developments in Hydrogen Energy Discharge Power Supply Vehicle Sector

- 2023: Significant government funding announcements for hydrogen infrastructure expansion in Europe and North America.

- 2023: Major automotive manufacturers announce accelerated timelines for the deployment of hydrogen fuel cell trucks and buses.

- 2022: Breakthroughs in fuel cell stack durability and power density demonstrated by leading technology providers like Ballard Power Systems.

- 2022: Expansion of hydrogen refueling networks in key transportation corridors in China and Japan.

- 2021: Increased M&A activity and strategic partnerships focused on fuel cell technology and hydrogen mobility solutions.

- 2020: Growing interest and investment in hydrogen for heavy-duty trucking applications from companies like Nikola Corporation.

- 2019: Continued robust sales growth of fuel cell electric buses in major urban centers globally.

Strategic Hydrogen Energy Discharge Power Supply Vehicle Market Outlook

- 2023: Significant government funding announcements for hydrogen infrastructure expansion in Europe and North America.

- 2023: Major automotive manufacturers announce accelerated timelines for the deployment of hydrogen fuel cell trucks and buses.

- 2022: Breakthroughs in fuel cell stack durability and power density demonstrated by leading technology providers like Ballard Power Systems.

- 2022: Expansion of hydrogen refueling networks in key transportation corridors in China and Japan.

- 2021: Increased M&A activity and strategic partnerships focused on fuel cell technology and hydrogen mobility solutions.

- 2020: Growing interest and investment in hydrogen for heavy-duty trucking applications from companies like Nikola Corporation.

- 2019: Continued robust sales growth of fuel cell electric buses in major urban centers globally.

Strategic Hydrogen Energy Discharge Power Supply Vehicle Market Outlook

The strategic outlook for the Hydrogen Energy Discharge Power Supply Vehicle market is highly optimistic, driven by an accelerating global transition towards sustainable energy and transportation. Growth accelerators include continued advancements in fuel cell technology, making vehicles more efficient and affordable. The expansion of dedicated hydrogen refueling infrastructure, supported by government policies and private investment, will be critical for unlocking mass adoption. Emerging applications, such as hydrogen-powered ferries, trains, and even aviation, present significant future market potential. Strategic opportunities lie in forming robust partnerships across the value chain, from hydrogen production and distribution to vehicle manufacturing and fleet operation. Companies that can effectively navigate regulatory landscapes, secure supply chains, and innovate in cost reduction and performance enhancement will be well-positioned to lead this transformative market.

Hydrogen Energy Discharge Power Supply Vehicle Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Hydrogen Energy Discharge Power Supply Vehicle Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Hydrogen Energy Discharge Power Supply Vehicle REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hydrogen Energy Discharge Power Supply Vehicle Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Hydrogen Energy Discharge Power Supply Vehicle Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Hydrogen Energy Discharge Power Supply Vehicle Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Hydrogen Energy Discharge Power Supply Vehicle Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Hydrogen Energy Discharge Power Supply Vehicle Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Hydrogen Energy Discharge Power Supply Vehicle Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Zhongtong Bus

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yutong Bus

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Refire Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SinoHytec

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vision Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Toyota

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hyundai Motor

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Plug Power

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ballard Power Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nikola Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Zhongtong Bus

List of Figures

- Figure 1: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Application 2024 & 2032

- Figure 3: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 4: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Type 2024 & 2032

- Figure 5: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 6: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Country 2024 & 2032

- Figure 7: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 8: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Application 2024 & 2032

- Figure 9: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 10: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Type 2024 & 2032

- Figure 11: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 12: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Country 2024 & 2032

- Figure 13: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Application 2024 & 2032

- Figure 15: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 16: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Type 2024 & 2032

- Figure 17: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 18: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Country 2024 & 2032

- Figure 19: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 20: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Application 2024 & 2032

- Figure 21: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 22: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Type 2024 & 2032

- Figure 23: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 24: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Country 2024 & 2032

- Figure 25: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Application 2024 & 2032

- Figure 27: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 28: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Type 2024 & 2032

- Figure 29: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Type 2024 & 2032

- Figure 30: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue (million), by Country 2024 & 2032

- Figure 31: undefined Hydrogen Energy Discharge Power Supply Vehicle Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 8: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 9: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 11: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 15: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 16: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 17: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Hydrogen Energy Discharge Power Supply Vehicle Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hydrogen Energy Discharge Power Supply Vehicle?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Hydrogen Energy Discharge Power Supply Vehicle?

Key companies in the market include Zhongtong Bus, Yutong Bus, Refire Technology, SinoHytec, Vision Group, Toyota, Hyundai Motor, Plug Power, Ballard Power Systems, Nikola Corporation.

3. What are the main segments of the Hydrogen Energy Discharge Power Supply Vehicle?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 564 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hydrogen Energy Discharge Power Supply Vehicle," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hydrogen Energy Discharge Power Supply Vehicle report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hydrogen Energy Discharge Power Supply Vehicle?

To stay informed about further developments, trends, and reports in the Hydrogen Energy Discharge Power Supply Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence