Key Insights

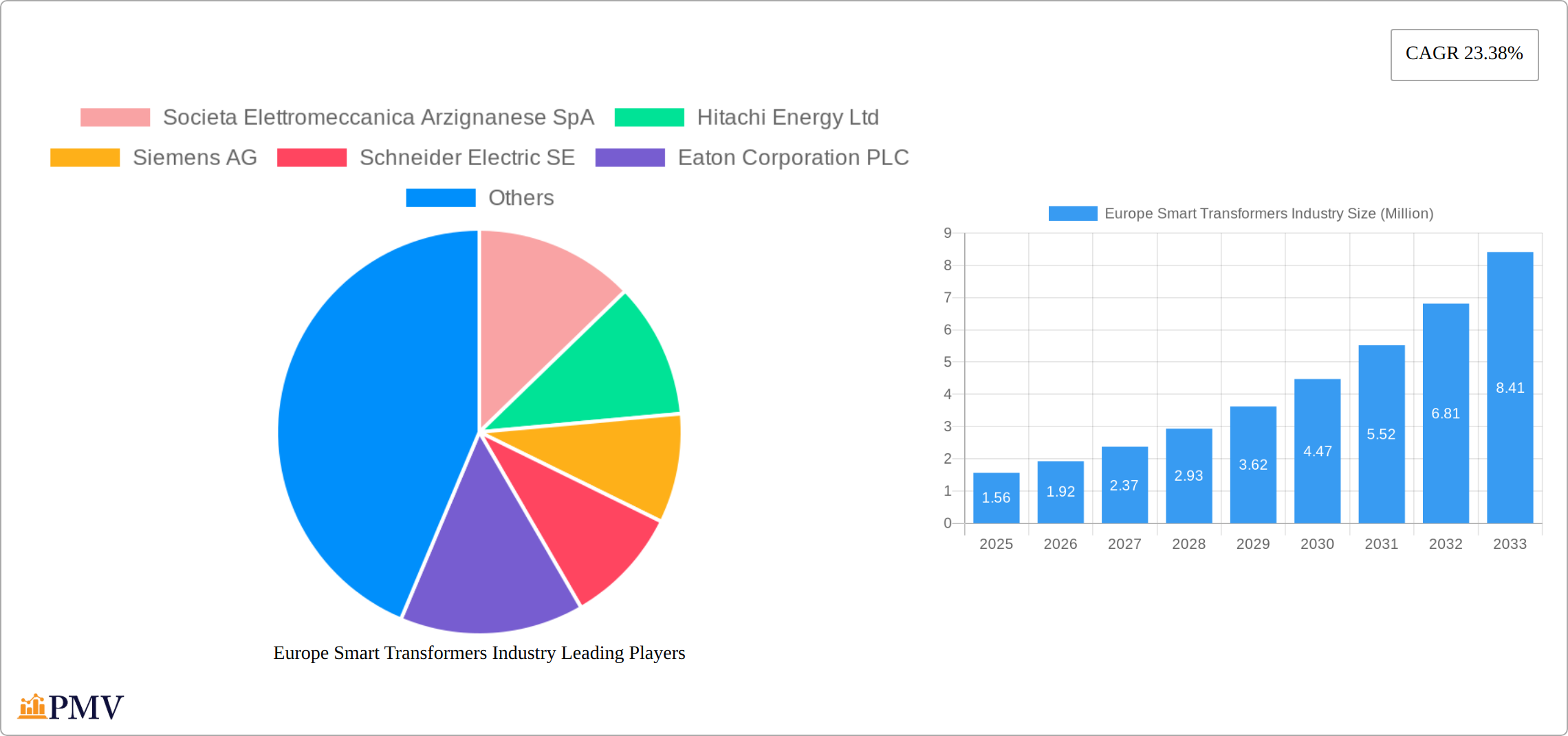

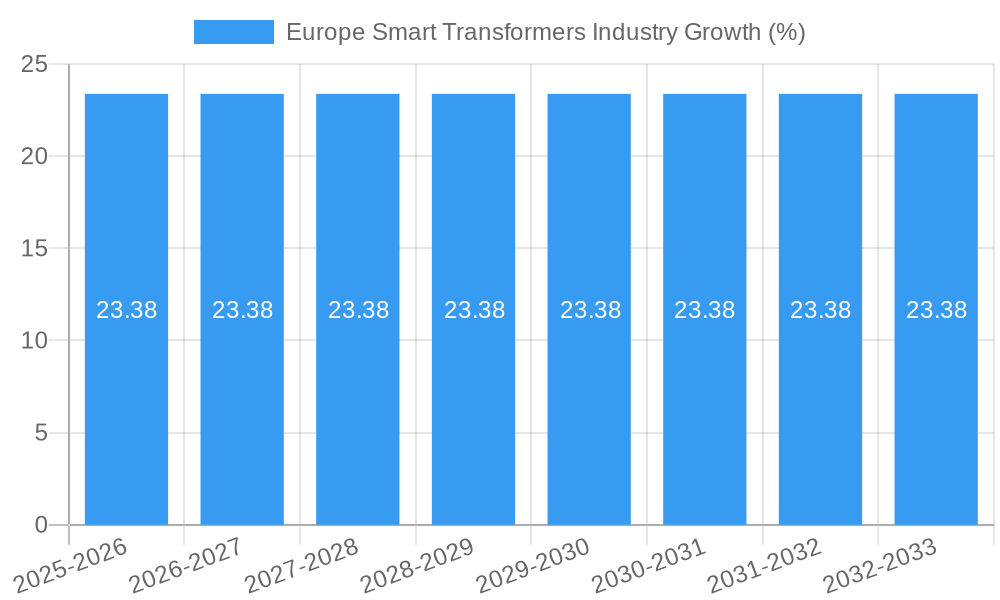

The Europe Smart Transformers Industry is poised for significant growth, with a market size projected to reach $1.56 million by 2025, growing at a compound annual growth rate (CAGR) of 23.38% from 2025 to 2033. This robust growth is driven by the increasing demand for energy-efficient solutions and the integration of smart grids across the continent. Key drivers include the need for improved grid reliability and the rising adoption of renewable energy sources, which necessitate advanced transformer technologies. The market is segmented by type into Distribution Transformers and Power Transformers, and by application into Smart Grid, Traction Locomotive, and Other Applications. Major players such as Societa Elettromeccanica Arzignanese SpA, Hitachi Energy Ltd, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, GBE SpA, General Electric Company, and Westrafo SRL are actively contributing to the industry's expansion through innovation and strategic partnerships.

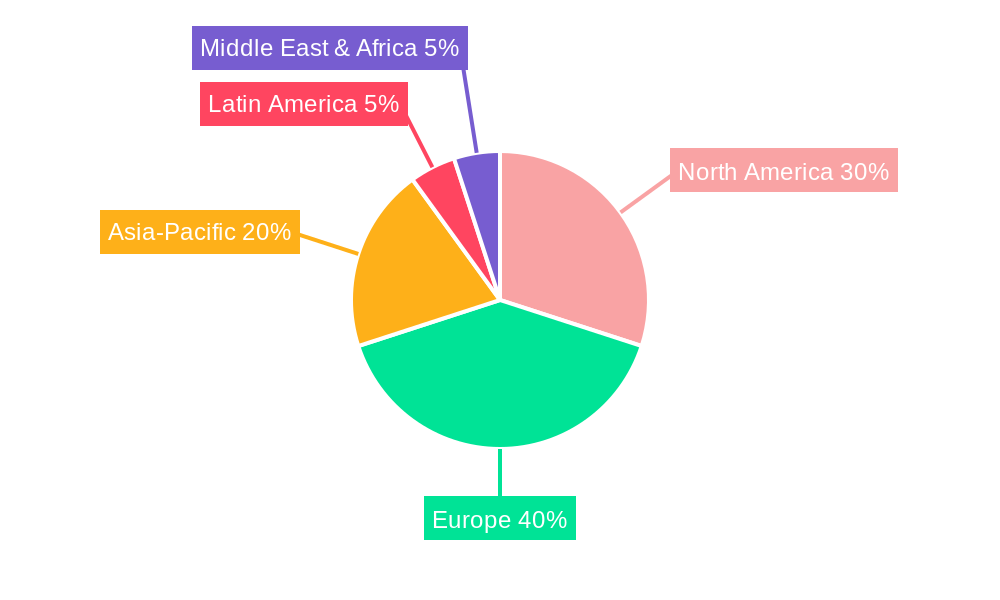

Regionally, Germany, France, Italy, the United Kingdom, the Netherlands, Sweden, and the rest of Europe are pivotal markets within the European landscape. Germany and the United Kingdom are expected to lead the market due to their advanced infrastructure and early adoption of smart technologies. However, challenges such as high initial investment costs and the complexity of integrating new technologies into existing systems may restrain market growth. Trends such as the development of IoT-enabled transformers and the focus on reducing carbon footprints are shaping the future of the industry. The study period from 2019 to 2033 provides a comprehensive view of historical data and future projections, with 2025 as the base year for estimations and forecasts extending to 2033. This detailed analysis underscores the transformative potential of smart transformers in enhancing Europe's energy infrastructure.

Europe Smart Transformers Industry Market Structure & Competitive Dynamics

The Europe Smart Transformers Industry is characterized by a blend of established players and emerging innovators, creating a dynamic competitive landscape. Market concentration is moderate, with key companies like Siemens AG and Schneider Electric SE holding significant market shares, estimated at around 20% and 15% respectively. The innovation ecosystem is thriving, driven by partnerships and technological advancements aimed at enhancing smart grid functionalities and energy efficiency.

Regulatory frameworks play a crucial role, with the European Union's stringent energy efficiency directives shaping product development and market strategies. Product substitutes, such as traditional transformers, remain a challenge, but smart transformers are gaining traction due to their superior monitoring and control capabilities. End-user trends show a growing preference for solutions that support sustainability and digitalization, particularly in the energy sector.

Mergers and acquisitions are pivotal, with notable deals like the acquisition of Power Transformers by Siemens for an estimated value of $100 Million in 2022, indicating a strategy to consolidate technological expertise and market presence. These dynamics underscore the competitive nature of the market, where innovation and strategic alliances are key to maintaining a competitive edge.

Europe Smart Transformers Industry Industry Trends & Insights

The Europe Smart Transformers Industry is witnessing robust growth, propelled by several key trends and insights. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033, driven by the increasing demand for smart grid technologies and the push towards a more sustainable energy infrastructure. Technological disruptions, particularly in IoT integration and data analytics, are revolutionizing the industry, enabling real-time monitoring and predictive maintenance of transformers.

Consumer preferences are shifting towards solutions that offer enhanced efficiency and reliability, with smart transformers gaining market penetration due to their ability to reduce energy losses and improve grid stability. Competitive dynamics are intense, with companies like Hitachi Energy Ltd and Eaton Corporation PLC investing heavily in R&D to develop innovative products that meet evolving regulatory standards and consumer needs.

The regulatory landscape continues to evolve, with initiatives like the European Green Deal fostering the adoption of smart technologies. This regulatory support, combined with economic incentives for energy efficiency, is accelerating market growth. Additionally, the integration of renewable energy sources into the grid is creating new opportunities for smart transformers, as they are crucial for managing the variability and unpredictability of renewable energy generation.

Dominant Markets & Segments in Europe Smart Transformers Industry

The European smart transformers industry is experiencing robust growth, driven by a confluence of factors including the urgent need for grid modernization, the integration of renewable energy sources, and the overarching push towards energy efficiency and sustainability across the continent. Several key market segments are leading this expansion:

Distribution Transformers: This segment remains the largest, fueled by the extensive deployment of these transformers in both urban and rural areas. The demand for efficient power distribution and the increasing integration of renewable energy sources, such as solar and wind power, are primary growth drivers. Government initiatives promoting grid infrastructure modernization across Europe are further accelerating expansion, with a projected CAGR of 8% from 2025 to 2033. This segment's substantial growth reflects the foundational role distribution transformers play in the effective delivery of electricity.

Power Transformers: While smaller than the distribution transformer segment, power transformers are indispensable for high-voltage applications. Growth in this segment is driven by significant investments in large-scale energy projects, industrial expansion, and the ongoing development of high-voltage transmission networks. A projected CAGR of 6.5% over the forecast period reflects a steady, albeit significant, contribution to the overall market expansion.

Smart Grid Applications: Smart transformers are integral to the development of smart grids, enhancing grid reliability, efficiency, and resilience. The European Union's strong commitment to smart grid development provides significant tailwinds for this segment. Market penetration is expected to reach 40% by 2033, indicating substantial growth potential as more grids are upgraded to incorporate advanced monitoring and control capabilities offered by smart transformers.

Traction Locomotive Applications: The electrification of rail networks across Europe is creating a niche but rapidly growing market for smart transformers in traction locomotive applications. This segment benefits from investments in sustainable transportation solutions and the broader shift towards decarbonization in the transport sector. A projected CAGR of 9% from 2025 to 2033 reflects strong growth prospects as countries prioritize environmentally friendly transportation infrastructure.

Other Applications: This diverse segment encompasses industrial and commercial applications where smart transformers contribute to enhanced energy management and efficiency. Driven by broader trends in digitalization and the need for energy conservation, this segment is expected to experience moderate but consistent growth, with a projected CAGR of 5% over the forecast period. The increasing adoption of smart technologies across diverse industries is a key factor driving growth in this sector.

Europe Smart Transformers Industry Product Innovations

Innovation in the European smart transformers industry is primarily focused on enhancing connectivity, efficiency, and operational capabilities. Recent developments highlight a strong emphasis on integrating Internet of Things (IoT) and Artificial Intelligence (AI) technologies. Real-time monitoring and predictive maintenance capabilities, enabled by these technologies, significantly improve operational efficiency, reduce downtime, and optimize maintenance schedules. Furthermore, manufacturers are concentrating on designing transformers seamlessly compatible with smart grids, offering advanced control and data management features. This convergence of sustainability and technological advancement positions smart transformers as crucial components in the future of energy management in Europe.

Report Segmentation & Scope

This report offers a detailed segmentation of the European smart transformers industry by type and application, providing a granular analysis of market dynamics and competitive landscapes. Market size projections for each segment offer insights into the growth trajectory of this vital sector:

Distribution Transformers: Projected to reach a market size of $2.5 Billion by 2033, this segment's growth is primarily driven by the ongoing need for efficient and reliable power distribution. Leading players like Siemens AG and Schneider Electric SE are at the forefront of competition in this space.

Power Transformers: With a projected market size of $1.8 Billion by 2033, this segment’s growth is closely linked to investments in high-voltage infrastructure and large-scale energy projects. Key players, including General Electric Company and Hitachi Energy Ltd., are focusing on developing high-capacity, high-performance solutions.

Smart Grid Applications: Projected to reach $3.2 Billion by 2033, this segment is experiencing rapid growth fueled by the widespread adoption of smart grid technologies. Companies like Eaton Corporation PLC are leading the innovation in this segment, responding to the increasing demand for smart grid solutions.

Traction Locomotive Applications: The electrification of rail networks is driving the growth of this segment, which is projected to reach $0.5 Billion by 2033. GBE SpA and other specialized players are actively targeting this expanding market.

Other Applications: This segment is expected to grow to $1.0 Billion by 2033, encompassing diverse industrial and commercial applications. Companies like Westrafo SRL are providing customized solutions to meet the specific needs of this varied sector.

Key Drivers of Europe Smart Transformers Industry Growth

The Europe Smart Transformers Industry is driven by several key factors:

Technological Advancements: The integration of IoT and AI in smart transformers enhances their functionality, meeting the industry's demand for efficiency and reliability.

Regulatory Support: The European Union's energy efficiency directives and initiatives like the European Green Deal are accelerating the adoption of smart transformers.

Economic Incentives: Government subsidies and incentives for energy-efficient technologies are boosting market growth, encouraging both manufacturers and consumers to invest in smart transformers.

Renewable Energy Integration: The increasing incorporation of renewable energy sources into the grid necessitates smart transformers to manage variable energy flows effectively.

Challenges in the Europe Smart Transformers Industry Sector

The Europe Smart Transformers Industry faces several challenges that could impact its growth:

Regulatory Hurdles: Compliance with evolving regulations and standards can be costly and time-consuming for manufacturers, potentially slowing market expansion.

Supply Chain Issues: The industry is vulnerable to disruptions in the supply of critical components, which can delay production and increase costs.

Competitive Pressures: Intense competition among key players can lead to price wars and reduced profit margins, affecting investment in R&D.

High Initial Costs: The high upfront cost of smart transformers can deter potential buyers, particularly in cost-sensitive markets.

Leading Players in the Europe Smart Transformers Industry Market

- Societa Elettromeccanica Arzignanese SpA

- Hitachi Energy Ltd

- Siemens AG

- Schneider Electric SE

- Eaton Corporation PLC

- GBE SpA

- General Electric Company

- Westrafo SRL

Key Developments in Europe Smart Transformers Industry Sector

March 2023: Ganz Transformers partnered with Maschinenfabrik Reinhausen (MR) to manufacture digital transformers utilizing MR's ISM digital platform. This collaboration signifies a major step towards enhancing the digital capabilities of transformers, introducing advanced monitoring and control functionalities that will shape the future of the industry.

February 2023: UK Power Networks launched Project Stratus, a pioneering trial employing "world-first" smart transformer technology from Amp X. This initiative provides invaluable real-time data on electricity usage and demand, significantly improving network resilience and contributing to the UK's low-carbon energy goals.

Strategic Europe Smart Transformers Industry Market Outlook

The European smart transformers industry presents a highly promising outlook, characterized by substantial growth potential driven by the ongoing transition to smart grids, the increasing emphasis on energy efficiency, and the continent's commitment to sustainability. Strategic opportunities abound for companies that can develop advanced technologies seamlessly integrating with renewable energy systems, enhancing grid stability and efficiency. Strategic partnerships and a commitment to innovation will be crucial for companies seeking to capture market share and drive the industry forward. The ongoing focus on sustainability and digitalization will remain key catalysts for market growth, ensuring a robust outlook for the sector through 2033 and beyond.

Europe Smart Transformers Industry Segmentation

-

1. Type

- 1.1. Distribution Transformers

- 1.2. Power Transfomers

-

2. Application

- 2.1. Smart Grid

- 2.2. Traction Locomotive

- 2.3. Other Applications

Europe Smart Transformers Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Spain

- 4. France

- 5. Italy

- 6. Nordic Countries

- 7. Russia

- 8. Turkey

- 9. Rest of Europe

Europe Smart Transformers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.38% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption of Smart Technology in Power Grid Infrastructure4.; Aging of Transmission and Distribution (T&D) Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Low Accessibility to Electricity in Underdeveloped Nations

- 3.4. Market Trends

- 3.4.1. Distribution Transformers to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Distribution Transformers

- 5.1.2. Power Transfomers

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smart Grid

- 5.2.2. Traction Locomotive

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. Spain

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Nordic Countries

- 5.3.7. Russia

- 5.3.8. Turkey

- 5.3.9. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Distribution Transformers

- 6.1.2. Power Transfomers

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Smart Grid

- 6.2.2. Traction Locomotive

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Distribution Transformers

- 7.1.2. Power Transfomers

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Smart Grid

- 7.2.2. Traction Locomotive

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Spain Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Distribution Transformers

- 8.1.2. Power Transfomers

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Smart Grid

- 8.2.2. Traction Locomotive

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Distribution Transformers

- 9.1.2. Power Transfomers

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Smart Grid

- 9.2.2. Traction Locomotive

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Distribution Transformers

- 10.1.2. Power Transfomers

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Smart Grid

- 10.2.2. Traction Locomotive

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Nordic Countries Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Distribution Transformers

- 11.1.2. Power Transfomers

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Smart Grid

- 11.2.2. Traction Locomotive

- 11.2.3. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Russia Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Distribution Transformers

- 12.1.2. Power Transfomers

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Smart Grid

- 12.2.2. Traction Locomotive

- 12.2.3. Other Applications

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Turkey Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. Distribution Transformers

- 13.1.2. Power Transfomers

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Smart Grid

- 13.2.2. Traction Locomotive

- 13.2.3. Other Applications

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. Rest of Europe Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - by Type

- 14.1.1. Distribution Transformers

- 14.1.2. Power Transfomers

- 14.2. Market Analysis, Insights and Forecast - by Application

- 14.2.1. Smart Grid

- 14.2.2. Traction Locomotive

- 14.2.3. Other Applications

- 14.1. Market Analysis, Insights and Forecast - by Type

- 15. Germany Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 16. France Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 17. Italy Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 18. United Kingdom Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 19. Netherlands Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 20. Sweden Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 21. Rest of Europe Europe Smart Transformers Industry Analysis, Insights and Forecast, 2019-2031

- 22. Competitive Analysis

- 22.1. Market Share Analysis 2024

- 22.2. Company Profiles

- 22.2.1 Societa Elettromeccanica Arzignanese SpA

- 22.2.1.1. Overview

- 22.2.1.2. Products

- 22.2.1.3. SWOT Analysis

- 22.2.1.4. Recent Developments

- 22.2.1.5. Financials (Based on Availability)

- 22.2.2 Hitachi Energy Ltd

- 22.2.2.1. Overview

- 22.2.2.2. Products

- 22.2.2.3. SWOT Analysis

- 22.2.2.4. Recent Developments

- 22.2.2.5. Financials (Based on Availability)

- 22.2.3 Siemens AG

- 22.2.3.1. Overview

- 22.2.3.2. Products

- 22.2.3.3. SWOT Analysis

- 22.2.3.4. Recent Developments

- 22.2.3.5. Financials (Based on Availability)

- 22.2.4 Schneider Electric SE

- 22.2.4.1. Overview

- 22.2.4.2. Products

- 22.2.4.3. SWOT Analysis

- 22.2.4.4. Recent Developments

- 22.2.4.5. Financials (Based on Availability)

- 22.2.5 Eaton Corporation PLC

- 22.2.5.1. Overview

- 22.2.5.2. Products

- 22.2.5.3. SWOT Analysis

- 22.2.5.4. Recent Developments

- 22.2.5.5. Financials (Based on Availability)

- 22.2.6 GBE SpA

- 22.2.6.1. Overview

- 22.2.6.2. Products

- 22.2.6.3. SWOT Analysis

- 22.2.6.4. Recent Developments

- 22.2.6.5. Financials (Based on Availability)

- 22.2.7 General Electric Company

- 22.2.7.1. Overview

- 22.2.7.2. Products

- 22.2.7.3. SWOT Analysis

- 22.2.7.4. Recent Developments

- 22.2.7.5. Financials (Based on Availability)

- 22.2.8 Westrafo SRL

- 22.2.8.1. Overview

- 22.2.8.2. Products

- 22.2.8.3. SWOT Analysis

- 22.2.8.4. Recent Developments

- 22.2.8.5. Financials (Based on Availability)

- 22.2.1 Societa Elettromeccanica Arzignanese SpA

List of Figures

- Figure 1: Europe Smart Transformers Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Smart Transformers Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Smart Transformers Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Smart Transformers Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Smart Transformers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Smart Transformers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Smart Transformers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Smart Transformers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Smart Transformers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Smart Transformers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Smart Transformers Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Europe Smart Transformers Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Europe Smart Transformers Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Europe Smart Transformers Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Smart Transformers Industry?

The projected CAGR is approximately 23.38%.

2. Which companies are prominent players in the Europe Smart Transformers Industry?

Key companies in the market include Societa Elettromeccanica Arzignanese SpA, Hitachi Energy Ltd, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, GBE SpA, General Electric Company, Westrafo SRL.

3. What are the main segments of the Europe Smart Transformers Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.56 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption of Smart Technology in Power Grid Infrastructure4.; Aging of Transmission and Distribution (T&D) Infrastructure.

6. What are the notable trends driving market growth?

Distribution Transformers to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Low Accessibility to Electricity in Underdeveloped Nations.

8. Can you provide examples of recent developments in the market?

March 2023: Ganz Transformers, the European technology provider for power grids, entered into a collaboration with Maschinenfabrik Reinhausen (MR) to manufacture digital transformers with the help of MR’s ISM digital platform for intelligent solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Smart Transformers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Smart Transformers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Smart Transformers Industry?

To stay informed about further developments, trends, and reports in the Europe Smart Transformers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence