Key Insights

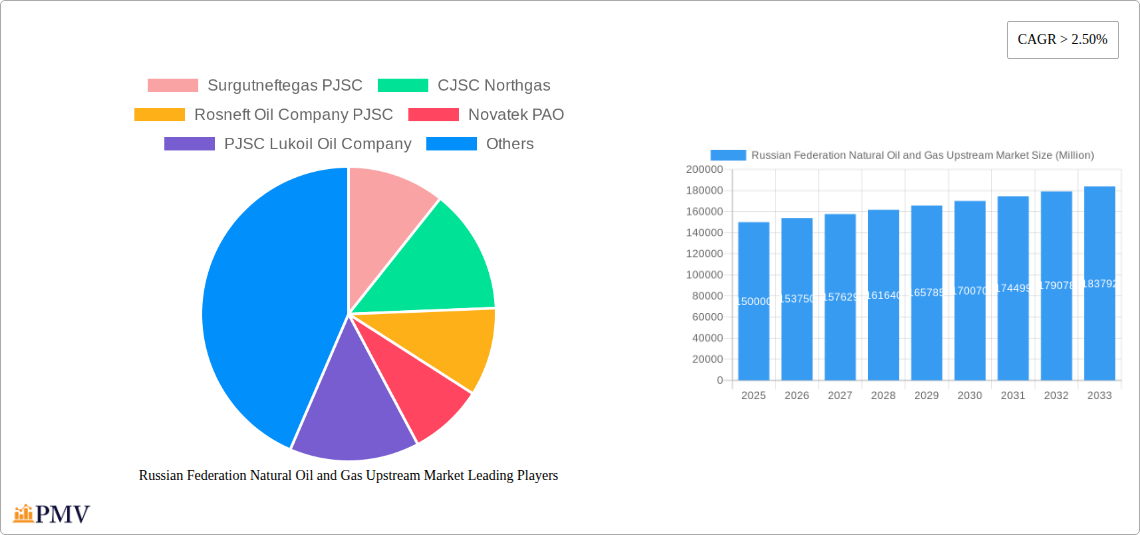

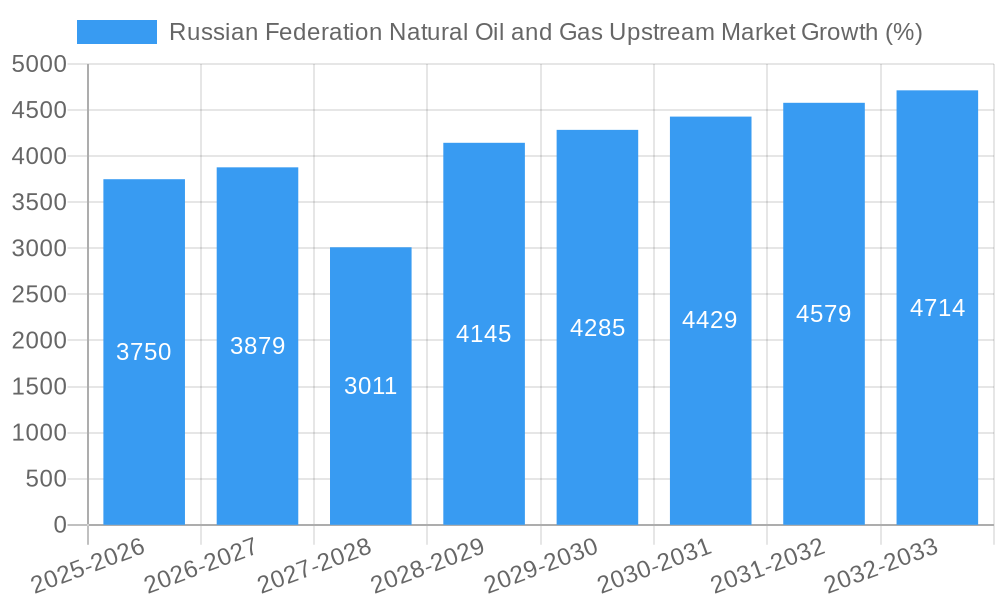

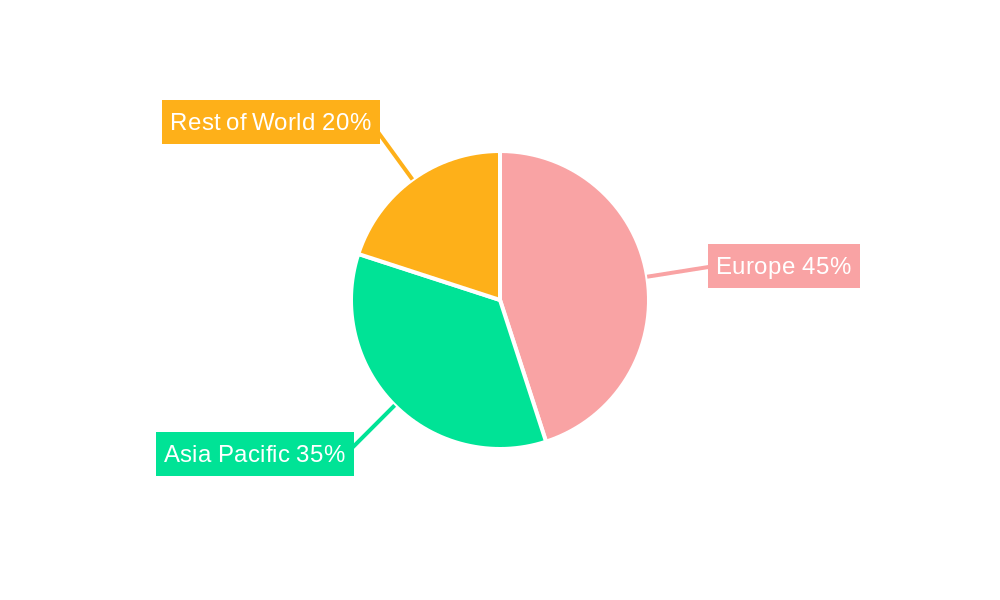

The Russian Federation's natural oil and gas upstream market, while facing geopolitical challenges, presents a complex landscape of significant size and growth potential. The market, estimated at approximately $XX million in 2025 (assuming a reasonable market size based on global oil and gas production figures and Russia's historical contribution), is projected to experience a Compound Annual Growth Rate (CAGR) exceeding 2.50% through 2033. This growth is driven by several factors, including continued global demand for energy, albeit with a transition towards renewable energy sources, and ongoing exploration and production activities within established and newly discovered fields. Major players such as Gazprom, Rosneft, Lukoil, and Surgutneftegas, along with international companies like Shell and Total, dominate the market, particularly in large-scale onshore operations. The market is segmented by company size (large, medium, small), type of operation (onshore, offshore), and field type (major, minor), influencing production volumes and investment strategies. However, the market faces significant restraints, including international sanctions, fluctuating global oil prices, and increasing pressure for environmental sustainability, impacting investment and operational efficiency. The Asia-Pacific region, particularly China, Japan, and India, represents a significant export market for Russian oil and gas, driving a portion of this growth. Furthermore, the shift toward environmentally conscious energy solutions is likely to impact the long-term growth trajectory, potentially moderating the CAGR from the initial years.

The market's future depends critically on the evolving geopolitical landscape, the pace of global energy transition, and the effectiveness of Russia's adaptation strategies. While significant reserves and established infrastructure contribute to the market's resilience, sustained growth will require a balance between meeting global energy demands, adapting to evolving energy markets, and addressing environmental concerns. Investment in technological advancements, operational efficiency, and diversification across different segments and markets will become crucial for market participants seeking sustained profitability and growth in the coming years. The medium-sized and smaller companies will need to adapt to compete with the giants, possibly through partnerships and specialized services.

This in-depth report provides a comprehensive analysis of the Russian Federation's natural oil and gas upstream market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, competitive landscapes, and future growth prospects, making it an essential resource for industry professionals, investors, and strategic planners. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033. Key players analyzed include Surgutneftegas PJSC, CJSC Northgas, Rosneft Oil Company PJSC, Novatek PAO, PJSC Lukoil Oil Company, Royal Dutch Shell Plc, PJSC TATNEFT, PJSC Gazprom, and Total S.A.

Russian Federation Natural Oil and Gas Upstream Market Market Structure & Competitive Dynamics

The Russian Federation's oil and gas upstream market is characterized by a high degree of concentration, with a few dominant players controlling a significant share of production. PJSC Gazprom, Rosneft Oil Company PJSC, and Lukoil PJSC hold the largest market share, exhibiting oligopolistic tendencies. The regulatory framework, heavily influenced by the state, plays a crucial role in shaping market access and investment decisions. Innovation within the sector is driven by a need for enhanced efficiency in extraction and exploration, particularly in challenging environments. The market witnesses continuous M&A activity, with deal values fluctuating based on global energy prices and geopolitical factors. Recent years have seen a significant increase in the focus on offshore exploration and production, leading to increased investment in specialized technologies and infrastructure. Product substitution, primarily in the form of renewable energy sources, poses a long-term challenge. End-user trends, primarily driven by global energy demand, influence production levels and pricing strategies. The average M&A deal value in the period 2019-2024 was approximately xx Million, with a total deal volume of xx Million.

- Market Concentration: High, with top three players holding approximately xx% of market share.

- Innovation Ecosystem: Focused on enhanced oil recovery (EOR) techniques and exploration in harsh environments.

- Regulatory Framework: Significant state influence, impacting market access and investment.

- Product Substitutes: Growing adoption of renewable energy sources presents a long-term challenge.

- End-User Trends: Global energy demand significantly impacts production levels and pricing.

- M&A Activity: Frequent mergers and acquisitions, driven by consolidation and expansion strategies.

Russian Federation Natural Oil and Gas Upstream Market Industry Trends & Insights

The Russian Federation's natural oil and gas upstream market is projected to experience a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several key factors, including rising global energy demand, particularly in emerging economies, and increasing investment in exploration and production activities, especially in new and challenging fields. Technological advancements, such as the adoption of advanced digital technologies and automation in drilling and production operations, are boosting efficiency and lowering costs. However, fluctuating global oil prices, geopolitical instability, and increasing pressure to reduce carbon emissions pose significant challenges to sustained growth. Market penetration of enhanced oil recovery techniques is estimated to reach xx% by 2033, representing a significant increase from xx% in 2024.

Dominant Markets & Segments in Russian Federation Natural Oil and Gas Upstream Market

The dominant segment within the Russian Federation's natural oil and gas upstream market is Onshore Oil and Gas production in Major Fields, primarily located in Western Siberia. Large companies dominate this segment due to the significant capital investment required for large-scale operations.

- Key Drivers for Onshore Major Fields:

- Established infrastructure.

- High initial production rates.

- Government support and incentives.

- Existing expertise and technology.

The dominance is primarily attributed to:

- Established Infrastructure: Existing pipelines, processing facilities, and transportation networks significantly reduce costs.

- Economies of Scale: Large-scale operations allow for greater efficiency and cost reductions.

- Government Policies: Favorable regulations and tax incentives promote investment in established fields.

While offshore exploration shows promise, the higher initial investment costs and technological complexities currently limit its contribution to overall market share compared to onshore major fields. The medium-sized and small companies tend to operate within smaller, less established fields.

Russian Federation Natural Oil and Gas Upstream Market Product Innovations

Technological advancements are driving innovation in the Russian oil and gas upstream sector. The increasing adoption of digital technologies, such as advanced analytics and automation, enhances operational efficiency, improves safety, and facilitates real-time monitoring of production. New drilling techniques and enhanced oil recovery (EOR) methods are being implemented to maximize extraction from existing fields. The focus is on optimizing production processes to increase yield and reduce environmental impact.

Report Segmentation & Scope

This report segments the Russian Federation's natural oil and gas upstream market across various parameters:

Company Size:

- Large Companies: Dominate the market, controlling the majority of production and reserves. They are expected to witness a CAGR of xx% during the forecast period. Competitive dynamics are primarily shaped by market share competition and strategic alliances.

- Medium-Sized Companies: Focus on niche areas and specific fields. Growth is projected at a CAGR of xx%, driven by partnerships and acquisitions from larger players.

- Small Companies: Operate on a smaller scale, often focusing on specific regions or technological niches. Growth projections are at xx% CAGR.

Type of Operation:

- Onshore: Remains the dominant segment due to established infrastructure and lower initial investment costs.

- Offshore: Presents significant growth potential but faces challenges related to high upfront capital costs and technological complexities.

Fields:

- Major Fields: Mature fields with established production and infrastructure.

- Minor Fields: Newer or smaller fields with varying levels of development and production potential.

Key Drivers of Russian Federation Natural Gas Upstream Market Growth

Several factors fuel the growth of the Russian Federation's natural oil and gas upstream market. These include consistent global demand for energy, particularly in developing economies, leading to increased production needs. Government policies supporting domestic energy production and infrastructure development contribute significantly. Technological advancements, like improved extraction techniques and digitalization, enhance efficiency and unlock new reserves. Furthermore, strategic investments in exploration and production, particularly in unexplored regions, further stimulate market expansion.

Challenges in the Russian Federation Natural Oil and Gas Upstream Market Sector

The Russian Federation's oil and gas upstream market faces several challenges. Fluctuating global oil prices create market volatility, impacting profitability and investment decisions. Geopolitical instability and sanctions can disrupt production and market access. Environmental concerns and the increasing push for decarbonization necessitate investment in sustainable practices, increasing operational costs. Competition from renewable energy sources represents a long-term threat to market share. Supply chain disruptions and potential labor shortages can hamper production efficiency.

Leading Players in the Russian Federation Natural Oil and Gas Upstream Market Market

- Surgutneftegas PJSC

- CJSC Northgas

- Rosneft Oil Company PJSC

- Novatek PAO

- PJSC Lukoil Oil Company

- Royal Dutch Shell Plc

- PJSC TATNEFT

- PJSC Gazprom

- Total S.A.

Key Developments in Russian Federation Natural Oil and Gas Upstream Market Sector

- November 2022: The Russian government approved Sakhalin Oil and Gas Development Co.'s role in the Sakhalin-1 project's new operator, boosting Japan's energy security.

- May 2022: Discussions took place regarding the potential purchase of BP's Rosneft stake by Indian companies, along with bids for ExxonMobil and Shell's shares in Sakhalin projects.

Strategic Russian Federation Natural Oil and Gas Upstream Market Market Outlook

The future of the Russian Federation's natural oil and gas upstream market is projected to be a blend of challenges and opportunities. While the transition towards cleaner energy sources presents a long-term threat, the country's vast reserves and ongoing investments in exploration and production technology ensure a continued role for hydrocarbons in the global energy mix. Strategic partnerships, technological advancements, and a focus on sustainable practices will be crucial for ensuring long-term growth and competitiveness. The market's success will depend on successfully navigating the complexities of geopolitical factors, environmental regulations, and price volatility.

Russian Federation Natural Oil and Gas Upstream Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Russian Federation Natural Oil and Gas Upstream Market Segmentation By Geography

- 1. Russia

Russian Federation Natural Oil and Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Onshore Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Federation Natural Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Russian Federation Natural Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Russian Federation Natural Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 8. India Russian Federation Natural Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Russian Federation Natural Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Russian Federation Natural Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Russian Federation Natural Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Russian Federation Natural Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Surgutneftegas PJSC

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 CJSC Northgas

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Rosneft Oil Company PJSC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Novatek PAO

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 PJSC Lukoil Oil Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Royal Dutch Shell Plc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 PJSC TATNEFT

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 PJSC Gazprom

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Total S A

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Surgutneftegas PJSC

List of Figures

- Figure 1: Russian Federation Natural Oil and Gas Upstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russian Federation Natural Oil and Gas Upstream Market Share (%) by Company 2024

List of Tables

- Table 1: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Production Analysis 2019 & 2032

- Table 5: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 15: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Country 2019 & 2032

- Table 17: China Russian Federation Natural Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: China Russian Federation Natural Oil and Gas Upstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Russian Federation Natural Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Russian Federation Natural Oil and Gas Upstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: India Russian Federation Natural Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Russian Federation Natural Oil and Gas Upstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea Russian Federation Natural Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Russian Federation Natural Oil and Gas Upstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Taiwan Russian Federation Natural Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Taiwan Russian Federation Natural Oil and Gas Upstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia Russian Federation Natural Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Russian Federation Natural Oil and Gas Upstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Asia-Pacific Russian Federation Natural Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia-Pacific Russian Federation Natural Oil and Gas Upstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 31: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 32: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Production Analysis 2019 & 2032

- Table 33: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 34: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Consumption Analysis 2019 & 2032

- Table 35: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 37: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 38: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 39: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 40: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 41: Russian Federation Natural Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Russian Federation Natural Oil and Gas Upstream Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Federation Natural Oil and Gas Upstream Market?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Russian Federation Natural Oil and Gas Upstream Market?

Key companies in the market include Surgutneftegas PJSC, CJSC Northgas, Rosneft Oil Company PJSC, Novatek PAO, PJSC Lukoil Oil Company, Royal Dutch Shell Plc, PJSC TATNEFT, PJSC Gazprom, Total S A.

3. What are the main segments of the Russian Federation Natural Oil and Gas Upstream Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Onshore Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

November 2022: According to Japan's Chief Cabinet Secretary, the Russian government accepted Sakhalin Oil and Gas Development Co.'s involvement in the new operator of the Sakhalin 1 oil and gas project. Tokyo views this as an important development for the country's energy security.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Federation Natural Oil and Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Federation Natural Oil and Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Federation Natural Oil and Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Russian Federation Natural Oil and Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence