Key Insights

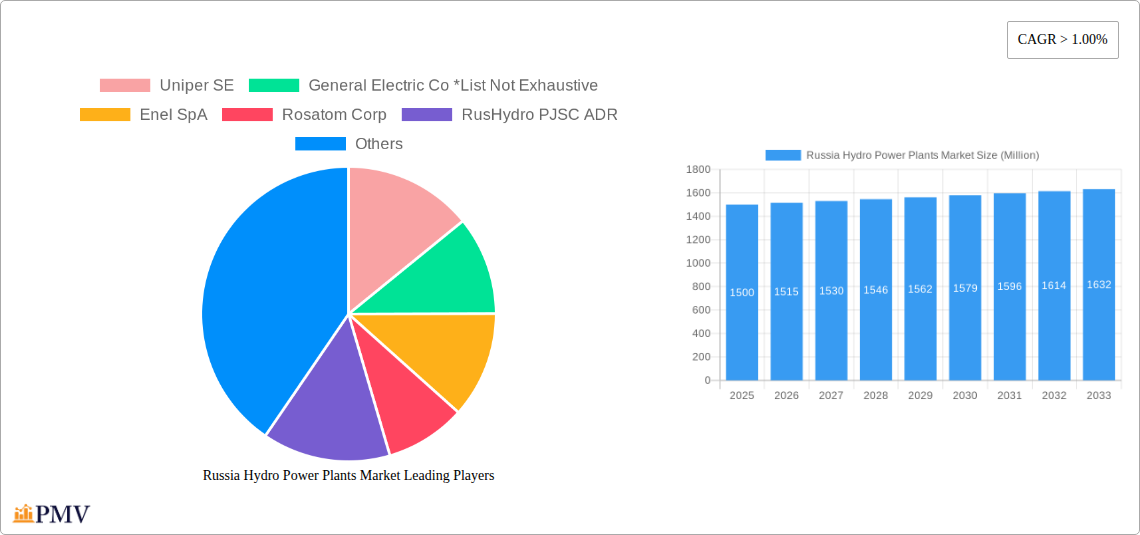

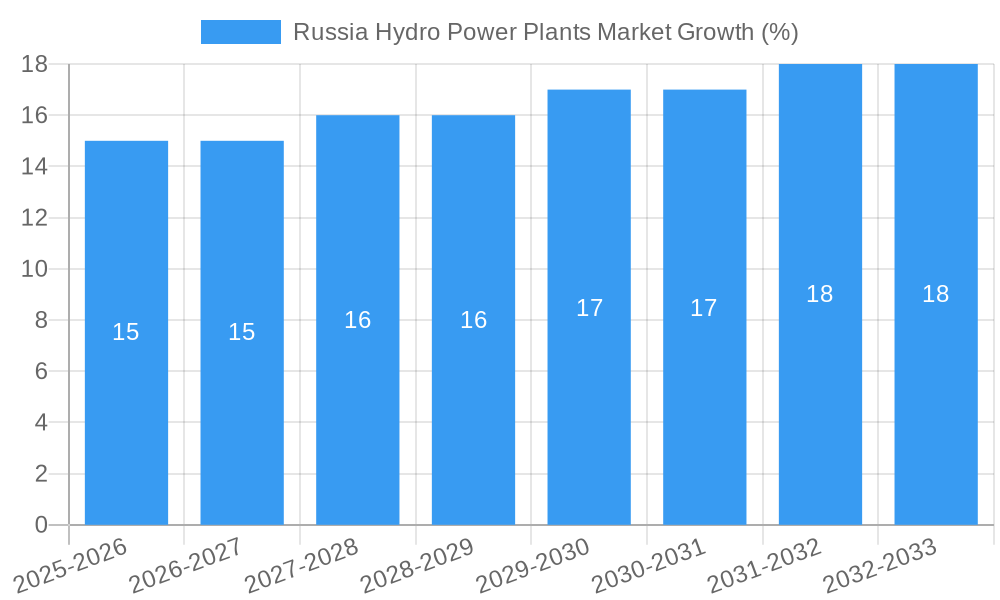

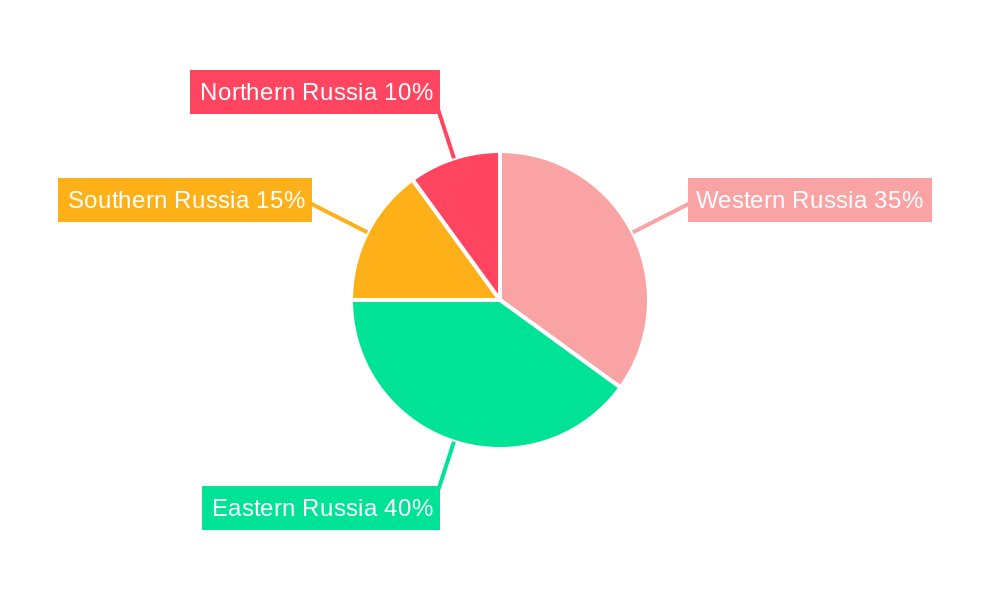

The Russia Hydro Power Plants market, currently valued at an estimated $XX million in 2025, exhibits a robust Compound Annual Growth Rate (CAGR) exceeding 1.00%, projecting significant expansion through 2033. This growth is fueled by several key drivers. Russia's vast hydropower resources, particularly in its Siberian region, present significant untapped potential. Government initiatives promoting renewable energy sources and energy independence are further bolstering investment in hydro power plant development and modernization. Increasing urbanization and industrialization contribute to rising electricity demand, creating a strong market pull for reliable and sustainable energy solutions like hydropower. Furthermore, technological advancements in hydropower plant design and efficiency are leading to increased output and reduced environmental impact. However, the market faces certain restraints, including the geographical challenges associated with building and maintaining hydropower infrastructure in remote regions, and potential environmental concerns related to dam construction and its effects on river ecosystems. The market is segmented by generation type (Thermal, Hydroelectric, Renewable, Other), with the Hydroelectric segment dominating due to existing infrastructure and ongoing expansion projects. Key players such as Uniper SE, General Electric, Enel SpA, and Rosatom Corp are actively involved, contributing to the market's competitive landscape. Regional data indicates significant market concentration in Russia’s various regions, with Western, Eastern, Southern and Northern regions each presenting unique opportunities and challenges in terms of resource availability and project feasibility.

The forecast period (2025-2033) anticipates sustained growth driven by continued investment in existing plants' upgrades and the construction of new facilities. The government's commitment to renewable energy and the ongoing efforts to diversify the country’s energy mix will remain crucial factors. The market will also witness the adoption of more efficient and sustainable technologies, mitigating environmental concerns and optimizing energy production. Competition among major players will likely intensify, focusing on innovation, project execution, and securing favorable government contracts. Regional variations will persist, reflecting the diverse geographic conditions and resource distribution across Russia. However, the overall outlook remains positive, predicting substantial expansion of the Russia Hydro Power Plants market over the coming decade.

Russia Hydro Power Plants Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia Hydro Power Plants Market, covering the period 2019-2033. It offers invaluable insights into market structure, competitive dynamics, industry trends, and future growth potential, making it an essential resource for investors, industry professionals, and strategic decision-makers. The report leverages extensive data analysis and expert insights to provide a clear picture of the current state and future trajectory of the Russian hydropower sector. The Base Year for this report is 2025, with an Estimated Year of 2025, and a Forecast Period spanning 2025-2033. The Historical Period covered is 2019-2024.

Russia Hydro Power Plants Market Market Structure & Competitive Dynamics

This section delves into the competitive landscape of the Russian hydropower market, analyzing market concentration, innovation ecosystems, regulatory frameworks, and key market dynamics. The market is characterized by a moderate level of concentration, with a few major players holding significant market share. However, the presence of numerous smaller players contributes to a dynamic competitive environment. Innovation within the sector is driven by the need for greater efficiency and sustainability, particularly in the face of evolving regulatory frameworks and international sanctions. The market structure is significantly influenced by government policies and regulations regarding energy production and distribution. Product substitutes, such as thermal and renewable energy sources, exert some competitive pressure, though the vast hydro resources within Russia ensure the sector's continued relevance. M&A activity has been relatively limited in recent years, with deal values averaging xx Million. Market share data for key players will be presented within the full report.

- Market Concentration: Moderate, with xx% market share held by the top 3 players.

- Innovation Ecosystems: Focus on efficiency improvements and technological advancements to enhance power generation and grid integration.

- Regulatory Frameworks: Subject to government regulation impacting investment and project development.

- Product Substitutes: Competition from thermal and renewable energy sources.

- End-User Trends: Increasing demand for reliable and sustainable energy sources.

- M&A Activities: Limited activity in recent years, with average deal values of xx Million.

Russia Hydro Power Plants Market Industry Trends & Insights

The Russia Hydro Power Plants Market exhibits a complex interplay of factors influencing its growth trajectory. While historical growth has been xx% CAGR (2019-2024), the forecast for the period 2025-2033 projects a CAGR of xx%, factoring in geopolitical influences and technological advancements. Market penetration of hydropower remains significant, with xx% of Russia's electricity generation sourced from hydropower. This is influenced by various driving forces. Government initiatives promoting renewable energy sources, while not solely focused on hydro, indirectly support the sector. Technological advancements in dam construction and turbine technology have enhanced efficiency and reduced environmental impacts. However, the impact of Western sanctions following the 2022 invasion of Ukraine poses a significant challenge, slowing down new project development and impacting investment flows. The market faces considerable uncertainty, and these projections are subject to ongoing geopolitical and economic developments.

Dominant Markets & Segments in Russia Hydro Power Plants Market

The Hydroelectric segment dominates the Russian power generation market, accounting for xx% of total electricity production in 2025. This dominance is largely attributable to Russia's vast network of rivers and abundant water resources, providing a significant cost advantage over other forms of energy generation. Siberia and the Far East regions hold the largest share of hydroelectric capacity due to their geographical characteristics.

Key Drivers of Hydroelectric Dominance:

- Abundant water resources.

- Established infrastructure.

- Government support for energy independence.

- Relatively low operational costs compared to thermal generation.

Regional Disparities: Uneven distribution of hydropower capacity across different regions, with some regions experiencing higher growth and capacity additions compared to others.

Russia Hydro Power Plants Market Product Innovations

Technological advancements are continuously improving the efficiency and sustainability of hydropower plants in Russia. Innovations in turbine design, dam construction materials, and grid integration technologies are improving energy output, reducing environmental impacts, and enhancing the reliability of hydropower plants. These innovations directly address challenges like optimizing energy yield from existing infrastructure, improving grid stability, and reducing environmental impact. The focus remains on maximizing output while minimizing environmental concerns.

Report Segmentation & Scope

The report segments the Russia Hydro Power Plants Market based on generation type: Thermal, Hydroelectric, Renewable (excluding Hydroelectric), and Other Generations.

- Hydroelectric: This segment is the largest, representing xx% of total generation in 2025 and is expected to grow at a CAGR of xx% during the forecast period. This segment faces the largest challenges from sanctions and investment limitations.

- Thermal: This segment is considerably smaller than Hydroelectric, contributes xx% to the total generation. This segment is expected to experience a slower growth rate due to environmental regulations.

- Renewable (excluding Hydroelectric): This segment, including solar and wind, is rapidly developing in Russia, but still holds a small share of the overall market, estimated at xx% in 2025. Growth will be highly influenced by government policy and investment.

- Other Generations: This includes nuclear power and other smaller niche technologies. It comprises xx% of total market share in 2025.

Key Drivers of Russia Hydro Power Plants Market Growth

The growth of the Russia Hydro Power Plants Market is propelled by several key factors. Government support for domestic energy production, particularly in light of international sanctions, is a significant driver. The abundant water resources within the country provide a reliable and cost-effective source of energy. Furthermore, advancements in technology, enhancing the efficiency and sustainability of hydropower plants, further contribute to market expansion. However, the impact of sanctions on access to foreign technology and investment remains a major uncertainty.

Challenges in the Russia Hydro Power Plants Market Sector

The Russia Hydro Power Plants Market faces several challenges. Western sanctions have significantly impacted access to foreign technologies and financing, hindering new project development. Environmental concerns, particularly related to dam construction and its impact on river ecosystems, continue to pose regulatory hurdles. Moreover, competition from other energy sources and the need for grid modernization add further complexity to the market’s evolution. These factors are predicted to collectively reduce the market's growth by an estimated xx% over the forecast period.

Leading Players in the Russia Hydro Power Plants Market Market

- Uniper SE

- General Electric Co

- Enel SpA

- Rosatom Corp

- RusHydro PJSC ADR

- Inter RAO UES PJSC

- Rosseti PJSC

- Gazprom PJSC

Key Developments in Russia Hydro Power Plants Market Sector

- September 2022: Suspension of the 100 MW Sputnik solar plant construction due to Western sanctions. This highlights the significant impact of geopolitical events on investment decisions within the broader energy sector, indirectly affecting hydropower development.

- November 2021: RusHydro's announcement to build three new small hydropower plants in the Northern Caucasus indicates continued investment in smaller-scale projects, potentially driven by localized energy needs and reduced reliance on large-scale foreign collaborations.

Strategic Russia Hydro Power Plants Market Market Outlook

Despite the challenges posed by sanctions and geopolitical uncertainty, the long-term outlook for the Russia Hydro Power Plants Market remains positive. The country's vast hydro resources offer a significant potential for energy generation, and continued investment in technological advancements and grid modernization could unlock significant growth opportunities. A focus on smaller-scale projects, domestic technology development, and strategic partnerships may be key to navigating the current challenges and achieving long-term sustainable growth. Despite the disruptions, the inherent advantages of hydropower in Russia will contribute to continued growth in the forecast period.

Russia Hydro Power Plants Market Segmentation

-

1. Generation

- 1.1. Thermal

- 1.2. Hydroelectric

- 1.3. Renewable

- 1.4. Other Generations

- 2. Transmission and Distribution

Russia Hydro Power Plants Market Segmentation By Geography

- 1. Russia

Russia Hydro Power Plants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; High Power Demand due to the Growing Population4.; Upcoming Power Generation Projects

- 3.3. Market Restrains

- 3.3.1. 4.; The New Government's Intentions to Reduce Private Investments

- 3.4. Market Trends

- 3.4.1. Thermal Power Generation a Major Source of Energy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Hydro Power Plants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Generation

- 5.1.1. Thermal

- 5.1.2. Hydroelectric

- 5.1.3. Renewable

- 5.1.4. Other Generations

- 5.2. Market Analysis, Insights and Forecast - by Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Generation

- 6. Western Russia Russia Hydro Power Plants Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Hydro Power Plants Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Hydro Power Plants Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Hydro Power Plants Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Uniper SE

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 General Electric Co *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Enel SpA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Rosatom Corp

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 RusHydro PJSC ADR

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Inter RAO UES PJSC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Rosseti PJSC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Gazprom PJSC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Uniper SE

List of Figures

- Figure 1: Russia Hydro Power Plants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Hydro Power Plants Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Hydro Power Plants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Hydro Power Plants Market Revenue Million Forecast, by Generation 2019 & 2032

- Table 3: Russia Hydro Power Plants Market Revenue Million Forecast, by Transmission and Distribution 2019 & 2032

- Table 4: Russia Hydro Power Plants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Hydro Power Plants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russia Hydro Power Plants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russia Hydro Power Plants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russia Hydro Power Plants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russia Hydro Power Plants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russia Hydro Power Plants Market Revenue Million Forecast, by Generation 2019 & 2032

- Table 11: Russia Hydro Power Plants Market Revenue Million Forecast, by Transmission and Distribution 2019 & 2032

- Table 12: Russia Hydro Power Plants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Hydro Power Plants Market?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Russia Hydro Power Plants Market?

Key companies in the market include Uniper SE, General Electric Co *List Not Exhaustive, Enel SpA, Rosatom Corp, RusHydro PJSC ADR, Inter RAO UES PJSC, Rosseti PJSC, Gazprom PJSC.

3. What are the main segments of the Russia Hydro Power Plants Market?

The market segments include Generation, Transmission and Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; High Power Demand due to the Growing Population4.; Upcoming Power Generation Projects.

6. What are the notable trends driving market growth?

Thermal Power Generation a Major Source of Energy.

7. Are there any restraints impacting market growth?

4.; The New Government's Intentions to Reduce Private Investments.

8. Can you provide examples of recent developments in the market?

Sept 2022: The government of Russia announced the construction of the 100 MW Sputnik solar plant in Russia's Volgograd oblast had been suspended due to Western sanctions imposed in response to the Russian invasion of Ukraine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Hydro Power Plants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Hydro Power Plants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Hydro Power Plants Market?

To stay informed about further developments, trends, and reports in the Russia Hydro Power Plants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence